Market Overview:

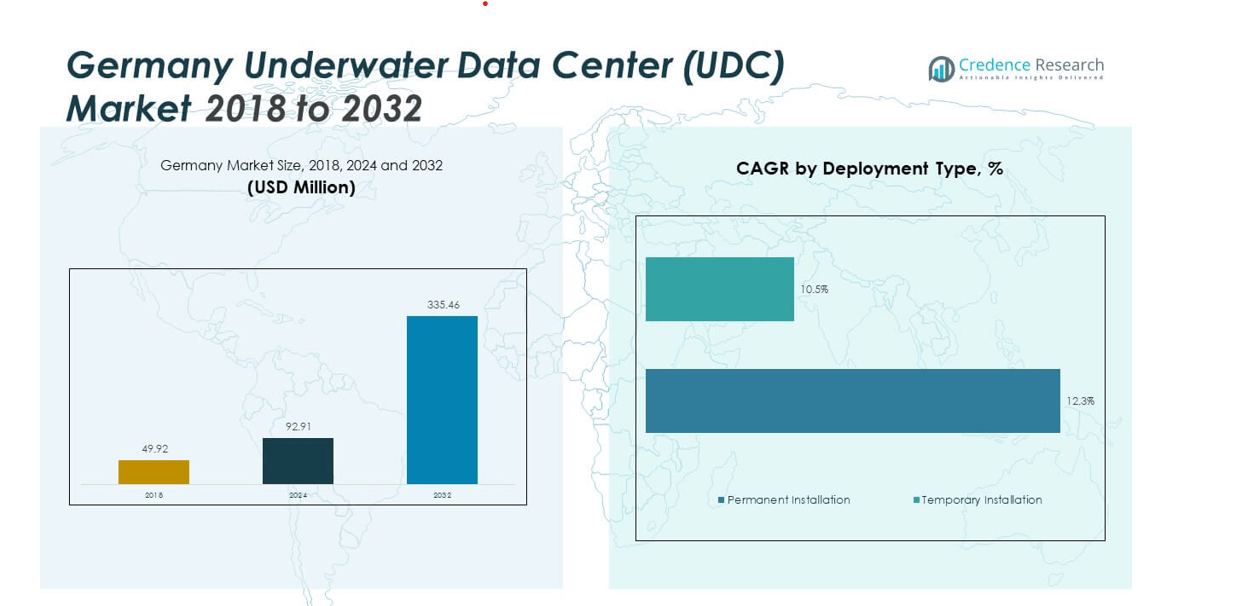

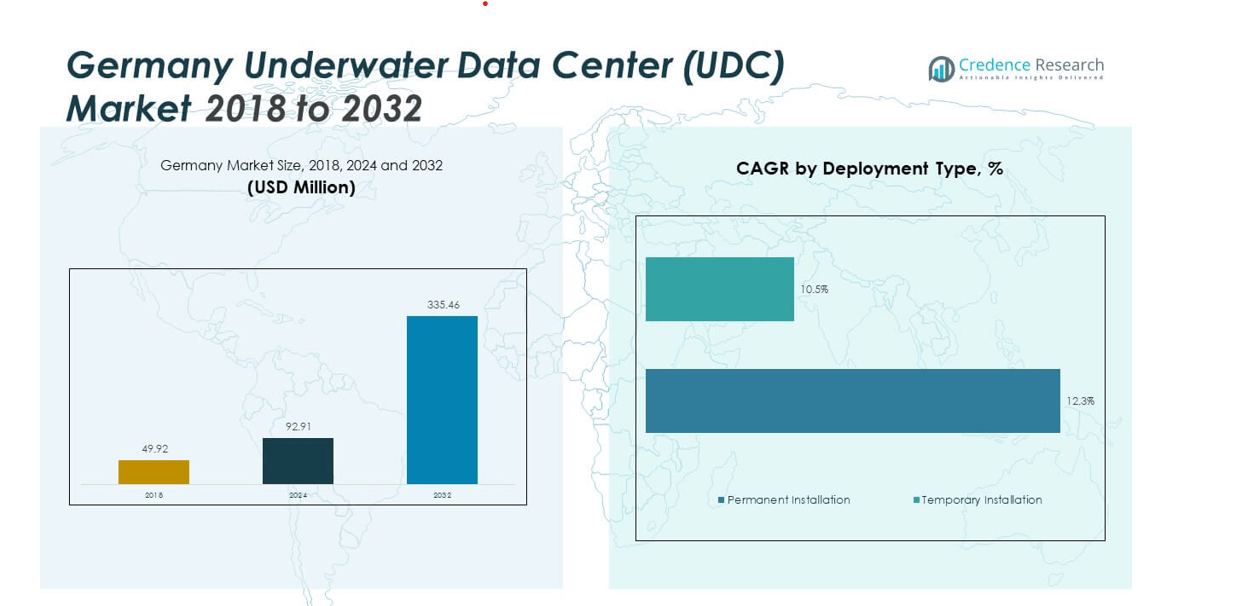

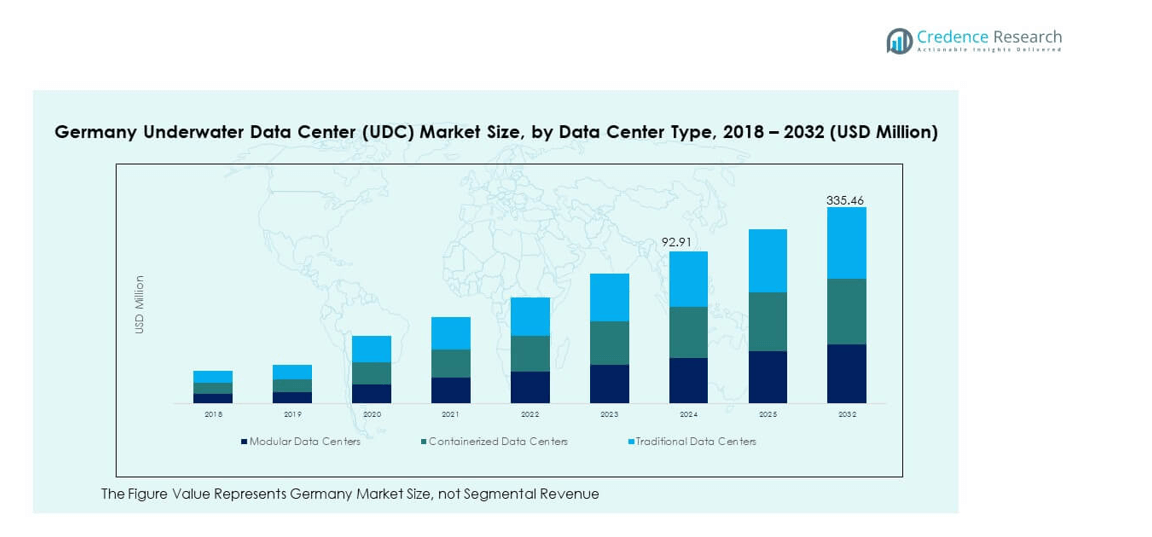

The Germany Underwater Data Center (UDC) Market size was valued at USD 49.92 million in 2018 to USD 92.91 million in 2024 and is anticipated to reach USD 335.46 million by 2032, at a CAGR of 17.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Underwater Data Center (UDC) Market Size 2024 |

USD 92.91 million |

| Germany Underwater Data Center (UDC) Market, CAGR |

17.41% |

| Germany Underwater Data Center (UDC) Market Size 2032 |

USD 335.46 million |

Strong government sustainability goals and the increasing need for scalable data storage are key drivers. Germany’s focus on green technology adoption encourages companies to explore underwater data centers for reducing energy use and increasing efficiency. The rise in digital transformation, demand for cloud computing, and growing data center capacity needs are further fueling market growth. Collaboration between technology providers and energy firms is driving innovation in subsea deployment systems and performance optimization.

