Market Overview:

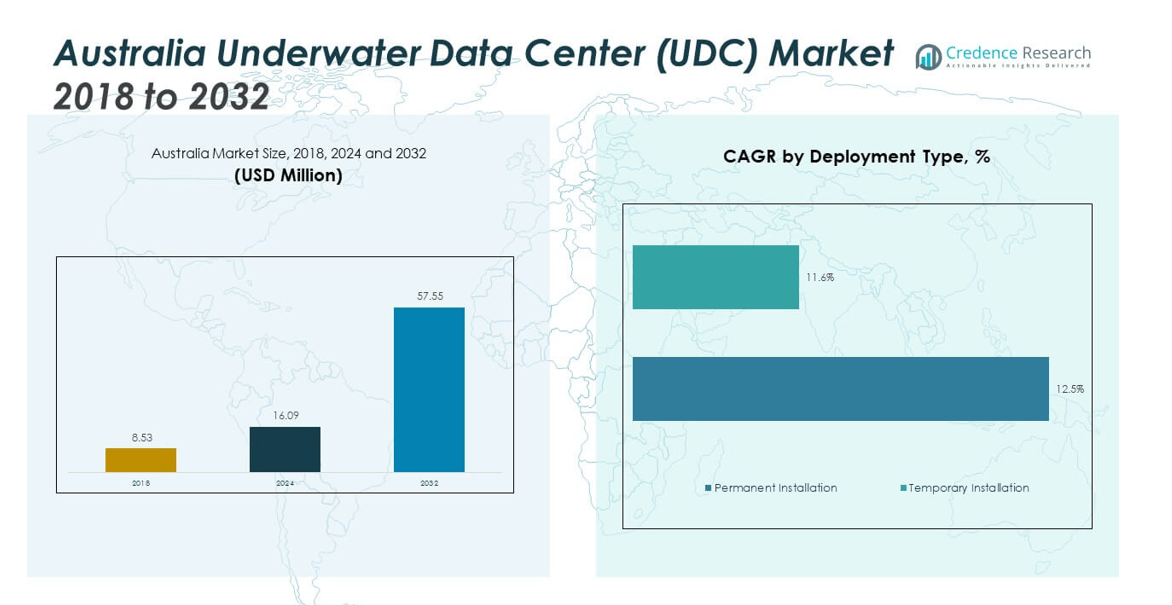

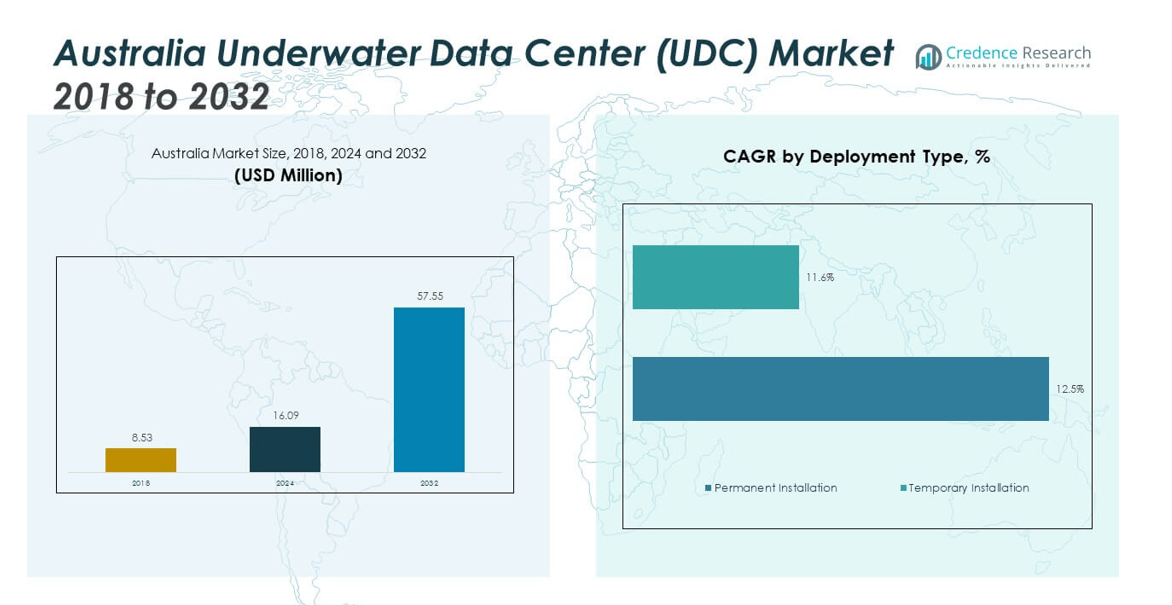

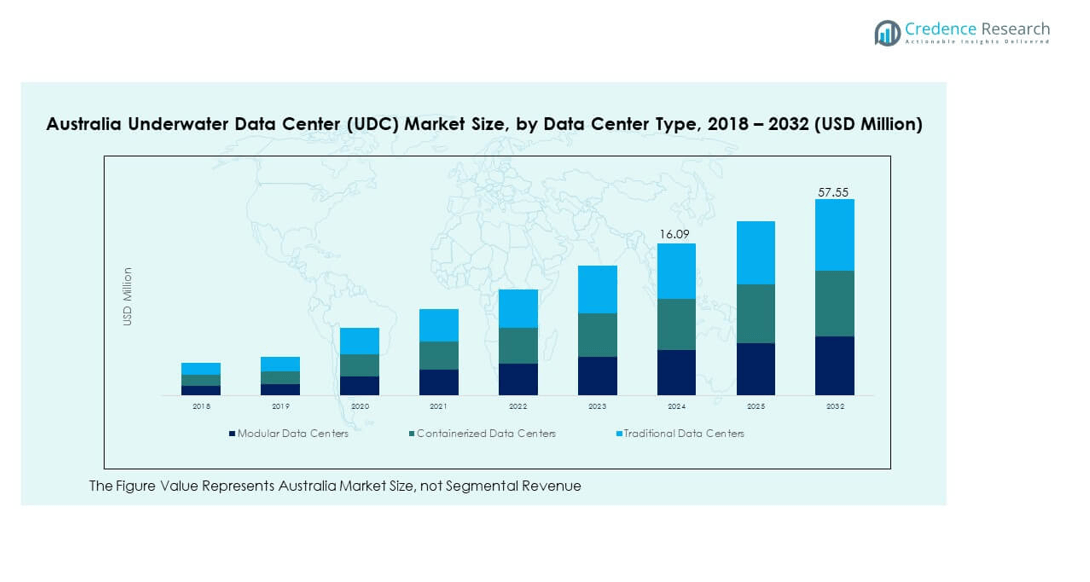

The Australia Underwater Data Center (UDC) Market size was valued at USD 8.53 million in 2018 to USD 16.09 million in 2024 and is anticipated to reach USD 57.55 million by 2032, at a CAGR of 17.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Underwater Data Center (UDC) Market Size 2024 |

USD 16.09 million |

| Australia Underwater Data Center (UDC) Market, CAGR |

17.27% |

| Australia Underwater Data Center (UDC) Market Size 2032 |

USD 57.55 million |

The market growth is driven by the rising need for sustainable and energy-efficient data storage systems. Australia’s coastal geography supports underwater infrastructure deployment, which offers better cooling efficiency and reduces land-based data center constraints. Growing adoption of cloud computing and AI workloads further fuels the demand for submerged data centers, enabling lower operational costs and improved energy management.

Geographically, the market sees strong potential across coastal regions such as Western Australia, Queensland, and New South Wales. These areas benefit from stable underwater conditions, existing telecom infrastructure, and government support for digital transformation. Emerging projects in Tasmania and Victoria are also contributing to the sector’s expansion, driven by renewable energy access and data localization initiatives.

Market Insights:

- The Australia Underwater Data Center (UDC) Market was valued at USD 8.53 million in 2018, grew to USD 16.09 million in 2024, and is projected to reach USD 57.55 million by 2032, registering a CAGR of 17.27%.

- Eastern Australia held the largest share of 45%, driven by strong coastal infrastructure, digital transformation projects, and renewable energy adoption. Southern and Western regions followed with 35% share due to deep-sea potential and hybrid energy integration.

- Northern and Central Australia captured 20% of the market and are the fastest-growing regions, supported by expanding telecom connectivity and industrial investments in underwater infrastructure.

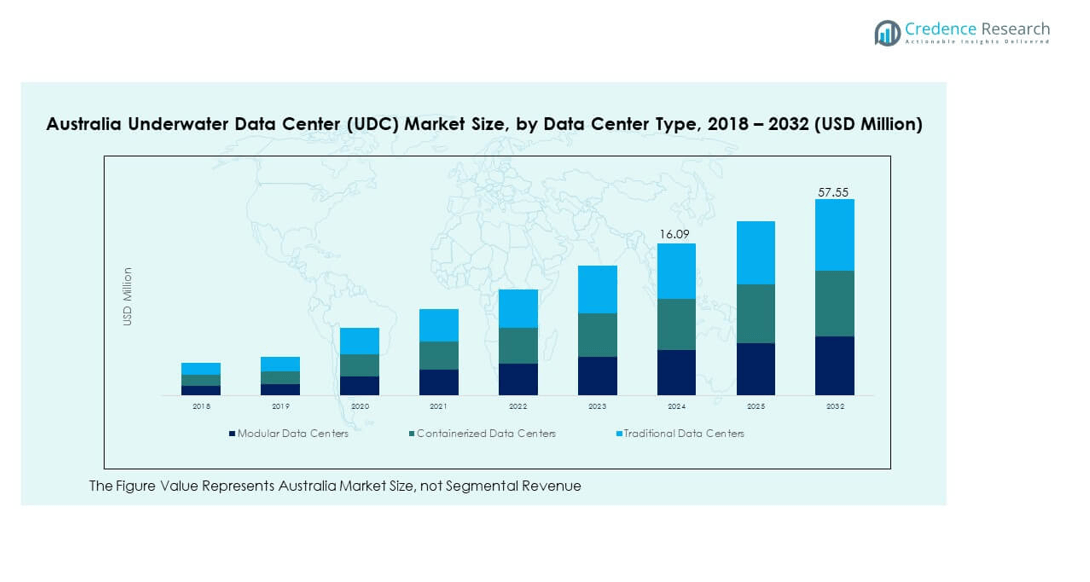

- Modular data centers accounted for the largest segment share, representing about 48% of the market, driven by their flexibility, scalability, and cost efficiency.

- Containerized data centers followed with approximately 33% share, gaining adoption for pilot deployments and easy relocation capabilities, while traditional setups maintained a smaller yet stable contribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Energy-Efficient and Sustainable Data Infrastructure

The Australia Underwater Data Center (UDC) Market is gaining momentum due to growing emphasis on energy efficiency and sustainability. Underwater facilities use natural ocean cooling, reducing reliance on mechanical systems and cutting power consumption. This approach aligns with Australia’s commitment to green energy goals and emission reduction targets. It also helps companies meet ESG compliance standards. Cloud service providers and hyperscale data operators are investing in submerged data centers to optimize energy use. The shift toward low-carbon digital infrastructure supports scalability and long-term cost savings.

- For instance, Microsoft’s Project Natick subsea datacenter achieved a power usage effectiveness (PUE) of 1.07 and recorded a server failure rate just 1/8th that of conventional land-based datacenters during its multi-year deployments, while using no water for cooling.

Growing Data Consumption and Cloud Service Expansion

The rapid increase in data generation across industries is driving large-scale investments in advanced data centers. Rising adoption of 5G networks, IoT devices, and AI applications adds to data processing requirements. Traditional land-based centers face capacity limits and high cooling costs, leading to the exploration of underwater solutions. The Australia Underwater Data Center (UDC) Market benefits from this trend by offering cost-effective and environmentally responsible options. Tech firms and telecom operators are testing ocean-based modules to meet data storage growth sustainably. The model offers high uptime, low latency, and better resource allocation.

- For instance, Subsea Cloud claims its modular subsea pods can reduce energy and carbon emissions by using passive seawater cooling, with the company’s website mentioning a 50% energy/CO2 reduction. Their modular design allows for rapid deployment, and by placing the pods near coastal population centers, they aim to reduce latency for nearby customers. The specific figures of “up to 40%” energy reduction and “up to 98%” lower latency are reported company claims and lack independent third-party verification.

Supportive Government Initiatives and Coastal Infrastructure Development

Government-led digitalization and renewable energy projects across coastal states promote new data infrastructure investments. Public-private partnerships are fostering innovation in underwater systems. Coastal regions such as Queensland and New South Wales have suitable marine environments and robust grid connectivity. The Australia Underwater Data Center (UDC) Market benefits from these favorable conditions. Policies promoting clean energy use and sustainable construction methods drive adoption. Research institutions and universities are also collaborating to enhance cooling efficiency and material durability. The synergy between infrastructure expansion and innovation supports rapid market development.

Advancements in Subsea Technology and AI-Based Monitoring Systems

Recent innovations in subsea engineering and real-time monitoring are improving underwater data center operations. Advanced sensors and AI tools detect temperature, pressure, and energy usage variations instantly. These technologies extend equipment lifespan and reduce maintenance downtime. The Australia Underwater Data Center (UDC) Market leverages these tools to enhance operational reliability and scalability. Robotics and autonomous maintenance systems simplify inspections and repairs in challenging marine environments. Integration of fiber-optic networks further enhances data transmission efficiency, enabling stable connectivity and high-speed performance across underwater facilities.

Market Trends:

Adoption of Modular and Scalable Underwater Data Center Designs

The Australia Underwater Data Center (UDC) Market is witnessing a shift toward modular architectures that allow flexible deployment and expansion. These designs reduce construction time and simplify installation near coastal hubs. Modular pods enhance scalability and lower maintenance costs while providing high performance. Companies are experimenting with prefabricated modules that can be quickly submerged and connected to existing grid systems. This modular approach helps data operators adjust capacity based on demand. It also improves operational resilience by allowing maintenance without disrupting the full network.

- For instance, Subsea Cloud’s modular data center pods are factory-assembled and can be deployed in weeks, much faster than the months or years needed for conventional facilities.

Integration of Renewable Energy Sources for Power Supply

The use of renewable energy, particularly offshore wind and tidal power, is becoming a core trend in underwater data operations. The Australia Underwater Data Center (UDC) Market benefits from the country’s renewable energy potential along coastal regions. Hybrid systems combining solar and marine energy help reduce carbon emissions and ensure stable power delivery. Energy-efficient cooling systems complement these sources by lowering thermal waste. This integration promotes green computing and strengthens the nation’s sustainability targets. It also attracts global firms seeking eco-friendly data storage solutions.

- For instance, Wave Swell Energy completed the UniWave200 project on King Island off Tasmania in 2024, deploying a 200 kW wave energy converter that supplied the local microgrid, validating marine renewables as a viable power supply for sustainable facilities.

Increasing Research Collaboration and Private Investment Growth

Universities, research institutes, and technology firms are collaborating to test new underwater cooling, communication, and material technologies. These partnerships aim to improve long-term reliability and safety of underwater systems. The Australia Underwater Data Center (UDC) Market attracts foreign and domestic investments in R&D projects. Private investors see long-term potential in reduced energy costs and minimal land usage. Government-backed research funding further supports pilot programs along strategic coastal areas. The research ecosystem is driving continuous technological evolution across underwater infrastructure.

