Market Overview:

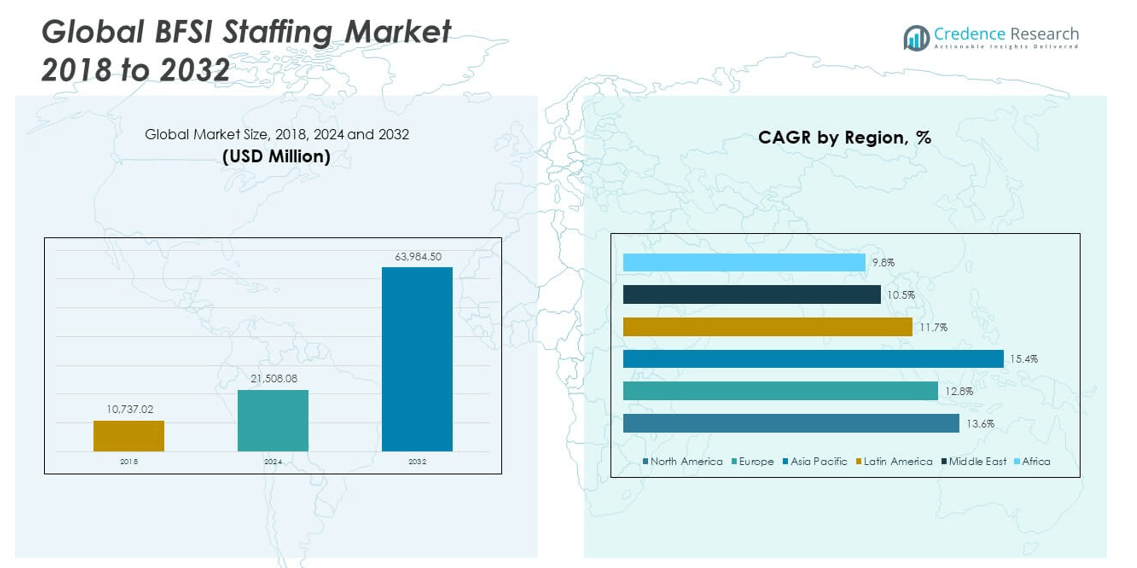

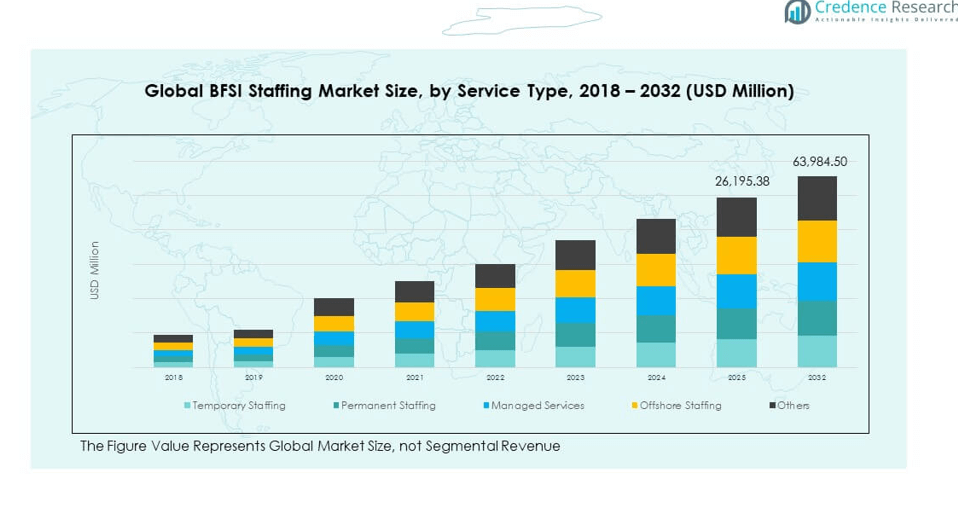

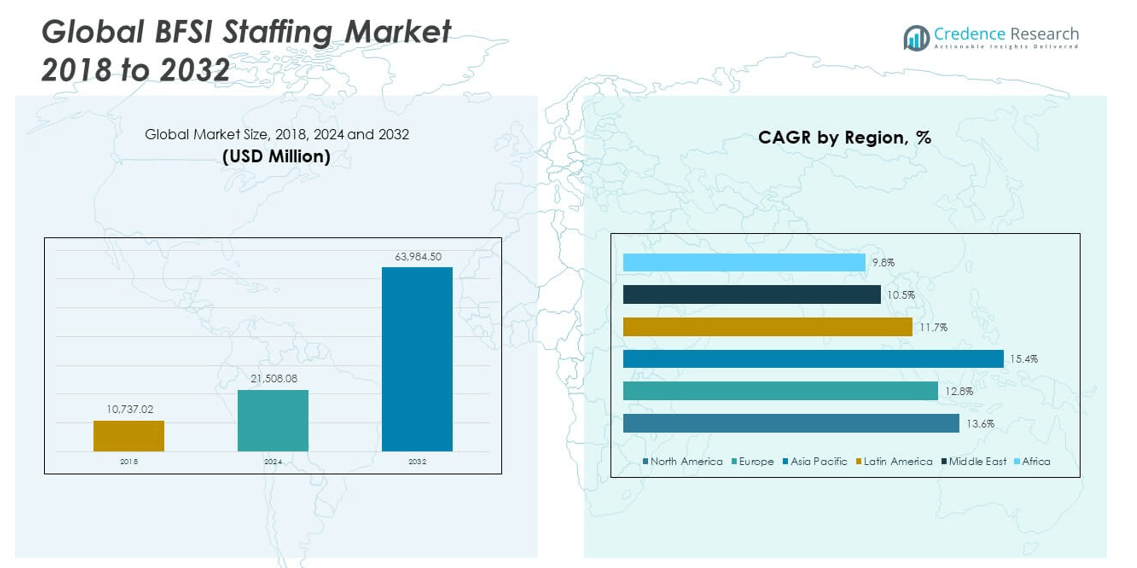

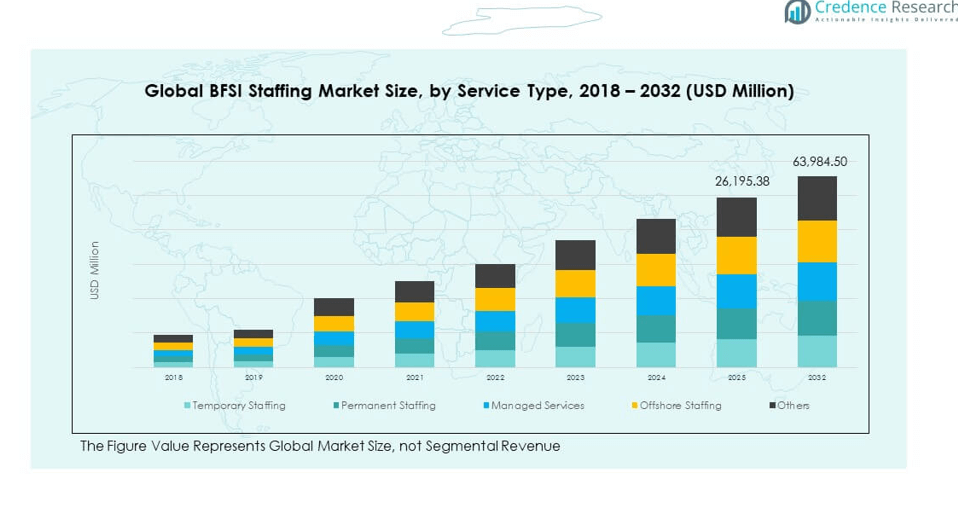

The Global BFSI Staffing Market size was valued at USD 10,737.02 million in 2018 to USD 21,508.08 million in 2024 and is anticipated to reach USD 63,984.50 million by 2032, at a CAGR of 13.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| BFSI Staffing Market Size 2024 |

