Market Overview:

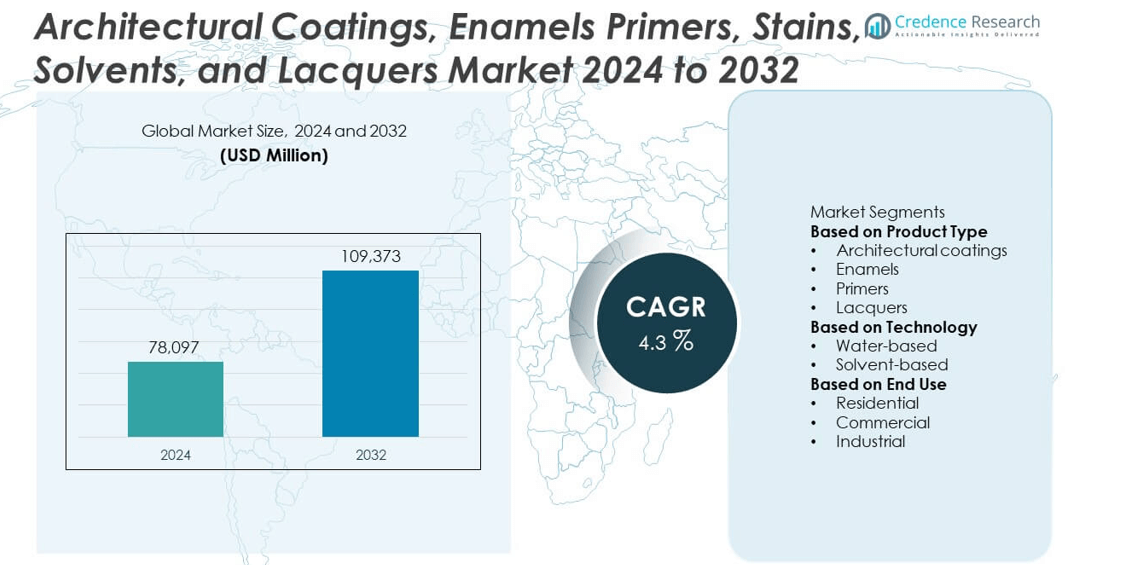

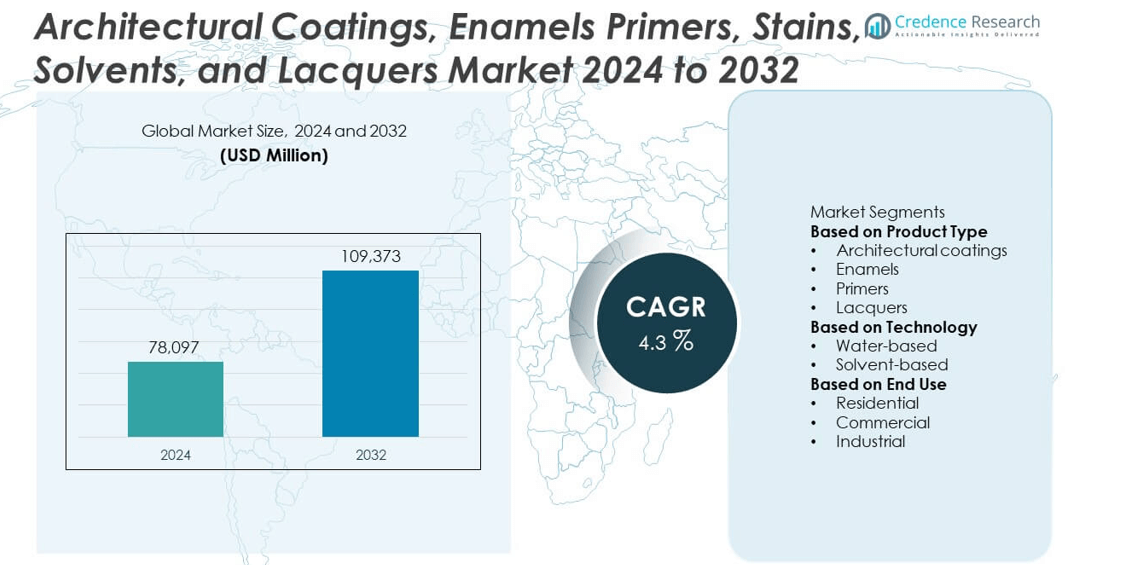

The global architectural coatings, enamels, primers, stains, solvents, and lacquers market was valued at USD 78,097 million in 2024 and is projected to reach USD 109,373 million by 2032, growing at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers Market Size 2024 |

USD 78,097 million |

| Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers Market, CAGR |

4.3% |

| Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers Market Size 2032 |

USD 109,373 million |

The architectural coatings, enamels, primers, stains, solvents, and lacquers market is dominated by leading players such as PPG Industries, The Sherwin-Williams Company, AkzoNobel N.V., RPM International Inc., Nippon Paint Holdings Co., Ltd., and BASF SE. These companies emphasize advanced, eco-friendly formulations and strong regional distribution networks to meet growing construction and renovation demands. North America led the market with a 34.5% share in 2024, supported by robust residential and commercial infrastructure projects. Asia Pacific followed with 31.7%, driven by rapid urbanization and industrial expansion, while Europe accounted for 27.2%, backed by stringent environmental standards and innovation in sustainable coatings.

Market Insights

- The architectural coatings, enamels, primers, stains, solvents, and lacquers market was valued at USD 78,097 million in 2024 and is projected to reach USD 109,373 million by 2032, growing at a CAGR of 4.3%.

- Rising construction and renovation activities in residential and commercial sectors are driving demand for durable and decorative coatings.

- The shift toward eco-friendly, low-VOC, and water-based technologies is shaping market trends, supported by sustainability-focused regulations.

- Key players such as PPG Industries, Sherwin-Williams, and AkzoNobel are focusing on innovation, digital color-matching tools, and smart coating solutions to enhance market presence.

- North America led the market with a 34.5% share, followed by Asia Pacific with 31.7% and Europe with 27.2%, while the architectural coatings segment accounted for the largest 41.6% share among product types in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Architectural coatings dominated the market with a 45.6% share in 2024, driven by extensive use in residential and commercial construction. These coatings provide durability, UV resistance, and aesthetic appeal for walls, facades, and ceilings. Growing demand for eco-friendly, low-VOC paints and coatings is further fueling segment growth. Manufacturers are developing advanced formulations with enhanced weatherability and antimicrobial properties. Rising renovation and infrastructure projects, particularly in Asia Pacific and North America, continue to support the strong adoption of architectural coatings in both interior and exterior applications.

- For instance, AkzoNobel launched its Interpon D2045 low-carbon architectural powder coating with 25% lower carbon footprint compared to standard coatings, designed to meet the sustainability goals of large-scale infrastructure projects.

By Technology

Water-based coatings held the largest market share of 58.7% in 2024, supported by environmental regulations limiting solvent emissions. Their lower toxicity, fast-drying nature, and ease of application make them preferred for both residential and commercial uses. The growing trend toward sustainable construction and green building certifications has accelerated demand for waterborne systems. Manufacturers are enhancing performance through hybrid polymer technologies to match solvent-based durability. The segment’s growth is also driven by technological advancements improving adhesion, weather resistance, and gloss retention in water-based coating products.

- For instance Croda International PLC expanded its Optislip range of bio based slip and anti block additives achieving up to 85 renewable carbon content verified under the International Sustainability and Carbon Certification ISCC PLUS framework

By End Use

The residential segment accounted for the largest market share of 48.3% in 2024, propelled by rising urbanization, renovation activities, and new housing developments worldwide. Consumers increasingly prefer decorative and protective coatings offering long-lasting finish and easy maintenance. Energy-efficient and low-odor products are gaining traction in indoor applications. In addition, government initiatives promoting affordable housing are fueling demand in emerging economies. The segment’s expansion is further supported by innovations in color technology and smart coatings that enhance surface aesthetics while improving environmental sustainability.

Key Growth Drivers

Growing Construction and Renovation Activities

Rapid urbanization and infrastructure expansion are major drivers of the market. The surge in residential and commercial construction, along with remodeling projects, has increased demand for architectural coatings, primers, and enamels. Consumers are seeking durable, aesthetic, and easy-to-apply coatings for both interior and exterior use. Government housing initiatives and smart city projects further contribute to growth. For instance, rising construction activity in Asia Pacific and North America supports consistent product consumption across decorative and protective applications.

- For instance, Sherwin-Williams is undertaking a significant expansion of its existing manufacturing facility and building a new distribution center in Statesville, North Carolina. The project includes a 36,000-square-foot extension to its existing 200,000-square-foot manufacturing facility and a new 800,000-square-foot distribution and fleet transportation center.

