| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Industrial Pumps Market Size 2024 |

USD 10,915.33 Million |

| Asia Pacific Industrial Pumps Market, CAGR |

5.71% |

| Asia Pacific Industrial Pumps Market Size 2032 |

USD 17,014.89 Million |

Market Overview:

The Asia Pacific Industrial Pumps Market is projected to grow from USD 10,915.33 million in 2024 to an estimated USD 17,014.89 million by 2032, with a compound annual growth rate (CAGR) of 5.71% from 2024 to 2032.

Several key drivers are fueling the expansion of the industrial pumps market in Asia Pacific. Rapid industrialization and urbanization have led to heightened demand for efficient fluid handling systems across sectors such as oil and gas, water and wastewater treatment, chemicals, and power generation. Infrastructure development, particularly in water and wastewater management, is a significant contributor, with substantial investments aimed at enhancing water supply and sanitation facilities. Technological advancements, including the integration of smart technologies like IoT-enabled pumps, are improving operational efficiency and energy savings, further propelling market growth. Additionally, the expansion of the food and beverage industry, driven by a growing population and rising disposable incomes, is increasing the demand for hygienic and efficient pumping solutions.

Regionally, Asia Pacific is witnessing diverse developments contributing to the industrial pumps market. China, with its extensive industrial base, is investing heavily in infrastructure projects, including water conservation and hydropower, thereby boosting the demand for industrial pumps. India’s focus on expanding water and wastewater treatment facilities, coupled with rapid urbanization, is driving the need for efficient pumping solutions. Southeast Asian nations are also investing in water infrastructure and industrial projects, further augmenting market growth. Japan’s advanced manufacturing sector and emphasis on technological innovation are fostering the adoption of energy-efficient and smart pumping systems. These regional dynamics highlight the varied and robust growth drivers within the Asia Pacific industrial pumps market, reflecting a complex interplay of industrial, infrastructural, and technological factors across different countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Asia Pacific Industrial Pumps Market is expected to grow from USD 10,915.33 million in 2024 to USD 17,014.89 million by 2032, driven by a CAGR of 5.71%.

- The global industrial pumps market is projected to grow from USD 45,756.97 million in 2024 to USD 63,738.11 million by 2032, driven by increasing demand across multiple sectors.

- Rapid industrialization and urbanization are key drivers, creating an increased demand for efficient fluid handling systems across industries such as oil & gas, chemicals, and power generation.

- The expansion of water and wastewater treatment infrastructure is crucial for market growth, with significant investments in water management and sanitation systems.

- Technological advancements, including IoT-enabled pumps, are improving operational efficiency and energy savings, propelling the market’s growth across various sectors.

- The growing food and beverage industry, driven by rising disposable incomes and changing dietary preferences, is a significant contributor to the increasing demand for hygienic pumping solutions.

- China, India, and Southeast Asian nations are making substantial investments in infrastructure projects, such as water conservation and hydropower, boosting the demand for industrial pumps.

- Challenges such as high initial costs, maintenance, and stringent regulatory standards pose barriers to market expansion but create opportunities for innovation and efficiency improvements.

Market Drivers:

Industrialization and Infrastructure Development

The rapid industrialization across the Asia Pacific region is one of the primary drivers of the industrial pumps market. As countries such as China, India, and various Southeast Asian nations continue to experience significant industrial growth, the demand for industrial pumps to support diverse applications is increasing. For instance, China’s “Made in China 2025” initiative and India’s “Make in India” campaign have spurred investments in domestic production and manufacturing, leading to increased demand for industrial pumps in sectors like oil and gas, chemicals, and power generation. The expansion of key industries like oil and gas, chemicals, power generation, and manufacturing necessitates the use of efficient pumping systems to transport fluids, gases, and other materials. Furthermore, the rise in infrastructure projects, including water treatment plants, irrigation systems, and sewage management, has significantly contributed to the demand for industrial pumps. Governments across the region are investing heavily in infrastructure, enhancing the need for advanced pumping solutions that can support large-scale, continuous operations.

Technological Advancements in Pumping Systems

Advancements in pump technology are playing a crucial role in the growth of the Asia Pacific industrial pumps market. The integration of smart technologies, such as IoT-enabled pumps, is transforming traditional pumping systems by enhancing their efficiency and performance. These pumps provide real-time monitoring and data analytics, enabling operators to optimize their energy consumption and maintenance schedules. As a result, industrial pumps are becoming more energy-efficient and cost-effective, driving adoption across various industries. Additionally, innovations like variable frequency drives (VFDs), magnetic drive pumps, and advanced sealing technologies are offering greater reliability and longer service life, which are essential for the growing industrial demands in the region.

Water and Wastewater Treatment Expansion

The growing demand for clean water and the need for effective wastewater treatment are significant factors driving the industrial pumps market in Asia Pacific. With rapid urbanization, increased population density, and the rising effects of climate change, the need for efficient water management systems is intensifying. Governments and private entities are investing in advanced water treatment plants to ensure sustainable water supply and waste management. For instance, China has invested heavily in water conservation projects, aiming to increase its treatment capacity to 200 million cubic meters per day by 2023. Industrial pumps are integral to these systems, as they are used for transporting water and chemicals during filtration, disinfection, and distribution processes. Additionally, the need for efficient pumps in desalination plants, especially in coastal regions, is further increasing market demand, as countries seek to secure alternative water sources.

Expansion of the Food and Beverage Industry

The food and beverage industry in Asia Pacific is witnessing substantial growth due to rising disposable incomes, changing dietary habits, and increased demand for processed food products. This growth is directly influencing the demand for industrial pumps designed for hygienic and sanitary applications. Pumps used in food and beverage manufacturing processes must meet stringent health and safety standards to avoid contamination. As the industry continues to expand, there is an increasing need for pumps that can efficiently handle liquids, such as milk, juices, sauces, and oils, while maintaining high levels of hygiene and minimizing product loss. The growth of this sector is a key contributor to the expanding market for industrial pumps in the region.

Market Trends:

Integration of Smart Technologies

The Asia Pacific industrial pumps market is witnessing a significant shift towards the integration of smart technologies, enhancing operational efficiency and reliability. The adoption of Internet of Things (IoT)-enabled pumps allows for real-time monitoring, predictive maintenance, and improved energy management. These advancements facilitate proactive decision-making, reduce downtime, and optimize pump performance across various industrial applications. As a result, industries are increasingly focusing on automating their processes to improve operational visibility and control, making smart pumps a valuable investment for future growth.

Focus on Energy Efficiency

With rising energy costs and environmental concerns, there is a heightened emphasis on energy-efficient pumping solutions in the region. Industries are increasingly adopting pumps equipped with variable frequency drives (VFDs) and high-efficiency motors to minimize energy consumption and reduce carbon footprints. For example, manufacturers like Ebara Corporation are developing advanced pump technologies that align with sustainability goals by reducing carbon footprints and operational costs. This trend aligns with global sustainability goals and regulatory pressures, driving the demand for pumps that deliver optimal performance with lower energy inputs. Furthermore, these energy-efficient pumps contribute to long-term cost savings, which is a key factor for industries aiming to improve profitability while meeting stringent environmental standards.

Expansion in Water and Wastewater Treatment

The growing need for effective water and wastewater management systems is propelling the demand for industrial pumps in the Asia Pacific region. Rapid urbanization and industrialization have heightened the necessity for reliable water supply and wastewater treatment facilities. Governments and private entities are investing in advanced pumping solutions to address these challenges, ensuring sustainable water management and compliance with environmental standards. With increasing urban populations and the necessity to meet clean water standards, the market for water and wastewater pumps is expected to grow significantly, offering opportunities for innovation and investment.

Technological Innovations in Pump Design

Continuous innovations in pump design are leading to the development of more compact, efficient, and reliable pumps. Advancements such as the use of computational fluid dynamics (CFD) and 3D printing technologies enable manufacturers to create customized pump solutions tailored to specific industrial requirements. For example, PumpTech has leveraged IoT integration to develop smart pumping systems that offer predictive maintenance and operational flexibility. These technological developments enhance performance, reduce maintenance costs, and extend the operational lifespan of pumps, contributing to overall industrial efficiency. As industries demand increasingly sophisticated solutions, these innovations will continue to redefine pump technology and open new avenues for market growth.

Market Challenges Analysis:

High Initial Costs

One of the key restraints in the Asia Pacific industrial pumps market is the high initial cost associated with the procurement and installation of advanced pumping systems. For instance, small and medium-sized enterprises (SMEs) often find it challenging to invest in these systems due to tight budget constraints. While energy-efficient and technologically advanced pumps provide long-term benefits, the upfront capital investment can be prohibitive for small and medium-sized enterprises (SMEs). This financial barrier limits the widespread adoption of high-performance pumps, particularly in cost-sensitive industries or regions with limited budgets. As a result, businesses often opt for less efficient alternatives, which may hinder the overall market growth.

Maintenance and Operational Costs

Another challenge faced by the industrial pumps market in the Asia Pacific region is the ongoing maintenance and operational costs. Pumps, especially those in heavy industrial applications, require regular maintenance to ensure optimal performance and prevent downtime. The cost of spare parts, repair services, and operational adjustments can be significant, particularly for older models. Moreover, industries operating in remote areas may face logistical challenges in accessing specialized services and replacement parts. This can lead to extended downtimes and additional expenses, creating resistance to the adoption of new pumping technologies in some sectors.

Stringent Regulatory and Environmental Standards

The growing complexity of regulatory frameworks and environmental standards in the Asia Pacific region poses another challenge for the industrial pumps market. Countries are tightening regulations on water and air quality, energy consumption, and waste management. While this drives demand for more advanced and sustainable pumping solutions, it also increases the compliance burden for manufacturers. Meeting these stringent standards often requires significant investment in research and development to innovate pumps that meet evolving environmental and operational regulations. For manufacturers, this adds to the operational complexity and can delay product deployment in certain markets.

Market Opportunities:

The Asia Pacific industrial pumps market presents substantial opportunities driven by the region’s rapid industrial growth and infrastructure development. With major economies like China and India investing heavily in industrial sectors such as oil and gas, chemical processing, and manufacturing, the demand for advanced pumping solutions is expected to rise significantly. Additionally, the growing emphasis on energy efficiency and sustainability offers market players the opportunity to develop innovative pumps with enhanced performance, lower energy consumption, and longer lifespans. As industries continue to focus on cost-effective solutions while adhering to environmental regulations, there is a strong potential for the adoption of high-efficiency, IoT-enabled pumps that provide real-time monitoring, predictive maintenance, and energy management.

Moreover, the increasing need for water and wastewater treatment systems in urban and industrial areas provides a robust opportunity for the industrial pumps market. With urbanization accelerating across Asia Pacific, governments and private entities are prioritizing investments in infrastructure projects aimed at improving water supply, waste management, and pollution control. These efforts are creating a significant demand for reliable and efficient pumping systems. The growing focus on smart technologies, such as pumps integrated with variable frequency drives (VFDs) and advanced sealing systems, further expands the opportunities for innovation. Market players can capitalize on these trends by developing next-generation pumping solutions that meet the evolving needs of the region’s rapidly expanding industrial and urban landscapes.

