Market Overview:

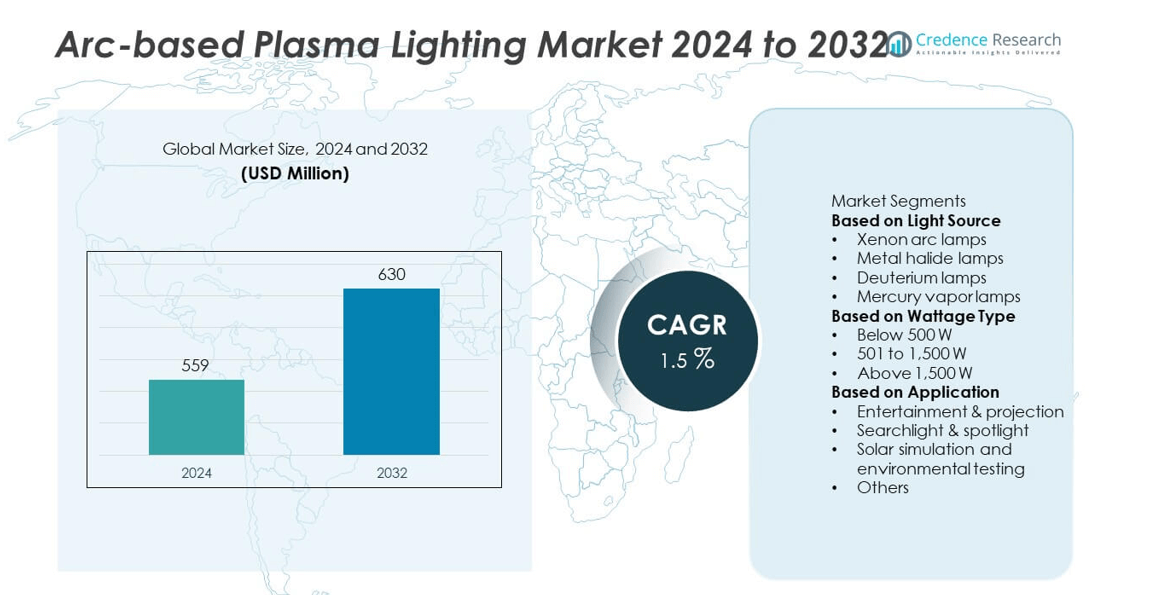

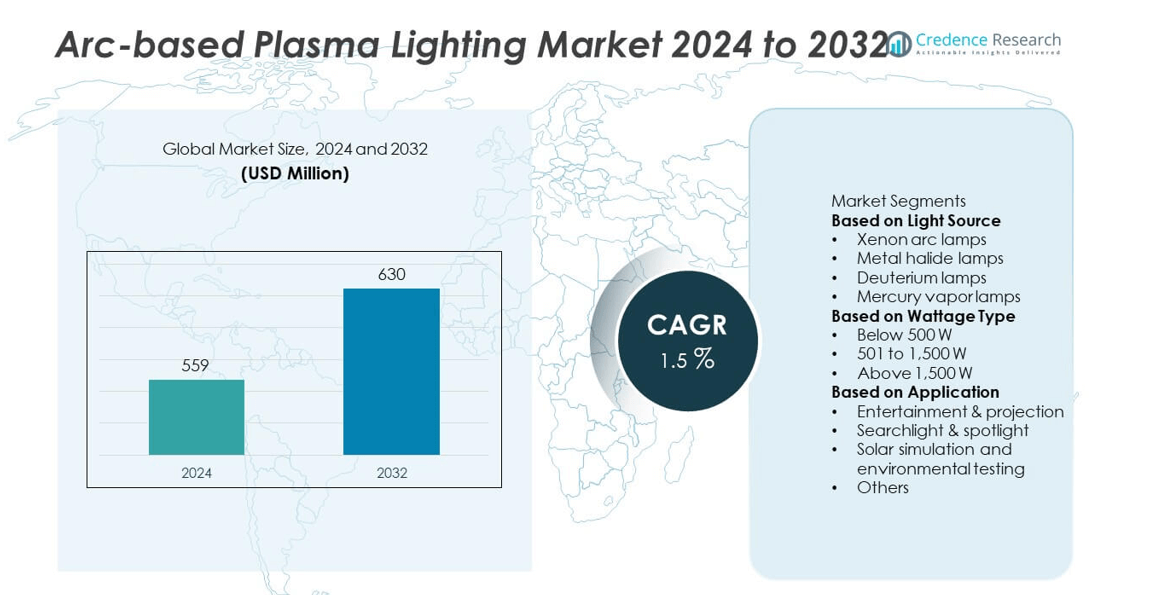

The global arc-based plasma lighting market was valued at USD 559 million in 2024 and is projected to reach USD 630 million by 2032, growing at a CAGR of 1.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Arc-based Plasma Lighting Market Size 2024 |

USD 559 million |

| Arc-based Plasma Lighting Market, CAGR |

1.5% |

| Arc-based Plasma Lighting Market Size 2032 |

USD 630 million |

The arc-based plasma lighting market is led by prominent players including Ushio Inc., Osram Licht AG, Excelitas Technologies Corp., Heraeus Holding GmbH, Iwasaki Electric Co., Ltd., Luxim Corporation, LUXTEL Co., Ltd., Advanced Lighting Technologies, Inc., Philips Lighting (Signify N.V.), and GE Lighting (a Savant company). These companies focus on developing high-intensity, energy-efficient plasma lighting solutions for industrial, projection, and testing applications. North America dominated the global market with a 35.7% share in 2024, driven by advanced research facilities and strong demand in cinema projection and aerospace testing. Europe followed with a 29.6% share, supported by its strong industrial and environmental testing base, while Asia Pacific accounted for 26.1% and emerged as the fastest-growing region due to rapid industrialization and rising investment in renewable energy and optical simulation technologies.

Market Insights

- The arc-based plasma lighting market was valued at USD 559 million in 2024 and is projected to reach USD 630 million by 2032, growing at a CAGR of 1.5%.

- Rising demand for high-intensity, full-spectrum lighting in industrial, entertainment, and scientific applications is driving market growth.

- Technological advancements in energy efficiency and lamp longevity, along with integration of smart control systems, are shaping market trends.

- Leading players such as Ushio Inc., Osram Licht AG, and Excelitas Technologies Corp. focus on innovation and partnerships to strengthen product portfolios and expand global reach.

- North America led the market with a 35.7% share in 2024, followed by Europe at 29.6% and Asia Pacific at 26.1%, while the xenon arc lamp segment accounted for the largest 44.3% share among light sources globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Light Source

Xenon arc lamps held a 44.3% share of the arc-based plasma lighting market in 2024, driven by their broad-spectrum illumination and high intensity. These lamps are essential in cinema projection, solar simulation, and optical testing due to their precise color temperature and stable light output. They are also used in aerospace and scientific research facilities that need accurate sunlight replication. Ushio and Heraeus supply advanced xenon arc lamps optimized for long lifespan and consistent spectral performance, which reinforces this segment’s leadership across technical and industrial lighting applications.

- For instance, Ushio developed its UXL series xenon lamps, which are known for a continuous spectrum that closely approximates daylight and are available with lumen outputs of up to 10,000 lumens in some models, and significantly higher (up to 43,000 lumens) in their DXL series for high-end cinema projection.

By Wattage Type

The 501 to 1,500 W category accounted for a 46.8% market share in 2024, supported by its balance of energy efficiency and strong light intensity. These systems are ideal for industrial, entertainment, and projection uses requiring high luminous flux and stable operation. Their reliability in continuous testing and visual display setups increases their adoption. Osram’s xenon and metal halide lamps in this wattage range are widely integrated into projection and simulation platforms, ensuring uniform brightness and accurate color reproduction under demanding performance conditions.

- For instance, Osram’s XBO 1200 W xenon short-arc lamp achieves a nominal luminous flux of 45,000 lumens and maintains over 85% brightness stability throughout 1,000 operating hours, ensuring accurate color performance in digital projection and advanced simulation systems used by aerospace and research institutes.

By Application

The entertainment and projection sector led with a 38.7% market share in 2024 due to growing use in cinema halls, stage performances, and live events. Arc-based plasma lamps deliver uniform, high-intensity illumination essential for detailed image projection and visual clarity. Rising digital cinema screens and global entertainment expansion support ongoing demand. Christie and Barco deploy xenon lamps in advanced projection systems to achieve exceptional brightness, color accuracy, and long operational stability, ensuring continued dominance of this segment in professional entertainment and large-format visual display markets.

Key Growth Drivers

Rising Demand in Industrial and Scientific Applications

The growing requirement for high-intensity, full-spectrum lighting in laboratories, aerospace testing, and material research is boosting the arc-based plasma lighting market. These lamps deliver precise light distribution and exceptional brightness for accurate experimental results. Sectors such as automotive and electronics increasingly use xenon and metal halide lamps for optical and environmental testing. Heraeus and Osram have introduced high-stability plasma lamps designed for photonics and analytical facilities, providing enhanced luminous output and temperature resistance to support continuous operation under demanding industrial and research conditions.

- For instance, Heraeus developed its FiberLight D2 deuterium lamp system, which is capable of instant-on stability and can operate in cycles for an extended service life of up to three years.

Expansion of the Entertainment and Projection Industry

The rapid growth of the global entertainment industry continues to fuel demand for arc-based plasma lamps used in cinema projection, stage performances, and large-scale events. Their high brightness, stable color temperature, and superior light uniformity make them ideal for high-definition imaging and immersive displays. Companies such as Christie and Barco utilize xenon-based lamps to ensure accurate visual rendering in large-screen projection systems. The ongoing digital transformation in the entertainment sector and the increasing number of global cinema screens are strengthening this segment’s dominance.

- For instance, Christie Digital employs RGB pure laser illumination in its CP4435-RGB projectors, achieving peak brightness of up to 35,000 lumens for premium large-format theaters.

Advancements in Plasma Lighting Efficiency and Longevity

Technological progress in plasma lamp design has significantly enhanced energy efficiency, thermal control, and operational lifespan. Innovations such as advanced electrode engineering and optimized cooling mechanisms extend lamp service life while maintaining consistent light quality. Manufacturers are focusing on higher luminous efficacy and reduced power loss to improve cost-effectiveness. Philips Lighting and Ushio have introduced plasma systems featuring extended operational hours and minimal degradation, making them preferred in industrial and research applications that require long-duration, high-precision illumination performance.

Key Trends & Opportunities

Integration with Automated and Smart Lighting Systems

The integration of automated lighting controls and digital diagnostics is emerging as a major opportunity for the arc-based plasma lighting market. Modern plasma systems can connect with programmable interfaces, allowing real-time monitoring and performance optimization. Research laboratories and entertainment venues are increasingly deploying intelligent plasma lighting linked to central management software. These systems enhance energy efficiency, predictive maintenance, and user safety. The adoption of IoT-enabled controls is helping industries achieve consistent illumination quality with reduced manual intervention and downtime.

- For instance, Current Lighting’s Daintree Wireless Control platform integrates with thousands of connected luminaires using IoT-enabled diagnostics, achieving significant energy cost reductions, often exceeding 60%, through strategies like occupancy sensing, daylight harvesting, and automated fault detection and system calibration.

Emerging Applications in Renewable Energy Testing and Simulation

Arc-based plasma lamps are gaining traction in renewable energy research, especially for solar simulation and photovoltaic calibration. Their ability to reproduce the solar spectrum with high precision makes them vital for testing solar cells and energy materials. Heraeus and Excelitas Technologies supply specialized xenon lamps used in environmental durability and performance testing for solar systems. Increasing global investment in clean energy research and certification processes is expanding the adoption of these lighting systems in solar laboratories and energy evaluation centers.

- For instance, Excelitas Cermax xenon short-arc lamps have a correlated color temperature of approximately 5,900 K to 6,000 K, closely matching the solar spectrum, which is essential for accurate solar simulation in applications like PV module evaluation.

Key Challenges

High Initial Costs and Energy Consumption

The market faces challenges due to high installation and operational expenses linked with plasma lighting systems. These lamps need strong power sources and active cooling units, raising infrastructure and maintenance costs. High-performance xenon lamps often require specialized housings to manage thermal output, limiting affordability for small-scale users. While energy efficiency has improved, overall system expenses remain higher compared to LED or laser-based options, restraining widespread adoption in cost-sensitive industrial and commercial applications.

Competition from LED and Solid-State Lighting Technologies

Advancements in LED and solid-state lighting pose significant competition to arc-based plasma systems. LEDs deliver longer lifespans, lower energy usage, and compact design advantages, making them more appealing in projection and display applications. Many equipment manufacturers are replacing plasma lamps with LED alternatives to reduce energy costs and maintenance. Despite the superior light intensity of plasma technology, the rapid innovation and affordability of solid-state systems continue to challenge its long-term relevance in both industrial and entertainment lighting markets.

Regional Analysis

North America

North America held a 35.7% share of the arc-based plasma lighting market in 2024, driven by strong adoption in entertainment, aerospace, and scientific research sectors. The United States leads regional growth with widespread use in cinema projection and solar simulation systems. Major manufacturers focus on developing high-intensity xenon and metal halide lamps for testing and laboratory environments. For instance, companies such as Excelitas Technologies and Ushio America continue to expand their presence through specialized lighting solutions. Increasing investments in advanced optical testing facilities and sustainable energy research further support regional market expansion.

Europe

Europe accounted for a 29.6% market share in 2024, supported by advanced industrial and research infrastructure. Countries such as Germany, France, and the United Kingdom are major contributors, emphasizing the use of plasma lighting in environmental testing, material analysis, and projection systems. Strong demand from automotive and aerospace R&D facilities enhances regional adoption. For instance, Osram and Heraeus are investing in high-efficiency xenon and mercury vapor lamps for precision applications. Europe’s focus on innovation, energy efficiency, and compliance with environmental standards continues to drive growth in high-performance lighting technologies.

Asia Pacific

Asia Pacific captured a 26.1% share of the arc-based plasma lighting market in 2024 and is expected to record the fastest growth through 2032. Rapid industrialization, expanding entertainment industries, and strong investments in solar energy testing are driving adoption across China, Japan, and South Korea. Regional manufacturers are focusing on cost-efficient lamp designs and high-performance systems for commercial projection and testing. For instance, Ushio and Iwasaki Electric supply advanced xenon lamps to meet growing regional demand. Government-led initiatives in clean energy and optical research are further accelerating market expansion across Asia Pacific.

Latin America

Latin America held a 5.1% share in 2024, driven by increasing demand from entertainment, event lighting, and industrial testing applications. Brazil and Mexico lead regional adoption with growing investments in digital cinema and scientific infrastructure. Partnerships with global lighting manufacturers are helping local distributors expand their product portfolios. For instance, regional projection equipment suppliers are integrating xenon lamps for enhanced illumination quality. Supportive government initiatives promoting renewable energy testing and infrastructure modernization are expected to strengthen the region’s presence in the arc-based plasma lighting market.

Middle East & Africa

The Middle East & Africa accounted for a 3.5% share in 2024, supported by rising infrastructure investments and growing adoption in defense and energy research. Countries such as the UAE, Saudi Arabia, and South Africa are integrating plasma lighting in testing and large-scale lighting projects. Expanding entertainment and architectural sectors further drive regional demand. For instance, global suppliers are partnering with local integrators to provide xenon-based lighting systems for research and event venues. Increasing focus on sustainability, innovation, and high-efficiency illumination technologies supports gradual market growth across this region.

Market Segmentations:

By Light Source

- Xenon arc lamps

- Metal halide lamps

- Deuterium lamps

- Mercury vapor lamps

By Wattage Type

- Below 500 W

- 501 to 1,500 W

- Above 1,500 W

By Application

- Entertainment & projection

- Searchlight & spotlight

- Solar simulation and environmental testing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the arc-based plasma lighting market is characterized by innovation, product differentiation, and technological advancement among key players such as Ushio Inc., Osram Licht AG, Excelitas Technologies Corp., Heraeus Holding GmbH, Iwasaki Electric Co., Ltd., Luxim Corporation, LUXTEL Co., Ltd., Advanced Lighting Technologies, Inc., Philips Lighting (Signify N.V.), and GE Lighting (a Savant company). These companies focus on enhancing lamp performance, energy efficiency, and lifespan to meet diverse industrial and entertainment lighting needs. Continuous R&D investment supports advancements in high-intensity xenon and metal halide lamps for solar simulation, projection, and testing applications. Strategic collaborations with research institutions and OEMs are expanding product applications in aerospace, photonics, and renewable energy sectors. Manufacturers are also adopting sustainable production techniques and smart integration features to improve operational control and system efficiency. This growing competition fosters technological evolution, ensuring consistent market development and global adoption of arc-based plasma lighting solutions.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ushio Inc.

- Osram Licht AG

- Excelitas Technologies Corp.

- Heraeus Holding GmbH

- Iwasaki Electric Co., Ltd.

- Luxim Corporation

- LUXTEL Co., Ltd.

- Advanced Lighting Technologies, Inc.

- Philips Lighting (Signify N.V.)

- GE Lighting (a Savant company)

Recent Developments

- In October 2024, Excelitas introduced Cermax PE300BFX and PE322BFX lamps. The short-arc xenon models target surgical and projection uses. They use a universal seven-hole base.

- In June 2024, Ushio announced continued leadership in cinema xenon lamps. The firm positioned itself as an exclusive high-quality source. Commitment covered “today, tomorrow, and beyond.”

- In January 2024, Excelitas Technologies Corp., a prominent manufacturer of industrial and medical technology dedicated to providing cutting-edge photonic solutions, announced the acquisition of the Noblelight business from Heraeus Group, with significant prospects to maximize their collective capabilities, ensuring optimal service to their valued customers and sustaining a rapid trajectory toward profitable expansion.

- In December 2023, Lumartix, a Swiss firm that focuses on plasma light engine technology, created a solar simulator for conducting characterization, aging, and stabilization tests, along with light-soaking and solar-simulation capabilities.

Report Coverage

The research report offers an in-depth analysis based on Light Source, Wattage Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-intensity lighting systems will continue to rise in research and industrial applications.

- Technological innovations will enhance energy efficiency and extend lamp lifespan.

- Adoption in solar simulation and environmental testing will expand due to precision requirements.

- Manufacturers will focus on compact, high-performance designs for projection and stage lighting.

- Integration of digital control systems will improve operational accuracy and system reliability.

- Replacement of conventional light sources with plasma technology will accelerate in specialized sectors.

- Strategic collaborations will drive product innovation and global distribution reach.

- Growing aerospace and defense testing facilities will boost high-wattage lamp demand.

- Sustainability initiatives will encourage low-emission and recyclable lighting solutions.

- Asia Pacific will emerge as a key growth hub due to industrial expansion and increasing R&D investments.