Market Overview

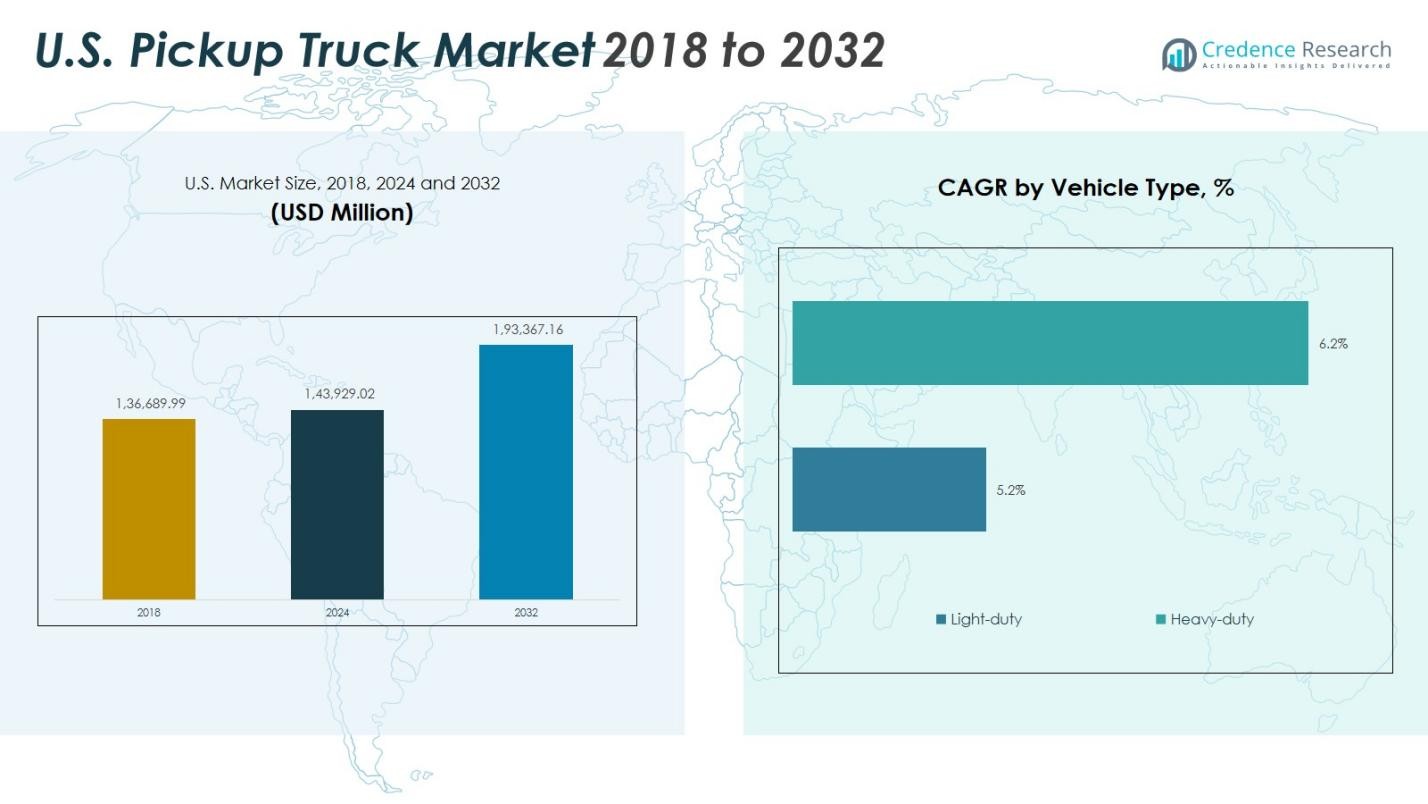

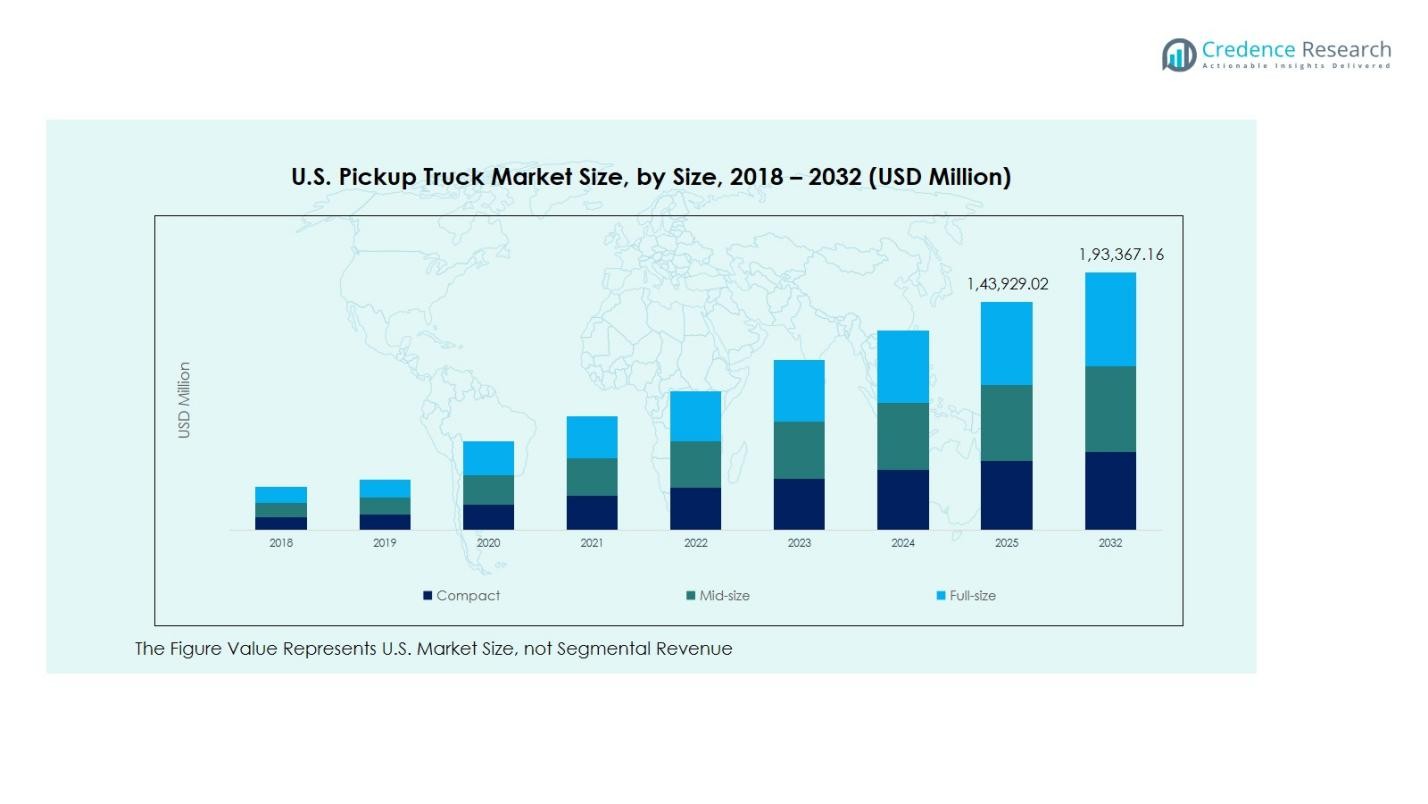

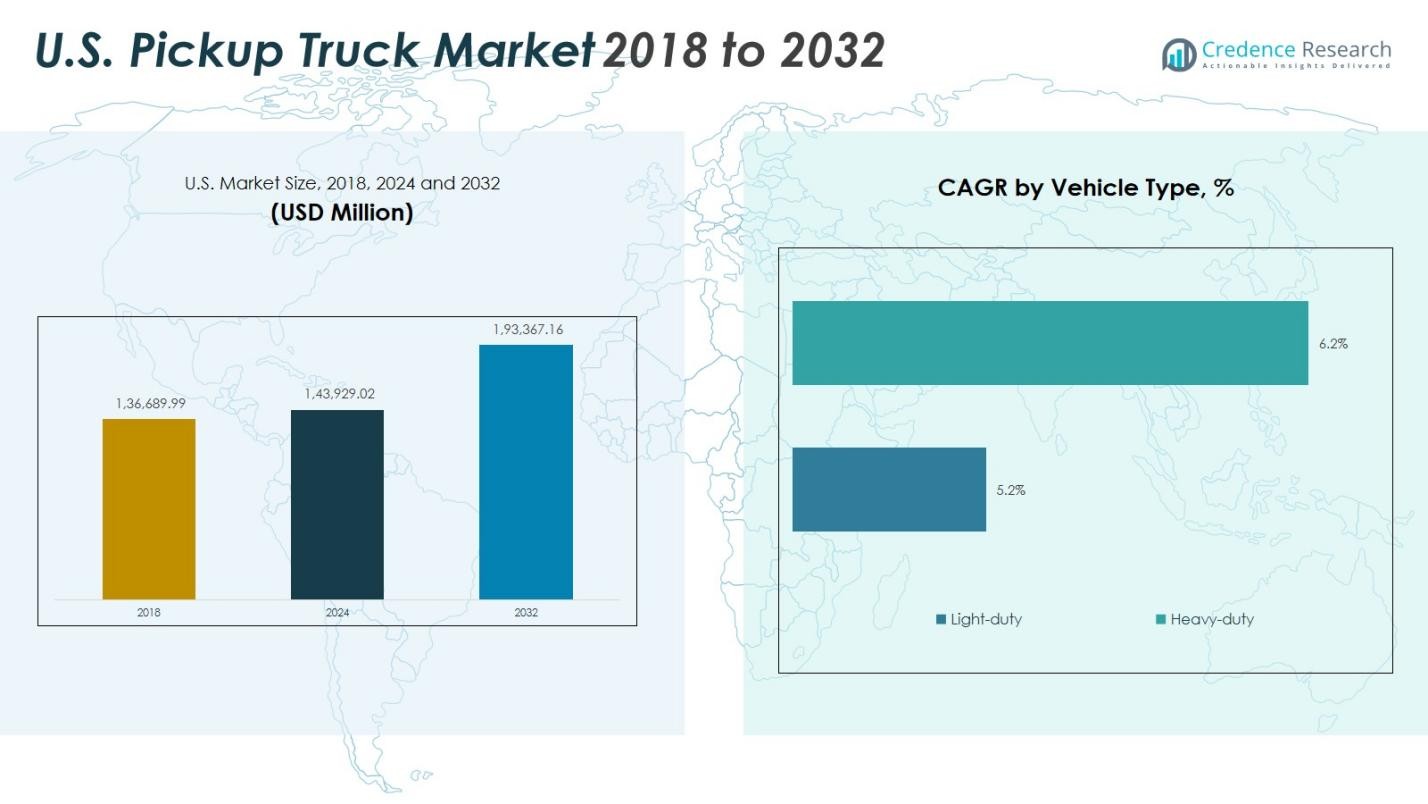

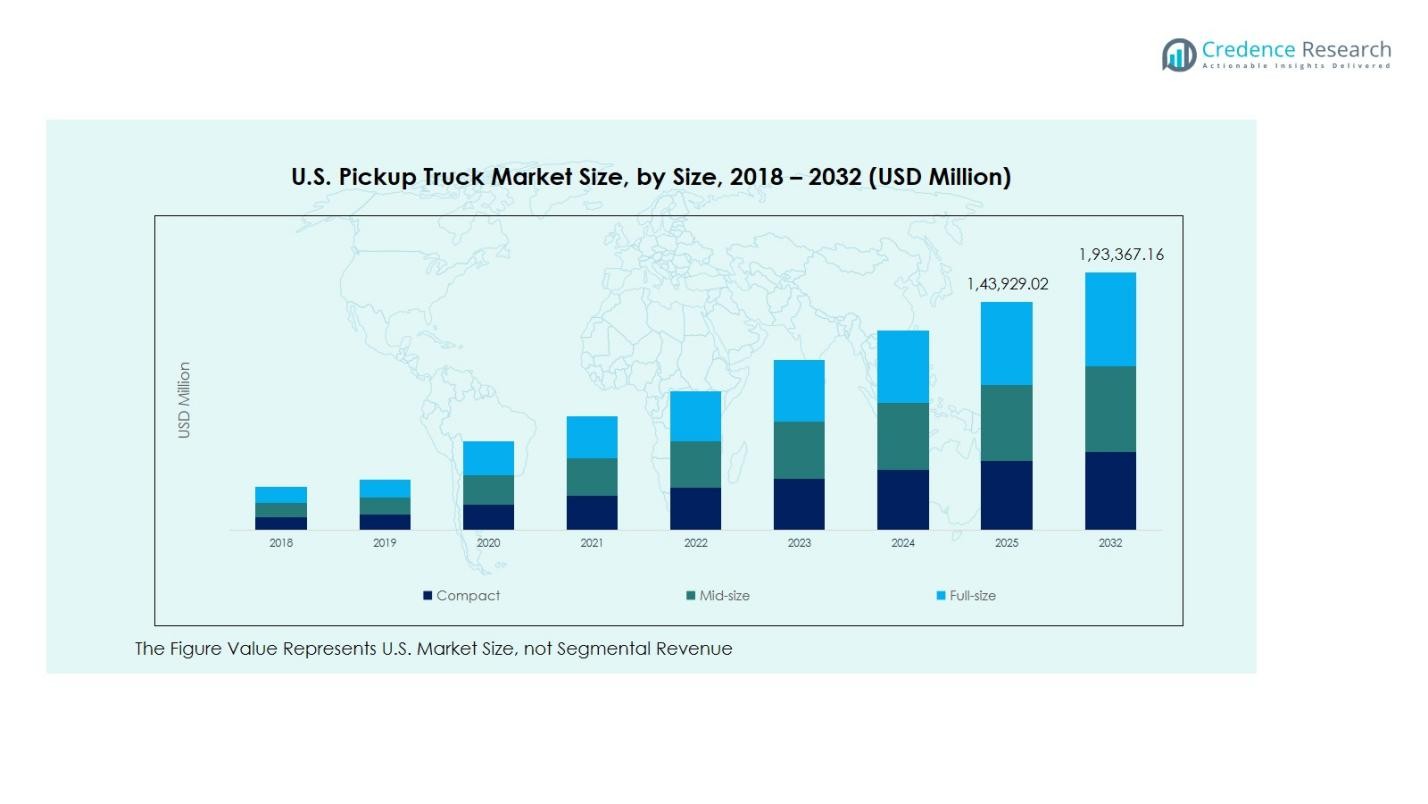

U S. Pickup Truck Market size was valued at USD 136,689.99 Million in 2018 to USD 143,929.02 Million in 2024 and is anticipated to reach USD 193,367.16 Million by 2032, at a CAGR of 3.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U S. Pickup Truck Market Size 2024 |

USD 143,929.02 Million |

| U S. Pickup Truck Market, CAGR |

3.76% |

| U S. Pickup Truck Market Size 2032 |

USD 193,367.16 Million |

U.S. Pickup Truck Market is driven by leading automakers such as Ford Motor Company, General Motors, Stellantis (Ram Trucks), Toyota Motor Corporation, and Tesla, Inc., who collectively shape product innovation and customer demand. Ford’s F-Series continues to lead nationwide due to its strong brand loyalty and advanced features, while Chevrolet Silverado and Ram models maintain strong market positions in durability and performance. Regional demand is highest in the South, which holds 38% of total revenue in 2024, supported by expansive rural areas and a strong culture of pickup ownership. The Mid-West follows with 26% share, driven by demand in agriculture, logistics, and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- S. Pickup Truck Market was valued at USD 143,929.02 Million in 2024 and is projected to grow at a CAGR of 3.76% through 2032.

- Steady demand from both personal and commercial users drives market expansion, supported by fleet upgrades and increased adoption of versatile utility vehicles.

- Trends toward electric and hybrid pickups are reshaping the segment, with electric models gaining traction due to emission regulations and high-performance features.

- Major players like Ford, General Motors, Stellantis, and Tesla are focusing on product innovation and technology upgrades to capture higher market share and respond to changing consumer preferences.

- The South region leads with 38% market share, followed by the Mid-West at 26%, while light-duty trucks dominate vehicle type sales with nearly 68% share due to lower costs and broader appeal.

Market Segmentation Analysis:

Market Segmentation Analysis:

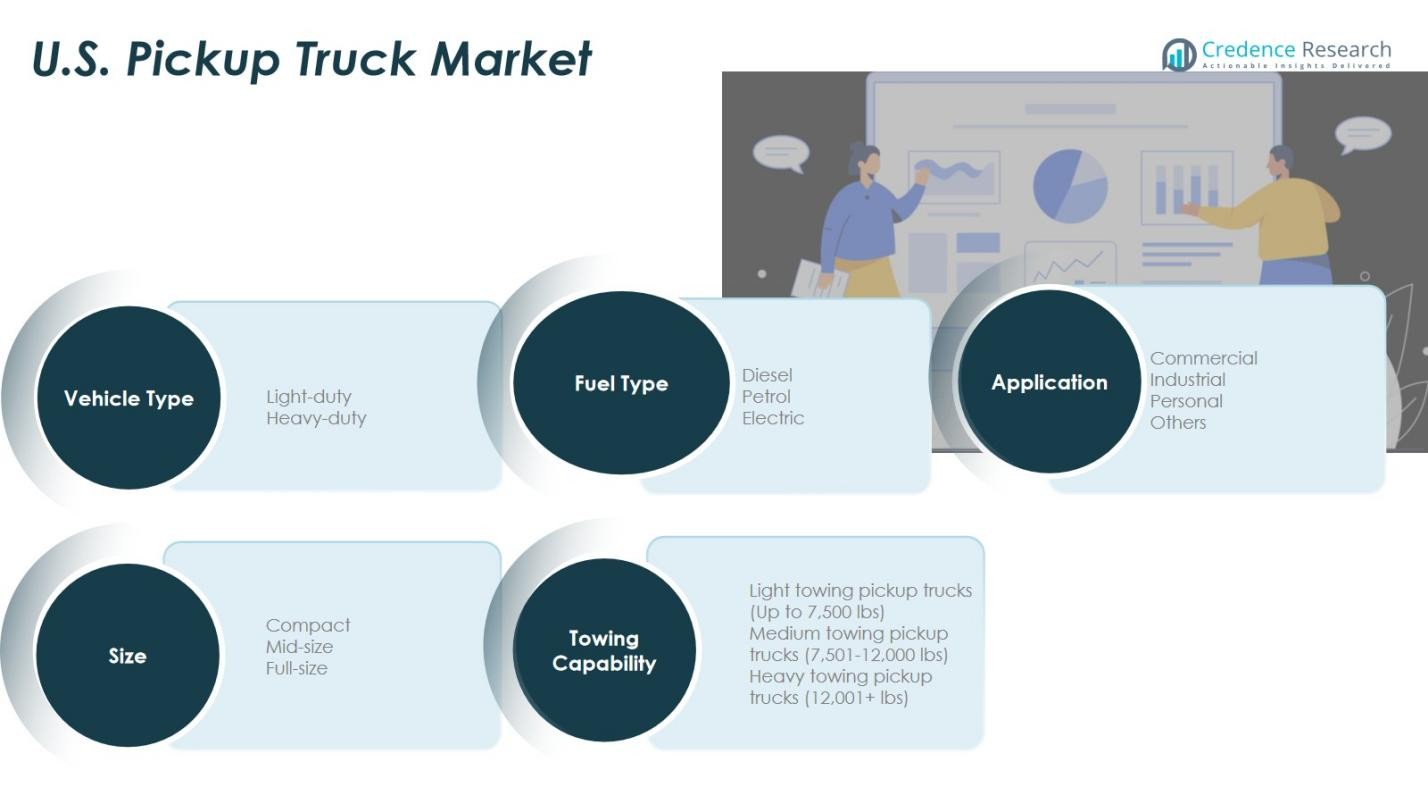

By Vehicle Type

The U.S. Pickup Truck Market by vehicle type is primarily driven by consumer preferences and utility needs across personal and commercial use cases. Light-duty pickup trucks dominate this segment, accounting for 68% of total market revenue in 2024. Their popularity stems from fuel efficiency improvements, lower ownership costs, and broad appeal among urban and suburban users. Heavy-duty trucks, while holding a 32% share, cater to industrial applications requiring high payload and towing capacity. The demand for advanced safety features and hybrid models in light-duty trucks continues to fuel growth in this segment.

- For instance, Ford’s 2024 F-150 Hybrid, with a 3.5-liter V6 engine combined with an electric motor, delivers 430 horsepower and features advanced safety systems like forward collision warning and lane-keeping assist, making it popular among light-duty truck buyers seeking fuel efficiency and tech integration.

By Application

The commercial segment leads the U.S. Pickup Truck Market by application, holding 42% of the total market share in 2024. Businesses in logistics, construction, and service industries prefer pickups due to their versatility and durability. Personal usage follows with a 35% share, influenced by lifestyle trends and recreational use. Industrial usage captures around 18%, while the “Others” category makes up the remaining 5%. Growth in the commercial segment is driven by fleet upgrades, urban deliveries, and construction activity rebound.

- For instance, Ford Motor Company supports fleet upgrades with its F-Series pickups widely used in commercial logistics and construction, known for durability and advanced connected fleet management features.

By Fuel Type

Diesel remains the dominant fuel type in the U.S. Pickup Truck Market, accounting for 52% share in 2024. Diesel-powered pickups remain favored for long-distance hauling and heavy-duty workloads due to superior torque and fuel economy. Petrol-based models hold a 38% market share, driven by lower upfront costs and broader availability. Electric pickups, though currently holding just 10%, are the fastest-growing sub-segment. The rise in electric pickups is fueled by emissions regulations, tax incentives, and launches from brands like Tesla, Rivian, and Ford.

Key Growth Drivers

Increasing Demand for Versatile Utility Vehicles

The U.S. Pickup Truck Market is witnessing strong growth due to the rising demand for versatile utility vehicles across both personal and commercial segments. Pickup trucks offer flexibility in payload capacity, towing capability, and off-road performance, making them attractive for varied applications. Consumers increasingly prefer trucks equipped with advanced safety, connectivity, and driver-assist features. Additionally, their dual-purpose design supporting work and leisure activities boosts adoption among lifestyle buyers. The growing trend of outdoor recreation and vehicle customization further strengthens this demand.

- For instance, the 2025 Ram 1500, when equipped with the 3.0L Hurricane I6 engine, achieves a maximum towing capacity of 11,550 pounds, making it a top choice for consumers needing robust towing performance for trailers or boats.

Expansion of Commercial and Fleet Applications

Commercial fleet expansion significantly drives demand in the U.S. Pickup Truck Market as businesses in logistics, construction, and public services rely heavily on these vehicles for operational efficiency. Companies are upgrading fleet vehicles to modern models offering better fuel efficiency, durability, and safety features. Additionally, pickup trucks play a pivotal role in last-mile delivery and mobile service operations, particularly in suburban and rural areas. Government incentives and business tax deductions for commercial vehicles further encourage fleet investments, bolstering overall market growth.

- For instance, Freightliner’s Cascadia Evolution truck improves fuel efficiency by up to 8% over previous models through aerodynamic design and advanced engine technology, supporting cost savings for long-haul fleets.

Shift Toward Electrification and Emission Reduction

The shift toward sustainability and emission reduction is accelerating the transition to electric pickup trucks in the U.S. market. Major manufacturers like Tesla, Ford, and Rivian are driving innovation with electric models offering enhanced torque, lower operating costs, and advanced technology integration. Government rebates, carbon-neutral targets, and stricter fuel economy standards are fostering EV adoption. Consumer preference for environmentally-friendly vehicles combined with broader charging infrastructure development supports this shift, positioning electrification as a key driver of long-term industry transformation.

Key Trends & Opportunities

Growth of Connected and Smart Pickup Trucks

The integration of connected technologies presents a major opportunity in the U.S. Pickup Truck Market. Features such as telematics, predictive maintenance, real-time diagnostics, advanced infotainment systems, and over-the-air updates are becoming standard. These advancements enhance vehicle safety, efficiency, and user experience. smart connectivity also benefits fleet managers through improved route optimization and vehicle tracking. As automakers integrate AI and IoT-based platforms, smart pickup trucks are expected to generate new revenue streams and drive digitization across the automotive value chain.

- For instance, Companies like Ericsson have piloted autonomous electric trucks equipped with cloud connectivity to enable remote supervision, showcasing the potential of AI and IoT platforms to drive digitization.

Rising Popularity of Lifestyle and Luxury Pickup Models

Lifestyle-oriented pickup trucks are gaining traction, as consumers increasingly view these vehicles as extensions of personal style rather than solely workhorses. This has led to a surge in demand for luxury trucks featuring premium interiors, advanced driving assistance, and customizable aesthetics. Automakers are responding with specialized trims and lifestyle editions, targeting the recreational segment. This trend aligns with growing consumer interest in adventure travel, camping, and off-roading, creating significant opportunities for brands offering high-performance and feature-loaded models.

- For instance, the Ram 1500 Limited edition features heated leather seats, a 12-inch touchscreen, and active safety systems, appealing to recreational users who value both performance and luxury.

Key Challenges

Impact of High Ownership and Fuel Costs

High initial purchase prices combined with rising fuel and maintenance costs pose a challenge for market penetration, especially among cost-sensitive buyers. Pickup trucks are generally more expensive to acquire and operate than passenger vehicles, limiting adoption in certain demographics. Fluctuating fuel prices and economic uncertainty further impact vehicle affordability. Additionally, commercial fleets must balance operational costs with performance needs, often delaying vehicle upgrades. These factors collectively slow down market expansion despite strong demand.

Regulatory Pressure and Emission Compliance

Stringent emission norms and regulatory standards for internal combustion engines present challenges for manufacturers. Achieving compliance with the Clean Air Act and Corporate Average Fuel Economy (CAFE) standards requires significant investment in powertrain innovation and lightweight materials. The transition to electric vehicles, while promising, also demands heavy capital expenditure on battery technology and infrastructure. Small and mid-sized automakers may struggle to keep pace with regulations, while delays in nationwide charging infrastructure further hinder electrification progress in the pickup segment.

Regional Analysis

North-East U.S.

The North-East region holds a notable share of the U.S. Pickup Truck Market, accounting for 17% in 2024. Demand is driven by construction activity, public services, and seasonal utility needs like snow removal. Urban areas such as New York and Boston show rising interest in compact and light-duty pickup models due to space constraints and fuel efficiency. Growing adoption of electric pickups is supported by state-level incentives and expanding charging infrastructure. Commercial use among municipal agencies also supports steady sales, particularly for fleet modernization and maintenance applications.

Mid-West U.S.

The Mid-West region represents 26% of the U.S. Pickup Truck Market in 2024, emerging as a significant hub due to its strong agricultural and industrial base. Consumers prefer full-size and heavy-duty pickups for farming, logistics, and towing needs. Major automakers with manufacturing facilities in Michigan and Ohio support regional demand, offering localized product availability and service networks. The region has seen accelerated fleet renewals, particularly within energy and mining sectors. Growing rural connectivity and infrastructure development continue to boost light-duty truck usage among households and small businesses.

South U.S.

The South holds the largest regional share, capturing 38% of the U.S. Pickup Truck Market in 2024. This dominant position is fueled by a strong culture of pickup truck ownership, expansive rural landscapes, and growing commercial activities such as oil and gas, agriculture, and small-scale logistics. Texas, in particular, remains the leading state for pickup sales. Consumer demand is split between lifestyle buyers and commercial fleets, with strong interest in both fuel-efficient light-duty models and high-performance heavy-duty trucks. The region also sees early adoption of electric pickups due to favorable climate and incentives.

West U.S.

The West region holds 19% of the market and is characterized by strong adoption of technology-driven and eco-friendly pickup models. States like California and Washington lead in electric pickup uptake, driven by aggressive emission laws and sustainable mobility initiatives. The region’s diverse terrain and outdoor lifestyle trends contribute to demand for premium and off-road pickup variants. Rising construction and infrastructure investments in cities such as Los Angeles and Phoenix further drive commercial fleet purchases. Additionally, the West is witnessing increasing demand for hybrid trucks supported by tech-savvy consumer segments and robust charging networks.

Market Segmentations:

Market Segmentations:

By Vehicle Type

- Light-duty pickup trucks

- Heavy-duty pickup trucks

By Application

- Commercial

- Industrial

- Personal

- Others

By Fuel Type

By Size

- Compact

- Mid-size

- Full-size

By Towing Capability

- Light towing pickup trucks (Up to 7,500 lbs)

- Medium towing pickup trucks (7,501–12,000 lbs)

- Heavy towing pickup trucks (12,001+ lbs)

By Region

- North-East U.S.

- Mid-West U.S.

- South U.S.

- West U.S.

Competitive Landscape

Competitive landscape in the U.S. Pickup Truck Market is led by major automakers such as Ford Motor Company, General Motors, Stellantis (Ram Trucks), Toyota Motor Corporation, and Tesla, Inc. These companies dominate through a combination of legacy brand strength, wide product portfolios, and extensive dealer networks. Ford’s F-Series, the long-standing segment leader, continues to capture substantial consumer and fleet demand due to its performance and advanced technology. General Motors’ Chevrolet Silverado and GMC Sierra provide strong competition with enhanced towing capacity and fuel efficiency. Stellantis’ Ram lineup has carved out a niche with refined interiors and heavy-duty capabilities. Emerging electric vehicle manufacturers like Rivian and Tesla are reshaping the segment with models such as the R1T and Cybertruck, emphasizing zero-emission performance and advanced connectivity features. Intense rivalry among key players is driving continuous innovation in powertrains, lightweight materials, and digital integrations to maintain market leadership and meet evolving customer expectations.

Key Player Analysis

- Ford Motor Company

- General Motors (USA)

- Stellantis N.V. (Ram Trucks)

- Toyota Motor Corporation

- Nissan Motor Co., Ltd.

- Tesla, Inc.

- Rivian Automotive, Inc.

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Lordstown Motors Corp.

- Canoo Inc.

- Bollinger Motors

Recent Developments

- In November 2025, Toyota launched a new electric pickup truck with several powertrain options, including a 48-volt mild-hybrid diesel and a full battery electric variant, expanding their presence in the U.S. pickup truck market.

- In October 2025, Ram Trucks (part of Stellantis N.V.) revealed that it will launch its first SUV in 2028 – alongside a new mid-size pickup – expanding beyond the brand’s traditional pickup and van lineup.

- In September 2025, Hyundai Motor Company announced plans for a new body-on-frame mid-size pickup truck for the U.S. market, to be developed in-house (not a rebadge) and targeted to launch by the end of the decade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Fuel Type, Size, Towing Capability and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric pickup trucks will grow rapidly driven by emissions regulations and expanding charging infrastructure.

- The market will see increased adoption of hybrid and fuel-efficient models, especially in urban and suburban areas.

- Advanced connectivity and autonomous features will become standard in premium and mid-range pickup segments.

- Fleet modernization in logistics, construction, and public sectors will boost commercial segment growth.

- Subscription-based ownership and leasing models will gain popularity, especially among younger consumers.

- Customization and lifestyle-oriented trims will drive higher demand in personal-use and recreational segments.

- Full-size and heavy-duty pickup trucks will remain dominant where towing and hauling capacity are essential.

- Battery advancements and lower production costs will reduce the price gap between electric and ICE pickups.

- Collaborative investments between automakers and tech firms will drive innovation in software and safety systems.

- Consumer preference for durable, smart, and multi-utility pickups will sustain long-term market expansion.

Market Segmentation Analysis:

Market Segmentation Analysis:

Market Segmentations:

Market Segmentations: