Market Overview

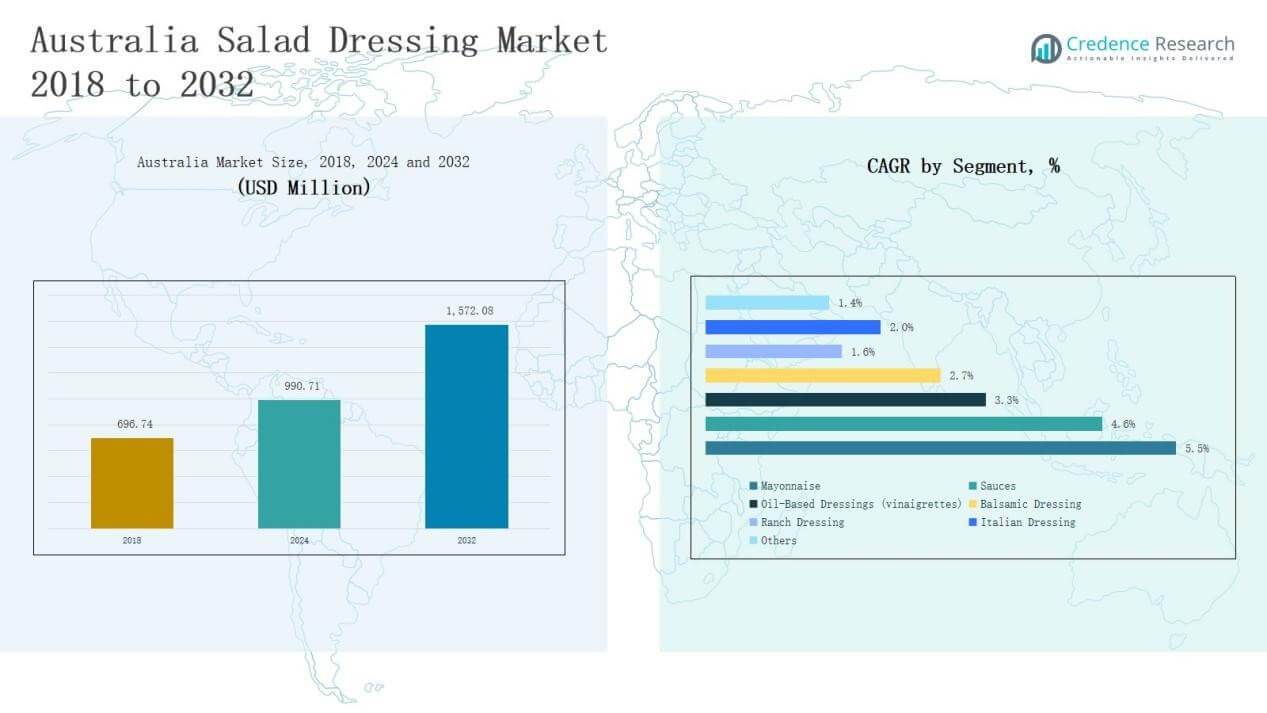

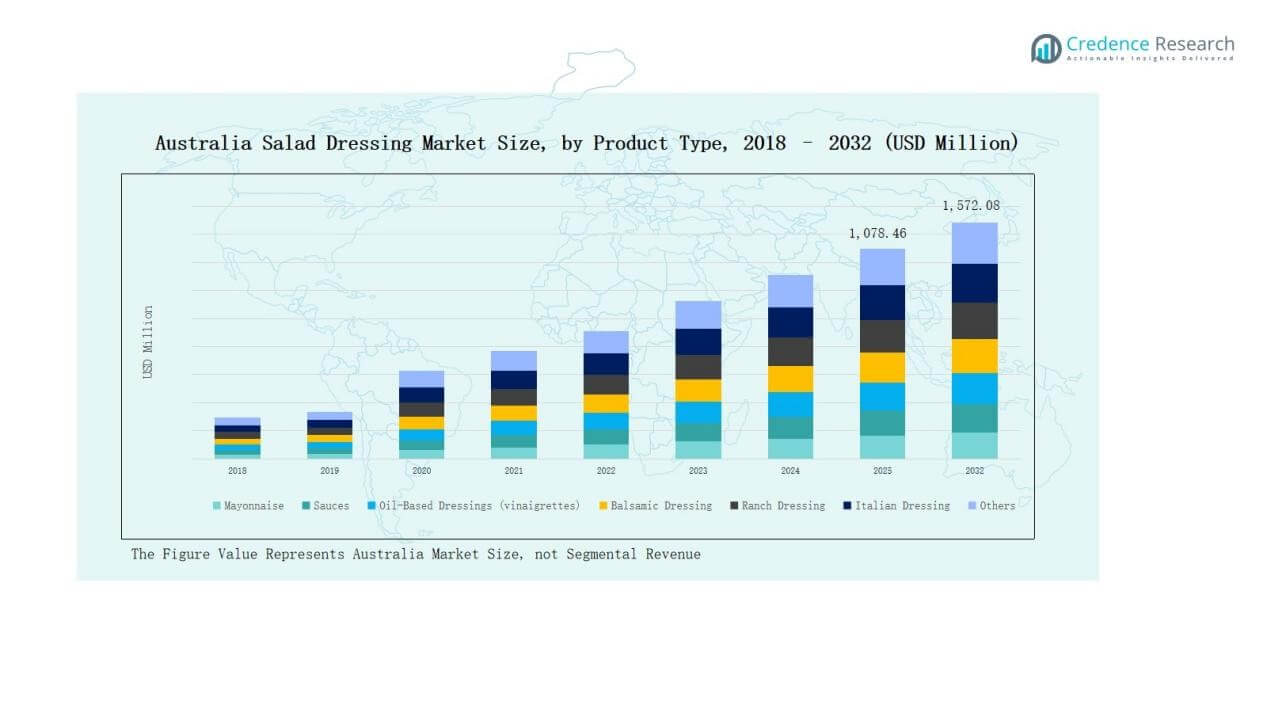

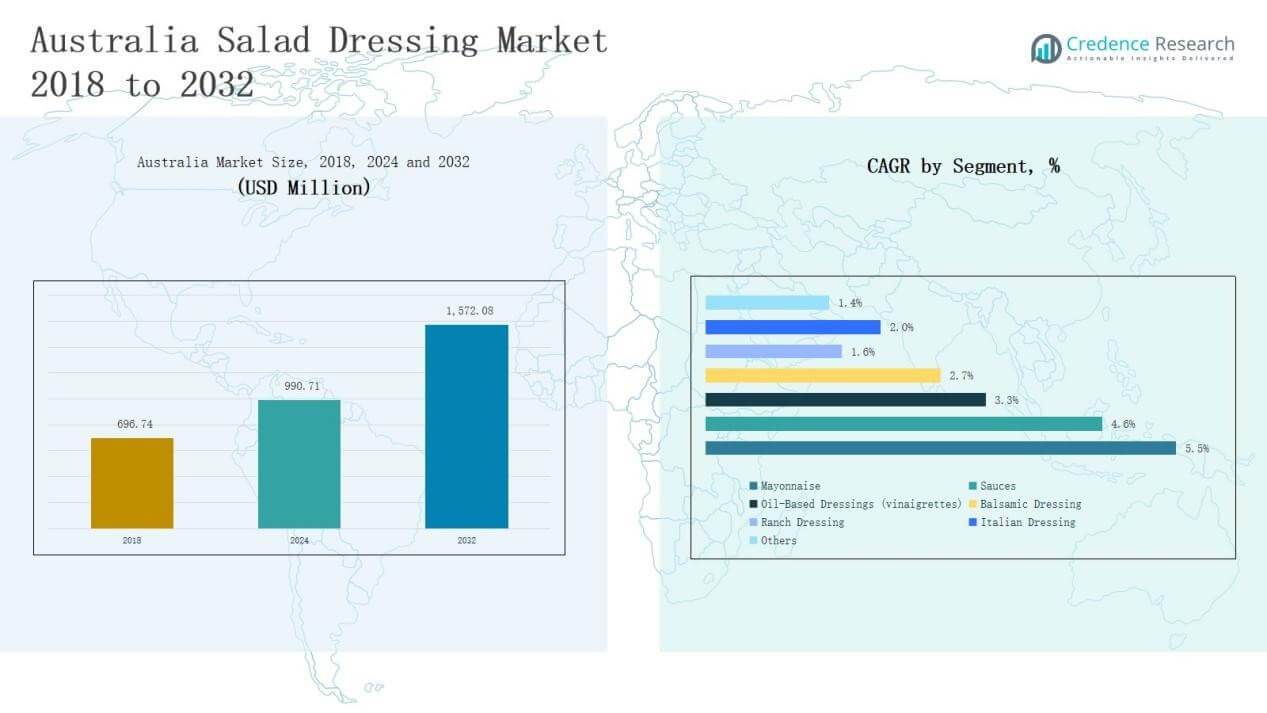

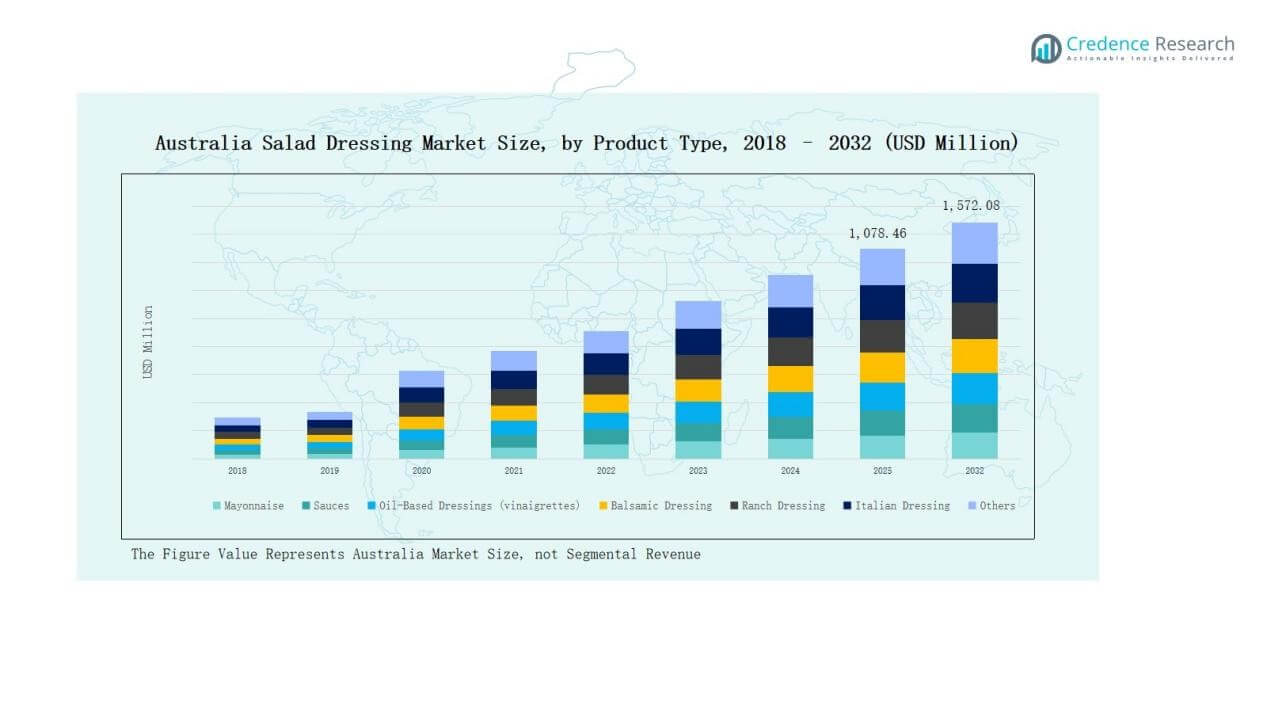

Australia Salad Dressing Market size was valued at USD 696.74 million in 2018, reaching USD 990.71 million in 2024, and is anticipated to reach USD 1,572.08 million by 2032, at a CAGR of 5.53% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Salad Dressing Market Size 2024 |

USD 990.71 Million |

| Australia Salad Dressing Market, CAGR |

5.53% |

| Australia Salad Dressing Market Size 2032 |

USD 1,572.08 Million |

The Australia Salad Dressing Market is shaped by a mix of multinational corporations, domestic manufacturers, and strong private-label competition. Leading players include Fountain Dressings, Beerenberg Farm, Coles, Woolworths, ABC Dressings, Zoosh, Masterfoods (Unilever), Wakaya Perfection, and Kraft Heinz Australia, each leveraging product innovation, distribution strength, and brand positioning to capture market share. Multinational brands dominate through wide portfolios and established retail presence, while domestic producers emphasize authenticity and premium flavors. Retail giants Coles and Woolworths expand influence with competitive private-label offerings. Regionally, New South Wales leads the market with 32% share in 2024, supported by its large urban population, strong foodservice industry, and high demand for both conventional and premium salad dressings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Salad Dressing Market reached USD 990.71 million in 2024 and is projected to hit USD 1,572.08 million by 2032, growing steadily at 5.53%.

- Mayonnaise leads product type with 38.5% share in 2024, supported by consumer demand for creamy textures and versatile meal applications.

- Conventional dressings dominate category share at 81.2% in 2024, while organic dressings at 18.8% grow faster due to rising health and clean-label preferences.

- Retail stores hold the largest distribution share at 54.7%, followed by foodservice at 33.9% and off-trade channels at 11.4% with strong e-commerce growth.

- New South Wales leads regionally with 32% share in 2024, followed by Victoria at 27%, Queensland at 18%, Western Australia at 13%, and Rest of Australia at 10%.

Market Segment Insights

Market Segment Insights

By Product Type

Mayonnaise dominates the product type segment, accounting for 38.5% of the market share in 2024. Its strong presence is driven by high consumer preference for creamy textures and versatile applications across sandwiches, salads, and dips. Sauces and oil-based dressings also hold notable shares, supported by growing demand for international cuisines and healthier vinaigrette alternatives. Specialty dressings such as balsamic, ranch, and Italian are steadily expanding due to rising interest in gourmet and premium food options.

For instance, Unilever extended its Hellmann’s range in the UK with plant-based mayonnaise variants to capture growing demand for vegan alternatives.

By Category

Conventional salad dressings lead the category segment with 81.2% share in 2024, reflecting their affordability and wide retail penetration. Strong brand presence and consumer familiarity continue to sustain dominance in this category. However, the organic sub-segment, with 18.8% share, is growing at a faster pace, driven by rising health awareness, clean-label demand, and the premiumization of food choices among younger consumers.

By Distribution Channel

Retail stores represent the largest distribution channel, holding 54.7% share in 2024, due to their extensive reach through supermarkets, hypermarkets, and specialty stores. Foodservice follows with 33.9% share, supported by the strong café and restaurant culture in Australia, where salad dressings are widely used in quick-service and casual dining. Other off-trade channels, accounting for 11.4% share, are gradually expanding through e-commerce platforms and direct-to-consumer sales models, driven by growing online grocery adoption.

For instance, Coles expanded its supermarket private-label range by introducing new salad dressings under its “Coles Brand,” with distribution across over 830 stores in Australia.

Key Growth Drivers

Key Growth Drivers

Rising Preference for Convenience Foods

Busy lifestyles in Australia are fueling demand for convenient meal solutions, with salad dressings offering quick flavor enhancement. Consumers increasingly rely on ready-to-use condiments that save preparation time while maintaining taste and variety. Packaged mayonnaise, vinaigrettes, and sauces are widely adopted in both households and foodservice. Strong distribution through supermarkets and online platforms further strengthens this demand. The convenience factor, coupled with innovative packaging, is a primary driver behind the sustained growth of the Australian salad dressing market.

For instance, ALDI’s Specially Selected range includes affordable, premium-style vinaigrettes, and while specific bottle details can vary by region and time, resealable bottles are a common feature of many dressing products, including those from ALDI’s private labels.

Expansion of Foodservice and Quick-Service Restaurants

The robust café and restaurant culture in Australia significantly supports salad dressing consumption. Quick-service restaurants, casual dining chains, and gourmet eateries use mayonnaise, sauces, and vinaigrettes extensively in salads, burgers, and sandwiches. Increasing urbanization and rising disposable incomes further encourage dining-out habits, boosting demand for premium and customized dressings. The growing popularity of international cuisines also adds variety to salad dressing use. This expansion of foodservice channels remains a key growth driver for the market.

For instance, McDonald’s Australia expanded its McCrispy burger range featuring new premium sauces and dressings to cater to evolving consumer tastes.

Rising Health and Wellness Awareness

Health-conscious consumers are driving demand for lighter, cleaner-label, and organic salad dressings. Oil-based vinaigrettes and balsamic dressings are increasingly chosen as healthier options compared to calorie-dense mayonnaise. The organic category is also expanding, fueled by consumer preference for natural ingredients, reduced additives, and sustainable sourcing. Manufacturers are innovating by offering low-fat, gluten-free, and plant-based alternatives to capture this trend. Rising health and wellness awareness is expected to accelerate premium product adoption and strengthen growth in the organic segment.

Key Trends & Opportunities

Premiumization and Flavor Innovation

Australian consumers are increasingly drawn to gourmet and premium dressings with unique flavors, such as herb-infused vinaigrettes, exotic sauces, and artisanal ranch varieties. This premiumization trend is fueled by evolving taste preferences, rising interest in international cuisines, and willingness to pay more for high-quality products. Manufacturers are capitalizing by introducing limited-edition flavors and clean-label innovations. Flavor innovation combined with premium positioning offers opportunities for brands to differentiate and capture the evolving consumer base in the salad dressing market.

For instance, Hidden Valley launched seven new ranch flavors, including Cajun Blackened Ranch and Sweet BBQ Ranch, expanding customization options and catering to flavor innovation demands.

Growth of Online and Direct-to-Consumer Channels

The adoption of e-commerce and digital grocery platforms in Australia presents a major growth opportunity. Consumers increasingly prefer ordering salad dressings online for convenience, bulk availability, and access to diverse brands. Subscription services and direct-to-consumer models allow companies to enhance customer loyalty and deliver exclusive products. Online sales channels also provide smaller or niche brands greater market visibility. The steady shift toward online grocery shopping, accelerated by digital adoption, is likely to further expand distribution and consumer reach.

For instance, Coles Group expanded its Subscriptions Plus program, allowing customers to schedule regular home deliveries of grocery items, including salad dressings, through both mobile apps and online platforms.

Key Challenges

Rising Competition from Private Labels

The market faces intense competition from private-label salad dressings offered by major retailers like Coles and Woolworths. These brands provide affordable alternatives with wide availability, capturing price-sensitive consumers. Private labels also focus on quality improvements and organic offerings, further challenging branded players. This increasing competition pressures established manufacturers to maintain brand differentiation and competitive pricing. Without innovation and marketing investments, branded products risk losing share to retailer-owned private labels in the Australian salad dressing market.

Price Sensitivity and Inflationary Pressures

Rising raw material costs, including edible oils, vinegar, and packaging materials, create pricing challenges for manufacturers. Inflationary pressures in Australia often force companies to pass costs to consumers, who remain highly price-sensitive in everyday grocery purchases. While premium segments attract niche buyers, a large portion of the market continues to favor affordable options. Price increases may therefore limit consumer adoption, especially in bulk retail. Managing inflation while sustaining profitability and consumer loyalty poses a critical challenge for market players.

Shifts Toward Healthier Alternatives

Although mayonnaise and traditional creamy dressings dominate sales, growing consumer focus on health is shifting preferences toward lighter and organic alternatives. This trend creates challenges for conventional dressings, which face declining acceptance among health-conscious buyers. High-fat and additive-heavy formulations risk being replaced by oil-based vinaigrettes, plant-based, or homemade alternatives. To counter this shift, brands must reformulate or diversify their offerings to remain relevant. The transition toward healthier alternatives is an ongoing challenge requiring continuous product innovation.

Regional Analysis

New South Wales

New South Wales leads the Australia Salad Dressing Market with 32% share in 2024. The region benefits from a large urban population, diverse food culture, and strong retail penetration. Supermarkets and hypermarkets play a major role in driving sales, supported by consumer demand for convenience foods and premium offerings. The café and restaurant culture in Sydney further sustains foodservice growth. Organic and gourmet dressings are gaining attention among health-conscious buyers. New South Wales remains the largest revenue contributor, supported by wide product availability and high disposable incomes.

Victoria

Victoria accounts for 27% share of the market in 2024, supported by strong consumer demand in Melbourne and surrounding areas. The foodservice industry, including fine dining and quick-service outlets, drives significant usage of salad dressings. Retail channels also perform well, with supermarkets and specialty stores ensuring wide access to different varieties. Increasing awareness of healthier food choices supports growth of organic and vinaigrette-based dressings. Victoria continues to strengthen its position through innovation and rising preference for premium food experiences.

Queensland

Queensland holds 18% market share in 2024, supported by growing urbanization and lifestyle changes. Consumers in Brisbane and coastal areas show rising demand for salad dressings as part of casual dining and home consumption. Foodservice operators, particularly in tourism-driven zones, boost the adoption of premium sauces and dressings. Retail expansion is also supporting growth, with supermarkets offering both branded and private-label products. Queensland is emerging as a key market for organic and plant-based options due to rising health awareness.

Western Australia

Western Australia contributes 13% share to the market in 2024, driven by a mix of urban and regional demand. Perth remains the focal point, with strong retail activity and a growing café culture. Foodservice channels are expanding, supported by population growth and cultural diversity. Organic and imported premium brands are steadily gaining traction. Despite its smaller base, Western Australia continues to register stable growth supported by evolving consumer preferences and expanding distribution networks.

Rest of Australia

The Rest of Australia, including South Australia, Tasmania, and Northern Territory, holds 10% share in 2024. Demand is led by retail sales of conventional mayonnaise and sauces. Organic offerings remain niche but are gaining visibility in urban centers. Foodservice outlets contribute to steady consumption, especially in South Australia’s metropolitan areas. Smaller population bases limit overall volume, yet rising digital grocery adoption is improving market reach. This segment contributes consistent growth to the overall market performance.

