Market Overview:

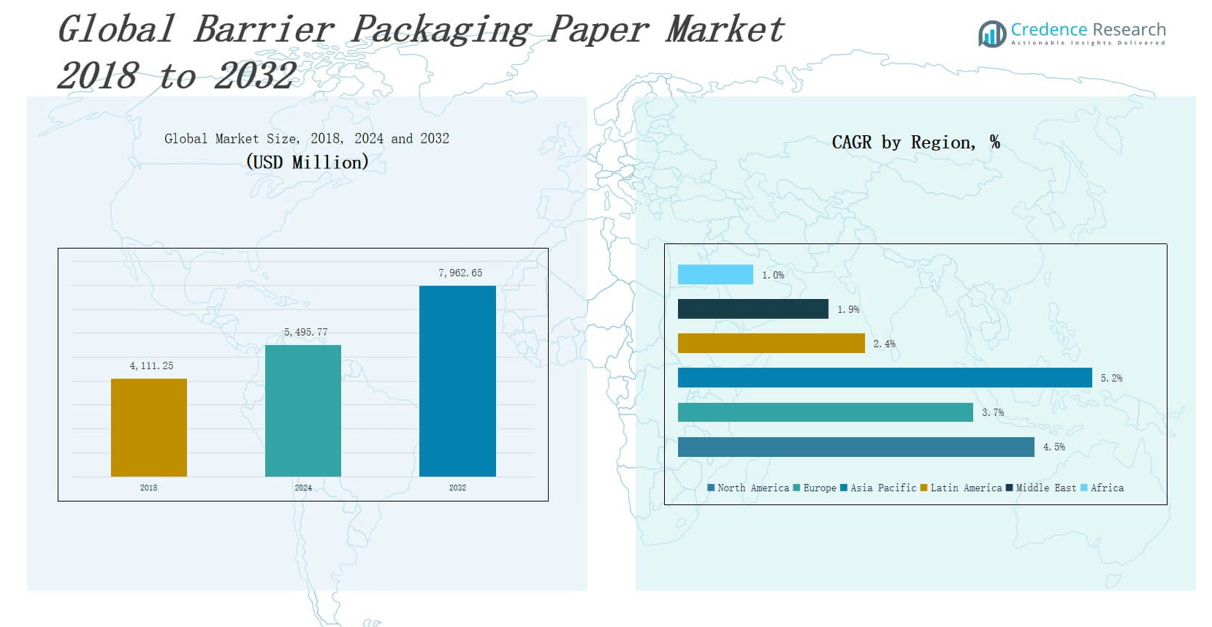

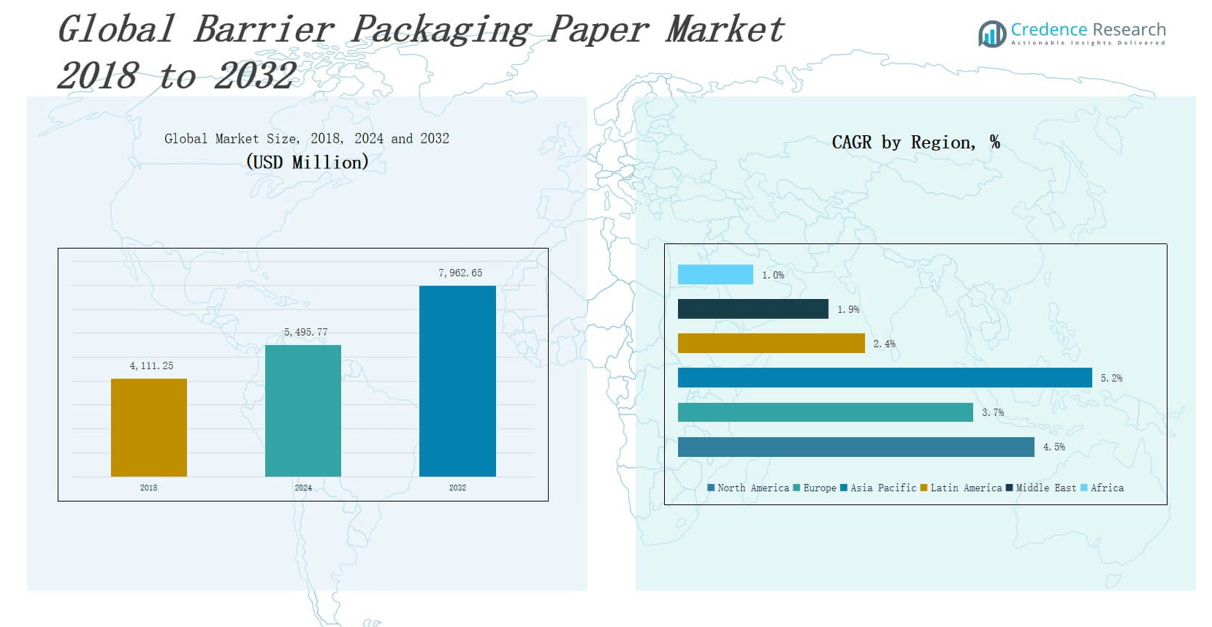

The Barrier Films Packaging Market size was valued at USD 36,028 million in 2024 and is anticipated to reach USD 55291.6 million by 2032, at a CAGR of 5.5 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Barrier Films Packaging Market Size 2024 |

USD 36,028 million |

| Barrier Films Packaging Market, CAGR |

5.5% |

| Barrier Films Packaging Market Size 2032 |

USD 55291.6 million |

The primary drivers for the market include the rising demand for convenience and packaged food products, the growing trend of sustainability in packaging, and innovations in film technology. As consumers become more health-conscious, there is a stronger emphasis on preserving food and pharmaceutical products for longer durations without the use of preservatives. Furthermore, manufacturers are increasingly focusing on biodegradable and recyclable materials to address environmental concerns, which is likely to contribute to market expansion. The increasing adoption of e-commerce and online food delivery services is boosting the demand for barrier films packaging, as these services require efficient and reliable packaging solutions to ensure product safety during transit.

Regionally, North America holds a significant share of the barrier films packaging market, driven by the strong demand from the food and beverage sector. The Asia Pacific region is expected to witness the highest growth rate, owing to rapid urbanization, increasing disposable incomes, and the expanding packaged food industry in countries like China and India. Additionally, the region’s growing focus on sustainability and environmental regulations is expected to propel the adoption of barrier films packaging in various industries.

Market Insights:

- The Barrier Films Packaging Market size was valued at USD 36,028 million in 2024 and is expected to reach USD 55,291.6 million by 2032, growing at a CAGR of 5.5% during the forecast period.

- The rising demand for convenience foods and packaged products is driving the need for barrier films that preserve product freshness.

- Sustainability is becoming a key driver as consumers demand eco-friendly packaging solutions, prompting manufacturers to adopt biodegradable and recyclable materials.

- Technological advancements in multi-layer films and nano-coatings are enhancing the durability and functionality of barrier films for better protection.

- The expansion of e-commerce and online food delivery services is increasing the demand for reliable packaging solutions, such as barrier films, to ensure product safety.

- Challenges such as rising raw material costs and supply chain disruptions are affecting production costs and market stability.

- Regional growth is led by North America’s strong food and beverage demand, Asia Pacific’s urbanization, and Europe’s sustainability initiatives in packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Packaged Food Products

The increasing consumer preference for convenience foods is one of the primary drivers for the Barrier Films Packaging Market. Busy lifestyles and changing dietary habits have led to greater reliance on ready-to-eat and packaged food products. These products require reliable packaging solutions that preserve their freshness and extend shelf life. Barrier films offer exceptional protection against moisture, oxygen, and contaminants, making them ideal for preserving the quality of packaged foods. The demand for these products is expected to continue rising as more consumers prioritize convenience without compromising product quality.

- For instance, Uflex Limited developed an antimicrobial flexible packaging material that, in trials, preserved a packed sandwich for up to 9 days compared to only 3 days with standard pouches, demonstrating a clear, validated numeric outcome for shelf-life extension.

Growing Focus on Sustainability in Packaging Solutions

Sustainability has become a significant factor influencing packaging decisions across industries, including the Barrier Films Packaging Market. Consumers are becoming more environmentally conscious, which has driven manufacturers to focus on eco-friendly packaging options. Barrier films, which are increasingly made from recyclable or biodegradable materials, meet these growing sustainability demands. Companies are now prioritizing materials that reduce environmental impact while still offering superior protection for food and pharmaceutical products. This shift in consumer preference is leading to increased adoption of barrier films.

Technological Advancements in Film Technology

The continuous development of film technology is another key factor propelling the growth of the Barrier Films Packaging Market. Advancements in multi-layer film structures, nano-coatings, and other innovations have significantly enhanced the performance and durability of barrier films. These developments allow packaging to offer higher protection against external elements such as moisture and light, which can degrade products over time. As the demand for advanced packaging solutions rises, manufacturers are investing in new technologies to improve the functionality and efficiency of barrier films.

- For instance, researchers at the University of Oxford achieved an oxygen transmission rate (OTR) reduction on 12μm PET film from 133.5cc·m⁻²·day⁻¹ to below 0.005cc·m⁻²·day⁻¹ by applying a coating of high aspect ratio 2D layered double hydroxide nanosheets.

Expansion of E-commerce and Online Food Delivery Services

The rapid growth of e-commerce and online food delivery services has further accelerated the demand for Barrier Films Packaging Market. Packaging solutions are crucial for ensuring that food products remain intact, fresh, and safe during delivery. The increasing reliance on online shopping and food delivery apps has pushed companies to adopt packaging that offers durability and preservation capabilities. Barrier films are especially effective in this regard, making them a preferred choice for packaging food and beverage products sold through e-commerce platforms.

Market Trends:

Shift Towards Sustainable and Eco-Friendly Packaging Solutions

One of the notable trends in the Barrier Films Packaging Market is the growing demand for sustainable and eco-friendly packaging options. Consumers and businesses alike are prioritizing environmental responsibility, prompting manufacturers to adopt recyclable and biodegradable materials for barrier films. The market is witnessing increased investments in green technologies, such as water-based coatings and compostable films. These innovations not only reduce the environmental impact of packaging but also align with stricter regulations and eco-conscious consumer preferences. Companies are exploring ways to balance high-performance barriers with sustainability, addressing both consumer demand for eco-friendly products and the need for product preservation.

- For instance, Amcor has commercialized AmPrima™ recycle-ready polyethylene shrink film in North America, enabling bottled beverage brands to incorporate exactly 30 metric tons of post-consumer recycled (PCR) content in the packaging for large-volume production runs.

Technological Advancements in Barrier Film Designs and Applications

The Barrier Films Packaging Market is also experiencing significant technological advancements, particularly in the design and application of films. Multi-layered and nano-coated films have become increasingly popular, offering enhanced protection against moisture, oxygen, and other external factors. These innovations have led to improved shelf life and product integrity, particularly in the food and pharmaceutical sectors. Advanced barrier films are also being used in emerging industries like electronics and cosmetics, where precise protection is required. As technology continues to evolve, manufacturers are focusing on creating barrier films that are not only effective but also versatile, catering to a wider range of applications and industries.

- For instance, Tera-Barrier Films developed a nano-sealing layer technology that achieved barrier properties up to 10,000 times greater than a standard oxide barrier, with independently verified oxygen transmission rates as low as 10⁻⁷g/m²/day, significantly outperforming traditional packaging solutions.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Disruptions

One of the significant challenges faced by the Barrier Films Packaging Market is the volatility in raw material costs. The prices of key materials, such as polyethylene, nylon, and polyester, fluctuate based on market conditions and global supply chain disruptions. These fluctuations affect manufacturing costs and profit margins for producers. The ongoing instability in the global supply chain, caused by factors like transportation delays and labor shortages, further complicates procurement and production processes. Manufacturers must find ways to optimize their supply chains and control costs to remain competitive, which may lead to increased operational expenses.

Regulatory Compliance and Environmental Concerns

The Barrier Films Packaging Market is also challenged by the growing complexity of regulatory requirements and environmental concerns. Stricter regulations regarding packaging materials, waste management, and recycling create pressure on manufacturers to comply with changing standards. Additionally, the push for sustainability is driving demand for more eco-friendly solutions, which can sometimes be difficult to balance with performance expectations. Developing barrier films that meet both regulatory standards and environmental goals while maintaining product protection remains a key challenge for the industry. Companies must navigate these hurdles to stay aligned with regulations while fulfilling consumer demands for sustainable packaging.

Market Opportunities:

Growing Demand for Sustainable Packaging Solutions

A significant opportunity in the Barrier Films Packaging Market lies in the increasing demand for sustainable packaging solutions. As consumer preferences shift towards eco-friendly products, there is a growing emphasis on packaging materials that are biodegradable, recyclable, or made from renewable sources. Companies that can innovate and develop barrier films that meet these sustainability criteria will likely gain a competitive edge. The transition to sustainable materials presents an opportunity for manufacturers to expand their product offerings and align with global trends focused on reducing plastic waste and minimizing environmental impact.

Expansion into Emerging Markets and Industries

The Barrier Films Packaging Market also holds opportunities in emerging markets and industries. Regions such as Asia Pacific, Latin America, and Africa are experiencing rapid urbanization, increasing disposable incomes, and greater demand for packaged food and consumer goods. These regions offer significant growth potential for barrier films packaging, especially in sectors like food and beverages, healthcare, and electronics. Moreover, the adoption of barrier films in new applications, such as cosmetics and medical devices, opens doors for market expansion and diversification. Companies that target these emerging sectors can capitalize on the evolving demand for high-performance packaging solutions.

Market Segmentation Analysis:

By Product Type:

The market is divided into flexible, rigid, and semi-rigid barrier films. Flexible films dominate the market due to their versatility and wide use in food packaging. They offer flexibility in design, lower costs, and superior sealing capabilities, making them ideal for products like snacks, ready-to-eat meals, and beverages. Rigid and semi-rigid films are gaining traction in high-end packaging, particularly for products that require extra protection during transportation.

- For instance, Klöckner Pentaplast’s Pentapharm® ultra-high barrier PVdC-coated rigid films are used extensively in pharmaceutical packaging to ensure optimum moisture and oxygen protection and maintain product integrity across millions of packaged medicine doses globally.

By Material Composition:

The material composition segment includes polyethylene, polyester, nylon, and others. Polyethylene holds the largest market share due to its cost-effectiveness and ease of processing. It is commonly used in food and beverage packaging. Nylon is preferred for applications requiring higher barrier properties, such as pharmaceutical and medical packaging. Other materials, including EVOH and PVDC, are used in specialized barrier films for specific applications where superior barrier performance is required.

- For instance, Impact Plastics offers multilayer extrusion solutions incorporating EVOH, with each EVOH film processed through lamination or coextrusion reaching up to the outer surfaces of monolayer sheets, thereby enabling the creation of high-barrier rollstock for a variety of food packaging formats.

By End-User Industry:

The primary end-user industries for barrier films packaging are food and beverages, pharmaceuticals, healthcare, and consumer goods. The food and beverage industry holds the largest share, driven by the demand for packaged food products. Pharmaceuticals also account for a significant share, as barrier films are essential for ensuring the integrity and shelf life of sensitive products like medications and vaccines. The growing focus on sustainability is pushing all industries to adopt more eco-friendly packaging solutions, contributing to market growth.

Segmentations:

By Product Type:

- Flexible Barrier Films

- Rigid Barrier Films

- Semi-Rigid Barrier Films

By Material Composition:

- Polyethylene

- Polyester

- Nylon

- EVOH (Ethylene Vinyl Alcohol)

- PVDC (Polyvinylidene Chloride)

- Other Materials

By End-User Industry:

- Food and Beverages

- Pharmaceuticals

- Healthcare

- Consumer Goods

- Electronics

By Barrier Properties:

- Oxygen Barrier Films

- Moisture Barrier Films

- Light Barrier Films

- Gas Barrier Films

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Dominance Driven by Food and Beverage Sector

North America holds a market share of 35% in the Barrier Films Packaging Market. The region’s dominance is driven primarily by the strong demand from the food and beverage sector. The preference for convenience foods, coupled with a growing focus on sustainable packaging, has accelerated the adoption of barrier films. North American consumers are increasingly seeking high-quality, eco-friendly packaging solutions, creating opportunities for manufacturers to offer innovative products. The presence of major packaging companies and advancements in film technology further support market growth. As the regulatory landscape continues to evolve, businesses in North America are also focusing on compliance with stringent environmental policies, fostering innovation in sustainable packaging solutions.

Asia Pacific: Rapid Growth Fueled by Urbanization and Disposable Income

The Asia Pacific region accounts for 28% of the Barrier Films Packaging Market share. Rapid urbanization, increasing disposable incomes, and a growing preference for packaged food are driving demand in countries like China, India, and Japan. These nations are experiencing significant shifts in consumer behavior, with more people opting for convenient, ready-to-eat food products. The rise in e-commerce and the expansion of the retail sector further boost the demand for packaging solutions that ensure product safety and freshness. Manufacturers are capitalizing on these trends by introducing advanced barrier films that cater to the specific needs of emerging markets in the region.

Europe: Strong Demand Driven by Sustainability Initiatives

Europe holds a market share of 22% in the Barrier Films Packaging Market, with sustainability driving much of the demand. European consumers and businesses are prioritizing eco-friendly packaging solutions, pushing manufacturers to adopt recyclable and biodegradable barrier films. The region’s strong regulatory framework focused on reducing plastic waste and promoting circular economy practices is fostering the growth of sustainable packaging. The food and beverage industry remains the largest end-user in Europe, where innovation in barrier films is crucial to maintaining product freshness while minimizing environmental impact. The increasing focus on environmental standards in Europe presents a valuable opportunity for companies to strengthen their market presence by offering sustainable, high-performance packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sealed Air

- Amcor

- Winpak

- Uflex

- Mondi

- Glenroy

- Huhtamaki

- Atlantis Pak

- Bischof & Klein

- Plastissimo

Competitive Analysis:

The Barrier Films Packaging Market is highly competitive, with several key players focusing on innovation and sustainability to maintain their market position. Leading companies include Amcor, Berry Global, Sealed Air Corporation, and Dow Chemical, each offering a diverse range of barrier film solutions. These players focus on expanding their product portfolios to meet the growing demand for eco-friendly and high-performance packaging. They invest in research and development to enhance barrier properties such as moisture, oxygen, and light resistance, catering to industries like food, pharmaceuticals, and consumer goods. Strategic mergers and acquisitions are also common in this market, allowing companies to diversify their offerings and increase their geographic presence. Regional players also contribute to market dynamics by focusing on cost-effective solutions and sustainability initiatives. The competitive landscape emphasizes innovation, cost efficiency, and the ability to comply with evolving environmental regulations.

Recent Developments:

- In May 2025, Sealed Air partnered with Qosina to offer the NEXCEL® BIO1250 Bioprocessing Bag Film, expanding its capabilities in healthcare and life sciences packaging.

- In April 2025, Amcorannounced the first commercial launch of its AmSky™ recyclable blister packaging, starting with U.S. sales of TheraBreath’s chewing gum.

- In June 2025, Uflexannounced a FSSAI-certified rPET solution for direct food contact applications, marking a major advancement in food-grade recycled plastics.

Market Concentration & Characteristics:

The Barrier Films Packaging Market exhibits moderate concentration, with a few large players dominating the market, such as Amcor, Berry Global, Sealed Air Corporation, and Dow Chemical. These companies hold a significant share due to their extensive product portfolios, advanced technologies, and global reach. The market is characterized by constant innovation, with a strong focus on sustainability and eco-friendly solutions to meet consumer and regulatory demands. Key players invest in research and development to improve barrier properties and expand their offerings in packaging for industries like food, pharmaceuticals, and healthcare. The presence of regional players also contributes to competition, particularly in emerging markets, where cost-effective solutions and localized production are essential for growth. The market’s dynamics are shaped by a blend of technological advancements, sustainability efforts, and strategic partnerships aimed at expanding market share.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material Composition, End-User Industry, Barrier Properties and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Sustainability initiatives by governments worldwide are driving the demand for eco-friendly barrier films.

- Technological advancements are leading to the development of high-performance barrier films with enhanced properties for various industry needs.

- The growth of e-commerce is increasing the demand for robust packaging solutions to ensure product safety during transit.

- Consumer preferences are shifting towards products with longer shelf life, prompting manufacturers to adopt advanced barrier packaging.

- Emerging markets, particularly in Asia-Pacific, are experiencing significant growth in barrier film demand due to rapid industrialization and urbanization.

- The development of recyclable and biodegradable materials is gaining traction, aligning with global sustainability goals.

- The pharmaceutical industry is adopting barrier films to protect sensitive products from environmental factors.

- Manufacturers are focusing on producing cost-effective barrier films without compromising quality, expanding accessibility across markets.

- There is a rising trend towards customized barrier films tailored to meet specific packaging requirements of various industries.

- Compliance with international standards and regulations is becoming increasingly crucial for manufacturers to maintain competitiveness in the market.