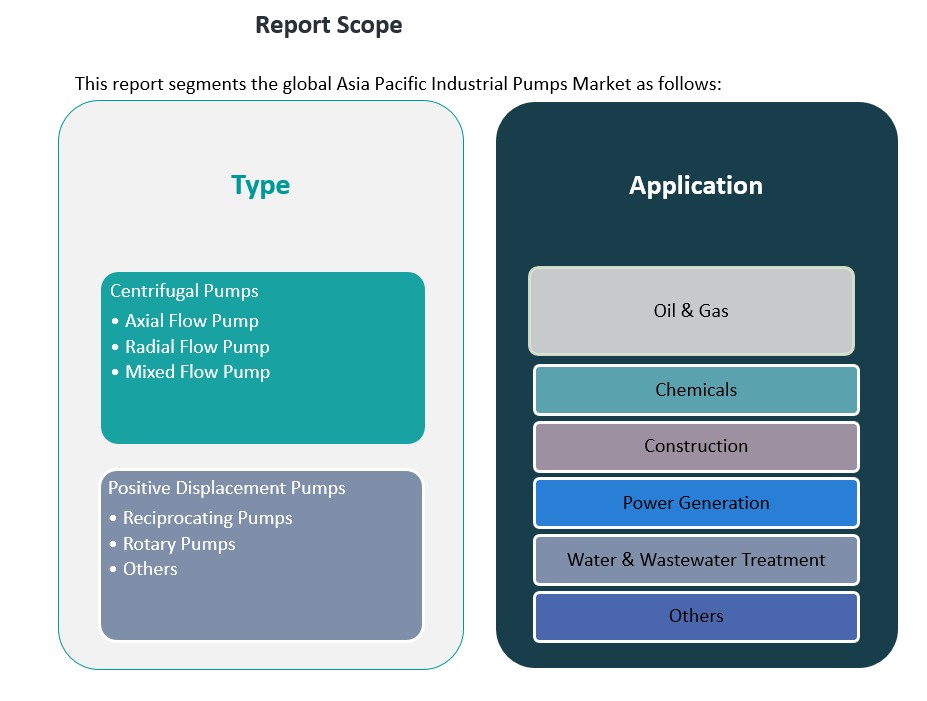

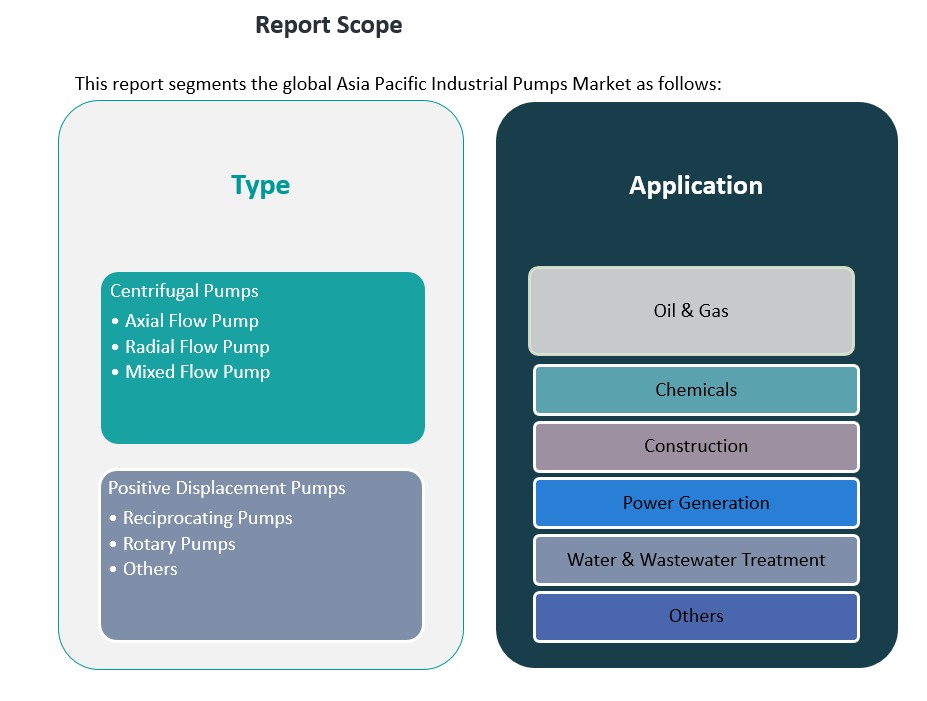

Market Segmentation Analysis:

The Asia Pacific industrial pumps market is segmented into two primary categories: product type and application. Each segment contributes significantly to the overall market growth and is shaped by the specific needs of various industries.

By Product Type, the market is divided into centrifugal and positive displacement pumps. Centrifugal pumps are the most widely used, particularly in applications requiring high flow rates. These pumps are further subdivided into axial flow pumps, radial flow pumps, and mixed flow pumps, each suited for different fluid handling tasks. Axial flow pumps are ideal for applications with high flow rates and low head, while radial flow pumps provide high pressure and moderate flow. Mixed flow pumps offer a combination of the features of both axial and radial types, making them versatile for various applications. Positive displacement pumps, including reciprocating and rotary pumps, are favored in applications requiring precise flow control and high pressure. Reciprocating pumps are typically used in high-pressure applications, while rotary pumps are used for continuous flow processes.

By Application, the market is segmented into oil & gas, chemicals, power generation, water & wastewater treatment, and others. The oil and gas industry remains a major driver for industrial pumps due to the need for fluid handling in extraction, transportation, and refining processes. The chemicals industry also contributes significantly, driven by the need for efficient pumping systems in the production and processing of chemicals. The construction sector relies heavily on pumps for dewatering, concrete mixing, and other fluid handling tasks. Water and wastewater treatment applications drive substantial demand for pumps, as efficient fluid distribution and filtration are essential for sustainable water management. Power generation requires reliable pumps for cooling, water supply, and waste management. The water and wastewater treatment segment continues to expand with increasing urbanization and investments in infrastructure development across the region. Other applications include the food and beverage, mining, and pharmaceutical industries, each requiring specific pumping solutions for their operational needs.

Segmentation:

By Product Type:

- Centrifugal Pumps

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pumps

- Reciprocating Pumps

- Rotary Pumps

- Others

By Application:

- Oil & Gas

- Chemicals

- Construction

- Power Generation

- Water & Wastewater Treatment

- Others

Regional Analysis:

The Asia Pacific region is a significant driver of growth in the global industrial pumps market due to its rapid industrialization, infrastructure development, and urbanization. The region is diverse, with varying industrial needs across countries, which influences market dynamics. The market share for different sub-regions within Asia Pacific varies significantly, with key players focusing on expanding their reach to capture growth in emerging economies.

China and India dominate the industrial pumps market in Asia Pacific, accounting for a large portion of the market share due to their expansive industrial bases and large-scale infrastructure projects. China’s industrial sectors, including oil and gas, manufacturing, and chemicals, continue to be major contributors to the demand for industrial pumps. With ongoing initiatives in water treatment and power generation, China holds a market share of approximately 40%. India follows closely, with its growing manufacturing and water infrastructure sectors, contributing to around 25% of the regional market share. The country’s rapid urbanization and industrial growth drive the need for advanced pumping solutions, particularly in wastewater treatment and irrigation systems.

Southeast Asia is another critical region, with countries such as Indonesia, Thailand, and Vietnam seeing increasing demand for industrial pumps due to their focus on infrastructure and industrialization. Southeast Asia’s industrial pumps market accounts for about 15% of the regional share. This demand is largely driven by the energy, water treatment, and food and beverage industries. Investments in water management and manufacturing expansion are expected to continue spurring growth in the coming years.

Australia and Japan are more developed markets, accounting for approximately 10% and 7% of the regional share, respectively. In Australia, the demand for industrial pumps is driven by the mining, agriculture, and water treatment industries. Japan, with its advanced manufacturing technology and stringent environmental regulations, focuses on energy-efficient and technologically advanced pumps. Both markets are expected to see steady growth, though at a slower pace compared to the emerging economies of China and India.

Key Player Analysis:

- Tsurumi Manufacturing Co., Ltd.

- KBL (Kirloskar Brothers Limited)

- Ebara Precision Machinery

- Sulzer Ltd

- Schneider Electric

Competitive Analysis:

The Asia Pacific industrial pumps market is highly competitive, with numerous global and regional players vying for market share. Leading companies such as Flowserve Corporation, ITT Inc., Sulzer Ltd., and Grundfos are major players, offering a wide range of industrial pumps tailored to various sectors including oil and gas, water treatment, and chemicals. These companies are focusing on product innovation, such as the integration of smart technologies and energy-efficient systems, to meet growing demand for sustainable solutions. Regional players, such as Kirloskar Brothers Limited and KSB Pumps, are also strengthening their market presence by offering localized products and services. Strategic partnerships, mergers, and acquisitions are common in the industry as companies aim to expand their geographical reach and improve their technological capabilities. The competitive landscape is further influenced by the increasing demand for customized pumping solutions, presenting opportunities for companies to differentiate through innovation, efficiency, and customer service.

Recent Developments:

- In January 2022, Sulzer expanded its clean water pump portfolio by launching the SES and SKS ranges. These new EN733 standard pumps are designed for municipalities, water treatment facilities, and commercial and irrigation applications. The pumps feature a robust cast iron casing with options for cast iron, stainless steel, or bronze impellers, and are supplied as complete packages including motors.

- In Tsurumi Manufacturing Co., Ltd., the company completed the acquisition of Zenit International SpA on July 2, 2024. This strategic move is expected to strengthen Tsurumi’s portfolio in submersible pumps and related equipment, enhancing its presence in the global market.

- In Kirloskar Brothers Limited (KBL), the company launched two advanced borewell submersible pumps, KU7P and LEHR, on March 11, 2025. These products are designed for superior performance and energy efficiency, catering to diverse industrial and agricultural needs.

Market Concentration & Characteristics:

The Asia Pacific industrial pumps market is characterized by a moderate level of concentration, with several key players dominating the landscape. Leading companies such as Grundfos Holding A/S, Flowserve Corporation, Sulzer Ltd., and Ebara Corporation significantly influence market dynamics through their extensive product portfolios and regional presence. These major players continually invest in technological advancements, offering energy-efficient and smart pumping solutions to meet the evolving demands of industries like oil and gas, water and wastewater treatment, chemicals, and power generation. Their focus on innovation and customer-centric solutions contributes to their substantial market shares. In addition to global corporations, regional companies such as Kirloskar Brothers Limited play a vital role in addressing local market needs. This blend of global expertise and regional understanding fosters a competitive environment that drives continuous improvement and diversification of industrial pump offerings across the Asia Pacific region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Asia Pacific industrial pumps market is expected to maintain a strong growth trajectory, driven by ongoing industrialization and urbanization.

- Technological innovations such as IoT-enabled pumps and energy-efficient systems will play a key role in enhancing market competitiveness.

- Increasing investments in water and wastewater treatment infrastructure will drive substantial demand for industrial pumps across the region.

- The chemical and petrochemical industries will remain significant contributors to market growth due to the rising demand for fluid handling systems.

- The growing focus on sustainability and compliance with environmental regulations will encourage the adoption of green and energy-efficient pumping solutions.

- Southeast Asia will emerge as a fast-growing market due to rapid industrial expansion and infrastructure development in countries like Indonesia and Vietnam.

- The adoption of smart pumps with real-time monitoring and predictive maintenance features will enhance operational efficiency across various industries.

- The rising demand for pumps in the food and beverage industry will create new growth opportunities, particularly for hygienic and sanitary pumps.

- Competitive pressure will intensify, leading to strategic mergers, acquisitions, and partnerships among market players.

- Advances in manufacturing technologies, including 3D printing, will enable the development of customized pumping solutions tailored to specific industrial needs.