Market Overview:

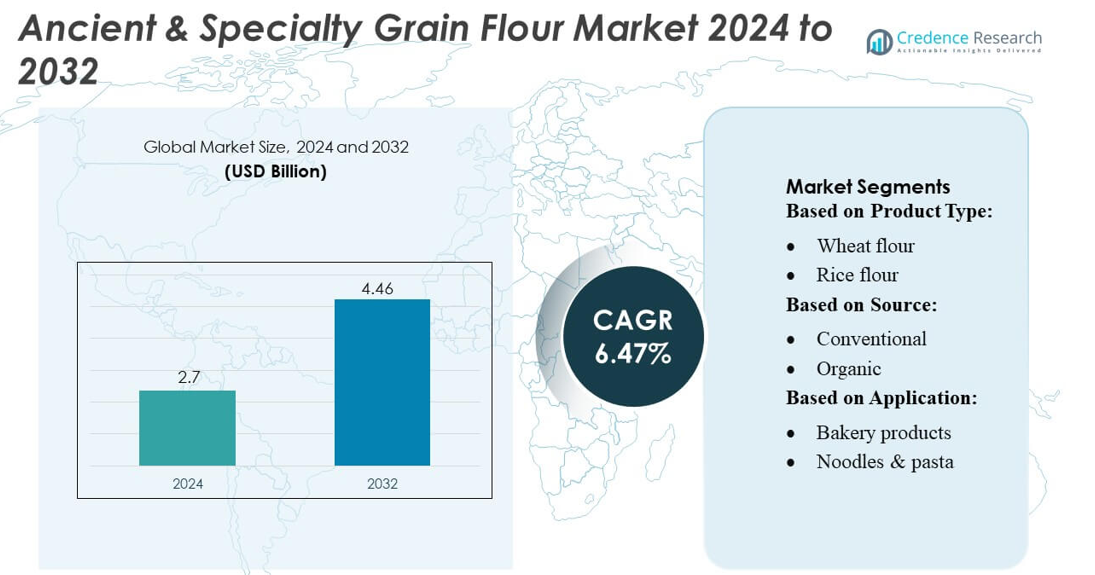

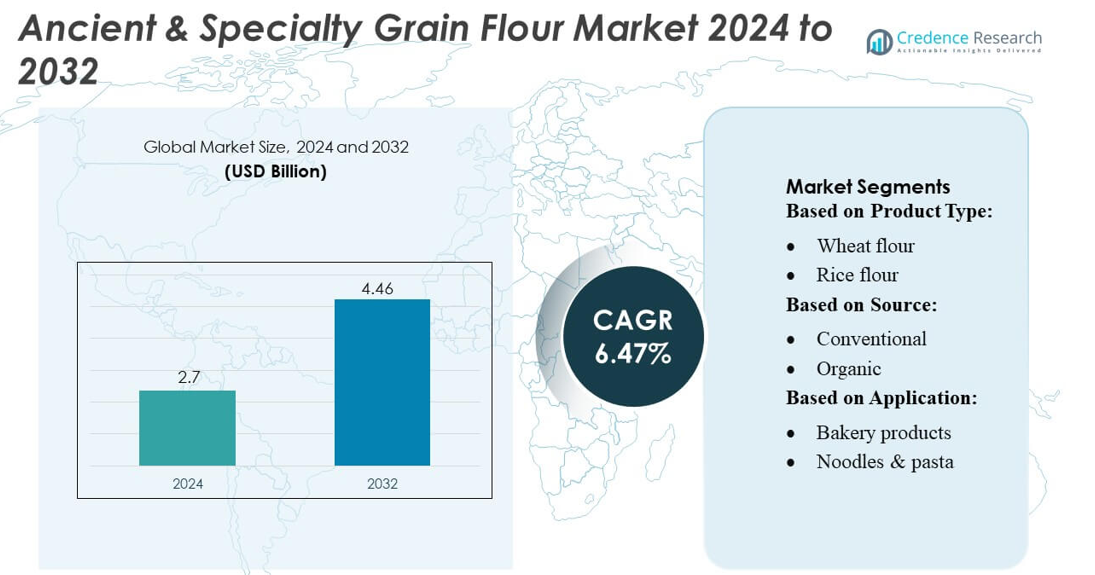

Ancient & Specialty Grain Flour Market size was valued USD 2.7 billion in 2024 and is anticipated to reach USD 4.46 billion by 2032, at a CAGR of 6.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ancient & Specialty Grain Flour Market Size 2024 |

