Market Overview

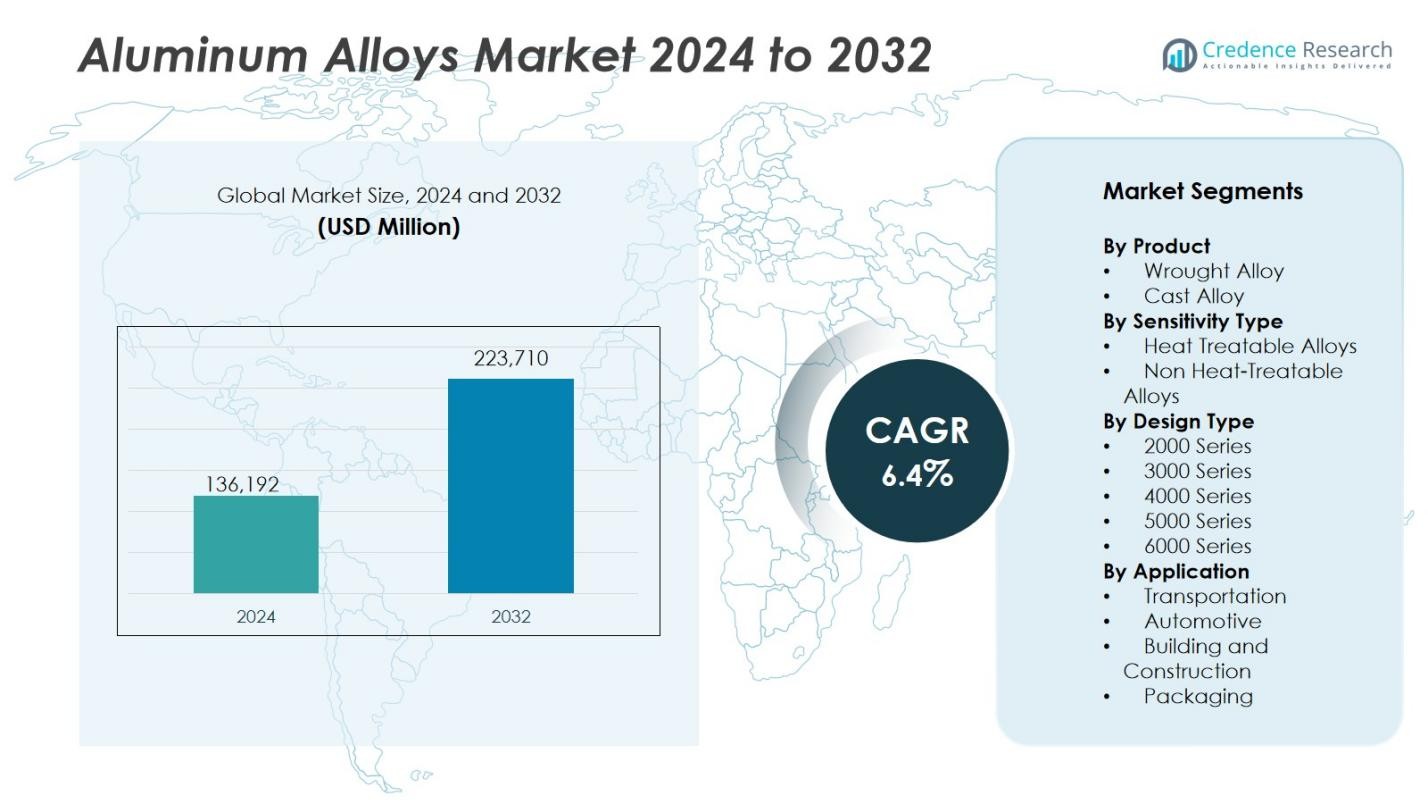

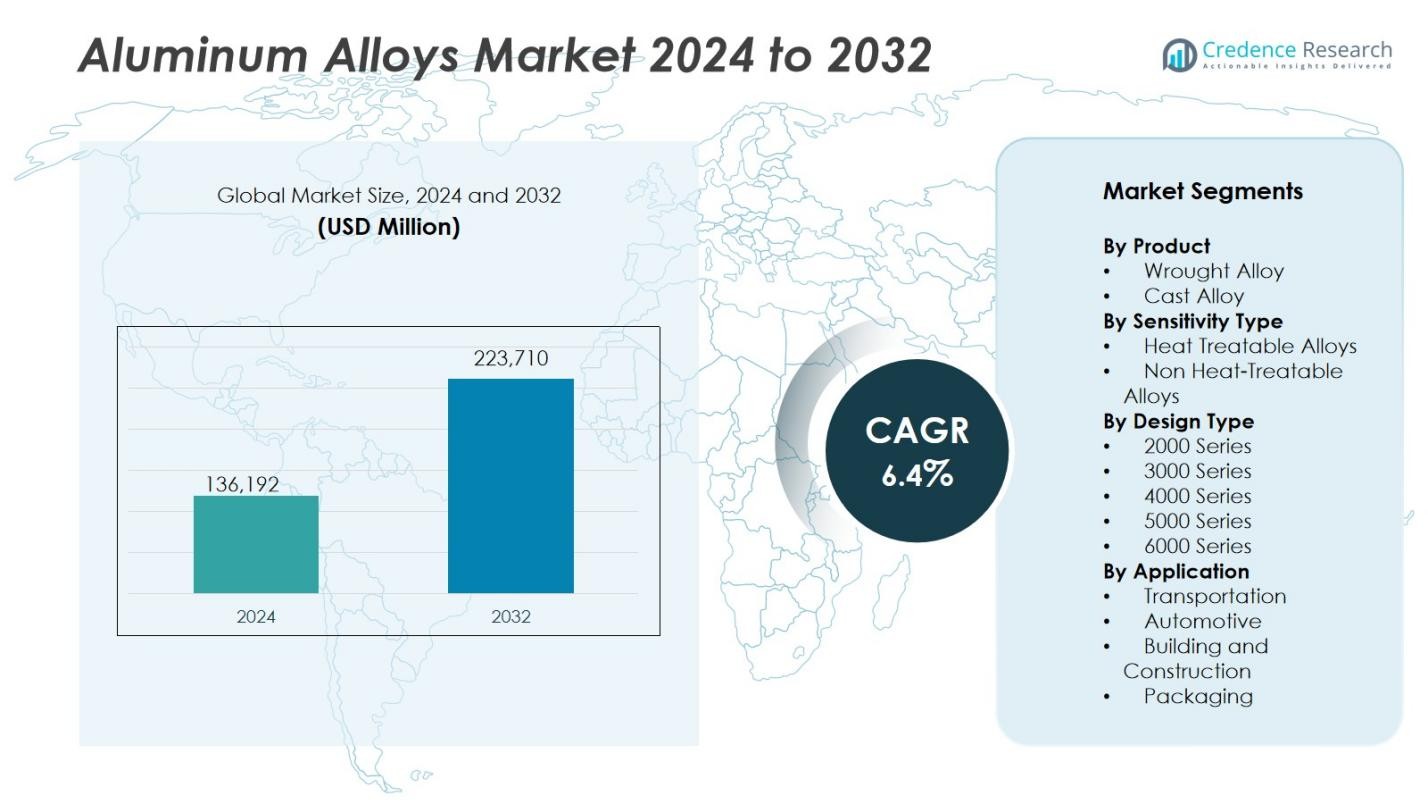

Aluminum Alloys Market size was valued at USD 136,192 million in 2024 and is anticipated to reach USD 223,710 million by 2032, growing at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminum Alloys Market Size 2024 |

USD 136,192 Million |

| Aluminum Alloys Market, CAGR |

6.4% |

| Aluminum Alloys Market Size 2032 |

USD 223,710 Million |

The aluminum alloys market is highly competitive, with key players including Constellium (Netherlands), Vedanta Limited (India), Rio Tinto (Australia), Emirates Global Aluminium (U.A.E.), Norsk Hydro (Norway), South32 (Australia), Novelis (Canada), China Hongqiao Group (China), Rusal (Russia), and Alcoa (U.S.). These companies focus on expanding production capacity, advancing recycling technologies, and developing high-performance alloys to meet the rising demand across automotive, aerospace, and construction sectors. Among all regions, Asia-Pacific leads the aluminum alloys market with a 41% share in 2024, driven by rapid industrialization, strong manufacturing capabilities, and large-scale infrastructure investments, particularly in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Aluminum Alloys Market was valued at USD 136,192 million in 2024 and is projected to reach USD 223,710 million by 2032, growing at a CAGR of 6.4% during the forecast period.

