Market Overview

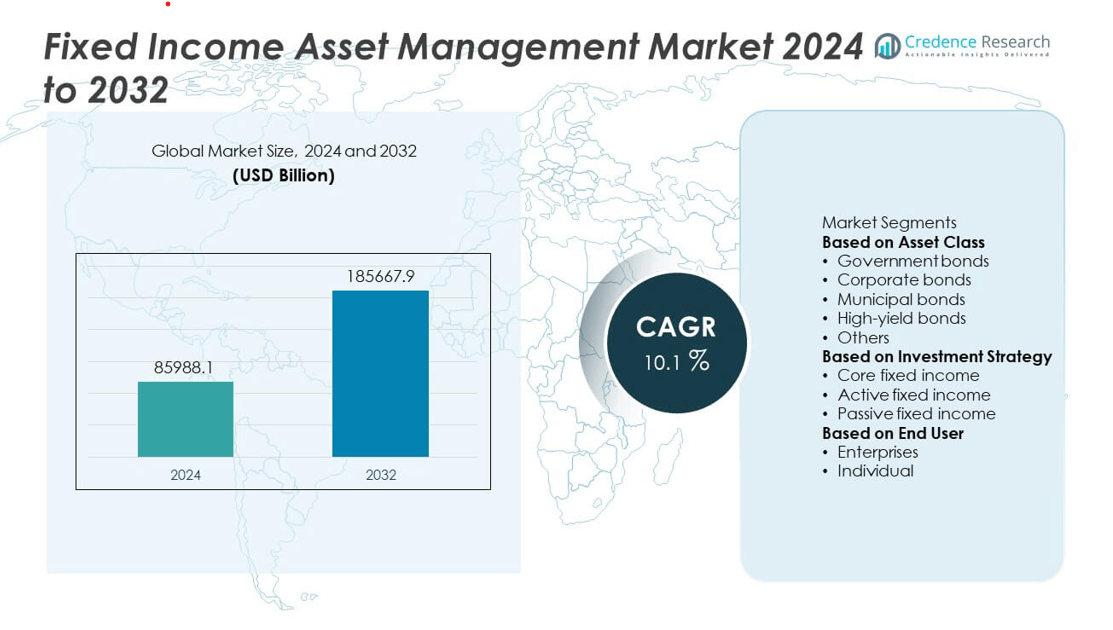

The Fixed Income Asset Management Market was valued at USD 85,988.1 billion in 2024 and is anticipated to reach USD 185,667.9 billion by 2032, expanding at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fixed Income Asset Management Market Size 2024 |

USD 85,988.1 Billion |

| Fixed Income Asset Management Market, CAGR |

10.1% |

| Fixed Income Asset Management Market Size 2032 |

USD 185,667.9 Billion |

Income Asset Management Market grows with rising demand for portfolio diversification, risk management, and stable returns. Institutional investors such as pension funds, insurers, and sovereign wealth funds allocate significant resources to bonds for liability matching and income stability.

North America leads the Fixed Income Asset Management Market with advanced capital markets and strong institutional investor participation. The region benefits from deep liquidity in U.S. Treasuries and corporate bonds, making it a preferred hub for global investors. Europe follows with strong demand for government bonds, corporate debt, and green financial instruments, supported by strict regulatory frameworks and ESG-focused strategies. Asia-Pacific emerges as the fastest-growing region, driven by expanding economies in China, India, and Japan, along with increasing institutional allocations to fixed income products. Latin America and the Middle East & Africa continue to expand through sovereign debt issuance, infrastructure bonds, and growing investor appetite for diversified products. Key players such as Vanguard, Allianz Global Investors, Fidelity International, and Schroders actively strengthen their presence across these regions through product innovation, digital integration, and sustainable investment strategies. It highlights a globally interconnected market shaped by regional dynamics and institutional priorities.

Market Insights

- Fixed Income Asset Management Market size was valued at USD 85,988.1 billion in 2024 and is projected to reach USD 185,667.9 billion by 2032, growing at a CAGR of 10.1% during the forecast period.

- The market grows with strong demand for portfolio diversification, income stability, and capital preservation, driven by institutional investors such as pension funds, insurers, and sovereign wealth funds.

- Trends highlight the rapid adoption of sustainable finance, with green, social, and sustainability-linked bonds attracting large-scale inflows, while passive investment products such as ETFs continue to expand due to cost efficiency.

- Key players including Allianz Global Investors, Vanguard, Fidelity International, and Schroders compete by expanding digital platforms, integrating ESG frameworks, and offering customized solutions for institutional and retail clients.

- Market restraints include interest rate volatility, inflationary pressures, and liquidity challenges in emerging bond markets, which create hurdles for consistent returns and efficient execution of strategies.

- North America remains the dominant region with strong institutional activity and deep capital markets, while Europe emphasizes green finance and regulatory compliance, and Asia-Pacific emerges as the fastest-growing hub supported by China, India, and Japan.

- Latin America and Middle East & Africa contribute through sovereign debt issuance, infrastructure bonds, and sovereign wealth fund activity, reinforcing the global nature of fixed income strategies and expanding opportunities for asset managers worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Portfolio Diversification and Stability

Fixed Income Asset Management Market expands due to investors seeking portfolio diversification and stable returns. Low volatility compared to equities drives institutional and retail demand. Bonds provide predictable income streams, making them essential in long-term strategies. Pension funds, insurers, and sovereign wealth funds rely heavily on fixed income assets. The market benefits from risk-averse investors preferring steady yields during economic uncertainty. Global asset managers increasingly promote fixed income funds to balance growth and protection.

- For instance, Franklin Templeton’s Franklin Income Fund (A1 shares, ticker FKINX) had total net assets of approximately $74.11 billion as of June 30, 2025. As of late August 2025, it had a 5.48% trailing yield and reported an average annual return of 9.00% over the past five years. The fund allocates approximately 50.41% to fixed income.

Rising Importance of Risk Management in Volatile Economies

Volatile global markets highlight the role of fixed income in risk management. Investors face inflation, interest rate shifts, and geopolitical uncertainty. Fixed income strategies mitigate downside risks and protect capital. The Fixed Income Asset Management Market grows as asset managers adopt advanced analytics to balance risks. Structured products and government bonds remain popular in uncertain cycles. It plays a central role in supporting investor confidence and financial system resilience.

- For instance, State Street Global Advisors expanded its proxy voting choice program to cover more than 600 index equity funds with $1.9 trillion in assets under management by Q1 2025, allowing institutions to align their equity holdings with tailored governance and risk strategies.

Expanding Institutional Investment and Pension Fund Allocations

Institutional investors drive consistent demand in fixed income markets. Pension funds allocate significant assets to bonds to match liabilities. Insurance companies increase exposure to fixed income to secure stable returns. Fixed Income Asset Management Market strengthens with growing allocations toward long-duration assets. Asset managers develop customized strategies for liability-driven investments. It ensures predictable cash flows that align with future obligations and long-term planning goals.

Technological Advancements and Data-Driven Investment Strategies

Technology reshapes how fixed income assets are managed. Artificial intelligence, predictive analytics, and digital platforms improve decision-making. Managers analyze credit spreads, yield curves, and macroeconomic data faster and with higher accuracy. Fixed Income Asset Management Market leverages these tools to optimize risk-adjusted returns. Automation reduces costs while expanding market accessibility. It creates opportunities for both institutional and retail clients to engage in more sophisticated investment solutions.

Market Trends

Shift Toward Sustainable and ESG-Focused Investments

Fixed Income Asset Management Market witnesses a strong trend toward sustainable and ESG-focused bonds. Investors demand greater alignment of capital with environmental and social goals. Green bonds, social bonds, and sustainability-linked instruments attract record inflows. Asset managers integrate ESG ratings and carbon disclosures into portfolio construction. Institutional investors adopt stricter frameworks to evaluate issuers. It reinforces transparency and builds long-term credibility in fixed income strategies.

- For instance, Allianz Global Investors has integrated ESG analysis into its assets under management and actively manages green and sustainability-linked bonds across Europe and Asia, as detailed in its public reports.

Growing Popularity of Passive and Index-Linked Fixed Income Funds

Passive investment strategies reshape the fixed income landscape. Investors seek cost-effective solutions with predictable benchmarks. Exchange-traded funds and index-linked products capture significant demand. Fixed Income Asset Management Market adapts with innovative passive fund structures. Institutions and retail clients use ETFs to gain diversified bond exposure quickly. It increases competition among managers while driving fee compression across the market.

- For instance, In July 2025, Vanguard expanded its bond lineup by launching several ETFs, including the Treasury ETF (VTG) with an expense ratio of 0.03% and the Total Inflation-Protected Securities ETF (VTP) with an expense ratio of 0.05%, strengthening its passive fixed income offering.

Integration of Advanced Analytics and Digital Platforms

Data-driven strategies transform fixed income investing practices. Artificial intelligence and machine learning enhance credit analysis and portfolio optimization. Managers deploy digital platforms for real-time monitoring of yield spreads and liquidity. Fixed Income Asset Management Market benefits from automation of trade execution and compliance. Advanced analytics enable better evaluation of default risks and interest rate impacts. It improves efficiency and strengthens portfolio resilience in uncertain markets.

Rising Demand for Customized and Alternative Fixed Income Products

Clients increasingly demand tailored investment solutions. Customized bond portfolios, multi-asset strategies, and private credit options gain momentum. Asset managers expand offerings to meet unique liability and income needs. Fixed Income Asset Management Market evolves with hybrid products combining traditional bonds and alternatives. Structured notes and infrastructure debt instruments attract institutional attention. It highlights a shift toward diversification beyond conventional fixed income categories.

Market Challenges Analysis

Impact of Interest Rate Volatility and Inflationary Pressures

Fixed Income Asset Management Market faces challenges from unpredictable interest rate movements and rising inflation. Sudden shifts in monetary policies erode bond values and create yield curve distortions. Investors encounter difficulty in predicting returns when central banks alter tightening cycles. Inflation reduces the purchasing power of fixed income streams, weakening long-term investor confidence. Asset managers struggle to balance duration risks while maintaining portfolio stability. It places constant pressure on strategies designed to secure consistent returns.

Regulatory Complexity and Liquidity Constraints Across Markets

Global regulations increase compliance costs and limit flexibility for asset managers. Fixed Income Asset Management Market adapts to stringent capital adequacy rules, disclosure standards, and reporting obligations. Tighter frameworks restrict innovation while slowing product launches. Liquidity constraints in emerging bond markets further complicate portfolio execution. Asset managers must navigate fragmented trading systems and widening bid-ask spreads. It challenges managers to maintain efficiency while ensuring access to diverse investment opportunities.

Market Opportunities

Expansion of Emerging Market Debt and Alternative Fixed Income Instruments

Fixed Income Asset Management Market presents strong opportunities in emerging market debt and alternative products. Developing economies issue higher-yielding bonds that attract global investors seeking diversification. Infrastructure debt, private credit, and securitized products open new channels for portfolio growth. Institutional clients adopt these instruments to improve yield in a low-interest environment. Asset managers leverage expertise to design solutions that balance risk and reward in complex markets. It strengthens competitive positioning and builds long-term revenue potential.

Rising Adoption of Digital Platforms and Sustainable Finance Strategies

Technological advancements create opportunities to expand client access and improve service delivery. Fixed Income Asset Management Market benefits from digital platforms that enhance efficiency, transparency, and customized portfolio building. Sustainable finance opens another growth pathway with demand for green and social bonds increasing globally. Asset managers integrate ESG frameworks to capture flows from environmentally conscious investors. The trend positions fixed income products as both profitable and socially impactful. It allows managers to differentiate offerings and secure competitive advantages in a growing market.

Market Segmentation Analysis:

By Asset Class

Fixed Income Asset Management Market is segmented by asset class into government bonds, corporate bonds, municipal bonds, and securitized products. Government bonds dominate due to their stability and low default risk, serving institutional investors seeking capital protection. Corporate bonds deliver higher yields, making them attractive for pension funds and insurers aiming to balance risk and return. Municipal bonds appeal to investors seeking tax-efficient instruments, particularly in developed economies. Securitized products such as mortgage-backed securities diversify income streams, though they require advanced risk management. It reflects investor demand for both safety and yield enhancement across varying economic cycles.

- For instance, PIMCO discussed its global strategy in an Income Strategy Update published in February 2025. The update indicated that PIMCO held “modest duration exposure to the U.K. and Australia” for diversification.

By Investment Strategy

Segmentation by investment strategy includes active management, passive management, and alternative strategies. Active management remains significant, with managers leveraging research, analytics, and expertise to optimize returns. Passive management grows rapidly as investors embrace index-linked funds and ETFs for cost efficiency. Alternative strategies, such as absolute return or liability-driven investments, expand in response to complex institutional requirements. Fixed Income Asset Management Market benefits from the interplay of these strategies, offering diversified approaches tailored to risk tolerance and objectives. It highlights a balance between traditional security and innovation-driven methods.

- For instance, Invesco expanded its fixed-income platform on July 23, 2025, with two actively managed ETFs—the Core Fixed Income ETF (GTOC) and the Intermediate Municipal ETF (INTM). This broadened its strategy mix with products that offer exposure to diversified bond holdings.

By End User

Segmentation by end user covers institutional investors, high-net-worth individuals, and retail clients. Institutional investors, including pension funds, sovereign wealth funds, and insurance companies, hold the largest share. They depend on fixed income assets for long-term liability matching and portfolio stability. High-net-worth individuals seek customized bond portfolios and structured fixed income solutions that ensure stable income. Retail clients increasingly access bond funds and ETFs through digital platforms, expanding overall market participation. Fixed Income Asset Management Market adapts to these distinct client needs with scalable and personalized solutions. It reinforces the role of fixed income in providing consistent value across user categories.

Segments:

Based on Asset Class

- Government bonds

- Corporate bonds

- Municipal bonds

- High-yield bonds

- Others

Based on Investment Strategy

- Core fixed income

- Active fixed income

- Passive fixed income

Based on End User

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Fixed Income Asset Management Market, accounting for 38% in 2024. The region benefits from strong institutional investor participation, including pension funds, endowments, and insurance companies that rely heavily on fixed income instruments. U.S. Treasuries remain a cornerstone, supported by deep liquidity and a reputation for stability, making them a global benchmark for risk-free returns. Asset managers in the region expand offerings with corporate bonds, municipal securities, and structured credit, meeting the diverse needs of investors. Regulatory stability and advanced capital markets infrastructure further reinforce growth. It continues to attract global capital inflows, solidifying North America’s position as the leading hub for fixed income management.

Europe

Europe accounts for 28% of the market share in 2024, driven by robust demand for government bonds, corporate bonds, and green debt instruments. The European Central Bank’s monetary policies and strict regulations shape portfolio strategies across the region. Sovereign bonds from countries like Germany and France dominate, while peripheral bonds from Spain and Italy offer higher yields. Growing momentum for sustainable finance pushes green and social bonds into mainstream investment strategies. Asset managers integrate ESG compliance into fixed income products to align with investor demand and regulatory expectations. It creates opportunities for both traditional and innovative products across developed and emerging European markets.

Asia-Pacific

Asia-Pacific represents 20% of the global market share in 2024, emerging as the fastest-growing regional segment. Rising demand from expanding economies such as China, India, and Japan supports rapid adoption of fixed income solutions. Government initiatives to deepen bond markets and improve liquidity attract global investors seeking diversification. Japanese government bonds remain significant, while Chinese corporate and municipal bonds gain traction. Regional pension funds and insurers increase allocations to fixed income assets to match liabilities and secure predictable returns. The Fixed Income Asset Management Market in Asia-Pacific benefits from digital adoption and rising wealth, strengthening long-term growth potential. It positions the region as a future driver of global expansion.

Latin America

Latin America holds 8% of the market share in 2024, with growth primarily led by Brazil, Mexico, and Chile. The region experiences high demand for sovereign bonds due to attractive yields compared to developed economies. Inflationary pressures and interest rate volatility remain challenges, yet institutional investors continue to allocate resources to fixed income portfolios for stability. Local pension funds dominate demand, while foreign investors cautiously expand exposure. Infrastructure debt and securitized assets offer new opportunities for diversification in select markets. It reflects both the risks and opportunities that shape fixed income strategies in emerging economies.

Middle East & Africa

Middle East & Africa accounts for 6% of the global market share in 2024, driven by sovereign wealth funds and government-led investment initiatives. Bonds issued by oil-exporting economies dominate, providing stable income streams supported by energy revenues. Regional investors allocate heavily to fixed income products to diversify portfolios beyond commodities. South Africa and Gulf states expand corporate and infrastructure bond markets, attracting institutional investors. Limited liquidity and fragmented regulatory structures remain hurdles for broader market development. It maintains steady demand, supported by wealth funds and rising institutional participation across both developed and emerging economies in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Competitive landscape of the Fixed Income Asset Management Market features leading players such as Allianz Global Investors, Vanguard, Fidelity International, Schroders, Franklin Templeton, Pacific Investment Management Company, Invesco, State Street Global Advisors, Deutsche Asset Management, and Natixis Investment Managers. These firms dominate the market by leveraging extensive global networks, diversified portfolios, and strong institutional client bases. Competition intensifies as they integrate advanced analytics, digital platforms, and artificial intelligence to enhance portfolio performance, streamline operations, and strengthen risk management practices. Sustainable finance plays a central role, with green bonds and ESG-focused strategies becoming core to product innovation and client offerings. Passive investment products such as fixed income ETFs continue to expand, driving fee compression and compelling asset managers to innovate further. Regional expansion strategies remain critical, with firms broadening access in Asia-Pacific and Latin America to capture rising institutional flows. Customized solutions for pension funds, insurers, and sovereign wealth funds reinforce competitive differentiation, while strong emphasis on liability-driven investments ensures alignment with client objectives. It underscores a market shaped by technological innovation, sustainability commitments, and strategic expansion, positioning these global players to compete across diverse geographies and rapidly evolving investor expectations.

Recent Developments

- In July 2025, Invesco launched two actively managed fixed income ETFs, the Invesco Core Fixed Income ETF (GTOC) and the Invesco Intermediate Municipal ETF (INTM).

- In June 2025, Vanguard reduced fees on 7 of its European bond ETFs, cutting expense ratios by two basis points and lowering the average to 0.11%.

- In June 2025, State Street Global Advisors rebranded to State Street Investment Management on June 30, 2025. The new identity underscores its renewed focus on growth, innovation, and client engagement across global markets.

- In April 2025, PIMCO recommended diversifying beyond U.S. bonds. It advised shifting into globally diversified high-quality bonds, including those from the UK and Australia, rather than relying on U.S. markets amid growing concerns about protectionism and fading U.S. exceptionalism

Report Coverage

The research report offers an in-depth analysis based on Asset Class, Investment Strategy, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fixed income strategies will rise as investors seek stability and diversification.

- ESG-focused bonds will gain traction, reinforcing sustainability as a core investment theme.

- Passive fixed income funds and ETFs will expand further due to cost efficiency.

- Digital platforms and AI-driven analytics will improve portfolio monitoring and decision-making.

- Institutional allocations will increase, led by pension funds, insurers, and sovereign wealth funds.

- Customized fixed income solutions will grow in demand among high-net-worth and retail clients.

- Emerging markets will offer higher-yielding opportunities and attract more global inflows.

- Regulatory compliance will remain a challenge but ensure greater transparency and credibility.

- Alternative fixed income products like private credit and infrastructure debt will gain relevance.

- Global asset managers will strengthen regional footprints to capture expanding opportunities.