Market Overview:

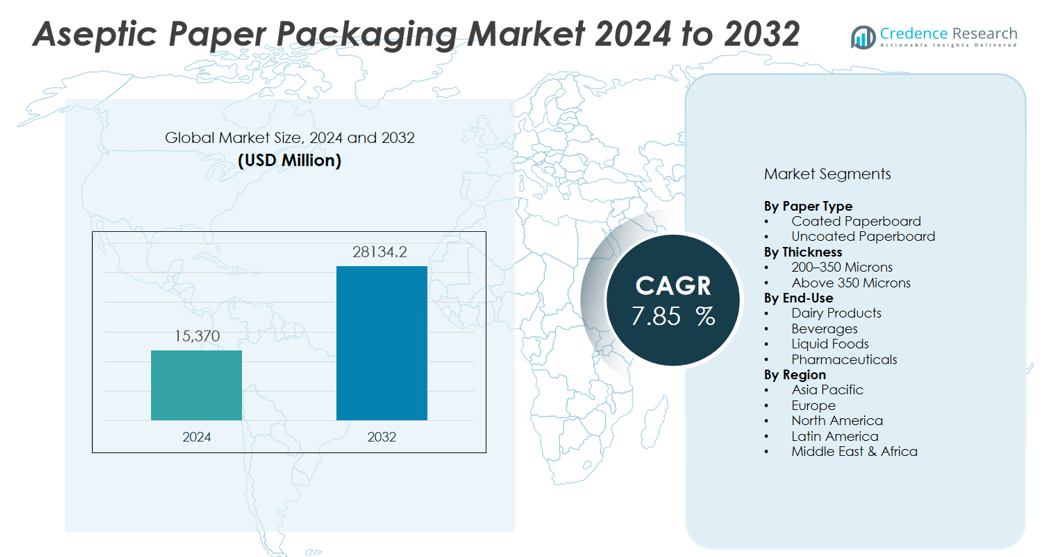

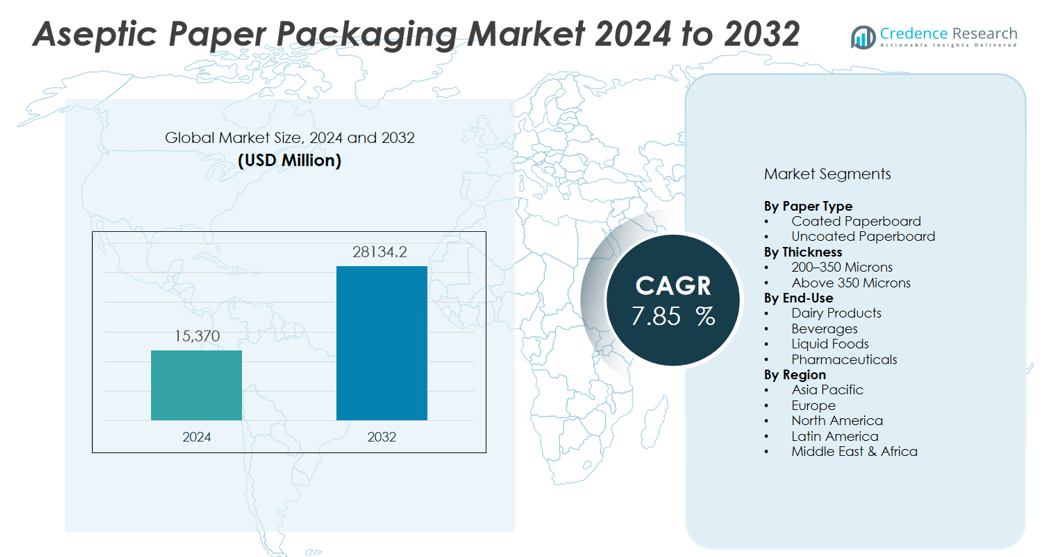

The Aseptic paper packaging market size was valued at USD 15,370 million in 2024 and is anticipated to reach USD 28134.2 million by 2032, at a CAGR of 7.85 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aseptic Paper Packaging Market Size 2024 |

USD 15,370 million |

| Aseptic Paper Packaging Market , CAGR |

7.85% |

| Aseptic Paper Packaging Market Size 2032 |

USD 28134.2 million |

Market growth is underpinned by several key drivers, including rising consumer awareness of food safety and hygiene, regulatory pressure to reduce the use of preservatives, and heightened demand for sustainable packaging solutions. The shift toward minimally processed foods and beverages has fueled the need for packaging that prevents microbial contamination while supporting extended shelf life. Environmental concerns have accelerated innovation in recyclable and biodegradable paper-based materials, allowing brands to meet both regulatory requirements and consumer expectations for eco-friendly packaging. Technological advancements, such as improved barrier coatings and multi-layer paperboard structures, are further enabling the use of aseptic packaging across a wider range of products.

Regionally, Asia Pacific dominates the aseptic paper packaging market, driven by rapid urbanization, a large consumer base, and strong dairy and beverage growth in China and India. Key companies include Tetra Pak International S.A., Nampak Ltd., Uflex Ltd., Ducart Group, Polyoak Packaging Group (Pty) Ltd., and SIG Combibloc Obeikan (South Africa) (Pty) Ltd. Europe follows with strict food safety regulations and a focus on sustainability. North America shows steady growth with rising demand for convenient, shelf-stable packaging, while Latin America and the Middle East & Africa are emerging markets benefiting from urbanization and higher incomes.

Market Insights:

- The Aseptic paper packaging market reached USD 15,370 million in 2024 and will likely hit USD 2 million by 2032.

- Growth is fueled by rising consumer awareness of food safety and the demand for minimally processed, shelf-stable foods.

- Strict regulations and a push for reduced preservatives drive adoption of advanced barrier coatings and aseptic processes.

- Sustainability concerns accelerate innovation in recyclable, biodegradable, and renewable paper-based packaging materials.

- Asia Pacific leads with 42% market share, followed by Europe at 28% and North America at 19%.

- Key players include Tetra Pak International S.A., Nampak Ltd., Uflex Ltd., Ducart Group, Polyoak Packaging Group, and SIG Combibloc Obeikan.

- Challenges include complex manufacturing, high investment costs, and limited recycling infrastructure for composite materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Safe and Shelf-Stable Food and Beverages:

The Aseptic paper packaging market benefits from increased consumer preference for food and beverages that remain safe and fresh over extended periods. The rise of urban lifestyles and busier schedules has fueled the popularity of ready-to-drink beverages, liquid dairy products, and nutritional supplements. Manufacturers turn to aseptic paper packaging to ensure that products retain their quality without refrigeration or added preservatives. This technology helps brands meet both consumer expectations and strict food safety requirements. Companies leverage aseptic paper cartons to deliver a wide range of products, including plant-based drinks, broths, and juices. Retailers value the extended shelf life and reduced spoilage rates these packages provide. The trend supports sustained growth and innovation in the market.

- For instance, Tetra Pak introduced an aseptic carton made up of around 90 percent renewable materials—including 80% paperboard—which enables products to remain shelf-stable for up to 12 months without refrigeration or preservatives.

Growing Regulatory Focus on Food Safety and Packaging Standards:

Governments and regulatory bodies are imposing stricter standards for food safety, packaging integrity, and shelf-life management. The Aseptic paper packaging market responds by adopting advanced barrier coatings and sealing technologies that prevent microbial contamination and preserve product freshness. Compliance with evolving food safety regulations drives ongoing investments in new materials and aseptic filling processes. It positions aseptic paper packaging as a preferred solution for companies seeking certification and market approval across multiple geographies. Strong regulatory oversight ensures continuous quality improvement and supports consumer trust in packaged products. Market participants continue to innovate to stay ahead of regulatory demands.

- For instance, Camvac International introduced its Cambag specialty laminates in 2024 for bag-in-box liquid packaging, offering all-polyethylene, high-barrier solutions that precisely control gas permeation and extend shelf-life for bags ranging from 1L to 200L, supporting rigorous food safety demands.

Accelerated Shift Toward Sustainable and Eco-Friendly Packaging:

Sustainability trends shape the direction of the Aseptic paper packaging market. Brands and consumers demand eco-friendly solutions that minimize plastic use and reduce environmental impact. Manufacturers introduce recyclable, compostable, and renewable paper-based materials that align with global sustainability goals. These initiatives address consumer concerns over waste and align with government mandates targeting single-use plastics. The industry invests in sourcing certified, responsibly managed paper fibers to reinforce green credentials. Sustainable packaging options help companies differentiate their offerings and appeal to environmentally conscious shoppers.

Technological Advancements Driving Packaging Performance:

Innovations in materials science and aseptic filling technology enhance the appeal of the Aseptic paper packaging market. Multi-layer paperboard structures and high-performance barrier coatings improve protection against light, oxygen, and moisture. These advances allow packaging to accommodate a broader range of food and beverage products. It enables brands to experiment with new product formats and formulations, knowing that the integrity and safety of the contents are preserved. The market benefits from the integration of digital printing, smart labels, and advanced filling automation. These technological gains support operational efficiency, product differentiation, and improved consumer experiences.

Market Trends:

Increased Focus on Sustainable Materials and Circular Economy Initiatives:

Sustainability drives a major trend in the Aseptic paper packaging market, with brands and manufacturers prioritizing renewable and recyclable paper-based solutions. Companies integrate responsibly sourced fibers and water-based barrier coatings to meet both regulatory expectations and consumer demand for eco-friendly packaging. Major players invest in closed-loop recycling programs and partnerships that reduce waste and extend the lifecycle of packaging materials. It also reflects a growing preference for biodegradable and compostable options that align with circular economy goals. Government mandates targeting plastic reduction and improved waste management accelerate the shift toward sustainable packaging formats. These trends reinforce the value of innovation and transparency throughout the supply chain.

- For instance, Stora Enso’s Oulu site will supply 750,000 tonnes of consumer board annually after conversion, targeting food and beverage packaging.

Adoption of Advanced Aseptic Technologies and Smart Packaging Features:

Technological advancements continue to shape the Aseptic paper packaging market, enabling improved product protection, shelf appeal, and user experience. The market witnesses increased adoption of multi-layer paperboard with enhanced barrier properties for oxygen, moisture, and light. Smart packaging features such as QR codes and tamper-evident seals offer greater product traceability and safety assurance. Manufacturers deploy advanced aseptic filling systems that allow for higher throughput and expanded product portfolios. It enables brands to introduce new ready-to-drink beverages, nutritional supplements, and dairy alternatives with confidence in product quality. These innovations position the market for sustained growth and further differentiation.

- For instance, Adragos Pharma’s Livron facility operates a modern aseptic filling line capable of producing over 150 million ampoules annually, demonstrating significant advances in production efficiency and product safety.

Market Challenges Analysis:

Complex Manufacturing Processes and High Initial Investment Requirements:

The Aseptic paper packaging market faces significant challenges due to the complexity of its manufacturing processes and the high costs associated with advanced filling and sealing equipment. Companies must invest heavily in specialized machinery and cleanroom environments to achieve the sterile conditions required for aseptic packaging. The need for skilled personnel and ongoing equipment maintenance can further raise operational costs. Small and mid-sized manufacturers may find it difficult to enter or scale within this segment due to these barriers. Market participants also contend with strict quality assurance protocols, which require continuous monitoring and validation. These factors collectively impact market expansion and speed of technology adoption.

Material Compatibility and Recycling Infrastructure Limitations:

Material compatibility issues present another challenge for the Aseptic paper packaging market, especially when integrating advanced barrier layers with paperboard. It can be difficult to achieve the necessary performance without compromising recyclability or sustainability. The lack of robust recycling infrastructure for composite materials can hinder efforts to close the material loop. Brands and manufacturers must balance the demand for superior product protection with environmental targets and evolving regulations. The industry continues to seek solutions that optimize material performance while supporting recycling and waste reduction goals. These challenges drive ongoing research and collaboration across the value chain.

Market Opportunities:

Expansion into Emerging Markets and New Product Categories:

The Aseptic paper packaging market holds significant opportunities in expanding into high-growth regions such as Asia Pacific, Latin America, and Africa. Rapid urbanization, rising disposable incomes, and increased demand for safe, convenient food and beverage options create favorable conditions for market entry. Companies can leverage local partnerships and adapt product formats to suit regional tastes and regulatory requirements. Diversification into new product categories, such as plant-based beverages, liquid nutritional supplements, and ready-to-serve meals, will open further avenues for growth. It allows brands to reach untapped consumer segments and address evolving dietary preferences. Early movers in these markets can establish strong brand presence and secure long-term contracts.

Advancements in Sustainable Packaging Materials and Digital Integration:

The Aseptic paper packaging market benefits from ongoing advancements in sustainable materials and digital integration. Innovations in biodegradable coatings, renewable fibers, and mono-material paperboard present new ways to reduce environmental impact while maintaining product integrity. Companies have the opportunity to develop and promote fully recyclable or compostable aseptic cartons that address regulatory and consumer sustainability goals. Digital features, such as smart labels and QR codes, can enhance traceability, consumer engagement, and supply chain transparency. It enables brands to differentiate their products and provide added value to customers. These opportunities support both environmental stewardship and competitive positioning in a dynamic marketplace.

Market Segmentation Analysis:

By Paper Type:

The Aseptic paper packaging market features coated paperboard and uncoated paperboard as its primary segments. Coated paperboard dominates due to its superior barrier properties, which protect against moisture, oxygen, and light. It supports product shelf life and aligns with the high standards required by dairy, beverage, and liquid food producers. Uncoated paperboard holds a smaller share and appeals to brands prioritizing recyclability and a natural look.

- For instance, Metsä Board launched its plastic-free eco-barrier paperboard, Prime FBB EB, which is fully recyclable and suitable for direct food contact, available in basis weights from 195–320g/m² and recognized for being the brightest OBA-free board on the market.

By Thickness:

Market participants offer packaging across a range of thicknesses, typically between 200 and 450 microns. Products with thickness above 350 microns lead, providing enhanced strength, puncture resistance, and durability for heavier or larger volume products. Cartons in the 200–350 micron range address standard beverage and dairy requirements and offer cost efficiency. Manufacturers continue to develop lighter, high-performance options to meet sustainability goals.

- For instance, Amcor’s recyclable PrimeSeal and DairySeal thermoforming films are available in thicknesses ranging from 85 to 200 microns and have demonstrated excellent puncture and abrasion resistance for meat and dairy packaging applications.

By End-Use:

The Aseptic paper packaging market serves dairy products, beverages, liquid foods, and pharmaceuticals. Dairy and beverage applications hold the largest share, reflecting growing demand for milk, juices, and plant-based drinks. Liquid food products, such as broths and soups, show rising adoption as consumers seek convenience and food safety. The pharmaceutical sector adopts aseptic paper cartons for select liquid medicines, where sterility and secure transport are critical.

Segmentations:

By Paper Type:

- Coated Paperboard

- Uncoated Paperboard

By Thickness:

- 200–350 Microns

- Above 350 Microns

By End-Use:

- Dairy Products

- Beverages

- Liquid Foods

- Pharmaceuticals

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific:

Asia Pacific holds 42% share of the Aseptic paper packaging market, supported by a large population base and rapid urbanization. China and India drive the region’s dominance, fueled by increasing demand for ready-to-drink beverages, dairy products, and packaged foods. Manufacturers invest in modern processing infrastructure and adapt packaging to local consumer preferences. Government initiatives for food safety and sustainability accelerate adoption across the region. Leading domestic and global brands compete by launching innovative products tailored for fast-growing urban centers. The region’s dynamic retail landscape further supports growth in aseptic packaging. Strategic investments and rising incomes position Asia Pacific as a central hub for future expansion.

Europe:

Europe accounts for 28% share of the Aseptic paper packaging market, led by countries such as Germany, France, and the United Kingdom. Strict environmental regulations and a strong focus on recyclable materials drive market dynamics. Food safety standards and consumer demand for clean-label products boost the adoption of aseptic cartons in beverages and liquid foods. Leading manufacturers invest in advanced barrier coatings and recycling solutions to meet regional sustainability targets. Innovation in packaging design and material sourcing supports brand differentiation. The region benefits from a mature retail sector and widespread consumer awareness regarding environmental issues. Europe’s leadership in sustainability shapes global market strategies.

