Market Overview

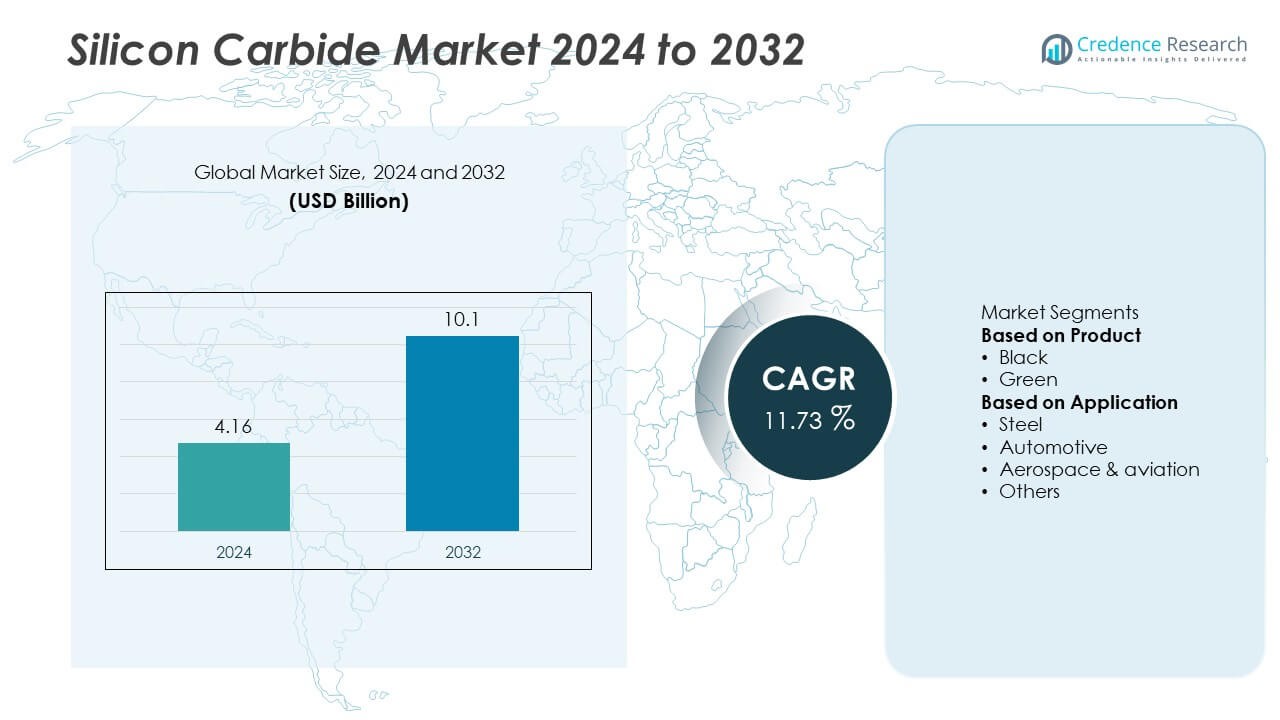

The Silicon Carbide Market was valued at USD 4.16 billion in 2024 and is projected to reach USD 10.1 billion by 2032, expanding at a CAGR of 11.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicon Carbide Market Size 2024 |

USD 4.16 Billion |

| Silicon Carbide Market, CAGR |

11.73% |

| Silicon Carbide Market Size 2032 |

USD 10.1 Billion |

The Silicon Carbide market is dominated by key players such as Carborundum Universal Limited, Coorstek, Washington Mills, Entegris Inc., ESD-SIC b.v., Grindwell Norton Ltd., Snam Abrasives Pvt. Ltd., SK siltron Co., Ltd., AGSCO Corporation, and Gaddis Engineered Materials. These companies maintain leadership through advanced production technologies, product innovation, and strong integration with semiconductor and automotive industries. North America leads the global market with a 37.2% share, supported by extensive use in electric vehicle components and power electronics. Europe holds 30.5% driven by high adoption in aerospace and industrial manufacturing, while Asia-Pacific accounts for 25.9% due to expanding electronics and renewable energy sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Silicon Carbide market was valued at USD 4.16 billion in 2024 and is projected to reach USD 10.1 billion by 2032, growing at a CAGR of 11.73% during the forecast period.

- Rising demand for high-performance materials in electric vehicles, semiconductors, and energy systems is driving strong market growth globally.

- The green silicon carbide segment dominated with a 57.4% share due to its superior hardness and thermal resistance, widely used in electronics and aerospace applications.

- The market is moderately consolidated, with major players such as Carborundum Universal, Coorstek, and Washington Mills focusing on advanced manufacturing and strategic expansion.

- North America leads with a 37.2% share, followed by Europe at 30.5% and Asia-Pacific at 25.9%, driven by rapid industrialization, EV adoption, and increased investments in renewable energy-based applications.

Market Segmentation Analysis:

By Product

The black silicon carbide segment dominated the Silicon Carbide market in 2024, accounting for a 59.3% share. This dominance is driven by its extensive use in steel manufacturing, grinding, and refractory applications due to its superior hardness and thermal conductivity. Black silicon carbide’s cost-effectiveness and durability make it ideal for heavy-duty industrial operations. Its increasing use in metallurgical processes and abrasives enhances production efficiency and material longevity. The green silicon carbide segment, while smaller, is gaining traction in high-precision electronics and ceramics, supported by its higher purity and fine-grain properties.

- For instance, Washington Mills produces black silicon carbide grains with a Mohs hardness of approximately 9.25 and high thermal conductivity, ensuring superior performance in high-temperature furnaces. The green silicon carbide segment, while typically smaller in production volume, is highly valued for high-precision electronics and advanced ceramics due to its higher purity and fine-grain properties.

By Application

The steel segment held the largest 47.6% share of the Silicon Carbide market in 2024. It is primarily used as a deoxidizing and desulfurizing agent in steel production, improving strength, resistance, and surface finish. Silicon carbide’s ability to enhance furnace efficiency and reduce energy consumption supports its dominance in metallurgical applications. The automotive sector also shows rapid growth with increased adoption of SiC-based power electronics in electric vehicles. Rising demand for lightweight materials and energy-efficient components continues to propel the market across aerospace and other industrial sectors.

- For instance, Grindwell Norton Ltd. supplies various grades of silicon carbide for metallurgical applications, which are effective in steel furnace operations at above 1,600 °C. The automotive sector also shows rapid growth with increased adoption of SiC-based power electronics in electric vehicles.

Key Growth Drivers

Rising Adoption in Electric Vehicles (EVs)

The growing demand for electric vehicles is a major driver of the silicon carbide market. SiC-based semiconductors are increasingly used in EV power electronics due to their high voltage resistance, thermal efficiency, and compact size. Automakers are integrating SiC MOSFETs and inverters to extend vehicle range and improve charging efficiency. Government incentives and emission reduction goals are further accelerating EV adoption, creating sustained demand for SiC materials across powertrains, charging stations, and battery management systems.

- For instance, STMicroelectronics supplies SiC MOSFETs rated at 1,200 V and capable of operating at junction temperatures up to 200 °C, enabling Tesla’s inverter systems to achieve over 98% power conversion efficiency in Model 3 and Model Y vehicles.

Expanding Renewable Energy and Power Electronics Sector

The rapid expansion of renewable energy installations is boosting demand for silicon carbide components. SiC is widely used in solar inverters, wind converters, and grid management systems for its superior energy conversion efficiency and durability. Power electronics manufacturers are favoring SiC over traditional silicon due to its ability to handle higher voltages and reduce energy losses. As global energy transition efforts intensify, SiC materials are becoming crucial for sustainable power infrastructure development.

- For instance, Infineon Technologies developed its CoolSiC™ MOSFETs with a blocking voltage of 1,700 V and switching frequency up to 150 kHz, integrated in SMA Solar Technology’s inverter platform to enhance energy yield and reduce power losses in photovoltaic systems.

Technological Advancements in Semiconductor Manufacturing

Continuous innovation in semiconductor fabrication is driving silicon carbide market growth. Improvements in wafer production, epitaxial growth, and material purity are enabling the mass production of high-performance SiC devices. Leading chipmakers are investing in 150 mm and 200 mm wafer technologies to scale up manufacturing capacity. These advancements reduce production costs and enhance yield rates, making SiC components more accessible for automotive, industrial, and consumer electronics applications. The trend supports long-term expansion in power and energy-efficient semiconductor markets.

Key Trends & Opportunities

Integration in 5G and Smart Infrastructure

The rollout of 5G networks and smart grid infrastructure is creating new opportunities for silicon carbide adoption. SiC’s high-frequency and heat-resistant properties make it ideal for power amplifiers, base stations, and data center components. The technology enables faster data transmission with lower power consumption, enhancing network reliability. As global 5G deployment expands, demand for SiC-based components in telecommunications and connected infrastructure is expected to rise significantly.

- For instance, Wolfspeed supplies GaN-on-SiC power amplifiers (PAs) integrated into Ericsson’s 5G radio units, contributing to improved base station energy efficiency and a reduction in overall energy consumption by up to 30%.

Growth in Aerospace and Defense Applications

Silicon carbide is gaining importance in aerospace and defense sectors due to its exceptional strength, lightweight structure, and high-temperature tolerance. It is used in structural materials, radar systems, and advanced sensors that operate under extreme conditions. Defense modernization programs and satellite manufacturing advancements are fueling this demand. Manufacturers are focusing on high-performance SiC composites that enhance fuel efficiency and performance, presenting a promising opportunity for market growth in high-precision applications.

- For instance, Coorstek produces SiC ceramic matrix composites with flexural strength above 400 MPa and thermal stability beyond 1,500 °C, which are deployed in NASA’s propulsion systems and radar antenna substrates to improve thermal endurance and reduce structural weight.

Key Challenges

High Production and Material Costs

The high cost of producing silicon carbide materials and components remains a major challenge. Complex manufacturing processes, such as crystal growth and wafer polishing, add to overall expenses. Limited raw material availability and the need for specialized fabrication equipment further raise production costs. These factors restrict affordability for small-scale manufacturers and limit widespread adoption in cost-sensitive markets. Addressing these cost barriers through improved production efficiency and economies of scale is critical for broader SiC commercialization.

Limited Fabrication Infrastructure and Technical Expertise

Despite growing demand, the silicon carbide industry faces constraints in production capacity and skilled workforce availability. Existing semiconductor fabrication plants require significant upgrades to handle SiC materials due to their higher hardness and temperature resistance. The lack of standardized design tools and expertise in SiC integration slows technology adoption across industries. Investments in R&D, technical training, and foundry expansion are essential to overcome infrastructure limitations and meet rising global demand for advanced SiC solutions.

Regional Analysis

North America

North America held a 38.6% share of the Silicon Carbide market in 2024, driven by strong demand from the electric vehicle, aerospace, and semiconductor industries. The United States leads the region with large-scale adoption of SiC power modules in EVs and renewable energy systems. Major semiconductor manufacturers are expanding wafer production capacity to meet rising industrial demand. Supportive government initiatives for clean energy and advanced manufacturing further accelerate growth. Continuous R&D investments and collaboration between automotive OEMs and technology firms are enhancing the region’s dominance in high-performance SiC applications.

Europe

Europe accounted for a 30.1% share of the Silicon Carbide market in 2024, supported by growing adoption in electric mobility and renewable power systems. Countries such as Germany, France, and the United Kingdom are leading in SiC-based power electronics used in EV drivetrains, charging networks, and solar inverters. The European Union’s decarbonization goals and strict energy efficiency standards are promoting SiC integration across multiple sectors. Continuous innovation in industrial automation and aerospace applications further strengthens regional demand, positioning Europe as a key hub for advanced SiC semiconductor and material development.

Asia-Pacific

Asia-Pacific captured a 25.4% share of the Silicon Carbide market in 2024, driven by strong industrial growth and expanding semiconductor manufacturing infrastructure. China, Japan, and South Korea are major contributors, with increasing investments in SiC wafer production and EV technology. The region benefits from government initiatives promoting clean transportation and renewable energy projects. Rapid urbanization and the rise of consumer electronics manufacturing also enhance SiC component demand. Additionally, collaborations between local manufacturers and global chipmakers are improving production efficiency, making Asia-Pacific one of the fastest-growing regions in the global market.

Middle East & Africa

The Middle East and Africa region held a 3.2% share of the Silicon Carbide market in 2024. Market expansion is supported by the growing adoption of renewable energy and power grid modernization projects. Countries such as the United Arab Emirates and Saudi Arabia are investing in solar and electric infrastructure, creating demand for efficient SiC-based components. The region’s industrial diversification and focus on sustainability are further driving opportunities in power electronics and energy conversion systems. However, limited semiconductor manufacturing capabilities pose a challenge, though international partnerships are gradually improving technological access.

Latin America

Latin America accounted for a 2.7% share of the Silicon Carbide market in 2024, with growth primarily driven by industrial and renewable energy applications. Brazil and Mexico are leading markets due to rising adoption of energy-efficient systems in automotive and manufacturing sectors. Government initiatives promoting electric mobility and sustainable energy sources are supporting SiC integration in power devices. The region’s emerging electronics industry is also creating new opportunities for semiconductor use. Despite infrastructure limitations, increasing foreign investments and renewable expansion projects are helping strengthen Latin America’s role in the global SiC market.

Market Segmentations:

By Product

By Application

- Steel

- Automotive

- Aerospace & aviation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Silicon Carbide market features leading players such as Carborundum Universal Limited, Washington Mills, Coorstek, Entegris Inc., ESD-SIC b.v., Snam Abrasives Pvt. Ltd., Gaddis Engineered Materials, Grindwell Norton Ltd., SK siltron Co., Ltd., and AGSCO Corporation. These companies dominate through robust manufacturing capabilities, advanced material processing, and extensive global distribution networks. They focus on product innovation, expansion of production capacity, and partnerships with semiconductor and automotive manufacturers to meet the growing demand for high-performance materials. Continuous R&D investments are directed toward developing high-purity SiC for power electronics and advanced ceramics. Strategic acquisitions and technology collaborations are helping major players strengthen market presence across key sectors such as electric vehicles, aerospace, and steel manufacturing. Additionally, efforts to enhance cost-efficiency and sustainability in production processes are shaping competition in the evolving silicon carbide industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Carborundum Universal Limited

- ESD-SIC b.v.

- Coorstek

- SK siltron Co., Ltd.

- Washington Mills

- Grindwell Norton Ltd.

- Snam Abrasives Pvt. Ltd.

- Entegris, Inc.

- Gaddis Engineered Materials

- AGSCO Corporation

Recent Developments

- In February 2025, Infineon Technologies AG announced the release of its first products based on advanced 200 mm silicon carbide technology, marking a significant milestone in the company’s efforts to enhance SiC device performance and production capacity.

- In January 2025, China’s Silan Microelectronics and STMicroelectronics advanced their 8-inch SiC production lines, with STMicroelectronics’ facility in Chongqing expected to commence wafer production by late February, aiming to meet the growing demand for SiC devices in electric vehicles and power grids.

- In January 2025, Snam Abrasives Pvt. Ltd. launched a high-purity silicon carbide product line (HP-SiC, 4N purity) for advanced applications across semiconductors, EVs, aerospace and others.

- In August 2024, Entegris, Inc. entered into a long-term supply agreement with ON Semiconductor to provide chemical-mechanical planarization (CMP) solutions for SiC wafer applications.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing demand for high-efficiency semiconductors will continue to fuel silicon carbide adoption.

- Increasing use of silicon carbide in electric vehicles and renewable energy systems will drive production growth.

- Advancements in wafer technology will enhance material performance and lower manufacturing costs.

- Expansion of 5G infrastructure and power electronics will boost semiconductor-grade silicon carbide demand.

- Companies will focus on vertical integration to strengthen supply chain stability and pricing control.

- Rising investments in R&D will lead to improved thermal conductivity and higher durability materials.

- Environmental regulations promoting energy-efficient materials will encourage silicon carbide usage across industries.

- Asia-Pacific will become a key production and consumption hub driven by EV and electronics manufacturing.

- Strategic collaborations between semiconductor firms and automotive OEMs will accelerate innovation.

- Long-term growth will rely on scaling production capacity and improving cost competitiveness globally.