Rising Role of Edge Computing and Low-Latency Data Transfer

The growing use of AI, 5G, and IoT applications is increasing the need for fast data transmission. Underwater data centers support edge computing by positioning data closer to users, minimizing latency. The Australia Underwater Data Center (UDC) Market is aligning with this need through fiber-optic integration and improved networking systems. These centers reduce signal travel distance, improving real-time analytics and cloud-based services. Telecom operators are deploying marine cables to link subsea centers to key business districts. The trend enhances user experience and service efficiency.

Market Challenges Analysis:

High Installation Costs and Complex Maintenance Operations

Building underwater data centers involves heavy initial capital investment and technical expertise. The Australia Underwater Data Center (UDC) Market faces challenges in securing funding due to high upfront costs for construction, pressure-resistant enclosures, and cooling systems. Maintenance operations under deep-sea conditions require specialized equipment and skilled divers. Repair and recovery processes are time-consuming and expensive, limiting operational flexibility. Environmental approvals also delay project execution. Many investors remain cautious due to the uncertain long-term returns of subsea systems. These financial and logistical barriers slow down large-scale deployment.

Environmental Concerns and Regulatory Compliance Issues

Environmental preservation is a major concern for underwater installations. Marine ecosystems near deployment sites must be protected from potential heat discharge or contamination. The Australia Underwater Data Center (UDC) Market must comply with strict government regulations governing ocean construction and sustainability. Delays in approvals can affect project timelines and increase costs. Limited understanding of long-term ecological effects adds uncertainty to operations. The market requires clear policies and monitoring standards to balance technological advancement with environmental responsibility. Compliance and transparency remain key to gaining public and institutional trust.

Market Opportunities:

Rising Digital Transformation and Demand for Edge Infrastructure

Expanding digital services and cloud adoption across industries present strong growth potential. The Australia Underwater Data Center (UDC) Market can serve as a vital hub for edge computing and data storage. Increasing demand for low-latency connections supports the installation of coastal data nodes. These centers enable faster access to cloud services for businesses and consumers. The expansion of fintech, e-commerce, and telecom networks further boosts infrastructure demand. Strategic positioning along major coastal cities allows efficient regional service coverage.

Technological Innovation and Strategic Partnerships with Global Firms

Continuous R&D and collaboration with international technology providers open new growth avenues. The Australia Underwater Data Center (UDC) Market benefits from partnerships that bring advanced cooling materials, AI monitoring tools, and renewable integration systems. Joint ventures with global cloud service providers improve scalability and reliability. Strategic cooperation enhances local expertise and accelerates pilot projects. The focus on automation and smart monitoring ensures cost optimization. These opportunities position Australia as a leading center for sustainable data innovation in the Asia-Pacific region.

Market Segmentation Analysis:

