Market Overview:

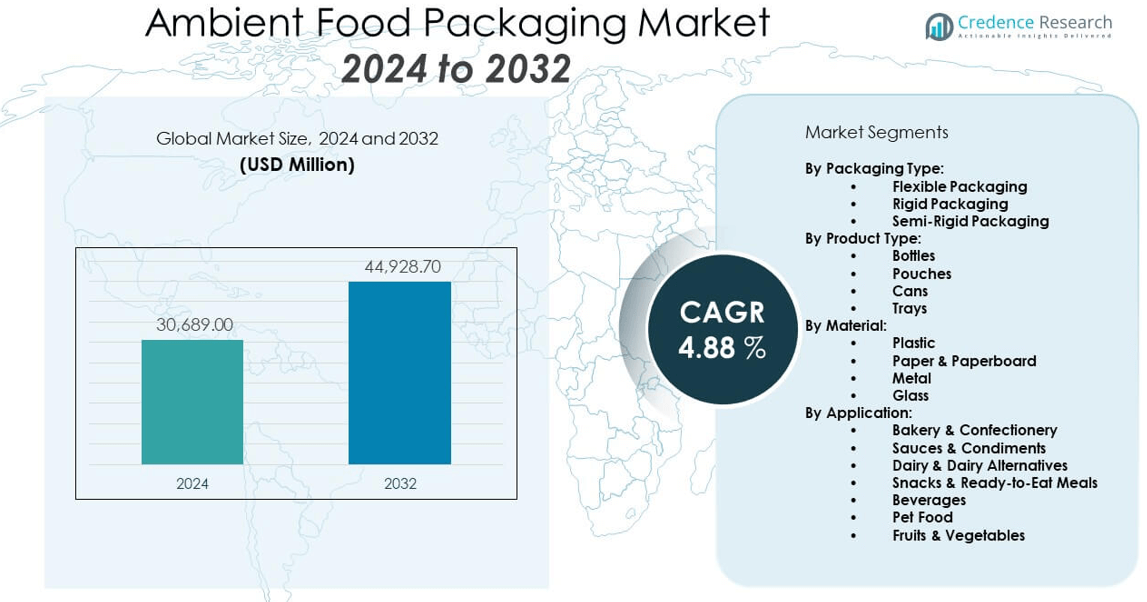

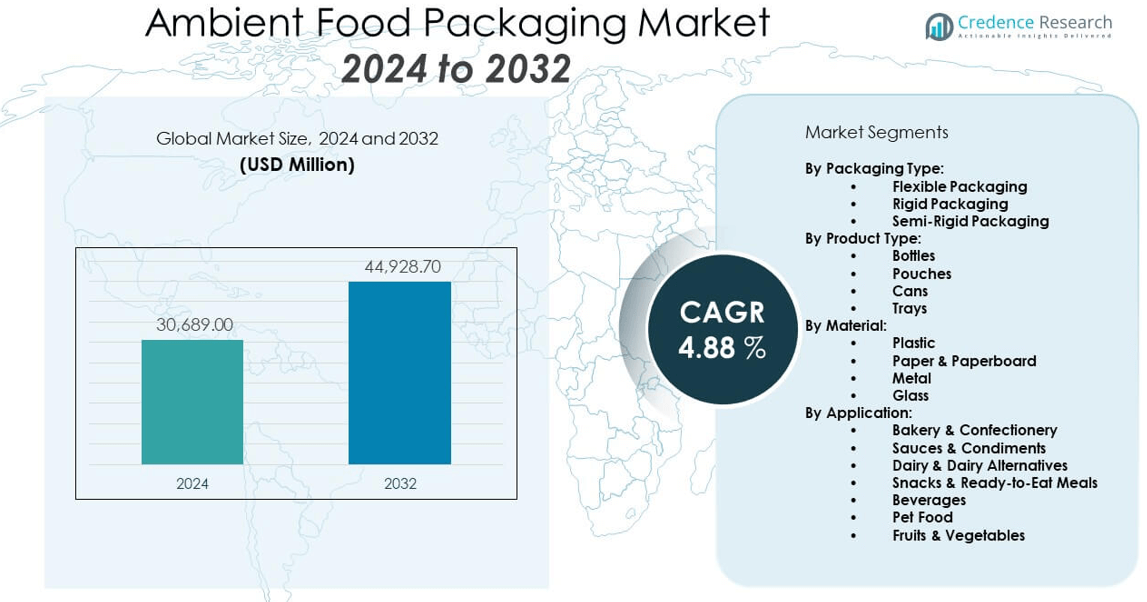

The Ambient Food Packaging Market is projected to grow from USD 30,689 million in 2024 to an estimated USD 44,928.7 million by 2032, with a compound annual growth rate (CAGR) of 4.88% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ambient Food Packaging Market Size 2024 |

USD 30,689 million |

| Ambient Food Packaging Market, CAGR |

4.88% |

| Ambient Food Packaging Market Size 2032 |

USD 44,928.7 million |

The market is experiencing steady growth driven by the increasing demand for shelf-stable food products that require minimal refrigeration. Rising urbanization, busy lifestyles, and a growing preference for convenience are pushing manufacturers to adopt packaging solutions that preserve food quality over longer periods. Technological advancements in materials and barrier properties are enabling packaging that maintains freshness, nutritional value, and taste, supporting the expansion of ambient food products in both developed and developing economies.

Geographically, Europe holds a prominent position in the ambient food packaging market due to strong retail infrastructure and high demand for ready-to-eat meals. North America follows closely with innovations in sustainable packaging and high consumption of packaged foods. Meanwhile, Asia Pacific is emerging as a key growth region, driven by rapid urbanization, expanding middle-class populations, and changing dietary habits. Countries like China and India are witnessing increased investments in packaging technologies to meet rising food demand and reduce food waste.

Market Insights:

- The Ambient Food Packaging Market is projected to grow from USD 30,689 million in 2024 to USD 44,928.7 million by 2032, at a CAGR of 4.88%.

- Increasing demand for shelf-stable, ready-to-eat meals is driving the adoption of ambient packaging across retail and e-commerce channels.

- Rising urbanization and busy lifestyles are pushing food companies to offer convenient, long-lasting packaged food products.

- Technological advancements in barrier materials are enabling improved preservation without refrigeration, fueling market growth.

- Regulatory hurdles and the complexity of recycling multi-layered packaging materials may limit market expansion.

- Europe leads the market due to high consumption of convenience foods and established packaging infrastructure.

- Asia Pacific is emerging rapidly, driven by urban growth, expanding food retail, and changing dietary patterns in countries like China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Preference for Shelf-Stable Foods Due to Urban Lifestyle Demands:

Rising urbanization has led to increased demand for food products that do not require refrigeration. Consumers seek convenience in meal preparation due to busy schedules and dual-income households. The Ambient Food Packaging Market supports this demand by offering packaging that ensures product safety and longevity. Manufacturers continue to shift focus toward ambient formats to reduce cold chain dependency. The extended shelf life also benefits retailers by reducing stock rotation and spoilage rates. Consumers in both developed and developing regions increasingly favor ready-to-eat meals and pantry-stable snacks. The market grows with the shift in dietary habits and time-saving preferences. It continues to attract investments from food processors aiming to meet long-term storage needs.

- For instance, Nestlé’s Maggi 2-Minute Noodles in India are packed in high-barrier laminate pouches, allowing for a shelf life of up to 9 months without refrigeration, supporting both urban retail and remote distribution.

Technological Advancements in Barrier Materials Enhancing Food Preservation:

Improved materials such as high-barrier plastics and aluminum laminates extend food shelf life without compromising flavor or nutritional value. These advancements allow food to stay safe for consumption for several months without refrigeration. The Ambient Food Packaging Market benefits from innovations in multilayer films that prevent moisture and oxygen ingress. Companies adopt technologies that combine light weighting with structural integrity. Enhanced sealing capabilities and tamper-proof designs build consumer trust in ambient-packaged goods. The ability to package a broader range of food types fuels market diversification. Innovations also support reduced use of preservatives in packaged foods. It enhances product appeal to health-conscious consumers seeking clean-label options.

- For instance, Amcor’s AmLite Ultra Recyclable packaging uses high-barrier polyolefin films that reduce oxygen transmission rates to less than 0.2 cc/m²/day, enabling ambient storage of sensitive dairy and snack foods for up to 12 months.

Growth in E-Commerce and Extended Supply Chain Requirements:

The rise of online grocery platforms boosts the demand for packaging that withstands long-distance transportation. Ambient food products suit this supply chain model by requiring no refrigeration during transit or storage. The Ambient Food Packaging Market supports cost savings for e-commerce retailers through reduced logistics complexity. It enables broader geographic reach and shelf presence for brands targeting remote areas. Longer shelf life also minimizes returns due to spoilage. E-commerce growth pushes brands to adopt sturdy and lightweight packaging to reduce damage and shipping costs. It aligns with consumer expectations of undamaged, safe deliveries. The need for reliable, ambient-ready packaging has become critical for digital-first food companies.

Sustainability Goals Aligning with Reduced Refrigeration and Waste Reduction:

Ambient packaging supports global sustainability initiatives by minimizing cold chain energy consumption. It reduces greenhouse gas emissions associated with refrigeration and frozen storage. The Ambient Food Packaging Market benefits from industry efforts to reduce food waste through longer shelf lives. Packaging manufacturers develop recyclable and bio-based materials compatible with ambient requirements. It allows brands to meet both regulatory and consumer sustainability expectations. Government policies promoting energy-efficient practices also boost interest in ambient formats. Retailers benefit from decreased product loss and enhanced stock management. The sustainability factor drives adoption across food categories including beverages, snacks, and ready meals.

Market Trends:

Rise of Smart Packaging Solutions Integrating Freshness Indicators:

The demand for intelligent packaging that provides real-time product condition feedback is increasing. Sensors and time-temperature indicators help detect spoilage risk and monitor freshness. The Ambient Food Packaging Market is witnessing interest in data-enabled packaging that enhances consumer confidence. These smart systems support inventory management for retailers and reduce waste. Brands adopt freshness indicators to differentiate premium ambient offerings. It allows users to verify quality without opening the product. These features add transparency in supply chains where refrigeration is absent. The trend also aligns with food safety regulations and traceability standards globally.

- For instance, Timestrip’s time-temperature indicators are used on ready-to-eat foods and monitor exposure between 5°C and 60°C, adhering to internationally recognized “2-hour/4-hour” food safety rules. These irreversible indicators are trusted for visual spoilage tracking in global retail and food logistics.

Expansion of Aesthetic and Convenience-Oriented Packaging Formats:

Packaging that combines visual appeal with user-friendly features is gaining traction. Resealable closures, portioned packs, and easy-open lids improve consumer experience. The Ambient Food Packaging Market responds to these trends with pouch-based and tray-sealed formats. It enhances portability and supports on-the-go consumption. Brands focus on package aesthetics to stand out in crowded retail aisles. The rise in solo households and elderly consumers drives demand for single-serve options. Consumer engagement improves through clear labeling and modern designs. It strengthens brand loyalty and promotes trial among first-time buyers. Functional design continues to influence purchasing decisions.

- For instance, Cadbury Oreo (Mondelez International) focuses on packaging that enhances brand image, functionality, and consumer satisfaction, boosting engagement and loyalty.

Surge in Private Label Ambient Food Brands Across Retail Chains:

Retailers increasingly launch their own ambient product lines to attract value-conscious shoppers. Private label offerings deliver price competitiveness without compromising quality. The Ambient Food Packaging Market supports this trend with flexible production and packaging scalability. Supermarkets and discounters invest in ambient formats to expand product assortment. It allows quick shelf replenishment and longer stock intervals. Packaging vendors collaborate with retailers for customized design and branding. The rise in store-brand popularity fosters innovation in cost-effective yet durable materials. It creates opportunities for packaging firms to serve high-volume retail clients.

Digital Printing Technologies Supporting Short Runs and Customization:

Digital printing in food packaging allows brands to create personalized designs and regional variations. It supports rapid product launches and marketing flexibility. The Ambient Food Packaging Market integrates digital print technologies to meet changing consumer preferences. It enables localized campaigns, seasonal packaging, and QR code integration. Digital printing reduces setup costs and supports eco-friendly production. The trend allows small and medium enterprises to compete with larger brands. Quick design changes enhance responsiveness to market shifts. It provides packaging agility that matches the speed of product development cycles.

Market Challenges Analysis:

Material Compatibility and Shelf Life Optimization Remain Complex Issues:

Ensuring that packaging materials meet both safety and performance standards poses a technical challenge. The Ambient Food Packaging Market must balance shelf stability with material sustainability and cost. High-barrier packaging requires precise formulation to resist oxygen, moisture, and light. It becomes complex when handling diverse food categories with unique preservation needs. Food compatibility testing adds cost and time to product development cycles. Some packaging materials remain difficult to recycle due to multilayer compositions. Consumers demand green packaging, but alternatives may compromise barrier properties. It limits material options for producers striving to balance safety, sustainability, and cost.

Regulatory Compliance and Shifting Global Standards Increase Cost Burden:

Global markets operate under differing food safety and packaging material regulations. The Ambient Food Packaging Market faces hurdles in aligning with varied compliance requirements. Companies must adapt to evolving legislation concerning recyclability, chemical migration, and labeling. Regulatory shifts require continuous investment in testing, certification, and reformulation. Import-export complexities create barriers for international market expansion. It becomes critical for manufacturers to monitor regulatory updates in all target regions. Non-compliance risks penalties and product recalls, impacting brand reputation. Navigating regulatory diversity increases administrative and operational overheads for packaging firms.

Market Opportunities:

Growth of Packaged Food Consumption in Emerging Economies Creates Demand:

Rapid urban development and rising incomes in Asia, Latin America, and Africa fuel packaged food demand. The Ambient Food Packaging Market gains traction in these regions due to limited cold storage infrastructure. It supports shelf stability in high-temperature climates. Consumers in rural and peri-urban areas increasingly turn to shelf-stable products. Manufacturers expand into these markets with ambient formats tailored for regional diets. It helps bridge access gaps where refrigeration is unreliable or absent. Local packaging partnerships support cost-effective distribution. Emerging economies provide a significant growth frontier.

Advancements in Bio-Based Packaging Materials Open New Revenue Streams:

Eco-conscious consumers drive demand for sustainable packaging made from renewable sources. The Ambient Food Packaging Market explores plant-based polymers and biodegradable films. It aligns with corporate ESG goals and green labeling requirements. Material innovations attract environmentally aware food brands. It provides an edge in competitive retail environments. Governments offer incentives for adopting recyclable and compostable materials. The opportunity lies in replacing legacy plastics without compromising food safety. It positions suppliers to meet both functional and ethical expectations.

Market Segmentation Analysis:

By Packaging Type

Flexible packaging dominates the Ambient Food Packaging Market due to its lightweight design, cost-efficiency, and ability to extend shelf life. It is widely adopted for snacks, condiments, and ready meals. Rigid packaging remains essential for beverages and dairy, offering durability and protection. Semi-rigid packaging, used in trays, provides a balanced solution between flexibility and structural support for ready-to-eat applications.

- For instance, Kraft Heinz’s Capri Sun drink pouches have transitioned to recyclable polypropylene mono-material, aligning with new regulatory requirements and sustainability goals. The new pouch maintains product durability and supports ambient shelf life but specific breakage reduction statistics were not available in the reviewed trade publications.

By Product Type

Pouches lead the market due to ease of use, portability, and reduced material usage. Bottles hold a significant share in the packaging of beverages and sauces. Cans continue to be the preferred format for processed fruits, vegetables, and pet food, offering excellent barrier protection. Trays are common in bakery and meal segments requiring form retention and stackability.

- For instance, Campbell Soup packages its Chunky soups in steel cans with a double seam – each can pass a vacuum leak test with a failure rate of less than 0.01%, supporting reliable shelf lives exceeding 18 months.

By Material

Plastic remains the most used material, offering flexibility, strength, and affordability. Paper and paperboard are gaining traction as recyclable options, particularly for dry foods. Metal provides high-barrier protection and long shelf life, especially for canned goods. Glass is used in premium segments for its inertness and visual appeal.

By Application

Snacks and ready-to-eat meals drive demand, supported by consumer preference for convenient ambient products. Bakery and confectionery follow closely with strong uptake in shelf-stable formats. Sauces, condiments, and dairy alternatives contribute to steady market growth. Beverages, pet food, and processed fruits and vegetables also show consistent demand, expanding the application base for ambient packaging solutions.

Segmentation:

By Packaging Type:

- Flexible Packaging

- Rigid Packaging

- Semi-Rigid Packaging

By Product Type:

- Bottles

- Pouches

- Cans

- Trays

By Material:

- Plastic

- Paper & Paperboard

- Metal

- Glass

By Application:

- Bakery & Confectionery

- Sauces & Condiments

- Dairy & Dairy Alternatives

- Snacks & Ready-to-Eat Meals

- Beverages

- Pet Food

- Fruits & Vegetables

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a significant share of the Ambient Food Packaging Market, accounting for approximately 26% of the global market in 2024. Strong demand for packaged food, well-developed retail infrastructure, and high adoption of convenience meals support market strength. Consumers in the U.S. and Canada prefer shelf-stable options that align with busy lifestyles and longer product storage. Manufacturers focus on innovations in resealable, lightweight, and recyclable packaging formats to meet evolving expectations. The rise in e-commerce grocery platforms continues to boost demand for ambient-packaged goods. Regulatory initiatives on sustainable packaging practices drive investments in bio-based and recyclable solutions.

Europe

Europe leads the global Ambient Food Packaging Market with a market share of around 32% in 2024. High consumption of ready-to-eat and processed foods across Germany, France, and the U.K. contributes to market dominance. The region benefits from strong environmental policies, pushing companies to integrate recyclable and compostable materials. Advanced packaging technologies and stringent food safety regulations support product quality and shelf life. Retailers in the region continue to expand private label offerings in ambient formats to meet demand from cost-conscious consumers. Growth in functional and organic food products further enhances the relevance of ambient packaging in this market.

Asia Pacific

Asia Pacific captures an estimated 28% share of the Ambient Food Packaging Market in 2024 and represents the fastest-growing regional segment. Rising urbanization, expanding middle-class population, and increasing demand for convenient food drive regional growth. Countries such as China, India, and Indonesia are witnessing a surge in consumption of ambient-packaged snacks, beverages, and ready meals. The growth of modern retail and online grocery platforms contributes to the rising volume of shelf-stable food distribution. Packaging companies invest in affordable yet durable formats suited for hot and humid climates. Government initiatives supporting food safety and reduced post-harvest loss further promote ambient packaging adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- Tetra Pak

- Mondi Group

- Constantia Flexibles

- Sealed Air

- Huhtamaki Oyj

- DuPont

- SIG Group AG / SIG Combibloc Obeikan

- Berry Global Inc.

- Crown Holdings Inc.

Competitive Analysis:

The Ambient Food Packaging Market features intense competition among global and regional players focused on innovation, sustainability, and cost efficiency. Companies like Amcor plc, Tetra Pak, Mondi Group, and Huhtamaki Oyj lead the market by offering advanced materials and customizable packaging formats tailored to consumer convenience and shelf-life extension. It attracts continuous R&D investment aimed at developing high-barrier, recyclable, and lightweight packaging. Market players differentiate through material innovation, aseptic technologies, and eco-conscious product lines. Strategic collaborations with food manufacturers and expansion into high-growth regions further strengthen competitive positions.

Recent Developments:

- In June 2025, Huhtamaki signed a EUR150 million Schuldschein loan agreement to support refinancing and general corporate purposes. While not a direct product launch, this financing underpins Huhtamaki’s continued investment in sustainable food packaging solutions globally.

- In June 2025, DuPont introduced the FilmTec™ Hypershell™ XP RO-8038, a high-performance reverse osmosis element engineered for dairy processing. The new product offers up to 50% higher productivity and flow or significantly lower energy use, enabling more efficient, sustainable, and high-quality dairy production in ambient packaging applications.

- In May 2025, Constantia Flexibles launched EcoVerHighPlus, a recyclable-ready mono polypropylene laminate for coffee packaging, in partnership with Delica AG. This innovation provides superior barrier protection and runnability without equipment modifications, demonstrating progress toward high-performance, sustainable coffee packaging.

- In April 2025, Mondi completed the acquisition of Schumacher Packaging’s Western Europe operations, adding over 1 billion square meters of additional packaging capacity. This acquisition significantly expands Mondi’s product range and enhances its ability to serve eCommerce and FMCG customers with sustainable corrugated and solid board packaging solutions.

Market Concentration & Characteristics:

The Ambient Food Packaging Market is moderately concentrated, with key players holding significant shares across global and regional levels. It features a mix of multinational corporations and niche suppliers competing on innovation, material sustainability, and distribution capabilities. The market exhibits high entry barriers due to compliance requirements, technological complexity, and capital intensity. It continues to evolve with growing demand for recyclable solutions and extended shelf life across multiple food categories.

Report Coverage:

The research report offers an in-depth analysis based on Packaging Type, Product Type, Material, Application, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for shelf-stable packaging will grow with the global shift toward convenient food consumption.

- Technological innovation in barrier materials will improve shelf life and reduce reliance on preservatives.

- Flexible packaging formats will gain wider adoption due to ease of storage, transport, and cost efficiency.

- Sustainable packaging solutions will shape procurement decisions across food manufacturers and retailers.

- E-commerce expansion will drive demand for lightweight, durable packaging for ambient food delivery.

- Smart packaging integration will enhance transparency and freshness tracking in long-shelf-life food products.

- Regulatory pressures will push for greater use of recyclable and bio-based materials in ambient packaging.

- Emerging markets in Asia and South America will witness rapid adoption driven by urbanization and middle-class growth.

- Retailers will expand private label ambient food offerings, increasing demand for customized packaging solutions.

- Strategic partnerships between packaging companies and food brands will accelerate innovation and global reach.