Market Overview

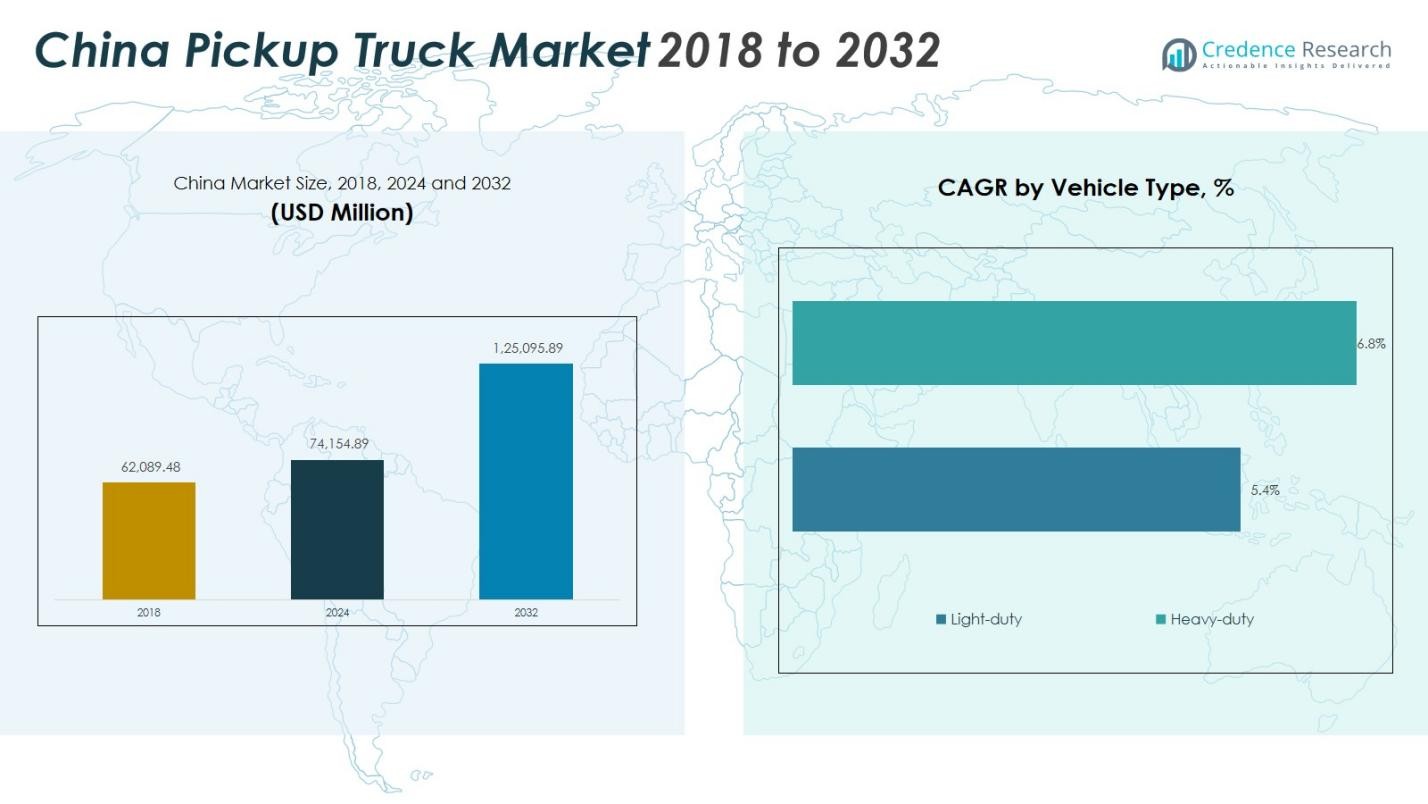

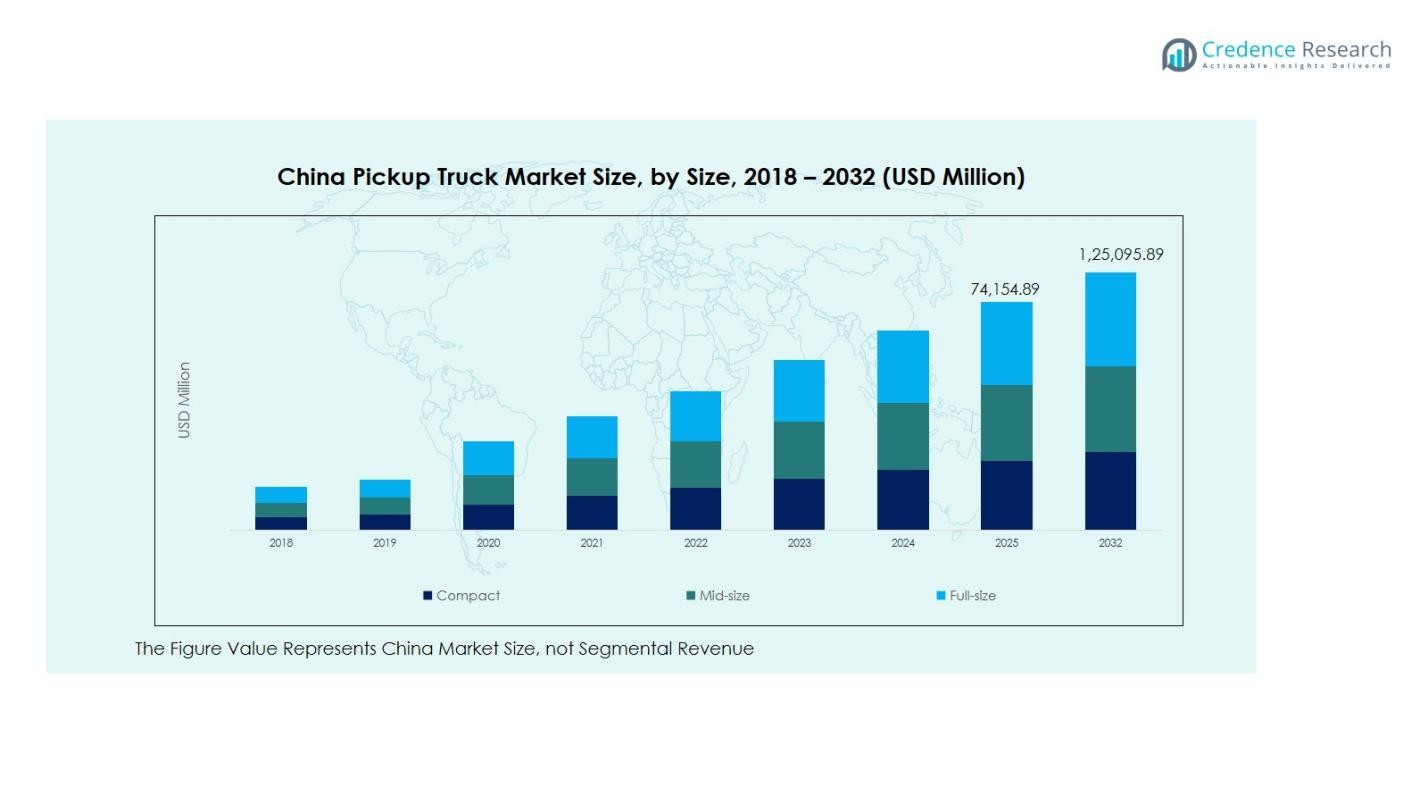

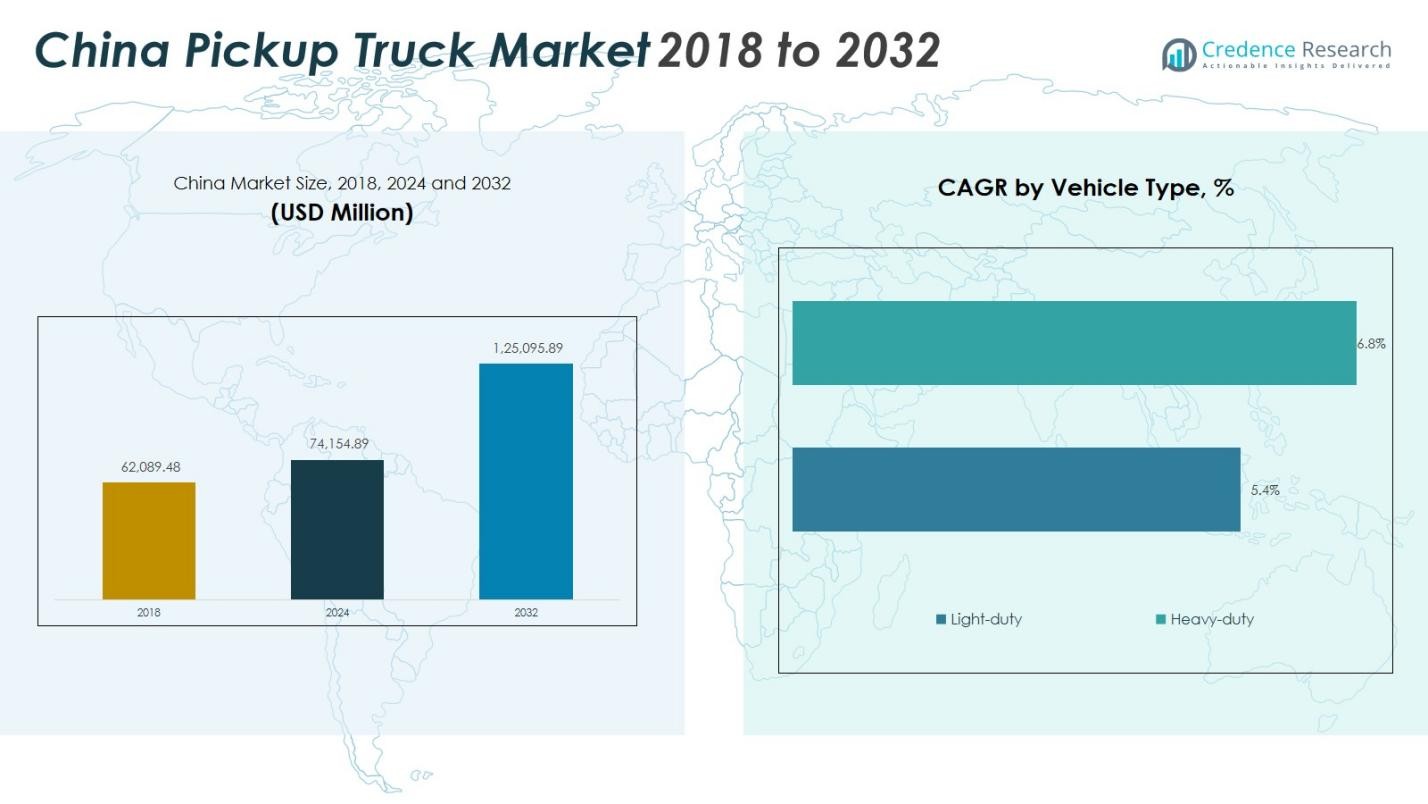

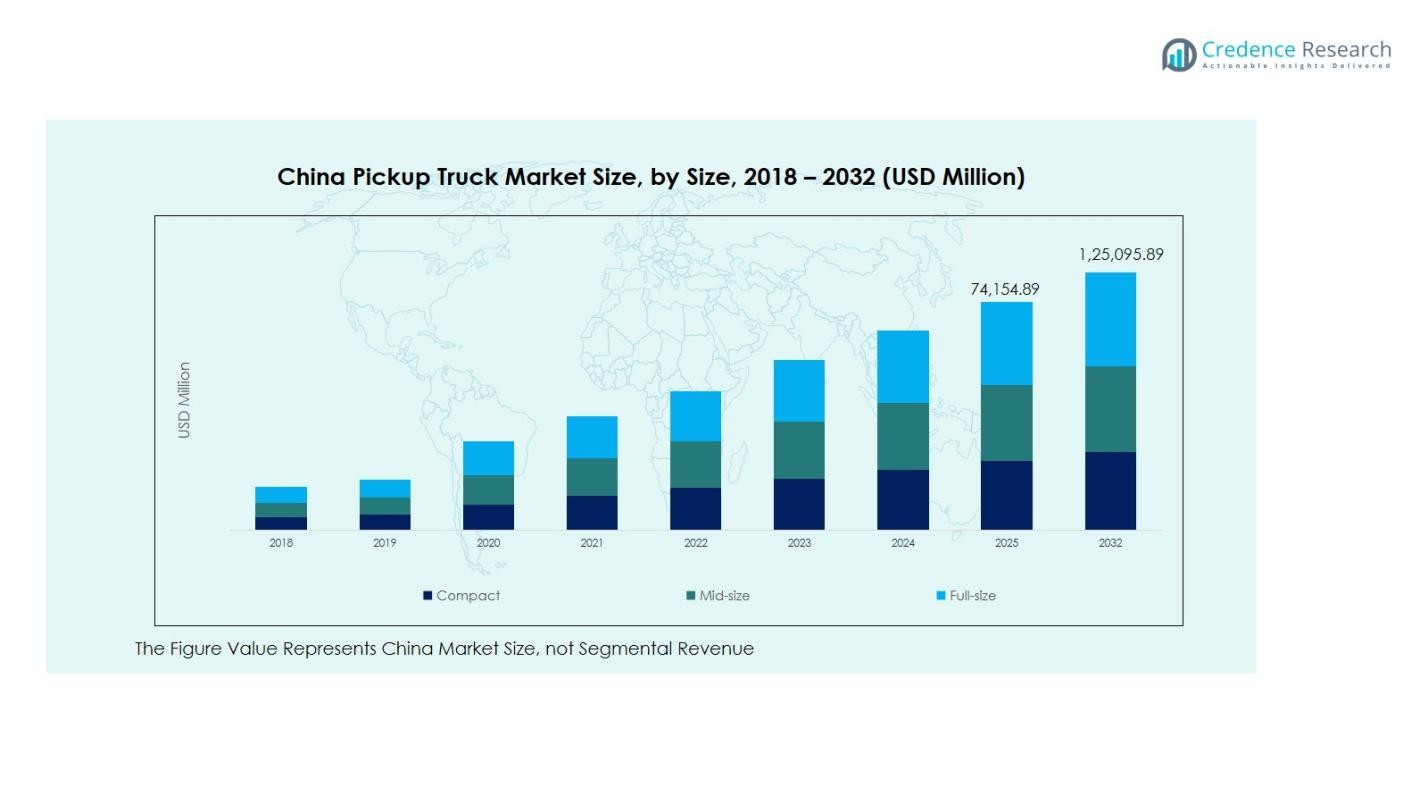

China Pickup Truck Market size was valued at USD 62,089.48 Million in 2018, increasing to USD 74,154.89 Million in 2024, and is anticipated to reach USD 125,095.89 Million by 2032, at a CAGR of 6.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Pickup Truck Market Size 2024 |

USD 74,154.89 Million |

| China Pickup Truck Market, CAGR |

6.75% |

| China Pickup Truck Market Size 2032 |

USD 125,095.89 Million |

The China Sample‑Pickup Truck Market is led by major players such as Great Wall Motors Co., Ltd. (GWM), Jiangling Motors Corporation, Ltd. (JMC), SAIC Motor Corporation Limited, and FAW Group Corporation. These manufacturers leverage strong production bases, expansive dealer networks and evolving product lines including electric and heavy‑duty variants to maintain leadership. Regionally, Eastern China commands a significant 45% market share, driven by dense urbanization, logistics infrastructure and rapid fleet upgrades. Meanwhile, Southern China holds approximately 25%, powered by robust personal and light‑duty pickup adoption in areas like Guangzhou and Shenzhen. Combined, these regions form the backbone of the market and guide strategic investment and growth decisions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The China Pickup Truck Market reached USD 74,154.89 Million in 2024 and is projected to grow at a CAGR of 6.75% through 2032.

- Rising demand for light‑duty pickup trucks, which hold over 60% market share, drives market expansion as businesses and individuals seek versatile and cost‑efficient transport.

- A key trend centers on electric pickup trucks gaining traction, supported by government incentives and growing eco‑conscious consumer behavior.

- The presence of strong players such as Great Wall Motors Co., Ltd., Jiangling Motors Corporation, Ltd., SAIC Motor Corporation Limited and FAW Group Corporation fuels competitive intensity and product innovation.

- Regionally, Eastern China dominates with a 45% share, followed by Southern China at 25%, Northern China at 20%, Western China at 10% and Northeastern China at 5%, highlighting growth potential in less‑penetrated regions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Vehicle Type:

The China Pickup Truck Market is divided into Light-duty and Heavy-duty Pickup Trucks. The dominant sub-segment is Light-duty Pickup Trucks, which accounts for a significant share of the market, driven by the increasing demand for versatile and fuel-efficient vehicles in urban areas. As of the latest market analysis, Light-duty Pickup Trucks hold over 60% of the market share. Their popularity is fueled by their affordability, lower operational costs, and ability to serve both commercial and personal purposes, making them highly attractive for small businesses and individual consumers alike.

- For instance, the GWM Poer pickup truck, known for its high-end performance and advanced technology, caters to both commercial and personal users with powerful yet efficient engines, maintaining strong sales domestically and internationally.

By Application:

The Commercial Pickup Trucks sub-segment leads the Application segment, capturing the largest market share in the China Pickup Truck Market. It holds 45% of the total market, driven by the growing demand for pickup trucks in sectors like logistics, construction, and transportation. The adoption of these trucks is primarily due to their robustness, higher payload capacity, and the growing need for efficient transport solutions in urban and rural areas. The increasing industrialization and infrastructure development further contribute to the market growth of commercial pickups.

- For instance, Sinotruk’s HOWO series is renowned for its robustness and high payload capacity, widely used in heavy-duty transport and construction projects.

By Fuel Type:

In the Fuel Type segment, Diesel Pickup Trucks dominate the China Pickup Truck Market, with a market share of 60%. This dominance is attributed to the greater fuel efficiency and higher towing capacity of diesel-powered trucks, making them ideal for both commercial and industrial use. Diesel engines are widely preferred in heavy-duty vehicles due to their durability and ability to handle long-distance travel and heavy loads. However, with rising environmental concerns, the adoption of Electric Pickup Trucks is growing, albeit at a smaller pace, representing the shift toward more sustainable transportation options.

Key Growth Drivers

Increasing Demand for Versatile Transportation Solutions

The growing need for versatile transportation solutions is a major growth driver in the China Pickup Truck Market. With rapid urbanization and the expansion of small and medium-sized enterprises, pickup trucks are being increasingly adopted for both personal and commercial purposes. The versatility of these trucks, offering both cargo space and passenger comfort, makes them ideal for a wide range of applications. As more businesses rely on efficient transportation for logistics, the demand for pickup trucks is expected to continue rising.

- For instance, Clion EV, a private tech enterprise in Jiangsu, is emerging with electric light-duty pickups designed to meet the urban logistics demand for greener, efficient vehicles.

Urbanization and Infrastructure Development

Urbanization and large-scale infrastructure development are significant drivers in the growth of the China Pickup Truck Market. As more cities expand and new construction projects emerge, there is an increased need for robust vehicles capable of transporting goods and materials. Pickup trucks, especially heavy-duty variants, are preferred in construction, logistics, and agriculture due to their high payload capacity and durability. The government’s focus on infrastructure growth and economic development supports the rising demand for pickup trucks across various sectors.

- For instance, Sinotruk’s HOWO heavy-duty pickup trucks are widely deployed in large-scale construction projects due to their high payload capacity and ruggedness.

Growing Preference for Fuel-efficient and Eco-friendly Vehicles

The shift toward fuel-efficient and eco-friendly vehicles is fueling the growth of the China Pickup Truck Market. Rising fuel prices and increasing environmental concerns are driving consumers and businesses to opt for trucks that offer better fuel efficiency and lower emissions. Diesel-powered trucks remain popular due to their efficiency, but the adoption of electric and hybrid pickup trucks is gaining momentum. Government incentives for electric vehicles and the growing availability of charging infrastructure are also contributing to the market’s expansion in the eco-friendly segment.

Key Trends & Opportunities

Shift Toward Electric Pickup Trucks

The shift toward electric vehicles presents a significant opportunity in the China Pickup Truck Market. With China leading the global electric vehicle market, the demand for electric pickup trucks is expected to rise. Consumer preferences for sustainable and cost-effective transportation solutions, combined with government incentives and subsidies, are accelerating this transition. Manufacturers are investing in the development of electric pickup models, offering lower operational costs and minimal environmental impact. As the charging infrastructure improves, the adoption of electric pickup trucks will likely see substantial growth.

- For instance, companies like Great Wall Motor (GWM) have launched the Pao EV, combining rugged utility with zero emissions, appealing to environmentally conscious consumers.

Integration of Advanced Technology Features

Another key trend driving the growth of the China Pickup Truck Market is the integration of advanced technology features in pickup trucks. Features such as autonomous driving systems, improved safety technologies, and advanced infotainment systems are becoming increasingly popular among consumers. The demand for high-tech, feature-rich vehicles is being driven by the younger generation, who prioritize connectivity, convenience, and safety. This trend presents manufacturers with opportunities to differentiate their products by offering trucks equipped with cutting-edge technology, catering to the tech-savvy consumer base.

- For example, BYD’s electric pickup features Level 2 driver-assistance systems, including adaptive cruise control and lane-keeping, reflecting a strong focus on safety and autonomy.

Key Challenges

High Initial Purchase Cost of Electric Pickup Trucks

One of the major challenges in the China Pickup Truck Market is the high initial purchase cost of electric pickup trucks. Despite their long-term cost benefits, such as lower fuel consumption and maintenance costs, the upfront price remains a barrier for many consumers and businesses. The premium price of electric trucks compared to traditional diesel or petrol models may slow their adoption in price-sensitive segments. Manufacturers and policymakers will need to work together to lower costs and provide more attractive incentives to drive the broader adoption of electric pickups.

Fluctuating Fuel Prices and Supply Chain Disruptions

Fluctuating fuel prices and supply chain disruptions are ongoing challenges for the China Pickup Truck Market. The volatility of fuel prices can impact the operational costs for businesses relying on pickup trucks for commercial transportation. Additionally, disruptions in the supply chain, especially in the procurement of critical components such as semiconductors and batteries, may affect the production and availability of pickup trucks. These challenges can create uncertainties in pricing and delivery timelines, hindering market growth and impacting consumer purchasing decisions.

Regional Analysis

Eastern China

Eastern China holds the largest market share in the China Pickup Truck Market, accounting for 45% of the total market. This region, which includes major economic hubs like Shanghai, Jiangsu, and Zhejiang, is characterized by rapid urbanization and industrial growth, leading to a strong demand for both light-duty and heavy-duty pickup trucks. The region’s robust infrastructure development, along with an expanding logistics and transportation sector, drives the demand for commercial and industrial pickups. Additionally, the growing adoption of electric vehicles in cities like Shanghai contributes to the region’s rising share in the market.

Southern China

Southern China is another key market for pickup trucks, representing 25% of the market share. With major cities like Guangzhou, Shenzhen, and Hong Kong, the region benefits from a highly developed economy, a flourishing logistics sector, and a rising demand for personal vehicles. The popularity of light-duty pickup trucks, due to their efficiency and versatility, is a major driver in this region. Additionally, the increasing focus on eco-friendly transportation options has boosted the adoption of electric pickup trucks, making it a dynamic market with opportunities for both traditional and electric vehicle manufacturers.

Northern China

Northern China holds 20% of the market share in the China Pickup Truck Market. The region’s demand is largely driven by industries such as agriculture, mining, and construction, where heavy-duty pickup trucks are highly sought after for their ability to handle rugged terrain and heavy loads. Cities like Beijing, Tianjin, and Inner Mongolia are key contributors to the market growth. The rise in rural infrastructure development and increasing industrial activities is expected to maintain strong demand for both commercial and industrial vehicles in the region.

Western China

Western China, with its mountainous terrain and vast rural areas, accounts for 10% of the market share in the China Pickup Truck Market. The demand in this region is primarily driven by the need for durable vehicles in agriculture, mining, and construction. While electric pickup trucks are still in the early adoption phase, there is potential for growth as urbanization spreads to cities like Chengdu and Xi’an. Additionally, government initiatives to improve infrastructure and transportation networks in western provinces are expected to drive long-term growth for pickup trucks in this region.

Northeastern China

Northeastern China, representing 5% of the market share, shows a growing demand for pickup trucks driven by industrial and commercial activities. The region’s key markets, including Heilongjiang, Jilin, and Liaoning, have traditionally relied on heavy-duty trucks for manufacturing, logistics, and mining industries. As these sectors continue to expand, there is a gradual increase in the need for both light-duty and heavy-duty pickup trucks. However, the market remains smaller compared to other regions due to the lower population density and slower urbanization pace, although it holds potential for future growth as industrial development progresses.

Market Segmentations:

Market Segmentations:

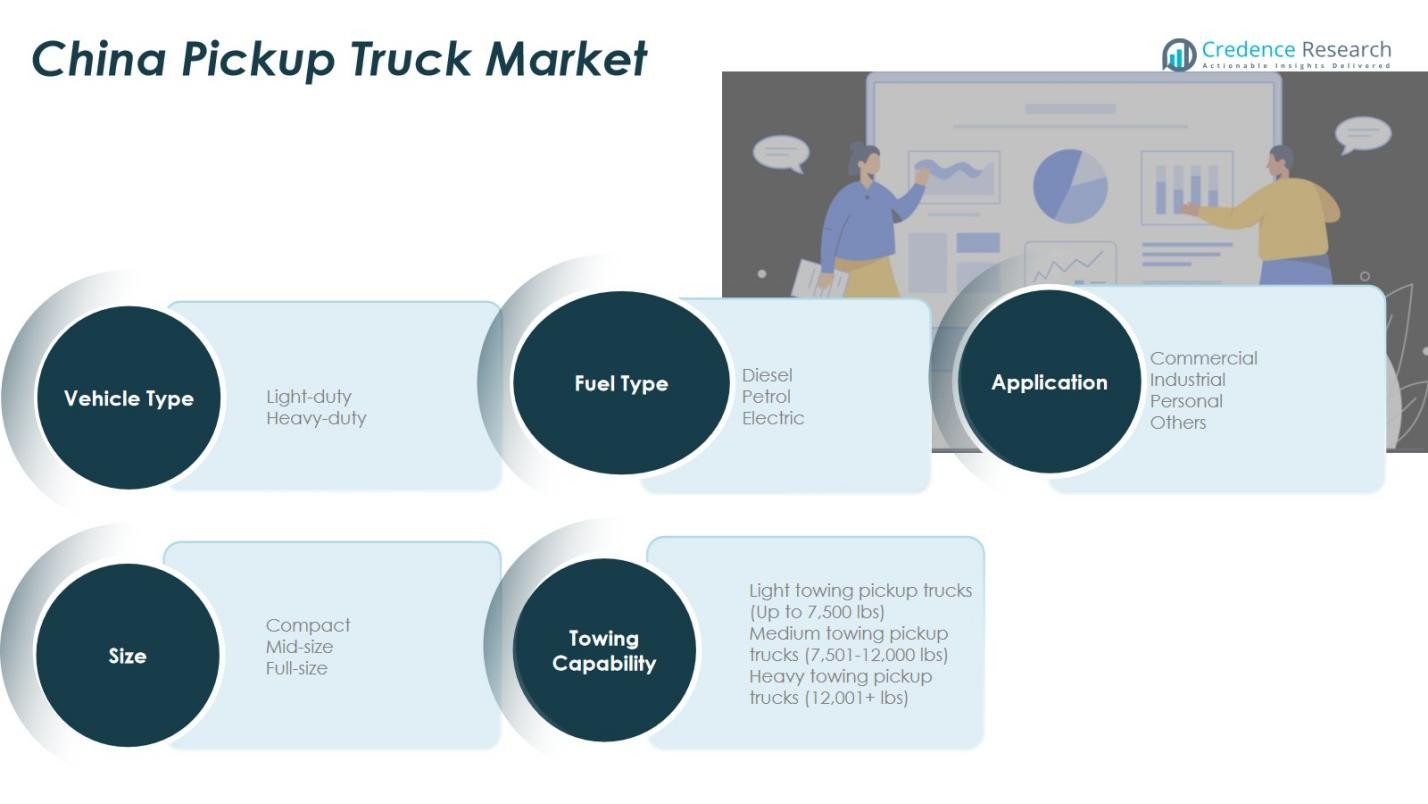

By Vehicle Type:

- Light-duty Pickup Trucks

- Heavy-duty Pickup Trucks

By Application :

