Market Overview:

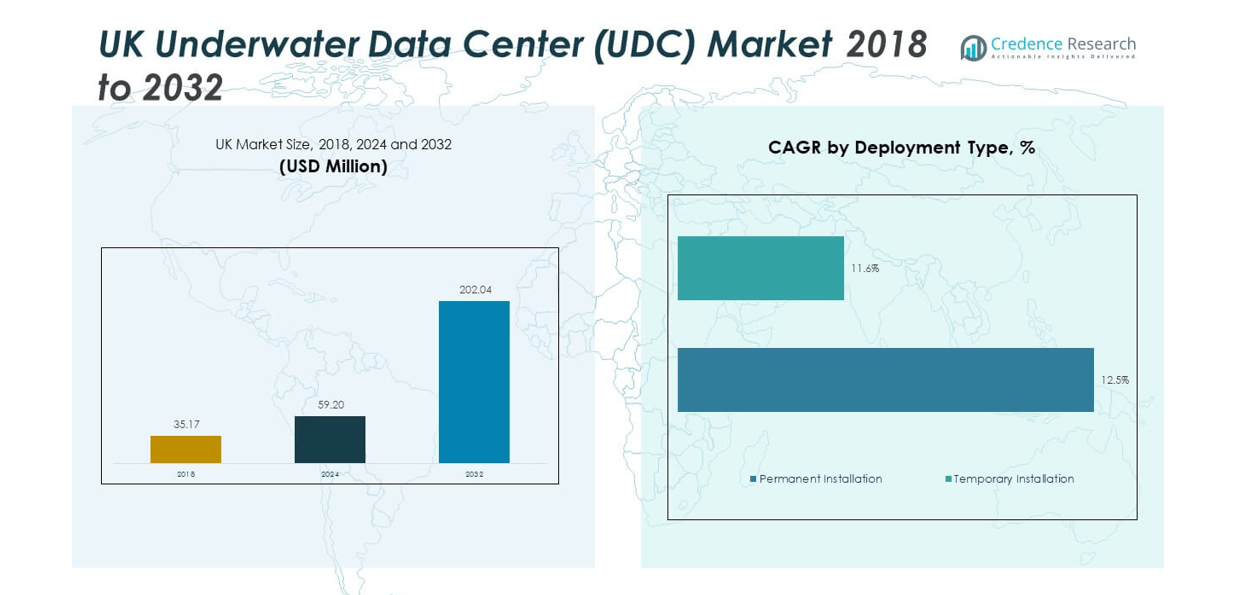

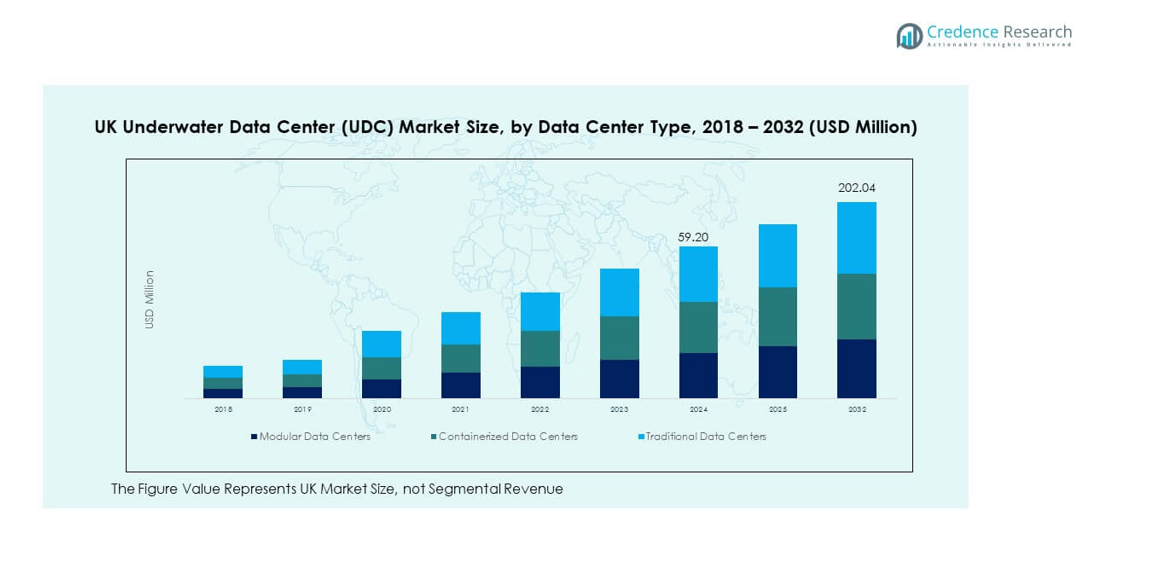

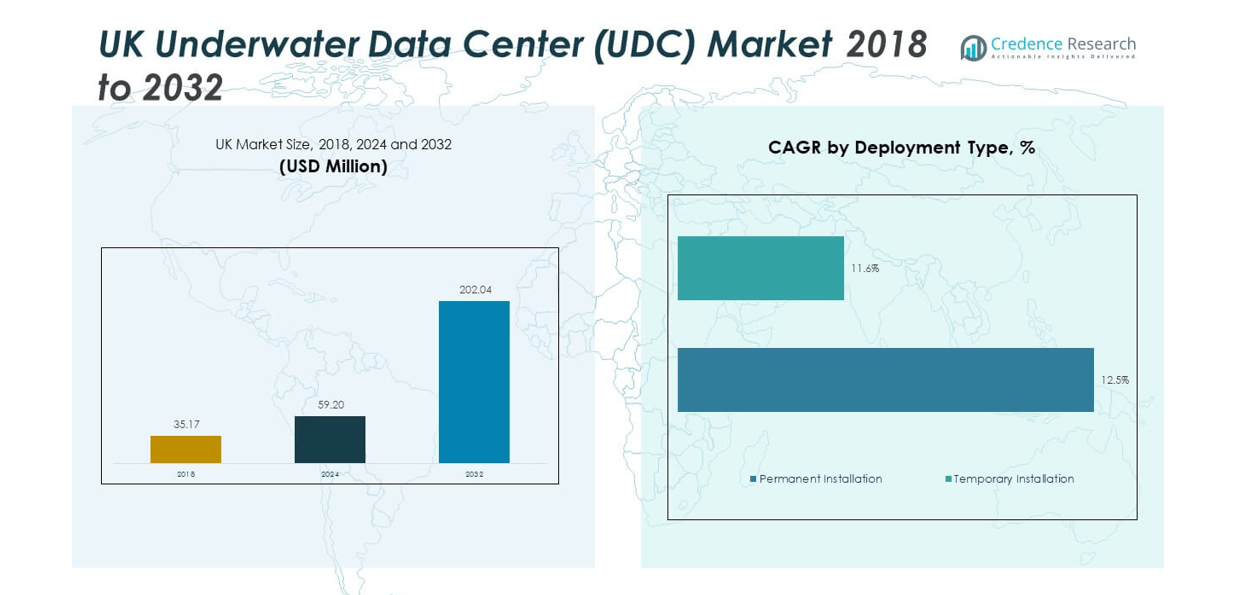

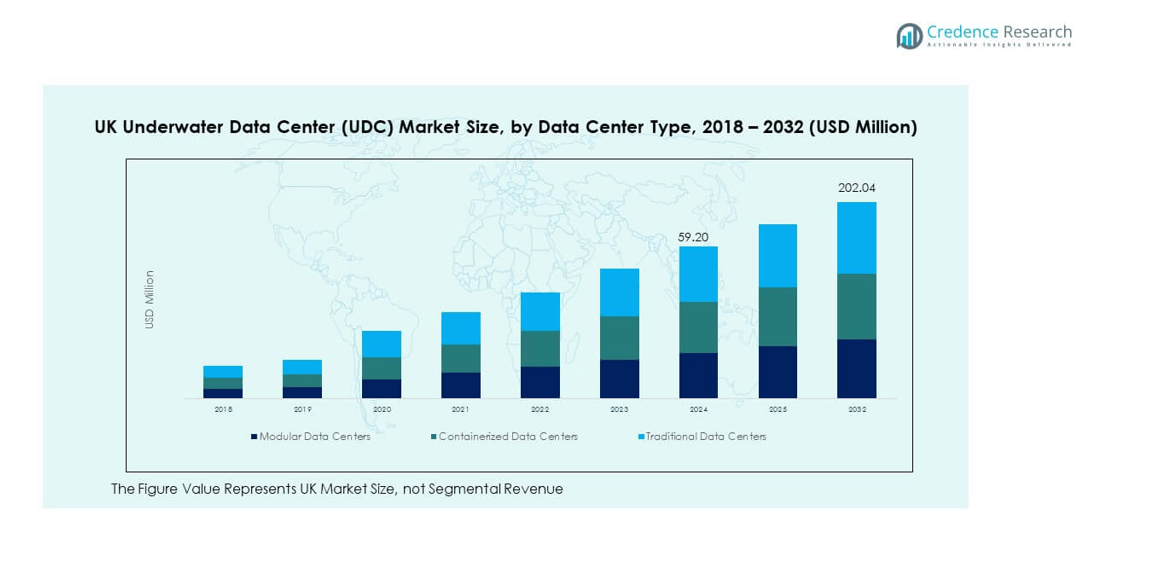

The UK Underwater Data Center (UDC) Market size was valued at USD 35.17 million in 2018, reaching USD 59.20 million in 2024, and is anticipated to reach USD 202.04 million by 2032, at a CAGR of 16.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Underwater Data Center (UDC) Market Size 2024 |

USD 59.20 million |

| UK Underwater Data Center (UDC) Market, CAGR |

16.58% |

| UK Underwater Data Center (UDC) Market Size 2032 |

USD 202.04 million |

The market growth is driven by increasing data traffic, demand for sustainable IT infrastructure, and energy efficiency. Companies are adopting underwater data centers to reduce cooling costs and carbon emissions. The stable oceanic temperatures and renewable energy integration help improve system performance and reliability. Government support for green technology and growing hyperscale data center investments also stimulate market expansion in the United Kingdom.

Geographically, the UK remains one of Europe’s leading hubs for underwater data center innovation, supported by its strong telecom infrastructure and coastal geography. Scotland and Northern England are emerging regions due to suitable offshore environments and renewable power availability. The nation’s focus on data sovereignty and sustainable digital transformation positions it as a key player in Europe’s growing UDC ecosystem.

Market Insights:

- The UK Underwater Data Center (UDC) Market size was USD 35.17 million in 2018, reached USD 59.20 million in 2024, and is projected to reach USD 202.04 million by 2032, registering a CAGR of 16.58%.

- England led the market with 52% share in 2024 due to strong digital infrastructure, followed by Scotland at 31% with renewable energy integration, and Wales & Northern Ireland jointly at 17% driven by emerging coastal projects.

- Scotland is the fastest-growing region with 31% share, supported by offshore wind farms, cold-water conditions, and marine engineering expertise that enhance subsea deployment feasibility.

- Modular data centers accounted for the largest segment share of nearly 46% in 2024, reflecting demand for scalability and energy efficiency.

- Containerized data centers followed with around 33% share, while traditional models held a smaller portion, showing gradual transition toward flexible and sustainable designs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Energy-Efficient and Sustainable Data Infrastructure

The growing emphasis on sustainability is a key driver of the UK Underwater Data Center (UDC) Market. Companies are shifting toward eco-friendly infrastructure to minimize environmental impact and operational costs. Underwater data centers consume less energy due to natural seawater cooling, improving efficiency and reducing carbon footprints. It supports the UK’s carbon neutrality goals while addressing the rising energy needs of data-driven industries. The government’s green initiatives and corporate ESG commitments further encourage adoption. This alignment between technology and sustainability strengthens investment confidence. The trend reflects the nation’s focus on renewable energy integration and sustainable digitalization.

- For instance, Microsoft’s Project Natick’s large-scale deployment off the Orkney Islands operated 864 servers and 27.6 petabytes of storage underwater for two years, achieving up to 40% lower energy consumption compared to traditional data centers while relying entirely on local renewable energy sources for power.

Increasing Data Volume and Cloud Computing Adoption

The exponential rise in data usage and cloud-based services is fueling market growth. Businesses are generating vast amounts of digital information through IoT, AI, and 5G networks. Underwater data centers provide scalable solutions for storage and computation near coastal connectivity hubs. The UK’s robust digital economy relies on efficient data processing systems. It allows faster data transmission while minimizing latency and maintenance costs. Cloud service providers are investing heavily in UDC projects to enhance network resilience. The growing demand for low-latency processing positions the UK as a strategic base for next-generation computing.

- For instance, BT integrated Google Cloud’s low-latency subsea optical links into its Global Fabric platform in 2025, providing customers across 50 global cloud regions—including the UK—with direct, resilient, high-speed connections for digital workloads and ensuring 99.99% reliability backed by both BT and Google.

Government Support and Renewable Energy Integration

Government initiatives supporting renewable energy adoption play a crucial role in market expansion. The UK’s investment in offshore wind energy aligns well with the power needs of underwater data centers. It allows the seamless integration of clean energy into data infrastructure, reducing dependency on fossil fuels. Policy incentives and funding for green technology enhance private-sector participation. Coastal regions with renewable energy potential are becoming attractive deployment zones. The collaboration between energy firms and tech companies is accelerating large-scale UDC projects. It strengthens the UK’s leadership in sustainable data technology across Europe.

Technological Advancements and Cooling Efficiency Gains

Advances in subsea engineering and server cooling systems have increased the commercial viability of underwater data centers. Improved designs ensure better maintenance, corrosion resistance, and data security. It enables operators to deploy units in deeper, colder environments with minimal downtime. The evolution of modular container-based systems supports rapid installation and scalability. Enhanced heat exchange mechanisms have made underwater cooling more reliable than land-based systems. AI and predictive analytics improve performance monitoring and maintenance planning. These innovations are driving efficiency, reliability, and wider adoption across the UK’s data infrastructure landscape.

Market Trends:

Growing Focus on Modular and Scalable Data Center Design

The UK Underwater Data Center (UDC) Market is witnessing a shift toward modular system designs. Modular units allow faster deployment and easy scaling to meet fluctuating data demands. It provides operational flexibility for enterprises expanding their digital footprint. The modular concept also minimizes downtime during upgrades and repairs. Organizations benefit from reduced installation costs and improved space utilization. This design trend supports distributed computing across multiple offshore zones. The growing acceptance of containerized systems highlights the UK’s leadership in adaptive data infrastructure solutions.

Integration of Artificial Intelligence for Predictive Maintenance

AI and machine learning technologies are being widely implemented to improve system reliability. Predictive analytics detect performance anomalies before they affect operations. It enables proactive maintenance scheduling and reduces the risk of system failure. AI-driven monitoring ensures consistent uptime and optimal energy use in submerged conditions. The technology also enhances automation and operational efficiency across subsea networks. Cloud operators are integrating AI for real-time cooling control and network load balancing. These advancements contribute to longer operational lifespans and reduced human intervention requirements.

- For instance, Microsoft’s underwater Project Natick utilized extensive remote monitoring and AI analytics to observe and optimize operational stability, and the system experienced an eightfold reduction in hardware failure rates compared to traditional on-land data centers during its two-year submerged trial.

Expansion of 5G and Edge Computing Infrastructure

The rapid rollout of 5G and edge computing has accelerated interest in underwater data centers. Businesses need distributed networks to manage increasing device connectivity and data volumes. It allows localized data processing closer to users, improving latency and network responsiveness. The UK’s advanced telecom infrastructure supports hybrid deployments linking land and subsea systems. Edge computing partnerships between telecom operators and data firms are strengthening. This convergence is improving real-time data transfer for smart cities, autonomous systems, and cloud applications. The alignment with 5G expansion is shaping future network architecture strategies.

Rising Investments from Hyperscale and Cloud Providers

Hyperscale cloud providers are significantly investing in underwater data center research and projects. It helps them meet growing data storage and energy efficiency requirements. The interest stems from reduced cooling costs, higher reliability, and environmental sustainability. Major technology players are testing pilot facilities to evaluate long-term operational performance. The focus on decentralized data networks aligns with the UK’s strategic coastal locations. Increased collaboration between cloud operators, telecom firms, and infrastructure providers is fueling innovation. These investments are expected to push the underwater data ecosystem toward commercial maturity.

Market Challenges Analysis:

High Installation and Maintenance Costs in Offshore Environments

The UK Underwater Data Center (UDC) Market faces high capital investment barriers. Deploying infrastructure in subsea environments demands specialized engineering, materials, and logistics. It increases project setup costs compared to traditional land-based centers. Maintenance operations are complex due to limited accessibility and harsh underwater conditions. Any malfunction may require full retrieval of the unit, adding downtime and expenses. The need for waterproofing, corrosion-resistant materials, and reliable sealing compounds adds further cost pressure. It limits adoption among small and medium enterprises lacking financial capability for large-scale projects.

Regulatory Compliance and Environmental Concerns

Compliance with marine environmental standards remains a critical challenge for market growth. Government regulations governing oceanic construction and marine ecosystems impose strict requirements. It requires thorough environmental impact assessments before project approval. Concerns about aquatic biodiversity, waste heat discharge, and material disposal are increasing. Operators must ensure their systems do not disrupt underwater habitats or coastal balance. Managing environmental risks raises operational complexity and time-to-deployment. Meeting sustainability goals while complying with regulatory expectations creates strategic challenges for technology providers and investors in this sector.

Market Opportunities:

Expansion of Offshore Renewable Energy Integration and Smart Grids

The growing synergy between underwater data centers and renewable energy networks presents strong opportunities. Offshore wind and tidal power can directly support data center energy needs. It enhances operational sustainability and reduces dependence on fossil-based power sources. Smart grid integration further allows dynamic energy balancing and efficient load distribution. Collaborative projects between energy utilities and data companies are expanding along the UK coastline. This convergence strengthens national digital infrastructure and energy resilience. The trend positions the UK as a leader in low-carbon, offshore-powered data ecosystems.

Emergence of Subsea Infrastructure Innovation and Export Potential

Innovations in subsea construction and robotics are opening new pathways for growth. Advanced materials and remote-operated maintenance tools enhance reliability and reduce lifecycle costs. It enables the creation of deeper and more durable underwater facilities. Local engineering firms are gaining expertise, fostering export potential for global markets. Collaboration with European partners can extend technology reach and standardization. The UK’s strong research base and marine engineering capabilities support long-term competitiveness. This opportunity will expand the country’s role in shaping global underwater data center development.

Market Segmentation Analysis:

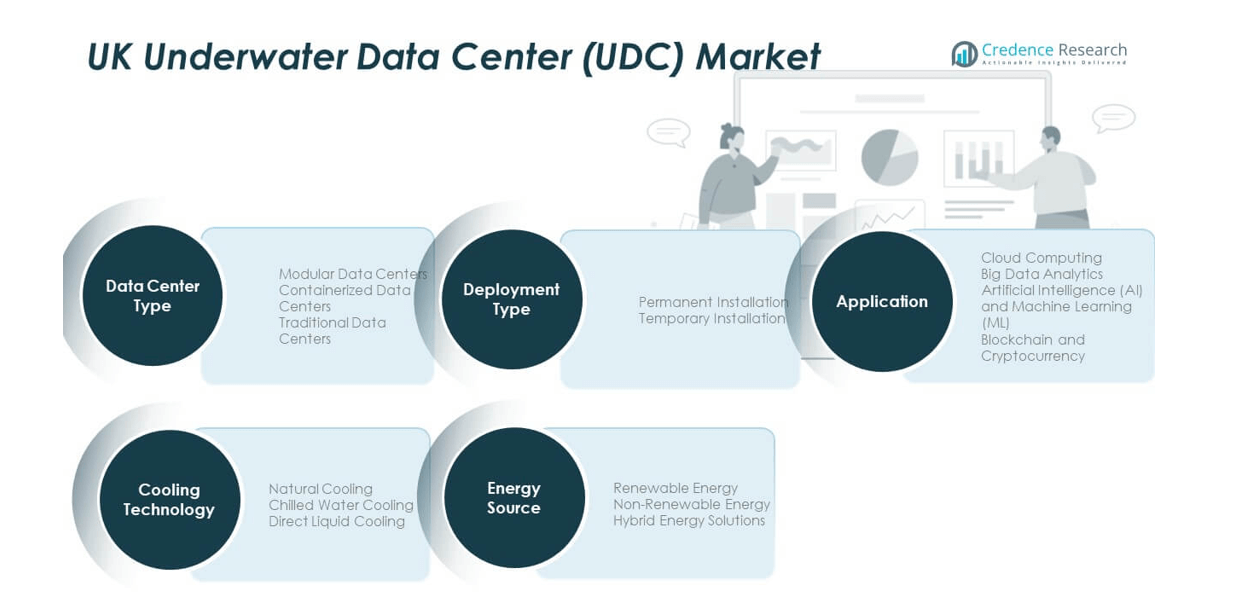

By Data Center Type

The UK Underwater Data Center (UDC) Market is segmented into modular, containerized, and traditional data centers. Modular data centers dominate due to scalability, quick deployment, and cost efficiency. Containerized models are gaining traction for offshore adaptability and ease of maintenance. Traditional setups hold a limited share but remain relevant for legacy infrastructure and integration needs. The modular approach supports flexible expansion aligned with the UK’s data growth demands.

By Application

Cloud computing leads the application segment due to rising demand for remote storage and seamless scalability. Big data analytics follows, driven by enterprise data processing needs. AI and machine learning applications are expanding rapidly, requiring high computational power and low-latency environments. Blockchain and cryptocurrency workloads benefit from underwater cooling stability, enhancing processing efficiency.

- For instance, Google Cloud’s Waltham Cross center in the UK, scheduled to go fully online by the end of 2025, is being designed for high-performance, low-latency AI and enterprise cloud applications, meeting the increased computational requirements for AI deployment and advanced analytics across the nation.

By Energy Source

Renewable energy dominates due to national sustainability goals and offshore wind integration. Non-renewable sources are declining with the transition toward green power. Hybrid systems are emerging, combining stability and environmental performance to ensure consistent energy supply.

By Technology (Deployment Type)

Permanent installations lead due to long-term operational benefits and reduced maintenance frequency. Temporary installations are preferred for pilot projects and technology trials, allowing testing before large-scale deployment.

By Cooling Technology

Natural cooling holds the largest share due to the ocean’s thermal stability and low energy use. Chilled water systems are used in deeper or warmer regions, ensuring thermal efficiency. Direct liquid cooling is an emerging method improving heat transfer and supporting higher computing density.

Segmentation:

By Data Center Type

- Modular Data Centers

- Containerized Data Centers

- Traditional Data Centers

By Application

- Cloud Computing

- Big Data Analytics

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain and Cryptocurrency

By Energy Source

- Renewable Energy

- Non-Renewable Energy

- Hybrid Energy Solutions

By Technology (Deployment Type)

- Permanent Installation

- Temporary Installation

By Cooling Technology

- Natural Cooling

- Chilled Water Cooling

- Direct Liquid Cooling

Regional Analysis:

England – The Core Hub of Innovation and Deployment

England holds the dominant share of the UK Underwater Data Center (UDC) Market, accounting for nearly 52% of the total market. The region benefits from strong digital infrastructure, robust energy networks, and significant investments in offshore data technology. Major tech firms and cloud service providers have established facilities along the southern and eastern coasts to leverage high connectivity and energy availability. It supports large-scale deployment of modular and containerized underwater centers. Government-backed sustainability initiatives and growing partnerships with renewable energy developers enhance the regional advantage. The proximity to major financial and technology hubs such as London and Manchester strengthens England’s position as the primary center for subsea data innovation.

Scotland – Expanding Offshore Potential and Renewable Integration

Scotland represents approximately 31% of the market, supported by its vast coastal areas and renewable energy capacity. The region’s offshore wind farms and cold-water conditions provide ideal environments for efficient data center operations. It has become a testing ground for advanced underwater systems combining green energy and high-performance computing. Local authorities promote collaboration between energy providers and technology firms to attract investment. Scotland’s expertise in marine engineering and subsea infrastructure enhances its competitiveness. The focus on reducing carbon emissions and supporting clean energy transition makes it a strategic location for sustainable UDC expansion.

Wales and Northern Ireland – Emerging Corridors of Growth

Wales and Northern Ireland collectively account for around 17% of the UK Underwater Data Center (UDC) Market. Both regions are emerging destinations for pilot projects due to available coastal zones and improving energy frameworks. It offers untapped potential for small to medium-scale underwater data centers aimed at local data processing and storage needs. Wales leverages its growing digital economy and renewable integration efforts, while Northern Ireland focuses on improving connectivity through subsea cable expansion. Strategic investments in digital transformation programs are creating favorable conditions for market entry. The growing interest in sustainable technology solutions positions these regions as the next frontier for future underwater data infrastructure development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The UK Underwater Data Center (UDC) Market is characterized by a competitive environment driven by innovation, sustainability, and strategic collaboration. Leading players such as Microsoft, Nautilus Data Technologies, Google, and Amazon Web Services are investing in pilot projects to enhance energy efficiency and reliability. It focuses on leveraging renewable energy integration, subsea engineering, and modular deployment technologies. The competition is intensifying as firms pursue patents, new product designs, and environmentally sustainable models. Strategic alliances between technology companies and energy providers are strengthening market positioning. Continuous advancements in AI-based monitoring and cooling efficiency are becoming major differentiators among competitors.

Recent Developments:

- In September 2025, Google opened its $1 billion data center in Waltham Cross, Hertfordshire—its largest UK development—designed for sustainability and advanced AI, cloud, and data analytics workloads.

- In October 2025, China Telecom became an anchor client for Highlander’s new commercial underwater AI data center near Shanghai, leveraging a facility designed to cut cooling energy use by about 90% and operate primarily on renewables.

Report Coverage:

The research report offers an in-depth analysis based on data center type, application, energy source, deployment type, and cooling technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Renewable-powered subsea data centers will gain strong traction across UK coastal regions.

- Modular underwater data centers will dominate future installations due to scalability benefits.

- AI-based monitoring systems will enhance reliability and predictive maintenance efficiency.

- Hybrid energy solutions will support continuous operations and grid independence.

- Strategic collaborations will accelerate innovation and infrastructure expansion.

- Offshore engineering and material advancements will improve long-term durability.

- Rising data consumption will push adoption across cloud and AI-driven industries.

- Government incentives will continue to support clean technology adoption.

- The UK will strengthen its position as a European hub for sustainable digital infrastructure.

- Investment in subsea R&D and renewable integration will shape the next decade of growth.