Market Overview:

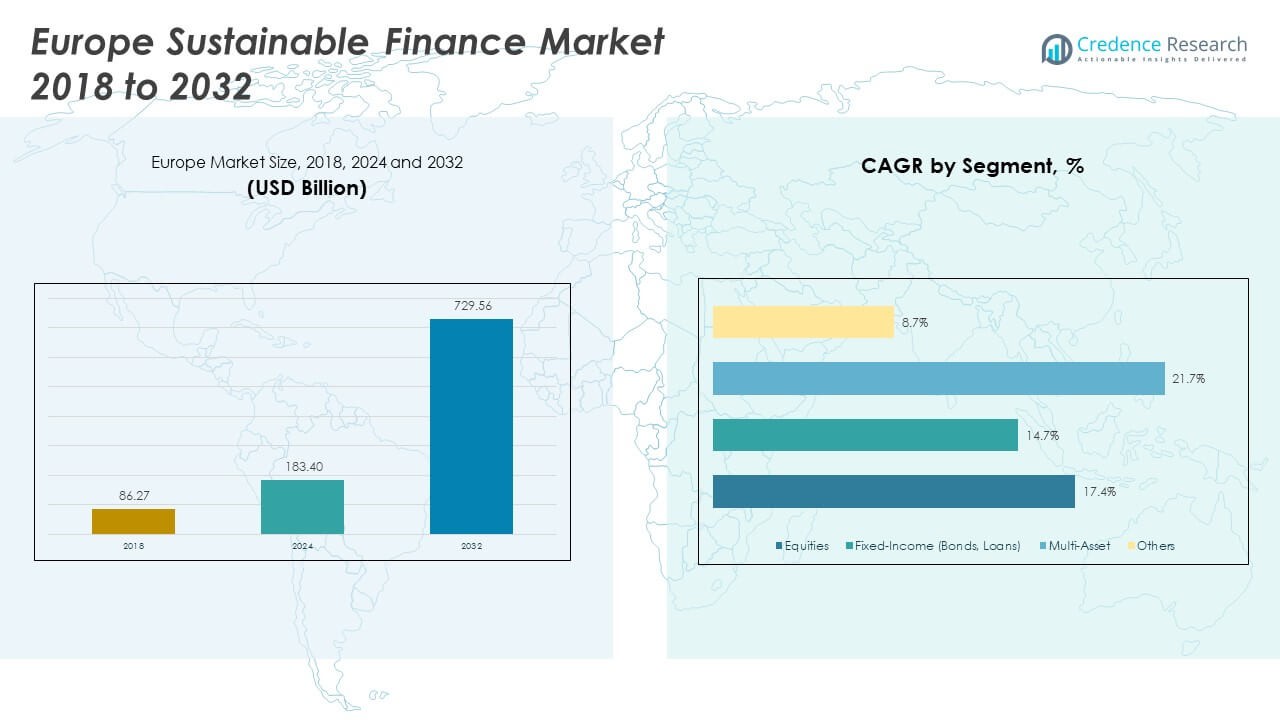

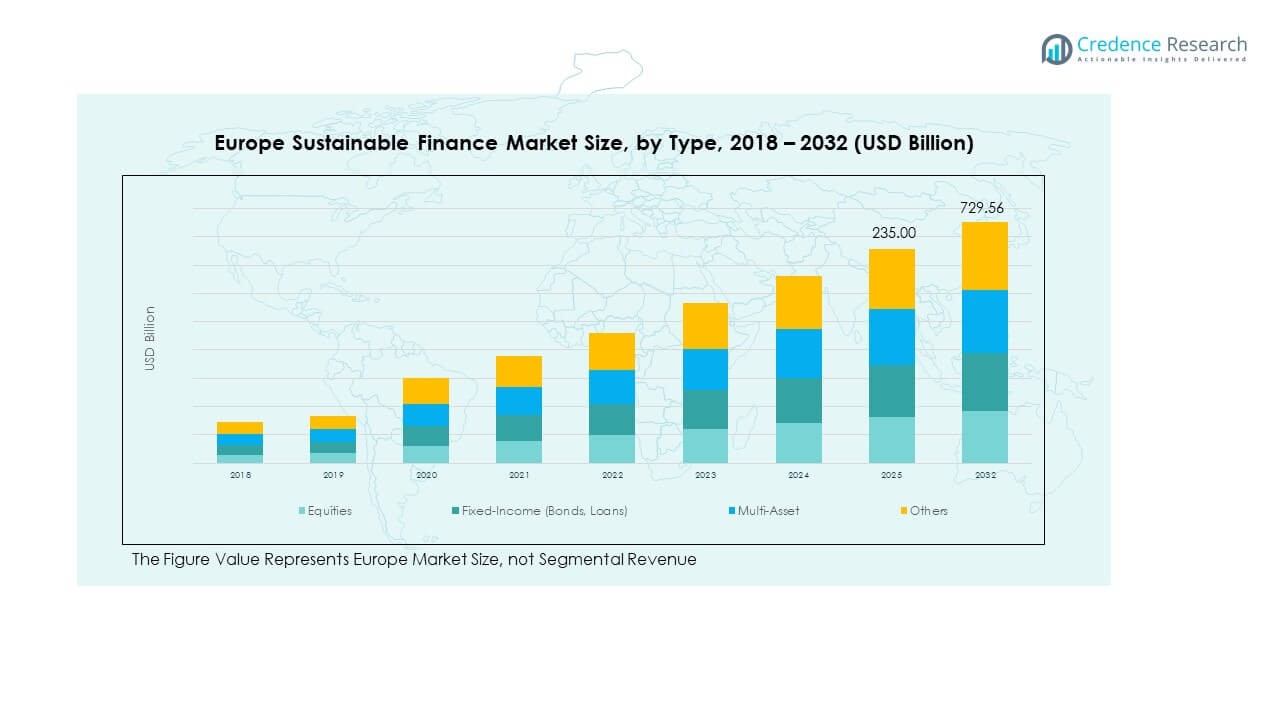

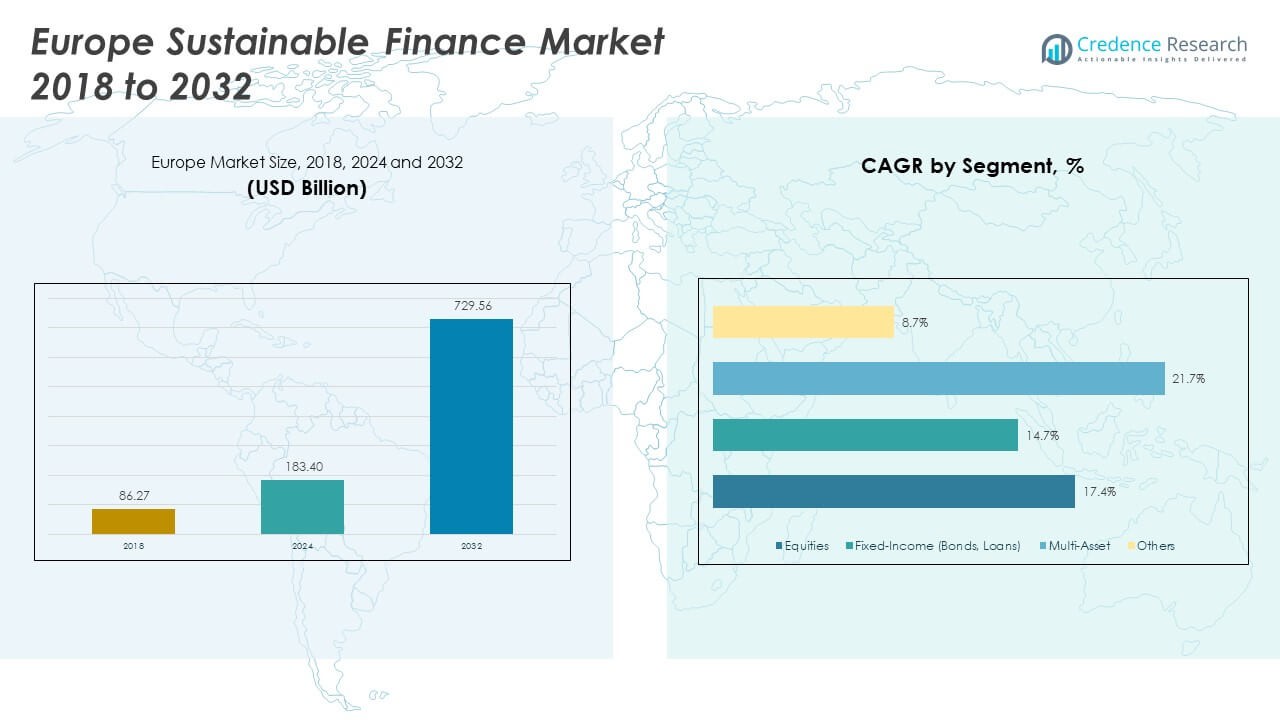

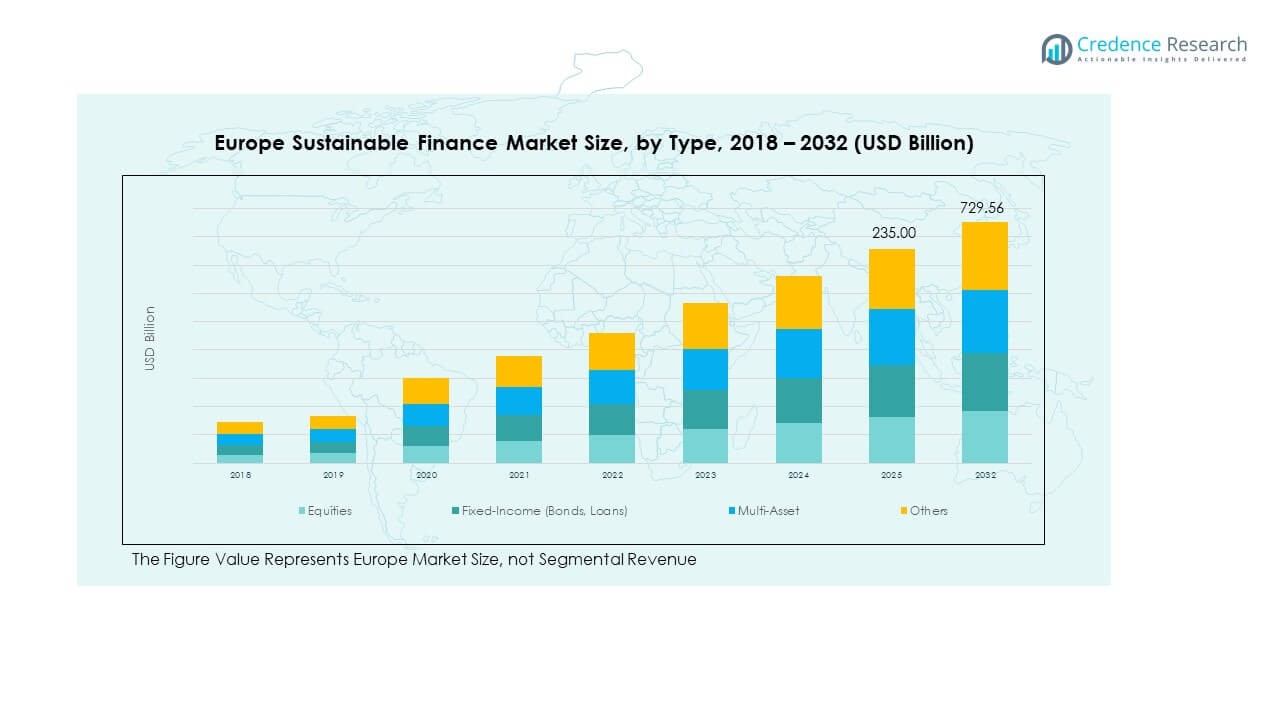

The Europe Sustainable Finance Market size was valued at USD 86.27 billion in 2018 to USD 183.40 billion in 2024 and is anticipated to reach USD 729.56 billion by 2032, at a CAGR of 17.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Sustainable Finance Market Size 2024 |

USD 183.40 Billion |

| Europe Sustainable Finance Market, CAGR |

17.57% |

| Europe Sustainable Finance Market Size 2032 |

USD 729.56 Billion |

The growth of the Europe Sustainable Finance Market is fueled by strong regulatory backing, increasing investor demand for ESG-focused assets, and corporate commitments to net-zero strategies. Financial institutions actively develop green bonds, sustainability-linked loans, and ESG funds to align with climate goals. Consumer awareness of responsible investment also drives adoption across retail and institutional investors. Companies recognize sustainable finance as a means to reduce risks, enhance reputational value, and secure long-term funding. Technology-driven reporting systems support accountability, building further trust in the market.

Western Europe leads the market with robust financial infrastructure, stringent sustainability regulations, and high participation from institutional investors. Northern Europe, led by countries like Sweden and Denmark, emerges as a pioneer due to progressive climate policies and innovative green instruments. Southern Europe shows steady momentum, driven by renewable energy projects and infrastructure finance. Eastern Europe remains in the early stages but is gaining traction through EU-backed programs and increasing awareness. The geographic distribution highlights Europe’s coordinated but diverse approach to expanding sustainable finance across mature and emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Sustainable Finance Market was valued at USD 86.27 billion in 2018, USD 183.40 billion in 2024, and is projected to reach USD 729.56 billion by 2032, growing at a CAGR of 17.57%.

- Western Europe holds 46% share, led by advanced financial infrastructure and strong policy frameworks, while Northern Europe follows with 22% supported by innovative green finance adoption, and Southern Europe accounts for 19% driven by renewable infrastructure.

- Eastern Europe, with a 13% share, is the fastest-growing subregion, supported by EU-backed programs and rising investor awareness.

- Equities dominate the market with 41% share, driven by ESG-focused investments and shareholder sustainability demands.

- Fixed-income instruments, including bonds and loans, account for 34%, supported by corporate and government green bond issuances.

Market Drivers

Strong Regulatory Frameworks Encouraging Green Investments

European regulators continue to strengthen sustainability-focused policies that encourage capital flows toward green projects. The European Union’s taxonomy for sustainable activities provides standardized criteria that enhance transparency and reduce risks for investors. Governments set ambitious climate targets that create opportunities for climate-aligned financial products. Mandatory disclosures and reporting requirements raise accountability and push firms to adopt sustainable practices. Banks and asset managers align strategies with long-term environmental goals to secure compliance. Public institutions also incentivize private sector financing for renewable and low-carbon infrastructure. This push builds investor confidence in sustainable portfolios. The Europe Sustainable Finance Market benefits directly from these coordinated policy measures.

- For example, in April 2025, the European Investment Bank (EIB) issued a €3 billion Climate Awareness Bond under the new European Green Bond Standard, the largest of its kind to date. The issuance attracted demand exceeding €40 billion, making it more than 13 times oversubscribed.

Growing Institutional Investor Demand For ESG Integration

Institutional investors increasingly integrate environmental, social, and governance (ESG) factors into investment strategies. Pension funds, insurance companies, and sovereign wealth funds allocate significant resources to sustainable finance products. The shift reflects a need to mitigate climate-related risks while pursuing stable returns. It also indicates rising demand for transparency and resilience in investment portfolios. Investor coalitions and networks encourage collective action to expand ESG adoption. The Europe Sustainable Finance Market gains momentum from these large capital commitments. Asset managers develop innovative ESG-linked funds to meet investor needs. Such initiatives strengthen the long-term growth of sustainable investment ecosystems.

- For example, in October 2024, Iberdrola and Norges Bank Investment Management commissioned the 50 MW Peñarrubia solar PV plant in Murcia as the first project of their €2 billion renewables alliance. The joint venture aims for 2,500 MW of renewable capacity in Iberia enough to power over 400,000 homes and avoid about 350,000 tonnes of CO₂ emissions annually.

Corporate Commitments To Climate Neutrality

Large corporations across Europe pledge climate neutrality goals that reshape capital allocation. Firms invest in renewable energy projects, sustainable supply chains, and green technologies to meet net-zero commitments. This corporate push creates steady demand for financing mechanisms tailored to sustainability. Companies view sustainable finance tools as vital for achieving reputational advantages and stakeholder trust. The Europe Sustainable Finance Market grows as businesses adopt long-term ESG strategies. Green loans and sustainability-linked bonds become attractive instruments to support transitions. Supply chain financing models also evolve to prioritize environmentally responsible suppliers. The expanding corporate focus ensures continued market development.

Consumer Awareness Driving Demand For Responsible Products

Consumers demonstrate increasing interest in sustainable goods and services that align with climate responsibility. This demand places pressure on businesses to adopt greener practices and financing structures. Financial institutions respond by creating products that reflect consumer values and expectations. The Europe Sustainable Finance Market gains momentum from this shift in societal behavior. Retail investors contribute to growth by favoring sustainable investment funds. Awareness campaigns and educational initiatives raise understanding of environmental impacts. Companies that ignore consumer sentiment face reputational risks and reduced market relevance. This cultural change reinforces the adoption of sustainable finance strategies across industries.

Market Trends

Expansion Of Sustainable Bonds And Green Loan Instruments

Sustainable bonds and green loans experience rapid adoption across European financial markets. Issuers use these instruments to fund renewable energy, clean transportation, and circular economy projects. The Europe Sustainable Finance Market benefits from their growing acceptance by both public and private entities. Investors prefer these products due to clear accountability and measurable outcomes. Governments also back such instruments through incentives and supportive frameworks. Sustainable loans tied to performance targets gain popularity across corporate borrowers. Financial institutions expand offerings to meet rising demand for green credit solutions. This expansion ensures long-term stability for sustainable finance mechanisms.

- For example, Iberdrola’s Baltic Eagle offshore wind farm in the Baltic Sea has a planned capacity of 476 MW and is expected to avoid around 800,000 tonnes of CO₂ emissions annually. In March 2024, Masdar and Iberdrola reached financial close for the project, with Masdar holding a 49% stake.

Integration Of Digital Platforms In Sustainable Finance

Digital solutions transform how financial institutions track and report sustainability metrics. Blockchain and AI tools enhance transparency and reduce risks of greenwashing in portfolios. Platforms offer real-time monitoring of ESG performance to improve accountability. The Europe Sustainable Finance Market adapts to these advancements by incorporating data-driven models. Investors use analytics to evaluate climate risks and opportunities more accurately. Startups and fintech firms play a key role in building scalable systems. Digitalization creates efficiency for compliance with stringent reporting standards. Technology integration strengthens trust and broadens adoption of sustainable financial solutions.

Rising Popularity Of Sustainability-Linked Derivatives

Financial markets in Europe explore sustainability-linked derivatives to hedge risks while supporting ESG goals. These products tie returns to environmental or social performance metrics. The Europe Sustainable Finance Market incorporates them to expand innovative investment options. Multinational corporations and banks use derivatives to align financing structures with sustainability objectives. Regulators monitor these instruments to ensure compliance with standards. Demand grows as investors seek more diverse tools beyond traditional bonds. Derivatives support long-term strategies by integrating flexibility into sustainable portfolios. Their development signals maturing sophistication in sustainable finance offerings.

Cross-Border Collaboration Enhancing Market Development

Cross-border initiatives strengthen Europe’s leadership in sustainable finance. Partnerships between regional governments, banks, and institutions support knowledge sharing and investment opportunities. The Europe Sustainable Finance Market expands as transnational alliances mobilize capital for large-scale projects. Collaborative frameworks help channel funds into renewable energy corridors and cross-country infrastructure. Multilateral development banks play a vital role in coordinating financing efforts. European nations align with international standards to create consistency for global investors. Cross-border deals also attract foreign participation in European green projects. Such cooperation ensures broader access to capital and sustained market growth.

- For example, in January 2025, the European Investment Bank committed €400 million to Baltica 2, a 1.5 GW offshore wind project in Poland by PGE and Ørsted. The project is part of a €1.4 billion EIB-backed funding package for two offshore farms, totaling 2.5 GW capacity.

Market Challenges Analysis

Concerns Over Greenwashing And Lack Of Standardization

Greenwashing concerns undermine confidence in sustainable finance initiatives across Europe. Investors question the reliability of disclosures when standards vary between regions and industries. The Europe Sustainable Finance Market struggles to maintain trust without uniform reporting systems. Inconsistent ESG ratings and methodologies make it difficult to compare performance. Companies sometimes overstate sustainability achievements to attract funding. This creates reputational risks for financial institutions and asset managers. Regulators attempt to address these issues through stricter taxonomies and verification systems. Yet, ensuring complete standardization across diverse markets remains a complex task.

Limited Access To Capital In Emerging Economies Within Europe

Emerging economies in Eastern and Southern Europe face difficulties in accessing sustainable finance. Limited financial infrastructure and lower investor confidence restrict their growth potential. The Europe Sustainable Finance Market experiences uneven development between advanced economies and emerging regions. Smaller institutions struggle to secure funding due to higher perceived risks. Lack of technical expertise further slows adoption of innovative finance tools. EU support programs attempt to bridge the gap, but disparities remain. Investors prefer established markets where risks are better managed. This challenge highlights the need for broader inclusion to strengthen overall market resilience.

Market Opportunities

Expansion Of Green Infrastructure And Renewable Energy Projects

Investments in renewable energy and green infrastructure create major opportunities for financial institutions. The Europe Sustainable Finance Market aligns with these projects to support long-term climate targets. Solar parks, offshore wind farms, and energy-efficient transport networks require large-scale funding. Governments introduce favorable policies that enhance private sector participation. Financial institutions develop innovative instruments to channel capital into these areas. Green infrastructure also attracts international investors seeking stable and impactful returns. It offers opportunities for creating blended finance models to reduce risks. Such developments ensure consistent growth and resilience for the sustainable finance ecosystem.

Growth Potential In Sustainable Retail Investment Products

Retail investors increasingly demand access to sustainable financial products. The Europe Sustainable Finance Market addresses this demand by expanding ESG-focused funds and savings products. Banks and asset managers create accessible options tailored for individual investors. Educational campaigns improve awareness of sustainability-linked investment benefits. Demand for ethical and transparent financial solutions strengthens product innovation. Retail-driven growth diversifies the investor base and spreads adoption across demographics. Financial institutions position these products as mainstream rather than niche offerings. This trend creates new opportunities for scaling sustainable finance beyond institutional markets.

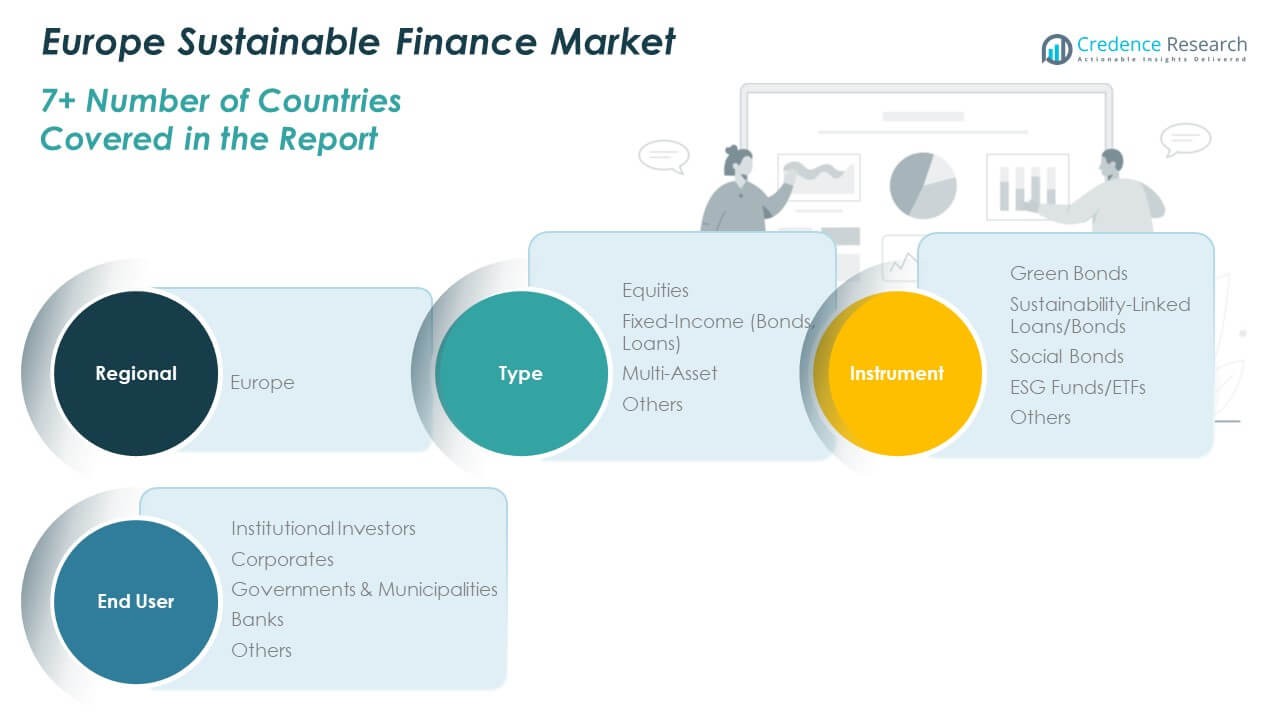

Market Segmentation Analysis

By type

The Europe Sustainable Finance Market demonstrates strong momentum across type. Equities represent a major share, supported by growing ESG-focused investment funds and rising shareholder pressure on sustainability practices. Fixed-income instruments, particularly bonds and loans, attract significant interest due to their ability to provide stable returns with measurable environmental outcomes. Multi-asset portfolios gain traction among investors seeking diversified exposure to sustainable opportunities, while other asset classes continue to evolve with niche offerings. It reflects investor appetite for both growth and stability in sustainable strategies.

- For example, Luxembourg remains Europe’s largest hub for sustainable funds, hosting ~34% of sustainable funds’ net assets. In 2023, these Luxembourg-domiciled sustainable funds grew by 1%.

By instrument

Green bonds remain dominant due to established frameworks and widespread acceptance in financing renewable energy, infrastructure, and environmental projects. Sustainability-linked loans and bonds show rapid adoption, driven by corporate commitments to measurable ESG targets. Social bonds gain visibility by supporting projects in healthcare, education, and social housing. ESG funds and ETFs expand access for institutional and retail investors, offering diversified exposure at scale. Other instruments contribute to innovation in structured sustainable finance solutions.

- For example, in January 2025, Italian utility A2A raised €500 million through its first European Green Bond (EuGB), fully aligned with the EU Taxonomy. The bond drew over €2.2 billion in orders, making it roughly 4× oversubscribed.

By End-user

Demand highlights institutional investors as the leading participants, allocating capital toward long-term sustainable portfolios. Corporates adopt sustainability-linked loans and bonds to achieve net-zero commitments and enhance reputational value. Governments and municipalities play a critical role by issuing green bonds to fund national and regional sustainability initiatives. Banks act as both facilitators and issuers, channeling capital into sustainable lending portfolios. Other end users, including foundations and non-profits, support the ecosystem by aligning financing models with climate and social goals. This segmentation reflects the broad reach of sustainable finance across sectors and stakeholders.

Segmentation

By Type

- Equities

- Fixed-Income (Bonds, Loans)

- Multi-Asset

- Others

By Instrument

- Green Bonds

- Sustainability-Linked Loans/Bonds

- Social Bonds

- ESG Funds/ETFs

- Others

By End User

- Institutional Investors

- Corporates

- Governments & Municipalities

- Banks

- Others

By Region

Regional Analysis

Western Europe holds the largest share of the Europe Sustainable Finance Market at 46%. The region benefits from advanced financial systems, strong regulatory frameworks, and established sustainability policies. Countries such as Germany, France, and the UK lead with active issuance of green bonds, sustainability-linked loans, and ESG funds. Banks, institutional investors, and corporates adopt sustainable finance instruments to align with net-zero commitments. Public policies and EU taxonomy compliance further accelerate adoption. It demonstrates maturity through both institutional strength and widespread integration of sustainable finance principles.

Northern Europe accounts for 22% of the market, reflecting the influence of progressive climate agendas and early adoption of renewable energy investments. Sweden, Denmark, and Finland lead with innovation in green financial products and strong government-backed frameworks. Investors in these countries prioritize sustainability, creating high demand for ESG-linked instruments. The region also benefits from advanced transparency and accountability standards. It attracts global capital by offering reliable and impactful investment opportunities. This subregion positions itself as a model for integrating sustainability with long-term financial planning.

Southern and Eastern Europe collectively represent 32% of the market, with Southern Europe holding 19% and Eastern Europe at 13%. Southern Europe, including Italy and Spain, shows steady growth through expanding renewable energy projects and infrastructure financing. Eastern Europe is emerging, supported by EU funding programs and growing awareness of sustainable investment frameworks. It faces challenges in scaling due to less-developed financial systems, yet the potential remains strong. Governments and corporates are gradually adopting green bonds and sustainability-linked products. This shift expands the reach of sustainable finance across Europe’s diverse economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BlackRock Inc.

- Morgan Stanley

- UBS Group AG

- JPMorgan Chase & Co.

- Deutsche Bank AG

- State Street Corporation

- Goldman Sachs Group Inc.

- BNP Paribas

- KPMG International Limited

- London Stock Exchange Group plc

- CP Kelco

- Gelymar

- KitoZyme

- EcoSynthetix

- Clariant

Competitive Analysis

The Europe Sustainable Finance Market features a competitive landscape shaped by global financial institutions, regional banks, and specialized asset managers. Leading players such as BlackRock, Morgan Stanley, UBS, and Deutsche Bank dominate through diversified sustainable investment products and strong regulatory alignment. These firms leverage their global networks to channel capital into green bonds, ESG funds, and sustainability-linked instruments. Their strategies emphasize transparency, reporting standards, and partnerships with governments and corporates to maintain leadership positions. It reflects high entry barriers created by scale, credibility, and compliance expertise. European banks such as BNP Paribas and London Stock Exchange Group play an integral role by structuring sustainable instruments and enabling liquidity in secondary markets. Asset managers expand their presence through ESG-focused ETFs and thematic funds designed for institutional and retail clients. Smaller firms and advisory groups contribute by offering niche expertise in sustainability assessments and impact measurement. Competition is also influenced by technological adoption, where digital tools improve monitoring, reporting, and risk management. The Europe Sustainable Finance Market continues to evolve with new entrants seeking differentiation through innovative products, but established firms retain dominance due to their scale and regulatory advantage.

Recent Developments

- In September 2025, Euronext, a leading European capital market infrastructure company, announced several strategic developments during its annual Sustainability Week. Notably, on September 14, 2025, Euronext introduced the Euronext Sustainability Network with founding partners including PwC, ING, ERM, Moody’s Ratings, South Pole, CDP, PRI, ClimeFi, De Pardieu Avocats, and the EU Chapter Zero network. This initiative aims to provide high-quality intelligence to strengthen sustainable finance impact across Europe.

- In September 2025, EQT, a major European investment organization, introduced a European Long-Term Investment Fund (ELTIF) structure as part of its Nexus evergreen suite. This move is poised to broaden access to sustainable private capital markets for individual investors, further propelling long-term sustainable finance in Europe by allowing a new investor class to participate in green and resilience-focused markets.

Report Coverage

The research report offers an in-depth analysis based on Type, Instrument and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Regulatory frameworks will strengthen, driving higher adoption of transparent sustainable finance practices.

- Green bond issuances will continue expanding across corporate and government sectors.

- Institutional investors will deepen ESG integration into diversified portfolios.

- Digital platforms will enhance monitoring and reduce risks of misreporting in investments.

- Northern Europe will maintain leadership in innovation for climate-linked financial products.

- Southern Europe will attract sustainable finance through infrastructure and renewable energy projects.

- Eastern Europe will gradually gain traction with EU-backed programs and rising awareness.

- Retail investors will increase participation through accessible ESG funds and ETFs.

- Competition will intensify as global and regional players expand offerings.

- Collaboration between governments, banks, and corporates will ensure steady growth of the Europe Sustainable Finance Market.