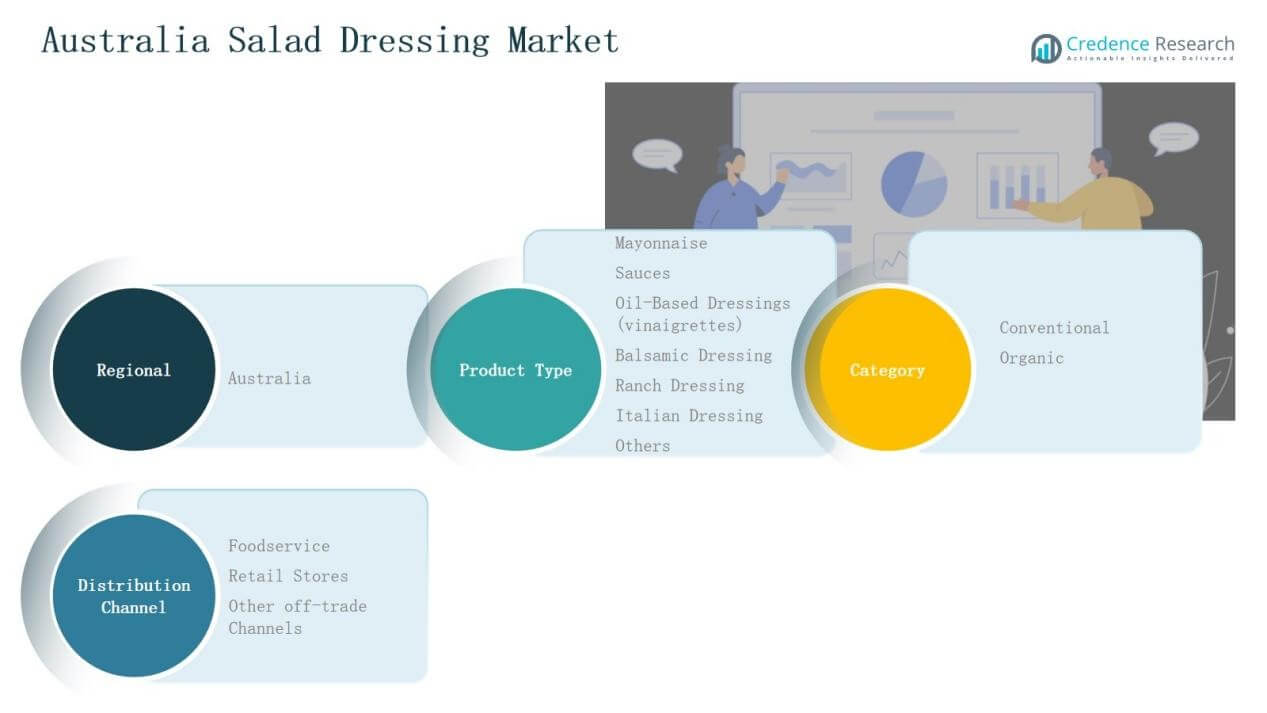

Market Segmentations

Market Segmentations

By Product Type

- Mayonnaise

- Sauces

- Oil-Based Dressings (Vinaigrettes)

- Balsamic Dressing

- Ranch Dressing

- Italian Dressing

- Others

By Category

By Distribution Channel

- Foodservice

- Retail Stores

- Other Off-Trade Channels

By Region

- New South Wales

- Victoria

- Queensland

- Western Australia

- Rest of Australia

Competitive Landscape

The Australia Salad Dressing Market features a competitive mix of multinational corporations, domestic manufacturers, and private-label players. Leading companies such as Kraft Heinz Australia, Masterfoods (Unilever), and Fountain Dressings maintain strong market positions through extensive product portfolios, robust retail distribution, and established brand equity. Domestic brands like Beerenberg Farm and Zoosh focus on authenticity, premium flavors, and innovation to attract health-conscious and gourmet-seeking consumers. Retail giants Coles and Woolworths further intensify competition by promoting private-label dressings at competitive prices, appealing to cost-sensitive buyers while expanding into organic and healthier product lines. Emerging brands and niche players are leveraging direct-to-consumer channels and e-commerce to enhance visibility and reach targeted audiences. Continuous flavor innovation, clean-label formulations, and sustainable packaging are central strategies across the competitive landscape. Intense rivalry encourages companies to differentiate through pricing, branding, and innovation while responding to evolving consumer preferences for both conventional and organic segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In July 2023, Birch & Waite Foods acquired EP Food Company in Australia. EP Food Company, based in Queensland, produces fresh salad dressings and sauces and serves commercial clients across Australia.

- In December 2024, SPC Australia rebranded and relisted on the ASX as SPC Global Limited, following its merger with Original Juice Company and Nature One Dairy, strengthening its food portfolio.

- In April 2025, Hidden Valley introduced seven new ranch flavor varieties and a redesigned “Easy Squeeze” bottle catering to flavor innovation and customization trends in dressings.

- In July 2024, PMFresh acquired HS Fresh Food Group, expanding its fresh produce and ready-made salad supply chain in Australia.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Category, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic and clean-label dressings will expand steadily across urban markets.

- Premium and gourmet flavors will attract younger consumers seeking unique food experiences.

- Retail private-label products will gain more traction with competitive pricing and wider reach.

- Foodservice demand will rise further due to strong café and restaurant culture.

- Online grocery platforms will become a major growth channel for salad dressing sales.

- Health-conscious buyers will drive higher adoption of oil-based and low-fat vinaigrettes.

- Sustainability in packaging will remain a priority for leading and emerging brands.

- Flavor innovation with global and ethnic influences will strengthen product differentiation.

- Domestic brands will focus on authenticity and local sourcing to build stronger loyalty.

- Intense competition will push companies to invest in marketing, innovation, and product diversification.

Market Segment Insights

Market Segment Insights Key Growth Drivers

Key Growth Drivers Market Segmentations

Market Segmentations