Market Overview:

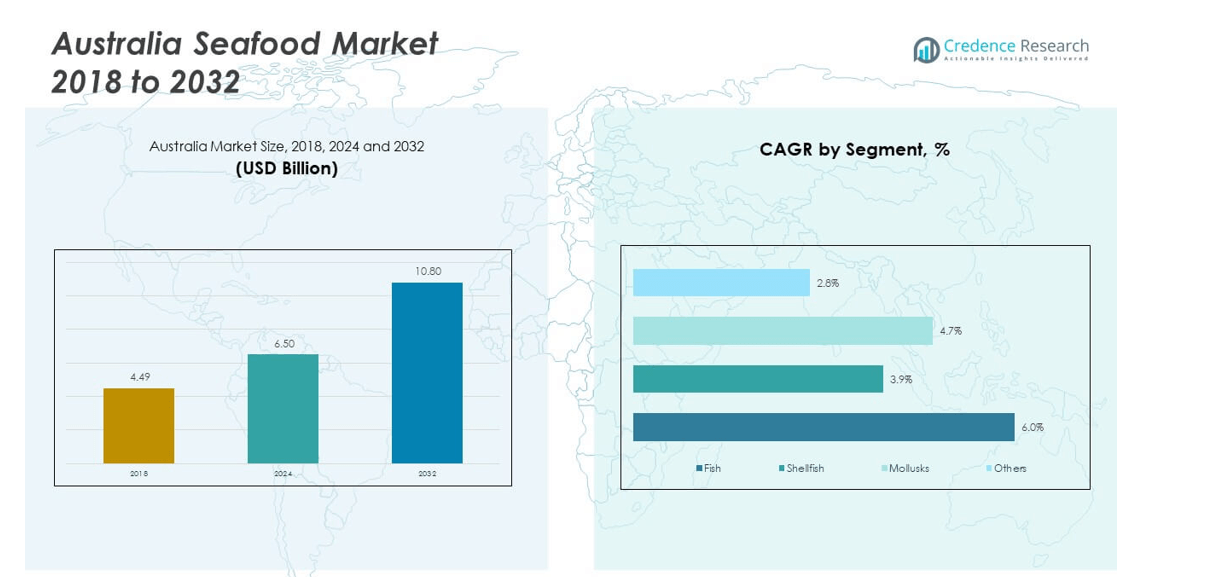

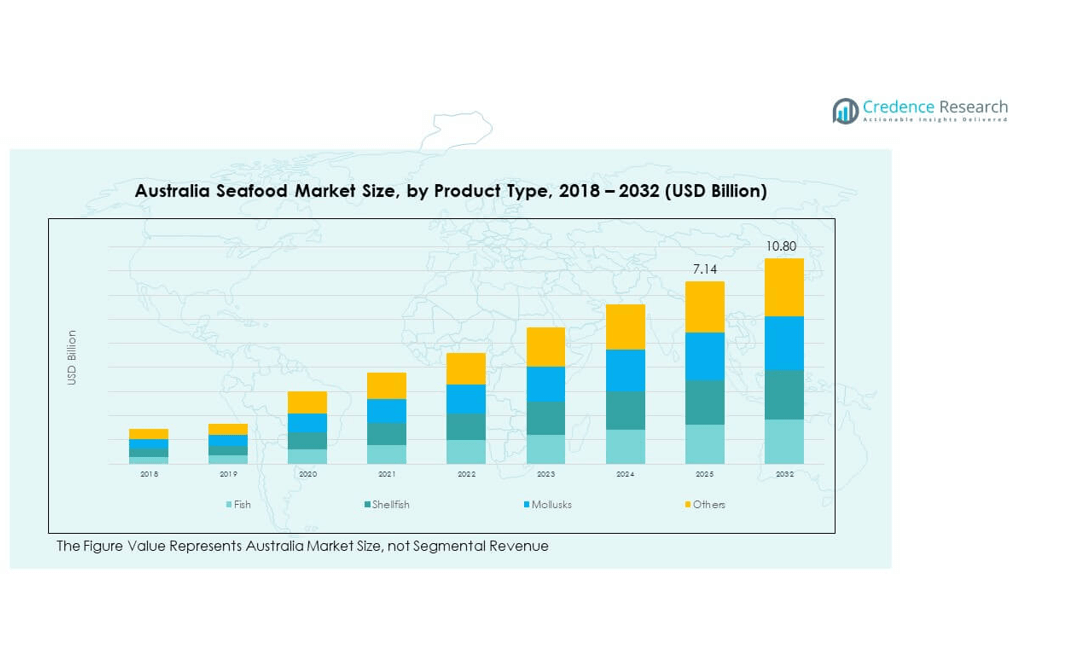

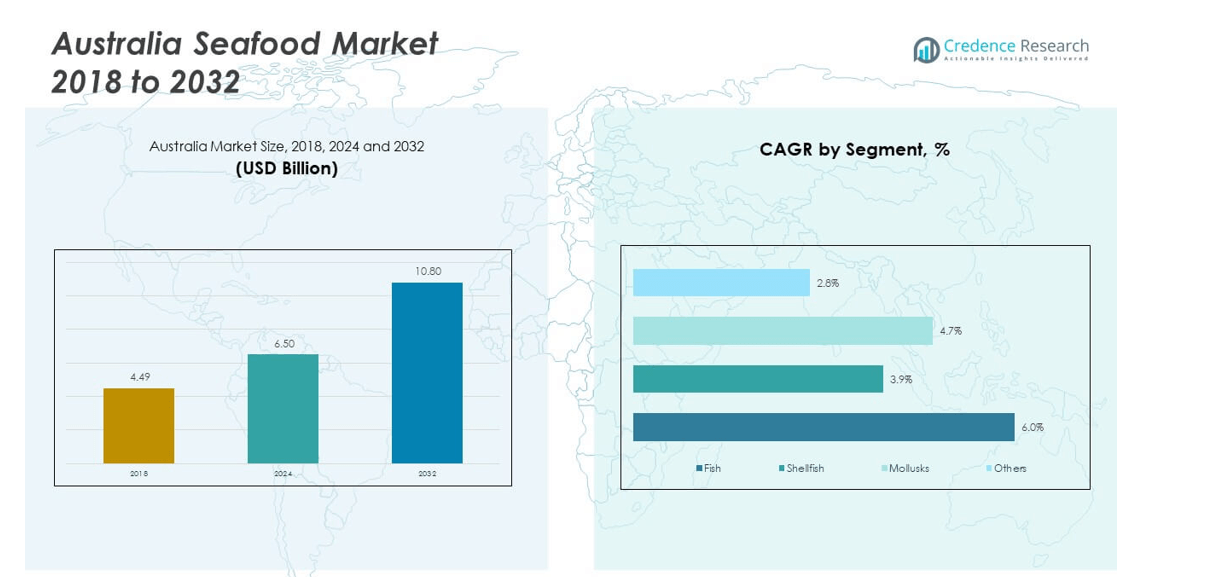

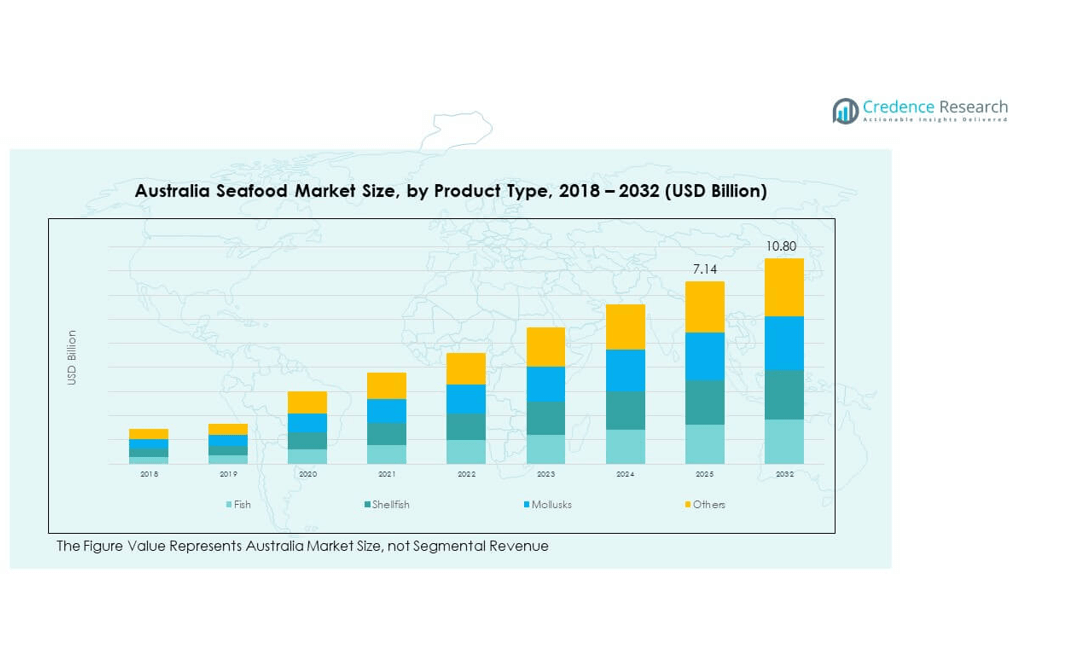

The Australia Seafood Market size was valued at USD 4.49 billion in 2018 to USD 6.50 billion in 2024 and is anticipated to reach USD 10.80 billion by 2032, at a CAGR of 6.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Seafood Market Size 2024 |

USD 6.50 billion |

| Australia Seafood Market, CAGR |

6.90% |

| Australia Seafood Market Size 2032 |

USD 10.80 billion |

Market drivers include the growing preference for protein-rich diets, which boosts demand for fish, shellfish, and mollusks across retail and hospitality sectors. Consumers increasingly choose seafood due to health awareness and convenience, with strong traction for ready-to-cook and value-added products. Government-backed aquaculture projects and innovations in farming technologies further strengthen production capacity, while exports to Asia remain a vital growth pillar for the industry.

Regionally, eastern states dominate due to high urban demand and aquaculture expansion in Queensland and New South Wales. Southern regions, led by Tasmania and Victoria, play a central role in premium salmon, abalone, and lobster production. Western Australia remains a leader in lobster exports, while northern regions are emerging with tropical aquaculture development. This geographic mix reflects both domestic demand patterns and export-oriented strengths that reinforce the market’s competitive edge.