- Rising demand from the automotive and aerospace industries for lightweight, high-strength materials is a major driver, supported by growing EV production and fuel-efficiency regulations.

- The market is witnessing a strong trend toward high-performance and recyclable alloys, particularly in the 6000 series, which accounted for 35% of the segment share in 2024 due to its versatility and strength.

- The competitive landscape is dominated by leading players such as Constellium, Vedanta Limited, Rio Tinto, Norsk Hydro, and Alcoa, focusing on technological innovation and sustainable production to strengthen their market position.

- Asia-Pacific held a 41% regional share in 2024, leading the market due to large-scale manufacturing, infrastructure growth, and increasing aluminum consumption in China and India.

Market Segmentation Analysis:

By Product:

The wrought alloy segment dominated the aluminum alloys market in 2024, accounting for 78% of the total share. Its dominance is driven by its superior mechanical strength, corrosion resistance, and excellent formability, making it ideal for applications in automotive, aerospace, and construction industries. Increasing demand for lightweight materials in electric vehicles and aircraft structures further accelerates its adoption. In contrast, the cast alloy segment, though smaller, continues to gain traction in complex component manufacturing due to its cost-efficiency and design flexibility.

- For instance, aluminum alloy 2024, widely used by aerospace manufacturers, is known for its high strength and fatigue resistance in aircraft structural components such as wing skins and fuselage panels.

By Sensitivity Type:

The heat-treatable alloys segment held the largest market share of 64% in 2024, primarily due to its enhanced strength and machinability achieved through controlled heat treatment processes. These alloys are widely used in transportation and aerospace applications, where high performance and durability are essential. The growing demand for high-strength lightweight materials in aircraft and EVs supports this segment’s expansion. Meanwhile, non-heat-treatable alloys find niche use in marine and architectural applications for their superior corrosion resistance and weldability.

- For instance, aluminum 7075-T6, known for its very high strength and machinability, commonly used in aerospace components requiring lightweight yet durable materials.

By Design Type:

The 6000 series alloys emerged as the leading segment, representing 35% of the aluminum alloys market in 2024. Their dominance stems from excellent extrudability, moderate strength, and corrosion resistance, which make them highly preferred in automotive frames, building facades, and structural applications. The 5000 series follows, favored for marine and transportation uses due to its strength-to-weight ratio and saltwater resistance. Increasing construction and EV production activities across Asia-Pacific and Europe continue to fuel the demand for 6000 series alloys as the preferred design type.

Key Growth Drivers

Rising Demand from Automotive and Aerospace Industries

The increasing emphasis on lightweight and fuel-efficient vehicles has positioned aluminum alloys as a preferred material in the automotive and aerospace sectors. Automakers are increasingly using aluminum alloys to reduce vehicle weight, enhance fuel economy, and lower emissions. Similarly, aircraft manufacturers utilize these alloys for structural components due to their high strength-to-weight ratio and corrosion resistance. The shift toward electric vehicles and expanded aircraft production in emerging economies further propels market growth.

- For instance, General Motors has been using aluminum alloys extensively in engine blocks and body panels to reduce vehicle weight and improve fuel efficiency, achieving notable emission reductions.

Expansion in Construction and Infrastructure Projects

Rapid urbanization and infrastructure development across Asia-Pacific, Europe, and the Middle East have amplified the use of aluminum alloys in building and construction. These alloys are extensively used in curtain walls, roofing, window frames, and facades due to their durability and aesthetic appeal. Government investments in sustainable infrastructure and smart city projects also boost the adoption of aluminum alloys for energy-efficient buildings, reinforcing long-term demand across both residential and commercial sectors.

- For instance, Indian infrastructure projects under the National Infrastructure Pipeline are also significantly increasing aluminum cladding and paneling applications for sustainable urban development.

Advancements in Recycling and Alloy Processing Technologies

Technological advancements in aluminum recycling and alloy processing are driving market expansion by lowering production costs and reducing environmental impact. Modern recycling techniques enable high recovery rates without compromising material properties, supporting circular economy initiatives. Innovations in alloy formulation and processing have led to enhanced strength, corrosion resistance, and thermal conductivity, widening the application range in transportation, packaging, and electronics industries. These advancements are key to meeting sustainability targets and strengthening the competitive position of manufacturers globally.

Key Trends & Opportunities

Integration of Aluminum Alloys in Electric Vehicles (EVs)

The rapid electrification of the automotive industry presents a major growth opportunity for aluminum alloys. EV manufacturers increasingly use aluminum alloys for battery housings, chassis, and body panels to reduce overall weight and improve energy efficiency. The growing focus on range optimization and thermal management in EVs further increases alloy utilization. As global EV production surges, aluminum alloy demand is expected to accelerate, driven by their ability to meet performance and sustainability standards.

- For instance, Audi’s e-tron electric vehicles utilize a mixed-material hybrid construction body that strategically combines both ultra-high-strength steel (for the passenger cell backbone and safety components) and aluminum (for the outer skin, suspension components, and the protective battery housing frame) to enhance both crash safety and energy efficiency through lightweight construction.

Growing Adoption of High-Performance Alloy Grades

The industry is witnessing a trend toward high-performance aluminum alloys with enhanced strength, corrosion resistance, and formability. Manufacturers are investing in research and development to create specialized alloys for aerospace, marine, and defense applications. The introduction of advanced 7000 and 6000 series alloys with superior mechanical and thermal properties has broadened their use across critical sectors. This ongoing innovation supports product differentiation and positions aluminum alloys as key materials for next-generation engineering solutions.

- For instance, AA7050 alloy is widely used in aerospace for fuselage frames and bulkheads, offering enhanced corrosion resistance and durability compared to earlier alloys.

Key Challenges

Fluctuating Raw Material Prices

Volatility in aluminum prices poses a major challenge to alloy manufacturers and end-users. Factors such as energy costs, supply chain disruptions, and geopolitical tensions directly affect bauxite and alumina prices, impacting production margins. Manufacturers often face difficulties maintaining price stability and profitability amid unpredictable market conditions. These fluctuations can also hinder long-term contracts and investment planning, forcing companies to adopt cost-optimization strategies and explore alternative sourcing options.

Environmental and Energy Consumption Concerns

Despite recyclability advantages, primary aluminum production remains energy-intensive and contributes significantly to carbon emissions. Stringent environmental regulations and rising energy costs challenge manufacturers to adopt cleaner and more efficient production technologies. Transitioning to renewable energy sources and low-carbon smelting processes requires substantial capital investment. Balancing sustainability goals with cost competitiveness remains a persistent issue, especially for producers operating in regions with limited access to green energy infrastructure.

Regional Analysis

North America

North America accounted for 26% of the global aluminum alloys market share in 2024, driven by strong demand from the automotive, aerospace, and construction sectors. The United States remains the key contributor, supported by high aluminum consumption in aircraft manufacturing and lightweight vehicle production. Government initiatives promoting energy-efficient materials and recycling further boost regional growth. Additionally, technological innovations and investments in electric vehicle production strengthen the market outlook. Canada’s growing construction industry and increasing adoption of aluminum in renewable energy infrastructure also contribute significantly to market expansion.

Europe

Europe held a 24% share of the global aluminum alloys market in 2024, primarily driven by stringent environmental regulations and the strong presence of automotive and aerospace manufacturers. Countries such as Germany, France, and the United Kingdom lead in lightweight material adoption for sustainable mobility solutions. The region’s focus on circular economy practices and high recycling efficiency enhances aluminum alloy demand. Furthermore, ongoing investments in renewable energy projects and electric vehicle production are propelling consumption, while technological advancements in alloy manufacturing continue to support Europe’s competitive edge in the global market.

Asia-Pacific

Asia-Pacific dominated the aluminum alloys market with a 41% share in 2024, making it the largest regional market globally. Rapid industrialization, infrastructure expansion, and growing automotive production in China, India, and Japan are the key growth drivers. China leads regional consumption, fueled by robust demand in transportation, construction, and consumer electronics. India’s rising investments in infrastructure and electric mobility also strengthen market dynamics. The region benefits from cost-effective manufacturing capabilities, abundant raw material availability, and increasing foreign investments, establishing Asia-Pacific as a major hub for aluminum alloy production and exports.

Latin America

Latin America accounted for a 5% share of the global aluminum alloys market in 2024, driven by expanding construction and automotive sectors in Brazil and Mexico. The region’s growing focus on industrial modernization and lightweight vehicle manufacturing supports aluminum alloy adoption. Brazil’s strong mining sector and government initiatives promoting infrastructure development further contribute to market growth. Additionally, increasing foreign investment in automotive and aerospace manufacturing enhances demand for high-strength aluminum alloys. However, limited technological infrastructure and fluctuating economic conditions continue to challenge consistent market expansion across the region.

Middle East & Africa

The Middle East & Africa region held a 4% market share in 2024, supported by growing construction and transportation activities. The United Arab Emirates and Saudi Arabia are leading markets, with aluminum alloy demand driven by large-scale infrastructure projects and industrial diversification initiatives. The region benefits from abundant aluminum resources and investments in smelting and downstream processing facilities. Expanding aerospace and renewable energy sectors further create opportunities for alloy applications. However, limited manufacturing capacity and reliance on imports in certain areas pose challenges to long-term market growth and self-sufficiency.

Market Segmentations:

By Product

By Sensitivity Type

- Heat Treatable Alloys

- Non Heat-Treatable Alloys

By Design Type

- 2000 Series

- 3000 Series

- 4000 Series

- 5000 Series

- 6000 Series

By Application

- Transportation

- Automotive

- Building and Construction

- Packaging

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the aluminum alloys market is defined by the presence of major players such as Constellium (Netherlands), Vedanta Limited (India), Rio Tinto (Australia), Emirates Global Aluminium (U.A.E.), Norsk Hydro (Norway), South32 (Australia), Novelis (Canada), China Hongqiao Group (China), Rusal (Russia), and Alcoa (U.S.). These companies dominate the global market through strong production capabilities, diversified product portfolios, and extensive distribution networks. Competition is primarily driven by innovation in lightweight, high-strength, and corrosion-resistant alloys catering to automotive, aerospace, and construction industries. Key players are focusing on sustainable production practices, including low-carbon smelting and enhanced recycling technologies, to align with environmental goals and reduce operational costs. Strategic mergers, capacity expansions, and collaborations with end-use industries are common approaches to gain market advantage. Additionally, advancements in alloy processing technologies and investments in R&D are enabling manufacturers to deliver superior performance materials and strengthen their global competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2024, Bharat Forge announced an investment of USD 40 million for its subsidiary BFA in the U.S., which focused on aluminum components for the automotive industry. With this investment, the company plans to increase its capital expenditure and improve its footprint in the U.S.

- In February 2024, Hydro announced an investment of USD 193 million for the construction of a new recycling plant in Torjia, Spain. The company aims to supply aluminum billets to industries such as automotive, consumer durables, and energy in the Europe region.

- In August 2023, Aluminium Bahrain B.S.C. (Alba), the largest aluminum smelter globally outside China, has introduced a new aluminum alloy, 6060.HE, as part of its AA6060 series. Developed in partnership with the University of Bahrain and Bahrain Aluminum Extrusion Company (BALEXCO), this alloy enhances the extrusion process, elevating the quality and performance of extruded products.

Report Coverage

The research report offers an in-depth analysis based on Product, Sensitivity Type, Design Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The aluminum alloys market will witness steady growth driven by rising demand for lightweight materials in automotive and aerospace sectors.

- Expansion of electric vehicle manufacturing will significantly boost the use of high-strength and heat-treatable aluminum alloys.

- Increased construction and infrastructure development will create sustained demand for durable and corrosion-resistant alloys.

- Recycling and circular economy initiatives will enhance aluminum alloy production efficiency and reduce environmental impact.

- Advancements in alloy processing technologies will lead to improved strength, formability, and performance.

- Growing adoption of aluminum alloys in renewable energy systems and battery enclosures will support market expansion.

- Strategic partnerships between alloy producers and automotive OEMs will drive innovation in custom alloy formulations.

- Asia-Pacific will continue to dominate the global market due to large-scale industrialization and manufacturing capacity.

- Rising investments in green aluminum production will align industry growth with global sustainability goals.

- Technological integration through automation and AI-based quality control will optimize manufacturing and supply chain efficiency.