Market Overview

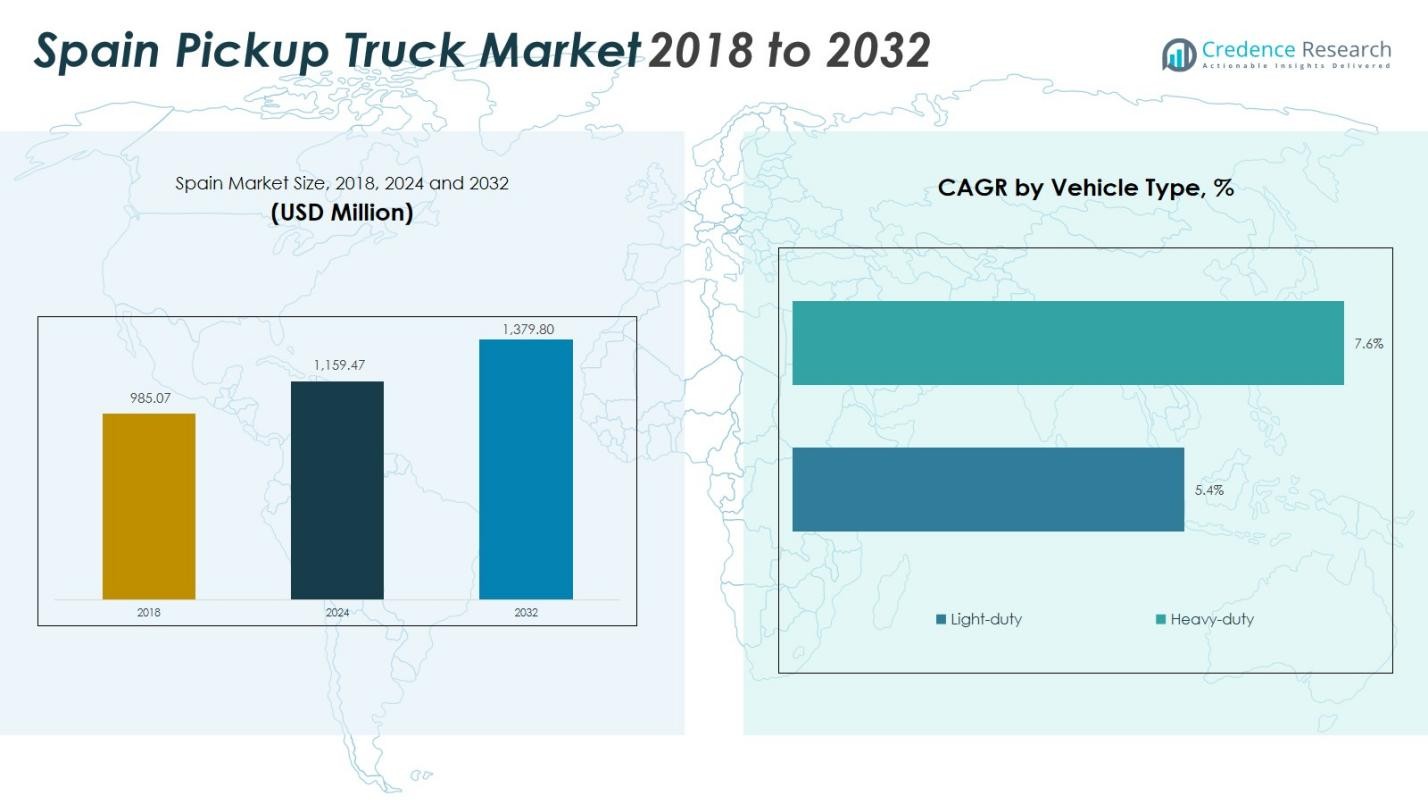

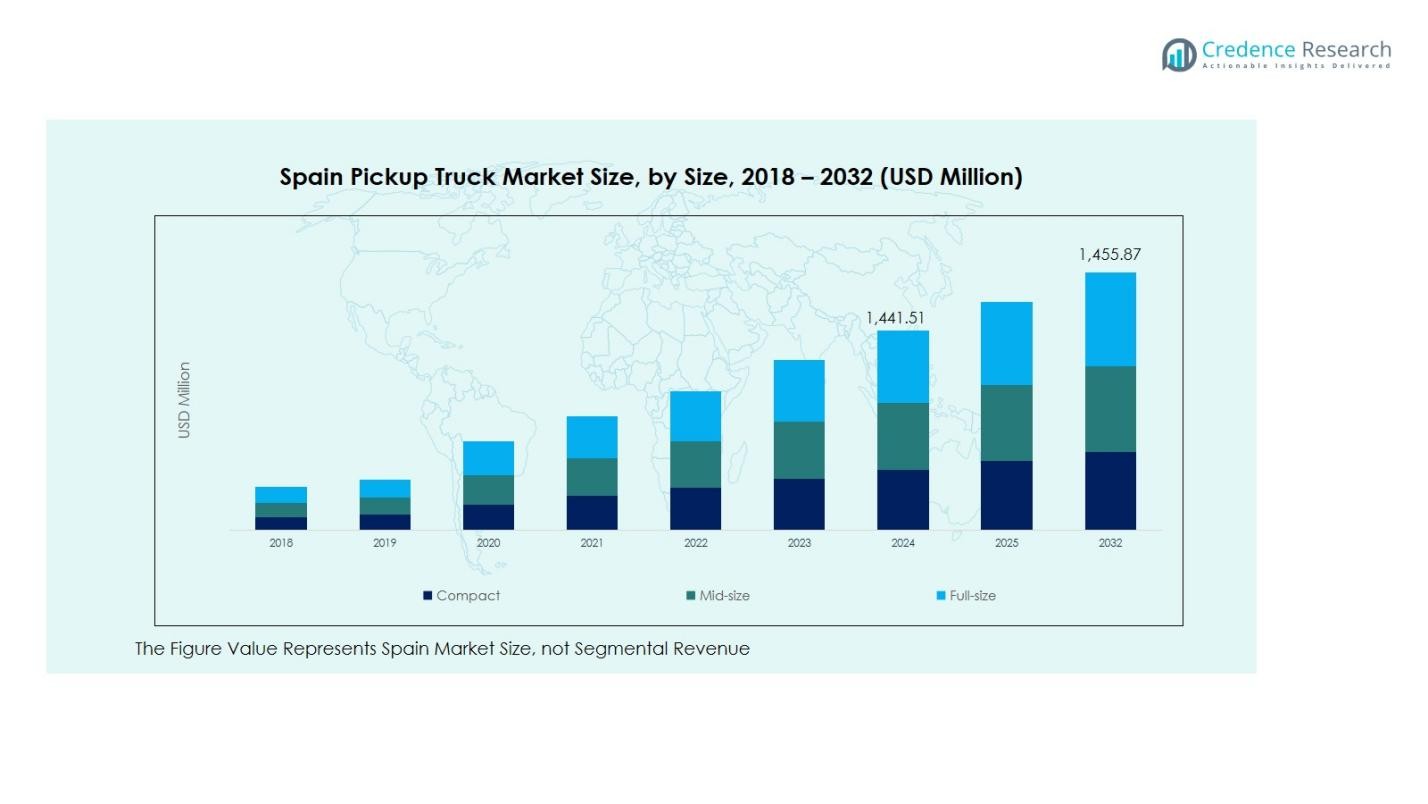

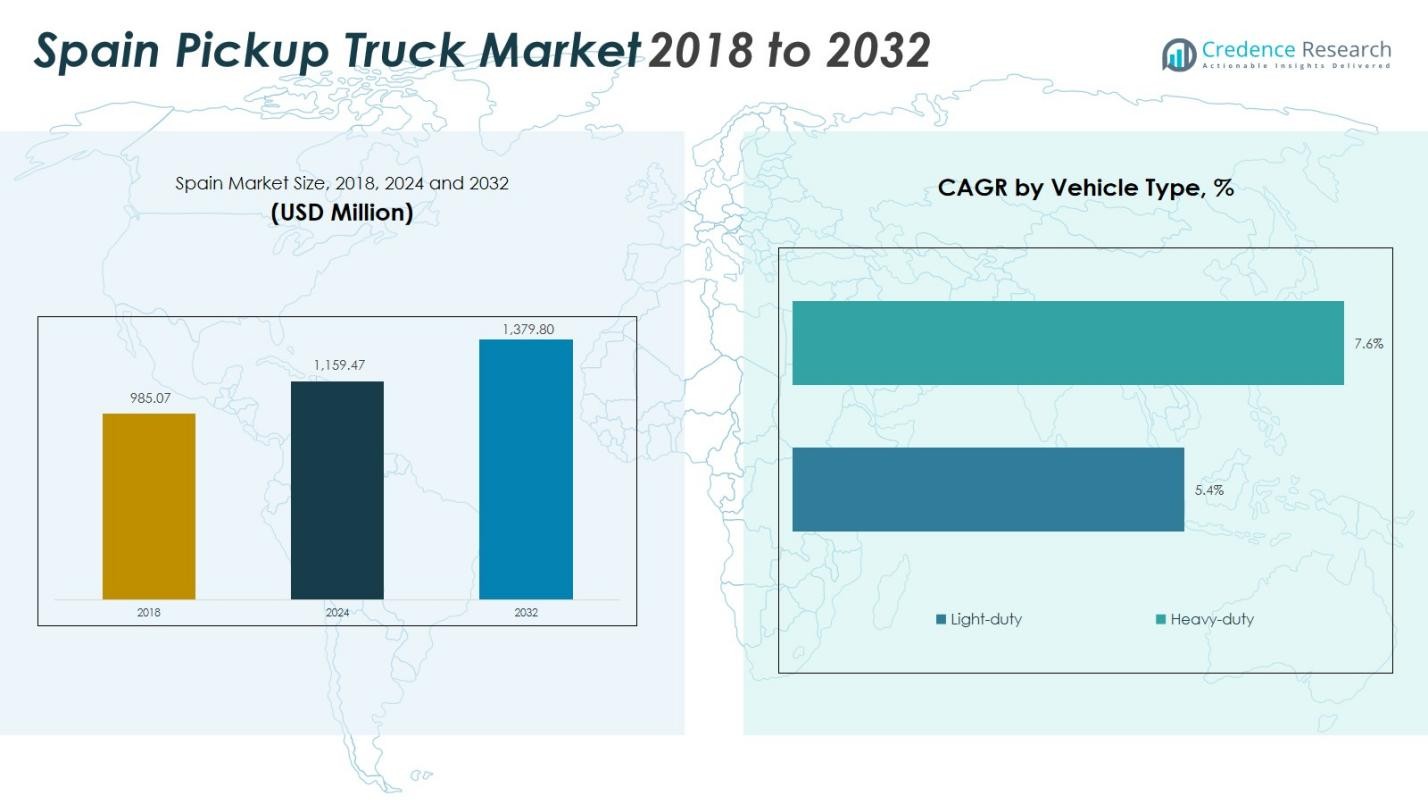

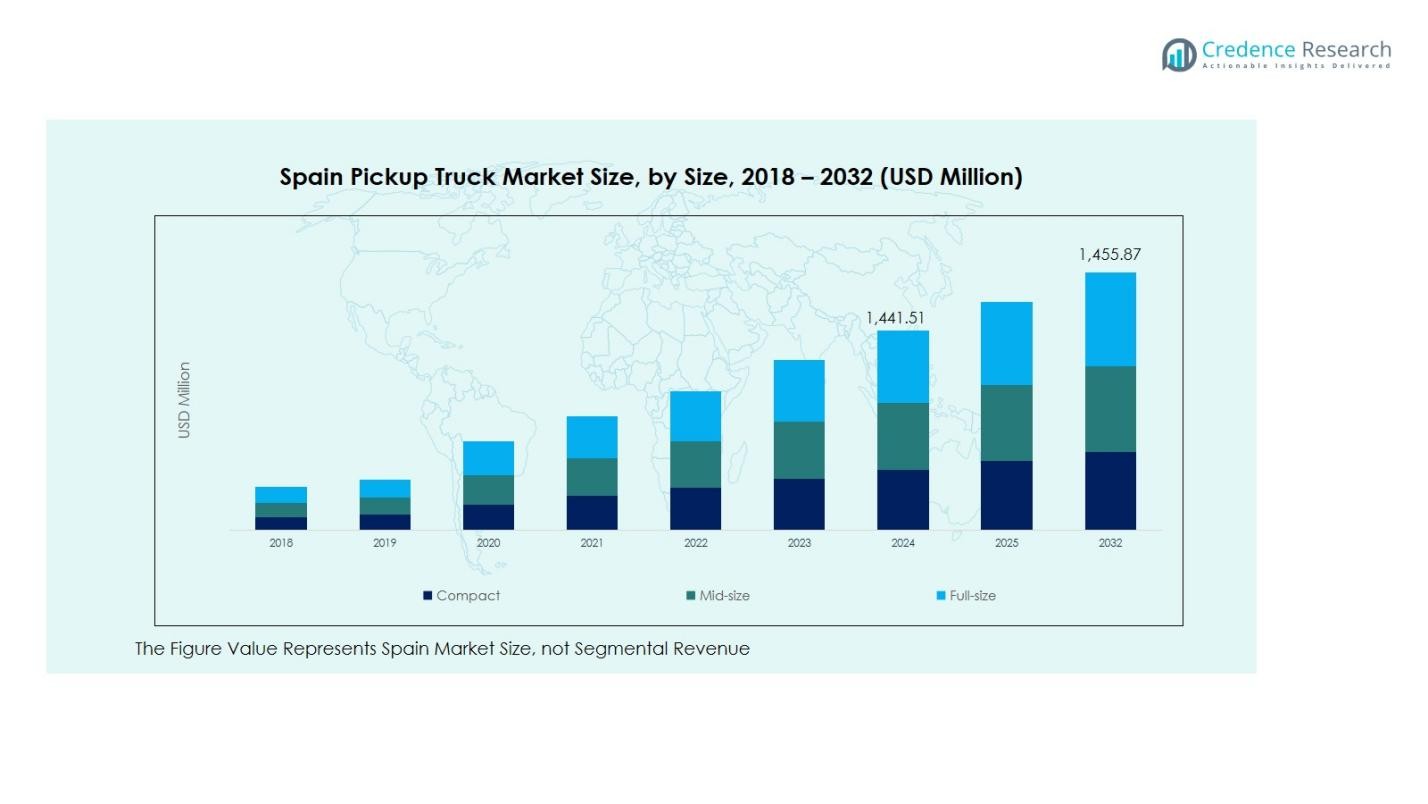

Spain Pickup Truck Market size was valued at USD 985.07 Million in 2018 to USD 1,159.47 Million in 2024 and is anticipated to reach USD 1,379.80 Million by 2032, at a CAGR of 2.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Pickup Truck Market Size 2024 |

USD 1,159.47 Million |

| Spain Pickup Truck Market, CAGR |

2.20% |

| Spain Pickup Truck Market Size 2032 |

USD 1,379.80 Million |

Spain Pickup Truck Market is driven by established players such as Toyota, Ford, Volkswagen, Isuzu, Mitsubishi, Nissan, and Foton, who offer a varied lineup tailored to both commercial and personal applications. These brands continue to focus on innovation, with offerings that combine performance, durability, and enhanced connectivity features. Central Spain holds the largest regional share at 34.2% in 2024, supported by intensive fleet operations, construction projects, and urban logistics needs. Northern Spain follows, strengthened by agricultural and industrial sectors, while Southern Spain benefits from growing tourism-related utility usage. Manufacturers are expanding dealership networks, introducing low-emission models, and targeting fleet buyers to address rising demand across key segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Spain Pickup Truck Market was valued at USD 1,159.47 Million in 2024, with a CAGR of 2.20% forecasted through 2032.

- Rising demand for light-duty pickups, holding 72.5% share, is fueled by urban delivery, fleet renewal, and small business growth.

- Key trends include adoption of electric pickups with 8.2% share and growing personalization for lifestyle and recreational use.

- Strong presence of major OEMs such as Toyota, Ford, and Volkswagen enhances product competition and model diversification.

- Central Spain leads with 34.2% regional share, followed by Southern Spain at 21.3%, while the commercial application segment dominates with 54.3% share.

Market Segmentation Analysis:

By Vehicle Type:

The Spain Pickup Truck Market by vehicle type is dominated by the light-duty segment, accounting for 72.5% market share in 2024. This dominance is driven by rising consumer preference for compact and fuel-efficient trucks suitable for urban and suburban use. Light-duty pickups are widely adopted for both personal and small business applications, benefiting from lower operational costs and flexible loading capabilities. In contrast, heavy-duty pickups hold the remaining market share, primarily used by industries demanding higher towing capacities and durability. Growth in construction and public works is likely to support future demand for heavy-duty models.

- For instance, Ford launched its Ranger PHEV in Europe in 2025, offering a 1-tonne payload capacity and 3.5-tonne towing capability with 281 PS and 697 Nm of torque from its 2.3-litre EcoBoost engine combined with a 75kW electric motor.

By Application:

The commercial segment leads the Spain Pickup Truck Market by application with a 54.3% market share in 2024, supported by the strong utilization of pickups for logistics, small-scale deliveries, utility services, and fleet operations. The industrial segment holds 22.8%, driven by mining, construction, and agro-industrial activities. Personal use constitutes 18.9%, reflecting the growing lifestyle appeal of pickups as dual-purpose vehicles. The remaining share is attributed to the “Others” category, which includes government and rental agencies. Fleet electrification incentives and improved powertrain options are expected to expand usage in both commercial and industrial domains.

- For instance, In 2024, Toyota updated the Hilux with new features, including the addition of a 48V mild-hybrid powertrain option for certain trims in markets like Australia, enhancing efficiency and driveability.

By Fuel Type:

Diesel-powered pickup trucks dominate the Spain market, representing 67.2% market share in 2024, driven by superior torque, towing capacity, and fuel efficiency, making them the preferred choice in commercial and industrial sectors. Petrol-powered pickups account for approximately 24.6%, appealing to personal and light-duty users seeking quieter performance and lower upfront costs. Electric pickups, though currently at 8.2% share, are gaining momentum due to regulatory support, rising environmental awareness, and growing infrastructure for EV charging. Government incentives and advancements by OEMs are expected to push EV adoption, particularly in urban commercial fleets.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Versatile Commercial Transport

The Spain Pickup Truck Market is benefiting from increased adoption of pickups as versatile vehicles for small and medium-sized enterprises. These vehicles are favored for their adaptability across logistics, construction, utilities, and agriculture sectors. The rise in last-mile delivery services, fueled by e-commerce growth, is further boosting demand for light-duty pickups. Fleet operators prefer pickups due to their combination of cargo capacity, maneuverability, and lower maintenance costs. As businesses seek reliable transport solutions, the segment is witnessing steady growth, especially in urban and semi-urban corridors.

- For instance, Ford is promoting its F-150 Lightning electric pickup, appealing to fleet operators with its blend of sustainability and advanced technology.

Government Incentives and Emission Regulations

Supportive government policies aimed at reducing vehicular emissions are encouraging the adoption of fuel-efficient and alternative powertrain pickups in Spain. Tax benefits, subsidies, and emission norms under the EU’s Green Deal are driving OEMs to launch cleaner diesel, hybrid, and electric pickup variants. These regulations are reshaping the vehicle mix in favor of low-emission trucks, particularly for commercial use. Fleet replacements driven by sustainability commitments are enhancing market penetration. This regulatory push, combined with incentives for EV-based fleet adoption, is expected to significantly influence purchasing decisions over the forecast period.

- For instance, Renault Trucks sold over 1,600 electric vehicles in Europe in 2024 and is advancing electric truck adoption in Spain by leveraging incentive schemes such as purchase subsidies and preferential toll rates to reduce total cost of ownership, thus facilitating fleet electrification.

Infrastructure Growth and Industrial Activity

Spain’s infrastructure development and industrial expansion, especially in construction, mining, and energy sectors, are major contributors to pickup truck demand. Heavy-duty pickups are increasingly used for transporting equipment and materials across rough terrains and large industrial sites. Public investments in transport and utilities are fostering increased usage of commercial vehicles, including pickups, as part of logistical operations. Additionally, the rise of regional trade and inter-city logistics is propelling demand for durable, high-torque pickups. This industrial momentum provides a stable foundation for the segment, complementing growth in associated aftermarket services.

Key Trends & Opportunities

Growth of Electric and Hybrid Pickup Models

The shift toward electric mobility is shaping the future of the Spain Pickup Truck Market, with major OEMs launching electric pickup models to align with emission goals. Expanding EV infrastructure, rising environmental awareness, and declining battery costs are enhancing adoption prospects. Electric pickups are gaining traction among commercial operators seeking to reduce fuel costs and meet sustainability targets. Government-backed incentives and charging infrastructure investments further support this trend. This creates opportunities for new market entrants and established players to innovate in drivetrains and vehicle design.

- For instance, Maxus has introduced its fully electric T90 pickup in Spain, featuring a 177-horsepower motor, a 330-kilometer range, and an 88.5 kWh battery capacity, catering to commercial and private users aiming for zero-emission transport.

Increasing Customization and Lifestyle Appeal

Pickup trucks are gaining recognition beyond utility roles and are increasingly seen as lifestyle vehicles in Spain. Consumers are seeking customizable models with enhanced comfort, safety features, and advanced infotainment systems. This trend is supported by a rise in adventure travel and recreational use. OEMs are responding by offering premium interiors, off-road packages, and performance enhancements. Personalization options and aftermarket modifications are creating additional revenue streams. As consumer preferences evolve, brands that offer unique combinations of utility and luxury are well-positioned to capture market share.

- For instance, the 2025 RAM 1500 offers premium interiors featuring ventilated and heated seats with massage functions, premium leather, and a high-end Klipsch Reference Premiere audio system, merging luxury with rugged performance.

Key Challenges

High Upfront Costs and Financing Limitations

One of the key challenges in the Spain Pickup Truck Market is the relatively high initial purchase cost of pickup trucks, especially electric and hybrid variants. While these vehicles offer lower operational costs over time, the upfront investment can deter price-sensitive buyers, particularly in the small business and personal use segments. Limited access to tailored financing or leasing options exacerbates this issue. Without competitive pricing and financing flexibility, many buyers continue to favor older or smaller utility vehicles, slowing the adoption of next-generation pickup models.

Infrastructure Limitations for Electric Pickups

Despite growing interest in electric pickups, the lack of widespread charging infrastructure remains a major hurdle in Spain. Rural areas, where many commercial and industrial operators function, have limited access to fast charging facilities. Range anxiety and longer charging durations reduce the appeal of EV pickups for businesses that require consistent uptime. While public and private investments in infrastructure are underway, the current pace risks slowing EV pickup adoption. OEMs and policymakers need to collaborate on expanding fast-charging networks to fully unlock the segment’s potential.

Regional Analysis

Regional Analysis

Northern Spain

Northern Spain accounts for 18.7% of the Spain Pickup Truck Market, driven by strong industrial and agricultural activity in regions such as the Basque Country, Galicia, and Asturias. The presence of manufacturing hubs and high commercial vehicle usage in logistics and timber industries boosts pickup demand. Light-duty pickups dominate due to versatile terrain and rural distribution needs, while fleet owners increasingly adopt diesel and hybrid models to enhance operational efficiency. Infrastructure upgrades and cross-border trade proximity to France further reinforce the region’s growth. However, harsh climatic conditions pose challenges for electric vehicle adoption.

Central Spain

Central Spain holds the largest market share, representing 34.2%, led by Madrid’s dense urban infrastructure and economic activity. Pickup demand is propelled by construction, public works, and logistics services supporting the capital’s supply chain. Fleet operators in this region prefer light-duty and mid-size pickups due to high freight mobility, while electric models gain adoption in metropolitan transport. Central Spain offers favorable connectivity, which supports intra-regional business expansion. Additionally, government policies in Madrid promoting low-emission zones encourage the transition toward cleaner pickup technologies. This region remains a strategic hub for sales and distribution.

Southern Spain

Southern Spain commands 21.3% market share, driven by agriculture, tourism-related logistics, and the construction sector across Andalusia and Murcia. Pickup trucks are widely used for on-field transport and commercial support, particularly in rural and coastal areas. The adoption of diesel pickups remains dominant, although urban centers like Seville and Málaga are beginning to witness increasing interest in electric variants. The region’s hot climate and expansive terrain contribute to higher utility-focused vehicle usage. Local dealerships and aftermarket services also strengthen the pickup ecosystem. Seasonal tourism boosts short-term rental demands for light-duty pickups.

Eastern Spain

Eastern Spain holds 15.9% of the market, led by Valencia and Catalonia, where industrial clusters, ports, and trade activities stimulate vehicle demand. Pickup trucks are crucial for supporting logistics, manufacturing operations, and coastal tourism services. The region’s economic diversification and high urban density influence a growing preference for low-emission and compact pickup variants. The shift towards sustainability is stronger in cosmopolitan areas, where electric pickup adoption is more feasible. Eastern Spain offers substantial opportunities for OEM expansion due to its export-oriented industries and evolving regulations that favor EV-friendly infrastructure development.

Western Spain

Western Spain contributes 9.9% market share, with moderate demand driven by agriculture, mining, and cross-border trade with Portugal. This region, which includes Extremadura and parts of Castilla y León, leans heavily on traditional diesel-powered pickups due to longer distances and challenging terrain. The market remains less penetrated by electric variants due to limited charging network availability. However, development projects in renewable energy and mining are expected to boost future product needs. Local fleet modernization and road infrastructure upgrades could further support incremental pickup adoption across commercial and industrial applications.

Market Segmentations:

By Vehicle Type

By Application

- Commercial

- Industrial

- Personal

- Others

By Fuel Type

By Size

- Compact

- Mid-size

- Full-size

By Towing Capability

- Light towing pickup trucks (Up to 7,500 lbs)

- Medium towing pickup trucks (7,501–12,000 lbs)

- Heavy towing pickup trucks (12,001+ lbs)

By Region

- Northern Spain

- Central Spain

- Southern Spain

- Eastern Spain

- Western Spain

Competitive Landscape

The competitive landscape of the Spain Pickup Truck Market is shaped by leading players such as Toyota (Hilux), Ford (Ranger), Volkswagen (Amarok), Isuzu (D-Max), Mitsubishi (L200), Nissan (Navara), and Foton (Tunland G7). These manufacturers focus on introducing versatile and efficient models tailored to the needs of both commercial and personal users. Light-duty pickups dominate the market due to rising urban utility and fleet demand, with brands like Toyota and Ford offering strong resale value and proven durability. Electric and hybrid variants are emerging as strategic priorities, particularly for fleets operating in low-emission zones. Market strategies include expanding dealership networks, enhancing after-sales service, and offering financing and leasing solutions to increase vehicle accessibility. OEMs are also investing in digital platforms, online configurators, and customer-centric services to improve engagement. Competitive pricing, model diversity, and continuous product innovation remain critical success factors as OEMs aim to capture market share in a steadily growing segment.

Key Player Analysis

- Toyota (Hilux)

- Ford (Ranger)

- Volkswagen (Amarok)

- Isuzu (D-Max)

- Mitsubishi (L200)

- Nissan (Navara)

- Foton (Tunland G7)

Recent Developments

- In April 2025, Santana Motors S.L. (Spain) announced a strategic partnership with Chinese firms Zhengzhou Nissan Automobile Co. and Anhui Coronet Tech Co. to revive vehicle production at its Linares (Jaén) plant, targeting the pickup-truck/off-road segment with diesel and plug-in hybrid models.

- In October 2025, Santana unveiled its new pickup model, the Santana 400, built in Linares in collaboration with Zhengzhou Nissan and Anhui Coronet Tech, available in both diesel (400D) and plug-in hybrid (400 PHEV) variants.

- In June 2025, Ford launched the new Ranger Plug-In Hybrid (PHEV) for the European market (including Spain), combining its proven pickup capability with a hybrid powertrain that allows up to 43 km of pure electric driving.

- In May 2025, Maxus announced its planned launch in Spain of the electric pickup eTerron 9 (with all-wheel drive, air suspension and 442 hp) scheduled for spring 2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Fuel Type, Size, Towing Capability and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Spain Pickup Truck Market is expected to grow steadily due to increased commercial and personal vehicle demand.

- Electric and hybrid pickup models will gain traction as emission regulations tighten.

- Light-duty pickups will continue to dominate due to urban suitability and fleet replacement cycles.

- Commercial and logistics operators will drive bulk purchasing and fleet expansion.

- Automotive OEMs will focus on integrating advanced safety and connectivity features.

- Local dealer network expansion will improve after-sales service and market penetration.

- Government incentives for EV adoption will accelerate the shift toward cleaner powertrains.

- Customization and lifestyle-oriented pickup models will increase consumer appeal.

- Infrastructure investment, particularly in rural areas, will boost demand for high-torque pickups.

- Digital sales and financing platforms will enhance customer engagement and acquisition.

Key Growth Drivers

Key Growth Drivers Regional Analysis

Regional Analysis