Market Insights

- The Australia Seafood Market was valued at USD 4.49 billion in 2018, reached USD 6.50 billion in 2024, and is projected to hit USD 10.80 billion by 2032, growing at a CAGR of 6.09%.

- Eastern Australia led with 42% share in 2024, followed by Southern Australia at 36% and Western & Northern combined at 22%, driven by aquaculture, salmon farming, and lobster exports.

- Western and Northern Australia form the fastest-growing region with 22% share, supported by strong lobster exports and expanding tropical aquaculture.

- Fish accounted for 48% share of the market by product type in 2024, reflecting strong domestic and export demand.

- Shellfish held 27% share, while mollusks represented 18% and others contributed 7%, highlighting premium value in prawns, abalone, and oysters.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Domestic Consumption Supported By Changing Dietary Preferences

The Australia Seafood Market benefits from increasing demand for healthy protein sources in daily diets. Consumers are replacing red meat with seafood due to health awareness and lifestyle shifts. It has gained acceptance in younger demographics seeking convenient and nutritious meals. Rising per capita seafood consumption strengthens retail sales and hospitality sector demand. Value-added products such as pre-marinated fillets and frozen packs enhance accessibility for urban households. Strong marketing campaigns by producers highlight nutritional benefits, boosting awareness further. Domestic consumption aligns with sustainable practices, which ensures long-term supply stability. Retail chains and supermarkets expand their seafood offerings to meet this surge in demand.

Strong Export Growth Driven By Asian Market Demand

Export expansion is a primary growth driver, with Asian countries fueling sustained international demand. China, Japan, and Southeast Asian nations remain critical markets for Australian seafood exports. High-value products such as rock lobster, abalone, and salmon hold a premium position abroad. The Australia Seafood Market leverages strong brand reputation for quality, safety, and sustainability. It benefits from government trade agreements that improve access to overseas markets. Logistics improvements ensure efficient cold chain transport to international destinations. Export-focused aquaculture projects help scale production for long-term supply commitments. The export sector’s growth reinforces overall market stability and competitive positioning globally.

- For instance, the Geraldton Fishermen’s Co-operative, which accounts for 64% of Western Australia’s rock lobster export volume, celebrated the reopening of live lobster exports to China in December 2024. This followed official notification from China’s Ministry of Foreign Affairs confirming that full trade could resume in time for the 2025 Lunar New Year, marking a significant milestone for the industry.

Aquaculture Expansion Backed By Government Incentives And Technological Integration

Aquaculture development drives steady growth, supported by modern farming practices and regulatory backing. Tasmania leads salmon production, while other coastal regions expand aquaculture output. The Australia Seafood Market invests heavily in sustainable technologies for efficient farming operations. It benefits from innovations in water monitoring, feeding automation, and disease prevention. Government funding programs support industry adoption of best practices and eco-friendly methods. Aquaculture expansion reduces reliance on wild-catch, ensuring supply for domestic and export needs. It helps address rising demand while preserving natural marine resources. Strong collaboration between research institutes and industry stakeholders enhances aquaculture’s long-term viability.

- For instance, in September 2024, the Queensland Government announced a USD 15 million funding package dedicated to aquaculture research and development, automation, and biosecurity. This initiative formed part of a broader USD 22.5 million commitment to strengthen the sector, with support directed toward innovative industry leaders such as Tassal operating in the region.

Shifting Consumer Preference Toward Sustainable And Traceable Products

Sustainability and traceability remain vital market drivers influencing consumer purchase decisions. The Australia Seafood Market adapts by ensuring certified sourcing and eco-labeled products. It faces rising expectations from consumers who demand full transparency of origin. Supply chains integrate blockchain and digital tracking to validate sourcing practices. Retailers highlight sustainable certification labels to attract environmentally aware buyers. Restaurants and hospitality businesses source responsibly to enhance brand value. Global buyers demand rigorous compliance with sustainability standards, shaping export readiness. Investment in traceable practices strengthens trust, which directly drives sales growth. This shift aligns the market with long-term environmental and consumer expectations.

Market Trends

Technological Integration Across Aquaculture And Processing Facilities

The Australia Seafood Market demonstrates strong adoption of technology across aquaculture and processing units. It benefits from automated feeding systems, water quality sensors, and advanced harvesting equipment. Robotics and AI-based monitoring improve efficiency, reduce costs, and enhance yields. Processing plants integrate automation to handle scaling demand for packaged seafood. Quality control improves with digital tools that track freshness and product safety. Blockchain-based platforms streamline traceability and compliance for both domestic and international trade. It encourages stakeholders to modernize their infrastructure to remain competitive. Technology adoption establishes a foundation for efficiency and higher margins across the industry.

- For example, Tassal Group introduced hydrophone-based automatic feeding systems for prawns and integrated real-time water quality sensors managed through its Smart Farm technology. According to Tassal’s Sustainability Report, these initiatives improved feed efficiency, reduced waste, and supported better environmental outcomes.

Expansion Of Premium And Value-Added Seafood Products

Demand for premium seafood categories shows continuous growth in both retail and foodservice. Consumers seek ready-to-cook, marinated, and packaged products with high quality assurance. The Australia Seafood Market gains traction by offering innovative flavors and convenient packaging. It responds to urban consumers with busy lifestyles who prefer quick meal solutions. Export demand supports value-added premium products that highlight Australia’s seafood reputation. Restaurants emphasize premium species such as abalone and rock lobster to attract high-spending clients. Growth in e-commerce and online delivery platforms further boosts accessibility. Value-added innovation strengthens profitability and widens the market’s consumer base.

Sustainability Certifications Becoming Mainstream Across Supply Chains

Sustainable practices shift from niche initiatives to industry-wide commitments across the seafood value chain. The Australia Seafood Market aligns with international certification standards to maintain credibility. It benefits from eco-labels such as MSC and ASC, which influence consumer confidence. Retailers dedicate more shelf space to certified products, reflecting rising demand. Hospitality businesses source certified seafood to reinforce brand integrity. Export buyers prefer suppliers with verified sustainable practices, strengthening global competitiveness. Supply chain integration ensures reliable reporting and accountability for every stakeholder. Sustainability certifications evolve into a necessity rather than a market differentiator.

Rising Role Of Online Platforms And Direct-To-Consumer Sales

Digital platforms and online marketplaces reshape seafood distribution and consumer engagement. The Australia Seafood Market explores e-commerce strategies to capture younger demographics. It benefits from direct-to-consumer channels that emphasize transparency and freshness. Subscription models and home delivery services increase accessibility for urban buyers. Marketing through social media platforms enhances consumer awareness and brand loyalty. Online sales channels extend producer reach beyond traditional retail and foodservice outlets. Data-driven platforms enable targeted promotions and personalized offers for customers. The growing digital shift ensures long-term consumer engagement and market diversification.

- For example, Sydney Fish Market operates a Dutch clock auction system that sells over 1,000 crates (≈20 tonnes) of fresh seafood every hour and handles about 50-55 tonnes per weekday through more than 2,900 crates Remote bidding and an online portal allow wholesalers, retailers, and restaurants to participate alongside in-person buyers.

