Market Overview:

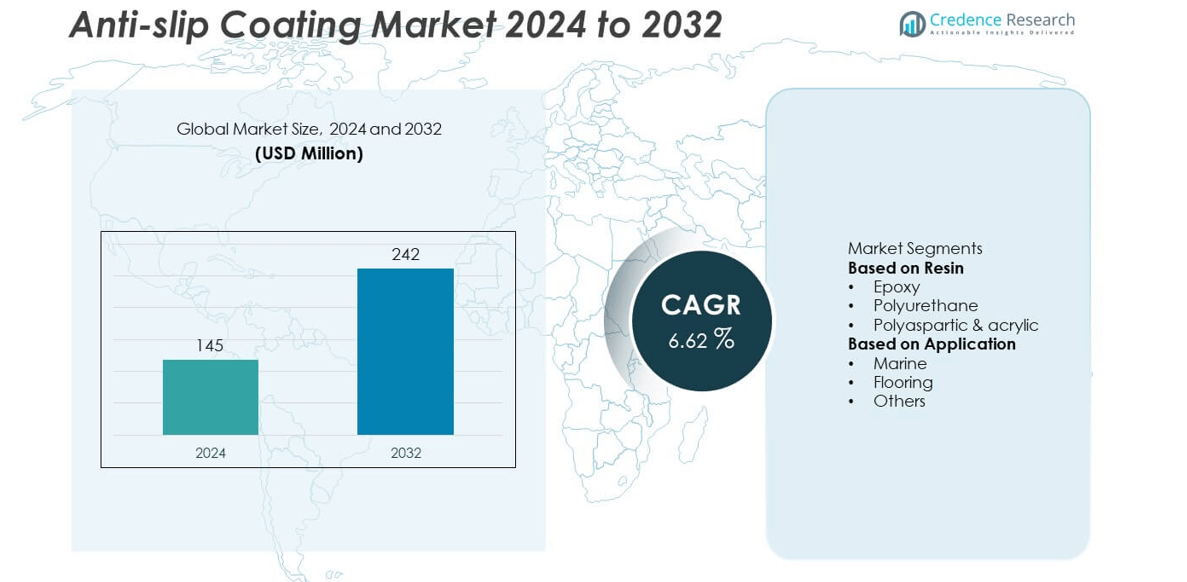

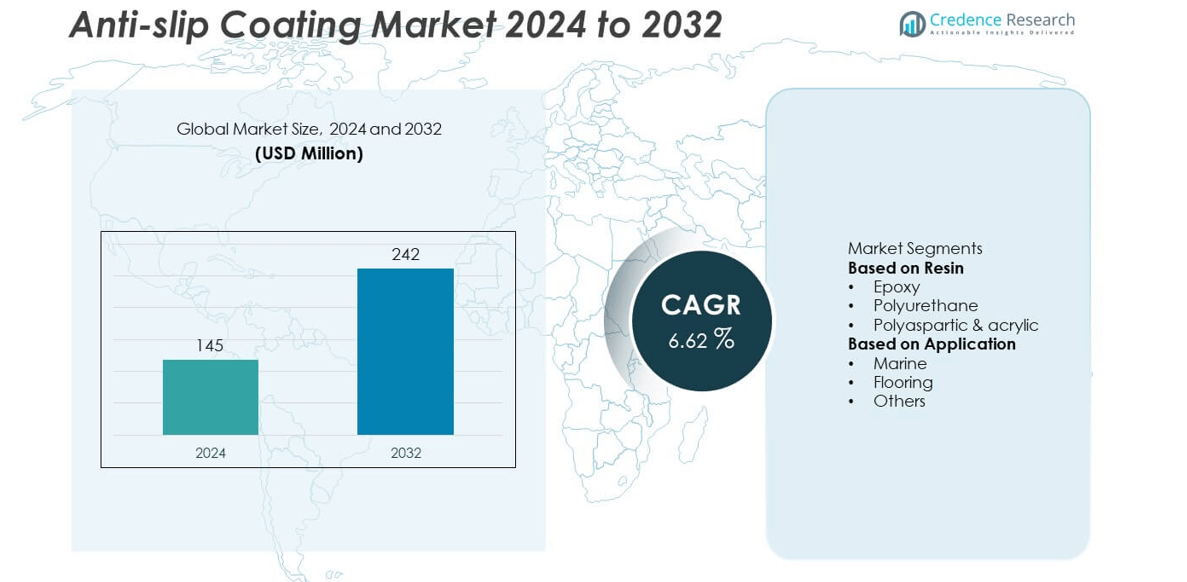

The global anti-slip coating market was valued at USD 145 million in 2024 and is projected to reach USD 242 million by 2032, growing at a CAGR of 6.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-slip Coating Market Size 2024 |

USD 145 million |

| Anti-slip Coating Market, CAGR |

6.62% |

| Anti-slip Coating Market Size 2032 |

USD 242 million |

The top players in the anti-slip coating market include Randolph Products, Tesoplas, PPG Industries, RPM International, Sherwin Williams, Hempel A/S, Paramelt, Axalta Coating Systems, 3M, and Amstep Products. These companies lead through innovation in durable, low-VOC coatings that enhance traction and safety across industrial, marine, and construction sectors. North America dominated the global anti-slip coating market with a 35.4% share in 2024, driven by stringent workplace safety regulations and robust demand from manufacturing and commercial infrastructure. Europe followed with a 29.1% share, supported by strong adoption of sustainable coating solutions, while Asia-Pacific held 30.8%, fueled by rapid industrialization, large-scale infrastructure projects, and expansion in marine applications.

Market Insights

- The global anti-slip coating market was valued at USD 145 million in 2024 and is projected to reach USD 242 million by 2032, expanding at a CAGR of 6.62% during the forecast period.

- Growing awareness of workplace safety and strict industrial standards across construction, marine, and manufacturing sectors are driving strong demand, with the flooring application segment holding a 62.8% share in 2024.

- Advancements in epoxy and polyurethane formulations with low-VOC, fast-curing, and UV-resistant properties are shaping key product development trends.

- Major companies such as PPG Industries, Sherwin Williams, Hempel A/S, and Axalta Coating Systems are focusing on sustainable innovations, partnerships, and R&D expansion to enhance product performance and global reach.

- North America led the market with a 35.4% share in 2024, followed by Asia-Pacific with 30.8% and Europe with 29.1%, supported by rising infrastructure projects and regulatory emphasis on slip-resistant surface coatings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Marke Segmentation Analysis:

By Resin

In the resin segment, epoxy coatings dominated the anti-slip coating market with a 54.3% share in 2024. Epoxy coatings are widely preferred for their superior adhesion, chemical resistance, and durability across industrial and commercial flooring applications. Their high mechanical strength and long service life make them ideal for warehouses, factories, and parking decks. The growing focus on workplace safety and maintenance-free surfaces supports steady demand. Additionally, advancements in epoxy formulations offering UV resistance and low VOC emissions further enhance their adoption in construction and marine sectors globally.

- For instance, ROCOL Safe Step 200 is a two-part epoxy anti-slip coating designed for heavy foot and vehicle traffic, with application by hard roller resulting in a theoretical coverage of 5 m² per pack. It has been tested to demonstrate a low slip potential in both dry and wet conditions based on pendulum tests.

By Application

The flooring segment led the anti-slip coating market with a 62.8% share in 2024, driven by increasing use in industrial, commercial, and residential environments. These coatings provide durable traction, reducing slip-related accidents in wet or high-traffic areas such as factories, hospitals, and garages. Rapid urbanization and growth in renovation projects further stimulate demand. Manufacturers are developing advanced formulations with enhanced surface grip and weather resistance to meet diverse environmental conditions. The marine segment also shows strong growth potential due to the rising need for corrosion- and saltwater-resistant surfaces.

- For instance, Alesta Anti-Skyd powder coatings (by Axalta Coating Systems) provide a high coefficient of friction, offering significantly improved slip resistance over a standard powder coating.

Key Growth Drivers

Rising Emphasis on Workplace and Industrial Safety

The growing enforcement of occupational safety regulations is a major driver of the anti-slip coating market. Industries such as manufacturing, construction, and transportation are adopting anti-slip solutions to prevent accidents and ensure compliance with safety standards. Governments and organizations are implementing strict guidelines for floor safety in commercial and public spaces. The ability of anti-slip coatings to provide durable traction and reduce fall-related risks makes them a critical choice for industrial flooring and high-traffic environments worldwide.

- For instance, 3M’s Safety-Walk™ Anti-Slip Peelable Coating 3500 achieves a wet British Pendulum Number (BPN) of 35+ BPN in accordance with AS 4586-2013 standards.

Expansion in Construction and Infrastructure Projects

Rapid urbanization and large-scale construction projects are fueling the demand for anti-slip coatings. These coatings are increasingly applied to commercial buildings, parking zones, and public facilities to enhance durability and surface grip. The global rise in infrastructure spending and the renovation of aging structures support market expansion. Anti-slip coatings provide long-lasting protection against wear and weathering, making them suitable for both indoor and outdoor applications in modern architectural developments.