Shift Toward Sustainable and Low-VOC Coatings

Environmental awareness and regulatory restrictions on volatile organic compounds are driving a shift toward eco-friendly coatings. Manufacturers are focusing on water-based formulations and bio-based raw materials to reduce emissions and improve indoor air quality. This transition supports compliance with global sustainability standards. Companies are also investing in advanced polymer technologies for superior performance and durability. The growing demand for green building materials across residential and commercial projects continues to accelerate adoption of sustainable coating solutions worldwide.

- For instance, BASF developed its Acronal PRO 7600 binder technology, which is an environmentally compatible water-based acrylic dispersion that provides light to medium corrosion protection for industrial metal coatings.

Technological Advancements in Formulation and Application

Continuous innovation in coating chemistry and application technologies is enhancing product quality and performance. Developments in nanotechnology, self-cleaning coatings, and smart pigments are improving UV resistance, stain protection, and color stability. Automated spray systems and digital color-matching tools are optimizing application efficiency for large-scale projects. Manufacturers are also focusing on anti-microbial and thermal-reflective coatings to meet evolving consumer needs. These advancements strengthen competitiveness and expand the applicability of coatings across diverse climatic and architectural conditions.

Key Trends & Opportunities

Rising Demand for Decorative and Specialty Finishes

The growing preference for premium decorative finishes presents significant opportunities for manufacturers. Demand for matte, textured, metallic, and high-gloss coatings is increasing as consumers seek personalized aesthetics. Urbanization and interior design trends are fueling this shift toward high-performance decorative solutions. For instance, manufacturers are introducing customizable and long-lasting finishes that enhance visual appeal while providing protection. The trend aligns with rising disposable income levels and growing investments in modern residential and hospitality spaces.

- For instance, Jotun introduced its Fenomastic Wonderwall Lux paint range featuring advanced easy-clean technology and a wide range of customizable shades available through the Jotun Multicolor system, which improves surface durability and is recommended for high-traffic residential and commercial spaces.

Expansion in Emerging Markets and Construction Investments

Emerging economies such as India, China, and Brazil offer strong growth potential due to expanding infrastructure and industrial projects. Government-led housing programs and commercial developments are creating new opportunities for coating manufacturers. Rising consumer awareness of sustainability and quality also drives adoption of premium coatings. Manufacturers are establishing local production facilities and distribution networks to meet regional demand. This strategic expansion supports cost optimization, market accessibility, and long-term growth in fast-developing regions.

- For instance, Kansai Nerolac commissioned a new plant at Sayakha Industrial Estate in Gujarat with an initial capacity of 42,000 tonnes per year in 2015, a capacity later approved for an increase of 4200 KL/annum of auto paints in February 2025.

Key Challenges

Fluctuating Raw Material Prices

Volatility in prices of key raw materials such as titanium dioxide, resins, and solvents remains a major challenge. Supply chain disruptions and global economic fluctuations impact production costs, reducing profit margins for manufacturers. Companies are focusing on backward integration and alternative formulations to manage cost pressures. However, frequent price variations hinder consistent pricing strategies across regions. Maintaining product quality while controlling raw material expenses continues to be a balancing challenge for coating producers worldwide.

Stringent Environmental and Safety Regulations

Strict environmental standards regarding VOC emissions, waste disposal, and worker safety pose compliance challenges for coating manufacturers. Governments across Europe and North America have implemented regulations limiting solvent-based products, increasing pressure to adopt sustainable alternatives. Meeting these standards requires significant R&D investments and process upgrades. Smaller players often face difficulties adapting due to high costs of regulatory compliance. This shift toward eco-friendly manufacturing practices demands continuous innovation to ensure environmental responsibility without compromising product performance.

Regional Analysis

North America

North America held a 31.4% share of the architectural coatings, enamels, primers, stains, solvents, and lacquers market in 2024, driven by robust construction activity and rising renovation projects. The United States leads regional demand due to strong investments in residential remodeling and infrastructure renewal. Consumers increasingly prefer eco-friendly and low-VOC coatings supported by stringent environmental regulations. Companies such as PPG Industries, Sherwin-Williams, and RPM International dominate through innovative water-based and specialty formulations. Continuous growth in urban housing and smart city projects further strengthens the region’s leadership in premium and sustainable coating solutions.

Europe

Europe accounted for a 29.7% market share in 2024, supported by advanced infrastructure and strong environmental standards promoting water-based technologies. Germany, France, and the United Kingdom are leading contributors, emphasizing high-quality decorative and protective coatings. The region’s strict VOC regulations and increasing adoption of green building materials encourage innovation in eco-friendly solutions. Leading European players, including AkzoNobel and Hempel A/S, are expanding portfolios with bio-based and low-emission products. Renovation projects in historical structures and energy-efficient buildings are fueling steady market demand across both residential and commercial applications.

Asia Pacific

Asia Pacific dominated the market with a 33.2% share in 2024 and is projected to record the fastest growth through 2032. China, India, and Japan are key markets, driven by rapid urbanization, industrial expansion, and housing development. Increasing government investment in infrastructure and sustainable construction enhances product demand. Rising disposable incomes and growing awareness of durable finishes support the shift toward premium coatings. Companies such as Nippon Paints and Kansai Paint are expanding regional production capacities. The growing middle-class population and modern architecture trends continue to fuel regional market expansion.

Latin America

Latin America captured a 3.8% market share in 2024, driven by increasing construction and renovation activity across Brazil, Mexico, and Chile. Expanding urban housing projects and government investments in infrastructure are boosting demand for architectural coatings and primers. Consumers are shifting toward cost-effective yet durable finishes for both residential and commercial use. Regional distributors collaborate with global players to introduce sustainable and decorative coating solutions. Despite economic fluctuations, rising awareness of product quality and environmental performance supports gradual market growth across Latin American economies.

Middle East & Africa

The Middle East & Africa accounted for a 1.9% share of the global market in 2024, supported by infrastructure modernization and commercial construction growth. The UAE, Saudi Arabia, and South Africa are key contributors, focusing on large-scale real estate and hospitality projects. Demand for heat-resistant and decorative coatings is rising due to the region’s climatic conditions. International manufacturers are partnering with local firms to meet growing demand for sustainable and premium finishes. Increasing investment in urban development and tourism infrastructure continues to drive steady adoption of high-performance architectural coatings and enamels.

Market Segmentations:

By Product Type

- Architectural coatings

- Enamels

- Primers

- Lacquers

By Technology

- Water-based

- Solvent-based

By End Use

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the architectural coatings, enamels, primers, stains, solvents, and lacquers market is defined by strong innovation, sustainability efforts, and global expansion strategies among major players such as PPG Industries, The Sherwin-Williams Company, AkzoNobel N.V., RPM International Inc., Nippon Paint Holdings Co., Ltd., Axalta Coating Systems Ltd., BASF SE, Hempel A/S, Kansai Paint Co., Ltd., and Jotun A/S. These companies focus on developing eco-friendly, low-VOC, and water-based formulations to meet evolving environmental regulations. Strategic mergers, acquisitions, and regional expansions enhance distribution networks and product reach. Continuous R&D investments are directed toward advanced coating technologies that improve durability, color retention, and surface protection. Digital color-matching tools, automated tinting systems, and smart coatings are becoming key competitive differentiators. Increasing demand from residential and commercial construction sectors is driving players to strengthen manufacturing capacity and sustainability credentials, ensuring long-term competitiveness in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, The Sherwin-Williams Company completed BASF’s Brazilian architectural paints acquisition. The deal included Suvinil and Glasu! brands.

- In June 2025, PPG showcased new architectural metal coatings at AIA 2025. The range emphasized weathering, design, and durability for building envelopes.

- In 2024, AkzoNobel launched a new bio-based primer, which is developed using renewable starting materials. This underscores the company’s efforts toward sustainability as well as marketing architectural coatings.

- In February 2023, PPG Industries launched an advanced epoxy intumescent fire protection coating for architectural steel, PPG STEELGUARD 951. It provides up to three hours of cellulosic fire protection and effective corrosion resistance in extremely corrosive environments without a topcoat

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and low-VOC coatings will continue to rise across all applications.

- Water-based technologies will gain dominance as environmental regulations become stricter.

- Growth in construction and renovation projects will drive coating consumption globally.

- Digital color technologies and smart coating solutions will enhance user customization.

- Major manufacturers will expand regional production facilities to meet local demand.

- Innovation in nanotechnology-based coatings will improve durability and surface protection.

- Strategic collaborations will boost R&D for energy-efficient and self-cleaning coatings.

- Rapid urbanization in Asia Pacific will remain a major growth driver for the market.

- Increasing adoption of bio-based solvents and resins will support sustainability goals.

- Continuous product diversification and design-oriented solutions will shape future market competitiveness.