Market Overview:

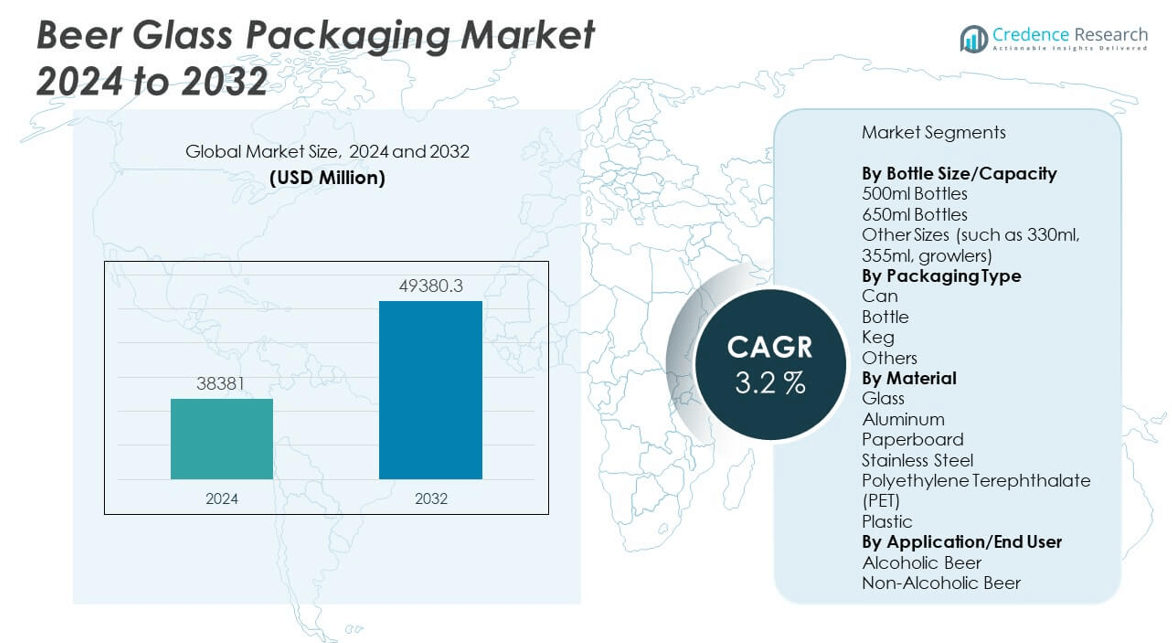

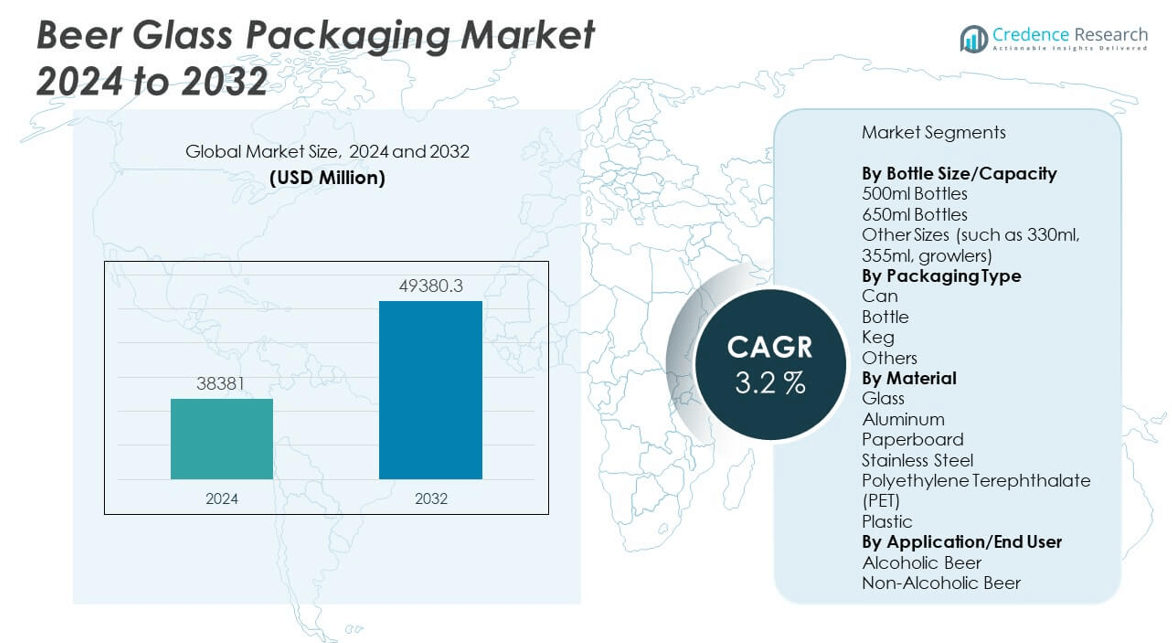

The Beer Glass Packaging Market is projected to grow from USD 38,381 million in 2024 to an estimated USD 49,380.3 million by 2032, with a compound annual growth rate (CAGR) of 3.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Beer Glass Packaging Market Size 2024 |

USD 38,381 million |

| Beer Glass Packaging Market, CAGR |

3.2% |

| Beer Glass Packaging Market Size 2032 |

USD 49,380.3 million |

The growth of the Beer Glass Packaging Market is driven by increasing global beer consumption, especially premium and craft variants that emphasize presentation and quality. Consumers are showing a strong preference for sustainable, recyclable packaging, and glass bottles align well with this demand. Moreover, manufacturers are leveraging glass packaging to preserve the flavor and freshness of beer, ensuring product differentiation. The rising demand for alcohol-free and flavored beer has also contributed to diversified packaging needs, fueling innovation in design, size, and labeling within the glass packaging segment.

Regionally, Europe dominates the beer glass packaging market due to its deep-rooted beer culture and presence of major breweries across Germany, Belgium, and the Czech Republic. North America follows closely, with a thriving craft beer industry that prioritizes premium packaging aesthetics. Meanwhile, Asia Pacific is emerging as a fast-growing region, driven by expanding urban populations, changing consumption patterns, and rising disposable incomes in countries like China and India. Latin America and parts of Africa are witnessing moderate growth, supported by increasing brand penetration and a shift toward branded beer consumption.

Market Insights:

- The Beer Glass Packaging Market is projected to grow from USD 38,381 million in 2024 to USD 49,380.3 million by 2032, registering a CAGR of 3.2% during the forecast period.

- Rising demand for premium and craft beers is encouraging brands to invest in custom-designed and visually appealing glass packaging.

- Sustainability concerns and the recyclability of glass are pushing manufacturers and consumers toward glass over plastic or metal alternatives.

- High production costs, energy-intensive manufacturing, and transportation challenges are limiting scalability in price-sensitive regions.

- Europe leads the market due to its strong brewing culture and advanced recycling infrastructure, followed by North America with significant craft beer activity.

- Asia Pacific is emerging rapidly, driven by increasing urbanization, disposable income, and evolving social drinking habits.

- Regulatory initiatives promoting eco-friendly packaging continue to support growth, especially in regions with strict environmental mandates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Premiumization and Growing Global Demand for Craft Beer are Fueling Packaging Innovations

The Beer Glass Packaging Market is experiencing steady growth due to the increasing consumer inclination toward premium and craft beer products. Breweries are focusing on distinctive packaging to communicate quality and uniqueness, encouraging a shift toward custom-designed glass bottles. Craft beer producers rely on attractive packaging to differentiate from mass-market offerings, which elevates demand for specialized glass containers. The rising consumer willingness to spend on high-end beverages enhances the market’s value. It benefits from brand storytelling enabled through elegant, embossed, or colored glass bottles. Consumers often associate glass packaging with purity and freshness, reinforcing its importance in premium segments. Growing urbanization and social drinking culture also sustain the demand for aesthetically appealing beer packaging.

- Companies such as Verallia Group, O-I Glass Inc., and Ardagh Group have introduced custom-designed bottles featuring advanced embossing, textured finishes, and a wide range of shapes and color gradients, specifically responding to craft breweries’ branding needs

Sustainability Concerns are Prompting a Shift Toward Recyclable Glass Solutions

Environmental awareness among both consumers and manufacturers is driving the adoption of eco-friendly glass packaging in the Beer Glass Packaging Market. Glass is 100% recyclable without loss of quality, making it a preferred material for sustainable branding. Governments and regulatory bodies encourage industries to reduce plastic usage, which boosts the demand for glass containers. It helps companies align with ESG goals and attract environmentally conscious consumers. Glass bottles support circular economy practices, enhancing their value in a competitive landscape. Beer producers are also launching refillable glass initiatives to minimize environmental footprints. Regulatory pressures on carbon emissions and landfill reduction favor the use of returnable and reusable packaging systems.

Brand Differentiation and Visual Shelf Impact are Increasing the Use of Custom Glass Packaging

Brands aim to enhance visibility and recognition through packaging, which fuels the demand for customized glass bottles in the Beer Glass Packaging Market. Glass enables unique shapes, embossing, and labeling that plastic or cans cannot offer with the same visual appeal. It helps manufacturers convey heritage, exclusivity, and product story through packaging design. In competitive retail environments, shelf impact influences consumer decisions, making packaging a powerful marketing tool. Premium glass designs increase perceived value and brand recall. It allows craft and mainstream beer producers to target specific demographics with niche aesthetics. Personalized and seasonal packaging campaigns attract attention and stimulate purchases.

Flavor Preservation and Extended Shelf Life are Reinforcing the Preference for Glass

Glass provides an impermeable barrier that prevents oxygen and moisture from affecting the beer’s quality, which is critical in the Beer Glass Packaging Market. It helps maintain carbonation, taste, and aroma longer than most alternatives. Unlike plastics and metals, glass does not interact chemically with its contents, ensuring product integrity. Breweries consider it an ideal material for storage and distribution of sensitive formulations. Health-conscious consumers prefer non-reactive materials, which improves the market position of glass packaging. It also supports unpasteurized and live-fermentation beer styles requiring protection from contaminants. The neutral nature of glass helps premium brands safeguard flavor, making it the go-to choice for longer shelf life.

- For example, Beatson Clark produces high-quality glass containers that offer excellent barrier protection against moisture and oxygen, helping preserve the integrity and freshness of products during extended storage and transport. Known for serving the craft beer industry, the company uses precision manufacturing processes to ensure consistency, durability, and compatibility with various filling and capping systems.

Market Trends:

Smart Packaging Integration is Transforming Consumer Engagement and Product Tracking

The Beer Glass Packaging Market is witnessing a gradual rise in the adoption of smart technologies such as QR codes and NFC tags. Brands utilize these tools to deliver interactive content, authenticity verification, and promotional offers. It enables consumers to connect with brand stories through digital touchpoints on the glass bottle. Track-and-trace features also enhance supply chain visibility, helping reduce counterfeiting risks. Smart packaging allows breweries to collect user data and personalize marketing campaigns effectively. It supports regulatory compliance through tamper-evident features embedded in the packaging. The growing convergence of physical and digital experiences makes glass packaging a key platform for innovation. Interactive packaging appeals to tech-savvy customers and increases brand loyalty.

- For instance, RASTAL Smartglass® integrates NFC chips directly into the glass, enabling consumers to access product details, promotional offers, and interactive content by tapping smartphones on the bottle.

Emergence of Limited Editions and Collectible Packaging as Promotional Strategies

Brands are leveraging limited-edition designs and collectible beer glass packaging to create buzz and boost sales in the Beer Glass Packaging Market. Seasonal releases, event-based promotions, and collaborations with artists elevate packaging aesthetics. It helps create a sense of urgency and exclusivity, encouraging immediate consumer response. Limited-run packaging often becomes memorabilia, enhancing brand association and retention. This strategy supports direct-to-consumer and e-commerce sales, where visuals play a pivotal role. It contributes to social media engagement, as consumers share and discuss unique bottle designs. Breweries treat packaging not just as a container but as a collectible asset. This growing focus on exclusivity increases design investments and production flexibility.

- For example, Newell Brands’ Ball® 140th Anniversary Jar, which incorporates ornate embossing reminiscent of designs from the 1880s. The collector’s jar campaign resulted in an unprecedented sell-out within three weeks of limited production, as verified through company documentation.

Rising Influence of E-commerce is Reshaping Packaging Formats and Durability Standards

The expansion of online alcohol sales is pushing companies to design more durable and shipping-friendly glass packaging in the Beer Glass Packaging Market. E-commerce platforms require tamper-proof, break-resistant formats to ensure safe last-mile delivery. It compels producers to enhance packaging protection without compromising visual appeal. Compact and lightweight designs gain popularity due to lower shipping costs and better handling. Retail-ready packs tailored for e-commerce improve inventory management and logistics efficiency. The demand for protective secondary packaging adds complexity to the overall packaging system. Brands also develop packaging that maintains product aesthetics upon delivery, ensuring a strong unboxing experience. E-commerce thus plays a pivotal role in redefining packaging priorities and innovations.

Revival of Traditional Bottle Shapes and Retro Designs to Attract Nostalgic Consumers

Heritage-inspired packaging is gaining traction as brands look to revive legacy appeal in the Beer Glass Packaging Market. Retro labels, classic bottle shapes, and vintage branding reconnect consumers with tradition and authenticity. It helps companies tap into emotional branding strategies that resonate across age groups. This trend promotes continuity and heritage storytelling, especially among family-owned breweries. Traditional packaging often aligns with local culture and artisanal values, creating stronger community ties. Brands restore discontinued packaging designs to evoke nostalgia and stimulate engagement. It also appeals to older demographics that prefer familiarity in product presentation. The revival of retro packaging underlines a renewed interest in legacy craftsmanship and identity.

Market Challenges Analysis:

High Energy Consumption and Manufacturing Costs are Constraining Market Scalability

The Beer Glass Packaging Market faces cost-related challenges due to the energy-intensive nature of glass production. Melting raw materials requires high-temperature furnaces, leading to elevated fuel consumption and carbon emissions. It increases the production cost per unit compared to alternative packaging materials. Fluctuating energy prices also make cost forecasting difficult for manufacturers. Glass manufacturing demands substantial infrastructure investments, limiting entry for smaller players. Transporting heavy glass bottles adds to distribution expenses, particularly in export-driven operations. It also elevates breakage risks and insurance costs across the supply chain. These economic factors hinder mass-scale adoption, especially in price-sensitive markets where affordability is key.

Stringent Regulations and Complex Recycling Infrastructure are Slowing Adoption

Regulatory compliance is a challenge in the Beer Glass Packaging Market, where varying international standards complicate production consistency. Manufacturers must meet packaging weight limits, recycling requirements, and safety regulations that differ across regions. Recycling infrastructure remains underdeveloped in several emerging markets, leading to inefficient glass reuse. It limits the availability of post-consumer recycled glass, increasing dependency on virgin materials. Contamination during sorting processes further reduces recycling effectiveness. Governments often impose packaging levies or container deposit schemes that require administrative overhead. These factors increase operational complexity and restrict smooth market expansion. Regulatory barriers continue to impact supply chain agility and innovation adoption.

Market Opportunities:

Expansion in Developing Economies and Growing Middle-Class Consumption Create Demand

Emerging markets offer significant opportunities for the Beer Glass Packaging Market due to expanding urbanization and rising disposable incomes. Consumers in these regions show increasing interest in premium beverages, supporting demand for glass packaging. It benefits from growing on-premise consumption in bars and restaurants across Asia Pacific and Latin America. Expanding retail chains and alcohol liberalization policies further enable market entry for global beer brands. As consumer lifestyles evolve, glass-packaged beverages are seen as sophisticated choices aligned with aspirational living.

Innovation in Lightweight Glass Bottles and Returnable Systems Enhances Competitiveness

Ongoing R&D in lightweight glass technology opens doors for cost-effective packaging solutions in the Beer Glass Packaging Market. It addresses logistics challenges by reducing material weight without compromising strength. Returnable bottle systems gain traction in regions focused on sustainability, lowering environmental impact and long-term costs. Brands partner with logistics firms to streamline reverse logistics and collection programs. These innovations increase adoption across mid-sized breweries and regional producers seeking scalable, green solutions.

Market Segmentation Analysis:

By Bottle Size/Capacity, In the Beer Glass Packaging Market, the 500ml bottle segment holds a dominant position due to its standard use across global beer brands and suitability for both retail and on-premise consumption. The 650ml bottles serve value-driven markets and are popular in regions with strong demand for shared consumption. Other sizes such as 330ml, 355ml, and growlers cater to niche and craft brewers, providing flexibility in serving styles and packaging appeal.

- For instance, Heineken NV commonly uses the 500ml glass “export bottle” across many European and Asia-Pacific markets, where it serves as a standard format for both retail and on-premise consumption. The company emphasizes glass packaging as a key component of its global distribution strategy, supporting brand consistency and consumer expectations in international markets.

By packaging types, bottles remain the leading format owing to their ability to preserve flavor, support branding, and align with premiumization trends. Cans offer convenience and portability, while kegs continue to serve the hospitality sector efficiently. Others, including innovative or hybrid formats, hold a minor share but contribute to packaging diversity.

By material, glass remains the core component of the Beer Glass Packaging Market, valued for its recyclability and inert nature. Aluminum and PET follow in popularity, especially in multi-material packaging strategies. Paperboard and stainless steel serve niche and sustainable initiatives.

- For example, Stella Artois, a flagship premium brand under AB InBev, maintains its 330ml chalice-style Euro bottle as a global standard for reinforcing its premium positioning. AB InBev highlights the role of glass packaging in preserving beer quality and supporting brand identity, particularly within its premium portfolio.

By application segment, alcoholic beer dominates due to widespread global consumption and traditional packaging standards. Non-alcoholic beer is growing steadily, supported by health-conscious consumers and evolving social trends. It is fostering innovation in packaging design and material selection across both product types.

Segmentation:

By Bottle Size/Capacity

- 500ml Bottles

- 650ml Bottles

- Other Sizes (such as 330ml, 355ml, growlers)

By Packaging Type

By Material

- Glass

- Aluminum

- Paperboard

- Stainless Steel

- Polyethylene Terephthalate (PET)

- Plastic

By Application/End User

- Alcoholic Beer

- Non-Alcoholic Beer

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe dominates the Beer Glass Packaging Market with a market share of 37.5%, driven by its established brewing culture, strong consumer preference for glass-packaged beers, and the presence of major global beer brands. Countries like Germany, Belgium, and the UK maintain high consumption levels, encouraging continuous demand for premium packaging formats. It benefits from advanced recycling systems, supportive sustainability policies, and high packaging quality standards. Traditional glass bottle usage in pubs and restaurants further reinforces the region’s leadership. The regional market remains saturated, yet product innovation and branding continue to attract investments. Strong export activity from European breweries also contributes to consistent packaging demand.

North America holds a 29.4% market share in the Beer Glass Packaging Market, supported by a robust craft beer industry and growing consumer interest in sustainable packaging. The U.S. leads the region with a large number of microbreweries and independent labels that prioritize premium glass containers for brand positioning. It faces high logistics and production costs, but consumer expectations around quality and aesthetics sustain demand. Canada contributes with increasing alcohol liberalization and growing demand for premium beverages. The region shows rising interest in refillable glass systems and eco-certifications. Investments in lightweight glass innovations are further enhancing regional competitiveness.

Asia Pacific accounts for a 23.8% share of the Beer Glass Packaging Market and represents the fastest-growing region. Rapid urbanization, rising disposable income, and shifting social norms in countries like China, India, and Vietnam are driving beer consumption. It gains from an expanding middle class and a younger demographic open to premium, Western-style packaging. Regional breweries are adopting glass to appeal to modern consumer tastes and align with evolving safety and hygiene standards. The region is investing in localized glass manufacturing to meet demand efficiently. Growth is supported by government policies favoring sustainable packaging alternatives over plastic.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Owens-Illinois, Inc. (O-I Glass)

- Ardagh Group S.A.

- Verallia

- Vidrala

- BA Glass

- Orora Packaging

- Consol Glass

- Piramal Glass Private Limited

- Heineken Glass (manufacturing business)

- Vetropack

Competitive Analysis:

The Beer Glass Packaging Market is moderately fragmented, with global and regional players competing across design, sustainability, and cost-efficiency. Companies such as Owens-Illinois Inc., Ardagh Group, Verallia, and Vidrala S.A. hold significant market positions due to their advanced manufacturing capabilities and wide distribution networks. It fosters innovation in bottle design, lightweight solutions, and refillable systems to meet diverse consumer and regulatory demands. Strategic partnerships with breweries and investments in regional production facilities improve responsiveness and cost control. Smaller players compete by offering niche customization and targeting craft beer segments with artisanal packaging solutions.

Recent Developments:

- In March 2025, the Moreira Salles family from Brazil launched a takeover bid for Verallia, aiming to acquire all shares it did not already own at €30 per share, valuing Verallia at €6.1 billion. This deal, which received French regulatory approval in June 2025 and is expected to close by July 25, 2025, ensures Verallia will remain a listed company with no planned job reductions. The transaction is intended to stabilize the company during challenging market conditions in the European beverage sector.

- In July 2025, Ardagh Group marked a breakthrough in sustainable spirits packaging by partnering with Jägermeister to produce the world’s first emerald green bottles using its NextGen hybrid furnace technology at Obernkirchen, Germany. This technology utilizes up to 80% electrical heating and high recycled content, achieving a substantial reduction in the carbon footprint of amber glass, with new green glass expansion targeting similar sustainability gains.

- In July 2024, O-I Glass announced a transformative $150 million investment plan for its historic Alloa, UK plant aimed at significantly enhancing sustainability and technology. The updates include rebuilding an existing furnace and constructing a new one, both designed with state-of-the-art technology such as gas-oxy combustion and a heightened use of renewable energy and recycled glass.

Market Concentration & Characteristics:

The Beer Glass Packaging Market features a balanced mix of established global manufacturers and emerging regional suppliers. It reflects moderate to high market concentration in Europe and North America, where major players dominate production volumes and distribution. Growth in Asia Pacific and Latin America attracts new entrants focusing on regional needs and customized formats. It is characterized by steady innovation, strong environmental focus, and brand-driven design strategies. Demand varies by consumption patterns and distribution channels, with a clear preference for visual appeal, recyclability, and product safety.

Report Coverage:

The research report offers an in-depth analysis based on Bottle Size/Capacity, Packaging Type, Material and Application/End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for sustainable and recyclable packaging materials will continue to shape product innovation and manufacturing strategies across global markets.

- The ongoing global expansion of the craft beer segment will increase the need for distinct, customized, and premium-looking glass bottle packaging formats.

- A growing shift toward refillable and returnable glass systems will influence design optimization and reverse logistics infrastructure development.

- Adoption of smart packaging technologies, including QR codes and NFC features, will improve traceability and consumer interaction across the value chain.

- Rapid urbanization and lifestyle changes in emerging markets such as India, Vietnam, and Brazil will create new growth avenues for glass-packaged beer.

- Premiumization trends in alcoholic beverages will drive demand for decorative, embossed, and colored glass bottles to enhance shelf appeal and brand identity.

- Technological advancements in lightweight glass manufacturing will reduce logistics costs and improve sustainability metrics across distribution networks.

- Expansion of online retail and home delivery services for alcoholic beverages will push the need for impact-resistant and e-commerce-optimized packaging formats.

- Revival of vintage packaging designs and heritage branding will resonate with nostalgic consumers seeking authenticity and emotional connection.

- Government regulations focused on plastic reduction and circular economy targets will reinforce the importance of recyclable glass packaging alternatives.