Market Overview:

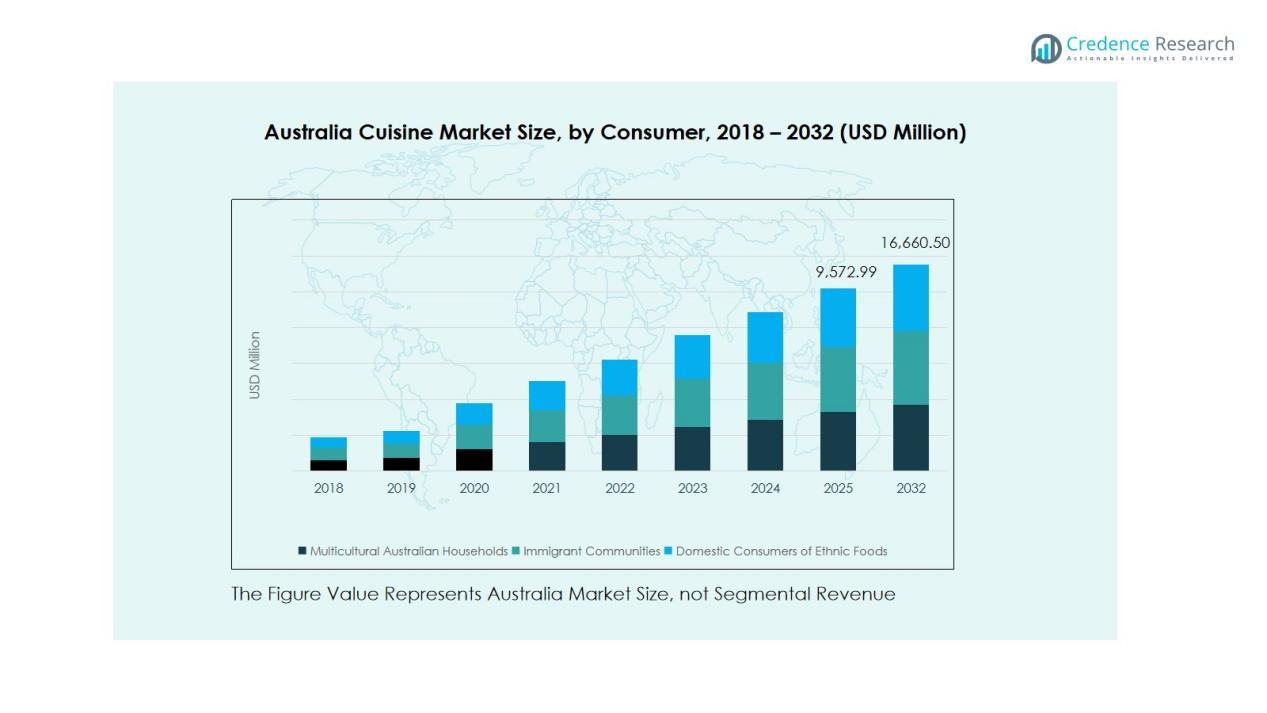

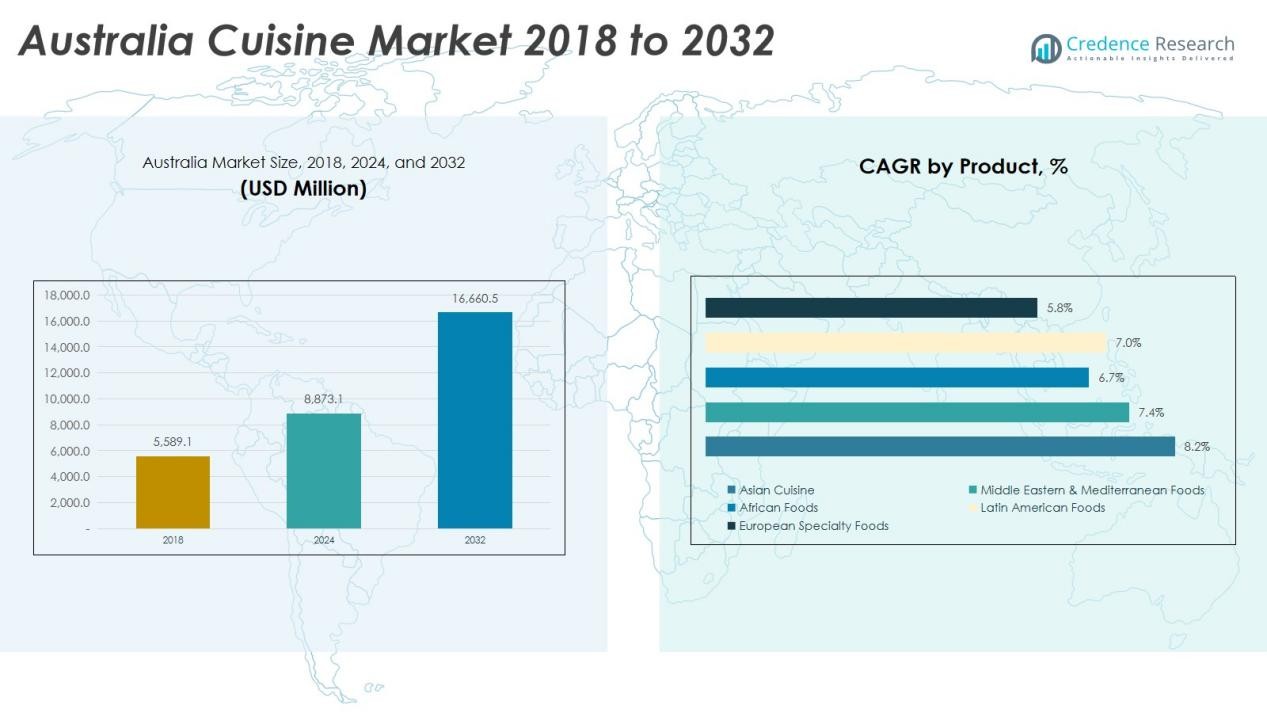

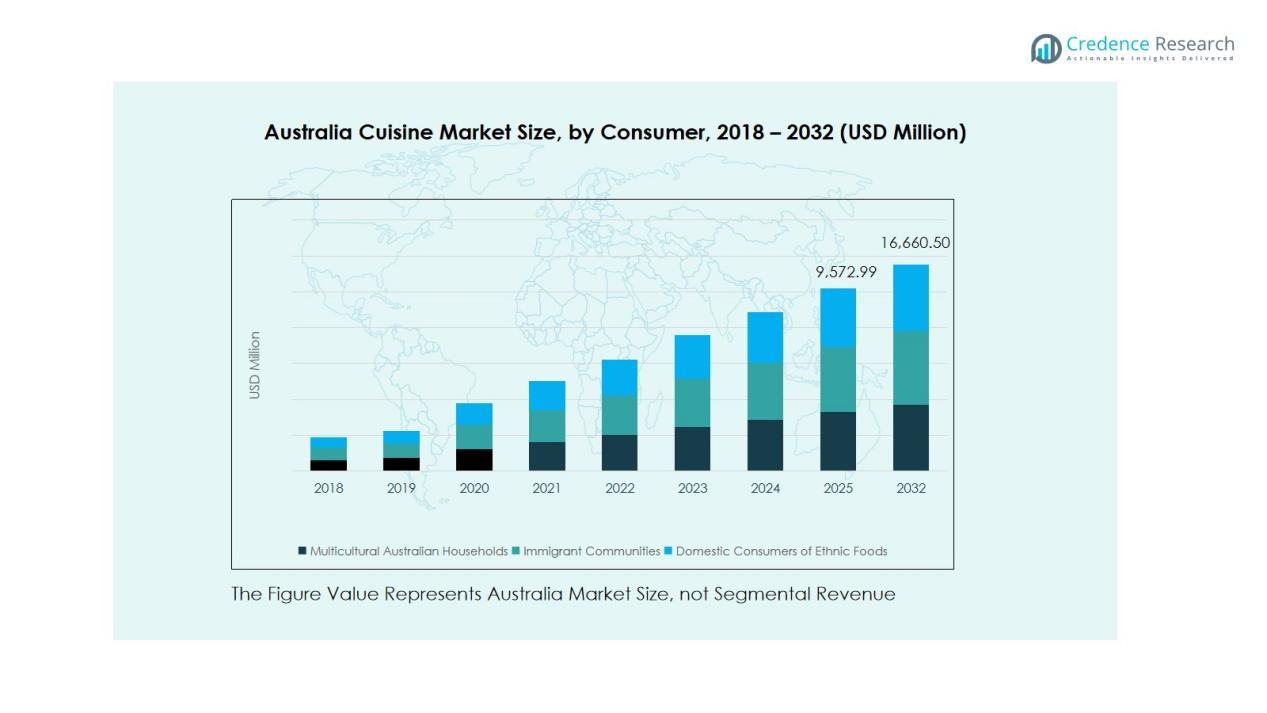

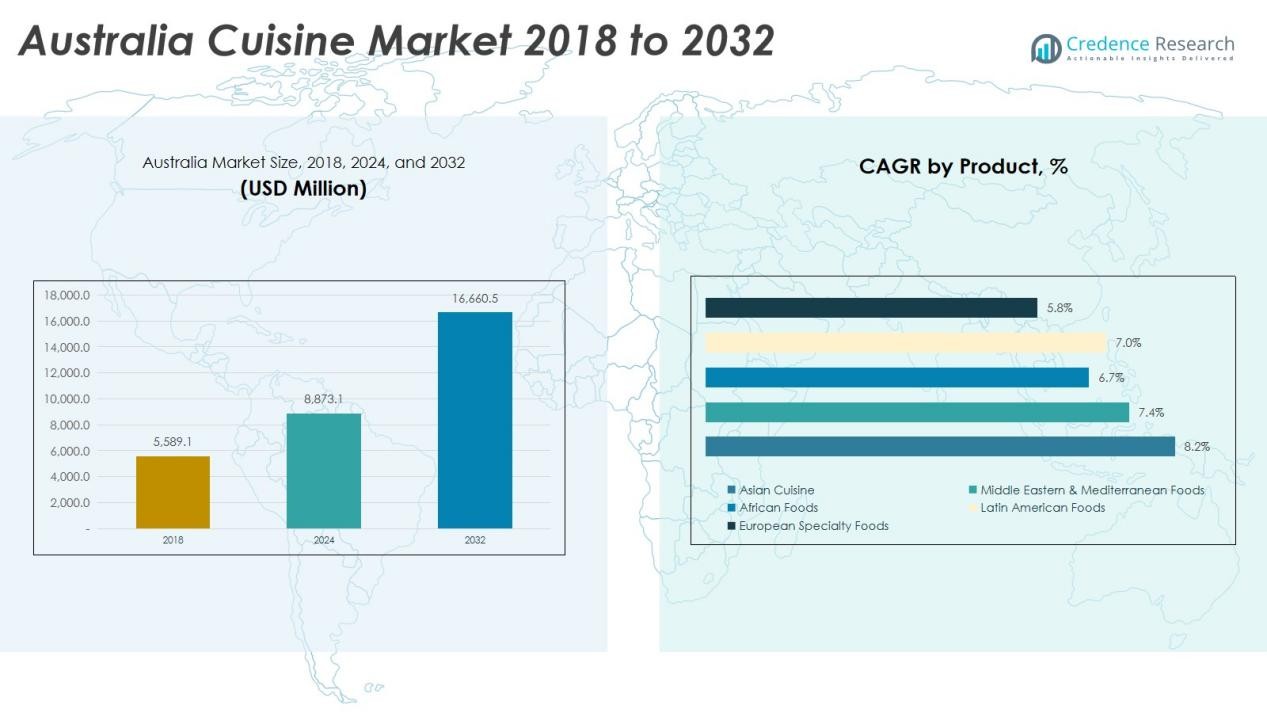

The Australia Cuisine Market size was valued at USD 5,589.1 million in 2018 to USD 8,873.1 million in 2024 and is anticipated to reach USD 16,660.5 million by 2032, at a CAGR of 8.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Cuisine Market Size 2024 |

USD 8,873.1 Million |

| Australia Cuisine Market, CAGR |

8.24% |

| Australia Cuisine Market Size 2032 |

USD 16,660.5 Million |

Key drivers fueling the cuisine market in Australia include rising disposable incomes and a shift towards convenience-led dining formats such as cafés, quick service restaurants, and home delivery. Furthermore, evolving consumer preferences for multicultural flavours and healthy, plant-based options are pushing operators to innovate menus and adopt digital ordering channels. The strong rebound in tourism and domestic travel following global disruptions further amplifies demand for varied dining experiences.