Within Europe, Germany is becoming a leading hub for underwater data center initiatives due to its advanced technology base and environmental policies. Neighboring countries like France and the Netherlands are also emerging, focusing on integrating underwater data solutions into renewable energy grids. Northern Europe shows strong adoption potential because of favorable coastal conditions and government-backed sustainability projects. This geographic advantage positions Germany as a strategic leader in Europe’s UDC development landscape.

Market Insights:

- The Germany Underwater Data Center (UDC) Market was valued at USD 49.92 million in 2018, reached USD 92.91 million in 2024, and is projected to attain USD 335.46 million by 2032, expanding at a CAGR of 17.41% during the forecast period.

- Northern Germany holds the largest share at 42%, driven by proximity to the North Sea and offshore renewable energy resources. Western and Central Germany follow with 33%, supported by high data traffic and industrial digitization. Southern and Eastern regions account for 25%, supported by emerging infrastructure and R&D initiatives.

- Southern and Eastern Germany are the fastest-growing regions, driven by renewable integration projects, coastal infrastructure expansion, and increased investment in AI-driven data management solutions.

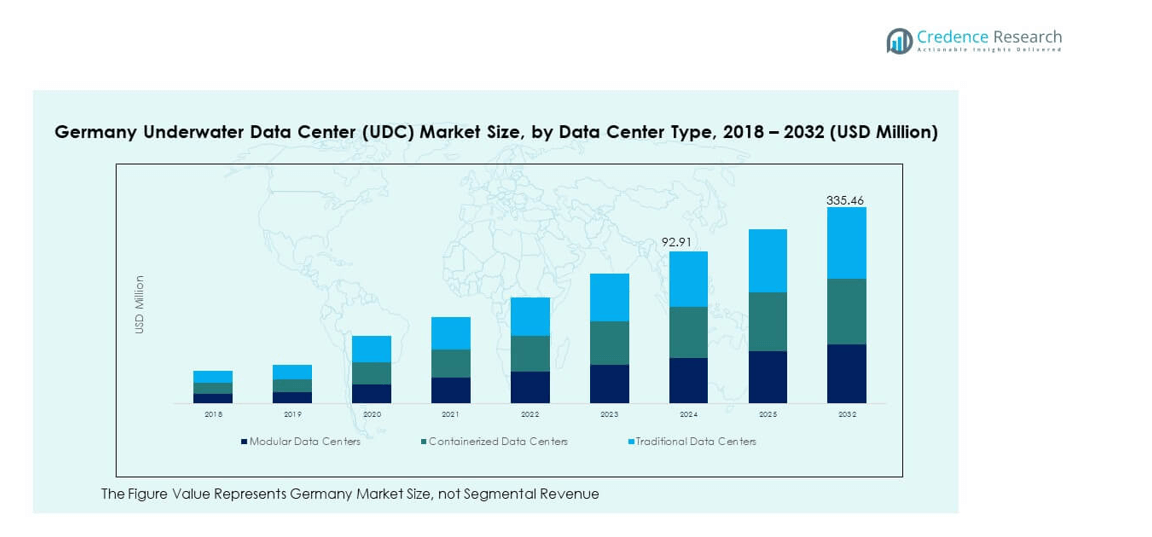

- Among data center types, Modular Data Centers dominate with 45% share, favored for scalability and energy efficiency.

- Containerized Data Centers hold roughly 35%, offering flexible deployment in coastal areas, while Traditional Data Centers contribute 20%, serving legacy systems with lower energy optimization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sustainable and Energy-Efficient Data Infrastructure

The Germany Underwater Data Center (UDC) Market is driven by the growing emphasis on sustainability and efficient energy use. Increasing data generation from digital transformation initiatives has led to higher energy consumption in traditional data centers. Underwater data centers use natural cooling from seawater, lowering power usage and reducing carbon emissions. Germany’s environmental policies and commitment to achieving carbon neutrality support investments in such solutions. Companies are exploring subsea systems to align with green technology goals and corporate ESG standards. The push for reduced operational costs and improved energy performance enhances market adoption. It is creating momentum for innovation in modular, eco-friendly data center designs.

- For instance, Microsoft’s Project Natick underwater data center achieved a Power Usage Effectiveness (PUE) of 1.07 and demonstrated 99.9% uptime over two years of continuous operation, using natural seawater cooling and renewable energy sources.

Growing Cloud Computing and Data Storage Requirements

The expansion of cloud computing, big data analytics, and edge computing significantly fuels demand for efficient storage systems. Businesses require data infrastructure that delivers high performance while optimizing space and power. Underwater data centers provide scalable and compact solutions, meeting both needs effectively. The rise in enterprise digitalization across sectors such as finance, healthcare, and manufacturing drives this growth. Germany’s strong IT ecosystem and data security standards encourage early adoption of advanced infrastructure. Cloud service providers are also exploring UDC integration for cost-effective scalability. It supports low-latency operations, essential for real-time applications in IoT and AI.

- For instance, Deutsche Telekom partnered with Google Cloud and Ericsson in 2023 to launch next-generation cloud-native edge solutions, resulting in improved network efficiency and faster provisioning of digital infrastructure to support real-time analytics and enterprise cloud adoption.

Technological Advancements in Subsea Deployment and Maintenance

Continuous research and innovation in subsea deployment technology are accelerating market development. Companies are designing pressure-resistant, corrosion-proof capsules that can function efficiently under deep-water conditions. Advances in remote monitoring and robotic maintenance have made underwater facilities more reliable. Integration of AI and IoT for predictive performance enhances system safety and uptime. Germany’s strong industrial engineering capabilities contribute to high-quality infrastructure designs. Collaboration between data center operators and marine engineering firms strengthens local innovation. It creates a foundation for developing next-generation underwater systems optimized for European climates.

Government Policies and Green Investment Incentives

Supportive government regulations and funding programs encourage investment in sustainable data infrastructure. Germany’s focus on reducing energy consumption and boosting renewable integration complements UDC technology adoption. Public-private partnerships promote testing and deployment of pilot projects across coastal regions. Environmental standards and incentives for clean technologies motivate enterprises to invest in energy-efficient systems. These efforts align with national goals for emission reduction and energy transition. Utility providers and telecom operators are also aligning infrastructure upgrades with sustainability frameworks. It enables expansion opportunities for domestic and global players entering the UDC market.

Market Trends:

Integration of Renewable Energy with Underwater Data Centers

A key trend in the Germany Underwater Data Center (UDC) Market is the integration of renewable energy sources. Companies are developing hybrid systems that link subsea data centers with offshore wind and tidal power. This approach ensures clean, reliable, and uninterrupted energy supply for continuous operations. Such integration helps reduce reliance on grid electricity and aligns with national sustainability targets. The trend enhances operational efficiency while reducing environmental impact. Partnerships between energy developers and data center firms are expanding to enable large-scale projects. It supports the transition toward climate-neutral digital infrastructure across the region.

- For instance, in October 2024, Equinor and Telenor Maritime collaborated on a Push-to-Talk (PTT) solution utilizing 5G technology for communication on the Johan Castberg Floating Production, Storage, and Offloading (FPSO) unit in the North Sea. This partnership supports maritime data operations with a focus on seamless and secure operational communication. Earlier, in 2021, Equinor also worked with partners Nokia and NetNordic to install a 5G-ready private LTE network for various offshore installations, including wind farms.