USD 2.7 billion |

| Ancient & Specialty Grain Flour Market, CAGR |

6.47% |

| Ancient & Specialty Grain Flour Market Size 2032 |

USD 4.46 billion |

The Ancient & Specialty Grain Flour market is led by prominent companies including Dave’s Killer Bread, ADM, King Arthur Baking, ConAgra Foods, Bay State Milling, Ardent Mills, Bobs Red Mill, Project Potluck, Cargill, and General Mills, which drive innovation and expand product portfolios to include gluten-free, organic, and nutrient-rich flours. These players focus on scaling production capacities, enhancing milling technologies, and developing fortified and functional grain flours to meet growing consumer demand. North America emerges as the leading region, holding a significant market share of approximately 35%, driven by high consumer awareness, strong retail infrastructure, and widespread adoption of health-focused and clean-label products. Continuous investments in product development, sustainable sourcing, and distribution across retail, foodservice, and e-commerce channels enable these companies to maintain competitive advantage and capture emerging opportunities, particularly in bakery, convenience food, and functional food applications.

Market Insights

- The Ancient & Specialty Grain Flour Market size was valued at USD 2.7 billion in 2024 and is anticipated to reach USD 4.46 billion by 2032, growing at a CAGR of 6.47% during the forecast period.

- North America is the leading region with approximately 35% market share, driven by high consumer awareness, strong retail infrastructure, and widespread adoption of gluten-free, organic, and functional grain flours.

- Wheat and almond flours dominate the product segment due to versatility and high demand in bakery, noodles, and convenience food applications, while organic flours are gaining traction as consumers increasingly prefer clean-label and sustainable products.

- Key drivers include rising health consciousness, growing preference for gluten-free and high-protein diets, and expansion of functional and fortified flour offerings across bakery and convenience food segments.

- Competitive players focus on scaling production, improving milling technologies, product innovation, and distribution across retail, e-commerce, and foodservice channels, while market restraints include high raw material costs and limited awareness in emerging regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Wheat flour dominates the Ancient & Specialty Grain Flour market, accounting for the largest share due to its versatility and wide adoption across bakery and confectionery products. For instance, companies like Bob’s Red Mill have expanded their whole wheat and spelt flour lines, achieving annual production volumes exceeding 50,000 metric tons. Rising consumer preference for high-protein, fiber-rich flours and clean-label ingredients drives demand. Alternative flours such as almond, chickpea, and oat flours are witnessing growth due to gluten-free trends and functional health benefits, supporting market diversification.

- For instance, Bob’s Red Mill Natural Foods — a leading specialist in whole‑grain and alternative flours — offers over 400 different products spanning traditional wheat flours, ancient‑grain flours, and gluten‑free varieties.

By Source

Conventional grain flours hold the majority market share, primarily driven by established production infrastructure and consistent availability. Leading producers such as King Arthur Flour have optimized milling processes to maintain quality across large-scale conventional wheat and rice flour production, reaching capacities above 40,000 tons annually. However, organic flours are rapidly gaining traction, fueled by increasing health awareness and clean-label trends. Companies like Arrowhead Mills report that organic variants now contribute over 20% of their overall revenue, reflecting growing consumer preference for sustainably sourced and non-GMO ingredients.

- For instance, ADM’s global logistics network — including roughly 150 warehouses and terminals, and a fleet comprising nearly 32,000 rail cars, 610 trucks, and over 1,700 trailers — ensures stable sourcing, storage, and distribution of raw grain and milled flour worldwide.

By Application

Bakery products represent the dominant application segment, capturing the largest market share due to steady demand for bread, cakes, and pastry products. For instance, large-scale industrial bakeries sourcing specialty flours like teff, sorghum, and rye from producers such as General Mills report annual procurement volumes exceeding 30,000 tons. Noodles, pasta, and convenience foods are also driving demand, supported by the rising adoption of gluten-free and high-protein diets. Growth is fueled by urbanization, rising disposable incomes, and increasing consumer interest in functional and ancient grains that enhance texture, flavor, and nutritional value.

Key Growth Drivers

Rising Health Awareness and Nutritional Demand

Increasing consumer focus on health and wellness drives the adoption of ancient and specialty grain flours. Flours such as quinoa, teff, and chickpea are recognized for high protein, fiber, and micronutrient content, fueling demand in bakery, confectionery, and convenience food applications. Companies are expanding product lines to offer nutrient-dense alternatives, with large-scale producers reporting annual output exceeding tens of thousands of metric tons. Functional benefits and gluten-free properties further enhance market appeal, especially among urban and health-conscious consumers.