From a regional perspective, metropolitan hubs such as Sydney, Melbourne, and Brisbane dominate the market due to dense population clusters, high consumer spending power, and vibrant food culture. Tourism-driven coastal regions and holiday destinations also present growth opportunities, with hospitality venues catering to both local and international visitors. Rural and regional segments, while smaller, are increasingly integrating diverse cuisine outlets and delivery-based services, narrowing the urban-regional gap.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia Cuisine Market was valued at USD 5,589.1 million in 2018, reached USD 8,873.1 million in 2024, and is projected to hit USD 16,660.5 million by 2032, growing at a CAGR of 8.24%.

- Sydney, Melbourne, and Brisbane collectively account for over 60% of the national market share due to dense populations, strong multicultural influence, and high consumer spending power.

- Coastal regions such as Perth, Adelaide, and the Gold Coast hold around 25% of the market, supported by tourism-driven demand and diverse dining formats.

- Regional and rural areas represent roughly 15% of the market and are the fastest-growing, driven by digital delivery expansion and increasing local entrepreneurship.

- By segment, Asian cuisine leads with nearly 40% market share, followed by Middle Eastern and Mediterranean foods at around 20%, supported by rising preference for global flavors and healthy meal options.

Market Drivers:

Rising Disposable Income and Expanding Dining Culture

The Australia Cuisine Market is driven by higher household incomes and a growing preference for dining out. Consumers are allocating more of their budgets to casual and premium dining experiences. It reflects a lifestyle shift where food is tied to social engagement and recreation. The increasing penetration of restaurants, cafés, and gourmet outlets in urban centers supports this upward trend. Tourism also boosts local cuisine spending, especially in metropolitan and coastal areas.

- For Instance, Guzman y Gomez aimed for a total of 32 new restaurant openings across all of Australia for the financial year 2026 (FY26), with at least two planned for Sydney metropolitan areas (Mona Vale and Carlingford) in late 2025. This expansion added to its total national store count of over 250 locations worldwide by late 2025, with 76 of those stores located in New South Wales as of August 2025.

Growing Influence of Multiculturalism and Culinary Diversity

Australia’s diverse population shapes the country’s food landscape through multicultural influences. The demand for global flavors such as Asian fusion, Mediterranean, and Latin American cuisines has expanded rapidly. It allows restaurants to cater to a wider audience while introducing authentic dishes. Local chefs blend international techniques with regional ingredients to create unique offerings. This cultural variety strengthens the country’s reputation for culinary innovation.

- For instance, Light Years expanded from Byron Bay to establish its fifth location in Perth in April 2025, bringing modern Asian dining across 5 coastal cities. Local chefs blend international techniques with regional ingredients to create unique offerings.

Shift Toward Health-Conscious and Sustainable Food Choices

Health awareness and sustainability trends continue to redefine food preferences across Australia. Consumers increasingly choose organic produce, low-fat meals, and plant-based options. It encourages restaurants and food producers to modify menus and sourcing strategies. The rise in vegan and vegetarian offerings highlights this transformation. Brands adopting transparent labeling and ethical sourcing gain strong consumer loyalty.

Digital Transformation and Convenience-Driven Consumption

Technology adoption across the food industry enhances customer accessibility and satisfaction. Online delivery platforms, mobile apps, and digital payments are now standard in urban dining. It helps restaurants reach a wider audience and streamline operations. Data analytics enables menu optimization based on customer behavior. The convenience of doorstep delivery and real-time tracking reinforces the market’s competitive edge.

