Market Overview:

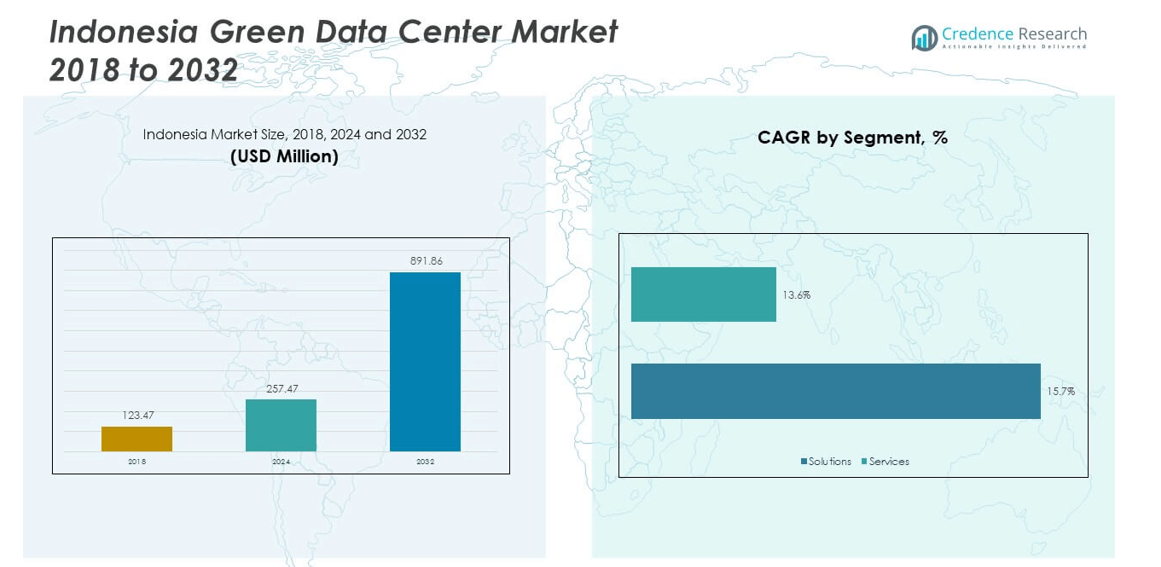

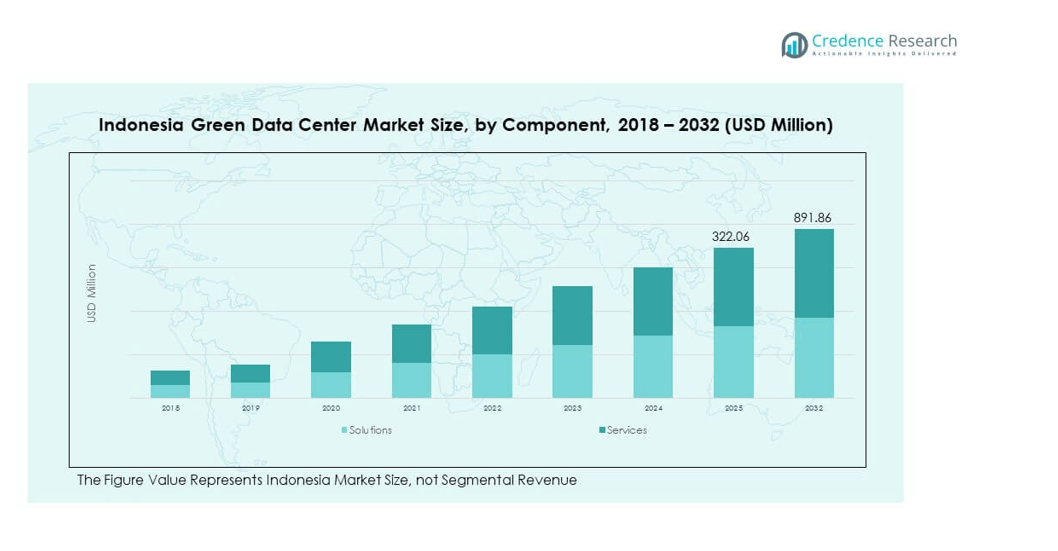

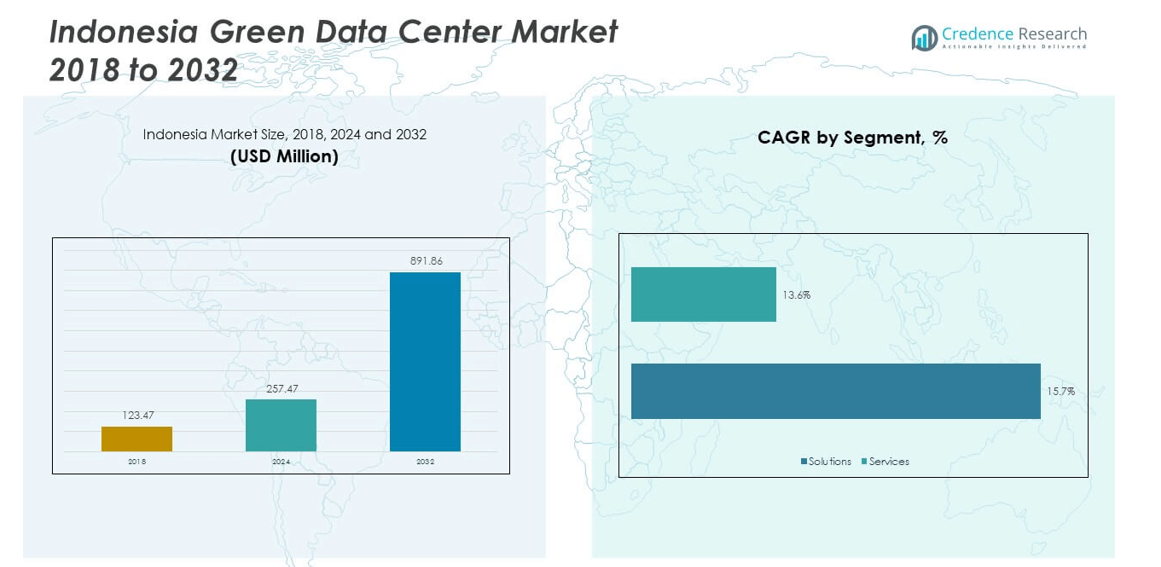

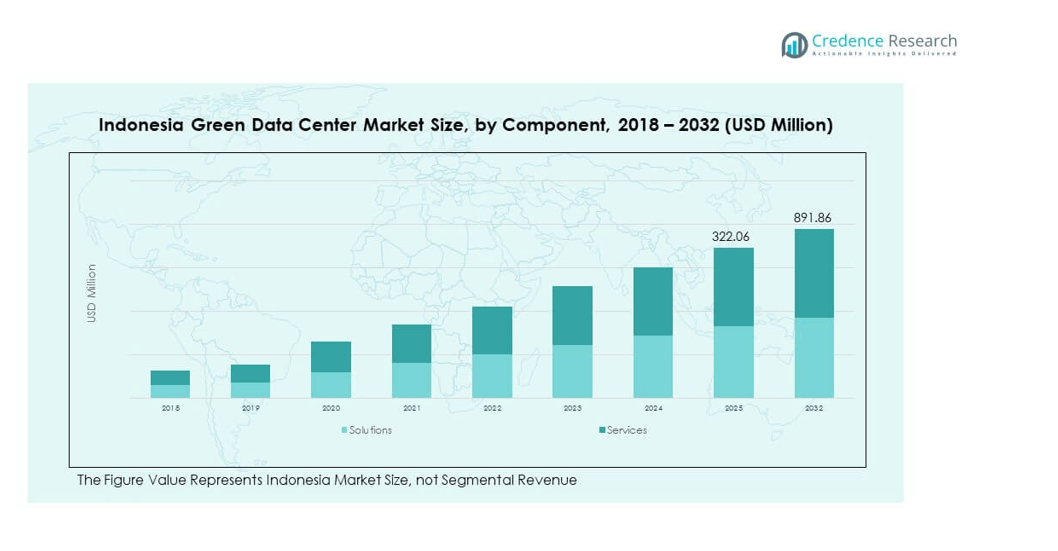

The Indonesia Green Data Center Market size was valued at USD 123.47 million in 2018 to USD 257.47 million in 2024 and is anticipated to reach USD 891.86 million by 2032, at a CAGR of 15.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Green Data Center Market Size 2024 |

USD 257.47 million |

| Indonesia Green Data Center Market, CAGR |

15.66% |

| Indonesia Green Data Center Market Size 2032 |

USD 891.86 million |

The market growth is driven by the rising demand for energy-efficient infrastructure and sustainable operations in the IT and telecom sector. Cloud adoption, increased digital services, and the expansion of hyperscale data centers are pushing companies to adopt green technologies to reduce operating costs and comply with environmental targets. Strong government initiatives promoting renewable energy integration, alongside growing investor interest in sustainable infrastructure, further accelerate adoption. Rising enterprise awareness about reducing carbon footprints also plays a critical role in fueling market demand.

Regionally, Jakarta remains the hub for green data centers due to its role as Indonesia’s financial and digital capital, hosting large enterprises and hyperscale operators. Other regions are emerging, with West Java and Batam gaining traction due to favorable infrastructure, proximity to Singapore, and supportive investment policies. Eastern Indonesia is still at a nascent stage but offers potential as connectivity improves and local demand rises. This geographic shift shows a balanced trend between established hubs and upcoming growth regions across the country.

Market Insights:

- The Indonesia Green Data Center Market was valued at USD 123.47 million in 2018, reached USD 257.47 million in 2024, and is projected to hit USD 891.86 million by 2032, growing at a CAGR of 15.66%.

- Jakarta led with 55% share in 2024, supported by its position as the financial and digital hub with strong infrastructure.

- Batam followed with 25% share, benefiting from proximity to Singapore and cross-border connectivity, while Surabaya held 12% share, driven by economic growth in Eastern Java.

- Secondary and remote regions accounted for 8% share, but they represent the fastest-growing areas due to SME adoption and government-backed infrastructure expansion.

- By component, solutions such as cooling and power systems dominated with over 65% share in 2024, while services including deployment, consulting, and support contributed around 35%, reflecting balanced growth across infrastructure and service models.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sustainable Digital Infrastructure Across Enterprises:

The Indonesia Green Data Center Market is fueled by rapid digital transformation across industries. Enterprises are expanding their IT capacity, which increases energy demand. Green data centers help lower operating costs through energy-efficient cooling and power management systems. Companies see them as strategic investments for long-term savings and compliance with environmental regulations. Government support for sustainable infrastructure adds further momentum to adoption. It positions Indonesia as a regional leader in eco-friendly digital development. Strong demand from telecom, banking, and e-commerce players strengthens this transition.

- For instance, IDC Indonesia operates multiple Tier III and Tier IV data centers across Jakarta, Batam, and Makassar, utilizing advanced cooling solutions and redundant power systems with N+1 and 2N configurations, which have resulted in a measured reduction in energy consumption per rack by up to 20%. Government support for sustainable infrastructure adds further momentum to adoption.

Government Policies Encouraging Renewable Energy Integration:

Public policy plays a critical role in accelerating the green data center shift. Indonesia has committed to reduce carbon emissions while supporting digitalization. Incentives for renewable energy usage in IT infrastructure align with these goals. This has created an environment where operators focus on solar, wind, and hybrid energy solutions. The Indonesia Green Data Center Market benefits directly from these policy measures. Companies adopting clean energy reduce dependency on traditional power sources. It enhances their market reputation while meeting global sustainability standards. Regulatory clarity attracts both domestic and foreign investors.

- For example, Datagarda is enabling Indonesian data centers to integrate on-site solar and hybrid energy systems coupled with battery storage, contributing to a broader industry shift away from coal dependency towards cleaner energy sources. The Indonesian Green Data Center Market benefits from national policies that encourage renewable energy adoption. By adopting clean energy, companies enhance their market reputation, meet global sustainability standards, and contribute to Indonesia’s green energy transition.

Growing Cloud Adoption and Hyperscale Expansion Across Indonesia:

The country’s increasing reliance on cloud services is a major driver. Hyperscale data centers require high efficiency and minimal environmental impact. Green solutions reduce electricity consumption while supporting high computing loads. Global players are entering Indonesia with large-scale investments. It has led to new projects in Jakarta and surrounding regions. Enterprises migrating workloads to the cloud also prefer eco-friendly solutions. The Indonesia Green Data Center Market gains momentum from this large-scale transition. Strong cloud growth is expected to sustain demand over the coming years.

Corporate Sustainability Goals and Carbon Neutrality Targets:

Enterprises are aligning operations with international sustainability benchmarks. Large corporations focus on achieving carbon neutrality across their supply chains. Green data centers provide measurable benefits by lowering greenhouse gas emissions. This makes them an attractive option for companies reporting ESG performance. Consumer awareness of sustainable practices further strengthens demand. The Indonesia Green Data Center Market reflects this corporate shift toward green IT. It allows enterprises to balance growth with environmental accountability. This driver ensures steady adoption across multiple industry verticals.

Market Trends:

Shift Toward Modular and Scalable Green Data Center Designs:

Enterprises demand flexible infrastructure that supports rapid digital expansion. Modular data center designs enable faster deployment with lower capital cost. Scalable green technologies allow operators to adapt to changing workloads. This trend reduces downtime while enhancing efficiency. The Indonesia Green Data Center Market is moving toward modular construction. It helps optimize space utilization and energy performance. The preference for modular systems aligns with the growing need for cost-effective and eco-friendly digital infrastructure.

- For example, Schneider Electric provides pre-engineered, modular data center elements that streamline commissioning times by 30%, which is being adopted by Indonesian data center operators to optimize space and energy performance. The preference for modular systems aligns with the growing need for cost-effective and eco-friendly digital infrastructure.

Integration of Advanced Cooling Systems for Energy Optimization:

Cooling consumes a significant portion of data center energy. Operators are shifting toward liquid cooling, free-air cooling, and AI-driven optimization. These systems reduce energy waste and extend equipment lifespan. The Indonesia Green Data Center Market shows growing adoption of innovative cooling strategies. It reflects a focus on operational excellence and sustainability. Companies deploying advanced cooling cut electricity bills and carbon output. This trend highlights technology-driven efficiency as a key differentiator. Operators adopting such solutions gain long-term competitive advantages.

- For instance, industry distributor Climanusa highlights its liquid cooling deployments in Indonesia, which offer significant energy efficiency improvements over traditional air cooling systems. While the company’s own marketing materials claim savings of up to 30%, numerous independent studies confirm that liquid cooling substantially cuts electricity consumption and carbon output for data centers.

Adoption of Smart Monitoring and Automation for Efficiency Gains:

Smart monitoring solutions are transforming operational management. Real-time analytics enhance energy utilization and detect inefficiencies early. Automation reduces manual oversight while improving reliability. The Indonesia Green Data Center Market increasingly incorporates AI and IoT systems. It ensures higher efficiency and predictive maintenance capabilities. Enterprises gain better visibility into resource consumption patterns. This trend also improves service uptime and client trust. Technology-driven automation is becoming a standard in Indonesia’s evolving green data ecosystem.

Collaborations Between Local and Global Players for Green Innovation:

Strategic alliances shape the growth of Indonesia’s green digital infrastructure. Local firms partner with global technology leaders to introduce advanced solutions. Such collaborations bring in capital, expertise, and renewable integration strategies. The Indonesia Green Data Center Market benefits from shared innovations in design and operations. It accelerates knowledge transfer and boosts infrastructure development. Multinational players establish regional facilities while local companies provide execution support. These partnerships create competitive advantages and scale up adoption. The trend highlights cooperation as a core enabler of green transition.

Market Challenges Analysis:

High Initial Investment and Operational Cost Pressures:

Building green data centers requires significant upfront capital. Energy-efficient equipment, advanced cooling, and renewable integration drive costs higher. Many enterprises hesitate to make large investments without guaranteed returns. The Indonesia Green Data Center Market faces delays due to financial concerns. It must balance sustainable goals with affordability for operators. Rising land and construction expenses add further strain. Operators face pressure to control costs while meeting sustainability targets. It creates barriers for smaller firms aiming to enter the market.

Infrastructure Gaps and Power Reliability Concerns in Emerging Regions:

Indonesia still faces uneven infrastructure development across its regions. Outside Jakarta, reliable power supply and connectivity remain inconsistent. Green data centers require stable grids and advanced utility support. The Indonesia Green Data Center Market struggles in areas with poor infrastructure readiness. It impacts expansion into secondary and remote markets. Power disruptions increase operational risks and reduce efficiency benefits. Enterprises prefer established hubs, slowing nationwide growth. Closing these gaps is critical for achieving balanced market expansion.

Market Opportunities:

Rising Investor Interest in Sustainable Infrastructure Development:

Sustainability is now a global investment priority. Indonesia attracts strong investor attention for renewable energy and green IT. The Indonesia Green Data Center Market stands to benefit from this momentum. It provides opportunities for partnerships, financing, and innovation. Foreign investors see it as a gateway to Southeast Asia’s digital economy. Domestic enterprises leverage these funds to scale operations. Investor appetite ensures long-term market stability and growth potential.

Emergence of Secondary Hubs to Support Digital Expansion Nationwide:

Beyond Jakarta, cities like Batam and Surabaya are evolving as new data center hubs. They offer strategic advantages such as connectivity, land availability, and proximity to Singapore. The Indonesia Green Data Center Market can diversify by expanding into these hubs. It opens new opportunities for enterprises targeting regional growth. It also helps balance demand across Indonesia’s digital economy. These emerging hubs enhance resilience and strengthen national competitiveness. Market opportunities are growing steadily across multiple geographies.

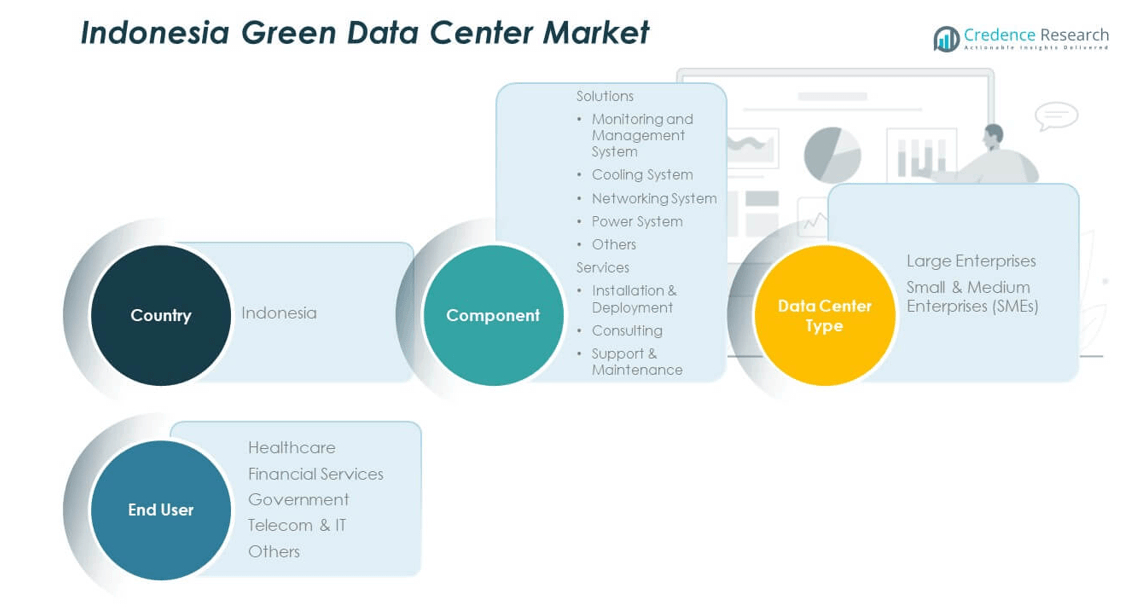

Market Segmentation Analysis:

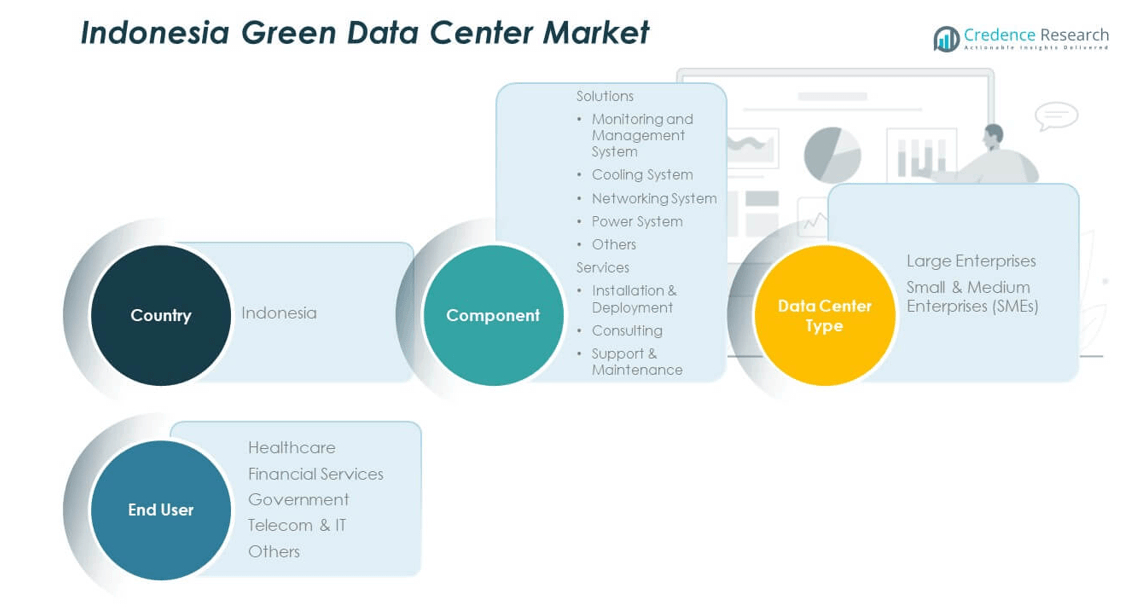

By Component

The Indonesia Green Data Center Market is divided into solutions and services. Solutions include monitoring and management systems, cooling systems, networking systems, power systems, and others. Cooling and power systems hold significant demand due to high energy consumption in data operations. Monitoring and networking solutions are gaining traction with the rise of automation. Service offerings such as installation & deployment, consulting, and support & maintenance provide strong recurring revenue opportunities. It demonstrates balanced growth between infrastructure and service-driven adoption.

- For instance, Cisco Systems and Huawei Technologies provide networking solutions that support automated monitoring and management, helping data centers reduce operational inefficiencies by analyzing real-time power usage data to optimize loads. Meanwhile, service offerings such as installation & deployment, consulting, and support & maintenance provide strong recurring revenue opportunities.

By Data Center Type

Large enterprises lead the market due to their capacity for capital investment and advanced infrastructure needs. They focus on energy-efficient technologies to align with sustainability targets. Small and medium enterprises are emerging adopters, supported by cloud migration and managed service models. It highlights the increasing democratization of green data solutions across business sizes.

- For example, NTT DATA’s Jakarta 2 Annex Data Center supports up to 12MW critical IT load with racks capable of handling densities up to 40kW, employing advanced cooling and power management to optimize energy use. Small and medium enterprises are emerging adopters, supported by cloud migration and managed service models.

By End User

Telecom and IT remain the dominant end-user segment, driven by digital transformation and rising connectivity needs. Financial services adopt green infrastructure to meet regulatory standards and secure high-performance operations. Government agencies emphasize sustainability mandates, while healthcare accelerates adoption for secure and efficient digital storage. Other industries show steady progress through pilot-scale deployments.

Segmentation:

By Component

- Solutions

- Monitoring and Management System

- Cooling System

- Networking System

- Power System

- Others

- Services

- Installation & Deployment

- Consulting

- Support & Maintenance

By Data Center Type

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End User

- Healthcare

- Financial Services

- Government

- Telecom & IT

- Others

By Country (within Indonesia scope)

- Country-level Revenue Analysis

- By Component

- By Data Center Type

- By End User

Regional Analysis:

Jakarta as the Core Market Hub

Jakarta dominates the Indonesia Green Data Center Market with a share of around 55% in 2024. The city’s position as the financial and digital capital makes it the prime destination for hyperscale operators and multinational enterprises. Strong connectivity, access to reliable power, and concentration of IT infrastructure support its dominance. Enterprises in banking, telecom, and cloud services establish their largest operations in Jakarta. It continues to attract foreign investors seeking scalable and energy-efficient facilities. The concentration of corporate headquarters further enhances Jakarta’s leadership role.

Emerging Growth in Batam and Surabaya

Batam holds nearly 25% of the market, driven by its strategic location near Singapore and supportive investment climate. The city benefits from competitive land costs and growing cross-border digital traffic. Surabaya contributes about 12% share, supported by its role as an economic hub in Eastern Java. Enterprises recognize its potential for regional expansion due to improving connectivity and infrastructure readiness. The Indonesia Green Data Center Market leverages these emerging hubs to balance national digital demand. It reflects a trend toward diversifying operations beyond Jakarta’s saturated ecosystem.

Potential of Secondary and Remote Regions

Other regions, including West Java and Central Java, collectively account for about 8% market share. These areas remain at a nascent stage but show potential with rising demand from SMEs and government initiatives to expand digital access. Infrastructure gaps such as inconsistent power reliability and limited fiber coverage still limit large-scale adoption. It is expected that investment in grid modernization and renewable integration will unlock these regions in the future. The Indonesia Green Data Center Market demonstrates a gradual expansion from established hubs to underserved geographies. This shift will help create a more balanced and resilient digital ecosystem across the country.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Indonesia Green Data Center Market is competitive, with local and global players expanding capacity and strengthening service portfolios. Telkom Indonesia, DCI Indonesia, SpaceDC, and NTT Communications lead through large-scale investments and advanced sustainable infrastructure. Indosat Ooredoo Hutchison and Telkomsigma strengthen their presence with cloud-driven solutions. Smaller players such as Aesler focus on innovation in energy-efficient design. It demonstrates intense rivalry, with firms investing in renewable integration, modular designs, and automation to differentiate. Strategic alliances, mergers, and regional expansions shape the competitive landscape.

Recent Developments:

- In August 2025, Telkom Indonesia announced a strategic partnership with OpenAI during Solution Day 2025. This partnership aims to bring advanced AI applications to businesses and communities across Indonesia, including deploying ChatGPT Enterprise and leveraging Telkom’s network to make AI accessible nationwide.

- In August 2025, Telkom Indonesia launched its AI Center of Excellence (AI CoE) to foster AI development and collaboration across sectors. The AI CoE aims to accelerate digital transformation by partnering with universities, industries, and government agencies to present AI solutions tailored for Indonesia’s needs.

- In June 2025, DCI Indonesia inaugurated its eighth data center, JK6, at the H1 Campus in Cibitung. This facility adds 36 megawatts of capacity, bringing the total installed capacity to 119 megawatts, making it the largest data center operator in Indonesia. The data center is AI-ready and supports global cloud providers, marking a significant milestone in Indonesia’s digital infrastructure development.

- In June 2025, Indosat Ooredoo Hutchison formed a strategic partnership with Transsion Holdings to boost digital inclusion in Indonesia. This partnership combines Indosat’s connectivity with Transsion’s affordable smart devices to improve digital access, especially in rural and underserved communities.

- In October 2023, Telkomsigma, a subsidiary of Telkom Indonesia, focused on expanding its cloud business portfolio, reaching an estimated market size of IDR 39.3 trillion. Telkomsigma is developing hybrid multicloud capabilities, supported by a team of certified cloud practitioners and 24/7 IT support, aiming to accelerate Indonesia’s digital economy through efficient cloud solutions.

Report Coverage:

The research report offers an in-depth analysis based on component, data center type, end user, and country-level segmentation. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising digital adoption will sustain demand for energy-efficient data infrastructure.

- Jakarta will remain the dominant hub, while Batam and Surabaya expand rapidly.

- Investments in renewable energy integration will strengthen competitive positioning.

- Modular and scalable designs will gain traction to optimize deployment speed.

- AI-driven monitoring and automation will enhance operational efficiency.

- Hyperscale data centers will lead capacity expansion across core regions.

- Telecom and IT will continue as the largest end-user segment.

- SMEs will increase adoption through managed and cloud-based solutions.

- Government policies will encourage carbon neutrality and green infrastructure.

- Competition will intensify with global entrants targeting Indonesia’s growth.