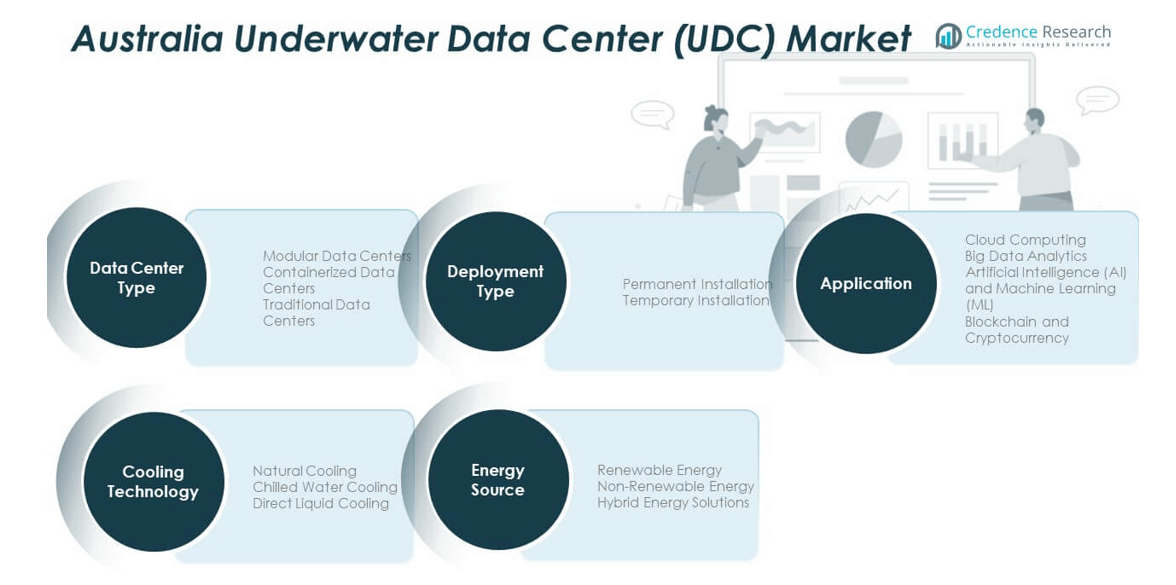

By Data Center Type

The Australia Underwater Data Center (UDC) Market is segmented into modular, containerized, and traditional data centers. Modular data centers hold the largest share due to their scalability, fast deployment, and cost efficiency. Containerized data centers are gaining traction for their portability and ability to adapt to diverse marine conditions. Traditional setups remain limited because of higher maintenance needs and lower flexibility. The modular model aligns with Australia’s coastal infrastructure goals, supporting efficient expansion across regions with strong renewable energy potential.

- For instance, DUG’s modular containerized facility, introduced in 2024, delivers up to 150 kW per 4.5-ton unit and uses immersion cooling technology that lowers power consumption by up to 51% and cuts water usage by 25% compared to traditional models.

By Application

Key applications include cloud computing, big data analytics, artificial intelligence (AI) and machine learning (ML), and blockchain. Cloud computing dominates due to rapid digitalization and growing enterprise data demand. AI and ML applications are expanding as industries adopt real-time analytics. Big data analytics plays a crucial role in government and enterprise decision-making. Blockchain integration is increasing, driven by financial and security applications.

- For instance, IBM’s blockchain platform, hosted on its compliant Sydney cloud data centers, allows Australian organizations to deploy secure blockchain applications locally, with data sovereignty for finance and government sectors.

By Energy Source, Technology, and Cooling Technology

By energy source, renewable energy leads due to sustainability targets and availability of marine wind and tidal resources. Hybrid systems are growing, balancing renewable integration with energy reliability. By deployment type, permanent installations dominate, offering long-term stability and performance, while temporary units support testing and research. In cooling technology, natural cooling prevails, using ocean water to maintain efficiency, while direct liquid and chilled water cooling support high-performance underwater systems needing precise temperature control.

Segmentation:

By Data Center Type

- Modular Data Centers

- Containerized Data Centers

- Traditional Data Centers

By Application

- Cloud Computing

- Big Data Analytics

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain and Cryptocurrency

By Energy Source

- Renewable Energy

- Non-Renewable Energy

- Hybrid Energy Solutions

By Technology (Deployment Type)

- Permanent Installation

- Temporary Installation

By Cooling Technology

- Natural Cooling

- Chilled Water Cooling

- Direct Liquid Cooling

Regional Analysis:

Eastern Australia – Market Leader with Strong Coastal Infrastructure (45% Share)

Eastern Australia dominates the Australia Underwater Data Center (UDC) Market with about 45% share, driven by advanced coastal infrastructure and strong connectivity networks. New South Wales and Queensland are leading states due to their renewable energy potential and government-backed digital transformation projects. The presence of major telecom hubs and proximity to metropolitan areas supports efficient data transmission. It benefits from an established ecosystem of technology firms and energy providers. The region’s ongoing investments in submarine cables and AI-driven data centers strengthen operational reliability and sustainability. Favorable environmental conditions and large enterprise demand make Eastern Australia the core center for underwater data installations.

Southern and Western Australia – Expanding Capacity and Renewable Integration (35% Share)

Southern and Western Australia collectively hold around 35% of the market share, supported by large-scale renewable projects and access to deep-sea zones ideal for data center placement. Western Australia’s coastal depth and stable temperatures enable long-term operational efficiency. Southern regions such as Victoria and Tasmania are integrating hydro and wind energy sources to power underwater facilities. It benefits from collaborations between energy firms and data infrastructure developers. Western Australia is also emerging as a technology hub connecting Asia-Pacific subsea routes. These regions are expected to attract new investments due to strategic geographic positioning and low environmental risks.

Northern and Central Australia – Emerging Growth Corridors (20% Share)

Northern and Central Australia account for nearly 20% of the market share, driven by growing investments in communication and renewable infrastructure. The Northern Territory government is promoting digital connectivity to bridge remote data gaps. It is also exploring partnerships with private operators to expand underwater network capacity. The region offers untapped potential for edge computing applications and hybrid data models. Increasing industrial activities and defense-related projects are boosting demand for localized storage. As infrastructure improves, Northern and Central Australia are projected to become strategic expansion corridors for future underwater data center deployments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mitsui O.S.K. Lines (MOL)

- NYK Line

- NEC Corporation

- KVH Co., Ltd.

- Google

- Amazon Web Services (AWS)

- IBM

- Alibaba Cloud

- Huawei

- Dell Technologies

- Fujitsu

Competitive Analysis:

The Australia Underwater Data Center (UDC) Market is characterized by intense competition among global and regional technology leaders. Key players focus on renewable-powered and modular underwater systems to improve efficiency and sustainability. Companies such as Google, Amazon Web Services, NEC Corporation, and Mitsui O.S.K. Lines (MOL) are investing in advanced subsea technologies and energy-efficient architectures. It reflects a growing collaboration between IT and marine engineering firms to enhance scalability and reliability. Partnerships with local telecom and energy providers are strengthening ecosystem integration and driving innovation across coastal regions.

Recent Developments:

- In July 2025, Mitsui O.S.K. Lines (MOL) entered into a strategic partnership with Kinetics—the energy transition arm of Karpowership—for the development of the world’s first integrated floating data center platform. This joint Memorandum of Understanding enables MOL and Kinetics to collaborate on designing, retrofitting, and operating a modular data center onboard a vessel, utilizing direct water cooling and renewable energy sources.

- In September 2025, NYK Line announced its movement toward the commercialization of offshore data centers powered by renewable energy. The initiative aligns with the company’s vision to utilize maritime assets for advanced IT infrastructure and builds on efforts to expand offshore digital capacity in anticipation of growing technological demands.

- In July 2025, Amazon Web Services (AWS) committed AU$20 billion (US$13.3 billion) to expand its Australian data center operations over the next five years. The investment—Australia’s largest tech infrastructure initiative—will enhance AWS regions in Sydney and Melbourne, support new solar farm developments in Victoria and Queensland, and focus on scaling infrastructure for generative AI and cloud transformation. Prime Minister Anthony Albanese welcomed the move as a major boost for skilled jobs and national AI capability.

- In June 2024, Fujitsu initiated efforts to auction its six Australian data centers, signaling a major shift in its market strategy. These facilities—spanning New South Wales, Victoria, Queensland, and Western Australia—total roughly 25MW and provide colocation and enterprise services, reflecting significant operational footprints relevant to regional underwater and hyperscale data processing demand.

Report Coverage:

The research report offers an in-depth analysis based on data center type, application, energy source, deployment technology, and cooling method. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Modular underwater data centers will dominate due to scalability and reduced setup time.

- Renewable-powered systems will become the preferred choice across coastal deployments.

- AI-driven monitoring will enhance operational reliability and reduce maintenance costs.

- Partnerships between technology and marine engineering firms will expand infrastructure capability.

- Western and Southern Australia will attract major investments in the next phase of growth.

- Cloud and AI applications will remain the top revenue-generating segments.

- Hybrid energy systems will grow due to increasing grid integration efforts.

- Government incentives for green infrastructure will accelerate project approvals.

- Containerized data centers will gain traction for temporary and pilot operations.

- Strategic collaboration among global cloud providers will define future market leadership.