Market Overview:

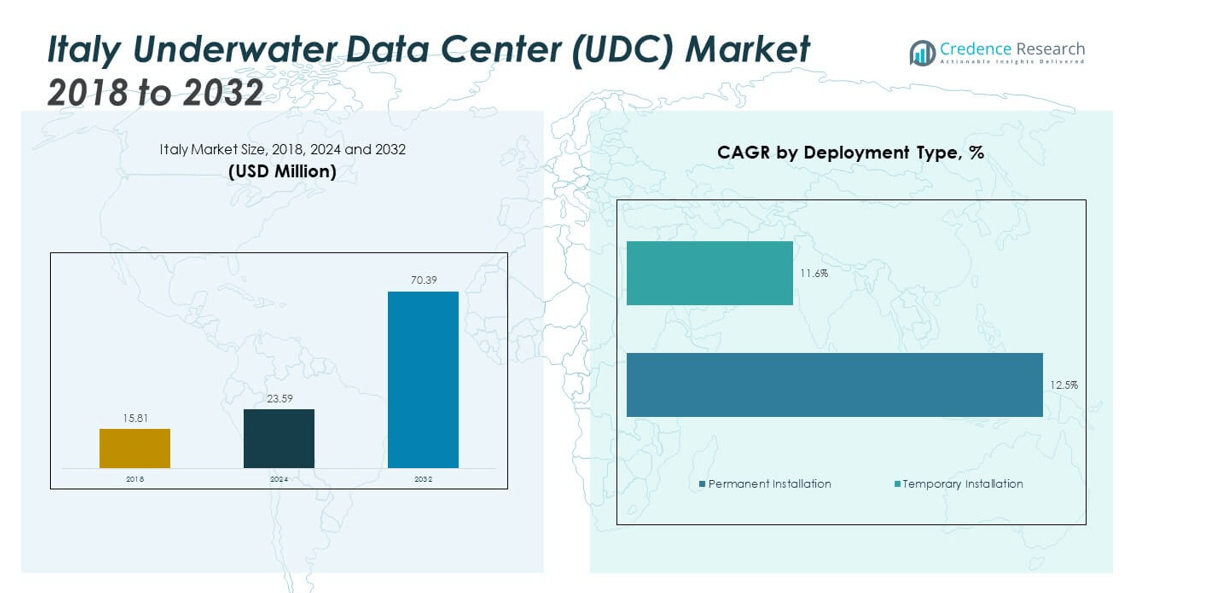

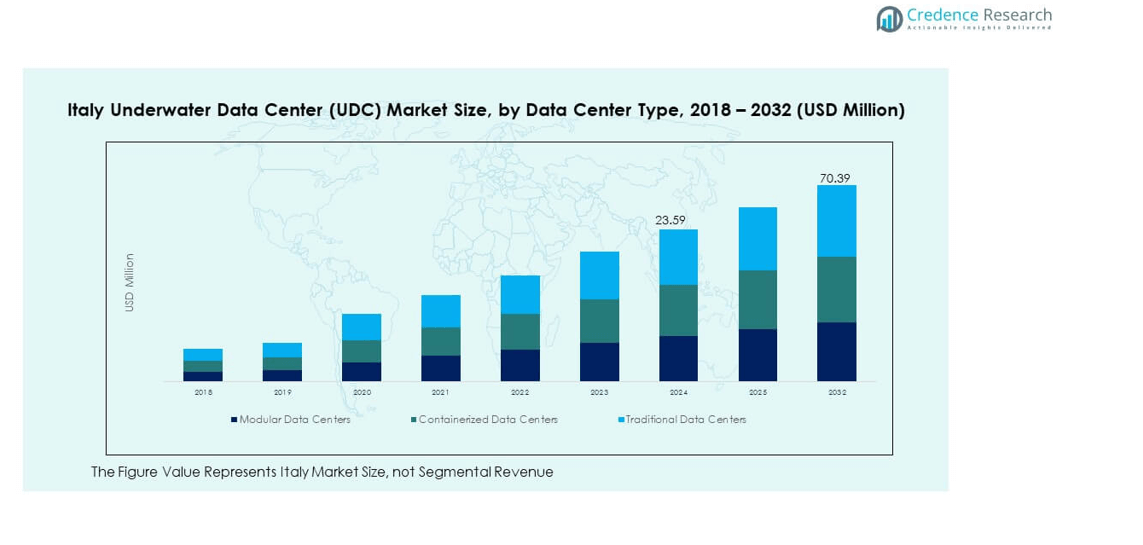

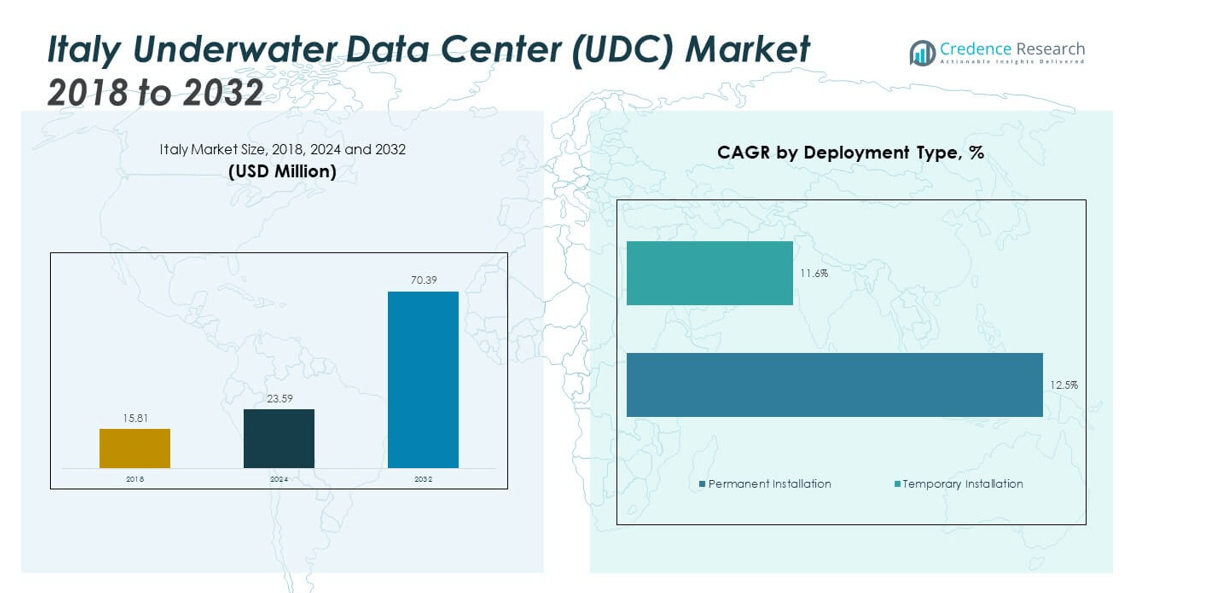

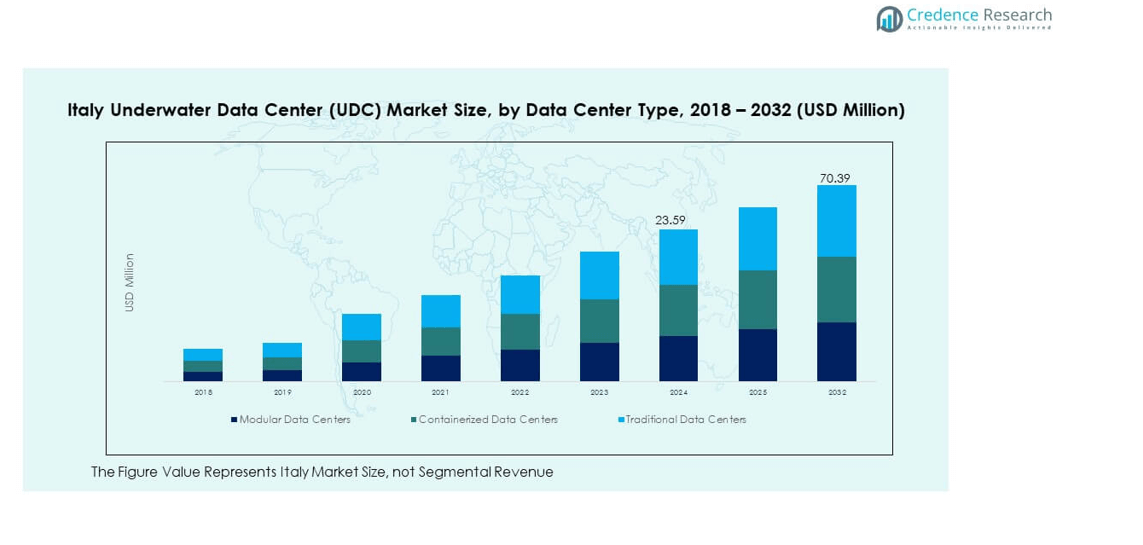

The Italy Underwater Data Center (UDC) Market size was valued at USD 15.81 million in 2018 to USD 23.59 million in 2024 and is anticipated to reach USD 70.39 million by 2032, at a CAGR of 14.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Underwater Data Center (UDC) Market Size 2024 |

USD 23.59 million |

| Italy Underwater Data Center (UDC) Market, CAGR |

14.64% |

| Italy Underwater Data Center (UDC) Market Size 2032 |

USD 70.39 million |

The market is gaining momentum due to increased demand for edge computing, cloud services, and digital transformation initiatives. Rising energy costs and carbon emission concerns are pushing operators to adopt underwater data centers for their natural cooling advantages. Government sustainability goals and growing collaboration between technology firms and energy providers further support innovation and deployment in the country. These factors collectively enhance system reliability and reduce operational costs.

Geographically, Western Europe remains the leading region in underwater data center deployment due to its strong technological infrastructure and environmental focus. Countries like Italy, France, and the UK are advancing initiatives toward energy-efficient data operations. Southern Europe is emerging as a growing hub driven by rising digitalization and renewable energy integration. In contrast, Eastern Europe is gradually adopting such technologies, supported by improving connectivity and infrastructure investments.

Market Insights:

- The Italy Underwater Data Center (UDC) Market grew from USD 15.81 million in 2018 to USD 23.59 million in 2024 and is projected to reach USD 70.39 million by 2032, reflecting a CAGR of 14.64%.

- Northern Italy leads with 45% market share, driven by strong industrial infrastructure, advanced connectivity, and collaboration between telecom and marine technology firms. Central Italy follows with 30%, supported by R&D institutions and digitalization projects, while Southern Italy and islands account for 25%, leveraging renewable integration.

- Southern Italy is the fastest-growing region due to coastal deployment opportunities, renewable energy expansion, and strategic positioning for Mediterranean data connectivity.

- Modular data centers hold the dominant share at around 48% due to scalability and cost advantages in underwater deployment.

- Containerized data centers capture nearly 33% of the segment, favored for flexible design and rapid installation across pilot and short-term projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Energy Efficiency Needs and Sustainable Infrastructure Development

The Italy Underwater Data Center (UDC) Market is driven by the growing demand for sustainable and energy-efficient data storage solutions. Traditional data centers consume vast amounts of power for cooling, making underwater deployment a viable alternative. Natural seawater cooling lowers energy use and operational costs significantly. The increasing commitment to achieving carbon neutrality in the digital infrastructure sector strengthens the market’s adoption. Tech firms and utilities are collaborating to align operations with environmental regulations. It supports Italy’s national energy goals and sustainability objectives. The focus on greener technologies enhances competitiveness across the data center ecosystem.

- For instance, in July 2025, Khazna Data Centers and Eni announced a joint venture to develop an AI-focused data center campus in Lombardy, Italy, with a planned capacity of 500 MW utilizing low-carbon “Blue Power” and CO2-capturing technology to advance sustainable data infrastructure in the region.

Expanding Cloud Computing and Edge Infrastructure Deployment

The rapid expansion of cloud computing and edge infrastructure drives the adoption of underwater data centers in Italy. Companies seek to minimize data latency while maintaining security and efficiency. The underwater model supports edge computing by placing data centers closer to end users. It reduces response times and enhances service delivery in 5G-enabled environments. Telecom providers are investing heavily in coastal digital infrastructure. This supports high-speed connectivity and data-intensive applications. The demand for faster, more reliable services fuels continued investment in underwater data systems.

- For instance, in July 2025, Italian edge data center provider Rai Way deployed Cubbit’s distributed cloud storage technology across its facilities—including coastal nodes—supporting latency-sensitive cloud and content delivery in edge environments.

Growing Need for Data Localization and Digital Sovereignty

The growing emphasis on data localization and sovereignty is boosting interest in underwater data centers. Governments are encouraging localized storage solutions to strengthen data security. Underwater data centers align with these policies by ensuring physical control within national waters. They also reduce dependency on foreign-based cloud infrastructure. Italy’s regulatory framework favors investments that protect digital assets and promote cybersecurity. Enterprises view these systems as strategic for compliance and resilience. The trend supports the expansion of Italy’s independent data infrastructure network.

Rising Integration of Renewable Energy with Submerged Systems

The integration of renewable energy sources enhances the viability of underwater data centers. Operators are linking underwater systems to offshore wind and tidal energy farms. This approach ensures a sustainable power supply and reduces carbon emissions. The synergy between green power and submerged computing strengthens Italy’s clean energy goals. It attracts investments from both tech firms and environmental agencies. The combination of renewable integration and reduced cooling demand improves efficiency. These factors collectively reinforce the market’s appeal for sustainable infrastructure development.

Market Trends:

Growing Public-Private Collaborations for Underwater Data Infrastructure Projects

Public-private partnerships are shaping the future of underwater data centers across Italy. Government bodies are working with global technology leaders to establish pilot and full-scale projects. These collaborations support R&D and accelerate deployment in coastal regions. They also foster innovation in design, cooling, and material durability. The Italy Underwater Data Center (UDC) Market benefits from strategic investments and shared expertise. Such partnerships enhance national competitiveness in digital transformation. The cooperative framework ensures scalability and long-term market growth.

- For instance, in February 2025, Eni initiated a strategic partnership with Khazna Data Centers and the UAE government to advance secure and energy-resilient digital infrastructure in Italy, aiming for a long-term program scaling up to 1 GW IT capacity through joint investment and research.

Adoption of Modular and Scalable Submerged Data Center Designs

The shift toward modular and scalable architectures is transforming underwater data deployment. Modular structures allow easier installation, maintenance, and expansion. It enables operators to adjust capacity based on demand fluctuations. The design also reduces construction time and operational risks. Italy’s marine engineering capabilities support the manufacturing of durable, corrosion-resistant modules. Companies are adopting flexible systems that meet changing IT requirements. The trend is improving operational resilience and cost management in underwater deployments.

- For instance, Europe’s modular and containerized data center solutions—including those from Vertiv—are being used to prefabricate scalable IT facilities for marine and coastal applications, providing ease of deployment while meeting European energy efficiency and corrosion-resistance benchmarks.

Advancements in Underwater Cooling and Monitoring Technologies

Technological innovation remains a defining trend in the Italian UDC sector. Companies are investing in sensors and AI-based monitoring systems to track pressure, temperature, and performance. These technologies prevent system failures and enhance reliability. It ensures optimal cooling efficiency and operational continuity under deep-sea conditions. Research institutions are collaborating with tech firms to develop next-generation cooling fluids. The Italy Underwater Data Center (UDC) Market benefits from continuous improvements in system design. These advancements support safer, smarter, and longer-lasting deployments.

Increased Focus on Circular Economy and Component Recycling

The circular economy concept is influencing data center development strategies in Italy. Companies are adopting recyclable materials and reusable components in underwater modules. It minimizes waste and improves sustainability across the system lifecycle. Environmental standards are encouraging eco-friendly production and decommissioning. The approach aligns with Italy’s green transition objectives and EU directives. It strengthens brand value and compliance in the global data infrastructure industry. The ongoing shift toward circular design ensures both environmental and economic advantages.

Market Challenges Analysis:

Technical Complexity and Maintenance Limitations of Submerged Data Centers

Deploying and maintaining underwater data centers involve complex technical challenges. Harsh marine conditions create risks of corrosion, pressure damage, and component failure. Specialized materials and advanced engineering are required to ensure long-term reliability. Routine maintenance is costly and time-consuming due to underwater accessibility constraints. The Italy Underwater Data Center (UDC) Market faces challenges in designing scalable yet durable systems. Continuous R&D is essential to optimize module recovery and repair efficiency. These factors limit rapid deployment across the broader data infrastructure network.

Regulatory, Environmental, and Cost Barriers to Large-Scale Deployment

Strict environmental regulations and high setup costs hinder widespread adoption. Approval processes for underwater installations are lengthy and involve multiple authorities. Concerns about marine life disruption and ecosystem impact slow project execution. The capital expenditure for deep-sea operations and energy supply infrastructure remains high. The Italy Underwater Data Center (UDC) Market must balance innovation with compliance and cost efficiency. Collaboration between government and private sectors is needed to streamline processes. Overcoming these barriers will be crucial to realizing large-scale commercial success.

Market Opportunities:

Expanding Role of Renewable Energy Integration and Coastal Digitization

The integration of renewable power sources presents major growth prospects for the Italian UDC market. Offshore wind and tidal energy plants offer stable and green electricity options. It enhances system efficiency while reducing environmental footprints. Coastal cities are promoting digital infrastructure to support smart governance and sustainable urbanization. Partnerships with clean energy developers can attract funding and technical expertise. These initiatives are expected to improve the overall economic viability of submerged systems.

Rising Demand for Edge Data Processing and Latency Reduction Solutions

The need for faster data processing close to end users drives new opportunities. Underwater data centers can provide low-latency services for IoT, 5G, and cloud platforms. It supports real-time applications in autonomous vehicles, remote healthcare, and industrial automation. Italy’s expanding digital ecosystem encourages investment in coastal edge networks. The Italy Underwater Data Center (UDC) Market can leverage this demand to enhance connectivity performance. Such opportunities will shape the next phase of data infrastructure transformation.

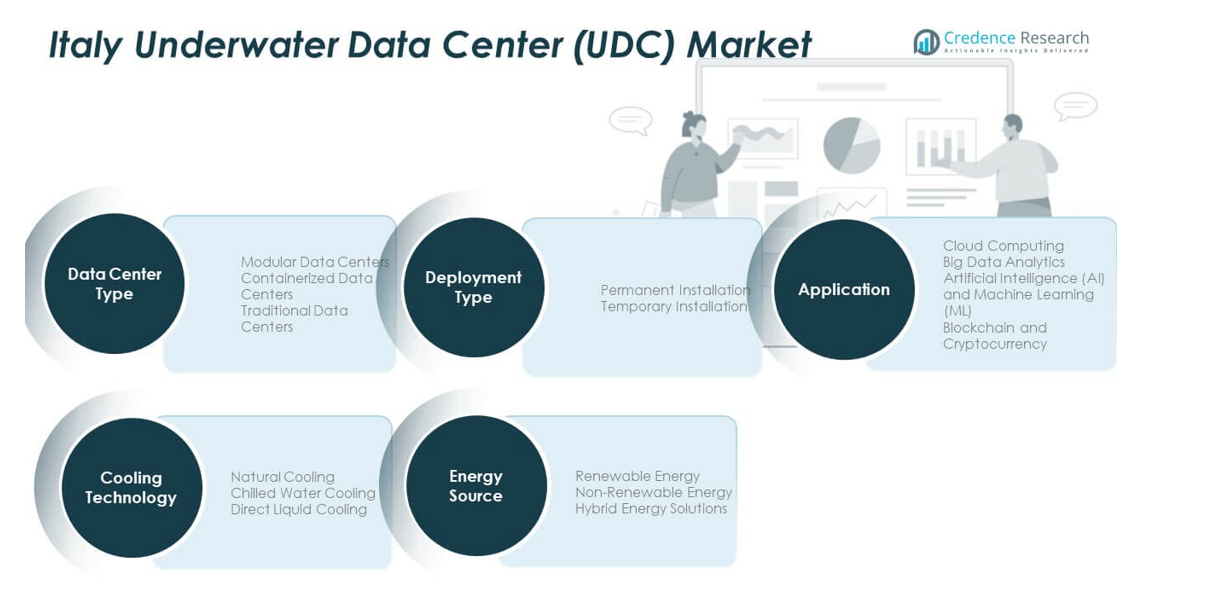

Market Segmentation Analysis:

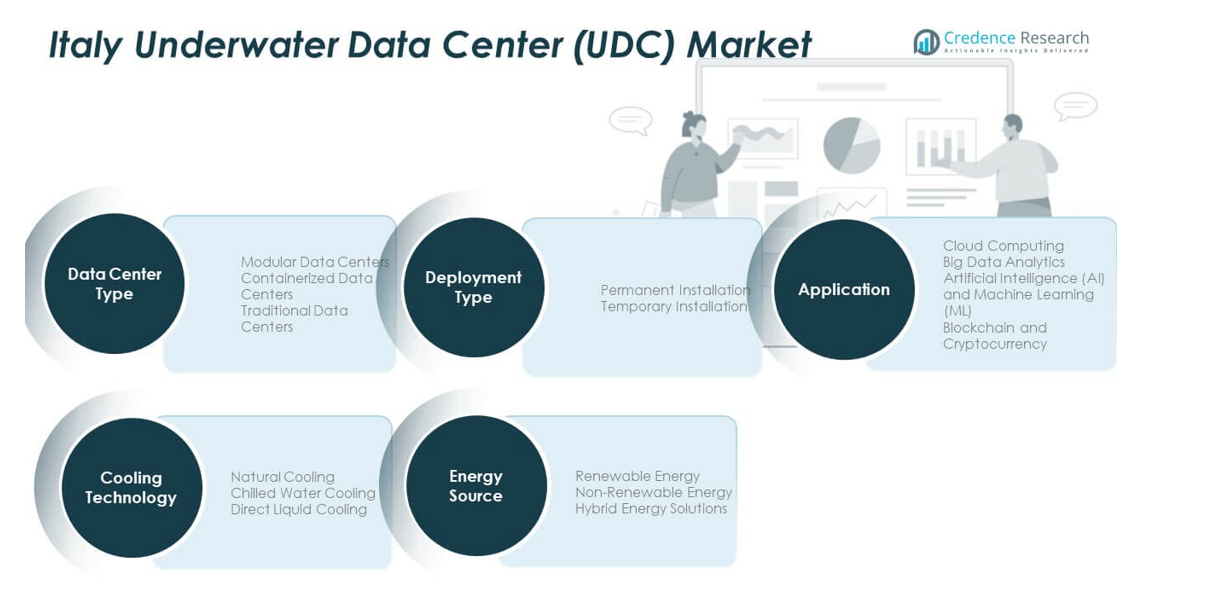

By Data Center Type

The Italy Underwater Data Center (UDC) Market is segmented into modular, containerized, and traditional data centers. Modular data centers dominate due to their scalability, cost efficiency, and ease of deployment in marine environments. Containerized models are gaining traction for temporary or pilot projects due to flexible setup and mobility. Traditional data centers hold a smaller share, primarily in legacy infrastructure transitioning toward submerged solutions.

- For instance, industry analysis from October 2025 confirms modular designs are favored across Europe, including Italy, because they streamline deployment and optimize cooling using prefabricated containers and flexible capacity models.

By Application

Key applications include cloud computing, big data analytics, artificial intelligence (AI) and machine learning (ML), and blockchain. Cloud computing leads the segment with strong enterprise adoption and data management needs. AI and ML drive demand for high-performance computing environments, while blockchain applications benefit from secure, low-latency infrastructure.

- For instance, the upcoming Eni-Khazna data center campus in Lombardy is set to focus specifically on AI and high-performance computing workloads, supporting both decarbonization initiatives and Italy’s digital transformation goals.

By Energy Source

Based on energy source, the market is divided into renewable, non-renewable, and hybrid energy solutions. Renewable energy, such as offshore wind and tidal power, supports sustainable operations and aligns with Italy’s carbon-neutral goals. Hybrid systems balance energy efficiency and reliability across deployments.

By Technology (Deployment Type)

Permanent installations hold the majority share, supporting long-term strategic projects with stable operations. Temporary installations serve short-term data processing or testing needs, offering flexibility for pilot and research initiatives.

By Cooling Technology

Natural cooling dominates due to seawater’s inherent thermal stability, reducing energy consumption. Chilled water and direct liquid cooling are used in advanced facilities requiring higher processing density. These technologies enhance efficiency and system lifespan in submerged environments.

Segmentation:

By Data Center Type

- Modular Data Centers

- Containerized Data Centers

- Traditional Data Centers

By Application

- Cloud Computing

- Big Data Analytics

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain and Cryptocurrency

By Energy Source

- Renewable Energy

- Non-Renewable Energy

- Hybrid Energy Solutions

By Technology (Deployment Type)

- Permanent Installation

- Temporary Installation

By Cooling Technology

- Natural Cooling

- Chilled Water Cooling

- Direct Liquid Cooling

Regional Analysis:

Northern Italy – Industrial and Technological Dominance

Northern Italy holds the largest share of the Italy Underwater Data Center (UDC) Market, accounting for nearly 45% of total revenue. The region benefits from strong industrial infrastructure, advanced digital ecosystems, and a high concentration of technology companies. Cities such as Milan and Turin serve as hubs for cloud computing and AI-based projects, driving early adoption of submerged data facilities. The availability of robust connectivity networks and skilled technical talent supports large-scale deployments. Investments in renewable energy sources, particularly offshore wind, strengthen the region’s capacity for sustainable operations. Northern Italy’s leadership is supported by collaboration between public institutions, telecom providers, and marine engineering firms.

Central Italy – Emerging Infrastructure and Research Focus

Central Italy represents about 30% of the market share, driven by ongoing digital transformation initiatives and strong research capabilities. Rome and Florence are emerging as regional centers for technology research and innovation in underwater data infrastructure. The region benefits from universities and R&D institutions working on advanced cooling and deployment technologies. It supports both commercial and experimental underwater data centers in cooperation with national energy programs. Public-private partnerships are expanding to enhance data storage capacity and sustainability standards. Central Italy’s coastal access allows flexible deployment of pilot-scale underwater systems in controlled environments.

Southern Italy and Islands – Renewable Integration and Strategic Expansion

Southern Italy and the island regions account for roughly 25% of the market share, supported by renewable energy and geographic advantages. Coastal areas such as Sicily and Sardinia provide ideal locations for submerged installations due to deeper waters and stable temperatures. Renewable integration through offshore wind and tidal systems offers consistent energy supply to underwater facilities. It also benefits from government incentives promoting clean technology investments. Growing interest from foreign investors is helping local firms establish testbeds and commercial-scale deployments. The region’s strategic position in the Mediterranean enhances potential for cross-border data connectivity and long-term expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sparkle (Telecom Italia)

- Unitirreno

- EXA Infrastructure

- Fincantieri

- WSense

- MGH Systems

- Aruba S.p.A.

- Eurotech S.p.A.

Competitive Analysis:

The Italy Underwater Data Center (UDC) Market is moderately concentrated, featuring established players and emerging innovators focused on submerged infrastructure development. Key participants such as Sparkle (Telecom Italia), Fincantieri, WSense, EXA Infrastructure, and Aruba S.p.A. are driving advancements in deployment design, connectivity, and sustainability. It emphasizes efficiency, low latency, and energy optimization through underwater modules. Strategic partnerships between telecom providers, marine engineering firms, and technology developers strengthen competitiveness. Companies are focusing on renewable integration and modular scalability to meet Italy’s growing data demand and environmental commitments.

Recent Developments:

- In July 2025, Sparkle and Algérie Télécom signed a memorandum of understanding to establish a new subsea cable linking Italy and Algeria, aiming to enhance international connectivity and data traffic between the regions.

- In April 2025, Sparkle, the submarine cable unit of Telecom Italia (TIM), was the subject of a major acquisition agreement in which a consortium led by Italy’s Ministry of Economy and Finance and involving fiber-optic operator Retelit agreed to acquire Sparkle for approximately €700 million, with the transaction expected to complete by year-end 2025.

- In March 2025, EXA Infrastructure and Ultranet entered a partnership to build a high-performance fiber route of about 175 km between Milan and Genoa, which will connect major landing stations and boost the resilience and capacity of Italy’s digital infrastructure.

Report Coverage:

The research report offers an in-depth analysis based on Data Center Type, Application, Energy Source, Technology (Deployment Type), and Cooling Technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing investment in underwater data centers to reduce energy consumption and enhance sustainability.

- Expansion of modular and containerized systems supporting scalable digital infrastructure.

- Increased integration of renewable energy sources, particularly offshore wind and tidal systems.

- Rising adoption of AI and big data analytics driving advanced computing requirements.

- Government initiatives promoting low-carbon, energy-efficient digital infrastructure.

- Strengthening partnerships between telecom operators and marine engineering firms.

- Advancements in underwater monitoring and pressure-resistant materials.

- Expanding role of Southern Italy and islands in renewable-powered data deployments.

- Growth of hybrid energy models combining renewable and non-renewable systems.

- Focus on regulatory alignment and innovation to attract foreign and domestic investments.