Market Overview:

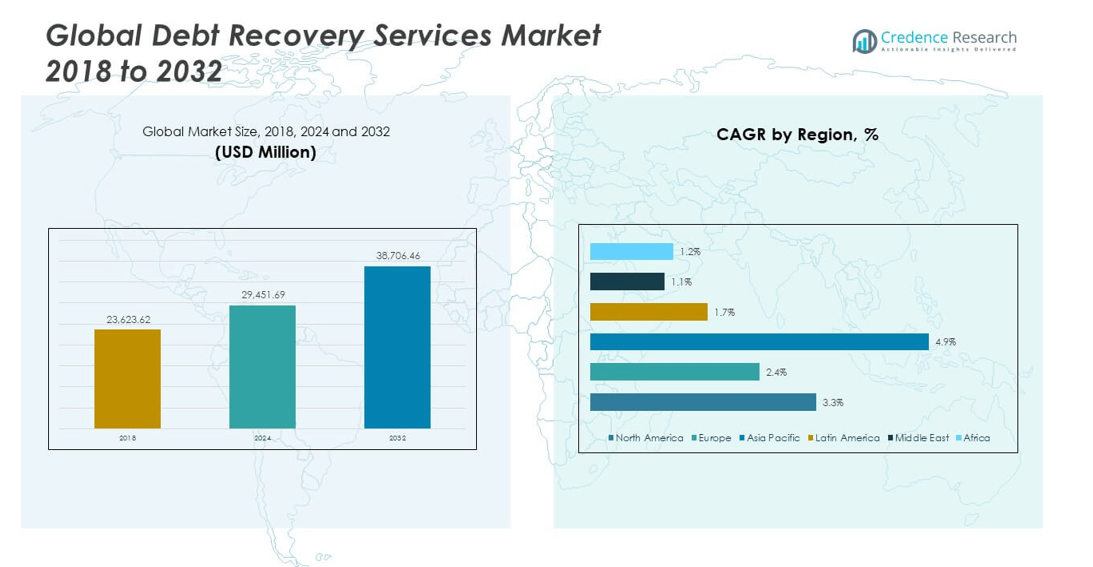

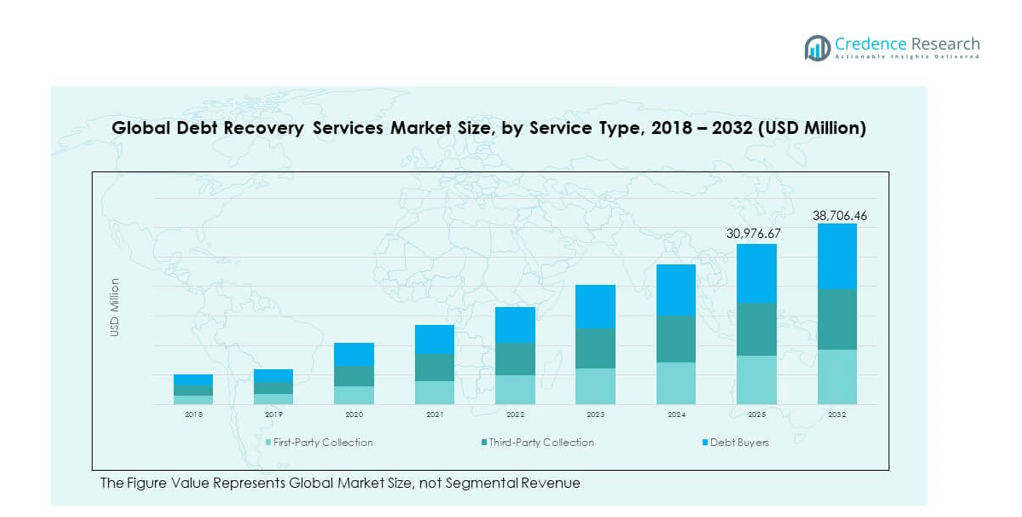

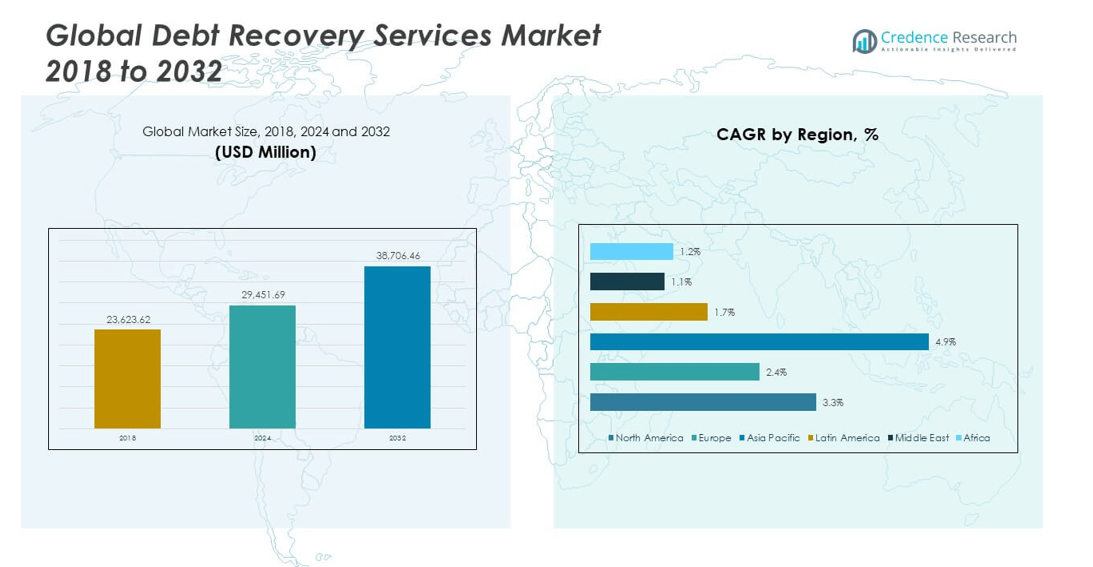

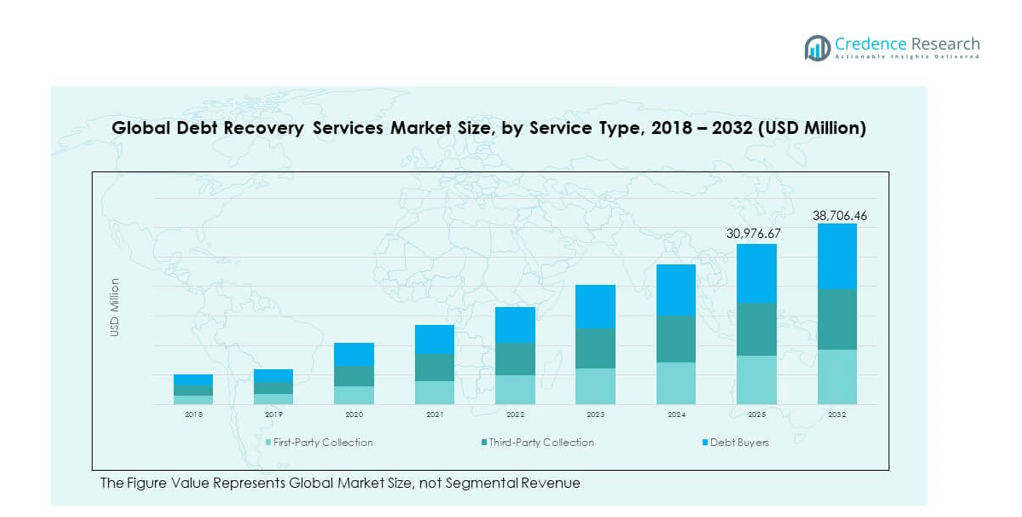

The Global Debt Recovery Services Market size was valued at USD 23,623.62 million in 2018 to USD 29,451.69 million in 2024 and is anticipated to reach USD 38,706.46 million by 2032, at a CAGR of 3.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Debt Recovery Services Market Size 2024 |

USD 29,451.69 million |

| Debt Recovery Services Market, CAGR |

3.23% |

| Debt Recovery Services Market Size 2032 |

USD 38,706.46 million |

The market growth is driven by the increasing demand for effective debt collection solutions across industries. Rising levels of consumer and corporate debt, coupled with regulatory pressures, have encouraged financial institutions and businesses to adopt professional recovery services. Companies also seek to maintain cash flow stability and reduce bad debt risks, which fuels the adoption of third-party recovery agencies. Additionally, the growing integration of digital tools, predictive analytics, and AI-driven collection platforms enhances recovery rates, reduces operational costs, and supports more transparent communication between agencies and debtors, further boosting market expansion.

Regionally, North America leads the market due to its established financial sector, strong regulatory framework, and widespread use of credit-based systems. Europe follows with steady growth, driven by robust financial institutions and legal enforcement processes. The Asia-Pacific region is emerging as a significant growth hub, supported by rising consumer borrowing, expanding business credit lines, and increasing adoption of digital recovery platforms in countries like China and India. Meanwhile, Latin America and the Middle East are gradually strengthening their positions, driven by evolving credit markets and the rising demand for structured recovery systems.

Market Insights:

- The Global Debt Recovery Services Market was valued at USD 23,623.62 million in 2018, reached USD 29,451.69 million in 2024, and is projected to hit USD 38,706.46 million by 2032, growing at a CAGR of 3.23%.

- North America accounted for 43.27% of the 2024 share, Europe held 26.81%, and Asia Pacific captured 20.14%, supported by strong financial systems, consumer credit adoption, and regulated debt collection practices.

- Asia Pacific emerged as the fastest-growing region with a 20.14% share in 2024, driven by rising middle-class borrowing, digital adoption, and higher non-performing loan volumes.

- First-party collection held 36% of the market in 2024, showing its continued importance for managing early-stage debt while preserving customer relationships.

- Third-party collection accounted for 42%, while debt buyers represented 22%, reflecting the growing adoption of outsourcing and portfolio acquisitions to enhance liquidity and efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Debt Levels Creating Greater Demand for Recovery Services

The Global Debt Recovery Services Market is expanding due to the steady rise in consumer and corporate debt worldwide. Increasing use of credit cards, personal loans, and business borrowings creates higher delinquency rates that require professional management. Banks and financial institutions seek external recovery agencies to ensure liquidity and reduce non-performing loans. It helps institutions focus on core operations while outsourcing specialized recovery functions. Governments continue to strengthen rules around debt recovery, which encourages companies to comply with best practices. This improves trust between lenders and borrowers, promoting wider market adoption. Economic fluctuations drive volatility in repayment patterns, creating consistent demand for structured recovery services. The continuous rise in credit dependency sustains long-term demand growth across industries.

- For instance, Experian reported total US consumer debt reached $17.57 trillionin Q3 2024, up 4% from $17.15 trillion in Q3 2023, with credit card balances increasing 8.6% to $1.16 trillion over the same period—the highest annual growth among major categories.

Growing Adoption of Third-Party Recovery Agencies by Businesses

The Global Debt Recovery Services Market benefits from businesses turning to third-party agencies for effective solutions. Many organizations prefer external agencies to handle overdue payments due to their expertise and efficiency. It improves operational flexibility, lowers internal costs, and enhances collection success rates. Recovery firms utilize advanced negotiation skills and compliance frameworks to secure payments. Companies across retail, telecom, and utilities prefer outsourcing to minimize disruption to customer relationships. Regulatory support strengthens the role of licensed agencies in maintaining transparency. Rising outsourcing reduces operational burdens on in-house teams while ensuring faster recovery cycles. This transition accelerates the expansion of professional recovery networks across global markets.

- For instance, PRA Group reported total portfolio purchases of $379.4 million in Q2 2024. The company has invested more in external legal channels in both the US and Europe to drive future cash collections growth. This reflects a growing reliance on third-party recovery services.

