Market Overview:

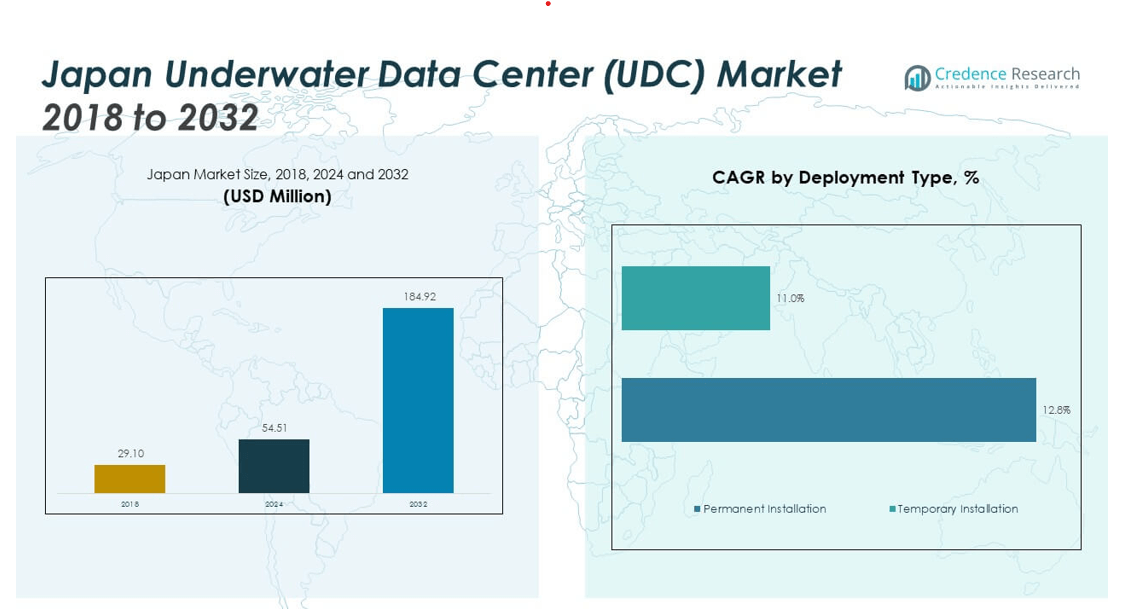

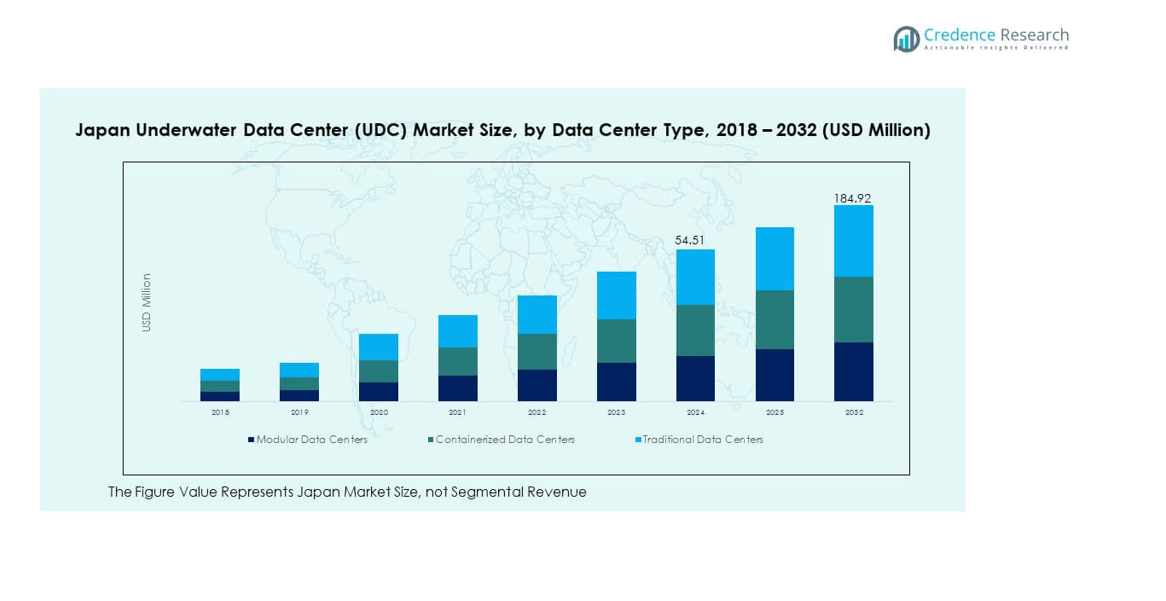

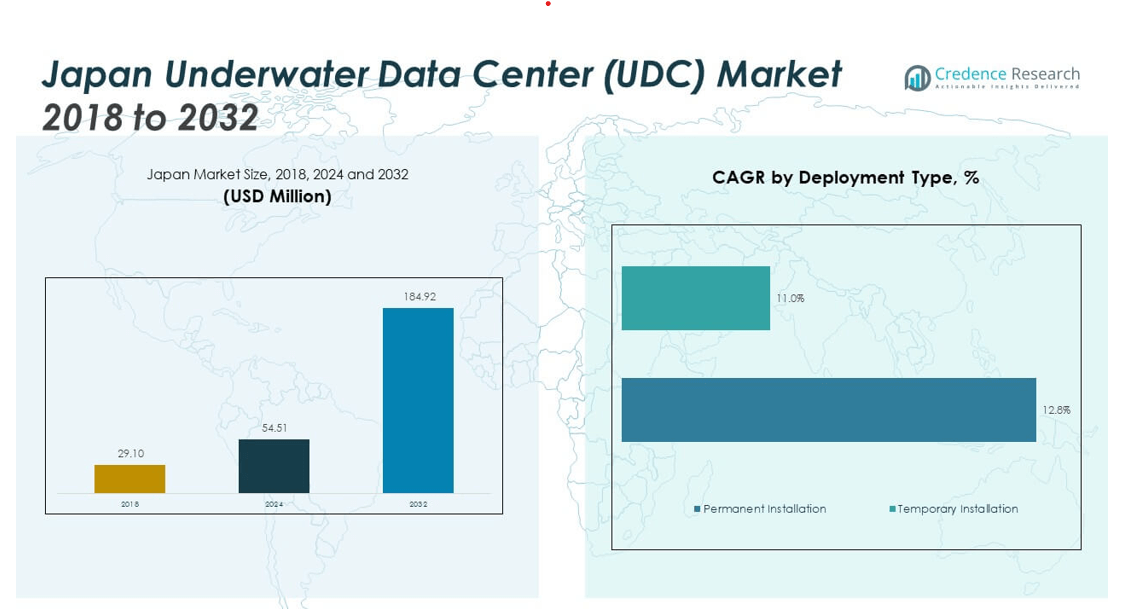

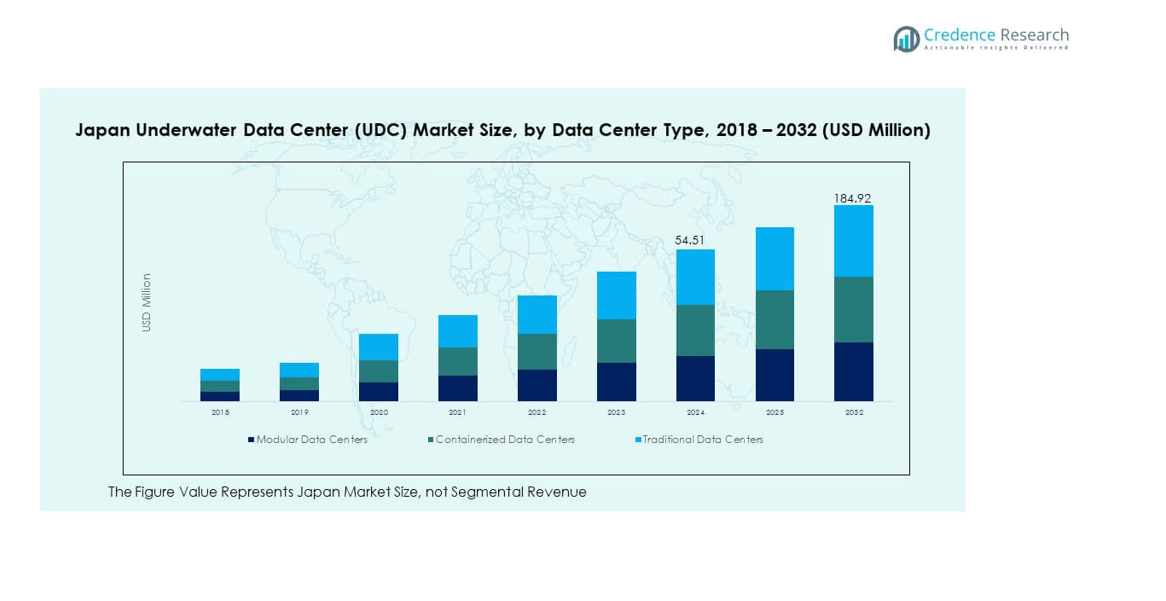

The Japan Underwater Data Center (UDC) Market size was valued at USD 29.10 million in 2018 to USD 54.51 million in 2024 and is anticipated to reach USD 184.92 million by 2032, at a CAGR of 16.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Underwater Data Center (UDC) Market Size 2024 |

USD 54.51 million |

| Japan Underwater Data Center (UDC) Market, CAGR |

16.50% |

| Japan Underwater Data Center (UDC) Market Size 2032 |

USD 184.92 million |

Japan Underwater Data Center (UDC) Market growth is driven by rising demand for energy-efficient and sustainable data infrastructure. The nation’s focus on green technologies and renewable energy integration supports this expansion. Growing data traffic from cloud computing, IoT, and AI-based services increases the need for advanced cooling systems, which underwater data centers provide. The market also benefits from reduced energy consumption, lower maintenance costs, and improved server reliability offered by submerged operations.

Regionally, Japan is leading the adoption of underwater data centers in the Asia-Pacific region due to strong government support and innovation-driven enterprises. Neighboring countries like South Korea and China are emerging participants, investing in pilot projects to enhance data efficiency and minimize environmental impact. Japan’s coastal geography, robust marine engineering expertise, and commitment to reducing carbon emissions position it as a central hub for regional UDC advancements.

Market Insights:

- The Japan Underwater Data Center (UDC) Market was valued at USD 29.10 million in 2018, reached USD 54.51 million in 2024, and is projected to attain USD 184.92 million by 2032, registering a CAGR of 16.50%.

- The Kanto region holds the largest share at 45%, driven by Tokyo Bay’s robust infrastructure and strong corporate presence. Kansai follows with 30%, supported by Osaka’s industrial expansion, while Kyushu and Hokkaido together account for 25% due to pilot deployments and renewable energy use.

- Hokkaido is the fastest-growing region, benefiting from its cold-water advantage and growing focus on energy-efficient infrastructure.

- Modular data centers dominate the market with around 50% share, owing to flexible deployment and lower maintenance.

- Containerized data centers hold nearly 35% share, supported by portable design and scalability for small and mid-scale projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Sustainable and Energy-Efficient Data Infrastructure

The Japan Underwater Data Center (UDC) Market is driven by the nation’s growing need for sustainable digital infrastructure. Rising electricity consumption by conventional data centers has pushed Japan to explore underwater cooling alternatives. Submerged data centers consume less power for cooling, significantly reducing operational expenses. The technology aligns with Japan’s carbon neutrality goals and its focus on green transformation. Strong public and private sector collaboration supports large-scale deployment of eco-friendly digital facilities. The integration of renewable power sources such as offshore wind further enhances efficiency. It creates a cost-effective and environmentally responsible model for large-scale data storage.

- For instance, Nautilus Data Technologies reported achieving energy savings of up to 30% in cooling operations at its water-cooled data centers, with Power Usage Effectiveness (PUE) as low as 1.15 in 2025, compared to conventional Japanese facilities where PUE routinely exceeds 1.40.

Expansion of Cloud Computing and Artificial Intelligence Applications

The rapid adoption of cloud computing, artificial intelligence, and big data analytics accelerates the need for high-performance infrastructure. Japan’s digital transformation initiatives generate massive data volumes that require scalable and reliable systems. Underwater data centers provide enhanced cooling and lower latency, ensuring seamless processing of AI workloads. Enterprises are increasingly shifting workloads to cloud environments, demanding robust and secure data hosting. The Japan Underwater Data Center (UDC) Market benefits from this shift, enabling faster data management. The technology enhances network speed and supports smart city initiatives. It also reduces the physical footprint of data infrastructure in dense urban areas.

- For instance, Amazon Web Services (AWS) announced in January 2024 a $15 billion expansion project for Japan, specifically targeting Tokyo and Osaka, resulting in sub-20 millisecond latency for cloud workloads in those regions, verified by official statements and industry news platforms.

Government Initiatives Supporting Technological Advancement

The Japanese government’s strong emphasis on sustainability and innovation fuels investment in advanced digital infrastructure. Policies promoting green energy and low-emission technologies favor underwater data centers. It supports public-private collaborations to accelerate pilot projects in marine-based data storage. Government-backed research programs encourage the use of ocean thermal energy for cooling purposes. This initiative reduces carbon emissions and enhances operational reliability. The Japan Underwater Data Center (UDC) Market benefits from these incentives, attracting global technology investors. Japan’s strong engineering capabilities and policy framework create a foundation for continued technological leadership.

Reduction in Operational and Maintenance Costs

Underwater data centers provide cost efficiency by minimizing the need for traditional air conditioning systems. Cooling expenses, which account for a major share of data center costs, are reduced through natural seawater circulation. The closed underwater environment also lowers maintenance frequency and hardware failure rates. Automated systems handle operations, further cutting down human intervention and costs. The Japan Underwater Data Center (UDC) Market gains competitiveness by offering lower total ownership costs to operators. These savings encourage long-term adoption by cloud service providers and telecom companies. It strengthens Japan’s position in sustainable and high-performance data management solutions.

Market Trends:

Integration of Renewable Energy Sources in Data Center Operations

The Japan Underwater Data Center (UDC) Market is witnessing increased integration of renewable energy sources to power submerged facilities. Offshore wind, tidal, and wave energy are becoming primary contributors to sustainable power generation. This approach aligns with Japan’s national energy strategy to cut emissions and reliance on fossil fuels. Companies are developing hybrid systems that combine underwater cooling with renewable generation for higher efficiency. The trend ensures operational stability and aligns with environmental goals. It enhances data center resilience against grid disruptions and energy price fluctuations. These innovations are redefining Japan’s approach to green digital infrastructure.

- For instance, NYK Line’s demonstration project at Yokohama port, commencing in autumn 2025, will test a floating data center running on 100% renewable energy from a 44 kW solar facility. The experiment is designed to test the system’s operational stability and salt damage resistance, with commercialization potentially explored around 2030, based on the results.

Advancement in Modular and Scalable Underwater Data Center Designs

Technological innovation drives the adoption of modular underwater data centers that can be rapidly deployed and scaled. Japan’s engineering firms are designing compact, pressure-resistant modules to simplify installation and maintenance. This trend reduces setup time while maintaining operational flexibility. The Japan Underwater Data Center (UDC) Market benefits from modular configurations that allow operators to expand capacity on demand. These structures also support faster recovery in disaster scenarios, making them ideal for coastal nations. The trend contributes to higher efficiency and reduced downtime. It positions Japan as a global leader in adaptive marine-based data systems.

Rising Collaboration Between Tech Companies and Marine Engineering Firms

Cross-industry partnerships are reshaping the development of underwater data infrastructure. Tech giants and marine engineering firms are joining forces to create resilient and energy-efficient systems. The Japan Underwater Data Center (UDC) Market benefits from this synergy through advanced cooling and structural innovations. Collaborative R&D accelerates technology commercialization and large-scale deployment. Joint pilot projects near Japan’s coasts test performance under varying ocean conditions. These alliances also support international knowledge exchange and standardization. It creates a foundation for a globally competitive underwater data center ecosystem.

Increasing Focus on Data Security and Disaster Resilience

Growing concerns about natural disasters and cyber threats are influencing investment priorities. Underwater data centers offer a secure environment protected from external tampering and extreme weather. The Japan Underwater Data Center (UDC) Market leverages this advantage to ensure continuity of operations. Enclosed underwater systems minimize exposure to environmental hazards, enhancing data reliability. Companies are adopting advanced encryption and AI-based monitoring for added protection. The trend strengthens Japan’s cybersecurity landscape in digital infrastructure. It reinforces confidence among enterprises adopting UDC solutions for mission-critical operations.

Market Challenges Analysis:

High Initial Investment and Complex Installation Requirements

The Japan Underwater Data Center (UDC) Market faces challenges due to high capital requirements for deployment. Establishing underwater facilities involves expensive marine engineering, specialized materials, and subsea cabling systems. Companies must manage environmental regulations and complex permitting processes. High upfront costs deter small and medium players from entering the market. The integration of renewable power and deep-sea monitoring adds further expense. It also demands collaboration among multiple stakeholders including telecoms, energy firms, and government bodies. Managing these complexities requires significant planning, technical expertise, and long-term financial commitment.

Limited Maintenance Access and Uncertain Long-Term Reliability

Maintaining submerged data centers remains a major challenge for operators. Accessing and servicing underwater units requires specialized equipment and remotely operated vehicles. It increases downtime risk and adds operational uncertainty. The Japan Underwater Data Center (UDC) Market must overcome these issues through innovations in self-healing materials and automated diagnostics. Corrosion, biofouling, and temperature variations also impact system reliability. Long-term data center recovery in emergencies poses technical hurdles. Ensuring consistent uptime requires rigorous design validation and advanced predictive maintenance. These constraints can slow adoption despite the technology’s environmental benefits.

Market Opportunities:

Growing Adoption of AI, IoT, and Cloud-Based Workloads

Japan’s expanding digital economy is creating new opportunities for underwater data center adoption. AI-driven analytics, IoT connectivity, and high-performance cloud applications require low-latency systems. The Japan Underwater Data Center (UDC) Market can cater to these demands through efficient cooling and close-to-shore data processing. Rising enterprise digitization and 5G expansion also increase infrastructure needs. It provides an opportunity for providers to offer energy-optimized and sustainable solutions. Enhanced data speed and reduced latency strengthen the technology’s commercial appeal across industries.

Government Support and Expansion into International Projects

Strong policy backing and public-private collaborations create favorable conditions for growth. Japan’s commitment to renewable technologies encourages investment in offshore data centers. The Japan Underwater Data Center (UDC) Market can expand by exporting technology to countries exploring similar solutions. Regional cooperation in Asia-Pacific fosters joint research and development. It enables Japan to position itself as a hub for sustainable data infrastructure innovation. Global expansion strengthens economic ties while advancing clean technology leadership.

Market Segmentation Analysis:

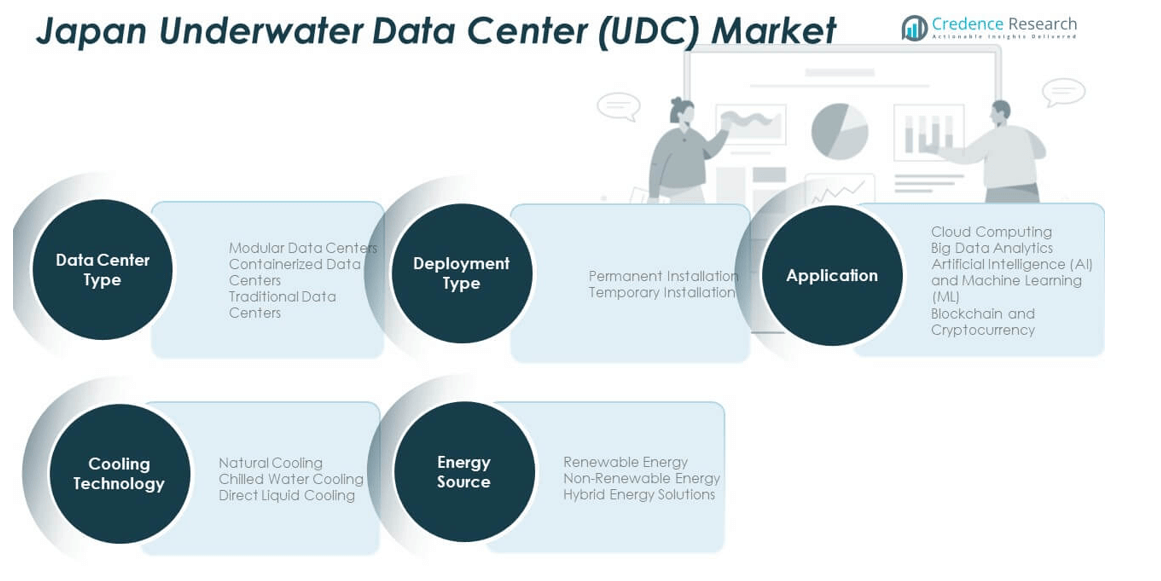

By Data Center Type

The Japan Underwater Data Center (UDC) Market is segmented into modular, containerized, and traditional data centers. Modular data centers dominate due to their flexibility, scalability, and easy deployment in marine environments. Containerized models are gaining traction for temporary or small-scale deployments, offering portability and faster setup. Traditional data centers maintain a limited presence, mainly for legacy integration and hybrid operations. The modular approach supports Japan’s focus on energy efficiency and space optimization, aligning with sustainability targets and urban infrastructure constraints.

- For instance, AT TOKYO’s 40MW Chuo Center #3 (CC3) data center, which was completed in May 2024 and began operations in July 2024, can accommodate approximately 3,000 server racks. It is a multi-story, traditional facility designed to function as a network hub for cloud services and enterprise customers, and it operates on nearly 100% renewable energy.

By Application

Cloud computing leads the application segment, driven by Japan’s strong enterprise digitalization and 5G adoption. Big data analytics follows, supported by rising demand for advanced data processing across industries. Artificial intelligence and machine learning applications use underwater centers for high-speed and low-latency computing. Blockchain and cryptocurrency deployments are emerging, leveraging secure and cost-efficient cooling systems for large-scale processing.

- For instance, NEC Corporation’s strategic move to expand its “green” data center business resulted in the May 2024 inauguration of new, high-efficiency data centers in Kanagawa and Kobe, Japan. These centers use advanced cooling techniques and renewable energy to support growing demands from AI and cloud services. This approach improves sustainability and contributes to the modernization of Japan’s IT infrastructure, as detailed in recent NEC press releases.

By Energy Source

Renewable energy dominates, supported by Japan’s emphasis on offshore wind and tidal integration. Non-renewable energy usage continues in hybrid models where renewables are limited. Hybrid energy solutions balance cost efficiency and supply reliability, gaining importance for continuous operations.

By Technology (Deployment Type)

Permanent installations account for the majority share due to long-term infrastructure planning and investment in fixed marine facilities. Temporary installations serve research and pilot testing purposes, providing flexibility in experimental deployments.

By Cooling Technology

Natural cooling leads the market, utilizing ocean temperatures for efficient heat management. Chilled water and direct liquid cooling systems enhance precision and performance in high-density modules.

Segmentation:

By Data Center Type:

- Modular Data Centers

- Containerized Data Centers

- Traditional Data Centers

By Application:

- Cloud Computing

- Big Data Analytics

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain and Cryptocurrency

By Energy Source:

- Renewable Energy

- Non-Renewable Energy

- Hybrid Energy Solutions

By Technology (Deployment Type):

- Permanent Installation

- Temporary Installation

By Cooling Technology:

- Natural Cooling

- Chilled Water Cooling

- Direct Liquid Cooling

Regional Analysis:

Kanto Region – Leading Innovation and Market Dominance

The Kanto region holds the largest share of the Japan Underwater Data Center (UDC) Market, accounting for nearly 45% of total revenue. Tokyo Bay serves as the core hub, driven by dense digital infrastructure and proximity to major corporate headquarters. The area benefits from robust fiber-optic connectivity, advanced maritime facilities, and strong investment from global technology companies. Government-backed projects focused on carbon neutrality and smart city development support large-scale underwater data initiatives. It attracts collaborations between domestic engineering firms and international cloud providers, accelerating commercialization. Kanto’s established ecosystem positions it as Japan’s strategic anchor for underwater data storage and sustainable digital transformation.

Kansai Region – Rising Adoption and Infrastructure Expansion

The Kansai region contributes around 30% of market share, supported by Osaka’s expanding role in Japan’s data economy. The region’s strong manufacturing and industrial base drives demand for high-performance computing and data reliability. It benefits from growing renewable energy adoption, especially offshore wind integration, enabling greener operations. Major ports in Kobe and Osaka are being considered for new underwater deployment sites. The Kansai area’s focus on disaster resilience and innovation in cooling technologies strengthens its competitiveness. It continues to attract data center investments aimed at balancing national digital capacity beyond the Kanto corridor.

Kyushu and Hokkaido Regions – Emerging Frontiers for Sustainable Deployment

Kyushu and Hokkaido together hold nearly 25% of the Japan Underwater Data Center (UDC) Market. Kyushu’s coastal access and geothermal energy potential create opportunities for hybrid power integration. Hokkaido’s cold waters and underutilized coastal areas are ideal for natural cooling systems. These regions are witnessing early-stage pilot projects supported by regional governments and academic institutions. It reflects Japan’s strategy to decentralize data infrastructure and improve energy efficiency nationwide. Both regions are expected to experience higher growth during the forecast period, driven by renewable energy development and technological experimentation in low-temperature environments. Their emerging role strengthens Japan’s position in sustainable, next-generation data infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mitsui O.S.K. Lines (MOL)

- NYK Line

- NEC Corporation

- KVH Co., Ltd.

- AT TOKYO Corporation

- RTI Connectivity Pte. Ltd.

- Nautilus Data Technologies

- Google

- Amazon Web Services (AWS)

Competitive Analysis:

The Japan Underwater Data Center (UDC) Market is characterized by a competitive environment shaped by both domestic and global technology leaders. Key participants such as Mitsui O.S.K. Lines (MOL), NEC Corporation, and Nautilus Data Technologies are investing in scalable and sustainable solutions. It is driven by collaborations that combine maritime expertise with advanced digital infrastructure. Companies are focusing on cost reduction, energy efficiency, and automation through modular and renewable-powered designs. Strategic partnerships between telecom providers, engineering firms, and data center operators strengthen Japan’s leadership in underwater infrastructure innovation.

Recent Developments:

- In October 2025, NEC Corporation strengthened its strategic partnership with IFS AB to co-develop advanced cloud solutions and AI-driven offerings within domestic Japanese data centers, aiming to enhance industry digital transformation and business growth.

- In September 2025, NYK Line progressed toward commercializing offshore floating data centers powered by 100% renewable energy, including the launch of a demonstration center at Yokohama Port, under a collaboration with NTT Facilities, Eurus Energy Holdings, MUFG Bank, and the City of Yokohama.

- In July 2025, Mitsui O.S.K. Lines (MOL) signed a Memorandum of Understanding with Kinetics to jointly develop a next-generation Floating Data Center platform, which will involve converting vessels into state-of-the-art, scalable, and mobile data centers to address digital infrastructure demand, targeting full deployment by 2027.

Report Coverage:

The research report offers an in-depth analysis based on data center type, application, energy source, deployment technology, and cooling technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable and low-emission data centers will drive large-scale underwater deployments.

- Integration of renewable energy will remain a central focus to improve operational efficiency.

- Modular underwater systems will expand due to scalability and cost advantages.

- Government initiatives promoting green innovation will accelerate technology adoption.

- AI, IoT, and cloud computing growth will increase data storage and processing demand.

- Strategic partnerships between tech and marine industries will enhance design innovation.

- Cooling technologies such as natural and liquid systems will become industry standards.

- Offshore zones in Kanto and Kansai will witness continuous infrastructure expansion.

- Pilot projects in Hokkaido and Kyushu will evolve into commercial-scale facilities.

- The Japan Underwater Data Center (UDC) Market will strengthen its role in global sustainable data infrastructure leadership.