Market Overview:

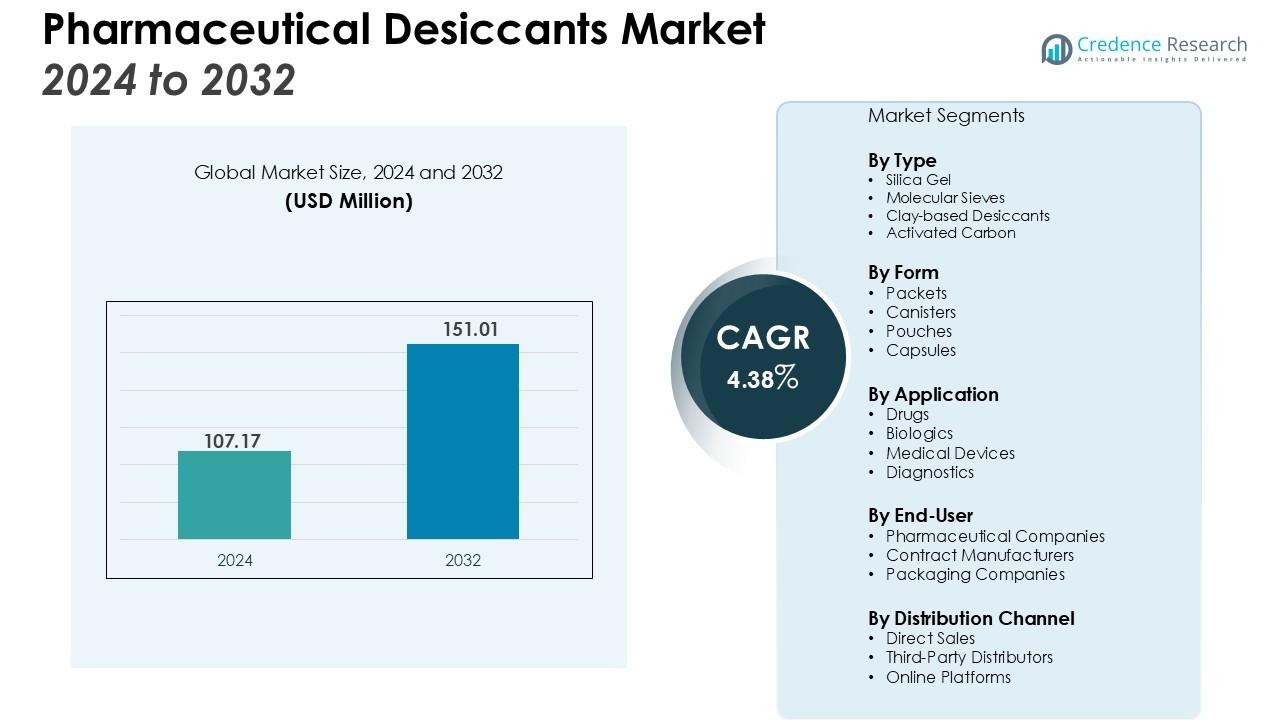

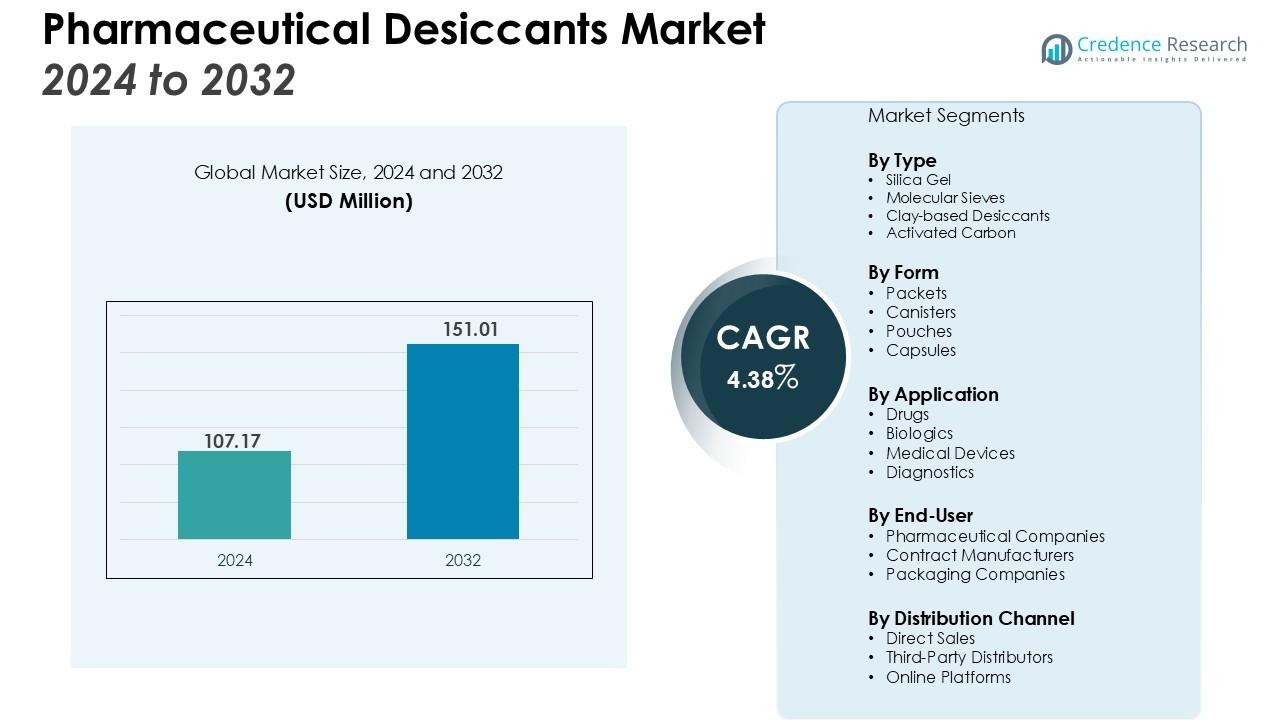

The Pharmaceutical Desiccants Market size was valued at USD 107.17 million in 2024 and is anticipated to reach USD 151.01 million by 2032, at a CAGR of 4.38% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmaceutical Desiccants Market Size 2024 |

USD 107.17 Million |

| Pharmaceutical Desiccants Market, CAGR |

4.38% |

| Pharmaceutical Desiccants Market Size 2032 |

USD 151.01 Million |

Key drivers of the pharmaceutical desiccants market include the rising need for effective moisture control in pharmaceutical products, the growth of the global pharmaceutical industry, and increasing government regulations regarding the storage and transportation of medicines. Desiccants help extend the shelf life of pharmaceutical products by preventing the degradation of moisture-sensitive compounds, thus boosting their demand. Furthermore, the growing adoption of personalized medicine and biologics, which require precise moisture control, is contributing to market growth. The increasing focus on sustainable and eco-friendly desiccants is also driving innovation in the market.

Regionally, North America holds the largest market share due to the presence of major pharmaceutical companies and stringent regulatory requirements for drug storage. Europe follows closely, driven by the increasing demand for advanced packaging solutions. The Asia-Pacific region is expected to witness the highest growth during the forecast period, driven by the rapid expansion of the pharmaceutical industry in countries like China and India, along with improvements in packaging infrastructure. Additionally, the region is seeing a rise in local manufacturing of desiccants to meet growing demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The pharmaceutical desiccants market was valued at USD 107.17 million in 2024 and is projected to reach USD 151.01 million by 2032, growing at a CAGR of 4.38%.

- The increasing need for moisture control in pharmaceutical products is driving the demand for desiccants, which help preserve the stability of moisture-sensitive drugs.

- The expansion of the global pharmaceutical industry, particularly the production of biologics and personalized medicines, boosts the demand for desiccants in packaging solutions.

- Stringent government regulations on pharmaceutical storage and transportation, including moisture control, are pushing the adoption of desiccants in pharmaceutical packaging.

- The growing focus on sustainability has led to the development of eco-friendly desiccants made from renewable and biodegradable materials.

- The high cost and fluctuation of raw materials like silica gel and molecular sieves pose challenges for desiccant manufacturers, particularly smaller companies.

- North America holds the largest share of the pharmaceutical desiccants market at 40%, followed by Europe at 30% and Asia-Pacific at 20%, with Asia-Pacific expected to experience the highest growth.