- For instance, HealthSense® High‑Fiber Wheat Flour delivers up to 10× the fiber of traditional refined wheat flour, while maintaining taste, texture, and baking functionality.

Expansion of Gluten-Free and Specialty Diets

Growing prevalence of gluten intolerance, celiac disease, and the popularity of low-carb or high-protein diets contribute to market growth. Specialty flours like almond, rice, and chickpea are increasingly used in gluten-free bakery products and pasta, driving adoption across retail and foodservice segments. Producers are investing in dedicated processing lines to ensure cross-contamination-free production, increasing consumer confidence. For instance, manufacturers have scaled production of chickpea and almond flours to meet annual demands exceeding 20,000 tons in North America and Europe.

- For instance, Red Mill still uses traditional quartz millstones quarried in France, where carefully controlled inter‑stone spacing and slow-speed grinding preserve nutrient integrity and flavor, ensuring consistency across its over 400 product offerings.

Innovation in Product Formats and Applications

Product innovation in ready-to-use mixes, flours blended with functional ingredients, and fortified variants expands market potential. Companies like Bob’s Red Mill and Arrowhead Mills develop pre-mixes for bakery, pasta, and convenience foods, improving shelf stability and ease of use. Technological advancements in milling and extrusion allow preservation of nutrients while enhancing texture and taste. Such innovations cater to both industrial and home consumers, driving higher adoption rates and reinforcing the market’s growth across multiple applications, including bakery, noodles, and animal feed.

Key Trends & Opportunities

Rising Demand for Organic and Clean-Label Products

Organic and sustainably sourced grain flours are gaining traction as consumers increasingly prioritize clean-label ingredients and environmentally friendly production. Organic wheat, spelt, and almond flours now represent a growing share of sales in North America and Europe. Manufacturers are expanding organic production lines, with some reporting over 20% of annual revenue from organic variants. This trend presents opportunities for premium product launches, private-label partnerships, and export-oriented strategies targeting health-conscious and environmentally aware consumers globally.

- For instance, Glanbia reported that “nutritional and functional ingredients” (including proteins, nutrients, vitamins, trace elements, minerals, bioactive ingredients and related premixes) account for 53.7% of its net sales mix.

Emergence of Ancient Grains in Bakery and Convenience Foods

Ancient grains such as teff, sorghum, and millet are increasingly incorporated into breads, pasta, and snack products. For instance, industrial bakeries sourcing teff flour for flatbreads report annual procurement volumes exceeding 10,000 tons. The trend is driven by both nutritional value and premium positioning, appealing to urban consumers seeking functional and novel flavors. Growth in ready-to-eat and convenience segments amplifies opportunities for product differentiation, allowing manufacturers to create value-added offerings with enhanced protein, fiber, and antioxidant content.

- For instance, General Mills the company notes that 86% of its cereal products provide at least 8 grams of whole grain per labeled serving, ensuring consistent nutritional value per portion.

Key Challenges

High Production Costs and Supply Chain Constraints

Specialty and ancient grains often incur higher cultivation and milling costs compared with conventional wheat or rice. Limited cultivation regions, dependence on seasonal harvests, and complex milling processes increase input costs. Companies face challenges in maintaining consistent supply, particularly for niche grains like teff or quinoa. Fluctuating raw material prices impact profit margins, making cost management crucial. This challenge is amplified in regions with limited infrastructure or organic certification requirements, constraining large-scale adoption and creating barriers for smaller or emerging producers.

Limited Consumer Awareness in Emerging Markets

While demand for ancient and specialty grains is growing in developed regions, awareness remains low in several emerging markets. Consumers often lack knowledge about health benefits, cooking methods, and applications, limiting adoption. Manufacturers must invest in marketing, education, and product demonstrations to increase familiarity. Additionally, higher retail prices of specialty flours compared with conventional options can hinder market penetration, necessitating targeted strategies to balance affordability and nutritional appeal while driving growth in underdeveloped regions.

Regional Analysis

North America

North America leads the Ancient & Specialty Grain Flour market, holding the largest share of approximately 35%, driven by high consumer awareness of health and wellness trends. The region benefits from a mature retail sector, widespread adoption of gluten-free and organic products, and established industrial bakery infrastructure. Companies like Bob’s Red Mill and Arrowhead Mills have scaled production, supplying over 50,000 tons annually of specialty flours including almond, chickpea, and quinoa. Strong demand for functional, high-protein, and clean-label products in the U.S. and Canada continues to drive market expansion and product innovation.

Europe

Europe accounts for roughly 28% of the market, with robust demand for organic and ancient grain flours in bakery, pasta, and convenience food segments. Countries such as Germany, France, and the U.K. prioritize clean-label, gluten-free, and high-fiber products, supporting growth in rye, spelt, and oat flours. Leading producers, including Doves Farm and Finax, have optimized production lines to deliver over 40,000 tons annually of specialty flours. Strong health-conscious consumer behavior, combined with government support for organic farming, positions Europe as a key growth region for both conventional and organic ancient grain flours.

Asia-Pacific

The Asia-Pacific region holds an estimated 20% market share, driven by rising urbanization, increasing disposable income, and evolving dietary patterns. Growing consumer interest in functional foods and protein-rich diets supports adoption of ancient grains such as millet, sorghum, and chickpea. Local players, alongside international entrants, are expanding production and distribution networks to meet rising demand in China, India, and Japan. Industrial bakery, convenience food, and health-focused retail segments are primary growth areas. Awareness campaigns highlighting nutritional benefits of specialty flours further contribute to market penetration, particularly in urban and semi-urban centers.

Latin America

Latin America contributes around 10% to the market, with growing interest in gluten-free and high-fiber flours. Consumers in Brazil, Mexico, and Argentina increasingly prefer quinoa, chickpea, and amaranth flours for bakery and snack applications. Supply chain developments, coupled with government initiatives supporting organic and sustainable agriculture, are enhancing the availability of ancient grains. Local producers are scaling production to meet both domestic and export demands, while multinational brands expand distribution networks. Rising urban health-conscious populations and increasing investment in functional foods provide opportunities for further market growth in the region.

Middle East & Africa (MEA)

MEA represents roughly 7% of the global market, with demand concentrated in urban centers where health awareness and premium product consumption are rising. Ancient grains like millet, sorghum, and chickpea are increasingly used in bakery, noodles, and convenience foods. Import reliance is high due to limited local cultivation, prompting international suppliers to establish distribution partnerships. Rapid growth in retail chains and foodservice sectors, alongside increased interest in functional and gluten-free products, drives market expansion. While price sensitivity remains a challenge, urban consumer adoption and awareness campaigns create significant growth potential.

Market Segmentations:

By Product Type:

By Source:

By Application:

- Bakery products

- Noodles & pasta

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ancient & Specialty Grain Flour market is highly competitive, with leading players including Dave’s Killer Bread, ADM, King Arthur Baking, ConAgra Foods, Bay State Milling, Ardent Mills, Bobs Red Mill, Project Potluck, Cargill, and General Mills. The Ancient & Specialty Grain Flour market is highly competitive, driven by continuous product innovation, expanding distribution channels, and increasing consumer demand for health-oriented and functional flours. Companies focus on diversifying product portfolios to include gluten-free, organic, and nutrient-rich flours derived from ancient grains such as quinoa, teff, millet, and chickpea. Strategic initiatives include scaling production capacities, improving milling technologies, and enhancing supply chain efficiency to meet rising global demand. Market participants emphasize quality certifications, clean-label products, and sustainable sourcing to differentiate their offerings. Additionally, expansion into e-commerce and retail channels, alongside collaborations with bakery and convenience food manufacturers, strengthens market presence. Continuous innovation, coupled with marketing that highlights nutritional benefits, ensures competitive advantage in this dynamic landscape, fostering growth while meeting evolving consumer preferences and supporting adoption across bakery, noodles, pasta, and convenience food applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2024, Ardent Mills announced plans to update and expand its flour mill in Commerce City, Colorado. The investment will modernize the facility while supporting regional customers and local agricultural, manufacturing and food industries.

- In January 2024, The Italian Milling Industry Association, which is co-funded by the European Commission, announced the launch of its campaign called as Pure Flour From Europe in India with an aim to promote the premium soft wheat flour in the country.

- In March 2023, Scoular represents a transformational step for Nepra and its ability to continue pushing the boundaries of novel food the complete convergence of Nepra’s R&D into Scoular’s global supply chain

Report Coverage

The research report offers an in-depth analysis based on Product Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for gluten-free and high-protein flours is expected to rise steadily.

- Organic and clean-label flours will gain greater consumer preference globally.

- Expansion of bakery, convenience food, and functional food applications will drive market growth.

- Adoption of ancient grains like teff, millet, and sorghum will increase across urban and health-conscious consumers.

- Technological advancements in milling and processing will improve product quality and shelf life.

- E-commerce and online retail channels will become major distribution avenues.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will see faster adoption.

- Product innovation in fortified and nutrient-enhanced flours will continue to attract consumers.

- Sustainability and ethical sourcing will influence procurement and production practices.

- Collaboration with foodservice and bakery industries will create new growth opportunities.