| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antipruritic Market Size 2024 |

USD 9,659.70 Million |

| Antipruritic Market, CAGR |

7.23% |

| Antipruritic Market Size 2032 |

USD 17,562.51 Million |

Market Overview:

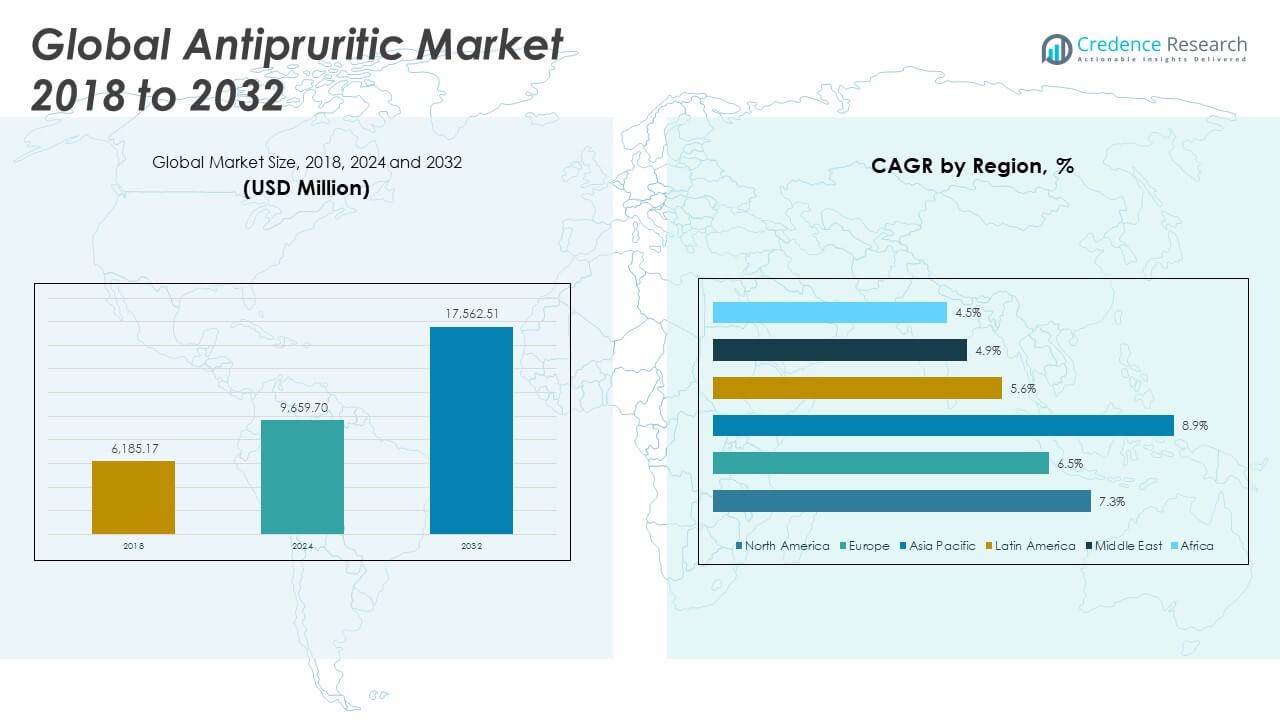

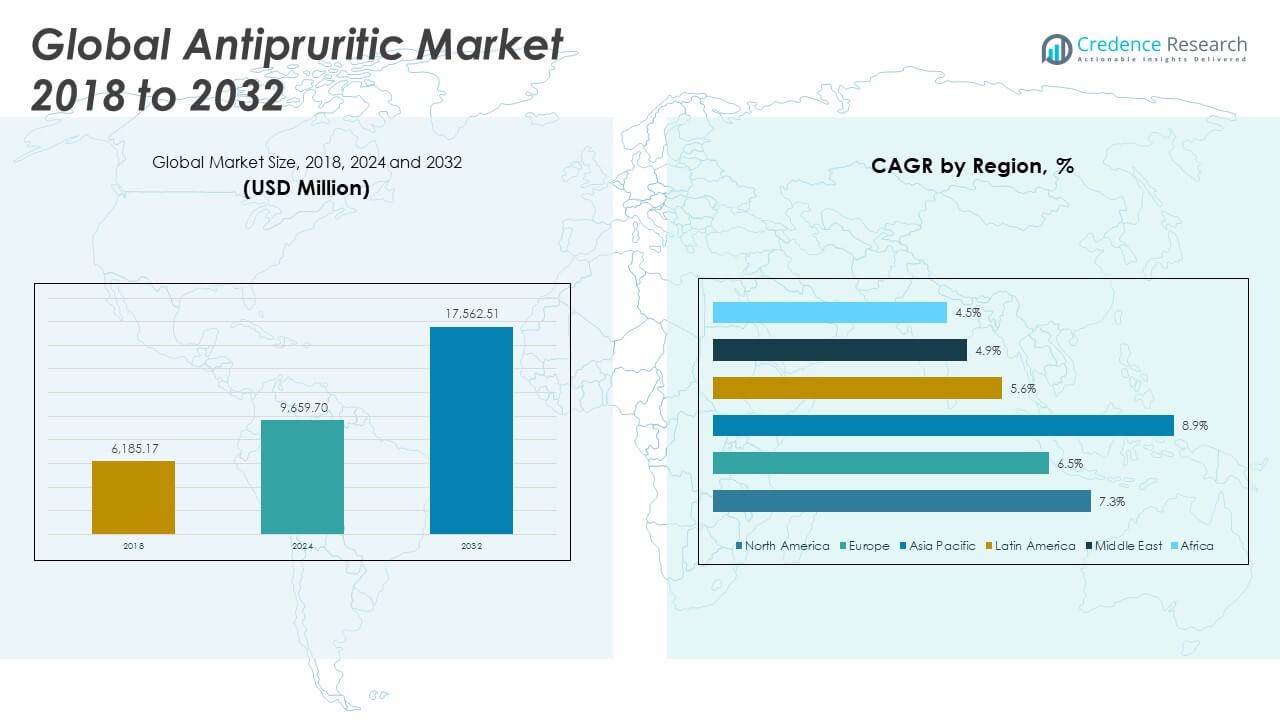

The Global Antipruritic Market size was valued at USD 6,185.17 million in 2018 to USD 9,659.70 million in 2024 and is anticipated to reach USD 17,562.51 million by 2032, at a CAGR of 7.23% during the forecast period.

The primary driver of the antipruritic market is the increasing prevalence of dermatological conditions and pruritus-associated chronic diseases. Aging populations are particularly susceptible to itch-related complications, driving demand for both preventive and therapeutic solutions. In addition to age-related skin disorders, the rising incidence of atopic dermatitis, allergic reactions, and autoimmune diseases has spurred the development and consumption of antipruritic products. Continuous innovation in drug formulation and delivery such as nanoemulsions, liposomal bases, and extended-release ointments has improved treatment efficacy and consumer compliance. Furthermore, the availability of biologics targeting specific cytokines and nerve pathways responsible for itch sensation has opened new revenue streams for pharmaceutical companies. Consumers are also increasingly opting for clean-label, plant-based, and non-steroidal antipruritics, reflecting a broader trend toward natural and holistic skincare. OTC accessibility, supported by digital platforms and e-pharmacies, has made antipruritic solutions more widely available, particularly in developing markets.

Regionally, North America holds the largest share of the global antipruritic market. This dominance is supported by the high prevalence of chronic skin conditions, robust healthcare infrastructure, and strong presence of leading dermatology-focused pharmaceutical companies. The United States leads in terms of biologic and prescription antipruritic use, aided by favorable insurance reimbursement policies and greater access to dermatologists. Europe is another key contributor, with countries such as Germany, France, and the UK exhibiting strong demand for advanced antipruritic therapies, particularly among their aging populations. Asia-Pacific is emerging as the fastest-growing region, driven by increasing healthcare expenditure, rising awareness of skin disorders, and expanding access to dermatological care. Countries such as China, India, and Japan are witnessing a rapid rise in both product launches and patient awareness. Meanwhile, Latin America and the Middle East & Africa represent growing but still underpenetrated markets, with expansion likely to be supported by healthcare reforms, urbanization, and rising demand for OTC topical treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Antipruritic Market was valued at USD 9,659.70 million in 2024 and is projected to reach USD 17,562.51 million by 2032, registering a CAGR of 7.23%.

- Increasing cases of atopic dermatitis, psoriasis, urticaria, and systemic diseases linked with chronic pruritus are fueling sustained product demand.

- The aging global population is driving higher usage of non-invasive topical antipruritic products, especially among seniors with sensitive skin conditions.

- Innovations such as nanoemulsions, liposomal delivery, and clean-label herbal formulations are improving treatment efficacy and user compliance.

- Expanded pharmacy networks, digital health platforms, and e-commerce channels are improving product accessibility, particularly in developing regions.

- The market faces challenges including limited long-term efficacy of conventional drugs and high cost barriers for advanced biologics.

- North America leads the market in revenue share, while Asia-Pacific is the fastest-growing region, supported by rising healthcare investment and consumer awareness.

Market Drivers:

Increasing Incidence of Dermatological and Chronic Pruritic Conditions

The rising prevalence of skin-related disorders such as atopic dermatitis, eczema, contact dermatitis, psoriasis, and urticaria is driving demand across the Global Antipruritic Market. These conditions often lead to chronic or severe itching, prompting patients to seek effective therapeutic options. The growing number of patients suffering from chronic kidney disease, liver disorders, and hematological malignancies is also contributing to the increased incidence of pruritus. Many of these systemic diseases are associated with persistent itching that requires both symptomatic relief and long-term management. Healthcare professionals are becoming more aware of the burden of pruritus, which is resulting in better diagnosis and increased prescription of antipruritic therapies. The growing patient pool is creating a consistent demand for both topical and systemic antipruritic products.

Rising Geriatric Population and Age-Associated Skin Conditions

The global rise in the aging population is a significant driver, as older adults are more prone to xerosis, neurogenic itch, and other age-related skin conditions. With advancing age, the skin loses its ability to retain moisture and maintain its barrier function, leading to increased susceptibility to pruritus. The Global Antipruritic Market is benefiting from this demographic shift, as older patients require prolonged treatment and often prefer easy-to-apply, non-invasive topical therapies. Pharmaceutical and consumer healthcare companies are expanding product lines specifically tailored to senior skin health, including fragrance-free and non-steroidal antipruritic formulations. Public health initiatives in developed economies are also emphasizing skin care for the elderly, supporting regular treatment and prevention of itch-related conditions. This trend is expected to fuel sustained demand over the forecast period.

Technological Advancements in Formulations and Drug Delivery

Ongoing innovation in antipruritic product formulations is enhancing therapeutic outcomes and patient compliance. Manufacturers are introducing fast-absorbing, long-acting, and non-greasy ointments that meet both clinical and cosmetic needs. Nanoemulsion-based creams, liposomal carriers, and polymeric gel systems are improving drug penetration and stability. It is creating competitive differentiation among key players while increasing accessibility of advanced therapies to broader consumer segments. The incorporation of herbal extracts, hydrocortisone alternatives, and antihistaminic agents into hybrid formulations is meeting growing consumer demand for clean-label and non-irritating solutions. These formulation breakthroughs are supporting market growth across prescription and over-the-counter categories.

- For example, a Piroxicam-loaded nanoemulsion gel demonstrated a 1.66-fold higher analgesic activity and double the duration of effect compared to commercial gels, with a 2.4-fold increase in bioavailability and a peak plasma concentration (Cmax) of 45.73±9.95 ng/mL versus 28.48±6.44 ng/mL for standard formulations/

Increased Access to Healthcare and Expansion of OTC Distribution Channels

Expanding healthcare infrastructure in emerging economies is allowing better access to dermatological consultations and treatments. The Global Antipruritic Market is witnessing higher product uptake due to the growing presence of pharmacies, dermatology clinics, and online platforms in countries across Asia-Pacific, Latin America, and the Middle East. E-commerce penetration and telemedicine are enabling consumers to easily access antipruritic products, including non-prescription formulations. Marketing campaigns by pharmaceutical companies and retail brands are improving consumer awareness regarding skin health and itch management. Rising disposable incomes and changing lifestyles are also influencing individuals to seek quicker relief from skin irritation, leading to an uptick in daily-use antipruritic products. The convergence of traditional retail and digital distribution is expanding the market’s reach across diverse consumer demographics.

- For example, Regeneron confirmed in April 2025 that it is investing approximately USD 3.6 billion to expand its Tarrytown, New York headquarters by adding new research, preclinical manufacturing, and support facilities. This expansion supports its development and production of biologics, including Dupixent (dupilumab), which is approved for conditions such as atopic dermatitis and chronic pruritus.

Market Trends:

Shift Toward Biologic and Targeted Therapies for Refractory Pruritus

A notable trend in the Global Antipruritic Market is the growing adoption of biologic and targeted therapies for patients with moderate to severe pruritus. Traditional antihistamines and corticosteroids often fail to provide sustained relief in chronic or systemic cases. Biologics targeting specific immune pathways, such as interleukin-4, interleukin-13, and Janus kinase (JAK) inhibitors, are gaining clinical relevance. These therapies address the underlying causes of pruritus rather than offering temporary symptom relief. Regulatory approvals for drugs like dupilumab and ruxolitinib have opened new avenues for treating atopic dermatitis and other refractory conditions. The trend is pushing pharmaceutical companies to invest in research pipelines focused on cytokine inhibition and neuroimmune signaling modulation.

Integration of AI and Digital Tools in Dermatological Treatment Plans

The incorporation of artificial intelligence (AI) and digital health tools is enhancing diagnostic accuracy and treatment customization within the Global Antipruritic Market. Dermatology-focused mobile applications, teledermatology platforms, and AI-enabled skin analysis tools are streamlining the identification and monitoring of pruritic conditions. These technologies enable remote consultations, early intervention, and personalized treatment adjustments, which are particularly valuable in underserved or rural areas. It is helping clinicians track treatment progress and patient adherence through image-based documentation and automated reminders. Pharmaceutical companies are also leveraging digital platforms to conduct virtual trials and gather real-world evidence on product efficacy. This digital integration is creating new touchpoints between healthcare providers, patients, and brands.

Growing Popularity of Combination Therapies to Improve Patient Outcomes

Healthcare providers are increasingly using combination therapies to improve effectiveness and reduce resistance in pruritus management. The Global Antipruritic Market is witnessing a rise in fixed-dose combinations and concurrent use of topical, oral, and biologic treatments tailored to individual patient profiles. This approach helps control multiple itch-inducing pathways simultaneously, especially in patients with complex or overlapping dermatological conditions. Combination therapies also reduce dependency on high-potency steroids and improve safety profiles. The trend is encouraging pharmaceutical companies to develop multi-action formulations and launch co-prescription support programs. It is also influencing clinical guidelines, which now emphasize individualized, multi-modal treatment strategies for chronic itch.

- For instance, tacrolimus ointment and pimecrolimus cream have demonstrated rapid pruritus relief—median time to ≥1-point improvement in pruritus score was 48 hours for pimecrolimus 1% cream in pediatric AD, compared to 72 hours for vehicle (P = 0.038).

Expansion of Pediatric and Infant-Specific Product Lines

A growing trend in the Global Antipruritic Market is the development of products specifically formulated for pediatric and infant use. Infants and children are highly susceptible to pruritic conditions such as diaper rash, eczema, and allergic reactions, requiring gentle and hypoallergenic treatments. Manufacturers are responding with pediatric lines that exclude fragrances, parabens, steroids, and harsh preservatives. These product lines include lotions, sprays, barrier creams, and bath additives designed to soothe itch while protecting delicate skin. The trend is supported by increased awareness among parents and pediatricians regarding the importance of early itch relief and skin barrier restoration. It is also driving retail expansion in baby care aisles and pediatric dermatology clinics globally.

- For example, Arcutis Biotherapeutics’ ZORYVE (roflumilast) cream 0.05% demonstrated that at week 4, 25.4% of children aged 2–5 achieved vIGA-AD success, defined as a ‘Clear’ or ‘Almost Clear’ score plus a 2-grade improvement from baseline, compared to 10.7% with vehicle (P < 0.0001)

Market Challenges Analysis:

Limited Long-Term Efficacy and Safety Concerns of Conventional Therapies

A significant challenge in the Global Antipruritic Market is the limited long-term efficacy of commonly used therapies such as antihistamines, corticosteroids, and topical anesthetics. Many of these agents offer only short-term relief and may lose effectiveness with repeated use. Patients with chronic or recurrent pruritus often experience treatment fatigue due to frequent flare-ups and inadequate symptom control. Corticosteroids, while effective, carry the risk of side effects such as skin thinning, pigmentation changes, and immune suppression with prolonged use. The lack of durable solutions for refractory pruritus discourages patient adherence and contributes to unmet clinical needs. It places pressure on researchers and manufacturers to develop safer and more sustainable treatment options with minimal side effects and long-term efficacy.

High Cost and Regulatory Hurdles for Biologic and Advanced Therapies

The high cost and regulatory complexities associated with biologics and novel antipruritic agents present barriers to wider adoption. Biologic therapies require rigorous clinical validation, extended approval timelines, and substantial investment in manufacturing and distribution. In many countries, access to these advanced treatments is limited due to reimbursement restrictions or lack of insurance coverage. The Global Antipruritic Market faces difficulty in penetrating lower-income and price-sensitive regions where cost remains a critical deciding factor for both healthcare providers and patients. It creates a divide between available innovation and real-world accessibility, particularly in developing economies. Regulatory uncertainty and inconsistent approval frameworks across regions further delay product launches and limit the speed of therapeutic innovation.

Market Opportunities:

Expansion into Emerging Markets with Untapped Demand

Emerging economies in Asia-Pacific, Latin America, and the Middle East present strong growth opportunities for the Global Antipruritic Market. Rising disposable incomes, improving healthcare infrastructure, and growing awareness of skin health are increasing demand for antipruritic products. Many of these regions face high prevalence of pruritic conditions due to environmental factors and limited access to dermatological care. It can benefit from tailored, affordable product lines and localized distribution strategies that address the needs of underserved populations. Companies can expand market penetration through partnerships with regional pharmacies, e-commerce platforms, and government health programs. Multinational brands and local manufacturers both stand to gain from proactive engagement in these fast-growing markets.

Product Innovation Focused on Natural and Steroid-Free Formulations

The growing consumer preference for clean-label and plant-based products creates new innovation avenues in the Global Antipruritic Market. Many consumers seek safer alternatives to steroids and synthetic chemicals, especially for pediatric and sensitive-skin applications. Formulators are exploring botanicals, essential oils, and bioactive peptides to create effective, non-irritating antipruritics. It allows companies to differentiate their offerings while aligning with wellness-focused consumer values. The rising trend of personalized skincare also supports the development of condition-specific formulations that target itch triggers with precision. Brands investing in R&D for novel, steroid-free antipruritics can capture a larger share of the growing natural therapeutics segment.

Market Segmentation Analysis:

The Global Antipruritic Market is segmented by drug class, disease, route of administration, and distribution channel.

By drug class, corticosteroids hold a leading share due to their rapid effectiveness in managing inflammation and itching. Antihistamines are widely used for allergic conditions, while local anaesthetics are preferred for localized itch relief. Immunosuppressants are gaining traction in chronic and severe cases, especially in dermatology clinics. The “others” category includes novel biologics and herbal-based antipruritics, which are gradually expanding in both prescription and OTC markets.

By disease, atopic dermatitis accounts for the highest demand, followed by allergic contact dermatitis and urticaria. Psoriasis treatments are also contributing significantly, particularly in biologic and immunosuppressant segments.

- For example, Sanofiand Regeneron are market leaders with Dupixent, which has transformed management of moderate-to-severe atopic dermatitis and is now approved for pediatric and adolescent populations

By route of administration, topical products dominate due to ease of use and broad OTC availability. Oral and parenteral routes are primarily used in clinical settings for moderate to severe cases.

By distribution channel, hospital pharmacies lead in prescription product sales, especially in North America and Europe. Drug stores and retail pharmacies remain dominant in Asia-Pacific and Latin America, where over-the-counter products are more accessible. Online stores are growing rapidly worldwide, driven by digital health trends and consumer demand for convenience.

- For example, in the U.S. and Europe, CVS Healthand Cigna’s Accredo specialty pharmacies are leading channels for prescription antipruritics, including restricted-distribution biologics.

Segmentation:

By Drug Class

- Corticosteroids

- Antihistamines

- Local Anaesthetics

- Immunosuppressants

- Others

By Disease

- Atopic Dermatitis

- Allergic Contact Dermatitis

- Urticaria

- Psoriasis

By Route of Administration

By Distribution Channel

- Hospital Pharmacies

- Drug Stores

- Retail Pharmacies

- Online Stores

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

The North America Antipruritic Market size was valued at USD 2,562.08 million in 2018 to USD 3,957.53 million in 2024 and is anticipated to reach USD 7,216.35 million by 2032, at a CAGR of 7.3% during the forecast period. North America holds the largest share of the Global Antipruritic Market, accounting for 37% of total revenue. It benefits from advanced healthcare systems, widespread awareness of skin health, and strong presence of dermatology-focused pharmaceutical companies. The United States leads in biologic adoption and prescription-based antipruritic therapies, supported by favorable reimbursement policies and frequent dermatological consultations. The market continues to expand through innovations in drug delivery, new product launches, and increased demand for OTC formulations. High prevalence of chronic skin conditions, including atopic dermatitis and psoriasis, sustains ongoing demand across patient demographics. It is positioned as a mature yet rapidly evolving market due to a strong pipeline and consumer willingness to adopt advanced therapies.

The Europe Antipruritic Market size was valued at USD 1,846.00 million in 2018 to USD 2,784.20 million in 2024 and is anticipated to reach USD 4,781.02 million by 2032, at a CAGR of 6.5% during the forecast period. Europe accounts for 26% of the Global Antipruritic Market and exhibits steady growth, driven by an aging population and increasing prevalence of inflammatory skin conditions. Countries such as Germany, France, and the United Kingdom contribute significantly to regional revenue, supported by strong healthcare infrastructure and access to dermatological care. The region has shown rising interest in clean-label, steroid-free formulations, prompting innovation in the OTC segment. Biologics and advanced topical treatments are gaining traction through structured clinical guidelines and government-supported healthcare programs. It continues to balance innovation and accessibility while expanding product portfolios across both prescription and consumer health categories. Public awareness campaigns are further encouraging proactive skin health management.

The Asia Pacific Antipruritic Market size was valued at USD 1,214.43 million in 2018 to USD 2,052.49 million in 2024 and is anticipated to reach USD 4,217.11 million by 2032, at a CAGR of 8.9% during the forecast period. Asia Pacific holds a 20% share of the Global Antipruritic Market and represents the fastest-growing regional segment. Rising disposable incomes, urbanization, and increasing awareness about skin disorders are driving demand in countries like China, India, Japan, and South Korea. The region benefits from improving access to dermatological care and rapid expansion of e-commerce platforms offering OTC antipruritic products. Domestic pharmaceutical companies are introducing affordable and locally adapted solutions to meet diverse consumer needs. It is gaining momentum through government health initiatives and increased investment in dermatology research. The growing pediatric and geriatric populations present significant opportunities for specialized antipruritic products.

The Latin America Antipruritic Market size was valued at USD 286.62 million in 2018 to USD 441.96 million in 2024 and is anticipated to reach USD 709.40 million by 2032, at a CAGR of 5.6% during the forecast period. Latin America contributes 4% of the Global Antipruritic Market, with growth driven by increased awareness of skin conditions and rising availability of dermatology treatments. Brazil and Mexico serve as the primary markets, supported by expanding retail pharmacy networks and improving healthcare access. There is growing consumer demand for OTC antipruritic creams and lotions due to climatic conditions that contribute to skin irritation. Market growth remains somewhat constrained by affordability issues and inconsistent access to specialist care. It is advancing through regional partnerships, medical education programs, and local manufacturing efforts. Multinational brands are gradually expanding their footprint through strategic distribution channels.

The Middle East Antipruritic Market size was valued at USD 169.10 million in 2018 to USD 240.85 million in 2024 and is anticipated to reach USD 367.64 million by 2032, at a CAGR of 4.9% during the forecast period. The Middle East accounts for 2% of the Global Antipruritic Market and shows moderate growth fueled by increasing skin sensitivity issues linked to climate, lifestyle changes, and pollution. The Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, dominate regional demand due to higher per capita healthcare spending. OTC antipruritic solutions are widely available through pharmacies and retail chains, supported by growing dermatological awareness. Prescription therapies remain limited to urban centers with access to specialists. It is expanding steadily through digital health initiatives and rising interest in dermatology-focused wellness products. Market players continue to explore partnerships with local distributors to strengthen supply chains.

The Africa Antipruritic Market size was valued at USD 106.94 million in 2018 to USD 182.67 million in 2024 and is anticipated to reach USD 270.99 million by 2032, at a CAGR of 4.5% during the forecast period. Africa represents just under 2% of the Global Antipruritic Market and remains a largely underserved region. Limited access to healthcare infrastructure and dermatological expertise constrains market penetration. However, demand for basic antipruritic treatments is rising due to increasing awareness of skin hygiene, urbanization, and growing distribution of OTC healthcare products. Nigeria, South Africa, and Kenya are showing gradual uptake in antipruritic therapies, primarily in urban and semi-urban areas. It has significant long-term potential through low-cost, accessible solutions and targeted public health interventions. Partnerships with NGOs, public hospitals, and regional distributors will be essential for improving access and market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amgen Inc.

- AbbVie Inc.

- Eli Lilly and Company

- Galderma SA

- Pfizer Inc.

- LEO Pharma

- Incyte

- Novartis AG

- Sanofi S.A.

- Johnson & Johnson

Competitive Analysis:

The Global Antipruritic Market features a mix of multinational pharmaceutical companies, consumer healthcare brands, and emerging biotech firms competing across prescription and over-the-counter segments. Key players include Johnson & Johnson, Pfizer Inc., Sanofi, Novartis AG, GlaxoSmithKline plc, Bayer AG, and Teva Pharmaceuticals. It is characterized by continuous product innovation, strong R&D investments, and strategic partnerships to develop novel formulations and biologics. Companies are focusing on expanding their dermatology portfolios through acquisitions and pipeline development targeting chronic pruritus. The market also sees growing participation from regional and local manufacturers offering cost-effective solutions, especially in Asia-Pacific and Latin America. Competitive advantage increasingly depends on the ability to deliver safe, fast-acting, and patient-friendly products that align with evolving consumer preferences. Digital marketing strategies, e-commerce penetration, and physician engagement programs are playing a larger role in brand positioning and customer retention across key markets.

Recent Developments:

- In June 2025, Amgen Inc.announced positive topline Phase 3 results for bemarituzumab in FGFR2b-positive first-line gastric cancer, highlighting ongoing innovation in its pipeline.

- In June 2025, AbbVie Inc.announced the acquisition of Capstan Therapeutics, a cell therapy developer specializing in CAR-T therapies, in a deal valued up to $2.1 billion. Capstan’s lead candidate, CPTX2309, is in development for autoimmune disorders, supporting AbbVie’s strategy to diversify beyond its flagship product Humira.

- In March 2023, Ipsen, a France-based biopharmaceutical company, announced the acquisition of Albireo Pharma Inc., a US-based clinical-stage biopharmaceutical firm. This acquisition significantly broadened and diversified Ipsen’s portfolio, especially by adding promising medicines for pediatric and adult uncommon cholestatic liver disorders.

Market Concentration & Characteristics:

The Global Antipruritic Market is moderately fragmented, with a few large pharmaceutical companies holding substantial market shares alongside numerous regional and niche players. It exhibits a balanced mix of branded prescription drugs, generic formulations, and over-the-counter products catering to a wide spectrum of consumer needs. The market supports strong product diversity, ranging from corticosteroid-based creams and antihistamines to biologics and herbal alternatives. It demonstrates moderate barriers to entry due to regulatory requirements, formulation expertise, and clinical trial demands. Product innovation, patent protection, and customer trust heavily influence brand competitiveness. While mature markets prioritize advanced therapies, emerging regions focus on affordability and accessibility. It continues to evolve through technological improvements in drug delivery systems and expanding online distribution networks.

Report Coverage:

The research report offers an in-depth analysis based on drug class, disease, route of administration, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Biologic therapies targeting chronic pruritus are expected to gain wider adoption across developed markets.

- OTC product sales will rise, supported by increased self-care awareness and digital pharmacy access.

- Asia-Pacific will emerge as the highest growth region due to rising income levels and healthcare investment.

- Natural and steroid-free formulations will see increased demand, especially in pediatric and sensitive-skin categories.

- Companies will expand their dermatology portfolios through mergers, acquisitions, and regional partnerships.

- Personalized medicine and precision dermatology will influence future antipruritic product development.

- E-commerce and direct-to-consumer models will play a critical role in distribution strategy.

- Technological innovation in transdermal delivery systems will enhance treatment efficacy and user compliance.

- Awareness campaigns and public health initiatives will drive early diagnosis and product adoption.

- Regulatory harmonization across emerging markets will improve access to innovative antipruritic therapies.