Market Overview:

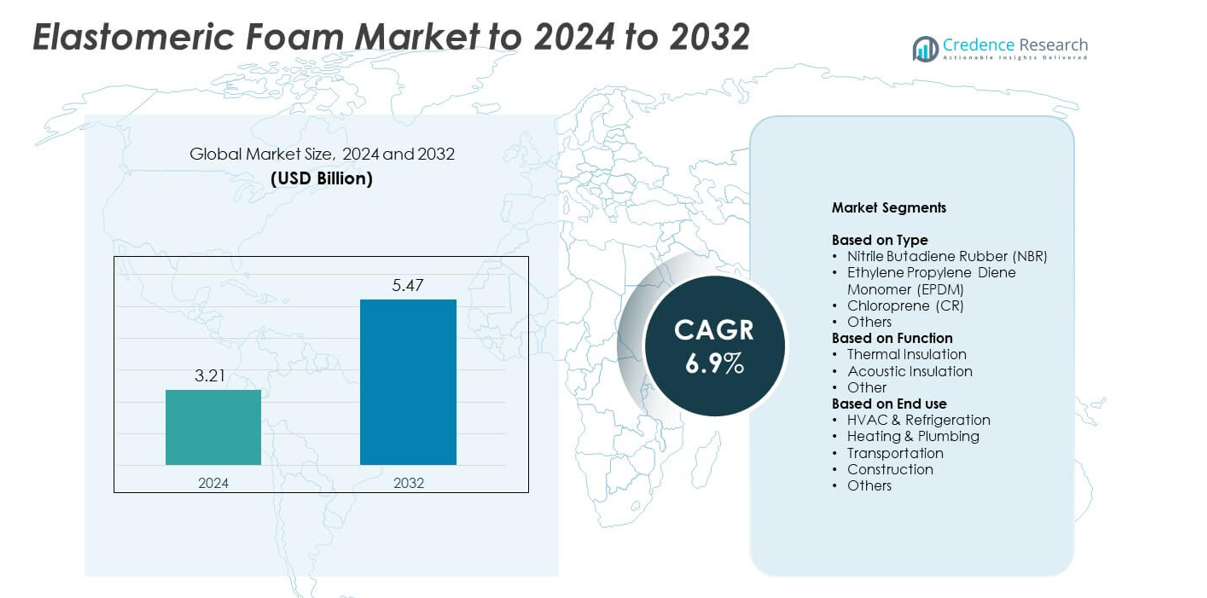

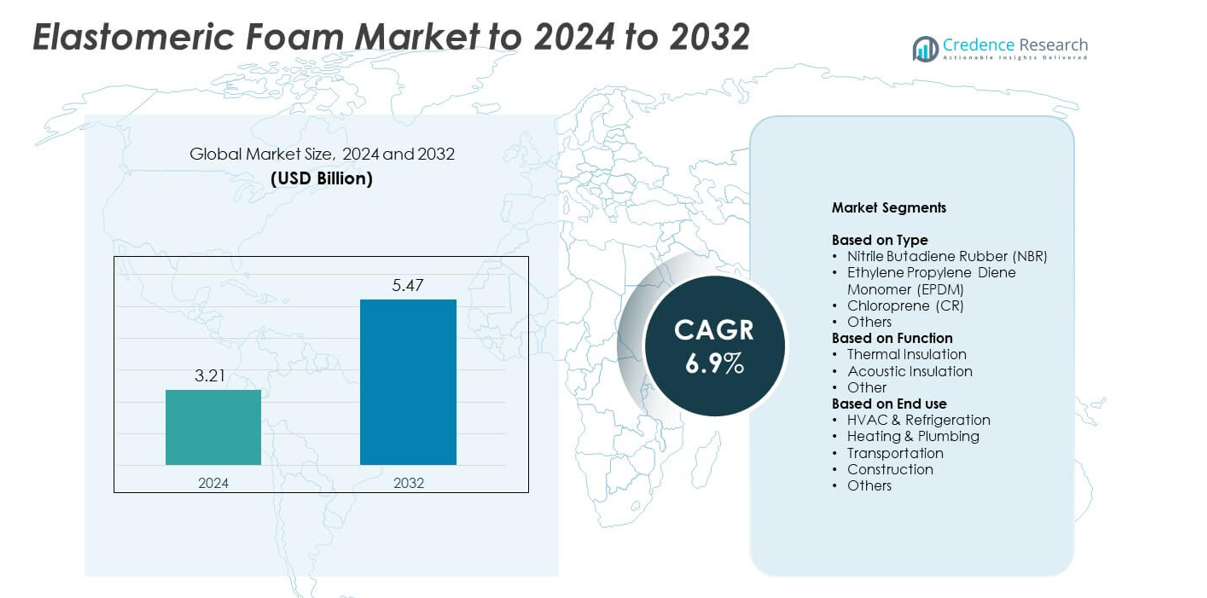

Elastomeric Foam Market size was valued at USD 3.21 billion in 2024 and is anticipated to reach USD 5.47 billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Elastomeric Foam Market Size 2024 |

USD 3.21 billion |

| Elastomeric Foam Market, CAGR |

6.9% |

| Elastomeric Foam Market Size 2032 |

USD 5.47 billion |

The elastomeric foam market is led by established players that focus on high-performance insulation solutions and strong global distribution. Key participants emphasize advanced thermal and acoustic insulation materials that meet energy-efficient building standards and industrial requirements. Their strategies center on product innovation, capacity expansion and compliance with strict fire-safety and environmental regulations. Asia Pacific stands as the leading region with a 38% market share, supported by large-scale construction, strong HVAC demand and rapid industrial growth. North America follows with a 30% share due to strict efficiency regulations and widespread adoption in commercial buildings, while Europe holds a 22% share driven by retrofit activity and regulatory compliance.

Market Insights

- The elastomeric foam market was valued at USD 3.21 billion in 2024 and is projected to reach USD 5.47 billion by 2032, growing at a CAGR of 6.9%.

• Demand rises due to strong adoption in HVAC and refrigeration, where the dominant segment holds a 52% share driven by energy-efficient cooling systems and moisture-resistant insulation needs.

• Key trends include rapid uptake of non-halogenated, low-emission foam and growing use in electric vehicles for thermal and acoustic management, supported by advancements in automated manufacturing.

• Competition remains strong as major producers expand capacity, improve fire-safe formulations and strengthen distribution, while facing restraints from raw-material price fluctuations and competition from alternative insulation materials.

• Asia Pacific leads with a 38% regional share due to construction and HVAC growth, followed by North America at 30% with strict efficiency standards, while Europe holds 22% supported by retrofit activity and insulation-focused regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Nitrile Butadiene Rubber holds the dominant position in the elastomeric foam market with a 46% share. NBR leads due to strong resistance to oils, chemicals, and moisture, which makes it suitable for HVAC, refrigeration, and industrial insulation. Its flexibility and durability support demand across temperature-sensitive applications. EPDM expands in outdoor and high-heat environments because of its strong weathering resistance, while CR finds use in specialized insulation tasks. Steady adoption across industrial facilities and commercial buildings strengthens NBR’s leadership as manufacturers prioritize performance and long service life.

- For instance, Armacell operates 26 manufacturing plants across 20 countries, enabling high-volume NBR insulation production supported by global supply reliability.

By Function

Thermal insulation is the leading function in the elastomeric foam market with a 68% share. This segment dominates due to rising use in HVAC systems, refrigeration lines, and industrial equipment where heat loss control and energy savings are crucial. The focus on meeting building efficiency codes boosts demand for thermal-grade elastomeric foams. Acoustic insulation grows in commercial buildings and transportation, driven by rising noise-control requirements. The broader shift toward energy-efficient infrastructure keeps thermal insulation ahead as the preferred application across residential, commercial, and industrial projects.

- For instance, K-FLEXsupplies insulation products through 14 global production facilities and distributes to more than 63 countries (served by 63 distribution areas and 25 sales offices), supporting thermal insulation availability at scale.

By End Use

HVAC and refrigeration hold the largest share in the elastomeric foam market at 52%. This dominance comes from extensive use in air-conditioning ducts, chilled-water pipes, and refrigeration lines that require moisture resistance and thermal stability. The sector benefits from rising global construction and strong replacement demand in commercial buildings. Heating and plumbing expand with growth in residential upgrades, while transportation uses foams for vibration control and thermal management. Increasing installation of energy-efficient cooling systems keeps HVAC and refrigeration as the primary consumer of elastomeric foam.

Key Growth Drivers

Rising Demand for Energy-Efficient HVAC Systems

Energy-efficient HVAC systems push strong demand for elastomeric foam. The material reduces heat loss and supports stable system performance. Strict building efficiency rules encourage wider use in commercial and residential projects. Many developers shift toward insulation materials that cut energy use. This trend strengthens long-term adoption across global construction markets.

- For instance, Johnson Controls is a leader in building technologies and solutions, and its 2023 Sustainability Report focuses on broader metrics such as reducing absolute operational emissions by 42% since 2017 and cutting customer emissions by 14% since 2017, using integrated solutions across various public and private sectors in multiple countries rather than a single, reported global figure of 1,200 modernized projects in that specific year.

Expansion of Cold-Chain Logistics and Refrigeration

Growth in food storage, pharmaceuticals, and frozen transport increases the need for reliable insulation. Elastomeric foam offers strong moisture control and stable thermal resistance. Cold-chain operators choose these materials to avoid condensation issues and maintain temperature accuracy. Rising vaccine transport and processed food trade add steady demand. This expansion boosts consumption across industrial refrigeration systems.

- For instance, As of May 2023, Schneider Electric reported a network of over 180 factories and almost 90 distribution centers, totaling around 270 sites.

Growth of Industrial and Infrastructure Projects

Industrial plants, data centers, and large utilities require insulation for safety and efficiency. Elastomeric foam handles vibration, temperature change, and moisture exposure in these settings. Infrastructure expansion in developing regions drives strong installation rates. Many facilities replace older insulation with higher-performance materials. This shift supports broad market growth across heavy-duty applications.

Key Trends and Opportunities

Shift Toward Non-Halogenated and Low-Emission Foam Grades

Many users prefer low-emission and non-halogenated foam due to safety needs. Green building rules expand demand for cleaner insulation materials. Manufacturers upgrade formulations to reduce VOC levels and meet global environmental standards. These improvements help win acceptance in sensitive spaces such as hospitals and schools. This trend creates strong long-term opportunities for high-purity elastomeric foam.

- For instance, Saint-Gobain insulation products meet stringent VOC emission thresholds under various international environmental compliance programs, with specific product lines certified to emit very low levels, often below 10 µg/m³ for Total Volatile Organic Compounds (TVOC) when tested according to standards such as the French A+ classification (ISO 16000).

Rising Use in Electric Vehicles and Modern Mobility Systems

Growth in electric vehicles increases demand for thermal and acoustic insulation. Elastomeric foam supports battery temperature control and reduces cabin noise. Mobility producers value its light weight and fire-resistant structure. EV manufacturing growth in Asia, Europe, and the US expands market potential. This creates a new opportunity outside traditional HVAC and refrigeration sectors.

- For instance, BYD delivered 3.02 million electric vehicles in 2023, increasing consumption of specialized insulation materials used in battery and cabin systems.

Adoption of Advanced Manufacturing and Automation

Producers adopt automated cutting, extrusion, and continuous foaming systems. These upgrades deliver consistent thickness and better performance. Automation reduces waste and improves distribution capacity. Large buyers prefer suppliers with predictable quality and fast output. This shift opens opportunities for global scale production.

Key Challenges

Fluctuating Raw Material Prices

Prices of synthetic rubber feedstocks change due to oil market shifts. These variations affect production cost and reduce pricing stability. Many manufacturers face pressure when large contracts require fixed rates. Some shift to blended or optimized formulations, yet volatility remains high. This challenge affects margins across global supply chains.

Competition from Alternative Insulation Materials

Mineral wool, polyurethane foam, and fiberglass compete in many sectors. Some alternatives offer lower upfront cost or higher temperature resistance. Buyers sometimes choose these options in industrial and construction projects. This competition pressures manufacturers to improve performance and reduce lifecycle cost. The challenge continues as new materials enter the market.

Regional Analysis

North America

The North America region commands around 30% of the global elastomeric foam market share, driven by strong insulation demand in HVAC, refrigeration, and automotive sectors. The United States leads with stringent energy-efficiency regulations and large infrastructure investments that support foam adoption. Canada follows with increasing retrofit projects in commercial buildings. Regional manufacturers benefit from integrated raw material supply chains, which boost production efficiency. Growth remains supported by shift toward green buildings and electric vehicle insulation. Nonetheless, the market faces cost pressures from feedstock volatility and shifting trade policies.

Europe

Europe accounts for about 22% of the global elastomeric foam market share, thanks to robust demand in the construction and automotive sectors. Germany, France and the UK lead due to focus on energy efficient building standards and noise-proofing needs in transport. Manufacturers in the region invest in halogen-free and fire-safe insulation grades to comply with EU regulations. The mature market drives incremental innovation rather than high growth. While opportunities exist in retrofit and infrastructure upgrade programs, competition from alternative insulation materials and raw material cost pressures remain notable challenges.