Market Drivers:

Rising Demand for Effective Moisture Control in Pharmaceutical Products

The pharmaceutical desiccants market is driven by the increasing need for moisture control in pharmaceutical products. Many pharmaceutical drugs and active ingredients are highly sensitive to moisture, which can lead to chemical degradation, reduced efficacy, and shorter shelf lives. Desiccants are critical in maintaining the stability of these moisture-sensitive products by absorbing excess humidity and preserving their quality. As the demand for more effective and longer-lasting pharmaceutical products grows, the need for reliable moisture control solutions has escalated, boosting the pharmaceutical desiccants market.

Growth of the Global Pharmaceutical Industry

The global pharmaceutical industry’s continuous expansion contributes significantly to the demand for pharmaceutical desiccants. The increase in the production of medicines, especially biologics and personalized treatments, calls for advanced packaging solutions to safeguard the integrity of the products. The rising number of pharmaceutical companies, both large and small, accelerates the need for desiccants that can effectively preserve drug formulations throughout the supply chain. This expansion fosters increased reliance on pharmaceutical desiccants to ensure that drugs reach consumers in optimal condition.

- For instance, Clariant, a key industry supplier, operates a desiccant manufacturing facility in New Mexico that has been producing these essential packaging components for over 40 years to support the pharmaceutical sector’s growth.

Stringent Government Regulations on Pharmaceutical Storage and Transportation

Government regulations on pharmaceutical storage and transportation further propel the growth of the pharmaceutical desiccants market. Regulatory bodies across the world enforce strict guidelines on the storage conditions of medicines, including temperature and humidity controls. Desiccants help meet these regulations by providing effective moisture control during the transportation and storage of pharmaceutical products. Companies are increasingly incorporating desiccants into their packaging systems to comply with these evolving regulatory standards.

Rise of Sustainable and Eco-friendly Desiccants

The growing demand for sustainable and eco-friendly solutions within the pharmaceutical industry is another key driver of the market. There is an increasing shift towards using renewable and biodegradable materials in pharmaceutical packaging, including desiccants. Companies are developing new desiccants that are both effective in moisture control and environmentally friendly. This shift aligns with the broader trends in sustainability, further supporting the growth of the pharmaceutical desiccants market.

- For instance, Evonik developed an innovative packaging for its AEROSIL® silica products by redesigning the bag from a 3-ply to a 2-ply construction, which allows it to be recycled as a pure paper bag.

Market Trends:

Increasing Adoption of Silica Gel and Clay-Based Desiccants

The pharmaceutical desiccants market is witnessing a growing preference for silica gel and clay-based desiccants. These materials offer superior moisture absorption capabilities and are widely used in pharmaceutical packaging for preserving moisture-sensitive products. Silica gel, in particular, is highly effective at maintaining optimal humidity levels and is non-toxic, making it an ideal choice for pharmaceutical applications. Its ability to absorb moisture without releasing it back into the product makes it a preferred material for packaging. Clay-based desiccants, which are often used in combination with silica gel, provide additional moisture control, further enhancing the protection of pharmaceutical goods during storage and transport. This trend is expected to continue as the demand for efficient and reliable moisture control solutions increases.

- For instance, Sanner launched its TabTec® CR desiccated, child-resistant container-closure system for tablets. This packaging solution can integrate up to 4.0 grams of silica gel desiccant directly into the container to ensure product stability.

Shift Towards Sustainable and Eco-Friendly Desiccants

Sustainability is emerging as a key trend in the pharmaceutical desiccants market. Manufacturers are increasingly developing eco-friendly desiccants that align with the global push towards sustainable packaging solutions. Natural desiccants, such as molecular sieve desiccants and plant-based materials, are gaining traction as alternatives to traditional silica gel and clay-based products. These sustainable options are biodegradable, reducing environmental impact without compromising performance. The pharmaceutical industry’s focus on eco-conscious practices, driven by both regulatory requirements and consumer demand, is expected to foster innovation in desiccant materials. As the industry continues to prioritize green packaging solutions, the market for eco-friendly pharmaceutical desiccants is likely to expand significantly.

- For instance, Clariant manufactures Desi Pak® desiccants using natural bentonite clay, a sustainable alternative to synthetic options. Under industry-standard testing conditions, a single unit of this desiccant will adsorb at least 6.0 grams of water vapor.