- For instance, Axalta Coating Systems specifies in its product sheet that approximately 113 g (4 oz) of Anti-Skid Particles should be added per gallon of their ready-to-spray paint for spray application, and for broadcast application, approximately 10 g (1/3 oz by weight) of particles should be applied per square foot of area onto a light, tacky first coat.

Technological Advancements in Coating Formulations

Ongoing innovations in coating technologies are significantly improving the performance and application versatility of anti-slip coatings. Manufacturers are introducing epoxy, polyurethane, and acrylic systems with enhanced adhesion, abrasion resistance, and fast-curing properties. The development of low-VOC, waterborne formulations aligns with environmental regulations and growing sustainability concerns. Integration of nanomaterials and texture-optimized finishes provides improved surface roughness without compromising aesthetics, further driving adoption in sectors that prioritize both safety and visual appeal.

Key Trends and Opportunities

Growing Preference for Eco-Friendly and Low-VOC Products

Sustainability trends are driving demand for eco-friendly anti-slip coatings that meet environmental compliance standards. Manufacturers are focusing on water-based and solvent-free coatings to reduce emissions and health hazards. These formulations are gaining traction in green building projects and LEED-certified infrastructure. Increasing consumer and industrial awareness regarding air quality and workplace health further supports this transition. This trend provides a key opportunity for companies to expand portfolios with biodegradable and recyclable coating materials.

- For instance, PPG Industries reports its waterborne coating technologies achieve VOC levels between 100 g/L and 300 g/L, significantly lower than traditional solvent-borne systems (700-900 g/L) in its operations.

Rising Adoption in Marine and Transportation Applications

Marine and transportation industries are emerging as major end-users of anti-slip coatings. The demand for coatings that withstand water, oil, and salt exposure is increasing for ships, docks, and offshore platforms. These coatings enhance crew safety and extend equipment life by reducing corrosion. In transportation, they are used in bridges, terminals, and aircraft maintenance areas where traction and durability are essential. Expanding global trade and shipping activity are expected to further strengthen demand for high-performance marine-grade coatings.

- For instance, Hempel A/S’s Non-Slip Deck Coating (product code 56251) specifies a dry film thickness of 50 microns, volume solids 46 ±2 %, and VOC content of 477 g/L for above-waterline use on steel, wood and glass fibre.

Integration of Smart Surface and Functional Coatings

The incorporation of functional additives and smart surface technologies is creating new opportunities in the anti-slip coating market. Coatings with self-cleaning, anti-bacterial, or wear-indicating properties are gaining traction in healthcare and industrial sectors. Smart coatings that monitor surface wear and provide visual alerts improve maintenance planning. Such multifunctional solutions enhance safety, reduce maintenance costs, and extend the service life of surfaces, reflecting a shift toward technologically advanced, value-added coating systems.

Key Challenges

High Raw Material and Production Costs

Fluctuating prices of resins, pigments, and minerals used in anti-slip coatings present cost challenges for manufacturers. Dependence on petrochemical-based raw materials and rising energy expenses contribute to production cost volatility. These factors affect pricing strategies and profitability, especially in price-sensitive markets. Manufacturers are focusing on developing cost-efficient formulations and optimizing supply chains to maintain competitiveness. Expanding local raw material sourcing and adopting sustainable alternatives are key strategies to mitigate this challenge.

Performance Limitations in Harsh Environments

Ensuring consistent performance of anti-slip coatings under extreme weather, chemical exposure, and heavy mechanical stress remains a challenge. In marine and industrial settings, coatings face degradation due to moisture, salt, or heat, affecting durability. Poor surface preparation or application inconsistencies can also reduce effectiveness. To overcome this, manufacturers are enhancing formulations with improved adhesion promoters and abrasion-resistant additives. Ongoing testing and quality control are essential to deliver coatings capable of maintaining long-term slip resistance and structural integrity.

Regional Analysis

North America

North America held a 35.4% share of the global anti-slip coating market in 2024, driven by strong demand from the construction, manufacturing, and transportation sectors. The United States leads the region with widespread use of epoxy and polyurethane coatings across industrial facilities, warehouses, and public infrastructure. Stringent OSHA and EPA safety standards are pushing industries to adopt high-traction, durable flooring solutions. Continuous renovation of commercial spaces and marine ports supports market expansion. Manufacturers are investing in advanced formulations with superior abrasion resistance and faster curing times to meet growing safety and performance expectations.

Europe

Europe accounted for 29.1% of the anti-slip coating market in 2024, supported by strict workplace safety regulations and a growing shift toward sustainable coating materials. Countries such as Germany, the United Kingdom, and France are leading contributors, driven by their advanced construction and marine sectors. The adoption of waterborne and solvent-free coatings aligns with the European Union’s VOC emission directives. Increasing infrastructure modernization and refurbishment of aging buildings are fueling regional demand. Strong emphasis on green building standards and surface durability continues to influence the formulation strategies of regional manufacturers.

Asia-Pacific

Asia-Pacific dominated the global anti-slip coating market with a 30.8% share in 2024, led by China, India, Japan, and South Korea. Rapid industrialization, large-scale construction projects, and expanding manufacturing activities are key growth drivers. Governments across the region are implementing safety regulations to reduce workplace accidents, increasing demand for high-performance floor coatings. Rising investment in smart city development and marine infrastructure is also contributing to market growth. Local and international manufacturers are expanding production capacities and introducing cost-effective epoxy and acrylic coatings tailored for regional climatic conditions.

Latin America

Latin America captured a 3.1% share of the anti-slip coating market in 2024, driven by rising construction activity and growing awareness of workplace safety standards. Brazil and Mexico are the major contributors due to ongoing infrastructure development and modernization of industrial facilities. The adoption of anti-slip coatings is increasing across public spaces, factories, and marine applications. However, fluctuating raw material prices and limited availability of advanced coating technologies pose challenges. Strategic partnerships between regional contractors and global coating manufacturers are improving market access and driving product innovation across emerging industries.

Middle East & Africa

The Middle East and Africa held a 1.6% share of the global anti-slip coating market in 2024, supported by expanding construction and oil & gas industries. Countries such as Saudi Arabia, the UAE, and South Africa are investing heavily in infrastructure and marine facilities, driving coating adoption. The region’s harsh climatic conditions demand UV- and heat-resistant formulations, prompting manufacturers to develop specialized products. Government initiatives promoting industrial safety and tourism infrastructure are further stimulating demand. Ongoing diversification projects and growth in marine transport are expected to strengthen market presence over the forecast period.

Market Segmentations:

By Resin

- Epoxy

- Polyurethane

- Polyaspartic & acrylic

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the anti-slip coating market includes key players such as Randolph Products, Tesoplas, PPG Industries, RPM International, Sherwin Williams, Hempel A/S, Paramelt, Axalta Coating Systems, 3M, and Amstep Products. These companies focus on developing high-performance, durable coatings with enhanced traction and weather resistance for industrial, marine, and construction applications. Strategic initiatives such as product innovation, mergers, and regional expansions are central to maintaining competitiveness. PPG Industries and Sherwin Williams emphasize R&D to create low-VOC, fast-curing coatings aligned with sustainability goals. Meanwhile, Hempel and Axalta invest in marine-grade and epoxy-based systems designed for long-term corrosion protection. 3M and RPM International leverage advanced surface technologies and global distribution networks to enhance customer reach. The market remains moderately consolidated, with leading players prioritizing performance efficiency, safety compliance, and environmental sustainability to strengthen their market position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Axalta introduced an advanced nanotechnology-enhanced polyurethane anti-slip coating tailored for marine and offshore surfaces.

- In August 2024, Hempel A/S completed a strategic partnership deal with CVC Funds and appointed two new board members, strengthening its organisational capacity for coating innovations.

- In March 2024, Orientbell Tiles announced a new product line Safegrip Collection. The product focuses on slip-resistant tiles without compromising aesthetics.

Report Coverage

The research report offers an in-depth analysis based on Resin, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The anti-slip coating market will grow steadily with increasing global focus on workplace safety.

- Rising construction and infrastructure projects will continue to drive coating adoption across sectors.

- Manufacturers will prioritize sustainable, low-VOC, and water-based formulations to meet green standards.

- Technological advancements will improve coating durability, adhesion, and resistance to chemicals and abrasion.

- Marine and transportation applications will expand due to increasing safety regulations and trade activities.

- Asia-Pacific will remain the fastest-growing region with ongoing industrialization and urban development.

- North America and Europe will sustain strong demand driven by regulatory compliance and refurbishment projects.

- Strategic collaborations between coating manufacturers and raw material suppliers will enhance innovation capacity.

- Digital monitoring and smart surface technologies will influence next-generation anti-slip solutions.

- Expanding use of epoxy and polyurethane systems will strengthen product performance in industrial and commercial facilities.