Market Overview

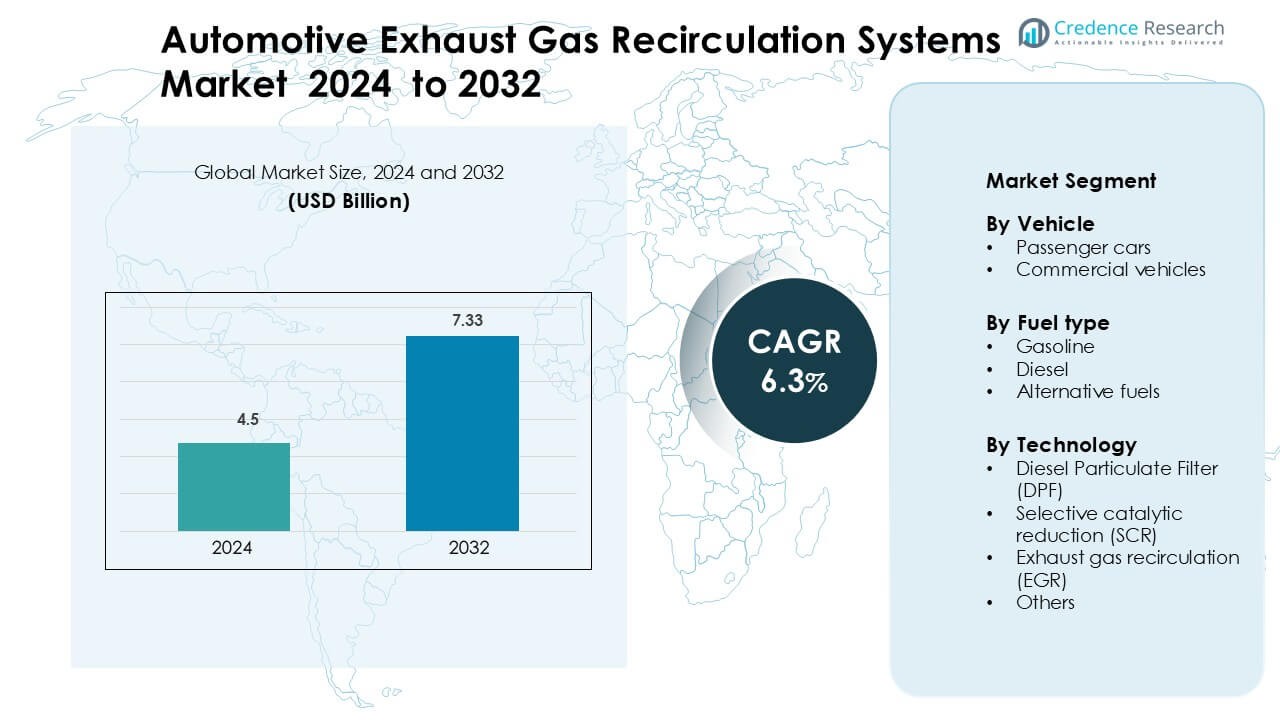

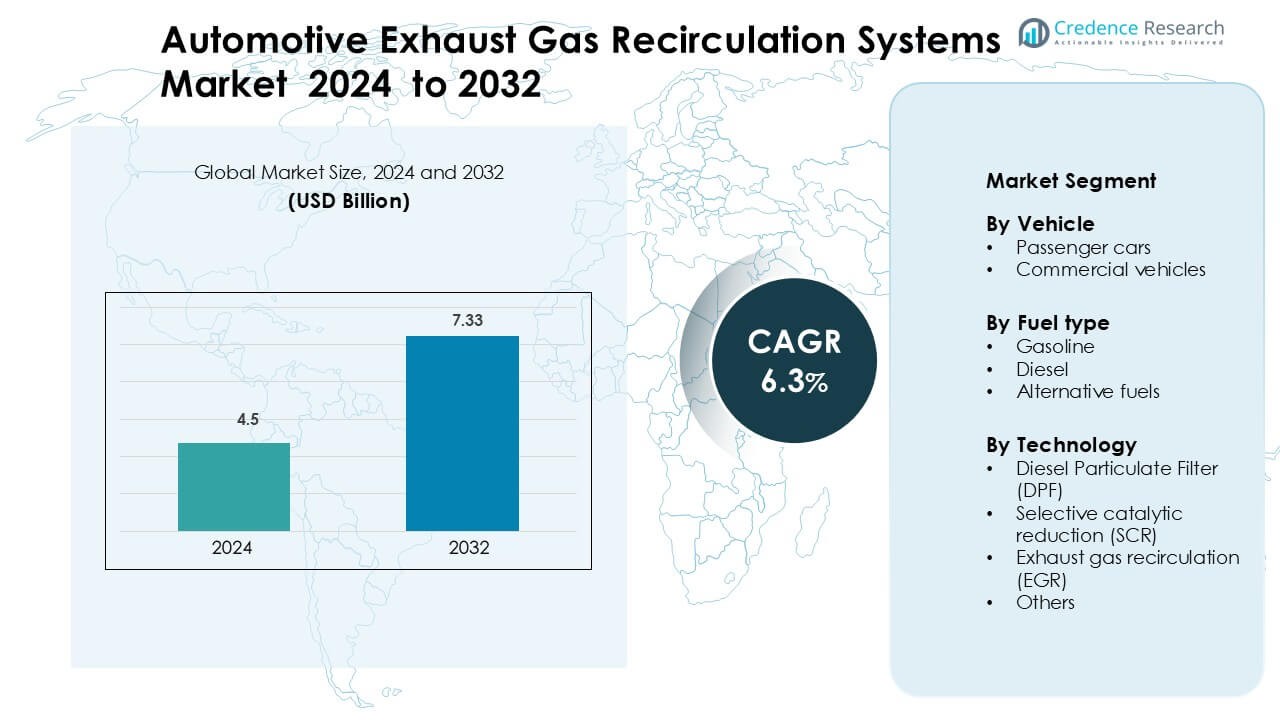

Automotive Exhaust Gas Recirculation Systems Market was valued at USD 4.5 billion in 2024 and is anticipated to reach USD 7.33 billion by 2032, growing at a CAGR of 6.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Exhaust Gas Recirculation Systems Market Size 2024 |

USD 4.5 Billion |

| Automotive Exhaust Gas Recirculation Systems Market, CAGR |

6.3% |

| Automotive Exhaust Gas Recirculation Systems Market Size 2032 |

USD 7.33 Billion |

Leading companies such as Faurecia, Tenneco Inc., Continental AG, Friedrich Boysen GmbH & Co. KG, BENTELER International, Sejong Industrial Co., Ltd., BOSAL, Yutaka Giken Company Limited, Eberspächer Group and Magna Flow Inc. dominate the automotive exhaust gas recirculation (EGR) systems market with strong OEM relationships and global footprints. These players invest significantly in cooled EGR, low‐pressure EGR and integrated module technologies, gaining preferential contracts with major automakers. The leading region is Asia Pacific, which holds approximately 50 % of the global EGR systems market share. The region’s dominance reflects growth in vehicle production, stringent emissions standards and high adoption of EGR technology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global automotive exhaust gas recirculation systems market registered a size of USD 4.5 billion in 2024 and is projected to reach approximately USD 7.33 billion by 2032, growing at a CAGR of 6.3%.

- Stringent emission standards globally and the need for improved fuel efficiency act as major growth drivers, with passenger vehicles and diesel‑fuelled engines accounting for high segment shares.

- A key trend is the integration of EGR systems into hybrid and mild‑hybrid powertrains and the increasing adoption in the Asia‑Pacific region—which holds the highest regional share to exploit growth in vehicle production and emission‑control requirements.

- A restraint remains the transition to battery electric vehicles (which don’t use EGR), and intense cost pressure on EGR system manufacturers limits margin expansion and slows uptake in some cost‑sensitive segments.

- Regionally, Asia‑Pacific leads with the dominant share (approximately 40% of the market) supported by growth in China and India, while Europe and North America follow with sizeable shares driven by advanced regulations and mature automotive industries.

Market Segmentation Analysis:

By Vehicle

Passenger cars hold the dominant share of 62% in the automotive exhaust gas recirculation systems market. High urban vehicle density, mass adoption of small and mid-size cars, and strict emission regulations drive EGR installation in passenger cars. Automakers integrate compact, low-pressure EGR systems to meet NOx limits while improving fuel efficiency. Commercial vehicles also deploy EGR units, but at a slower adoption rate due to higher reliance on SCR and DPF solutions for heavy-duty engines. Growing sales of electric buses and trucks may limit future EGR demand in commercial fleets.

- For instance, Cummins engines, including the 6.7L, utilize EGR systems to meet emissions standards by recirculating exhaust gas to lower combustion temperatures, which in turn reduces NOx emissions.

By Fuel Type

Diesel vehicles account for the largest share of 71% due to the need to control high combustion temperatures and NOx emissions. Diesel engines rely on EGR as a cost-effective solution to meet Euro 6 and Bharat Stage VI norms. Gasoline engines also adopt cooled EGR systems to improve turbocharged engine performance and reduce knocking. Alternative fuel engines such as CNG and LPG explore EGR integration for enhanced combustion control, but limited deployment keeps their market share comparatively small.

- For instance, Mazda’s naturally aspirated (NA) and turbocharged SKYACTIV-G engines do utilize a cooled EGR system. The EGR system is a key countermeasure for knocking in high-compression engines and helps improve fuel economy by reducing pumping losses.

By Technology

Exhaust Gas Recirculation (EGR) technology leads the market with a 54% share. Automakers prefer EGR due to its ability to cut NOx emissions without major engine redesign. Low-pressure and high-pressure EGR systems support diesel and gasoline engines across mass-market and commercial models. Selective catalytic reduction and diesel particulate filters complement EGR in heavy-duty diesel vehicles but increase system cost. Rising demand for hybrid and turbocharged engines further supports EGR integration as a fuel-saving and emission-reduction technology.

Key Growth Drivers

Stringent Emission Regulations

Growing global regulatory mandates targeting NOx and particulate emissions drive the demand for EGR technologies. Standards such as Euro 7, Bharat Stage VI, and China VI require automakers to integrate advanced emission control systems including EGR. Manufacturers respond by increasing adoption of cooled and low‑pressure EGR to meet limits while preserving engine efficiency. This regulatory pressure remains a key growth engine for the EGR systems market.

- For instance, Volkswagen introduced an enhanced low-pressure EGR system in its 2.0 TDI EA288 Evo engines, but the crucial technology enabling compliance with the Euro 6d standard and future norms is the “twin dosing” Selective Catalytic Reduction (SCR) system. This combined approach allows the engine to achieve very low NOx emissions, reportedly far below the official Euro 6d RDE (Real Driving Emissions) limit of 114.4 mg/km (based on the 80 mg/km lab limit and a 1.43 conformity factor).

Demand for Improved Fuel Efficiency

Consumers’ desire for lower fuel consumption and operating cost incentivises OEMs to deploy EGR solutions. Recirculating exhaust gases reduces combustion temperature, enhances charge dilution and improves thermal efficiency. Vehicles running on both diesel and gasoline increasingly incorporate EGR to meet fuel economy targets, especially in emerging markets where fuel costs are high.

- For instance, Hyundai, like most manufacturers, uses Exhaust Gas Recirculation (EGR) systems in its CRDi diesel engines (including the U2 series) to reduce NOx emissions by lowering combustion temperatures.

Rising Vehicle Production and Global Fleet Expansion

Expansion of vehicle sales, particularly in Asia‑Pacific, supports higher installation volumes for EGR systems. The growth of passenger cars and commercial vehicles in emerging markets amplifies demand for emission‑control components. As production ramps up, economies of scale reduce unit costs and further stimulate market expansion of EGR modules and peripherals.

Key Trends & Opportunities

Integration with Hybrid and Mild‑Hybrid Systems

As the automotive industry transitions toward electrification, hybrid and mild‑hybrid powertrains present a vital opportunity for EGR technologies. While fully electric vehicles do not require EGR, internal combustion engines in hybrids still face emission challenges. OEMs integrate cooled EGR and variable geometry EGR solutions into hybrid architectures to optimise NOx control and fuel economy. This adaptation extends the relevance of the EGR market even amid EV adoption.

- For instance, Ford’s 48V EcoBoost mild-hybrid system (mHEV) does use advanced technologies to improve efficiency, including a Belt-Driven Integrated Starter/Generator (BISG) and cylinder deactivation.

Expansion in Emerging Markets & Aftermarket Growth

Emerging economies such as India, China, and Southeast Asia are witnessing rapid vehicle growth and tightening emission norms. These regions offer high potential for EGR system adoption, both for new vehicles and retrofit markets. Moreover, aftermarket servicing and replacement of EGR components (valves, coolers, pipes) present additional revenue streams as regulatory enforcement increases.

- For instance, Bharat Benz (Daimler India Commercial Vehicles – DICV) has consistently used and advocated for the SCR (Selective Catalytic Reduction) technology as its core strategy for meeting BS-IV and BS-VI emission norms, including for its medium-duty and heavy-duty trucks.

Key Challenges

Transition to Electric Vehicles Reducing ICE Demand

The accelerating shift toward battery electric vehicles (BEVs) poses a structural challenge for the EGR systems market. As EV penetration rises, internal combustion engine (ICE) powertrains which require EGR become a smaller portion of new vehicle sales. This trend could reduce future volume opportunities for EGR producers unless alternative strategies such as retrofit or hybrid focus are adopted.

Complexity of Integration and Cost Pressures

EGR system implementation involves high engineering complexity, especially when integrated into modern engine architectures with turbocharging, downsizing, and multi‑fuel capability. Additionally, automakers face cost pressures and the availability of alternative emission control technologies. These factors challenge EGR suppliers to deliver compact, reliable, and cost‑effective modules, limiting margin growth and slowing adoption in cost‑sensitive segments.

Regional Analysis

Asia Pacific

The Asia Pacific region commands approximately 40 % of the global EGR systems market share, driven by rapid expansion of vehicle production in countries like China, India and Japan. Manufacturers there face increasingly stringent emission regulations, prompting wide deployment of EGR technologies in both passenger and commercial vehicles. The region’s strong manufacturing base and cost‑efficient production further support growth. However, rising adoption of electric vehicles may moderate future growth of internal‑combustion‑based EGR systems.

Europe

Europe occupies about 25 % of the market and leads in technology sophistication and regulatory compliance for emissions. The region’s adoption is accelerated by strict norms such as Euro 6/7 and by high penetration of downsized + turbocharged engines that benefit from EGR integration. OEMs in Germany, France and the UK are heavily investing in advanced EGR solutions. Yet the gradual shift toward electrification poses a headwind for long‑term EGR demand.

North America

North America accounts for close to 20 % of the market. The region benefits from established automotive industry infrastructure and enforcement of regulations by agencies such as the EPA. Fuel‑efficiency targets and NOx limits in the United States stimulate adoption of cooled and variable‑geometry EGR systems. The transition to electric vehicles and alternative powertrains remains a challenge for future volume growth.

Latin America

Latin America holds approximately 8 % of the global EGR market share. Growth stems from increasing vehicle ownership in Brazil and Mexico, and from gradually tightening emission standards. OEMs and suppliers expect aftermarket and retrofit opportunities as aging fleets require upgraded emission controls. Infrastructure limitations and slower regulatory implementation moderate pace of adoption.

Middle East & Africa

The Middle East & Africa region makes up around 7 % of the global market. Expansion is supported by rising commercial and passenger vehicle demand and improving emission regulation frameworks in GCC, North Africa and sub‑Saharan zones. Market growth remains uneven due to variation in regulatory stringency, economic volatility and competing technologies, but long‑term potential exists as regions upgrade to meet global standards.

Market Segmentations

By Vehicle

- Passenger cars

- Commercial vehicles

By Fuel type

- Gasoline

- Diesel

- Alternative fuels

By Technology

- Diesel Particulate Filter (DPF)

- Selective catalytic reduction (SCR)

- Exhaust gas recirculation (EGR)

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global Automotive Exhaust Gas Recirculation Systems Market manifests as a moderately consolidated arena dominated by established global suppliers. Leading players such as Tenneco Inc., Continental AG, Faurecia and Friedrich Boysen GmbH & Co. KG secure sizeable shares through their deep OEM partnerships and broad regional footprint. These firms invest heavily in advanced EGR technologies, such as cooled low‑pressure EGR, to meet tighter emissions regimes. Meanwhile, mid‑tier suppliers and regional players intensify competition by offering cost‑effective modules and leveraging local manufacturing capability, particularly in Asia‑Pacific. Strategic moves such as joint ventures, acquisitions and capacity ramp‑ups underscore the push to expand footprint and diversify product portfolios. As emission norms evolve globally, the competitive battleground increasingly pivots on innovation, cost‑efficiency and global reach.

Key Player Analysis

- BOSAL

- Faurecia

- Yutaka Giken Company Limited

- Tenneco Inc.

- Eberspacher

- Continental AG

- MagnaFlow

- Friedrich Boysen

- Sejong Industrial

- BENTELER International

Recent Developments

- In July 2024, Friedrich Boysen – Opened the “BAK Development Centre” at Simmersfeld, focusing on enviro‑ and energy‑technologies including e‑mobility and hydrogen indicating broader emission‑technology focus beyond conventional EGR systems.

- In Oct 2023, a joint venture between Eberspaecher and Aapico Hitech called Purem AAPICO, officially launched its new facility in southeast Bangkok, Thailand. This site will be used to manufacture exhaust systems for U.S.-based automotive manufacturers’ pick-up truck platforms. The facility stretches over 3,000 sq. meters and was built in only five months.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Fuel Type, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as emission norms tighten further worldwide.

- Increased adoption of mild‑hybrid and turbocharged engines will drive EGR system integration.

- Emerging markets will become key growth zones as vehicle production rises.

- Suppliers will focus on modular EGR solutions to reduce cost and complexity.

- Alternative fuel vehicles will still require tailored EGR systems, offering niche growth.

- Retrofit and aftermarket demand will grow for older diesel fleets in developing regions.

- Collaboration between OEMs and EGR suppliers will accelerate technology innovation.

- The shift toward full electric vehicles will gradually reduce reliance on ICE‑based EGR systems.

- Automation and digital control will enhance EGR performance and diagnostics in future engines.

- Market winners will leverage global footprint and strong R&D to stay competitive.