Market Challenges Analysis:

Challenges in Cost and Material Sourcing for Pharmaceutical Desiccants

One of the primary challenges in the pharmaceutical desiccants market is the cost and availability of high-quality materials. Silica gel, molecular sieves, and other specialized desiccants often require significant investment in manufacturing processes, which can increase costs for pharmaceutical companies. Fluctuations in the prices of raw materials, such as silica and clay, further complicate the cost structure for desiccant producers. Smaller manufacturers, in particular, may struggle to compete with larger companies that have access to better procurement and production resources. This cost pressure can hinder the adoption of desiccants, particularly in price-sensitive markets, and challenge the overall growth of the market.

Regulatory Compliance and Standardization Issues

The pharmaceutical desiccants market also faces challenges related to regulatory compliance and standardization. Various regulatory bodies across regions set different standards for packaging and moisture control requirements, which can create complexities for desiccant manufacturers. Ensuring that desiccants meet these stringent regulatory guidelines requires continuous monitoring and adaptation to evolving standards. Companies must also navigate the varying requirements for product labeling, testing, and certifications, which can delay market entry and add operational costs. Inconsistent regulations across regions can increase the complexity of global supply chains and limit the growth potential of the pharmaceutical desiccants market.

Market Opportunities:

Expansion in Emerging Markets for Pharmaceutical Desiccants

The pharmaceutical desiccants market holds significant opportunities in emerging markets, particularly in regions like Asia-Pacific and Latin America. Rapid industrialization, increased investment in the pharmaceutical sector, and rising healthcare needs are driving demand for effective packaging solutions. Countries such as China and India are witnessing growth in pharmaceutical production, especially in generics and biologics, which require moisture control for product stability. As these markets expand, the demand for pharmaceutical desiccants is expected to rise, presenting growth opportunities for manufacturers. This expansion is further supported by improving healthcare infrastructure and regulatory advancements, creating a favorable environment for the adoption of moisture control solutions.

Advancements in Eco-friendly and Innovative Desiccant Technologies

The push towards sustainability presents another key opportunity in the pharmaceutical desiccants market. Growing environmental concerns and regulatory pressure are driving innovation in eco-friendly desiccants made from biodegradable or renewable materials. Companies are increasingly developing sustainable alternatives that not only meet moisture control requirements but also align with the global shift towards greener practices in packaging. The development of more efficient desiccants with enhanced moisture absorption capabilities, such as molecular sieves and plant-based options, further opens avenues for market growth. These advancements allow pharmaceutical companies to meet both performance and environmental standards, thereby fostering greater market acceptance.

Market Segmentation Analysis:

By Type

The pharmaceutical desiccants market is primarily divided into silica gel, molecular sieves, clay, and activated carbon. Silica gel holds the largest share due to its excellent moisture-absorbing properties and non-toxicity. Molecular sieves are also gaining popularity due to their high efficiency in controlling moisture and maintaining the stability of pharmaceutical products. Activated carbon and clay-based desiccants are often used in specific applications, offering cost-effective solutions.

- For instance, BASF’s Sorbead® brand of silica gel provides a high water adsorption capacity due to its typical surface area of 700 m²/g.

By Form

Pharmaceutical desiccants are available in various forms, including packets, canisters, pouches, and capsules. Packets dominate the market due to their ease of use and versatility in packaging, making them suitable for a wide range of pharmaceutical products. Canisters are typically used for larger quantities of products, while pouches and capsules are ideal for smaller or individual dosage forms. These different forms cater to the diverse needs of pharmaceutical manufacturers.

By Application

The pharmaceutical desiccants market finds application in drugs, biologics, medical devices, and diagnostics. The drug segment leads, driven by the need to preserve moisture-sensitive medications and ensure their stability. The growing biologics market, including vaccines and monoclonal antibodies, also increases the demand for desiccants, as these products require precise moisture control. Medical devices and diagnostic tools further support market growth, as moisture control is crucial for their storage and efficacy.

- For instance, Clariant produces Sorb-It PHARMA desiccant bags in a standard 400-gram size specifically for protecting bulk drugs and active pharmaceutical ingredients during transport and storage.

Segmentations:

By Type

- Silica Gel

- Molecular Sieves

- Clay-based Desiccants

- Activated Carbon

By Form

- Packets

- Canisters

- Pouches

- Capsules

By Application

- Drugs

- Biologics

- Medical Devices

- Diagnostics

By End-User

- Pharmaceutical Companies

- Contract Manufacturers

- Packaging Companies

By Distribution Channel

- Direct Sales

- Third-Party Distributors

- Online Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America

North America holds the largest share of the pharmaceutical desiccants market, with a market share of 40%. The region benefits from the presence of major pharmaceutical companies and advanced regulatory standards. Strict guidelines from regulatory bodies such as the FDA emphasize moisture control to ensure product stability and safety, driving the need for desiccants. The U.S. leads the market, supported by a well-established pharmaceutical manufacturing and packaging infrastructure. The increasing focus on personalized medicine and biologics further accelerates the demand for moisture control, contributing to market growth in North America.

Europe

Europe accounts for 30% of the pharmaceutical desiccants market, driven by its strong pharmaceutical industry and regulatory requirements. Countries like Germany, France, and the U.K. play key roles in demand for moisture control solutions. The European Medicines Agency (EMA) enforces regulations to ensure safe pharmaceutical storage and transportation, increasing the adoption of desiccants. Europe’s growing emphasis on eco-friendly packaging solutions has also spurred the development of sustainable desiccants. The rising demand for biologics and generics continues to support steady market growth in the region.

Asia-Pacific

Asia-Pacific holds 20% of the pharmaceutical desiccants market and is the fastest-growing region. The rapid expansion of the pharmaceutical industry in countries such as China, India, and Japan fuels the need for moisture control solutions. The region’s growing healthcare needs, coupled with the rising production of generics and biologics, contribute to this growth. Enhancements in manufacturing standards and infrastructure further drive the adoption of desiccants. With investments in research and development and a focus on sustainable packaging, the Asia-Pacific market presents substantial opportunities for desiccant manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Clariant

- Oker-Chemie

- DowDupont

- Multisorb Technologies

- Sanner

- Desiccare

- W. R. Grace & Co

- CSP Technologies

- Capitol Scientific

- Desican

Competitive Analysis:

The pharmaceutical desiccants market is characterized by the presence of several key players striving to maintain product quality and meet stringent regulatory standards. Companies such as Clariant, W. R. Grace & Co., Multisorb Technologies, CSP Technologies, Sanner, and Desiccare Inc. lead the market by offering a range of desiccant solutions, including silica gel, molecular sieves, and activated carbon. These firms focus on developing innovative packaging solutions and expanding their product portfolios to cater to the growing demand for moisture control in pharmaceutical products. Strategic partnerships, acquisitions, and investments in research and development are common strategies employed to enhance market presence and technological capabilities. The market’s competitive landscape is further shaped by regional dynamics, with North America holding a significant share due to its established pharmaceutical industry and stringent regulatory frameworks. Companies operating in this space must navigate challenges such as regulatory compliance and material sourcing while capitalizing on opportunities presented by the expanding pharmaceutical sector and increasing demand for sustainable packaging solutions.

Recent Developments:

- In August 2025, DuPont won three R&D 100 Awards for its new technologies, including the DuPont™ Tychem® 6000 SFR protective garment and the FilmTec™ Fortilife™ XC160 Membrane reverse osmosis element.

- In December 2024, Dow announced a partnership with Macquarie Asset Management to create Diamond Infrastructure Solutions, a new entity, with the deal expected to be finalized in the first half of 2f 2025.

Report Coverage:

The research report offers an in-depth analysis based on Type, Form, Application, End-User, Distribution Channel and Region It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The pharmaceutical desiccants market will continue to grow as the demand for moisture control in pharmaceuticals rises.

- Innovations in desiccant technology, such as advanced molecular sieves and eco-friendly alternatives, will drive market development.

- Increasing adoption of biologics and personalized medicine will further fuel demand for moisture control solutions in packaging.

- Rising global healthcare needs, particularly in emerging markets, will contribute to the market’s expansion.

- Stringent government regulations on pharmaceutical storage and transportation will continue to enforce the use of desiccants for compliance.

- The shift towards sustainable and biodegradable desiccants will enhance market appeal, particularly among environmentally-conscious consumers and manufacturers.

- North America will maintain its dominant position in the market, but Asia-Pacific is expected to experience the fastest growth.

- Key players in the market will continue investing in research and development to create more effective and efficient moisture control solutions.

- The growing importance of packaging as a part of the pharmaceutical supply chain will increase the use of desiccants.

- Collaboration between pharmaceutical companies and packaging providers will become more common to ensure the stability of sensitive products throughout their lifecycle.