- Commercial Pickup Trucks

- Industrial Pickup Trucks

- Personal Pickup Trucks

- Others

By Fuel Type :

- Diesel Pickup Trucks

- Petrol Pickup Trucks

- Electric Pickup Trucks

By Size Segment:

- Compact Pickup Trucks

- Mid-size Pickup Trucks

- Full-size Pickup Trucks

By Towing Capability :

- Light Towing Pickup Trucks (Up to 7,500 lbs)

- Medium Towing Pickup Trucks (7,501-12,000 lbs)

- Heavy Towing Pickup Trucks (12,001+ lbs)

By Region

- Eastern China

- Western China

- Southern China

- Northern China

- Northeastern China

Competitive Landscape

Competitive landscape in the China Pickup Truck Market is dominated by key players such as Great Wall Motors Co., Ltd. (GWM), Jiangling Motors Corporation, Ltd. (JMC), SAIC Motor Corporation Limited, and FAW Group Corporation. These companies lead the market due to their strong manufacturing capabilities, extensive distribution networks, and diverse product portfolios catering to both light-duty and heavy-duty pickup truck segments. Great Wall Motors, with its popular Haval and Wingle models, holds a significant market share, followed by Jiangling Motors, which benefits from strong brand recognition and widespread dealer networks. Furthermore, the entry of electric pickup models by traditional automakers and new players, such as BYD and Geely, has added a layer of competition, particularly in the eco-friendly segment. Companies are focusing on technological innovation, offering features like advanced safety systems and improved fuel efficiency, while also exploring electric and hybrid vehicle segments to meet shifting consumer preferences for sustainable transportation solutions.

Key Player Analysis

- Great Wall Motors Co., Ltd. (GWM)

- Jiangling Motors Corporation, Ltd. (JMC)

- SAIC Motor Corporation Limited

- Dongfeng Motor Corporation

- Zhengzhou Nissan Automobile Co., Ltd.

- FAW Group Corporation

- Foton Motor Group

- Changan Automobile Co., Ltd.

- Maxus (SAIC Maxus Automotive Co., Ltd.)

- Qingling Motors Co., Ltd.

- Geely Auto Group

- BYD Auto Co., Ltd.

- Huanghai Automobile Co., Ltd.

- ZX Auto (Hebei Zhongxing Automobile Co., Ltd.)

Recent Developments

- In May 2025, Zhengzhou Nissan Automobile Co., Ltd. and China Jiangsu International Economic‑Technical Cooperation Group Import & Export Co., Ltd. (Zhongjiang International) signed a cooperation agreement to accelerate the global expansion of pickup‑truck business.

- In May 2024, BYD introduced the BYD Shark, a plug-in hybrid electric pickup truck gaining traction globally, particularly with its focus on fuel efficiency and hybrid powertrain technology.

- In April 2025, GAC Motor debuted its concept pickup truck “Pickup 01” featuring an all‑electric powertrain and a stainless‑steel exoskeleton at the Shanghai Auto Show.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Fuel Type, Size Segment, Towing Capability and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The China Pickup Truck Market is expected to continue growing, driven by increasing demand for both personal and commercial vehicles.

- Light-duty pickup trucks will remain the dominant segment due to their versatility and affordability for urban and rural consumers.

- Heavy-duty pickup trucks will see steady growth, particularly in industrial and agricultural sectors that require high payload capacities.

- Electric pickup trucks are projected to gain traction as consumers and businesses seek more eco-friendly and cost-effective transportation options.

- Rising urbanization and infrastructure development in both major cities and rural areas will support the demand for pickup trucks.

- Government initiatives and incentives for electric vehicles will encourage manufacturers to expand their electric truck offerings.

- The growing popularity of advanced safety and connectivity features will influence consumer purchasing decisions.

- Increased focus on fuel efficiency and lower operational costs will drive the shift toward more fuel-efficient diesel and hybrid models.

- Regional markets in Eastern and Southern China will continue to dominate, but there will be growth opportunities in less-developed areas such as Western and Northeastern China.

- The competitive landscape will become more dynamic as both traditional automakers and new entrants focus on expanding their electric and hybrid vehicle portfolios.

Market Segmentation Analysis:

Market Segmentation Analysis:

Market Segmentations:

Market Segmentations: