Market Overview:

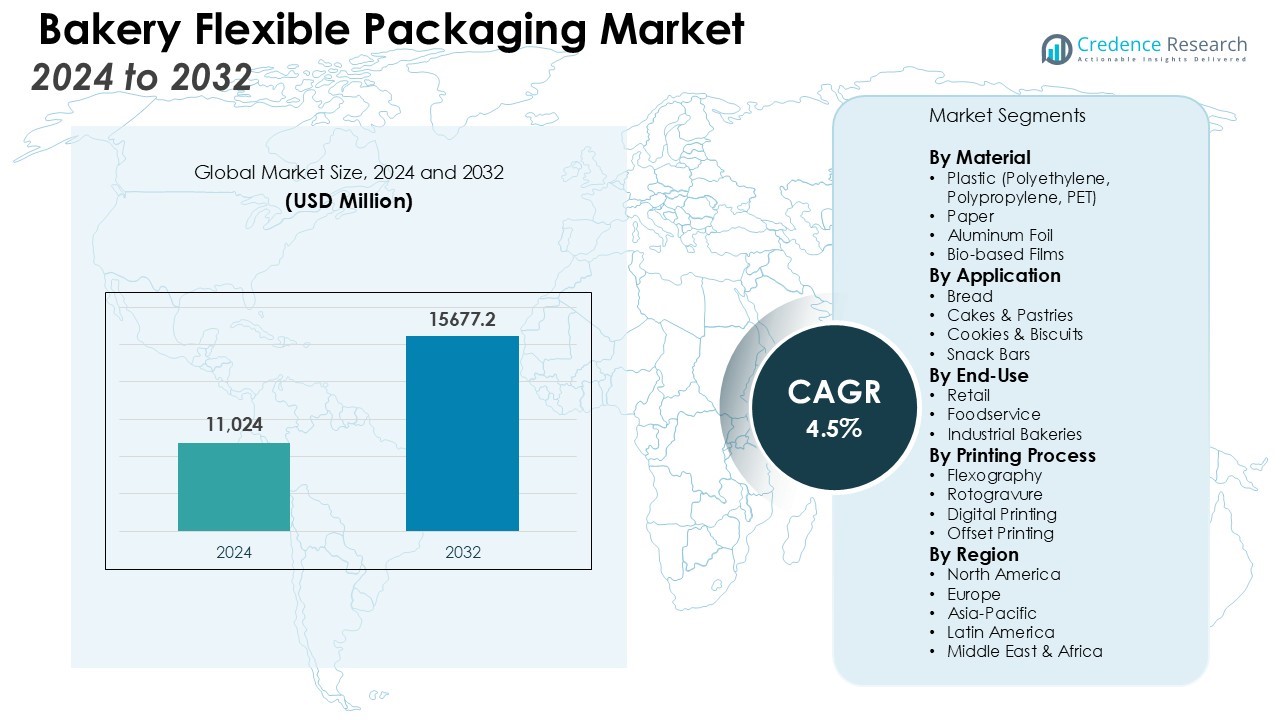

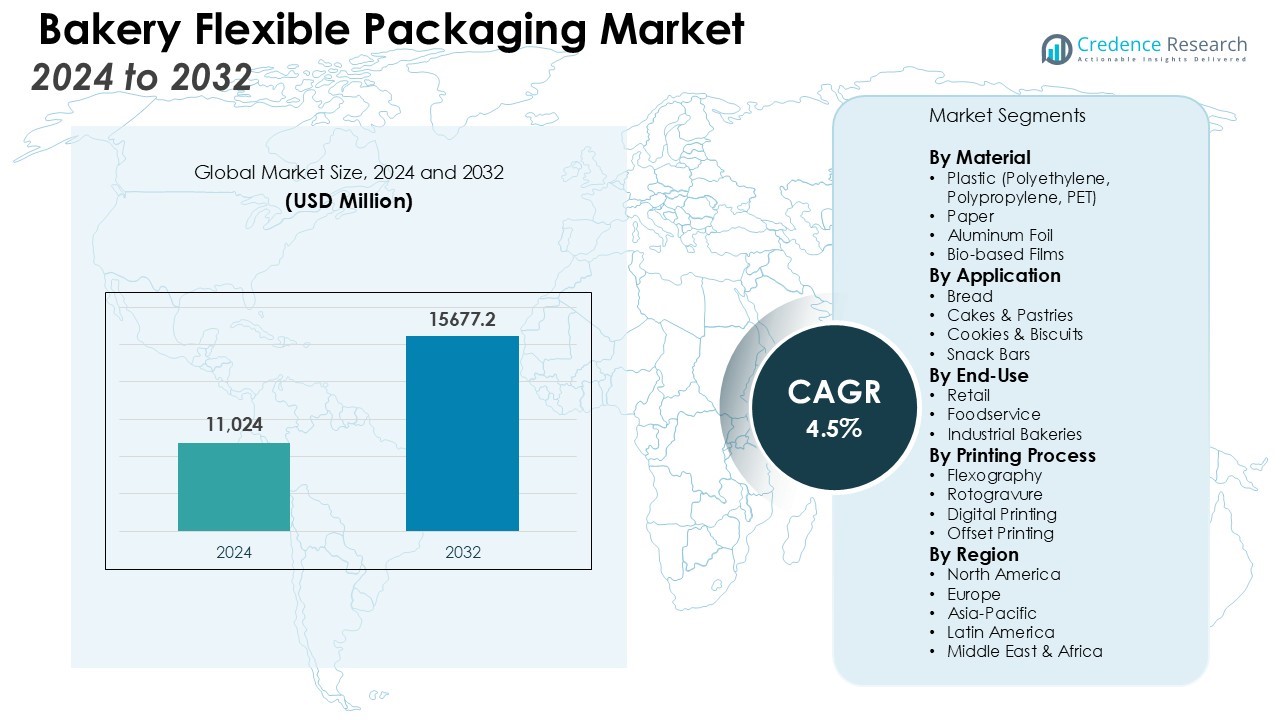

The Bakery flexible packaging market size was valued at USD 11,024 million in 2024 and is anticipated to reach USD 15677.2 million by 2032, at a CAGR of 4.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bakery Flexible Packaging Market Size 2024 |

USD 11,024 Million |

| Bakery Flexible Packaging Market, CAGR |

4.5% |

| Bakery Flexible Packaging Market Size 2032 |

USD 15677.2 Million |

Key factors driving the bakery flexible packaging market include rising demand for convenient, on-the-go bakery items and increased use of portion-controlled, resealable formats. Greater focus on food safety, shelf life, and waste reduction supports the adoption of advanced barrier films. The shift toward sustainability drives interest in recyclable and biodegradable solutions. Rapid growth in e-commerce and direct sales also boosts demand for protective and attractive packaging.

Regionally, North America holds a leading share of the bakery flexible packaging market, supported by a large bakery sector and advanced retail infrastructure. Europe follows, driven by strict environmental regulations, strong artisanal traditions, and leading companies such as Tetra Pak International S.A, Huhtamaki Group, Graphic Packaging Holding Company, Vipac Packaging, WestRock Company, and Constantia Flexibles Group GmbH. The Asia-Pacific region is the fastest-growing market, led by urbanization and rising incomes in China, India, and Japan. Latin America and the Middle East & Africa also see steady growth with evolving consumer lifestyles and a growing middle class.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The bakery flexible packaging market reached USD 11,024 million in 2024 and is projected to hit USD 15,677.2 million by 2032.

- Demand for on-the-go and portion-controlled bakery items drives growth in resealable and convenient packaging formats.

- Advanced barrier films support food safety and longer shelf life, helping reduce waste for both manufacturers and retailers.

- Sustainability trends fuel strong interest in recyclable, compostable, and biodegradable packaging materials.

- Rapid e-commerce growth increases demand for packaging that protects products during shipping and stands out on digital shelves.

- North America leads with 34% market share, driven by innovation, retail infrastructure, and a mature bakery sector.

- Asia-Pacific shows the fastest growth, fueled by urbanization, rising incomes, and expansion of modern retail and e-commerce platforms.

Market Drivers:

Rising Demand for Convenience and On-the-Go Consumption:

The trend toward convenience is a major force shaping the bakery flexible packaging market. Consumers seek easy-to-carry, resealable, and lightweight packaging for bakery items such as pastries, breads, and snack cakes. Modern lifestyles require quick meal options, prompting bakeries to introduce portion-sized and single-serve products. Flexible packaging enables brands to offer a wide variety of sizes and formats tailored to changing consumer habits. It supports the expansion of ready-to-eat and grab-and-go bakery products, which are increasingly popular in urban areas. The shift to convenience-driven purchasing behavior strongly drives innovation in packaging design and materials.

Focus on Shelf Life Extension and Food Waste Reduction:

Preserving freshness is essential for bakery products, which are highly perishable. The bakery flexible packaging market addresses this challenge with advanced barrier films and materials that protect products from moisture, oxygen, and contaminants. These features extend shelf life and maintain product quality, supporting both manufacturers and retailers in reducing food waste. Improved packaging performance allows for broader distribution and longer shelf displays, which is especially important for premium or artisanal baked goods. Food safety concerns further reinforce the need for superior protective packaging. The industry continues to prioritize packaging solutions that minimize spoilage.

- For instance, Sealed Air’s Cryovac Modified Atmosphere Packaging (MAP) extends the shelf life of premium baked goods from the traditional 1–2 weeks to over 40 days, by combining gas-flush processing with active barrier films.

Growing Emphasis on Sustainability and Eco-Friendly Materials:

Sustainability is a powerful driver in the bakery flexible packaging market. Brands and retailers respond to consumer and regulatory demands by investing in recyclable, compostable, and biodegradable packaging options. It is common for companies to redesign their packaging portfolios to reduce material usage and environmental footprint. The development of bio-based films and paper-based packaging provides viable alternatives to traditional plastics. Governments in Europe and North America enforce stricter packaging regulations, pushing the industry to adopt greener solutions. Consumers now factor sustainability into purchasing decisions, making eco-friendly packaging a critical differentiator.

Expansion of E-Commerce and Modern Retail Formats:

The rise of e-commerce and modern retail formats increases demand for bakery flexible packaging that can withstand handling and transportation challenges. Online grocery shopping requires packaging that protects against crushing and contamination during last-mile delivery. Flexible packaging provides durability and product visibility, supporting both online and brick-and-mortar sales. It plays a key role in enhancing shelf appeal and brand recognition in competitive retail environments. Retailers and bakeries benefit from packaging that improves logistics efficiency and reduces return rates due to product damage. The expansion of digital and organized retail channels continues to fuel packaging innovation across the sector.

- For instance, Amcor introduced its AmPrima® range of recycle-ready flexible packaging for bakery products, which offers up to 82% lower carbon footprint compared to conventional packaging and resists moisture to maintain a 12-month shelf life for bread products.

Market Trends:

Increasing Adoption of Smart and Functional Packaging Solutions:

Smart packaging technologies represent a significant trend in the bakery flexible packaging market. Brands incorporate features such as QR codes, freshness indicators, and tamper-evident seals to enhance consumer engagement and ensure product safety. It allows consumers to access product information, origin details, and usage instructions directly through packaging. Functional packaging, including resealable zippers and easy-open systems, improves convenience and helps preserve the quality of baked goods. These innovations respond to rising consumer expectations for both safety and user experience. The integration of intelligent features elevates brand differentiation in a crowded marketplace.

- For instance, Burford’s TCS-400M Tape Closure System can seal up to 70 bags per minute while providing resealable, tamper-evident closures used by leading bakeries.

Advancements in Sustainable and Aesthetic Packaging Designs:

Sustainable design remains at the forefront of the bakery flexible packaging market, with strong demand for recyclable, compostable, and minimal-material solutions. It drives the development of bio-based films and inks, as well as packaging formats that reduce overall plastic usage. Brands invest in visually appealing packaging with clear windows, matte finishes, and customized prints to capture consumer attention and support premium product positioning. The focus on aesthetics and sustainability aligns with growing consumer values and environmental awareness. Packaging suppliers collaborate closely with bakeries to deliver innovative formats that support both branding and eco-friendly commitments. The ongoing evolution in material science and graphic design continues to shape product presentation and market success.

- For instance, by the end of 2023, Lotus Bakeries saved 555 metric tonnes of packaging in a single year due to material optimization implemented across their products.

Market Challenges Analysis:

Navigating Regulatory Pressures and Compliance Costs:

Regulatory requirements present a persistent challenge for the bakery flexible packaging market. Governments worldwide enforce stricter rules on packaging materials, recycling, and food safety. It raises compliance costs for manufacturers and requires frequent updates to packaging designs and processes. Meeting global and regional regulations can create complexity in supply chains, especially for companies operating in multiple markets. Small and medium-sized bakeries often struggle to allocate resources for regulatory adaptation. The industry must consistently monitor and respond to evolving standards to avoid disruptions.

Addressing Material Costs and Supply Chain Volatility:

Fluctuating raw material prices impact the profitability of the bakery flexible packaging market. Prices for key inputs, such as polymers, paper, and specialty films, often fluctuate due to global supply and demand dynamics. It makes long-term cost planning difficult for manufacturers and can affect pricing strategies. Supply chain disruptions, such as delays or shortages, further challenge consistent product availability. Companies must invest in supply chain resilience and seek alternatives to traditional materials. Sustaining innovation while managing cost pressures remains a core challenge for the sector.

Market Opportunities:

Expansion into Emerging Markets and Untapped Consumer Segments:

Emerging markets present strong growth prospects for the bakery flexible packaging market. Rapid urbanization, rising disposable incomes, and changing dietary habits drive demand for packaged bakery products in Asia-Pacific, Latin America, and Africa. It enables global and regional brands to introduce innovative packaging formats tailored to local preferences. Untapped segments, such as health-conscious consumers and those seeking premium bakery products, offer new avenues for product differentiation. Companies that adapt packaging to local tastes and convenience requirements gain a competitive edge. The ongoing expansion of modern retail infrastructure in these regions accelerates packaging adoption.

Leveraging Technological Advancements for Product Innovation:

Technological advancements create new opportunities for the bakery flexible packaging market to deliver value-added solutions. Developments in smart packaging, such as freshness indicators and interactive labels, enhance product safety and consumer experience. It supports the use of sustainable materials and advanced printing techniques for high-impact branding. Automation in packaging lines increases efficiency and reduces costs, allowing for greater customization and flexibility. Companies investing in technology can quickly respond to shifting market trends and regulatory demands. Strategic partnerships with material suppliers and technology providers further strengthen the innovation pipeline.

Market Segmentation Analysis:

By Material:

The bakery flexible packaging market categorizes materials into plastic, paper, aluminum foil, and bio-based films. Plastic materials, such as polyethylene and polypropylene, dominate due to their flexibility, cost-effectiveness, and strong barrier properties. Paper-based packaging gains momentum with rising demand for recyclable and compostable formats. Aluminum foil appeals for its ability to protect against light, moisture, and oxygen, supporting specialty bakery applications. Bio-based films represent a fast-growing segment, supported by regulatory pressure and sustainability goals.

- For instance, Grupo Bimbo achieved a reduction of 272 tons in the packaging weight for its Hamburger Bread in the U.S. market in 2023, highlighting a significant resource efficiency through plastic packaging optimization.

By Application:

Key applications include bread, cakes and pastries, cookies and biscuits, and snack bars. Bread holds the largest share, driven by high consumption and the need for moisture-resistant packaging. Cakes and pastries require packaging that preserves freshness and prevents contamination, while cookies and biscuits benefit from resealable pouches and portion packs. Snack bars represent a dynamic segment, with flexible packaging enabling easy transport, shelf appeal, and portion control for health-conscious consumers.

By End-Use:

Retail, foodservice, and industrial bakeries are the primary end-use sectors. Retail leads demand for branded, shelf-ready packaging that combines visual appeal with functional benefits. Foodservice operators prioritize bulk packaging formats that support storage efficiency and quick service. Industrial bakeries focus on high-speed, automated packaging solutions to ensure product consistency and cost control. The bakery flexible packaging market serves diverse requirements across all end-use categories.

- For instance, Econo-Pak operates over 200 automated packaging machines in its 240,000 square-foot facility, providing large-scale bulk flexible packaging services that enable foodservice clients to fulfill high-volume, rapid-turnaround requirements.

Segmentations:

By Material:

- Plastic (Polyethylene, Polypropylene, PET)

- Paper

- Aluminum Foil

- Bio-based Films

By Application:

- Bread

- Cakes & Pastries

- Cookies & Biscuits

- Snack Bars

By End-Use:

- Retail

- Foodservice

- Industrial Bakeries

By Printing Process:

- Flexography

- Rotogravure

- Digital Printing

- Offset Printing

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America commands 34% of the global bakery flexible packaging market, driven by a mature bakery sector and robust packaging innovations. The United States leads in both consumption and packaging technology adoption, supporting rapid shifts toward sustainable and convenient formats. It benefits from extensive retail networks, a dynamic foodservice industry, and ongoing investments in research and development. Leading manufacturers collaborate with major bakery brands to launch new packaging formats that enhance shelf life and product safety. The region responds quickly to consumer trends such as clean-label and eco-friendly packaging, supported by regulatory alignment. Canada and Mexico contribute to steady growth with their own investments in bakery production and flexible packaging capabilities.

Europe :

Europe holds a 29% share of the bakery flexible packaging market, supported by strong regulatory oversight and a well-established artisanal bakery tradition. Countries such as Germany, France, and the United Kingdom set high standards for sustainable materials and food safety. It encourages packaging suppliers to innovate with recyclable films, compostable solutions, and visually distinct formats. The region’s focus on premium and specialty bakery products drives demand for high-quality, customizable packaging. Retailers and bakeries adapt quickly to shifts in consumer values, placing sustainability and convenience at the forefront of product development. European firms benefit from integrated supply chains and a culture of continuous improvement.

Asia-Pacific :

Asia-Pacific holds 22% of the bakery flexible packaging market and records the highest growth rate among major regions. The rapid expansion of urban centers, rising disposable incomes, and increased demand for packaged foods underpin the region’s momentum. China, India, and Japan lead in bakery product innovation and flexible packaging adoption. It creates opportunities for both global and local manufacturers to expand their presence with tailored packaging solutions. Modern retail infrastructure and e-commerce platforms accelerate product accessibility and distribution. Investments in automation and smart packaging technologies further strengthen Asia-Pacific’s role in shaping future market trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Huhtamaki Group

- Graphic Packaging Holding Company

- Vipac Packaging

- WestRock Company

- Constantia Flexibles Group GmbH

- Tetra Pak International S.A.

- Sealed Air Corporation

- Berry Group, Inc.

- Sonoco Products Company

- Smurfit Kappa Group plc

- Mondi Group

Competitive Analysis:

The bakery flexible packaging market features a highly competitive landscape shaped by global leaders and specialized regional suppliers. Key companies such as Huhtamaki Group, Graphic Packaging Holding Company, Vipac Packaging, WestRock Company, Constantia Flexibles Group GmbH, and Tetra Pak International S.A. drive innovation and set industry standards. It sees frequent advancements in sustainable materials, barrier technologies, and custom printing, as firms seek to differentiate through technical expertise and customer service. Strategic acquisitions and partnerships remain central to expanding product portfolios and market presence. Companies compete on product quality, speed to market, and the ability to meet strict regulatory and sustainability demands. Strong collaboration between packaging manufacturers and bakery brands fosters the rapid introduction of market-specific solutions. The competitive environment encourages continuous improvement and investment in R&D, with a clear focus on eco-friendly and value-added packaging options.

Recent Developments:

- In July 2025, Huhtamaki launched new compostable ice cream cups that are both home and industrially compostable as well as recyclable.

- In May 2025, Graphic Packaging International introduced a new portfolio of paperboard sushi packaging for the European foodservice sector.

- In May 2025, Constantia Flexibles, in collaboration with Delica AG (Migros Industrie), launched EcoVerHighPlus, a next-generation mono PP laminate for coffee packaging.

Market Concentration & Characteristics:

The bakery flexible packaging market features moderate market concentration, with several global players holding significant shares alongside a competitive landscape of regional and local suppliers. Leading companies drive innovation in material science, barrier technologies, and sustainable solutions, influencing market standards and trends. It exhibits strong collaboration between packaging producers and bakery brands to develop customized formats that meet evolving consumer demands. The market is characterized by continuous product development, rapid adoption of automation, and increasing focus on eco-friendly materials. Regulatory pressures and shifting consumer preferences shape both competitive strategies and product portfolios. The industry maintains a dynamic environment, balancing established players with emerging entrants and niche specialists.

Report Coverage:

The research report offers an in-depth analysis based on Material, Application, End-Use, Printing Process and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Companies will expand investment in bio-based, compostable, and recyclable materials to align with evolving environmental regulations.

- Intelligent packaging solutions with freshness sensors will gain wider adoption to enhance food safety and traceability.

- Brands will integrate QR codes and augmented reality labels to engage consumers with product details and brand stories.

- Manufacturers will drive efficiency through automation and smart manufacturing systems, reducing production costs and lead times.

- Suppliers will develop barrier-grade films that deliver extended shelf life for artisanal and premium bakery products.

- Retailers will introduce more branded formats featuring customized designs and premium finishes to attract shelf attention.

- E-commerce platforms will prompt demand for robust packaging that can resist handling stresses and maintain visual appeal.

- Regional players in Asia-Pacific and Latin America will penetrate markets by adapting formats to local preferences and price sensitivity.

- Partnerships between packaging innovators and bakeries will accelerate co-development of market-specific solutions.

- Standards organizations will promote circular economy models, encouraging film recycling infrastructure and packaging recovery programs.