USD 21,508.08 million |

| BFSI Staffing Market, CAGR |

13.61% |

| BFSI Staffing Market Size 2032 |

USD 63,984.50 million |

The Global BFSI Staffing Market is driven by increasing adoption of advanced technologies, higher regulatory demands, and the growing need for skilled professionals in cybersecurity, compliance, and data analytics. Banks and financial institutions are also expanding digital banking, wealth management, and insurance platforms, creating demand for workforce solutions. Rising competition among firms is pushing them to secure highly skilled talent through staffing agencies. Furthermore, the shift toward flexible and contract-based employment models supports market expansion.

Regionally, North America leads the Global BFSI Staffing Market due to its strong financial services ecosystem, technological advancements, and mature staffing industry. Europe follows closely, supported by regulatory reforms and the presence of global banking hubs. Asia-Pacific is emerging rapidly, driven by digital adoption, economic growth, and increasing fintech activity in countries such as India and China. Latin America and the Middle East are also showing notable potential, as growing financial inclusion initiatives and investments in banking services increase staffing needs.

Market Insights:

- The Global BFSI Staffing Market was valued at USD 10,737.02 million in 2018, reached USD 21,508.08 million in 2024, and is projected to touch USD 63,984.50 million by 2032, growing at a CAGR of 13.61%.

- North America led with a 43.7% share in 2024, driven by its mature financial ecosystem, high compliance staffing needs, and rapid digital banking adoption.

- Europe accounted for 28.2% of the 2024 share, supported by strong financial hubs and strict regulatory frameworks, while Asia Pacific held 20.2% due to its large talent pool and fintech expansion.

- Asia Pacific is the fastest-growing region, projected to expand rapidly on the back of digital transformation, outsourcing demand, and strong financial inclusion initiatives.

- By service type, temporary staffing contributed the largest share in 2024, while managed services showed the fastest growth, reflecting the rising outsourcing of recruitment and workforce management functions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Specialized Talent in Banking, Insurance, and Financial Services:

The Global BFSI Staffing Market benefits strongly from rising demand for specialized professionals across banking, financial services, and insurance sectors. Organizations seek skilled experts in compliance, auditing, and financial risk management to meet stricter regulatory requirements. Growing fintech adoption creates additional demand for specialists in payments, digital platforms, and mobile banking. Staffing agencies play a crucial role in connecting institutions with qualified professionals in short timeframes. They improve efficiency by offering access to trained candidates who can adapt quickly. Talent shortages in finance, technology, and compliance amplify reliance on staffing partners. It positions staffing providers as essential workforce enablers for industry stability. The steady recruitment momentum strengthens the long-term market outlook.

- For instance, JPMorgan Chase has consistently hired compliance officers specialized in Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) requirements to manage regulatory complexity, employing professionals with an average experience tenure of 7+ years to lead compliance programs and mitigate risks effectively. Growing fintech adoption creates additional demand for specialists in payments, digital platforms, and mobile banking.

Digital Transformation Accelerating the Demand for Technology-Driven Roles:

Digital transformation continues to fuel staffing demand in the Global BFSI Staffing Market. Financial institutions prioritize hiring technology professionals for artificial intelligence, blockchain, and automation systems. Cybersecurity specialists and IT consultants are increasingly sought to safeguard digital operations. Staffing agencies respond by expanding technology-focused candidate pools and offering contract-based hiring models. Contract staffing allows firms to remain agile in fast-changing technological landscapes. Institutions benefit from outsourcing recruitment to agencies with expertise in digital skills. It ensures access to talent aligned with rapid financial technology adoption. The ongoing digital shift reinforces the market’s critical role in workforce modernization.

- For example, J.P. Morgan Chase uses its AI-driven COiN (Contract Intelligence) platform that automates legal contract review, significantly reducing review times, and employs blockchain through its JPM Coin for immediate settlements between institutional customers. Cybersecurity specialists and IT consultants are increasingly sought to safeguard digital operations, a need exemplified by the World Bank’s deployment of an AI-powered platform that supports secure innovation across a 30,000-employee base.

Regulatory Complexity Driving Demand for Compliance and Risk Professionals:

Regulatory requirements remain a major driver for the Global BFSI Staffing Market. Financial institutions must meet stringent frameworks covering anti-money laundering, data protection, and risk reporting. This pushes demand for compliance officers, auditors, and legal experts who specialize in financial regulation. Staffing providers supply pre-screened professionals with updated regulatory knowledge. Institutions rely on agencies to reduce training expenses and shorten hiring cycles. The complexity of evolving legal requirements increases pressure to secure talent quickly. It highlights the role of staffing firms as trusted partners in regulatory workforce management. The growing compliance burden ensures sustained demand for staffing services.

Globalization Expanding Cross-Border Workforce Requirements in Financial Institutions:

Globalization drives expansion opportunities in the Global BFSI Staffing Market through cross-border banking and insurance growth. Multinational firms need professionals skilled in international finance and regional regulatory frameworks. Agencies provide multilingual and globally mobile talent to meet these requirements. Shared service centers and offshore banking hubs further accelerate staffing needs. Financial institutions seek project managers, analysts, and compliance experts for international operations. Staffing firms with global networks gain competitive advantages by providing localized solutions. It positions agencies as vital partners in supporting global workforce integration. Expanding international financial activity reinforces market strength across multiple regions.

Market Trends:

Flexible Workforce Models and Growing Demand for Contract Staffing:

The Global BFSI Staffing Market is witnessing significant adoption of flexible workforce models. Financial institutions increasingly prefer contract and project-based staffing over permanent hiring. This trend allows firms to adjust workforce levels quickly during market fluctuations. Agencies providing short-term professionals are gaining preference in the sector. Contract-based models also appeal to professionals seeking flexibility in career choices. Employers benefit from reduced long-term costs and increased adaptability. It positions staffing agencies as key partners in supporting workforce efficiency. The preference for flexibility reinforces the long-term relevance of staffing providers in financial services.

- For instance, Goldman Sachs and Morgan Stanley extensively utilize contract staffing for compliance and risk management roles during regulatory spikes or system migrations, often engaging contract professionals for periods ranging from six to twelve months. Agencies providing short-term professionals are gaining preference in the sector. Contract-based models also appeal to professionals seeking flexibility in career choices.

Artificial Intelligence and Talent Analytics Transforming Recruitment Practices:

Artificial intelligence is reshaping recruitment in the Global BFSI Staffing Market. Staffing firms are implementing AI-driven tools to screen and match candidates more effectively. Automated platforms shorten recruitment cycles and improve accuracy in candidate selection. Predictive analytics provide insights into retention probabilities and workforce planning. Institutions prefer agencies with data-driven recruitment strategies that reduce mismatched hires. It also helps lower overall hiring costs while maintaining talent quality. AI-driven platforms become essential in addressing large-scale staffing demands efficiently. This technology integration highlights the growing role of smart recruitment in financial services.

- For example, the recruitment platform Hirin uses AI to scan over 10,000 resumes overnight, executing advanced video pre-screens and risk assessments that flag high-risk compliance candidates, reducing time-to-hire and enhancing quality. Predictive analytics provide insights into retention probabilities and workforce planning. Institutions prefer agencies with data-driven recruitment strategies that reduce mismatched hires.

Remote Work Adoption Creating Global Access to Skilled Professionals:

The Global BFSI Staffing Market is experiencing expansion due to widespread adoption of remote work models. Financial institutions now offer hybrid or remote roles to access larger talent pools. Staffing agencies adapt by developing digital evaluation and collaboration tools. Employers benefit from lower operational costs and improved access to international candidates. Remote staffing helps institutions attract talent from non-traditional financial hubs. It also supports employee retention through greater flexibility. Agencies expand their reach globally while ensuring compliance with local labor rules. This shift establishes remote staffing as a lasting trend in financial services recruitment.

Diversity, Equity, and Inclusion Becoming Central to Staffing Strategies:

The Global BFSI Staffing Market is aligning strongly with diversity, equity, and inclusion goals. Institutions prioritize building diverse teams to improve innovation and corporate reputation. Staffing agencies focus on sourcing candidates across gender, cultural, and educational backgrounds. Firms seek measurable diversity outcomes when engaging recruitment partners. DEI strategies enhance compliance with global corporate governance standards. It creates long-term opportunities for staffing firms promoting inclusive practices. Agencies offering diversity-focused hiring solutions gain stronger positions with financial clients. This trend establishes inclusive staffing as a competitive advantage in the market.

Market Challenges Analysis:

Intense Competition for Specialized Financial and Technology Professionals:

The Global BFSI Staffing Market faces persistent challenges due to intense competition for limited specialized professionals. Compliance experts, cybersecurity specialists, and data analysts remain in short supply. This shortage increases placement costs and delays hiring timelines for institutions. Staffing firms must invest in larger candidate databases and advanced sourcing strategies. Employers compete aggressively, offering higher salaries to secure rare talent. It creates difficulty for agencies in balancing speed and quality of placements. Retention of top professionals becomes increasingly difficult with rising counter-offers. The talent gap continues to pressure market growth and agency performance.

Rapid Technological Advances Leading to Skill Gaps and Recruitment Barriers:

The Global BFSI Staffing Market also struggles with the impact of rapid technological innovation. Financial institutions demand expertise in blockchain, AI, and cloud-based platforms. Staffing providers face difficulties sourcing professionals with proven skills in these new areas. Continuous training and upskilling programs become necessary to bridge gaps. Smaller firms lack resources to reskill candidates at scale compared to global players. Extended hiring timelines often occur due to mismatched skill availability. Agencies must invest heavily to adapt talent pools for evolving technologies. It highlights the challenge of keeping staffing supply aligned with industry transformation.

Market Opportunities:

Expanding Financial Services in Emerging Economies Increasing Staffing Potential:

Emerging economies create strong growth prospects for the Global BFSI Staffing Market. Rising financial inclusion and adoption of mobile banking create demand for skilled professionals. Institutions seek experts for compliance, customer service, and digital banking operations. Staffing agencies with regional networks can provide quick access to qualified talent. It creates opportunities for firms to align global expertise with local workforce needs. Rural banking expansion adds further demand for tailored staffing solutions. Agencies with adaptable service models gain long-term contracts in these regions. Growth in financial penetration strengthens staffing potential across developing markets.

Outsourcing Recruitment Services Enhancing Efficiency and Cost Savings for Institutions:

Outsourcing is becoming a strong opportunity driver for the Global BFSI Staffing Market. Financial institutions increasingly delegate recruitment processes to specialized agencies. It allows them to focus on core operations while reducing hiring costs. Staffing firms gain contracts covering IT, compliance, and customer support roles. Agencies offering end-to-end recruitment solutions secure consistent long-term demand. Outsourcing also minimizes risks associated with mismatched hiring. Institutions benefit from faster placements and broader talent coverage. This trend reinforces staffing providers as strategic partners for financial sector efficiency.

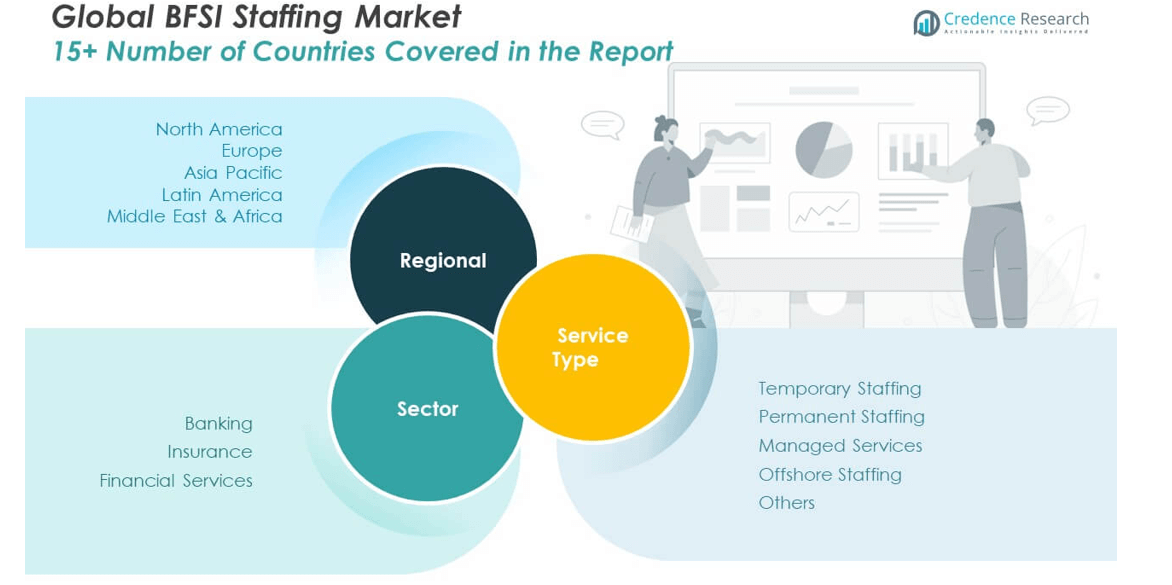

Market Segmentation Analysis:

By Service Type

The Global BFSI Staffing Market shows diverse growth across service type categories. Temporary staffing leads the market due to rising demand for flexibility and project-based hiring in financial institutions. Permanent staffing retains a strong share, driven by the need for leadership roles and regulatory-focused positions. Managed services expand quickly as banks and insurers outsource recruitment and workforce management to reduce costs and improve efficiency. Offshore staffing gains momentum in Asia Pacific, where abundant talent pools support IT, compliance, and customer service operations. Other service types, such as niche advisory staffing, provide specialized expertise to address emerging workforce gaps. It highlights the balance between flexibility, cost efficiency, and specialized knowledge shaping staffing preferences.

- For instance, a regional accounting firm hires temporary tax specialists and administrative staff during tax season to manage peak workloads without overwhelming permanent personnel. Permanent staffing retains a strong share, driven by the need for leadership roles and regulatory-focused positions. Managed services expand quickly as banks and insurers outsource recruitment and workforce management to reduce costs and improve efficiency.

By Sector

The Global BFSI Staffing Market is segmented into banking, insurance, and financial services, with each showing distinct drivers. Banking represents the largest sector, fueled by digital transformation, regulatory pressures, and expansion of retail and corporate banking. Insurance staffing grows steadily, supported by rising demand for risk assessment, claims management, and actuarial roles. Financial services, including wealth management and investment advisory, record strong momentum due to expanding fintech platforms and global capital markets. Staffing agencies play a key role in supplying skilled professionals across compliance, technology, and customer engagement. It reinforces the sectoral balance that ensures steady growth across all categories within the market.

- For example, Citigroup and Barclays regularly recruit contract investment analysts and model validators to address regulatory impacts on product lines, while UBS and Credit Suisse rely on contract hires for internal auditors and SOX compliance leads. Insurance staffing grows steadily, supported by rising demand for risk assessment, claims management, and actuarial roles. In the insurance sector, companies adopt extensive data mining and statistical tools for underwriting and risk profiling, supported by specialized staffing agencies.

Segmentation:

- By Service Type

- Temporary Staffing

- Permanent Staffing

- Managed Services

- Offshore Staffing

- Others

- By Sector

- Banking

- Insurance

- Financial Services

- By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Global BFSI Staffing Market size was valued at USD 4,738.68 million in 2018 to USD 9,394.84 million in 2024 and is anticipated to reach USD 28,025.53 million by 2032, at a CAGR of 13.6% during the forecast period. North America accounted for 43.7% of the global market in 2024. The region benefits from a mature financial services ecosystem and strong adoption of advanced staffing models. Institutions rely heavily on staffing firms to address talent shortages in compliance, risk management, and technology. Growth in digital banking and fintech creates rising demand for cybersecurity and IT professionals. Staffing agencies in the U.S. and Canada leverage AI-driven recruitment platforms to accelerate placements. Mexico is also contributing through increasing banking penetration and service outsourcing. The market remains highly competitive, with global players dominating contract and managed staffing solutions.

Europe

The Europe Global BFSI Staffing Market size was valued at USD 3,141.22 million in 2018 to USD 6,072.43 million in 2024 and is anticipated to reach USD 17,041.16 million by 2032, at a CAGR of 12.8% during the forecast period. Europe represented 28.2% of the global market in 2024. The region benefits from robust financial hubs in the UK, Germany, and France. Demand for staffing services is driven by regulatory frameworks such as MiFID II and GDPR. Institutions prioritize compliance and data protection, fueling recruitment of legal and auditing professionals. Remote and hybrid staffing models have gained momentum across Europe, enhancing workforce flexibility. Growth in Eastern Europe adds opportunities for outsourcing and shared service centers. Staffing firms are aligning with diversity and inclusion goals, strengthening their partnerships with European institutions. It continues to remain one of the most structured regional markets.

Asia Pacific

The Asia Pacific Global BFSI Staffing Market size was valued at USD 1,999.60 million in 2018 to USD 4,352.57 million in 2024 and is anticipated to reach USD 14,717.01 million by 2032, at a CAGR of 15.4% during the forecast period. Asia Pacific contributed 20.2% of the global market in 2024. Rapid economic growth, fintech expansion, and rising digital banking adoption drive regional demand. Countries like India and China dominate due to their large talent base and outsourcing capabilities. Staffing firms benefit from high demand for technology roles and customer service functions. Japan, South Korea, and Australia also contribute significantly through innovation-led financial ecosystems. Regional staffing companies partner with global firms to meet large-scale workforce requirements. It remains the fastest-growing region, supported by expanding financial inclusion and rising investment in BFSI infrastructure.

Latin America

The Latin America Global BFSI Staffing Market size was valued at USD 473.75 million in 2018 to USD 936.37 million in 2024 and is anticipated to reach USD 2,442.66 million by 2032, at a CAGR of 11.7% during the forecast period. Latin America accounted for 4.3% of the global market in 2024. The region is gradually expanding its staffing demand due to increasing banking and insurance penetration. Brazil and Mexico lead in workforce adoption, supported by growing financial services activity. Institutions face rising demand for compliance experts to address local regulatory shifts. Staffing firms also support outsourcing functions such as call centers and back-office operations. Smaller countries are witnessing adoption of digital banking, creating opportunities for staffing agencies. It highlights the growing importance of flexible and contract-based models in emerging economies.

Middle East

The Middle East Global BFSI Staffing Market size was valued at USD 241.11 million in 2018 to USD 431.23 million in 2024 and is anticipated to reach USD 1,026.92 million by 2032, at a CAGR of 10.5% during the forecast period. The Middle East represented 2.0% of the global market in 2024. Growth is supported by financial hubs in the UAE, Saudi Arabia, and Israel. Institutions seek staffing support in compliance, Islamic banking, and digital platforms. The region benefits from foreign investments that drive hiring in multinational banks. Staffing firms with expertise in bilingual and culturally aligned professionals gain an advantage. Expansion of fintech and digital wallets is creating additional staffing requirements. It positions the Middle East as a rising yet competitive market for BFSI staffing.

Africa

The Africa Global BFSI Staffing Market size was valued at USD 142.66 million in 2018 to USD 320.64 million in 2024 and is anticipated to reach USD 731.22 million by 2032, at a CAGR of 9.8% during the forecast period. Africa held 1.5% of the global market in 2024. Growth is fueled by financial inclusion initiatives across South Africa, Nigeria, and Egypt. Expansion of mobile banking and microfinance drives staffing demand for customer service and compliance roles. Institutions are gradually adopting outsourcing partnerships to address local workforce gaps. Staffing firms focus on cost-effective solutions to penetrate underserved markets. The region faces challenges with skill shortages and infrastructure limitations. It continues to offer long-term opportunities as digital banking adoption spreads widely across rural areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Adecco Group

- Allegis Group

- CSS Professional Staffing Group

- Randstad

- Eastridge Workforce Solutions

- E-Solutions

- Hays PLC

Competitive Analysis:

The Global BFSI Staffing Market is highly competitive with a mix of multinational firms and regional providers. Large players such as Adecco, Randstad, and Allegis Group dominate due to their global networks, advanced technology platforms, and diversified service offerings. Mid-sized firms compete by specializing in niche segments like compliance, IT staffing, and managed services. It shows a clear focus on innovation, with agencies adopting AI-based recruitment, predictive analytics, and remote staffing solutions to strengthen market presence. Intense competition encourages partnerships, acquisitions, and regional expansions to secure wider coverage. Smaller firms leverage local knowledge and industry-specific expertise to remain relevant. Competitive intensity remains high, pushing companies to differentiate through customized services and strategic investments.

Recent Developments:

- In March 2025, the Adecco Group launched a new company powered by Salesforce as part of a strategic partnership that aims to integrate human and digital talent seamlessly. This new venture will help organizations build workforces where humans and AI agents coexist and thrive, leveraging data and digital labor platforms to optimize workforce planning and task distribution between humans and AI.

- On September 5, 2025, Allegis Global Solutions announced hosting a panel on redefining talent acquisition for agility and growth at the HRO Today’s 2025 Talent Acquisition Summit. The company continues to emphasize strategic partnerships and innovative recruitment solutions geared towards adapting to shifting business needs, positioning itself as a leader in global workforce solutions.

- Randstad formed a strategic partnership with Workday in February 2025 to revolutionize talent acquisition by combining Workday’s AI-powered Recruiting Agent with Randstad’s extensive talent network. This partnership aims to improve hiring processes, expand access to qualified professionals, and leverage AI for smart matching and workflow integration.

- In February 2025, Eastridge Workforce Solutions divested its Workforce Management and Technology Divisions to Workwell Group to sharpen focus on core staffing competencies. This acquisition strengthens Workwell’s North American presence and enhances its client base and revenue growth within human capital management and Employer of Record services.

- E-Solutions entered a strategic joint venture with Corporate Information Systems (CIS) in December 2023, combining CIS’s recruitment expertise in advanced technologies with E-Solutions’ workforce management capabilities spread across multiple countries. This partnership enhances E-Solutions’ technology-driven workforce solutions providing clients a competitive edge.

- Hays PLC announced a strategic global technology partnership with Cognizant in July 2024. This deal entails Cognizant managing Hays’ IT operations worldwide, focusing on transforming IT infrastructure to enhance operational efficiency, customer experience, and agility in delivering recruitment services globally.

Report Coverage:

The research report offers an in-depth analysis based on service type and sector. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for contract staffing will expand with workforce flexibility needs.

- AI-driven recruitment platforms will shape faster and more accurate placements.

- Banking sector will remain the largest contributor to staffing demand.

- Insurance staffing will grow through actuarial, claims, and compliance roles.

- Offshore staffing will gain traction in Asia Pacific for cost efficiency.

- Diversity and inclusion hiring practices will become a global standard.

- Regulatory complexity will sustain demand for compliance professionals.

- Digital banking expansion will drive IT and cybersecurity staffing.

- Emerging markets will offer strong growth potential through financial inclusion.

- Partnerships and acquisitions will strengthen global service portfolios.