Market Trends:

Integration of Technology and Personalization in Dining Experiences

Digital technology continues to reshape the Australia Cuisine Market through enhanced customer engagement and operational efficiency. Restaurants increasingly use data analytics and AI to personalize menus, recommend dishes, and manage inventory. It supports faster decision-making and reduces food waste across outlets. Contactless ordering, digital kiosks, and loyalty apps create a seamless dining journey for consumers. Cloud kitchens and virtual brands also gain traction by lowering overhead costs and increasing delivery coverage. The expansion of delivery aggregators and online reservations has made convenience a key competitive factor. Tech-enabled experiences are becoming standard expectations among urban consumers.

- For instance, Uber Eats expanded throughout 2025 into 67 new regional locations across Australia, bringing services to over 100 regional towns and enabling restaurants in these newly launched locations to generate nearly $45 million in additional revenue while contributing $19 million to Gross Domestic Product.

Emphasis on Sustainability, Local Sourcing, and Ethical Consumption

Consumers are placing stronger value on sustainability and traceability within the food ecosystem. Restaurants are adopting locally sourced ingredients, eco-friendly packaging, and reduced-waste kitchen practices. It reflects a conscious effort to align operations with environmental and social priorities. The growing interest in farm-to-table concepts and indigenous ingredients highlights a shift toward authenticity and regional pride. Plant-based menus and alternative proteins also illustrate how ethical awareness is reshaping menu design. Tourism operators and chefs are collaborating to promote Australian produce and native flavors globally. Sustainability has evolved from a niche preference into a mainstream business imperative driving long-term growth.

- For instance, v2food launched the Plant Based Whopper with Hungry Jack’s across over 400 Australian locations, with the patty developed in collaboration with CSIRO to replicate meat texture using plant proteins including soybeans, pea protein, and coconut fat.

Market Challenges Analysis:

Market Challenges Analysis:

Rising Operational Costs and Workforce Shortages

The Australia Cuisine Market faces persistent challenges from rising operational expenses and labor shortages. High rental rates, energy costs, and ingredient price volatility pressure profit margins for small and medium establishments. It forces operators to streamline menus and adopt automation to maintain efficiency. The shortage of skilled chefs and hospitality staff has intensified competition for talent, increasing wage levels. Seasonal demand fluctuations also strain staffing consistency across regions. These factors collectively limit expansion for independent and emerging culinary businesses.

Regulatory Complexity and Supply Chain Disruptions

Strict food safety regulations and varying state compliance requirements create operational hurdles for market participants. It requires continuous monitoring of hygiene, labeling, and sourcing standards, adding administrative costs. Import restrictions and transportation bottlenecks disrupt ingredient availability, particularly for specialty and international cuisines. Global supply chain instability increases dependency on domestic production and raises inventory risks. Changing consumer expectations for transparency and sustainability further complicate compliance strategies. Businesses must balance regulatory obligations with profitability to sustain long-term operations.

Market Opportunities:

Expansion of Premium and Experiential Dining Segments

The Australia Cuisine Market holds strong opportunities in premium, experiential, and themed dining formats. Rising consumer interest in high-quality, locally inspired menus supports the growth of fine dining and boutique restaurants. It allows operators to differentiate through culinary storytelling and sensory presentation. Tourism growth and event-based dining experiences create new venues for local chefs to showcase innovation. Luxury hotels and resorts continue to invest in signature restaurants and chef collaborations. The emphasis on craftsmanship and local ingredients strengthens the connection between culture and cuisine.

Growth of Digital Delivery and Regional Penetration

The rapid adoption of digital ordering platforms continues to expand market access beyond major cities. It helps small and mid-sized operators reach new customer bases in regional towns. Demand for convenient, high-quality meal delivery creates scope for cloud kitchens and hybrid models. Partnerships between technology firms and foodservice operators improve service speed and reliability. Regional tourism and migration trends also encourage diversification in local cuisine options. The focus on accessibility and digital transformation ensures scalable growth opportunities for new entrants and established brands alike.

Market Segmentation Analysis:

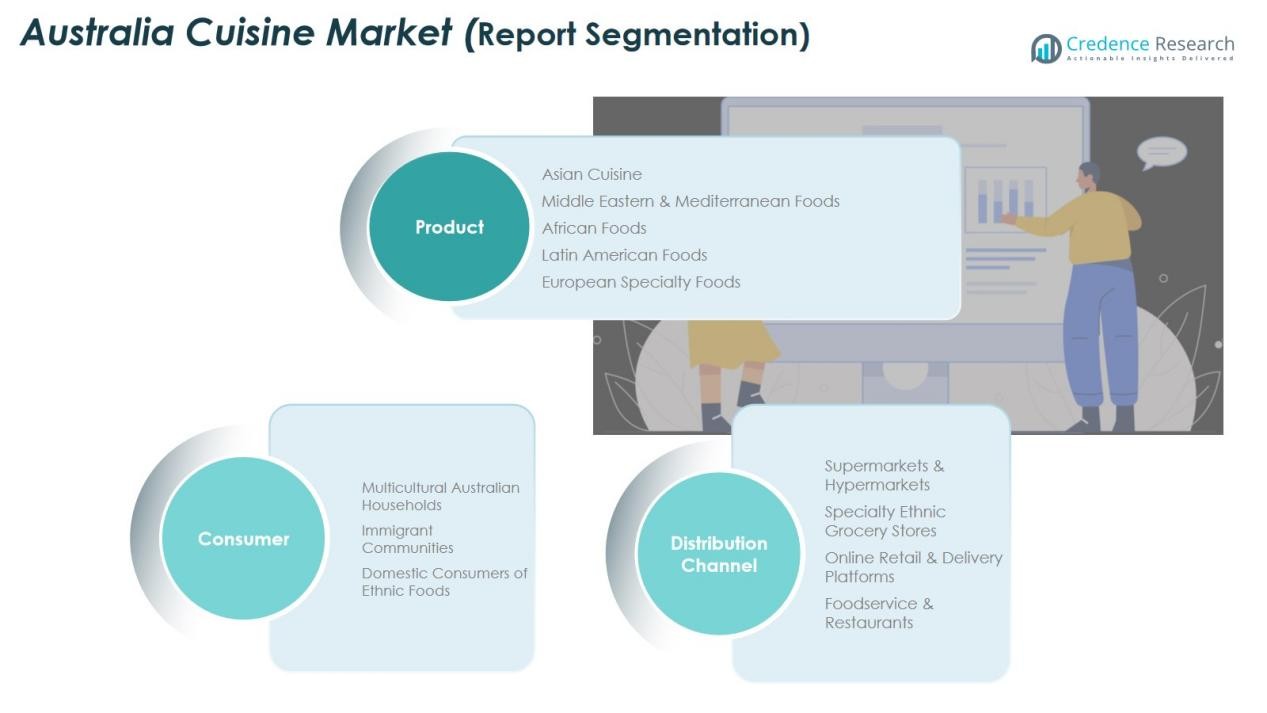

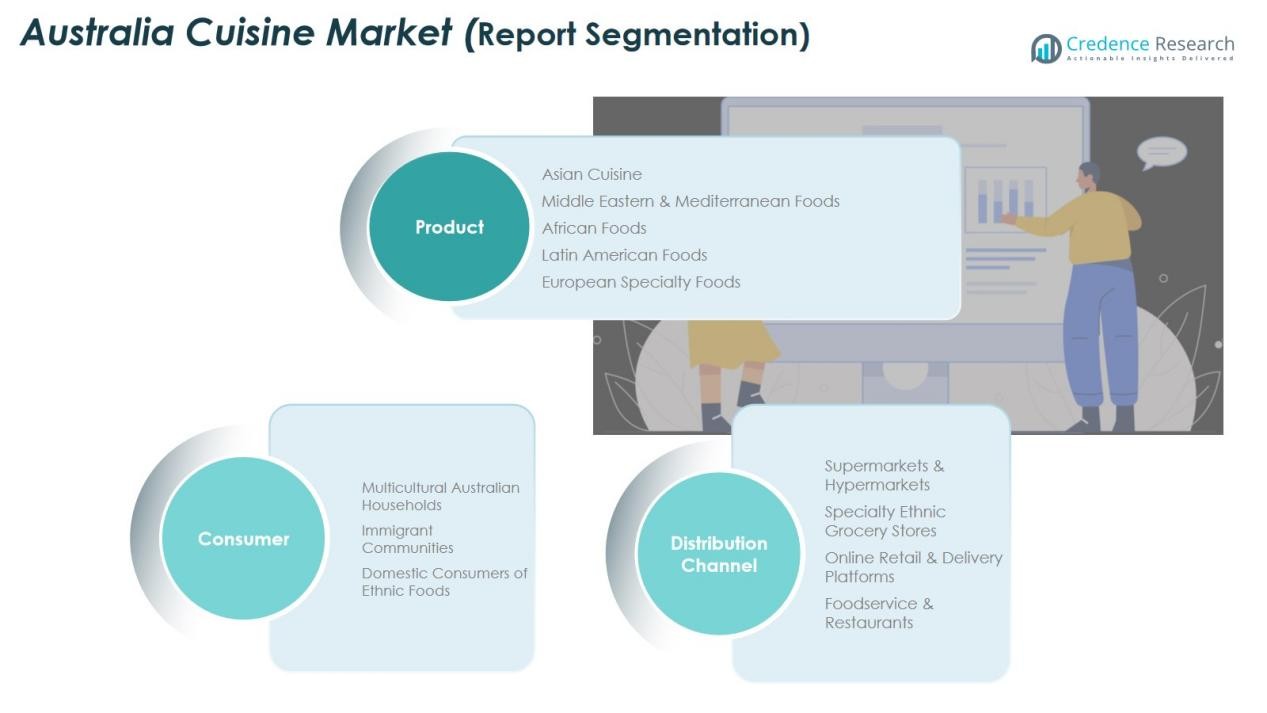

By Product Segment

The Australia Cuisine Market features a wide product spectrum covering Asian, Middle Eastern & Mediterranean, African, Latin American, and European specialty foods. Asian cuisine leads the market, supported by the popularity of Chinese, Japanese, Thai, and Indian dishes in both retail and foodservice outlets. It benefits from growing multiculturalism and the accessibility of ready-to-eat and frozen meal options. Middle Eastern and Mediterranean foods, including hummus, falafel, and pita-based products, gain traction for their perceived health benefits. European and Latin American specialties appeal to consumers seeking authenticity and gourmet dining experiences. African foods remain a niche segment but are expanding through restaurant menus and specialty stores.

- For instance, Woolworths offers a “Crispy Chicken Katsu Curry With Rice 800g” ready meal in its stores, which has been available since at least August 2024 and likely much earlier.

By Consumer Segment

The consumer base is diverse, driven by multicultural Australian households, immigrant communities, and domestic consumers of ethnic foods. Multicultural households sustain continuous demand for imported and traditional ingredients. It encourages retailers to expand product ranges catering to regional preferences. Immigrant communities promote cultural exchange, introducing diverse cooking styles and cuisines. Domestic consumers increasingly experiment with ethnic flavors, reflecting curiosity and openness to global culinary trends.

- For instance, Thai Kee IGA Supermarket in Sydney’s Chinatown expanded its specialty Asian food selection to over 10,000 products, serving multicultural communities and international students since establishing its current location in 1992

By Distribution Channel Segment

Supermarkets and hypermarkets dominate distribution through extensive networks and private-label ethnic ranges. It enables easy access to global cuisines under one roof. Specialty ethnic grocery stores maintain strong brand loyalty among immigrants and regional food enthusiasts. Online retail and delivery platforms continue to expand, driven by digital adoption and convenience. Foodservice and restaurants contribute significantly through dine-in and takeaway offerings, fostering experiential engagement with international cuisines.

Segmentations:

By Product Segment

- Asian Cuisine

- Middle Eastern & Mediterranean Foods

- African Foods

- Latin American Foods

- European Specialty Foods

By Consumer Segment

- Multicultural Australian Households

- Immigrant Communities

- Domestic Consumers of Ethnic Foods

By Distribution Channel Segment

- Supermarkets & Hypermarkets

- Specialty Ethnic Grocery Stores

- Online Retail & Delivery Platforms

- Foodservice & Restaurants

Regional Analysis:

Dominance of Major Metropolitan Regions

Sydney, Melbourne, and Brisbane lead the Australia Cuisine Market, driven by high population density and diverse cultural demographics. These cities offer a wide mix of fine dining, quick service, and multicultural restaurants catering to varied tastes. It reflects strong consumer spending power and openness to international culinary trends. The presence of immigrant communities fosters demand for authentic ethnic foods and specialty ingredients. Urban consumers increasingly prefer premium dining experiences and fusion cuisine that blends global flavors with local produce. The concentration of international chains and local innovators further strengthens the metropolitan market landscape.

Expansion Across Tourism-Driven and Coastal Areas

Coastal cities such as Perth, Adelaide, and the Gold Coast display rapid growth in cuisine diversity and restaurant density. Tourism plays a vital role in shaping menu offerings and seasonal demand. It encourages restaurants and hotels to emphasize fresh seafood, regional wines, and Australian fusion dishes. Local entrepreneurs are investing in pop-up dining and themed events to attract both residents and visitors. The rise of food festivals and culinary tourism supports brand visibility for emerging foodservice operators. Sustainable sourcing and farm-to-table dining continue to enhance regional appeal.

Emergence of Regional and Rural Food Hubs

Smaller cities and rural areas are gradually integrating diverse cuisine options supported by digital access and local entrepreneurship. It creates opportunities for growth in regional food production and distribution networks. Regional consumers are showing greater interest in authentic international flavors, supported by expanding retail access. Delivery platforms and online grocery services bridge the urban-rural supply gap. Local producers collaborate with ethnic retailers to introduce hybrid culinary concepts. The spread of multicultural dining culture highlights the growing inclusivity of Australia’s regional food economy.

Key Player Analysis:

- Woolworths Group

- Coles Group

- ALDI Australia

- Costco Australia

- Harris Farm Markets

- Merivale

- IGA Australia

- Metcash

- Drakes Supermarkets (The Little Kitchen)

Competitive Analysis:

The Australia Cuisine Market is highly competitive, featuring established retail and foodservice players that influence pricing, product variety, and regional accessibility. Major companies include Woolworths Group, Coles Group, ALDI Australia, Costco Australia, Harris Farm Markets, Merivale, IGA Australia, and Metcash. Each company operates across diverse formats ranging from supermarkets and specialty stores to hospitality venues. It reflects a strong balance between mass-market distribution and premium dining experiences. Retail giants focus on expanding ethnic food ranges and private labels to meet rising multicultural demand. Hospitality groups such as Merivale emphasize experiential dining and premium service innovation. Smaller regional operators and specialty importers compete through niche offerings and localized sourcing. Continuous investment in digital platforms, sustainability, and menu innovation drives competitiveness and customer retention across the market.

Recent Developments:

- In November 2025, ALDI Australia expanded its ALDI Solar package via a partnership with energy provider Tempo, offering installations in New South Wales, Queensland, Victoria, and the ACT from early November 2025.

- In October 2025, Costco Australia announced a major expansion with the confirmation of a new store to be constructed at Alkimos Central Home X Trade Hub in Perth, Western Australia, with construction set to begin in late 2025 and the opening expected in 2027.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Segment, Consumer Segment and Distribution Channel Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Australia Cuisine Market will continue to evolve through rising multicultural influences and diverse consumer tastes.

- Demand for authentic global cuisines will expand across both metropolitan and regional areas.

- It will experience growing investment in digital food delivery platforms and cloud kitchens.

- Sustainability and ethical sourcing will remain central to purchasing decisions and brand strategies.

- Restaurants and retailers will focus on local ingredients and seasonal produce to enhance authenticity.

- Premium dining and experiential food concepts will attract younger, urban consumers seeking novelty.

- It will witness deeper integration of technology such as AI-driven menu personalization and automated operations.

- Health-conscious dining will shape menu innovation, promoting plant-based and low-sodium meal options.

- Tourism recovery will boost the demand for fusion cuisine and international food events.

- Collaborations between chefs, producers, and delivery aggregators will redefine food accessibility and customer experience.

Market Challenges Analysis:

Market Challenges Analysis: