Market Overview

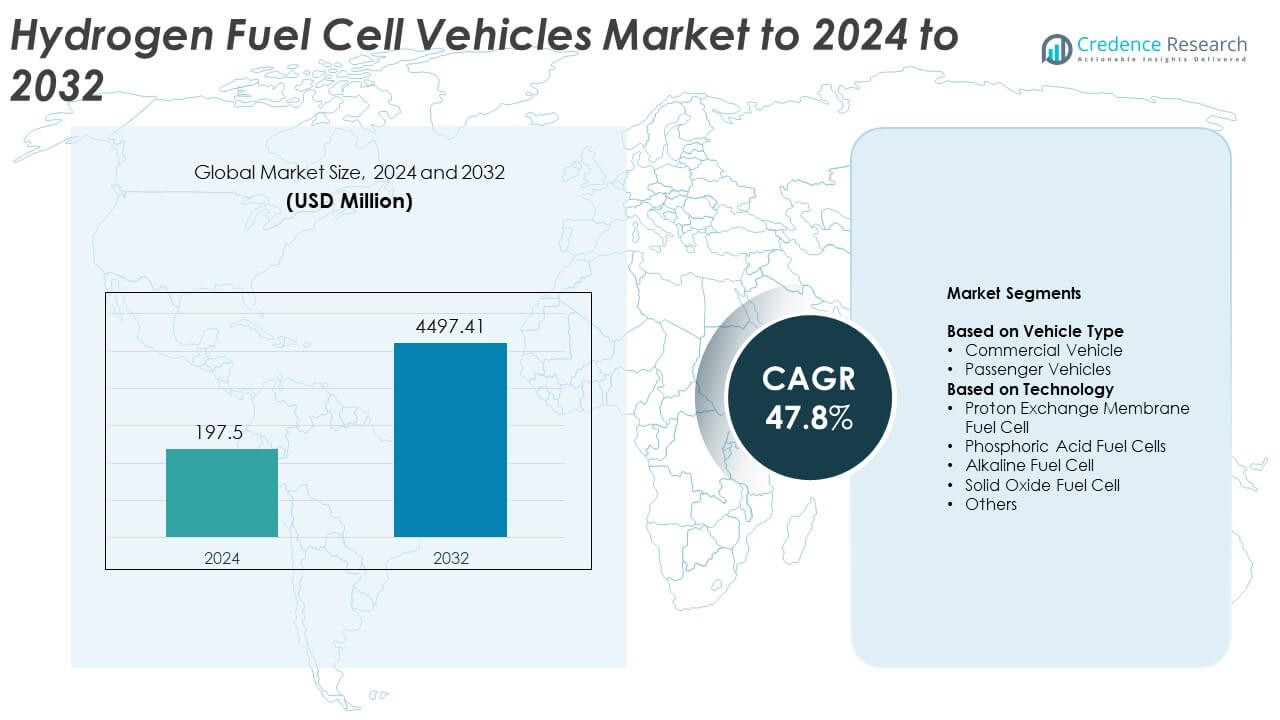

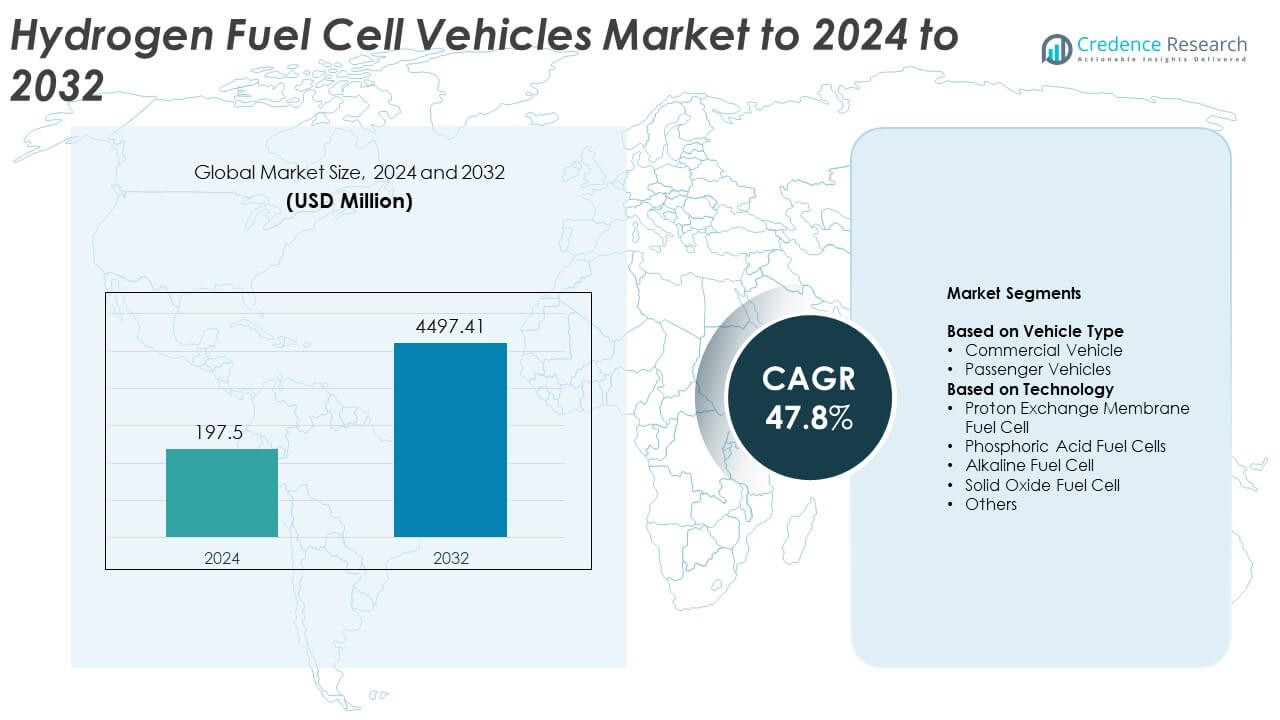

Hydrogen Fuel Cell Vehicles Market size was valued at USD 197.5 Million in 2024 and is anticipated to reach USD 4497.41 Million by 2032, at a CAGR of 47.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydrogen Fuel Cell Vehicles Market Size 2024 |

USD 197.5 Million |

| Hydrogen Fuel Cell Vehicles Market , CAGR |

47.8% |

| Hydrogen Fuel Cell Vehicles Market Size 2032 |

USD 4497.41 Million |

The Hydrogen Fuel Cell Vehicles Market is shaped by leading companies such as Intelligent Energy Holdings plc, Plug Power, Toyota, Pearl Hydrogen, Panasonic Corporation, Doosan Corporation, Hyundai Motor Company, Ballard Power System, Proton Power System PLC, Delphi Technologies, and ITM Power. These players expand fuel cell stack production, strengthen partnerships with energy providers, and invest in next-generation hydrogen storage systems to support wider commercial and passenger deployment. Asia Pacific leads the market with about 32% share in 2024, driven by large-scale hydrogen programs in China, Japan, and South Korea. North America follows with roughly 34% share, supported by strong fleet adoption and growing hydrogen corridor development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Hydrogen Fuel Cell Vehicles Market was valued at USD 197.5 Million in 2024 and is projected to reach USD 4497.41 Million by 2032, growing at a CAGR of 47.8%.

- Strong demand from commercial vehicles, which hold about 61% share in 2024, drives market growth through long-range performance and fast refueling for heavy-duty fleets.

- Proton exchange membrane fuel cells dominate the technology segment with nearly 74% share, shaping key trends such as improved stack efficiency, durability, and integration with green hydrogen supply chains.

- The competitive landscape strengthens as major manufacturers expand fuel cell production, build partnerships with energy firms, and lower system costs, while high hydrogen prices and limited refueling stations remain major restraints.

- North America accounts for about 34% share, Asia Pacific holds nearly 32%, and Europe captures around 30% share, supported by national hydrogen programs, while Latin America and Middle East & Africa together represent about 4% of the market.

Market Segmentation Analysis:

By Vehicle Type

Commercial vehicles lead this segment with about 61% share in 2024, driven by rising fleet adoption across logistics, public transport, and heavy-duty applications. Fleet operators prefer hydrogen fuel cell trucks and buses because they deliver long driving ranges, fast refueling, and strong performance on high-load routes. Governments in Asia, Europe, and North America continue to deploy large hydrogen bus fleets, which further lifts commercial uptake. Passenger vehicles grow steadily as automakers expand hydrogen sedan and SUV models, but adoption remains slower due to higher costs and limited refueling stations.

- For instance, Toyota provided around 3,700 mobility products and vehicles for the Tokyo 2020 Olympic and Paralympic Games, of which approximately 500 were Mirai fuel cell electric vehicles (FCEVs) and the total included other electric vehicles like the e-Palette and APM.

By Technology

Proton exchange membrane fuel cells dominate this segment with nearly 74% share in 2024 due to their high power density, quick start capability, and suitability for both passenger and commercial vehicle platforms. Automakers rely on PEMFC systems because they perform well in varying temperatures and support rapid refueling, making them ideal for daily fleet operations. Solid oxide and alkaline fuel cells gain interest for niche heavy-duty use but remain limited by higher operating temperatures. Phosphoric acid fuel cells hold a smaller share as development focuses on PEMFC advancements in efficiency and durability.

- For instance, Ballard Power Systems’ fuel cells have powered buses that have achieved durability records with more than 35,000 hours of revenue service. As of late 2024/early 2025, the company had over 850 vehicles deployed across European cities (and more than 1,700 globally).

Key Growth Drivers

Rapid expansion of hydrogen infrastructure

Growing investment in hydrogen production and refueling stations boosts the adoption of hydrogen fuel cell vehicles. Governments in Asia, Europe, and North America support large-scale hydrogen hubs that supply cleaner fuel for buses, trucks, and passenger fleets. This expansion reduces range anxiety and strengthens confidence among fleet operators. As refueling networks grow across highways and urban areas, commercial and logistics fleets shift toward hydrogen to meet emission rules and operational demands, making infrastructure growth a primary driver of market acceleration.

- For instance, Air Liquide has installed more than 200 hydrogen stations around the world and has key involvement in large stations such as the one in Daxing, China, which has a capacity of nearly 5 tons per day, demonstrating a much larger scale of supply than the 4 tons total mentioned.

Strong government incentives and zero-emission mandates

National policies that promote zero-emission transportation continue to push hydrogen fuel cell deployment. Authorities implement subsidies, tax benefits, and fleet procurement programs that reduce high upfront costs and speed market entry. Commercial operators adopt hydrogen trucks and buses to meet stricter fleet-level emission limits and urban clean-air requirements. These supportive regulations increase investment in fuel cell systems, supply chains, and hydrogen production, positioning policy strength as a major catalyst for long-term adoption across multiple regions.

- For instance, South Korea had a total of 29,733 fuel cell electric vehicles (FCEVs) on the road by the end of 2022.

Growing demand for long-range and heavy-duty mobility

Hydrogen fuel cell vehicles offer long driving ranges, fast refueling, and strong load-bearing capacity, making them ideal for heavy-duty and long-distance applications. Logistics firms adopt fuel cell trucks for stable performance on demanding routes, while transit agencies deploy hydrogen buses for continuous operations. As e-commerce and freight transport expand globally, operators seek solutions that reduce emissions without sacrificing range or uptime. This shift toward heavy-duty decarbonization establishes hydrogen mobility as a key driver of future fleet modernization.

Key Trends and Opportunities

Rising integration of green hydrogen supply chains

The shift toward green hydrogen production creates major opportunities for hydrogen mobility. Renewable-powered electrolysis improves fuel sustainability and helps fleets achieve deeper emission reductions. Automakers collaborate with energy providers to secure long-term green hydrogen supply for commercial operations. This alignment of clean fuel production with vehicle deployment strengthens ecosystem development and positions green hydrogen as a central trend that enhances environmental value and system reliability across the market.

- For instance, Nel Hydrogen has significantly increased its annual manufacturing capacity, with its Herøya facility in Norway achieving 1 GW annual alkaline electrolyzer production capacity.

Advancements in fuel cell durability and cost reduction

New material innovations and manufacturing improvements lower the cost of fuel cell stacks and enhance long-term durability. Companies work on catalysts, membranes, and lightweight components that improve efficiency while reducing maintenance. These advancements increase system lifespan and make ownership more viable for fleet operators. As cost gaps narrow compared with battery-electric and diesel alternatives, technology optimization becomes a major opportunity shaping the next wave of hydrogen vehicle adoption, especially in commercial fleets.

- For instance, Plug Power announced in April 2023 that its Rochester gigafactory was on track to achieve a production rate of 100 megawatts of PEM stack capacity per month by mid-Q2 2023.

Growing OEM partnerships and platform development

Vehicle manufacturers expand strategic partnerships to accelerate fuel cell platform development. Joint ventures between automotive and energy companies help scale production, reduce costs, and standardize components. These alliances enable faster model launches across trucks, buses, and passenger vehicles. As collaboration grows across regions, OEM partnerships create new opportunities for shared technology, broader fleet testing, and accelerated commercialization of hydrogen-powered mobility solutions.

Key Challenges

High production and operational costs

Hydrogen vehicles remain costly due to expensive fuel cell stacks, onboard storage systems, and limited economies of scale. Hydrogen fuel prices also remain higher than diesel or electricity in many regions, affecting operating margins for fleets. These cost pressures slow consumer adoption and delay large-scale deployment. Without continued subsidies, manufacturing expansion, and competitive hydrogen pricing, cost barriers pose a significant challenge to achieving widespread commercial viability.

Slow development of refueling infrastructure

Hydrogen refueling networks grow slower than required for mass adoption. Many countries have limited station availability, and installations involve high capital costs, regulatory delays, and complex safety requirements. This restricts long-distance travel and prevents smooth fleet operations on key routes. The slow pace of infrastructure expansion remains a major challenge that affects reliability, route planning, and overall market confidence, especially in emerging regions transitioning to hydrogen-based mobility.

Regional Analysis

North America

North America holds about 34% share in the Hydrogen Fuel Cell Vehicles Market in 2024, supported by strong adoption across commercial fleets and public transit programs. The United States drives most demand due to federal incentives, hydrogen corridor development, and fleet decarbonization goals. Canada expands deployment in heavy-duty trucking and municipal buses, supported by clean-fuel policies. Growing investments in green hydrogen, partnerships between automakers and energy companies, and large-scale truck pilot programs strengthen regional growth. Steady infrastructure expansion along major logistics routes continues to improve long-distance feasibility for hydrogen-powered mobility.

Europe

Europe accounts for nearly 30% market share in 2024, driven by strict emission rules and national hydrogen strategies across Germany, France, the Netherlands, and the Nordic region. Major automakers and energy providers collaborate on hydrogen hubs and large logistics fleet trials. Transit agencies deploy hydrogen buses to meet urban air-quality targets, while long-haul truck programs accelerate adoption on cross-border freight routes. Strong funding from the EU Hydrogen Strategy and growing green hydrogen production create a favorable environment. Expansion of refueling stations along key highways supports continuous growth across commercial and passenger segments.

Asia Pacific

Asia Pacific leads globally with about 32% share in 2024, anchored by major deployments in China, Japan, and South Korea. China scales hydrogen trucks and buses through national demonstration zones, while Japan advances passenger fuel cell vehicles supported by long-term hydrogen roadmaps. South Korea expands domestic manufacturing and invests in nationwide hydrogen corridors. Strong government-backed programs, rapid infrastructure rollout, and robust fuel cell production capacity strengthen regional dominance. Heavy-duty fleets and public transit operators increasingly shift toward hydrogen solutions to meet zero-emission goals across fast-growing urban and industrial centers.

Latin America

Latin America holds around 3% market share in 2024, with early adoption led by Brazil, Chile, and Colombia. Chile’s national green hydrogen strategy drives initial deployments in mining and heavy-duty transport. Brazil explores hydrogen buses and pilot truck programs in major cities as part of long-term decarbonization plans. Limited infrastructure and high costs slow broader uptake, but government interest and international partnerships create early momentum. As renewable energy projects expand, the region positions hydrogen mobility as a future solution for freight-heavy industries and long-distance transportation networks.

Middle East and Africa

Middle East and Africa account for about 1% market share in 2024, driven by emerging hydrogen ecosystem projects in the UAE, Saudi Arabia, and South Africa. Saudi Arabia and the UAE invest in large-scale green hydrogen production, enabling early pilot deployments in logistics and municipal fleets. South Africa explores hydrogen-powered heavy-duty transport supported by strong platinum fuel cell material supply chains. Infrastructure remains limited, but government-backed mobility pilots and expanding clean-energy megaprojects lay the groundwork for future adoption. The region’s strong renewable energy potential positions it for long-term hydrogen mobility growth.

Market Segmentations:

By Vehicle Type

- Commercial Vehicle

- Passenger Vehicles

By Technology

- Proton Exchange Membrane Fuel Cell

- Phosphoric Acid Fuel Cells

- Alkaline Fuel Cell

- Solid Oxide Fuel Cell

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Hydrogen Fuel Cell Vehicles Market features strong participation from Intelligent Energy Holdings plc, Plug Power, Toyota, Pearl Hydrogen, Panasonic Corporation, Doosan Corporation, Hyundai Motor Company, Ballard Power System, Proton Power System PLC, Delphi Technologies, and ITM Power. The competitive landscape continues to evolve as companies scale fuel cell stack production, improve system efficiency, and develop advanced hydrogen storage technologies. Many manufacturers focus on heavy-duty mobility platforms, where long range and rapid refueling offer clear advantages over battery-electric options. Strategic partnerships between automotive firms, hydrogen producers, and infrastructure developers strengthen ecosystem growth and support large fleet deployments. Companies invest in next-generation membranes, catalysts, and lightweight components to reduce costs and extend durability. Several players expand manufacturing footprints across Asia, Europe, and North America to meet rising demand. As green hydrogen production accelerates, competition intensifies around capturing early commercial fleet contracts and securing long-term supply agreements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Intelligent Energy Holdings plc

- Plug Power

- Toyota

- Pearl Hydrogen

- Panasonic Corporation

- Doosan Corporation

- Hyundai Motor Company

- Ballard Power System

- Proton Power System PLC

- Delphi Technologies

- ITM Power

Recent Developments

- In 2025, Ballard Power Systems unveiled its new fuel cell module, FCmove-SC, designed for city bus applications

- In 2024, Hyundai Motor Company unveiled its INITIUM hydrogen fuel cell electric vehicle (FCEV) concept at its “Clearly Committed” event in October 2024. The concept previews a new production FCEV planned for the first half of 2025.

- In 2023, Toyota unveiled a prototype of its hydrogen fuel cell electric Hilux pickup truck, developed in collaboration with consortium partners and supported by UK government funding.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as hydrogen refueling networks grow across major transport corridors.

- Commercial fleets will adopt fuel cell trucks and buses at a faster pace than passenger vehicles.

- Green hydrogen production will increase, improving sustainability and lowering lifecycle emissions.

- Advancements in fuel cell efficiency will reduce ownership costs for fleet operators.

- Heavy-duty logistics and long-range transport will remain the strongest demand drivers.

- Automakers will launch more dedicated fuel cell vehicle platforms for global markets.

- Government incentives and zero-emission policies will continue to accelerate adoption.

- Partnerships between energy providers and OEMs will shape large-scale fleet deployments.

- Asia Pacific will maintain leadership as large national programs scale hydrogen mobility.

- Falling hydrogen fuel prices and better distribution networks will support long-term market stability.