Market Overview:

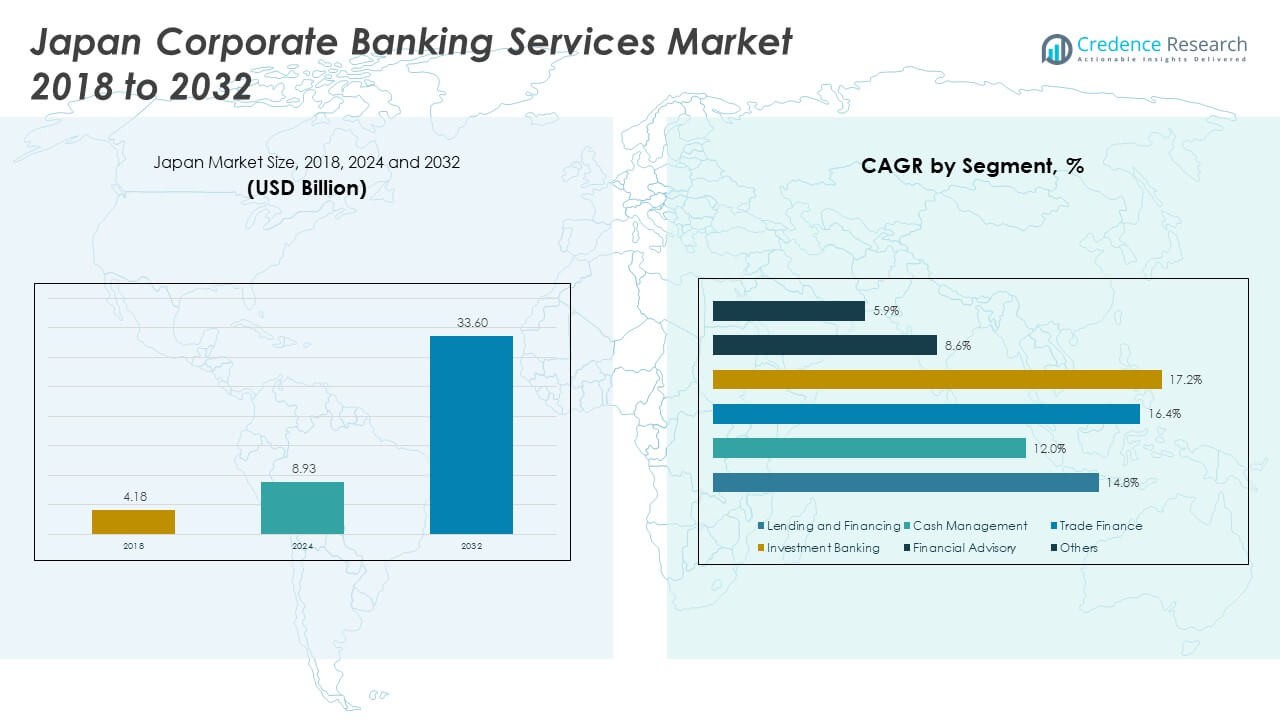

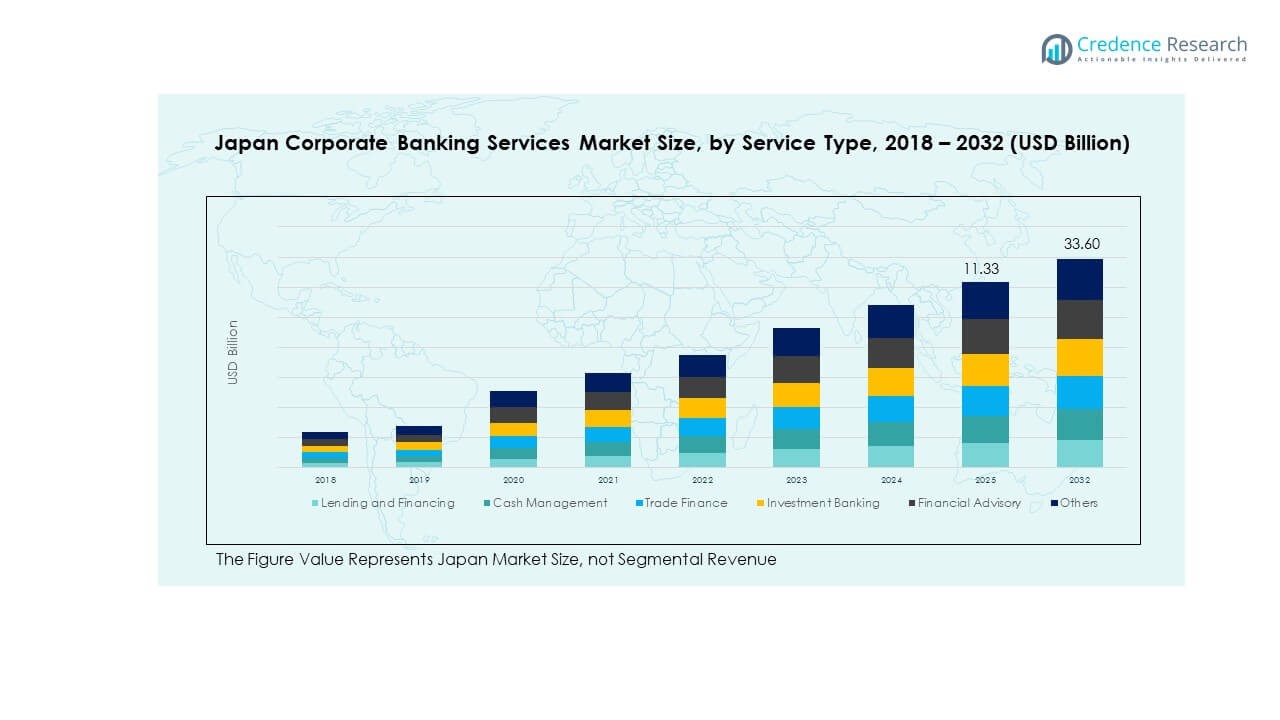

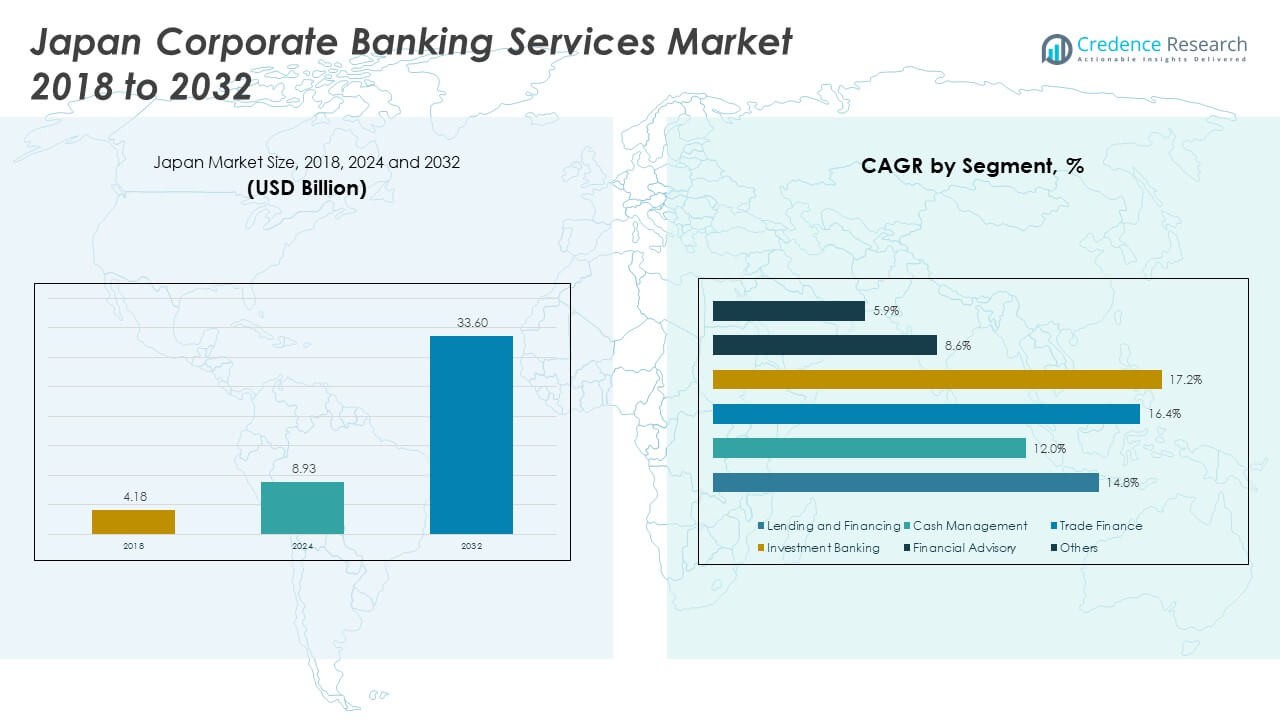

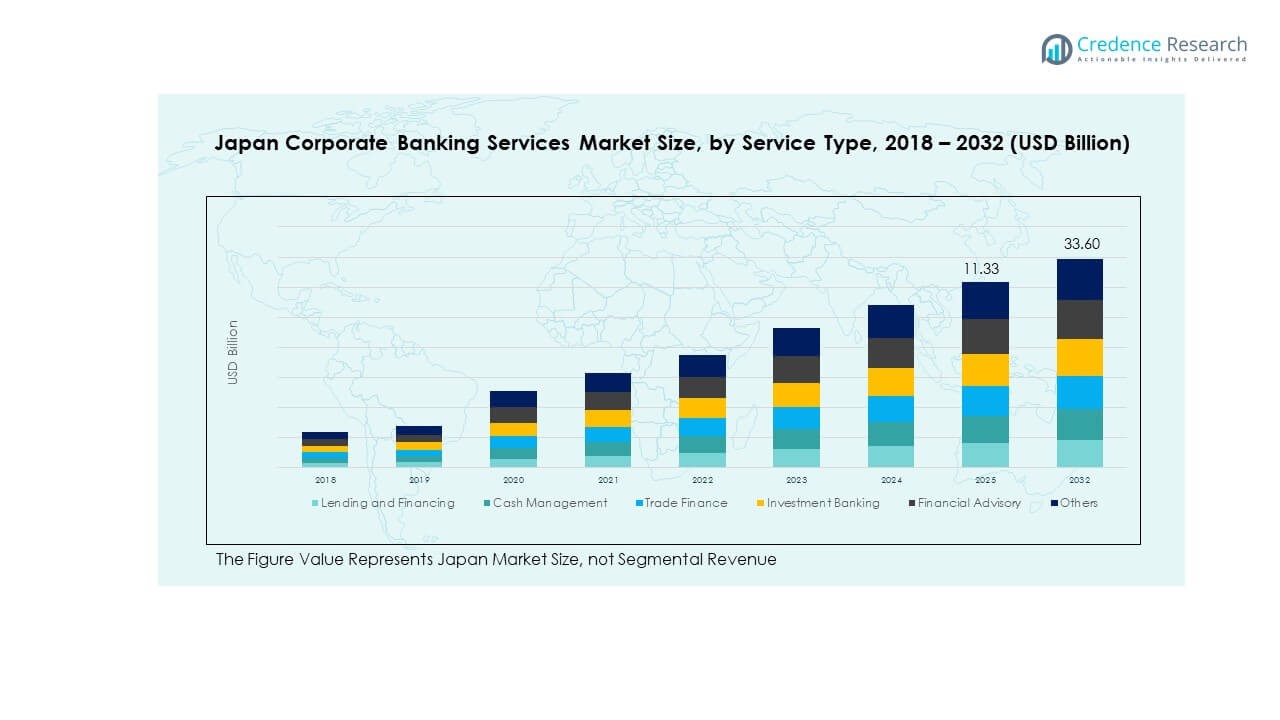

The Japan Corporate Banking Services Market size was valued at USD 4.18 billion in 2018 to USD 8.93 billion in 2024 and is anticipated to reach USD 33.60 billion by 2032, at a CAGR of 16.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Corporate Banking Services Market Size 2024 |

USD 8.93 Million |

| Japan Corporate Banking Services Market, CAGR |

16.80% |

| Japan Corporate Banking Services Market Size 2032 |

USD 33.60 Million |

The market growth is driven by the rising demand for digital transformation in banking, strong corporate lending needs, and an increasing focus on providing value-added services to enterprises. Japanese corporates are adopting advanced treasury management, trade finance, and investment solutions to optimize liquidity and improve efficiency. Furthermore, growing cross-border business activities, fintech integration, and regulatory initiatives to strengthen corporate governance are fueling the market expansion. Banks are also investing heavily in technological innovation and data-driven platforms to provide customized and seamless solutions to large and mid-sized enterprises.

Regionally, Japan dominates the market due to its mature banking ecosystem, strong regulatory framework, and high corporate credit demand. The Asia-Pacific region is emerging as a supportive hub, benefiting from regional trade ties and economic interconnectivity with Japan. While developed economies in North America and Europe maintain a stable position in corporate banking innovation, emerging Asian markets are becoming attractive for Japanese banks looking to expand their global footprint. This regional landscape reflects both the strength of Japan as a leader and the growing opportunities in neighboring economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Corporate Banking Services Market grew from USD 4.18 billion in 2018 to USD 8.93 billion in 2024, and it is projected to reach USD 33.60 billion by 2032 at a CAGR of 16.80%, reflecting strong growth momentum.

- Tokyo commanded the largest regional share at 48%, supported by its position as Japan’s financial hub with major banks and corporate headquarters. Kansai followed with 27%, anchored by Osaka’s industrial base, while Chubu and Kyushu together contributed 25%, driven by automotive, manufacturing, and SME activity.

- Kansai is the fastest-growing region within Japan, holding 27% share, driven by manufacturing demand, fintech adoption, and rising SME banking needs in Osaka’s expanding industrial and logistics ecosystem.

- By service type in 2024, lending and financing accounted for the largest portion, estimated at 35%, reflecting strong demand for capital support and structured credit across corporates.

- Cash management held nearly 25% of the market, supported by enterprises seeking liquidity optimization, payment efficiency, and advanced treasury solutions in both large enterprises and SMEs.

Market Drivers:

Growing Demand for Digitally Enabled Corporate Banking Ecosystem

The Japan Corporate Banking Services Market is expanding rapidly due to the strong demand for digital transformation in financial services. Large and mid-sized enterprises are prioritizing faster and more efficient banking solutions to support cash flow, liquidity management, and cross-border transactions. It is strengthening through the introduction of advanced treasury platforms and automated workflows designed to reduce operational inefficiencies. Fintech collaborations are driving momentum by offering banks scalable digital solutions aligned with corporate needs. Japanese banks are building secure digital platforms with integrated trade finance and investment services. Businesses are shifting to mobile-first and AI-driven models, creating pressure on traditional banking systems. Continuous investment in digital banking architecture is helping banks deliver seamless corporate services. Regulatory reforms are aligning with digital adoption, encouraging banks to expand innovative offerings.

- For example, in 2022, Mizuho Financial Group entered a strategic partnership with Google Cloud to accelerate its digital transformation efforts. The collaboration focuses on deploying a cloud‑based, AI‑powered analytics platform to enhance customer personalization, develop advanced Banking-as-a-Service (BaaS) capabilities, and modernize its security infrastructure—laying a robust foundation for digital corporate banking services.

Rising Corporate Lending Requirements and Capital Support Needs

Strong demand for corporate lending is creating consistent growth within the Japan Corporate Banking Services Market. It is being fueled by enterprises needing capital for global expansion, infrastructure projects, and technology upgrades. Japanese banks are supporting industries with long-term credit lines and working capital solutions. The growing need for sustainable financing is encouraging banks to introduce ESG-focused lending programs. Large corporates are adopting structured finance solutions to optimize debt management and improve resilience. Expansion into renewable energy, healthcare, and manufacturing is creating stronger lending pipelines. Banks are diversifying product portfolios with syndicated loans and credit risk solutions to mitigate exposure. Strong regulatory oversight is ensuring stability in lending practices while promoting innovation in capital distribution.

- For example, Mizuho’s sustainable finance investments (cumulative since FY2019) reached JPY 34.2 trillion by the first half of FY2024, including JPY 16.0 trillion for environment and climate-related finance.

Increasing Importance of Treasury Management and Risk Control Tools

The growth of the Japan Corporate Banking Services Market is strongly linked to the adoption of advanced treasury management and risk control services. Large enterprises are seeking tools that optimize liquidity, streamline payments, and manage currency fluctuations. It is accelerating due to the growing volume of cross-border business, where treasury automation reduces error rates and costs. Banks are enhancing offerings by integrating predictive analytics for risk monitoring. Rising awareness of cybersecurity threats is leading corporates to prioritize secure digital treasury operations. Expansion of cloud-based platforms is enabling flexible and scalable solutions for multinational firms. Demand for fraud detection systems and compliance monitoring tools is growing across industries. Treasury centralization is being adopted by enterprises to consolidate operations under a single platform, ensuring efficiency and governance.

Expanding Cross-Border Trade and Global Corporate Integration Strategies

The Japan Corporate Banking Services Market is experiencing growth due to expanding cross-border business integration. Global supply chains and trade agreements are pushing enterprises to seek banking partners that deliver international transaction support. It is enabling banks to offer stronger trade finance solutions tailored to exporters and importers. Japanese corporates are seeking customized hedging solutions to reduce foreign exchange exposure. Expansion of Japanese firms into Southeast Asia and Europe is strengthening the demand for structured financial products. Banks are investing in advanced payment corridors to support real-time international transfers. Partnerships with foreign banks are allowing Japanese institutions to extend service footprints across multiple markets. Regulatory harmonization across trade blocks is creating favorable conditions for corporate banking growth.

Market Trends:

Rapid Integration of Artificial Intelligence into Corporate Banking Solutions

The Japan Corporate Banking Services Market is evolving through the adoption of artificial intelligence in transaction monitoring, credit assessment, and fraud detection. It is allowing banks to deliver predictive insights for corporate clients, enabling smarter financial decisions. AI-powered chatbots and advisory systems are supporting customer engagement with personalized services. Banks are deploying machine learning algorithms to identify anomalies in high-value transactions. Integration of AI is reducing processing costs while improving service efficiency. Corporates are leveraging AI-based tools to assess supply chain risks and financial forecasts. The integration of AI into digital platforms is driving operational transparency. Banks are positioning AI as a competitive differentiator in an increasingly technology-driven corporate banking landscape.

- For example, Sumitomo Mitsui Financial Group (SMBC) launched its proprietary “SMBC-GAI” AI assistant in 2023, integrating it into call center support and business operations. By May 2024, SMBC reported that the AI system had automated the documentation of customer conversations across its branches and improved operational efficiency in its call center network, with ongoing plans for full-scale rollout groupwide.

Growing Focus on Sustainability and ESG-Oriented Corporate Banking Models

The Japan Corporate Banking Services Market is shifting toward sustainable banking practices aligned with ESG commitments. Corporates are seeking financing structures that support renewable energy, carbon reduction, and circular economy initiatives. It is leading banks to launch green bonds, ESG-linked loans, and sustainability-focused credit products. Enterprises are evaluating financial partners based on their ESG commitments and impact disclosures. Regulatory encouragement for climate-focused finance is reinforcing sustainable banking practices. Japanese banks are designing frameworks to measure environmental impact in corporate lending. Global investors are influencing Japanese corporates to prioritize sustainable financial instruments. The ESG-driven trend is positioning banks as enablers of environmental and social transformation.

- For example, Mitsubishi UFJ Financial Group (MUFG) reported in its climate and sustainability disclosures that it had achieved ¥28 trillion in cumulative sustainable finance by the end of 2023. The group also raised its target to ¥100 trillion by 2030, reinforcing its commitment to supporting renewable energy, energy efficiency, and social infrastructure projects under its Sustainable Finance Framework.

Expansion of Open Banking and API-Driven Corporate Finance Platforms

The Japan Corporate Banking Services Market is being influenced by the adoption of open banking frameworks and API-driven ecosystems. Banks are integrating with fintechs to enhance transparency and operational speed in corporate services. It is empowering enterprises to access real-time financial data and optimize transaction flows. Corporates are leveraging API connectivity to build custom treasury and reporting systems. Banks are rolling out secure API interfaces to support multi-banking environments. Regulatory backing for open banking is encouraging wider participation in corporate ecosystems. Enterprises are increasingly favoring flexible digital tools over rigid legacy systems. The open banking model is creating opportunities for banks to extend tailored services across industries.

Growing Role of Data Analytics in Customized Corporate Banking Services

The Japan Corporate Banking Services Market is adopting advanced analytics to deliver personalized services to enterprises. It is enabling banks to track transaction history, assess financial risks, and identify sector-specific opportunities. Predictive analytics is supporting demand forecasting in corporate finance. Banks are designing solutions that leverage big data to refine lending decisions. Corporates are benefiting from granular insights into working capital cycles. Real-time data is improving fraud prevention and compliance monitoring. Investment in analytics platforms is allowing banks to differentiate themselves in a competitive market. The adoption of data-driven decision-making is establishing new standards for corporate banking services.

Market Challenges Analysis:

Rising Competition and Need for Continuous Digital Infrastructure Investment

The Japan Corporate Banking Services Market faces the challenge of rising competition among traditional banks, fintechs, and global financial institutions. It is pressuring banks to innovate continuously while maintaining operational efficiency. The cost of upgrading digital infrastructure remains high, creating strain on profitability. Many institutions are struggling to balance the integration of new technologies with legacy systems. Data security concerns are growing with the expansion of online platforms. Smaller banks are at risk of being overshadowed by larger institutions with stronger digital budgets. The competition is also intensifying due to cross-border players entering the Japanese market. Strong differentiation strategies are required to maintain client loyalty.

Stringent Regulatory Landscape and Compliance Burden for Financial Institutions

The Japan Corporate Banking Services Market is influenced by strict regulatory requirements designed to ensure financial stability and corporate governance. It is driving banks to dedicate significant resources to compliance management. Regulatory changes increase complexity in reporting and operational frameworks. Frequent updates to anti-money laundering and data protection rules require constant adaptation. Compliance costs reduce profit margins and limit operational flexibility. Global harmonization of regulations also adds cross-border challenges for Japanese banks. Strict oversight is critical for maintaining transparency but it slows the pace of product innovation. Institutions must invest heavily in compliance technologies to remain competitive.

Market Opportunities:

Expansion of Fintech Partnerships and Development of Innovative Banking Models

The Japan Corporate Banking Services Market is benefiting from opportunities created through fintech collaborations and innovative service development. It is encouraging banks to expand beyond traditional models into AI-powered advisory, blockchain-based transaction systems, and decentralized finance integrations. Strong fintech ecosystems are enabling Japanese banks to deliver faster, more flexible, and cost-efficient services. Corporate clients are driving adoption of real-time payments and blockchain trade finance. This opportunity is positioning Japanese banks as global leaders in technology-enabled financial services.

Growing Cross-Border Connectivity and Integration of Global Supply Chains

The Japan Corporate Banking Services Market is expanding through opportunities linked to global trade and supply chain integration. It is pushing banks to strengthen cross-border transaction networks and enhance financing for exporters and importers. Rising activity across Southeast Asia, Europe, and North America is opening new markets for Japanese institutions. Enterprises require tailored financial instruments to manage international trade risks and liquidity. Banks are well-positioned to build strong service portfolios aligned with evolving global corporate demands. This expansion will continue to shape strategic growth opportunities.

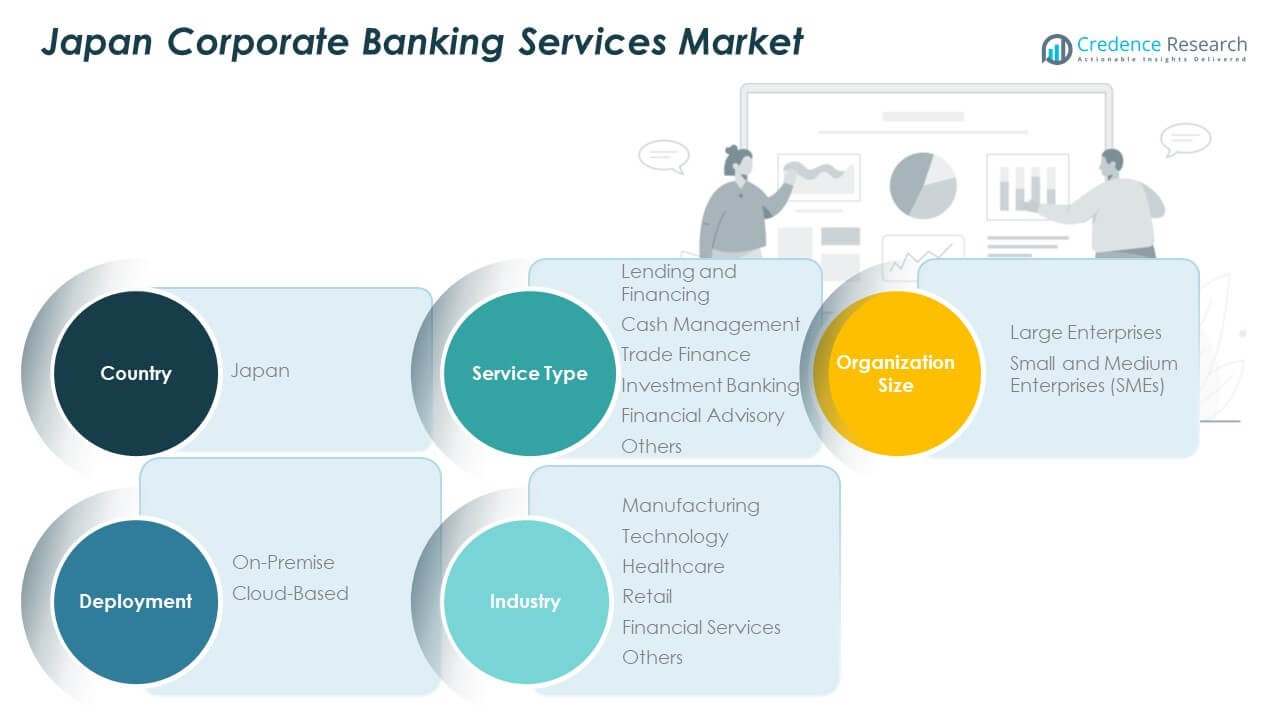

Market Segmentation Analysis:

The Japan Corporate Banking Services Market is segmented by service type, organization size, deployment, and industry, each shaping the competitive landscape.

By service type, lending and financing represent a major pillar, driven by strong demand for working capital and project financing among corporates. Cash management solutions are gaining traction as enterprises seek efficiency in liquidity and payment systems. Trade finance remains vital for Japan’s export-oriented economy, while investment banking supports mergers, acquisitions, and capital market activity. Financial advisory services are growing in importance for restructuring and risk optimization, while the “others” segment includes customized treasury and compliance solutions.

- For example, in early 2024, Mitsubishi UFJ Financial Group (MUFG), through its trust banking unit, collaborated with Progmat, Ginco, and Standage to pilot a blockchain-based trade settlement platform using stablecoins. The initiative focuses on improving settlement efficiency for Japanese exporters engaging in cross-border trade with emerging markets.

By organization size, large enterprises dominate demand with their need for global transaction services, structured financing, and treasury integration. Small and medium enterprises (SMEs) represent a growing customer base, supported by digital-first banking platforms and government-backed financing initiatives. It is creating opportunities for banks to design scalable, cost-efficient solutions tailored to smaller businesses.

- For example, Resona Group launched the Resona Group App for Business in 2023 for corporate customers. The application builds on the group’s experience with its individual banking app and aims to offer SME clients hassle-free and convenient digital transaction capabilities.

By deployment trends highlight a steady shift from on-premise systems to cloud-based platforms, reflecting the need for agility, scalability, and secure real-time access. Cloud adoption is accelerating innovation in corporate banking, reducing infrastructure costs, and enabling integration with fintech solutions.

By industry, manufacturing maintains strong reliance on banking services for supply chain financing and capital investment. Technology firms are driving demand for digital treasury and cross-border transaction tools. Healthcare organizations depend on tailored financing for infrastructure and R&D, while retail seeks efficient payment and working capital solutions. Financial services firms remain key users of investment and advisory offerings, while other industries contribute through niche banking requirements.

Segmentation:

By Service Type

- Lending and Financing

- Cash Management

- Trade Finance

- Investment Banking

- Financial Advisory

- Others

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Deployment

By Industry

- Manufacturing

- Technology

- Healthcare

- Retail

- Financial Services

- Others

Regional Analysis:

The Japan Corporate Banking Services Market is dominated by Tokyo, holding an estimated 48% share in 2024. Tokyo serves as the nation’s primary financial hub, hosting the headquarters of Mitsubishi UFJ Financial Group, Mizuho Financial Group, and Sumitomo Mitsui Banking Corporation. It is supported by the Tokyo Stock Exchange and the concentration of multinational corporaste headquarters, which creates consistent demand for lending, treasury management, and investment banking services. Trade finance and cross-border transactions also contribute significantly to its dominance. Tokyo remains the leading driver of digital banking innovation and regulatory alignment, strengthening its position at the core of the market.

The Kansai region, led by Osaka, accounted for nearly 27% of the market share in 2024, supported by a strong base of manufacturing, technology, and logistics industries. Regional banks such as Resona Holdings are active here, delivering tailored financial solutions to SMEs and mid-sized corporates. It is defined by rising demand for cash management, lending, and trade finance linked to regional supply chains and exports. Osaka is also becoming an emerging fintech hub, where digital-first banking services are gaining adoption. The Kansai market reflects a balance of industrial financing needs and new opportunities for digital banking expansion.

The remaining share of the Japan Corporate Banking Services Market is split between the Chubu and Kyushu regions, together accounting for 25% in 2024. Chubu, led by Nagoya, is heavily influenced by the automotive and industrial sectors, creating strong demand for corporate lending, investment banking, and structured finance. Kyushu, supported by Fukuoka Financial Group, plays a critical role in SME banking, agriculture finance, and trade activities linked with neighboring Asian economies. It is also witnessing an increase in cloud-based deployment as corporates adopt scalable digital solutions. Regional banks in these areas maintain strong client relationships through localized services while aligning with larger institutions to meet growing cross-border financing needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Japan Corporate Banking Services Market is defined by intense competition, with leading banks setting the pace through scale, innovation, and diversified offerings. Major players such as Mitsubishi UFJ Financial Group, Mizuho Financial Group, and Sumitomo Mitsui Banking Corporation dominate with strong capital bases, global reach, and advanced digital platforms. It is also influenced by regional banks like Resona Holdings, Chiba Bank, and Fukuoka Financial Group, which specialize in serving SMEs and local enterprises. Niche providers such as Norinchukin Bank and Japan Bank for International Cooperation strengthen diversity through agriculture finance and international project funding. Recent strategies highlight digital platforms, ESG-linked financing, and cross-border trade solutions. Banks are deploying AI, blockchain, and cloud technologies to improve efficiency and strengthen risk controls. Partnerships with fintechs and selective mergers are reshaping service delivery. Expansion into Southeast Asia remains a priority for global growth. Competitive intensity is reinforced by strict regulation, rising customer expectations, and the need for differentiated services.

Recent Developments:

- In August 2025, Mitsubishi UFJ Financial Group (MUFG) was reported to be engaged in talks with JPMorgan Chase to underwrite a $22 billion loan for a major data center project in Texas, underscoring MUFG’s expanding presence in structured finance for global technology infrastructure.

- In June 2025, Krungsri (Bank of Ayudhya PCL) reaffirmed its leadership as a trusted partner for Japanese corporations by unveiling its 2025 strategic direction for Japanese Corporate Banking. The bank highlighted its commitment to fostering sustainability and strengthening investment flows from Japan to ASEAN through the Japan-ASEAN Startup Business Matching Fair 2025, supporting innovation in new core industries and facilitating robust economic opportunities.

- In May 2025, the Asian Development Bank (ADB) and the Government of Japan announced the launch of a new Market Acceleration Platform, a multi-donor trust fund aimed at bolstering private sector development and investment across Asia and the Pacific. This strategic partnership focuses on providing greater market access and supporting sustainable economic growth initiatives within the region.

Market Concentration & Characteristics:

The Japan Corporate Banking Services Market demonstrates high concentration, with a few large financial groups dominating revenue and service delivery. It is marked by strong regulatory oversight, advanced technology adoption, and integration of sustainability frameworks into banking services. Large banks secure their position through broad portfolios in lending, trade finance, and investment services, while regional banks cater to SMEs and niche segments. The market reflects high barriers to entry due to capital requirements, compliance obligations, and established customer relationships, while fintech partnerships are gradually diversifying competition.

Report Coverage:

The research report offers an in-depth analysis based on service type, organization size, deployment, and industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Digital transformation will continue to shape service delivery, with AI, blockchain, and cloud adoption advancing efficiency and resilience.

- ESG-focused finance will gain momentum, with banks expanding green bonds, sustainable loans, and climate-linked investment solutions.

- Cross-border banking will strengthen as Japanese corporates expand into Asia and Europe, driving demand for trade finance and treasury tools.

- Fintech collaborations will intensify, enabling banks to offer faster, customer-centric, and cost-effective platforms.

- Data analytics and predictive insights will become integral to risk management, fraud detection, and tailored corporate solutions.

- Regulatory reforms will push institutions to balance compliance with innovation, ensuring transparency and operational stability.

- SME-focused banking will expand through digital platforms that offer scalable credit, payments, and advisory solutions.

- Cybersecurity and digital trust will remain critical, with growing investment in secure infrastructure to protect corporate transactions.

- Cloud-based deployment will accelerate, reducing reliance on legacy systems and improving integration with multi-banking ecosystems.

- Sustainable growth will be supported by regional banks aligning with evolving customer expectations while large banks leverage international networks.