Advancements in Predictive Analytics and Artificial Intelligence Tools

The Global Debt Recovery Services Market experiences strong momentum through the use of predictive analytics and artificial intelligence. It enables agencies to analyze borrower behavior and segment accounts for better strategies. Automated platforms allow quick identification of high-risk customers, reducing wasted effort on uncollectible debts. AI-driven chatbots improve communication with debtors while ensuring compliance with legal standards. Advanced tools streamline workflows, cut manual costs, and increase recovery efficiency. Lenders see value in data-driven decision-making, which enhances repayment outcomes. The adoption of these technologies creates a competitive advantage for agencies offering innovative services. Growing reliance on automation also improves debtor engagement and reduces conflict, strengthening repayment rates.

Regulatory Pressure and Legal Framework Enhancing Market Growth

The Global Debt Recovery Services Market expands under the influence of strict legal and regulatory requirements. Governments enforce standards that prevent harassment and unfair practices, ensuring ethical recovery procedures. It compels agencies to adopt transparent methods, boosting credibility among borrowers and lenders. Strong frameworks across North America and Europe serve as benchmarks for emerging markets. Compliance requirements increase the demand for licensed and certified recovery agencies. This enhances industry professionalism and creates long-term stability for debt collection operations. Lenders rely more on compliant partners to avoid legal disputes. Market participants aligning with evolving regulations secure broader business opportunities and greater trust from clients.

Market Trends

Increasing Integration of Digital Payment Platforms into Recovery Processes

The Global Debt Recovery Services Market evolves with the integration of digital payment solutions into recovery systems. It enables debtors to repay through mobile wallets, online platforms, and contactless transactions. Offering flexible repayment channels reduces friction and improves collection rates. Firms adopting digital-first approaches enhance customer convenience while improving speed of payments. Integration of secure gateways increases trust and compliance with financial rules. Widespread use of smartphones drives the adoption of mobile-enabled repayment systems. Digital ecosystems also allow faster reconciliation of accounts, improving efficiency for agencies. Growing consumer preference for digital tools accelerates modernization across global recovery operations.

Emergence of Specialized Debt Recovery Services for Small Enterprises

The Global Debt Recovery Services Market records strong demand from small and medium-sized enterprises (SMEs). It offers tailored services that help smaller businesses manage overdue accounts effectively. SMEs lack resources to build in-house collection teams, making external services crucial. Agencies provide flexible recovery packages that align with the financial needs of smaller firms. Market growth is influenced by increasing entrepreneurship, which expands the SME base. The trend also reflects rising cross-border business transactions requiring structured collection support. Specialized solutions improve liquidity management for SMEs, ensuring their business continuity. This growing segment strengthens long-term stability for the broader market.

- For example, Intrum, operating across 24 European countries, adopted QUALCO’s Collections & Recoveries platform in 2019 to standardize operations and improve effectiveness, enabling scalable and tailored services for its client base.

Rising Global Demand for Consumer-Centric Collection Approaches

The Global Debt Recovery Services Market shifts toward consumer-centric approaches focusing on debtor experience. It emphasizes respectful communication, flexible plans, and empathy in recovery strategies. Agencies adopt softer engagement methods to maintain customer relationships while recovering dues. Personalized repayment options improve compliance and reduce disputes. Digital portals enhance debtor transparency and provide easy account tracking. Consumer expectations for ethical interactions influence companies to refine their practices. This trend strengthens agency reputation and ensures regulatory compliance. Adopting customer-first strategies ensures higher recovery success while preserving loyalty in highly competitive industries.

- For instance, QUALCO provides omnichannel digital portals and self-service repayment tools to international agencies such as Intrum. These features enhance web and mobile interface adoption while supporting compliant and customer-centric debt collection practices.

Expansion of Cross-Border Debt Recovery and Globalized Services

The Global Debt Recovery Services Market observes growing importance of cross-border recovery solutions. It is influenced by increasing international trade and globalized financial activities. Companies with overseas clients require structured frameworks to manage unpaid debts. Specialized agencies with international expertise deliver legal support and multilingual communication. Growing demand arises from credit cards, retail, and service sectors engaged in global commerce. Firms offering cross-border capabilities improve client retention and business scalability. Expansion of global partnerships supports agencies in operating beyond local jurisdictions. This trend creates new opportunities for integrated, borderless recovery networks worldwide.

Market Challenges Analysis

Increasing Complexity of Regulatory Compliance Across Global Jurisdictions

The Global Debt Recovery Services Market faces challenges due to differing regulatory structures worldwide. It must align with varying legal frameworks, creating higher compliance costs for agencies. Strict enforcement of debtor rights complicates recovery procedures, especially in developed markets. Agencies face risks of penalties if they fail to meet legal requirements. It pressures companies to invest in compliance technology and continuous training. Smaller firms struggle to keep pace with rapidly changing laws across regions. Complex regulations slow recovery efforts, reducing efficiency in operations. Global players must balance compliance obligations with the need to maintain profitability.

Rising Consumer Awareness and Resistance to Aggressive Recovery Methods

The Global Debt Recovery Services Market also struggles with increasing consumer resistance. Debtors are more informed about their legal rights, leading to pushback against aggressive collection methods. It forces agencies to modify engagement strategies to maintain compliance and reputation. High consumer expectations demand personalized repayment solutions instead of strict approaches. Agencies face difficulty balancing recovery effectiveness with customer-friendly practices. Legal complaints and reputational damage present significant risks for market participants. Resistance to traditional collection practices limits the success of aggressive methods. Companies must adapt to debtor preferences to sustain long-term recovery outcomes.

Market Opportunities

Expansion of Digital and Automated Solutions in Recovery Processes

The Global Debt Recovery Services Market holds strong opportunities in digital automation. It benefits from advanced tools that optimize collections through AI, analytics, and robotic process automation. It allows agencies to reduce manual dependency and increase success rates. Automated platforms also improve communication, offering flexible repayment reminders. Digital opportunities expand across emerging economies adopting modern repayment channels. Rising awareness of efficiency encourages lenders to prioritize tech-driven agencies. Automation supports scalability and ensures faster integration into financial ecosystems. Expanding use of smart platforms enhances agency competitiveness globally.

Growing Demand in Emerging Economies with Expanding Credit Access

The Global Debt Recovery Services Market benefits from rising credit adoption in developing economies. It captures opportunities in regions with expanding access to personal loans, credit cards, and business credit. Growing middle-class populations drive borrowing and increase delinquency risks. Agencies can strengthen presence in markets like Asia-Pacific, Latin America, and Africa. Demand for structured recovery frameworks continues to rise in these regions. It enables businesses to safeguard liquidity while ensuring financial discipline among borrowers. Expansion in these economies creates new growth avenues for global agencies. Strengthened presence in emerging markets builds long-term opportunities for market participants.

Market Segmentation Analysis:

The Global Debt Recovery Services Market is structured

By service type into first-party collection, third-party collection, and debt buyers. First-party collection dominates in industries where companies prefer to manage early-stage delinquent accounts internally to retain customer relationships. Third-party collection shows strong demand as businesses outsource overdue accounts to specialized agencies that deliver higher recovery efficiency and compliance. Debt buyers form a growing segment, with firms purchasing delinquent accounts at a discount and assuming responsibility for recovery, providing lenders with immediate liquidity and reduced risk exposure.

- For example, major banks such as Citibank and lenders like Ford Motor Credit initiate first-party collections within 1–30 days of missed payments, contacting debtors through phone, email, or written notices, as documented in industry collection cycle practices.

By end user, the market spans healthcare, financial services, government, retail, and others. Healthcare providers increasingly rely on professional recovery services to manage rising unpaid medical bills and complex patient payment structures. Financial services lead adoption due to extensive credit card usage, personal loans, and high delinquency volumes. Government agencies utilize recovery services to handle overdue taxes, fines, and utility-related obligations. Retail businesses contribute significantly through unpaid consumer bills and credit-based purchases, fueling steady demand for efficient recovery solutions. Other sectors, including telecom and education, also adopt structured services to maintain consistent cash flow and mitigate credit losses.

- For instance, Revco Solutions serves as a medical debt collection partner for numerous hospital networks, including clients like Kettering Health Network. The company offers patient-centric strategies and leverages innovative tools to provide healthcare recovery services.

Segmentation:

By Service Type

- First-Party Collection

- Third-Party Collection

- Debt Buyers

By End User

- Healthcare

- Financial Services

- Government

- Retail

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Debt Recovery Services Market size was valued at USD 10,331.67 million in 2018 to USD 12,746.98 million in 2024 and is anticipated to reach USD 16,798.99 million by 2032, at a CAGR of 3.3% during the forecast period. North America holds a market share of 43.27% in 2024, driven by strong financial institutions and widespread credit card penetration. The Global Debt Recovery Services Market in this region benefits from robust regulations that enforce transparency and ethical recovery practices. It gains strength from high adoption of digital platforms and predictive analytics, improving collection efficiency. The U.S. leads growth, supported by large-scale consumer lending and advanced recovery technologies. Canada and Mexico also show steady demand, with businesses outsourcing collections to improve liquidity. Rising credit usage across industries sustains long-term opportunities. The regional dominance is reinforced by established agencies offering innovative recovery models tailored to complex debt structures.

Europe

The Europe Global Debt Recovery Services Market size was valued at USD 6,575.52 million in 2018 to USD 7,896.52 million in 2024 and is anticipated to reach USD 9,758.58 million by 2032, at a CAGR of 2.4% during the forecast period. Europe accounts for 26.81% of the market in 2024, supported by strong financial systems and established regulatory frameworks. The Global Debt Recovery Services Market in this region thrives on structured compliance standards that promote ethical collection practices. It benefits from significant adoption in countries like the UK, Germany, and France where lending volumes are high. Debt buyers are prominent in Europe, creating liquidity for lenders through portfolio acquisitions. Governments enforce strict consumer protection laws, ensuring transparent recovery methods. Demand for third-party collections remains stable, particularly in the retail and utility sectors. Technology integration, including automation and AI, strengthens operational efficiency. The region continues to focus on balancing creditor rights with consumer fairness.

Asia Pacific

The Asia Pacific Global Debt Recovery Services Market size was valued at USD 4,378.52 million in 2018 to USD 5,933.93 million in 2024 and is anticipated to reach USD 8,868.42 million by 2032, at a CAGR of 4.9% during the forecast period. Asia Pacific represents 20.14% of the global market in 2024, emerging as the fastest-growing region. The Global Debt Recovery Services Market here benefits from rising credit adoption across China, India, and Southeast Asia. It gains momentum from expanding middle-class populations and rapid digitalization of financial systems. Financial services dominate demand, supported by growing consumer lending and digital payment expansion. Government initiatives to regulate debt collection improve professionalism in the sector. Debt buyers also gain traction, especially in countries with high non-performing loan volumes. Outsourcing of collections by banks and telecom firms adds growth momentum. The region continues to attract investment from global recovery agencies expanding their footprint.

Latin America

The Latin America Global Debt Recovery Services Market size was valued at USD 1,142.08 million in 2018 to USD 1,406.55 million in 2024 and is anticipated to reach USD 1,641.07 million by 2032, at a CAGR of 1.7% during the forecast period. Latin America contributes 4.77% of the 2024 market share, supported by increasing consumer credit and retail lending activities. The Global Debt Recovery Services Market in this region benefits from rising awareness among businesses about outsourcing collection services. It gains traction in Brazil and Argentina, where large credit-driven economies create recovery opportunities. Governments are gradually strengthening regulations to improve transparency in recovery processes. Financial institutions remain the primary adopters, while healthcare and retail sectors show growing demand. Debt buyers expand their presence in urban centers where default rates are higher. Recovery agencies invest in digital solutions to improve efficiency across diverse markets. Regional growth remains steady, supported by expanding credit adoption and urbanization.

Middle East

The Middle East Global Debt Recovery Services Market size was valued at USD 669.61 million in 2018 to USD 763.93 million in 2024 and is anticipated to reach USD 849.16 million by 2032, at a CAGR of 1.1% during the forecast period. The Middle East accounts for 2.59% of the global market in 2024, influenced by steady adoption of structured credit systems. The Global Debt Recovery Services Market here benefits from expansion in banking and financial services across GCC countries. It is strengthened by regulatory efforts to enhance credit transparency and improve repayment culture. Debt recovery in the region often focuses on corporate loans and government-linked obligations. The UAE and Saudi Arabia dominate regional demand, supported by strong banking infrastructure. Outsourcing of third-party collections is rising among telecom and utility firms. Investment in digital tools improves efficiency while ensuring compliance with cultural and legal standards. The market’s growth remains modest but stable due to cautious lending environments.

Africa

The Africa Global Debt Recovery Services Market size was valued at USD 526.22 million in 2018 to USD 703.78 million in 2024 and is anticipated to reach USD 790.23 million by 2032, at a CAGR of 1.2% during the forecast period. Africa represents 2.40% of the market in 2024, driven by expanding credit adoption in emerging economies. The Global Debt Recovery Services Market benefits from rising mobile lending and digital payment platforms across countries like Kenya and Nigeria. It faces challenges from informal credit systems but gains support through formalization of banking activities. Financial services dominate adoption, while government agencies expand usage for tax and fine collections. South Africa leads with advanced recovery frameworks, followed by Egypt’s growing financial sector. Outsourcing of recovery services is expanding as businesses seek cost-effective solutions. Global players are exploring partnerships to expand in underpenetrated regions. Market growth remains slow but steady, supported by economic reforms and digital expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Experian

- FIS

- CGI

- TransUnion

- CollectOne (CDS Software)

- Comtronic Systems

- Quantrax Corp

- CollectPlus (ICCO)

- Comtech Systems

- Codix

- Katabat

- Decca Software

- Codewell Software

Competitive Analysis:

The Global Debt Recovery Services Market is highly competitive, driven by established players and emerging technology-focused firms. Leading companies such as Experian, FIS, CGI, and TransUnion dominate with strong portfolios, advanced analytics, and global networks. It benefits from their investment in digital platforms, predictive modeling, and compliance-driven solutions that enhance efficiency and credibility. Mid-tier firms including CollectOne, Comtronic Systems, Quantrax Corp, and Codix strengthen market diversity through specialized software and flexible service models. Regional firms expand through niche offerings, regulatory expertise, and cost-effective solutions tailored to local markets. Debt buyers gain prominence by acquiring distressed portfolios, creating liquidity for lenders. Competitive strategies focus on mergers, acquisitions, and partnerships to expand reach and improve technological integration. Companies prioritize customer-centric approaches, ethical practices, and automation to secure long-term contracts with financial institutions, healthcare providers, and government agencies. Market rivalry remains strong, encouraging innovation and the adoption of efficient, transparent recovery practices.

Recent Developments:

- In June 2025, Experian collaborated with Oakbrook to launch OakbrookOne, a new personal loan that makes borrowing simpler and fairer for underserved consumers, leveraging ReFi™ technology to consolidate debts into single payments.

- In May 2025, Experian unveiled the impact of its ReFi™ technology in debt consolidation, enabling over £70 million in loans and helping UK borrowers save an average of £5,000 on debt repayments through partnerships with lenders such as Oakbrook, MyCommunity Bank, Plata, and Admiral Money.

- In April 2025, FIS announced a definitive agreement to acquire Global Payments’ Issuer Solutions business (formerly TSYS) for $13.5 billion, strengthening FIS’s position in credit processing and enhancing its debt recovery product suite globally.

Report Coverage:

The research report offers an in-depth analysis based on Service Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Debt Recovery Services Market will expand with rising consumer and corporate debt across industries.

- Digital platforms, automation, and analytics will improve efficiency and strengthen recovery outcomes.

- Outsourcing to third-party agencies will increase, reducing operational burdens for businesses.

- Debt buyers will gain significance by acquiring distressed portfolios and offering liquidity to lenders.

- Healthcare and financial services will remain leading end-user sectors due to high default levels.

- Strong regulatory frameworks will drive transparent and ethical recovery practices, boosting credibility.

- North America will maintain dominance, while Asia Pacific will grow fastest with digital adoption.

- AI and predictive analytics will reshape strategies through advanced segmentation and engagement.

- Cross-border recovery solutions will expand with globalization and international credit flows.

- Customer-centric models emphasizing transparency and flexible repayment will improve debtor relationships and compliance.