Growing Adoption of Modular and Scalable Design Concepts

The market is witnessing a surge in modular UDC architecture for flexible deployment. Modular units allow faster installation, simplified maintenance, and easy relocation compared to traditional data centers. This trend aligns with Germany’s demand for efficient and space-saving infrastructure. Companies are investing in pre-fabricated, containerized modules to optimize costs and improve scalability. The modular approach supports incremental capacity expansion based on demand growth. It reduces downtime and enhances overall system resilience. Increased adoption among cloud providers and tech enterprises reinforces this trend across Europe.

- For instance, Schneider Electric’s EcoStruxure Modular Data Centers are engineered to support high-density compute workloads and are deployed as prefabricated, rapidly-installable containerized units suitable for edge environments. While the company announced new liquid-cooled solutions in late 2024 to meet AI demands, a rack density of up to 132 kW was offered in a co-developed reference design with NVIDIA, rather than being a standard feature across all models. Rack densities in modular data centers can vary significantly depending on the specific model and cooling configuration.

Emphasis on AI-Driven Monitoring and Predictive Maintenance

AI-based monitoring systems are becoming a standard component of underwater data infrastructure. These technologies enable predictive maintenance, performance optimization, and real-time fault detection. The Germany Underwater Data Center (UDC) Market benefits from AI’s ability to extend equipment lifespan and reduce operational costs. Machine learning algorithms analyze sensor data to detect temperature, vibration, and pressure variations. The automation of diagnostic tasks ensures consistent uptime and safety in harsh subsea environments. Germany’s technology ecosystem supports strong AI integration in critical systems. It helps operators achieve higher reliability and cost efficiency.

Collaborative Innovation between Technology and Marine Engineering Firms

Collaboration between technology providers, marine engineering companies, and research institutions is a defining trend. Joint R&D projects aim to develop sustainable materials and advanced submersible designs. The growing ecosystem fosters technological exchange and innovation acceleration. It strengthens Germany’s position as a leader in underwater digital infrastructure research. Companies are experimenting with eco-friendly materials for longer operational life. Partnerships are also focusing on environmental impact reduction and recycling strategies. This trend enhances innovation capabilities and competitiveness in the regional UDC market.

Market Challenges Analysis:

High Initial Costs and Complex Deployment Procedures

The Germany Underwater Data Center (UDC) Market faces significant challenges due to high initial investment costs. Constructing pressure-resistant capsules, subsea cables, and specialized cooling systems demands advanced engineering. These infrastructure requirements lead to high setup and maintenance expenses. Limited availability of skilled marine engineers and subsea contractors further adds to project delays. Companies must manage regulatory approvals and environmental assessments before deployment. These processes increase time and financial burdens on investors. It makes scalability difficult for small and medium enterprises.

Regulatory, Environmental, and Operational Constraints

Strict environmental regulations and marine conservation policies create challenges for underwater data projects. Approval processes require detailed environmental impact assessments and compliance with coastal authority standards. Germany’s commitment to marine protection increases project complexity. Harsh underwater conditions also cause corrosion, mechanical stress, and temperature-related issues. Regular monitoring and robotic maintenance raise operational costs. Risk of technical failures or power disruptions adds uncertainty to long-term performance. It challenges operators to develop robust safety and redundancy mechanisms for sustained reliability.

Market Opportunities:

Integration with Renewable Offshore Infrastructure

The Germany Underwater Data Center (UDC) Market holds strong potential for integration with offshore wind and tidal power systems. Combining underwater facilities with renewable energy platforms creates a sustainable digital ecosystem. It reduces dependence on traditional grid power while improving cost efficiency. Offshore regions in the North and Baltic Seas offer favorable conditions for hybrid installations. Energy companies are exploring co-location models for data centers and wind farms. The approach supports Germany’s renewable transition and boosts investment attractiveness.

Rising Investments in Research, Design, and Digital Resilience

R&D investments in subsea technology, AI-enabled monitoring, and materials science are expanding market potential. Germany’s innovation-driven industrial base supports advancements in automation and reliability. It allows developers to address corrosion, energy efficiency, and modular scalability challenges. Increasing corporate focus on climate-resilient infrastructure drives further interest in UDCs. Government funding and academic partnerships encourage experimentation with sustainable subsea technologies. The market is evolving toward intelligent, low-maintenance designs suitable for global export and replication.

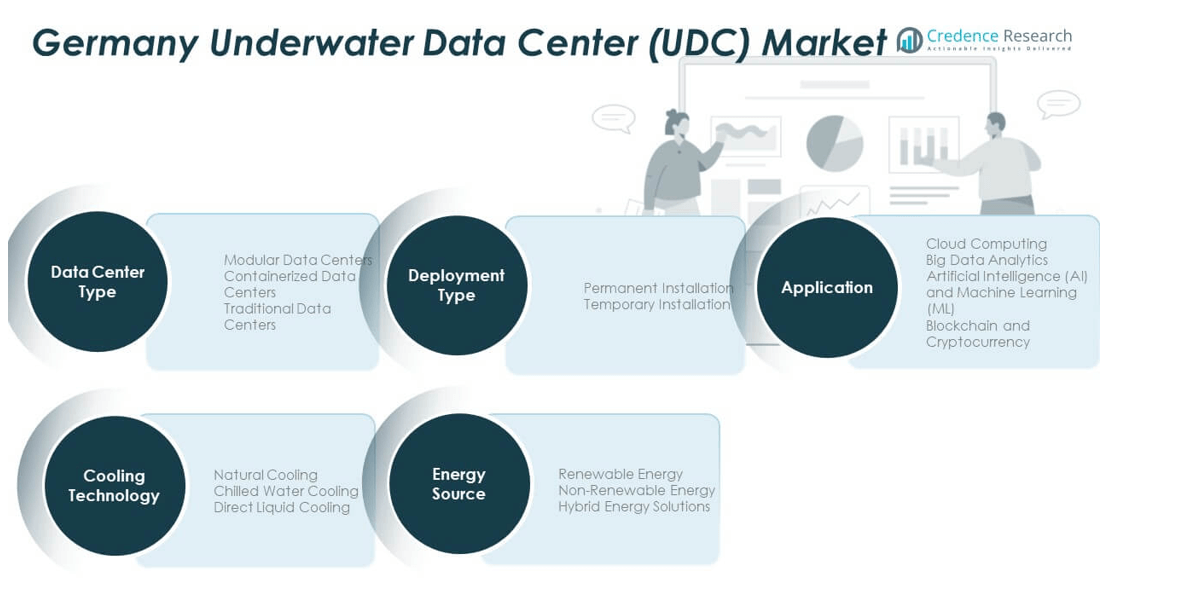

Market Segmentation Analysis:

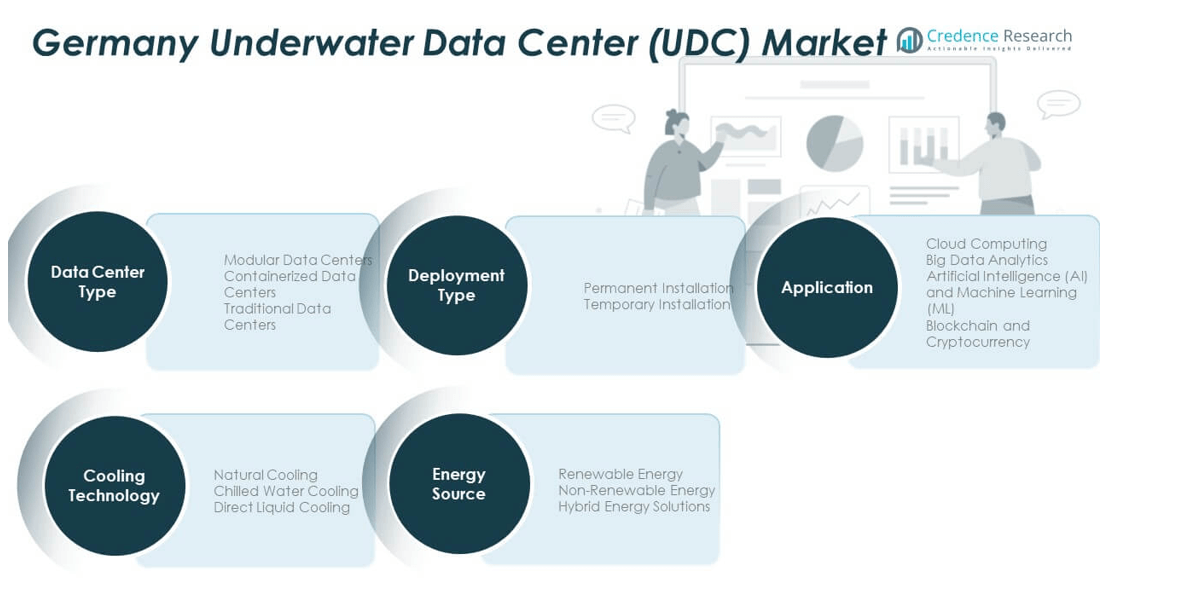

By Data Center Type

The Germany Underwater Data Center (UDC) Market is segmented into modular, containerized, and traditional data centers. Modular data centers dominate due to their scalability, faster deployment, and ease of maintenance. Containerized data centers gain traction for flexible installation in coastal and offshore environments. Traditional facilities continue to serve legacy operations but face limitations in energy efficiency and adaptability. The shift toward modular infrastructure aligns with Germany’s focus on sustainable and cost-effective digital ecosystems. It supports higher computing density with reduced carbon emissions.

- For instance, Dell Technologies’ modular data center pods, including liquid cooling solutions highlighted in 2023, offer flexible rack power configurations from 5 to 115 kW. These innovations increase space utilization and energy efficiency, particularly for high-density computing needs. The claim of deployment in experimental underwater installations is inaccurate and is instead associated with Microsoft’s Project Natick.

By Application

Key applications include cloud computing, big data analytics, artificial intelligence (AI) and machine learning (ML), and blockchain. Cloud computing leads adoption due to high data traffic and demand for efficient hosting environments. AI and ML workloads benefit from low-latency underwater systems designed for high processing power. Big data analytics relies on the storage capacity and consistent uptime provided by subsea centers. Blockchain applications are emerging, requiring secure and sustainable data handling frameworks.

- For instance, IBM, in its 2024 State of Sustainability Readiness Report and through other initiatives, documented its focus on sustainable, AI-powered infrastructure that leverages energy-efficient technologies. The company pursued lower operational energy consumption through investments in energy-efficient hardware and data center cooling improvements, which also offset the increased workloads from training its AI models.

By Energy Source, Deployment Type, and Cooling Technology

Underwater data centers in Germany primarily use renewable and hybrid energy solutions, supporting the national shift toward carbon-neutral operations. Permanent installations dominate deployment due to long-term stability and optimized efficiency, while temporary setups serve pilot projects. Natural cooling remains the preferred method due to energy savings, supported by chilled water and direct liquid cooling for enhanced thermal regulation. It strengthens operational performance while maintaining environmental sustainability.

Segmentation:

By Data Center Type

- Modular Data Centers

- Containerized Data Centers

- Traditional Data Centers

By Application

- Cloud Computing

- Big Data Analytics

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain and Cryptocurrency

By Energy Source

- Renewable Energy

- Non-Renewable Energy

- Hybrid Energy Solutions

By Technology / Deployment Type

- Permanent Installation

- Temporary Installation

By Cooling Technology

- Natural Cooling

- Chilled Water Cooling

- Direct Liquid Cooling

Regional Analysis:

Northern Germany – The Core Deployment Zone

Northern Germany holds the largest share of the Germany Underwater Data Center (UDC) Market, accounting for nearly 42% of total revenue. Coastal regions such as Schleswig-Holstein and Lower Saxony lead adoption due to their proximity to the North Sea and access to renewable offshore energy. These areas provide ideal marine conditions for subsea installations and integration with wind farms. Strong government support for clean energy projects further encourages infrastructure development in this region. Major technology companies and research institutions are investing in pilot underwater data centers to test performance and durability. It strengthens Northern Germany’s position as the hub for sustainable digital infrastructure in Europe.

Western and Central Germany – Expanding Digital Ecosystem

Western and Central Germany together contribute around 33% of the national UDC market share. The presence of major industrial cities such as Frankfurt, Cologne, and Düsseldorf supports high data traffic and digital infrastructure demand. These areas benefit from robust fiber-optic connectivity and energy supply networks, which facilitate efficient data transmission from underwater facilities. Local governments are collaborating with technology firms to integrate UDCs into regional smart city programs. Industrial and financial sectors are early adopters, using UDC solutions for secure and energy-efficient data management. It enhances operational resilience while reducing dependence on land-based data centers.

Southern and Eastern Germany – Emerging Growth Regions

Southern and Eastern Germany collectively account for nearly 25% of the total market share. These regions are gradually expanding adoption, driven by renewable energy initiatives and increased investment in digital transformation. Coastal infrastructure development projects in the Baltic region of Mecklenburg-Vorpommern are supporting small-scale underwater deployments. Southern cities such as Munich and Stuttgart show growing interest in leveraging UDC technology for AI and industrial automation applications. The expansion of research collaborations and government-led sustainability programs supports long-term adoption potential. It indicates a steady rise in regional participation, creating balanced nationwide growth for the underwater data center industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Germany Underwater Data Center (UDC) Market is moderately concentrated with strong participation from global and domestic technology players. Leading companies such as Microsoft, Nautilus Data Technologies, and Amazon Web Services dominate through innovation, sustainability initiatives, and strategic partnerships. These firms focus on integrating renewable energy, advanced cooling, and AI-based monitoring systems to enhance operational efficiency. Emerging players like NetworkOcean and China Telecom are investing in modular underwater solutions to expand deployment capacity. It remains highly competitive, with ongoing research collaborations and technological improvements shaping the market structure.

Recent Developments:

- In October 2025, China Telecom became a client for a pioneering commercial underwater data center project off the coast of Shanghai, leveraging undersea capsules to reduce cooling energy consumption by up to 90% and align with government strategies to lower the carbon footprint of data infrastructure.

- In September 2025, Nautilus Data Technologies unveiled an expanded EcoCore product line at Yotta 2025, including advanced in-row CDU cooling units and larger facility-scale CDUs, designed to improve AI data center efficiency using water-source-agnostic, sustainable cooling.

- In September 2025, Microsoft announced plans to develop a new data center in Elsdorf, Germany, on a 26-hectare site, contributing to a growing digital infrastructure footprint; while not explicitly underwater, this project signals larger-scale innovation for cloud and AI deployments in Germany.

Report Coverage:

The research report offers an in-depth analysis based on data center type, application, energy source, deployment technology, and cooling technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will witness accelerated adoption of modular and hybrid underwater systems.

- Integration with offshore renewable energy sources will drive future deployment growth.

- AI-based predictive maintenance will improve operational reliability and system uptime.

- Coastal regions in Northern Germany will remain key hubs for UDC installations.

- Increased R&D investment will advance subsea material durability and design efficiency.

- Cloud computing and AI applications will dominate underwater data processing demand.

- Collaborations between IT and marine engineering firms will strengthen technological leadership.

- Government sustainability targets will promote large-scale renewable-powered UDC projects.

- Hybrid energy models will gain preference for stable and low-carbon power supply.

- The market will evolve toward automated, intelligent, and cost-efficient underwater ecosystems.