Market Challenges Analysis

Environmental And Climatic Uncertainties Affecting Aquaculture And Wild Catch

The Australia Seafood Market faces risks from unpredictable climate patterns impacting marine ecosystems. It experiences disruption in fish stock levels due to warming waters and ocean acidification. Extreme weather events damage aquaculture infrastructure and increase mortality rates in farms. It struggles with balancing rising demand and natural resource conservation. Environmental uncertainties raise operational costs through additional monitoring and mitigation efforts. Export reliability also suffers when production declines due to natural challenges. Regulatory bodies enforce stricter sustainability requirements to address these vulnerabilities. The market needs to adapt quickly with innovative strategies to mitigate environmental risks.

Supply Chain Vulnerabilities And Rising Operational Costs

The Australia Seafood Market encounters persistent challenges with logistics and cost management. It deals with maintaining cold chain infrastructure across large domestic and export networks. Transportation delays and fuel costs increase operational expenses for producers. Packaging and processing requirements add further pressure on profit margins. Labor shortages in aquaculture and processing units disrupt production cycles. Export-oriented businesses face stricter compliance checks that slow trade movements. It requires sustained investments to ensure smooth supply chain operations. Rising costs reduce margins, forcing businesses to adopt leaner and more efficient models.

Market Opportunities

Expanding Export Opportunities Through Diversified Global Market Access

The Australia Seafood Market sees major opportunities in expanding trade with diverse global buyers. It leverages high demand from Asian markets while exploring emerging regions in Europe and the Middle East. It benefits from Australia’s reputation for premium seafood quality and safety standards. Export diversification reduces dependency on a single market, ensuring stable revenues. Governments support trade expansion through bilateral agreements and targeted export incentives. Aquaculture producers scale operations to match global requirements for consistency and quality. Access to premium-paying customers abroad enhances overall industry profitability. This strategy creates resilience and long-term export growth.

Innovation In Value-Added Products And Emerging Consumer Preferences

The Australia Seafood Market identifies innovation in product development as a key opportunity. It benefits from rising urbanization that drives demand for convenient, ready-to-eat seafood products. Flavor-infused fillets, frozen portions, and specialty seafood meals cater to diverse tastes. Premium packaging and branding help differentiate Australian seafood in competitive global markets. Consumer preference for healthy protein options supports product diversification. Restaurants and retail channels encourage producers to deliver innovative offerings. Product innovation improves margins, strengthens consumer loyalty, and attracts younger demographics. This opportunity supports sustainable expansion and greater value creation across the industry.

Market Segmentation Analysis

By Product Type, fish remains the largest category due to strong domestic consumption and export demand. Shellfish, particularly prawns and lobsters, hold significant value in premium markets. Mollusks such as abalone and oysters cater to niche but high-margin segments. Others include emerging aquaculture species that add diversity to production. The Australia Seafood Market benefits from its rich marine resources and strong aquaculture base supporting these categories. It maintains balanced growth across both mass-market and specialty seafood types. Product variety supports both domestic needs and international trade opportunities.

By Form, fresh seafood dominates due to consumer preference for quality and taste in retail and foodservice. Frozen seafood expands rapidly, supported by improved cold chain logistics and rising urban demand. Canned seafood retains steady growth due to affordability and long shelf life. Processed seafood, including ready-to-cook meals, addresses lifestyle shifts toward convenience. Others represent value-added items that expand consumer choices in specialty outlets. It adapts production capacity to meet diverse consumer expectations across formats. Packaging innovation ensures longer preservation and stronger market competitiveness.

- For instance, in 2024, KB Seafood Co implemented Modified Atmosphere Packaging (MAP) on its chilled seafood lines, confirmed in public disclosures, to extend shelf life and deliver fresher seafood across national supermarket chains.

By Distribution Channel, retail stores hold the largest share due to widespread supermarket penetration. Foodservice remains a vital segment driven by restaurants and hospitality sectors. Online retail grows fast, supported by digital adoption and home delivery services. Wholesale and bulk channels serve exporters and large distributors with consistent supply volumes. Others include niche outlets that cater to specialty and regional demand. It strengthens its distribution networks to ensure accessibility and freshness across all consumer groups. This structure provides resilience and supports sustained market growth.

- For instance, the Sydney Fish Market launched its SFMblue digital platform in September 2022, allowing seafood suppliers and buyers to trade online 24/7 nationwide, according to official market press releases and media reports

Segmentation

By Product Type

- Fish

- Shellfish

- Mollusks

- Others

By Form

- Fresh Seafood

- Frozen Seafood

- Canned Seafood

- Processed Seafood

- Others

By Distribution Channel

- Retail Stores

- Foodservice

- Online Retail

- Wholesale/Bulk

- Others

Regional Analysis

Eastern Australia accounts for 42% of the Australia Seafood Market, driven by New South Wales and Queensland. Strong demand in urban centers such as Sydney and Brisbane sustains retail and foodservice channels. Aquaculture facilities across Queensland expand fish and prawn production for both domestic and export needs. It benefits from advanced logistics that ensure quick access to major urban markets. Coastal infrastructure supports efficient processing and distribution. Eastern states maintain leadership due to population density and consistent seafood consumption trends.

Southern Australia represents 36% share, with Tasmania and Victoria leading production. Tasmania is recognized for its salmon farming, which contributes heavily to national aquaculture output. Victoria’s coastal waters and seafood ports support large-scale processing and export trade. The Australia Seafood Market leverages this region’s premium product reputation to strengthen international positioning. It gains competitive advantage through high-value exports such as abalone and lobster. Southern states emphasize sustainability certifications, enhancing credibility in both domestic and overseas markets. This subregion secures strong growth by combining aquaculture innovation with wild-catch resources.

Western and Northern Australia collectively hold 22% of the market, supported by lobster and prawn industries. Western Australia dominates rock lobster exports, particularly to China and other Asian buyers. Northern states, including the Northern Territory, focus on tropical seafood varieties and emerging aquaculture ventures. It benefits from strong natural resources and government-backed development programs. Remote locations pose logistical challenges, but exports remain resilient through advanced cold chain networks. Western and Northern regions demonstrate strong potential, driven by global demand for premium seafood. This subregion strengthens Australia’s position in high-value international seafood markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tasmanian Seafoods Group

- Walker Seafoods Australia

- Clean Seas Seafood Ltd.

- Huon Aquaculture Group

- Australian Ocean King Prawn Company

- Austral Fisheries

- MG Kailis Group

- Seafish Tasmania

- Craig Mostyn Group

- Geraldton Fishermen’s Co-operative

Competitive Analysis

The Australia Seafood Market is highly competitive with participation from aquaculture companies, wild-catch operators, processors, and exporters. Leading players include Tassal Group, Huon Aquaculture, Austral Fisheries, Geraldton Fishermen’s Co-operative, and Clean Seas Seafood. It features a mix of vertically integrated companies and regionally specialized producers. Tassal and Huon dominate salmon production, securing domestic leadership and export reach. Geraldton Fishermen’s Co-operative holds a strong position in lobster exports, leveraging Western Australia’s resources. Clean Seas Seafood emphasizes premium kingfish supply, targeting high-value markets in Asia and Europe. Companies invest heavily in sustainability certifications, digital traceability, and automation to meet evolving consumer and export requirements. Competitive pressure drives continuous innovation in value-added products, supply chain efficiency, and sustainability alignment. The market maintains growth by balancing domestic demand with strategic expansion into global trade.

Recent Developments

- In July 2025, Yumbah Aquaculture Limited completed the acquisition of Clean Seas Seafood Limited, marking a major shift in the aquaculture sector. The transaction, finalized on July 24, 2025, combines Clean Seas’ expertise in Spencer Gulf Kingfish with Yumbah’s strengths in the abalone and shellfish market, forming a diversified and sustainable seafood supply powerhouse.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium seafood will increase as consumers prioritize quality and health-focused diets.

- Aquaculture innovation will enhance efficiency through advanced feeding systems, disease management, and water monitoring.

- Sustainability certifications will become essential across supply chains, reinforcing consumer trust and global competitiveness.

- Export expansion will continue toward Asian markets while diversification into Europe and the Middle East strengthens resilience.

- Online retail and direct-to-consumer models will accelerate growth, supported by subscription services and digital platforms.

- Value-added products such as marinated fillets and ready-to-eat seafood will capture rising urban demand.

- Climate adaptation strategies will focus on protecting aquaculture infrastructure and mitigating environmental disruptions.

- Investment in cold chain logistics will improve product freshness and support reliable exports.

- Collaboration between government, research institutions, and industry players will drive innovation and sustainability alignment.

- Branding strategies highlighting origin, safety, and traceability will strengthen Australia’s positioning in international markets.