Asia Pacific

The Asia Pacific region leads with a market share of approximately 38%, driven by rapid urbanisation, infrastructure development and strong HVAC growth across China, India and Southeast Asia. Lower labour costs and local manufacturing capacities enhance competitiveness for foam producers. Governments promote energy-efficient building codes and cold-chain logistics expansions, creating new foam demand. Emerging automotive manufacturing hubs also favour elastomeric foam for thermal and acoustic insulation needs. The region presents the highest growth potential, though raw material supply chain constraints and quality standard gaps pose interim obstacles.

Latin America

Latin America holds near 6% of the global elastomeric foam market share, with Brazil and Mexico as key contributors. Growing investments in commercial construction and HVAC systems support demand, albeit at a slower pace compared to mature regions. Manufacturers target retrofit projects in older buildings and modest infrastructure upgrades. While foam adoption remains moderate, rising awareness of insulation benefits offers growth potential. Challenges include under-penetration of advanced insulation standards and higher impact of economic volatility on building investments.

Middle East & Africa

The Middle East & Africa region covers around 4% of the global elastomeric foam market share, fueled by infrastructure expansion, oil & gas sector growth and commercial real-estate development. High climate demands intensify the need for thermal insulation in HVAC and refrigeration systems. Foam manufacturers increasingly serve construction and industrial projects in GCC countries and South Africa. However, market growth is constrained by lower insulation awareness, fragmented regulation, and greater dependence on imports, which elevates costs and limits adoption speed.

Market Segmentations:

By Type

- Nitrile Butadiene Rubber (NBR)

- Ethylene Propylene Diene Monomer (EPDM)

- Chloroprene (CR)

- Others

By Function

- Thermal Insulation

- Acoustic Insulation

- Other

By End use

- HVAC & Refrigeration

- Heating & Plumbing

- Transportation

- Construction

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the elastomeric foam market features leading companies such as NMC SA, Hira Industries, Armacell International S.A., Kaimann GmbH, Huamei Energy-Saving Technology Group Co., Ltd., Aeroflex USA, L’isolante K-Flex S.P.A., Roka Yalitim, Anavid Insulation Products Kiryat Anavim Ltd., and Jinan Retex Industries Inc. The market remains highly competitive due to strong demand from HVAC, refrigeration, construction and industrial applications. Manufacturers focus on producing high-performance insulation materials with improved thermal resistance, moisture control, low VOC emissions and fire safety compliance. Many producers expand capacity, adopt automated systems and strengthen distribution networks to meet rising global demand. Product differentiation often depends on technical performance, durability, and compliance with regional building standards. Companies also invest in R&D to develop non-halogenated, sustainable and energy-efficient insulation solutions. Growing emphasis on energy-efficient buildings, cold-chain logistics and industrial expansion continues to intensify competition across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NMC SA

- Hira Industries

- Armacell International S.A.

- Kaimann GmbH

- Huamei Energy-Saving Technology Group Co., Ltd.

- Aeroflex USA

- L’isolante K-Flex S.P.A.

- Roka Yalitim

- Anavid Insulation Products Kiryat Anavim Ltd.

- Jinan Retex Industries Inc

Recent Developments

- In 2025, Armacell introduced ArmaGel XGC, a next-generation cryogenic and dual-temperature aerogel blanket that sets a new industry standard by combining superior insulation efficiency with improved worker safety through proprietary low-dust technology.

- In 2025, Armacell released an updated Environmental Product Declaration (EPD) for ArmaFlex FRV. This flexible elastomeric insulation product, designed for HVAC and refrigeration systems, includes documentation for its life-cycle environmental profile under the standards EN 15804 and ISO 14025

- In 2023, Aeroflex USA promoted AEROFLEX Breathe-EZ EPDM duct insulation, a fiber-free closed-cell elastomeric foam liner and wrap for HVAC systems, highlighting compliance with ASTM E84 / UL 723 25/50, CDPH 01350 low-VOC criteria and multiple ASHRAE / IECC energy-code requirements.

Report Coverage

The research report offers an in-depth analysis based on Type, Function, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as global HVAC adoption increases.

- Energy-efficient building rules will push higher use of advanced insulation.

- Cold-chain expansion will raise demand from food, pharma and logistics sectors.

- Manufacturers will invest more in halogen-free and low-emission foam grades.

- Automation in production will improve quality and reduce material waste.

- Electric vehicles will create new opportunities for thermal and acoustic insulation.

- Infrastructure upgrades in developing regions will support long-term demand.

- Rising focus on moisture-resistant materials will strengthen foam adoption.

- Partnerships between foam producers and HVAC OEMs will expand product reach.

- Increased replacement of aging insulation systems will add recurring demand.