North America:

North America holds 19% share of the Aseptic paper packaging market, with the United States and Canada serving as primary markets. Consumer preference for convenient, portable food and beverage options drives strong adoption in the region. Brands expand their product portfolios to include plant-based drinks, ready meals, and specialty nutritional products. Investments in advanced aseptic filling technologies enable companies to meet changing consumer needs. The region’s robust supply chain infrastructure and evolving retail formats support further market penetration. It offers significant potential for growth as manufacturers respond to trends in health, wellness, and sustainable packaging.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Tetra Pak International S.A.

- Nampak Ltd.

- Uflex Ltd;

- Ducart Group

- Polyoak Packaging Group (Pty) Ltd.

- SIG Combibloc Obeikan (South Africa) (Pty) Ltd.

- Mondi Ltd

- Amcor Limited

- Elopak SA

- IPI s.r.l.

Competitive Analysis:

The Aseptic paper packaging market features a competitive landscape shaped by both global and regional players. Key companies include Tetra Pak International S.A., Nampak Ltd., Uflex Ltd., Ducart Group, Polyoak Packaging Group (Pty) Ltd., and SIG Combibloc Obeikan (South Africa) (Pty) Ltd. It sees competition focused on technological innovation, sustainable material development, and efficient supply chain management. Leading firms invest in advanced aseptic filling lines, eco-friendly coatings, and recycling initiatives to strengthen market position. Companies differentiate by offering tailored solutions that address industry-specific safety, regulatory, and sustainability requirements. Strategic collaborations, R&D, and market expansion remain central to competitive strategies. The market’s high entry barriers—due to capital intensity and strict quality standards—support the dominance of established brands, while regional players capitalize on local expertise and agile service delivery.

Recent Developments:

- In March 2024, Ducera Growth Ventures, a platform related to Ducart Group, announced a strategic collaboration with Corteva Catalyst, focusing on leveraging proprietary AI tools to identify and invest in innovative companies supporting agricultural advancements.

- In July 2025, Amcor and Mediacor launched a new refill pouch for Nana laundry and cleaning products, targeting increased sustainability in consumer packaging.

- In March 2025, Elopak invested in Blue Ocean Closures (BOC), securing exclusive global rights to market and sell fiber-based molded caps for gable-top cartons, thereby advancing its sustainable packaging strategy.

Market Concentration & Characteristics:

The Aseptic paper packaging market demonstrates moderate concentration, with a mix of global leaders and regional players shaping its competitive landscape. It features established companies such as Tetra Pak, SIG Combibloc, and Elopak, which set industry standards through innovation and investment in sustainable materials. The market is characterized by high entry barriers due to the capital-intensive nature of aseptic technology, strict regulatory requirements, and the need for advanced manufacturing expertise. Companies compete on packaging quality, food safety, environmental performance, and the ability to deliver customized solutions. Strategic partnerships, R&D initiatives, and expansion into emerging markets define ongoing competition and drive continuous product development.

Report Coverage:

The research report offers an in-depth analysis based on Paper Type, Thickness, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Industry leaders plan to accelerate adoption of biodegradable barrier coatings to meet rising environmental standards.

- Companies will implement smart labeling technologies to enhance traceability and consumer engagement.

- Brands intend to explore mono-material paperboard solutions that simplify recycling and reduce complexity in waste streams.

- Manufacturers will expand aseptic packaging applications to include plant-based protein drinks, meal replacements, and functional beverages.

- Firms plan to increase investments in digital printing capabilities to support product differentiation and small-batch customization.

- Market participants will form strategic alliances with recycling facilities and fiber suppliers to strengthen circular economy initiatives.

- Packaging producers will introduce aseptic cartons with lighter weight and reduced material usage to lower their carbon footprint.

- Industry players will deploy advanced sterilization and filling lines to improve throughput, efficiency, and food safety compliance.

- Companies will pursue regional expansion into Africa, Latin America, and Southeast Asia to tap growing consumer demand and retail modernization.

- Suppliers will target cost-effective aseptic solutions for smaller manufacturers to broaden market participation and support market fragmentation.