Market Overview:

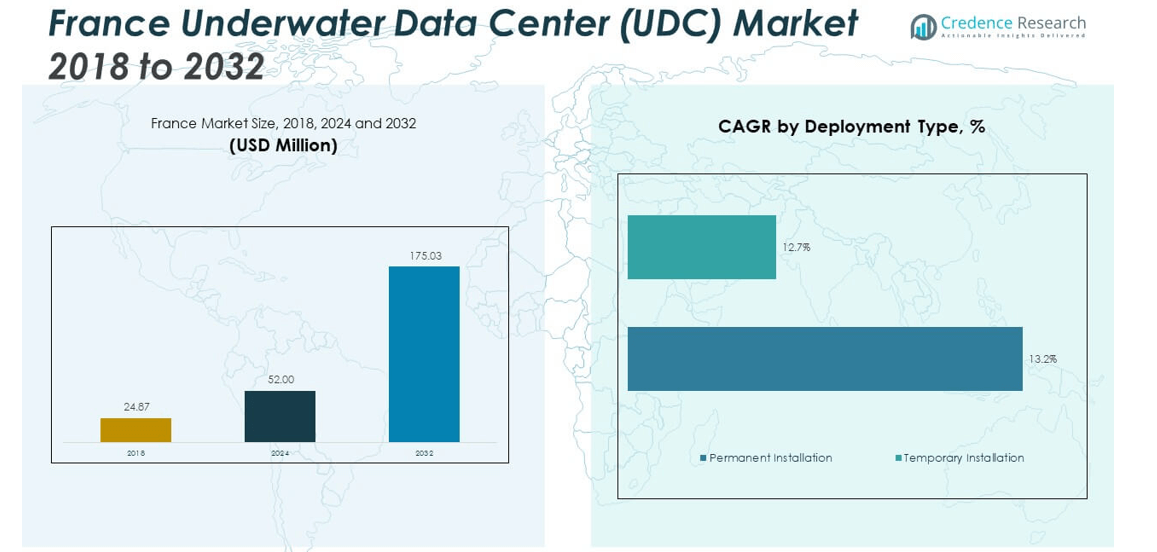

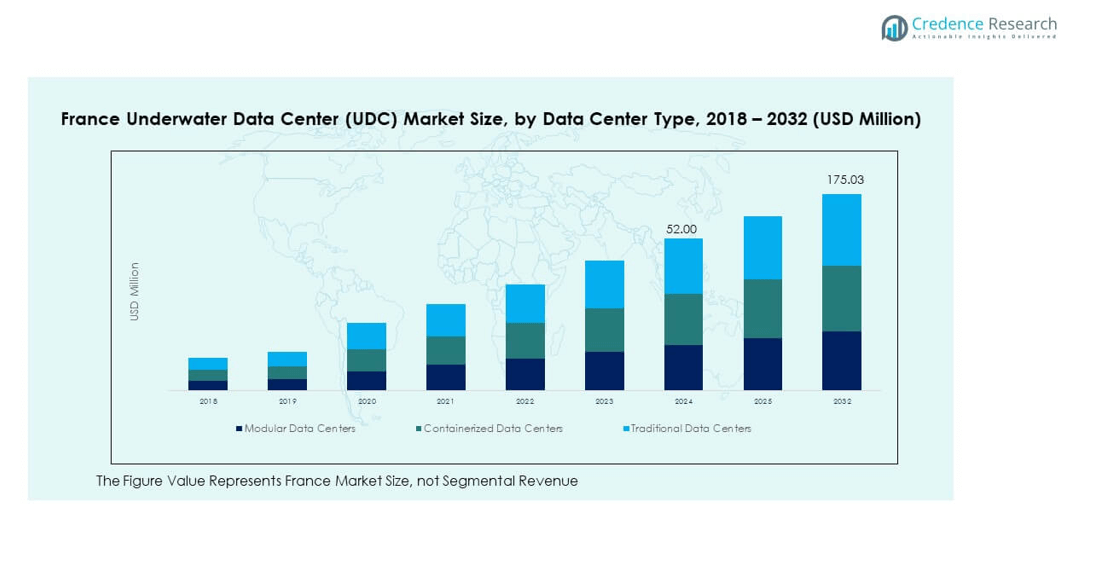

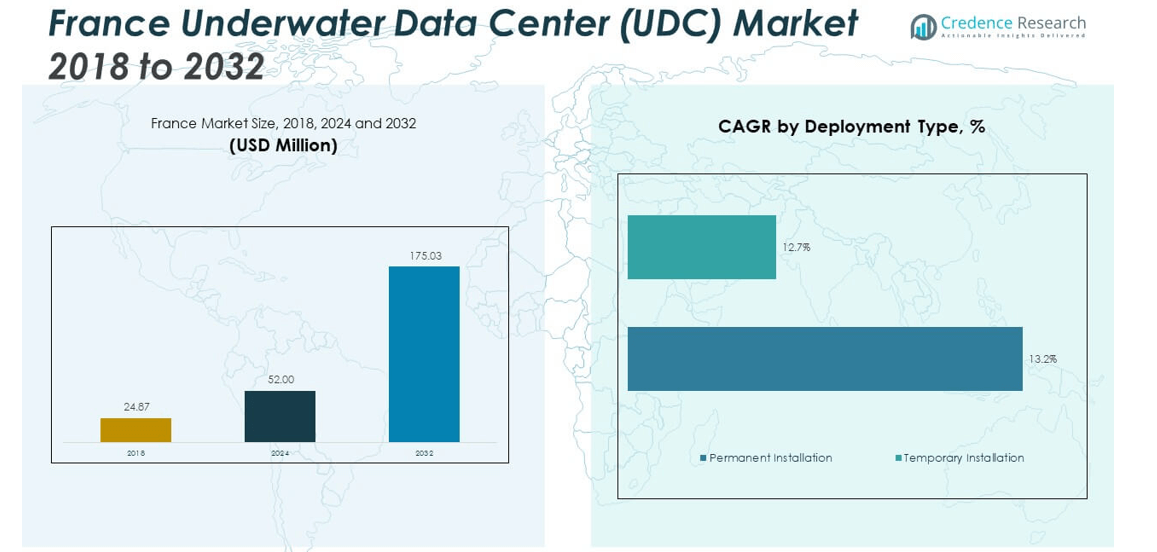

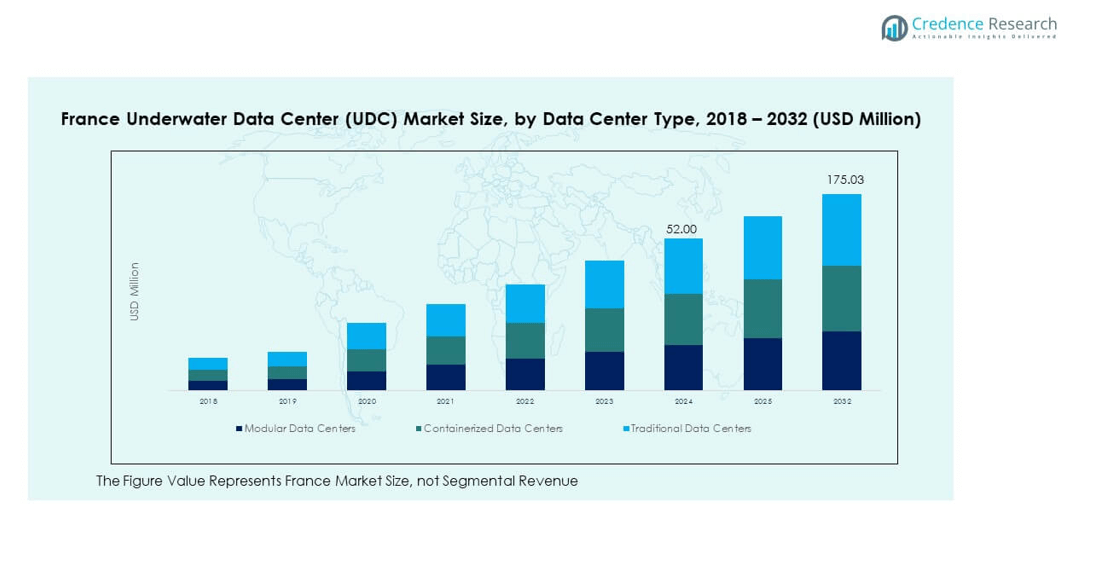

The France Underwater Data Center (UDC) Market size was valued at USD 24.87 million in 2018, reaching USD 52.00 million in 2024, and is anticipated to reach USD 175.03 million by 2032, at a CAGR of 16.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Underwater Data Center (UDC) Market Size 2024 |

USD 52.00 million |

| France Underwater Data Center (UDC) Market, CAGR |

16.38% |

| France Underwater Data Center (UDC) Market Size 2032 |

USD 175.03 million |

The market growth is driven by France’s strong focus on digital transformation, sustainable energy adoption, and innovation in data infrastructure. Companies are deploying underwater data centers to reduce energy consumption and improve operational efficiency. It supports France’s national strategy for green technology and carbon neutrality. The integration of renewable energy with subsea systems enhances performance and reduces environmental impact. Rising cloud demand and government support for data sovereignty strengthen market momentum across the country.

Geographically, the market is concentrated along France’s western and southern coastal regions due to their suitable marine conditions and access to renewable energy. Brittany, Normandy, and Provence are key zones for ongoing and planned deployments. It benefits from France’s robust telecom network, offshore energy capacity, and maritime engineering expertise. The combination of policy support and strong R&D collaboration positions France as one of Europe’s emerging leaders in underwater data center development.

Market Insights:

- The France Underwater Data Center (UDC) Market was valued at USD 24.87 million in 2018, reached USD 52.00 million in 2024, and is projected to reach USD 175.03 million by 2032, growing at a CAGR of 16.38%.

- Northern France led the market with a 46% share, supported by coastal infrastructure, renewable integration, and strong industrial connectivity. Western France followed with 34% due to its leadership in offshore energy and marine engineering, while Southern France held 20%, benefiting from digital infrastructure growth.

- Southern France is the fastest-growing region with a 20% share, driven by its Mediterranean access, hybrid energy integration, and collaboration between local governments and global technology companies.

- Modular data centers accounted for nearly 47% of total market share in 2024, driven by scalability, flexibility, and reduced setup time.

- Containerized data centers followed with approximately 32% share, reflecting their adaptability for offshore operations, while traditional models saw a gradual decline due to high operational costs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Focus on Energy Efficiency and Sustainable Infrastructure

The France Underwater Data Center (UDC) Market is gaining momentum due to rising emphasis on energy-efficient infrastructure. Companies are investing in underwater facilities to reduce power consumption and carbon emissions. It leverages ocean cooling to minimize energy waste, making operations more sustainable. The approach aligns with France’s national environmental policies and carbon neutrality goals. Government incentives for green data infrastructure encourage greater private-sector participation. The underwater concept also ensures better thermal management, reducing reliance on mechanical cooling systems. Sustainability commitments from major corporations continue to strengthen market expansion.

- For instance, Microsoft’s Project Natick operated an underwater data center off the coast of Scotland for two years, achieving a power usage effectiveness (PUE) of 1.07 and exhibiting a hardware failure rate that was one-eighth that of comparable land-based facilities, while running on 100% renewable energy sources including wind and solar.

Rising Data Generation and Cloud Computing Demand

The rapid growth of cloud computing and data storage needs is driving strong adoption of underwater data centers. Enterprises and public agencies are managing exponential data volumes requiring high-speed processing and low latency. The France Underwater Data Center (UDC) Market benefits from this digital transformation trend. It supports France’s position as a European technology hub with expanding cloud and AI-driven applications. The subsea model enhances connectivity across Europe’s digital networks while maintaining data sovereignty. Major cloud providers are exploring underwater installations to reduce land constraints. This trend contributes to building a more resilient and decentralized data infrastructure across the nation.

- For instance, Google’s Grace Hopper subsea cable system, operational as of 2022, connects the U.S., U.K., and Spain—with infrastructure linked to France—and is engineered to deliver a total capacity of 352 Tbps via 16 fiber pairs, significantly enhancing cross-border data transfer for cloud and AI workloads in the region.

Government Policies and Renewable Energy Integration

France’s government initiatives supporting renewable integration and green innovation are accelerating underwater data center deployment. The alignment with offshore wind and tidal power generation ensures a consistent, clean energy supply. It helps minimize dependence on fossil fuels and enhances sustainability in data operations. Incentives under France’s national energy transition program attract both local and international investors. Coastal regions with renewable potential are becoming preferred deployment zones. Collaborative efforts between energy firms and data center operators are promoting scalable subsea ecosystems. This policy-backed framework creates a favorable environment for long-term infrastructure development.

Advancements in Subsea Engineering and Cooling Technologies

Continuous innovations in marine construction and cooling systems have improved operational safety and cost efficiency. It allows deployment in deeper environments with greater reliability and reduced maintenance needs. The France Underwater Data Center (UDC) Market benefits from these advances through optimized power use and better data performance. Modern designs ensure resistance to corrosion, pressure, and temperature fluctuations. AI-based monitoring and predictive maintenance enhance operational continuity. Modular underwater systems allow faster installation and easier scalability. These technological gains strengthen commercial feasibility and attract new entrants to the industry.

Market Trends:

Adoption of Modular and Scalable Infrastructure Models

The France Underwater Data Center (UDC) Market is shifting toward modular infrastructure models to meet growing data requirements. Modular designs allow faster deployment, scalability, and cost efficiency. It helps operators expand capacity without major reconstruction. This flexibility supports France’s growing digital economy and need for agile data storage solutions. The modular trend aligns with the sustainability goal by minimizing resource use. Enterprises favor containerized solutions for remote offshore deployment. The approach enhances both operational reliability and flexibility in infrastructure management.

- For instance, the French defense technology firm Naval Group collaborated with Microsoft on Project Natick, assisting in the manufacturing and deployment of an experimental underwater data center. The data center was deployed in 2018 off the coast of the Orkney Islands in Scotland, not in Brittany.

Integration of Artificial Intelligence and Automation

AI and automation are transforming underwater data center operations by improving real-time monitoring and predictive maintenance. AI systems detect anomalies, optimize power consumption, and reduce downtime. It ensures reliability in deep-sea environments where accessibility is limited. Automation enables seamless temperature control and performance management. The France Underwater Data Center (UDC) Market is witnessing investments in smart sensors and analytics. These advancements enhance operational efficiency and support proactive decision-making. The trend fosters continuous improvement in reliability, sustainability, and cost optimization.

- For instance, Schneider Electric, in partnership with leading AI technology firms, developed and deployed real-time AI monitoring and smart automation solutions for sustainable European data centers, enabling major gains in operational efficiency and supporting advanced environmental control strategies for subsea and high-efficiency sites.

Expansion of Edge and 5G Infrastructure

The growth of edge computing and 5G networks is driving interest in underwater data centers. It supports faster data transfer, reduced latency, and improved connectivity for high-demand applications. France’s advanced telecom infrastructure provides a strong foundation for integration. Coastal cities and industrial zones benefit from improved digital responsiveness. The France Underwater Data Center (UDC) Market leverages 5G-enabled architecture for distributed computing. Strategic collaborations between telecom operators and technology firms enhance performance and scalability. This evolution strengthens France’s digital competitiveness across sectors.

Rising Investments and Strategic Collaborations

Investments from global and regional technology firms are intensifying across France’s coastal regions. It reflects growing confidence in subsea data center viability and sustainability. Partnerships between data operators, energy companies, and research institutions are expanding. These collaborations aim to develop next-generation underwater infrastructure supported by renewable energy. The France Underwater Data Center (UDC) Market is attracting venture capital for pilot testing and commercial-scale projects. The push for energy-efficient digital systems continues to inspire new partnerships. These alliances strengthen France’s leadership in Europe’s emerging underwater data industry.

Market Challenges Analysis:

High Installation Costs and Operational Complexities

The France Underwater Data Center (UDC) Market faces significant financial and technical challenges due to high installation costs. Subsea infrastructure requires specialized design, durable materials, and advanced logistics. It increases project expenses compared to traditional land-based systems. Maintenance and retrieval operations in deep-sea environments remain complex and time-consuming. Any malfunction could require full recovery of units, adding additional downtime and costs. Limited technical expertise in underwater infrastructure further complicates large-scale deployment. These barriers limit small and mid-sized enterprises from entering the market.

Regulatory Barriers and Environmental Compliance

Strict environmental regulations governing marine ecosystems add complexity to project execution. Compliance with maritime and ecological standards demands detailed assessments and continuous monitoring. It slows down approval timelines for new installations. The France Underwater Data Center (UDC) Market must address concerns about marine biodiversity and waste heat emissions. Regulators focus on ensuring operations do not harm underwater habitats. Balancing ecological protection with infrastructure expansion remains challenging. Managing these compliance factors requires close coordination with environmental agencies and technology developers.

Market Opportunities:

Integration of Offshore Renewable Energy and Smart Grids

The integration of underwater data centers with France’s offshore renewable energy grid presents major opportunities. It allows seamless connection with wind and tidal power networks for sustainable operations. Smart grid integration enhances energy efficiency and supply reliability. The France Underwater Data Center (UDC) Market can benefit from France’s leadership in clean energy. Collaborative ventures between power producers and data operators are emerging along the Atlantic coast. This alignment supports national goals for green energy and digital transformation. The trend strengthens energy resilience and reduces carbon footprints.

Expansion of Research, Innovation, and Export Capabilities

France’s expertise in marine engineering and digital technology creates global expansion potential. Research institutions and private companies are collaborating to advance subsea data designs. It supports the development of exportable technologies and partnerships across Europe. The France Underwater Data Center (UDC) Market is positioned to lead in subsea innovation. Government-backed R&D initiatives and public-private partnerships enhance competitive advantage. Local firms can leverage innovation funding to develop scalable, energy-efficient systems. This opportunity establishes France as a key contributor to Europe’s sustainable data infrastructure network.

Market Segmentation Analysis:

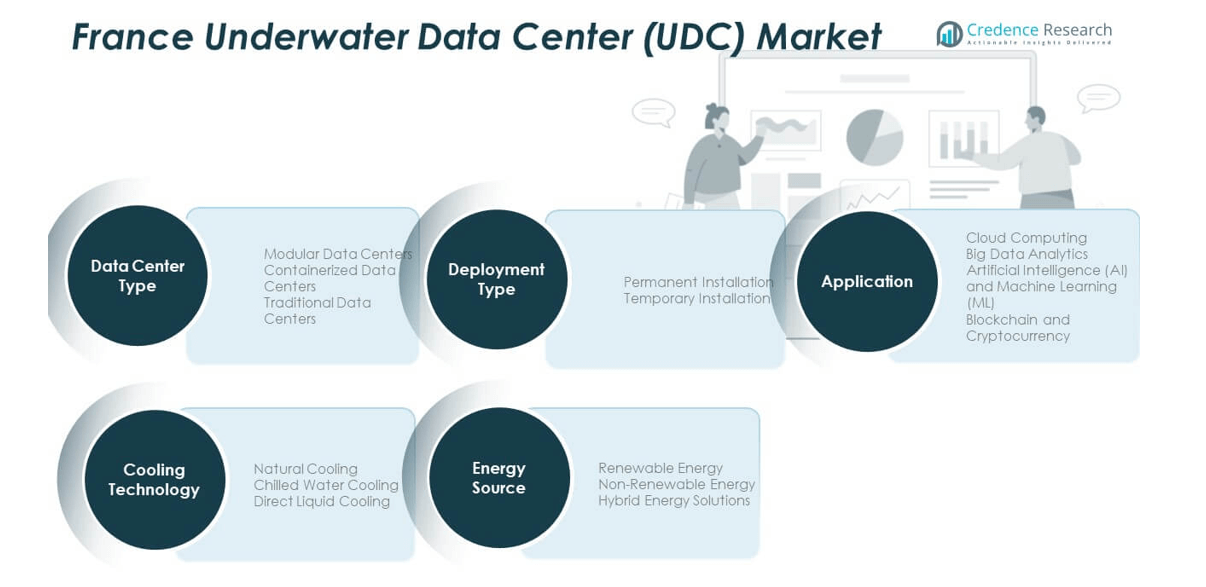

By Data Center Type

The France Underwater Data Center (UDC) Market is segmented into modular, containerized, and traditional data centers. Modular data centers dominate due to scalability, cost efficiency, and ease of deployment. Containerized facilities are growing in demand for their flexibility and suitability for offshore environments. Traditional data centers maintain limited use, primarily for legacy infrastructure integration. The shift toward modular systems supports France’s sustainability and digital transformation goals by enabling faster expansion and reduced environmental impact.

- For instance, in March 2023, the Chinese company Highlander launched the world’s first commercial modular underwater data center near Hainan, China. The facility uses seawater for cooling, which significantly reduces energy consumption and water use compared to land-based data centers. The project cited advantages such as rapid deployment, modular scaling, and reduced operating costs.

By Application

Cloud computing leads the segment due to rising demand for high-capacity, low-latency data storage. Big data analytics follows, supported by increasing enterprise data processing requirements. AI and machine learning applications are expanding rapidly, driven by automation and real-time insights. Blockchain and cryptocurrency utilize underwater centers for improved energy efficiency and secure processing environments.

- For instance, Nautilus Data Technologies pioneered the concept of a floating barge data center using sustainable, water-based cooling in Stockton, California, which became operational in 2021. The company has since shifted its business model, putting the Stockton facility up for sale in late 2024 to focus on providing its modular cooling technology, EcoCore, to other data center operators.

By Energy Source

Renewable energy holds the largest share, driven by France’s investment in wind and tidal power. Non-renewable energy use continues to decline amid strong regulatory focus on sustainability. Hybrid systems are emerging as a balanced solution for reliability and efficiency.

By Technology (Deployment Type)

Permanent installations dominate due to long-term operational stability and reduced maintenance requirements. Temporary installations are preferred for research projects and early-stage deployments to evaluate site feasibility.

By Cooling Technology

Natural cooling is the most widely adopted method due to the ocean’s consistent thermal regulation. Chilled water cooling is used in warmer waters, ensuring stable performance. Direct liquid cooling is an emerging innovation improving energy efficiency and computational density.

Segmentation:

By Data Center Type

- Modular Data Centers

- Containerized Data Centers

- Traditional Data Centers

By Application

- Cloud Computing

- Big Data Analytics

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain and Cryptocurrency

By Energy Source

- Renewable Energy

- Non-Renewable Energy

- Hybrid Energy Solutions

By Technology (Deployment Type)

- Permanent Installation

- Temporary Installation

By Cooling Technology

- Natural Cooling

- Chilled Water Cooling

- Direct Liquid Cooling

Regional Analysis:

Northern France – Coastal Leadership and Industrial Connectivity

Northern France dominates the France Underwater Data Center (UDC) Market, holding nearly 46% of the total share. The region benefits from its extensive coastline, advanced industrial base, and strong data infrastructure. Key zones such as Normandy and Hauts-de-France provide ideal conditions for subsea deployment due to stable marine temperatures and proximity to energy grids. It also hosts several technology hubs with high-speed connectivity, attracting both domestic and international investors. The integration of renewable energy from offshore wind farms strengthens sustainability and operational reliability. Government-backed innovation initiatives and regional digital transformation programs continue to reinforce the market position of Northern France as a primary deployment hub.

Western France – Renewable Synergy and Technological Expansion

Western France accounts for around 34% of the market, supported by its leadership in renewable energy production and marine engineering. The Brittany and Pays de la Loire regions play a key role in integrating offshore wind energy with data infrastructure. It provides a favorable ecosystem for modular and containerized underwater data centers due to strong maritime expertise. Local universities and research centers collaborate with tech companies to advance subsea cooling technologies. The western coastline offers deep-water access and stable environmental conditions, reducing installation challenges. This synergy between technology and renewable power reinforces the region’s position as a sustainable innovation hub.

Southern France – Emerging Growth and Strategic Advantage

Southern France holds approximately 20% of the France Underwater Data Center (UDC) Market and is emerging as a strategic growth region. The Provence-Alpes-Côte d’Azur area benefits from its proximity to the Mediterranean Sea and established energy infrastructure. It serves as an ideal location for hybrid and renewable-powered underwater data centers targeting regional data processing demand. The region’s technology corridors and port facilities support logistics and equipment deployment. It is also witnessing increased collaboration between local governments and global tech firms to expand subsea connectivity networks. The combination of renewable integration, strategic geography, and expanding digital infrastructure positions Southern France as a promising frontier for future underwater data center developments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The France Underwater Data Center (UDC) Market is characterized by growing competition among global technology leaders and emerging regional innovators. Companies such as Microsoft, Nautilus Data Technologies, Amazon Web Services, and Google are investing in pilot projects to explore subsea deployment feasibility. It focuses on improving energy efficiency, cooling performance, and operational sustainability. Strategic collaborations between technology firms and renewable energy providers are shaping the market structure. Local engineering expertise supports integration with France’s offshore energy grid. The competition emphasizes innovation, cost optimization, and compliance with environmental regulations. Rising investments in AI-driven monitoring and modular system design further intensify market rivalry and development momentum.

Recent Developments:

- In May 2024, Microsoft announced a €4 billion investment (about $4.3 billion) in French data center expansion, including upgrades to its existing Paris and Marseille facilities and a new campus near Mulhouse. The upgrade will bring 25,000 GPUs for AI workloads online by the end of 2025. This initiative directly supports France’s national AI strategy and marks Microsoft’s largest commitment to the region to date.

- In June 2025, Google, via its subsidiary Tricolore Computing, initiated the acquisition of 195 hectares in Châteauroux, France, for what could become its first self-built French data center campus. The project is linked to advancing artificial intelligence capacity and remains in preliminary land study phases, with environmental assessments and local council approval pending.

- In September 2025, Amazon Web Services announced its participation in the new Water-AI Nexus Center of Excellence, formed in collaboration with researchers, utilities, and nonprofits to pioneer advanced sustainable water practices for AI data centers globally.

- In July 2025, IBM France entered a collaboration with Elior Group to launch an “agentic AI & Data Factory” in the country, supporting Elior’s digital transformation and operational performance improvements via advanced AI and data center services. While not exclusively underwater, this initiative highlights IBM’s expansion in the French data center and AI-aligned infrastructure space.

Report Coverage:

The research report offers an in-depth analysis based on data center type, application, energy source, deployment type, and cooling technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Modular underwater data centers will dominate new installations across coastal regions.

- Renewable energy integration will remain a primary focus for sustainable data operations.

- AI-based monitoring systems will enhance predictive maintenance and uptime efficiency.

- Partnerships between technology firms and energy utilities will expand further.

- The market will attract long-term investments from global hyperscale operators.

- Hybrid energy models will improve operational resilience in varying marine conditions.

- Innovation in subsea materials will increase durability and performance reliability.

- France will emerge as a European hub for green and decentralized data infrastructure.

- Marine environmental compliance will shape deployment strategies and design standards.

- Continuous research collaboration will drive advancements in subsea cooling efficiency.