Market Overview:

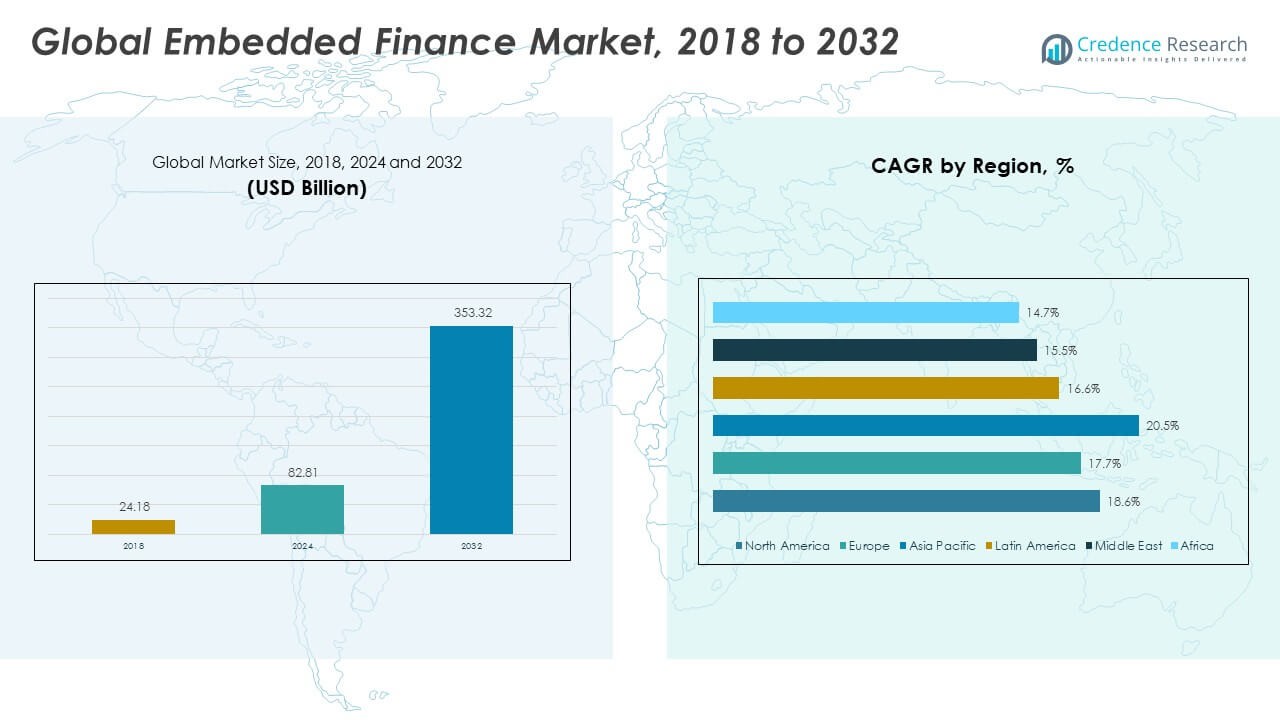

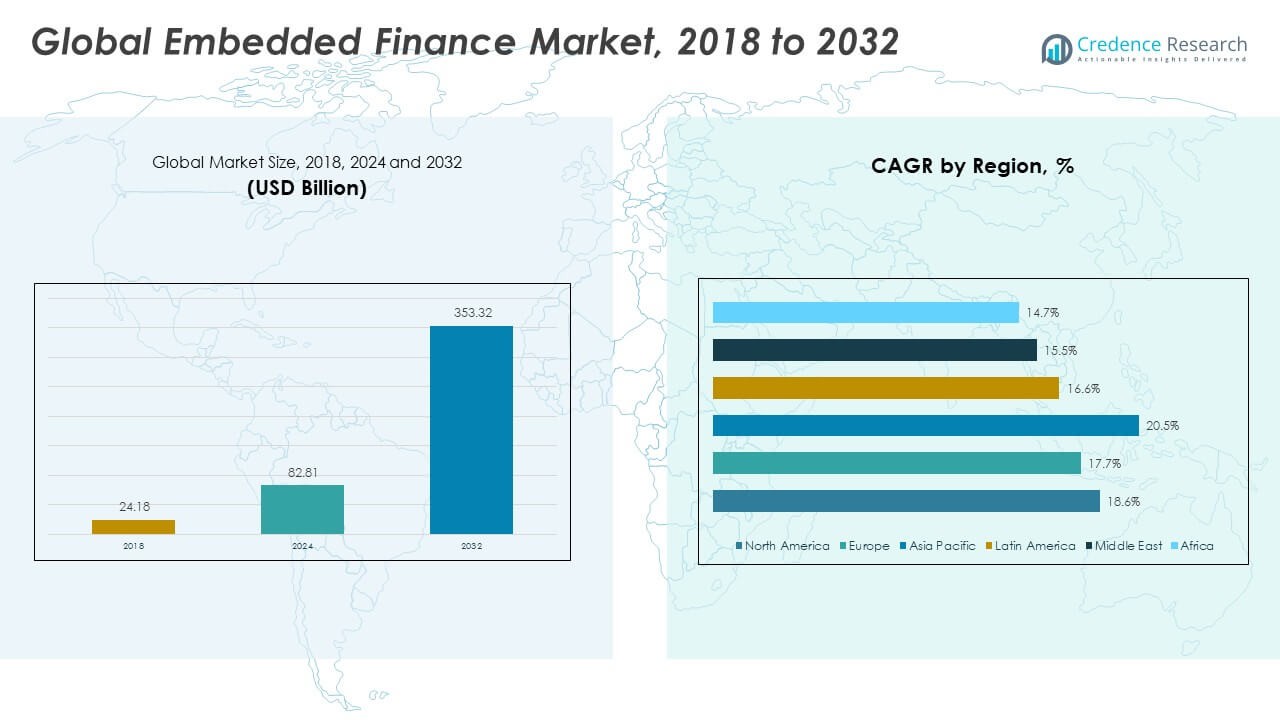

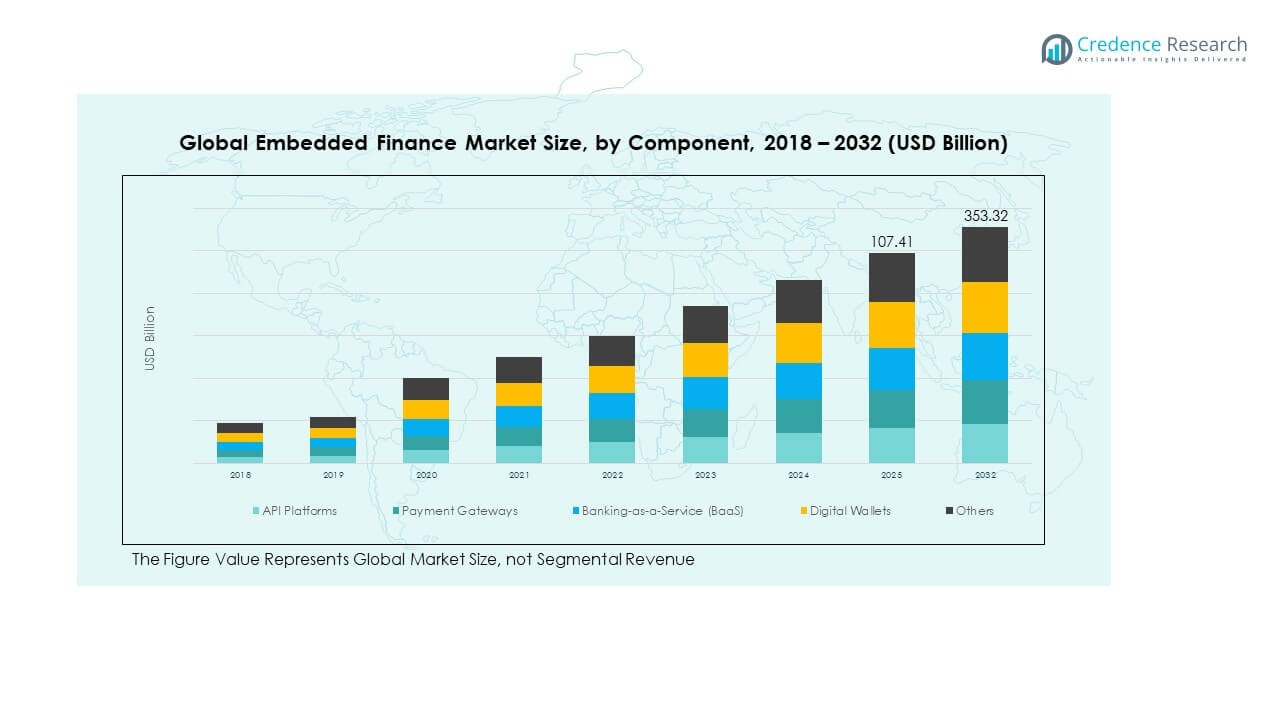

The Global Embedded Finance Market size was valued at USD 24.18 Billion in 2018 to USD 82.81 Billion in 2024 and is anticipated to reach USD 353.32 Billion by 2032, at a CAGR of 18.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Embedded Finance Market Size 2024 |

USD 82.81 Billion |

| Embedded Finance Market, CAGR |

18.54% |

| Embedded Finance Market Size 2032 |

USD 353.32 Billion |

The market growth is driven by the rising integration of financial services within non-financial platforms, allowing businesses to offer seamless payment, lending, and insurance solutions. Increasing digital transformation across industries, growing adoption of APIs, and the expansion of e-commerce ecosystems are key catalysts. Demand for frictionless user experiences and personalized financial services is fueling innovation and attracting investments from fintech startups and technology firms.

North America leads the market due to its advanced fintech infrastructure, strong consumer adoption of digital banking, and presence of major technology companies. Europe follows closely, supported by regulatory frameworks promoting open banking and financial inclusion. Asia-Pacific is emerging rapidly, driven by expanding digital ecosystems, rising smartphone penetration, and government support for fintech innovation in countries like India, China, and Singapore.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Embedded Finance Market was valued at USD 24.18 billion in 2018, reached USD 82.81 billion in 2024, and is projected to attain USD 353.32 billion by 2032, growing at a CAGR of 18.54% during the forecast period.

- North America (44%), Europe (26%), and Asia Pacific (23%) collectively capture over 90% of the total market share, driven by strong fintech adoption, open banking regulations, and integration of embedded payment systems across industries.

- Global Ethernet Access Device Market Size

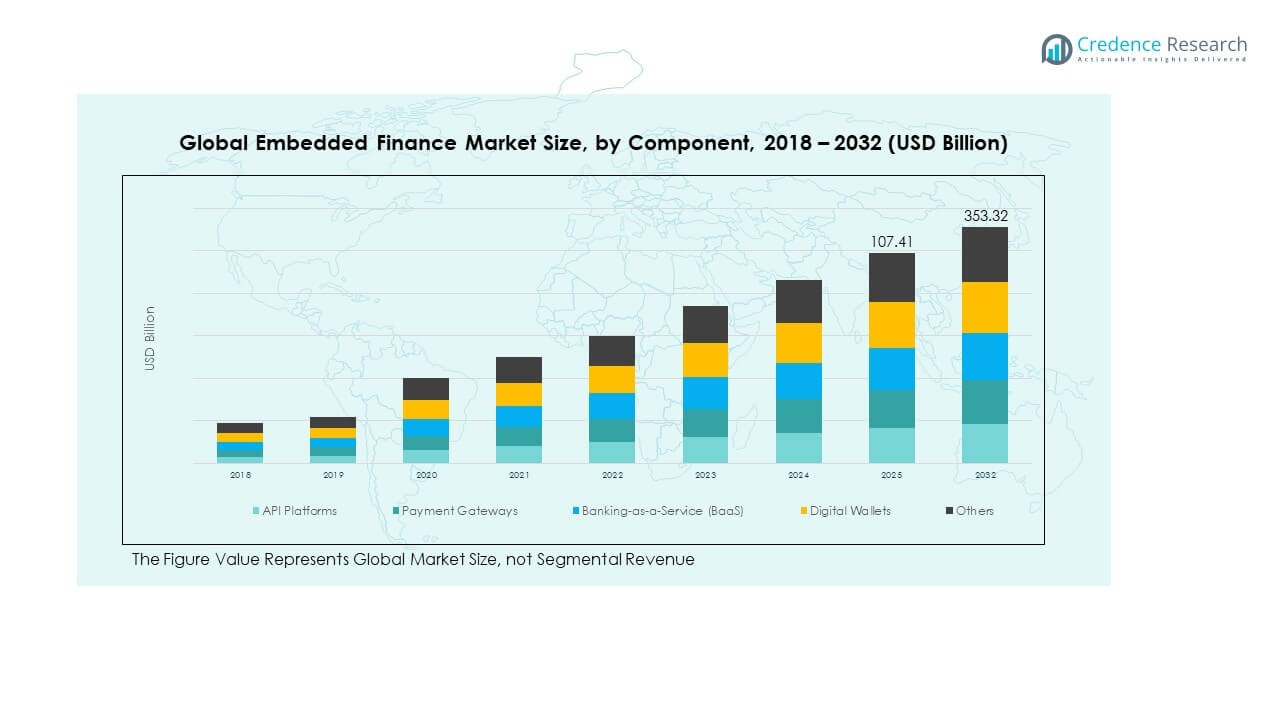

- By component, API Platforms hold approximately 35% of the market share, reflecting their importance in enabling financial connectivity and seamless integration across digital ecosystems.

- Banking-as-a-Service (BaaS) and Digital Wallets together account for about 45% of the total component distribution, driven by rising cashless transactions, embedded lending models, and scalable financial infrastructure.

Market Drivers:

Growing Integration of Financial Services Across Digital Platforms

The Global Embedded Finance Market is expanding due to the integration of financial services into non-financial ecosystems such as retail, travel, and e-commerce. Businesses are embedding payment gateways, lending solutions, and insurance options directly into their customer interfaces. This integration enhances customer convenience and increases engagement rates. Financial institutions collaborate with digital platforms to extend reach and streamline operations. The adoption of APIs allows faster deployment of financial tools. It enables companies to offer value-added services without heavy infrastructure investments. Rising consumer demand for seamless and frictionless financial experiences further accelerates adoption. The shift toward platform-based finance models drives competition and innovation across industries.

- For instance, Stripe processed over $1.4 trillion in payments in 2024, representing a 38% year-on-year increase, which underscores how embedding payments at checkout drives scale. Businesses are embedding payment gateways, lending solutions, and insurance options directly into customer interfaces.

Rise of Fintech Partnerships and Open Banking Ecosystems

Fintech companies are forming strategic alliances with traditional banks to enable embedded financial ecosystems. These partnerships bridge technological expertise with regulatory and compliance frameworks. Open banking regulations encourage data sharing, fostering transparency and competition. The market benefits from increased innovation and rapid integration of embedded payment and lending features. Businesses adopt digital wallets, buy-now-pay-later (BNPL) options, and micro-loan facilities to attract users. It enhances user trust and drives recurring engagement. The strong emphasis on interoperability and data-driven decision-making strengthens financial inclusion. Governments and regulators support this shift by promoting standardized API frameworks for safe data exchange.

- For instance, Marqeta states that consumers feel positively about brands offering financial services, which reflects how brand-finance partnerships scale. These partnerships bridge technological expertise with regulatory and compliance frameworks. Open banking regulations encourage data sharing, fostering transparency and competition.

Expanding E-Commerce and Digital Payment Infrastructure

The rapid growth of e-commerce and mobile payment systems creates fertile ground for embedded finance. Consumers expect quick checkout experiences with secure payment options. Businesses leverage embedded payment gateways to reduce transaction friction and enhance user satisfaction. The rise of mobile banking and contactless transactions supports broader adoption. It allows small and medium-sized enterprises to integrate financing and payment services into their digital channels. The trend supports financial accessibility across emerging economies. Companies deploy AI-driven analytics to offer credit and insurance products tailored to user behavior. Increasing online transaction volumes continue to drive demand for embedded financial services worldwide.

Rising Demand for Personalized and Data-Driven Financial Services

Data analytics and artificial intelligence are transforming embedded finance by enabling personalized offerings. Platforms analyze customer data to design contextual financial products. Consumers benefit from customized loan options, spending insights, and dynamic insurance coverage. It strengthens customer loyalty and engagement within digital ecosystems. Businesses use predictive analytics to identify creditworthiness and risk levels accurately. Embedded finance solutions help create financial experiences aligned with user behavior. The trend promotes financial empowerment and user-centric innovation. The ability to provide targeted financial solutions fosters customer retention and market growth.

Market Trends:

Expansion of Embedded Lending and Credit Solutions in Consumer Markets

The Global Embedded Finance Market is witnessing a surge in embedded lending solutions integrated within e-commerce and service platforms. Businesses provide instant credit options at the point of sale to boost customer spending. These services attract users seeking flexible financing alternatives. The rise of buy-now-pay-later (BNPL) models enhances customer affordability and loyalty. Fintech firms introduce AI-driven risk assessment tools for faster credit approvals. It helps reduce default rates and improve operational efficiency. Retailers and travel companies adopt embedded loans to promote higher-value purchases. This trend expands consumer access to responsible and transparent financial solutions.

- For instance, Marqeta notes embedded credit-related transactions are projected to grow 5× over five years in the U.S. alone. Businesses provide instant credit options at the point of sale to boost customer spending. These services attract users seeking flexible financing alternatives. The rise of BNPL models enhances customer affordability and loyalty—Marqeta finds that 62% of co-branded cardholders view themselves as customers of the brand rather than the bank.

Adoption of Embedded Insurance and Risk Management Platforms

Embedded insurance is becoming a core trend within digital ecosystems across automotive, travel, and healthcare sectors. Service providers integrate coverage options into customer journeys to simplify purchase experiences. Users can buy tailored insurance policies during transactions without leaving the platform. It reduces complexity and boosts adoption rates among digital consumers. Insurtech firms collaborate with digital platforms to offer micro-insurance and subscription-based policies. This transformation enhances affordability and accessibility. AI-driven claim management and fraud detection tools further streamline processes. Growing interest in embedded insurance strengthens market maturity and cross-industry collaboration.

- For instance, research from OpenPayd found that 74% of businesses plan to launch an embedded finance offering and that only 9% currently have one, highlighting how insurance-embedded use cases remain nascent yet poised for growth. Service providers integrate coverage options into customer journeys to simplify purchase experiences. Users can buy tailored insurance policies during transactions without leaving the platform.

Emergence of Banking-as-a-Service (BaaS) Models Supporting Fintech Innovation

The evolution of BaaS platforms fuels innovation across the Global Embedded Finance Market. Technology providers enable businesses to integrate banking functionalities like account creation, fund transfers, and lending into digital platforms. This flexibility accelerates product deployment and enhances scalability. BaaS platforms provide compliance-ready infrastructure for startups and enterprises. It simplifies the process of embedding regulated financial services into applications. Companies leverage these solutions to reduce development costs and expand service portfolios. Growing investment in cloud-native banking APIs supports this transformation. BaaS continues to redefine how enterprises deliver integrated financial experiences globally.

Growth of Embedded Wealth Management and Investment Platforms

Embedded investment tools are gaining traction within mobile applications and e-commerce ecosystems. Companies integrate investment and savings features into digital wallets and retail apps. Users can invest small amounts through automated and user-friendly interfaces. It democratizes access to financial planning and wealth creation. Financial firms use AI and machine learning to provide portfolio insights and real-time advice. Businesses adopt embedded investment options to retain high-value customers. The trend supports financial inclusion by encouraging micro-investing habits. This evolution strengthens consumer engagement across digital financial ecosystems.

Market Challenges Analysis:

Regulatory Complexities and Compliance Barriers Across Multiple Jurisdictions

The Global Embedded Finance Market faces significant challenges due to regulatory diversity and compliance obligations. Each region enforces distinct laws governing data privacy, financial licensing, and consumer protection. Businesses integrating financial services must comply with complex frameworks such as PSD2 in Europe and KYC/AML rules globally. It increases operational costs and delays deployment across borders. The evolving nature of digital finance regulations creates uncertainty for fintechs and non-financial entities. Companies need continuous monitoring to stay compliant with financial authorities. Regulatory fragmentation hampers scalability and discourages new entrants. Harmonizing rules across regions remains a key challenge to sustainable growth.

Data Security Risks and Limited Consumer Trust in Digital Finance Ecosystems

Cybersecurity concerns and privacy issues hinder adoption within the embedded finance ecosystem. Digital platforms handle large volumes of sensitive user data, creating exposure to breaches and misuse. Consumers remain cautious about sharing financial details with non-traditional entities. It limits user engagement and slows market penetration. Businesses must invest heavily in encryption, identity verification, and fraud prevention systems. Strengthening cybersecurity frameworks and data governance becomes essential to sustain trust. Platform providers collaborate with cybersecurity firms to implement multi-layered protection models. Building long-term user confidence remains critical for market growth.

Market Opportunities:

Emerging Scope of Embedded Finance in Underbanked and Developing Economies

The Global Embedded Finance Market presents strong opportunities in developing nations where financial inclusion is limited. Digital ecosystems are bridging the gap by integrating financial tools into retail, transport, and telecom applications. Consumers in emerging economies benefit from simplified access to credit, insurance, and savings products. Governments promote fintech expansion through supportive policies and digital ID systems. It fosters inclusion among unbanked populations and small enterprises. Local fintech startups are using mobile platforms to extend microfinance services. Partnerships between banks and digital firms strengthen this shift. Expanding smartphone and internet access enhances the market potential significantly.

Integration of Artificial Intelligence and Blockchain for Secure Transactions

Advancements in artificial intelligence and blockchain create new opportunities for secure and transparent embedded financial solutions. Companies deploy AI models for real-time credit assessment and fraud detection. Blockchain ensures data integrity and simplifies cross-border payments. It supports the automation of lending, underwriting, and insurance claims. Technology-driven innovations help financial and non-financial players collaborate more efficiently. Embedded finance platforms leveraging decentralized systems enhance transparency and compliance. The combination of AI and blockchain reduces operational costs and human errors. These technologies will shape the next phase of market evolution.

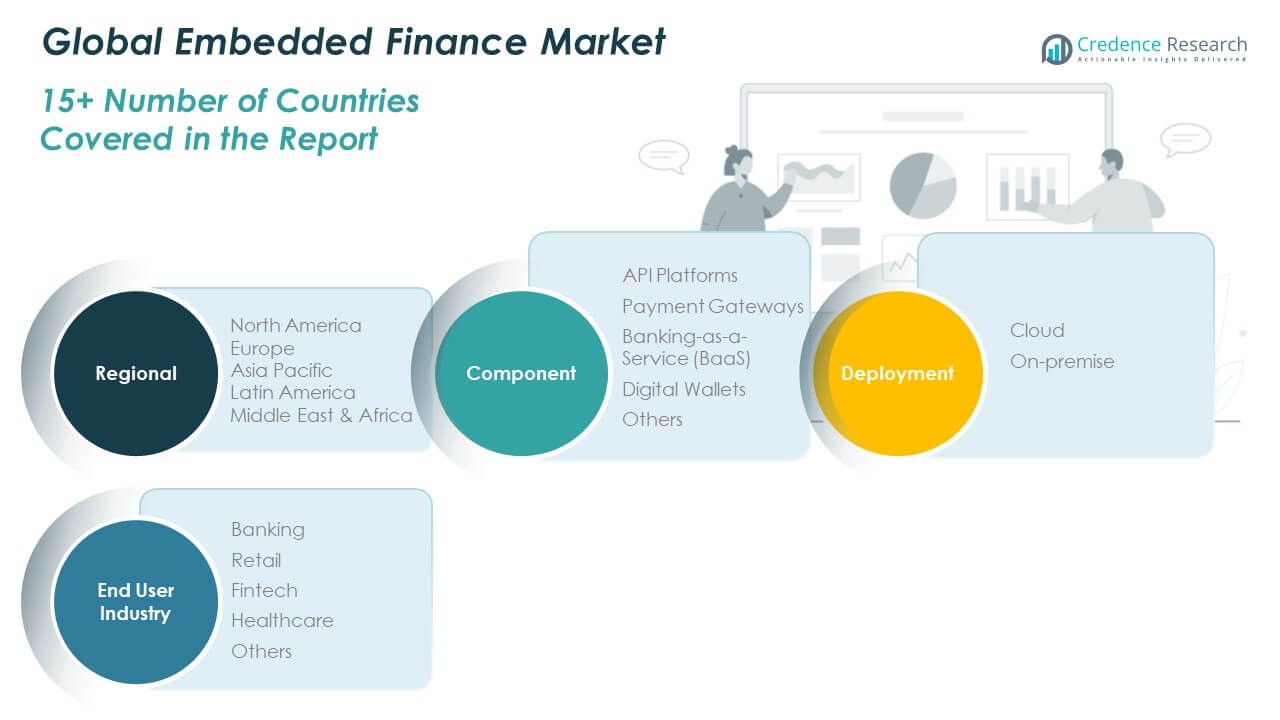

Market Segmentation Analysis:

By Component

The Global Embedded Finance Market is segmented into API Platforms, Payment Gateways, Banking-as-a-Service (BaaS), Digital Wallets, and Others. API platforms hold a dominant position, supporting seamless integration between financial institutions and digital businesses. Payment gateways are gaining traction with the rise of e-commerce and contactless transactions. Banking-as-a-Service is expanding rapidly, enabling enterprises to embed regulated financial services efficiently. Digital wallets continue to grow due to the increasing preference for cashless payments. Other components include credit and insurance modules that extend financial access to non-traditional sectors.

- For instance, Stripe processes over 500 million API requests daily across 47 countries, underpinning the dominance of API Platforms. Payment Gateways gain traction as e-commerce expands, highlighted by Stripe handling 465 million transactions and over $31 billion in payment volume during one busy shopping weekend. Banking-as-a-Service expands rapidly, exemplified by Marqeta supporting issuance of more than 270 million cards in 40 + countries.

By Deployment

Deployment segments include Cloud and On-premise. The cloud segment leads the market due to scalability, flexibility, and cost efficiency. Enterprises prefer cloud-based solutions for quick integration and continuous updates. It supports API connectivity, advanced analytics, and compliance management across multiple platforms. On-premise deployment retains relevance in organizations with strict data governance and internal control needs.

- For instance, Stripe reports an API uptime of more than 99.9999 % during high-volume events, illustrating the reliability and scalability of cloud deployment. Enterprises prefer cloud-based solutions because they support rapid integration and frequent updates across multiple platforms. Cloud deployments offer API connectivity, advanced analytics, and compliance management much more efficiently. On-premise deployment retains relevance in organizations with strict data governance and internal control needs, especially in regulated industries.

By Application

Applications of embedded finance span Banking, Retail, Fintech, Healthcare, and Others. The banking sector leverages embedded finance to improve service delivery and customer retention. Retail is experiencing rapid adoption due to in-app payments and loyalty integrations. Fintech companies drive innovation through micro-lending and digital investment tools. The healthcare sector is using embedded payment models for telemedicine and insurance claims. Other sectors, including mobility and travel, are also embracing embedded finance to enhance transaction convenience and improve customer engagement.

Segmentation:

By Component:

- API Platforms

- Payment Gateways

- Banking-as-a-Service (BaaS)

- Digital Wallets

- Others

By Deployment:

By Application:

- Banking

- Retail

- Fintech

- Healthcare

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Global Embedded Finance Market size was valued at USD 10.74 million in 2018 to USD 36.40 million in 2024 and is anticipated to reach USD 155.74 million by 2032, at a CAGR of 18.6% during the forecast period. North America holds the largest market share of around 44%. The region benefits from advanced fintech infrastructure, high digital literacy, and the presence of leading players such as Stripe, Square, and Marqeta. Strong regulatory frameworks like open banking support innovation while ensuring compliance. It experiences strong adoption across banking, retail, and healthcare platforms. The integration of embedded payments and lending into digital ecosystems enhances consumer engagement. Financial institutions collaborate with technology providers to expand product accessibility. The region’s early adoption of Banking-as-a-Service models strengthens its leadership position in the global market.

Europe

The Europe Global Embedded Finance Market size was valued at USD 6.97 million in 2018 to USD 23.03 million in 2024 and is anticipated to reach USD 92.61 million by 2032, at a CAGR of 17.7% during the forecast period. Europe accounts for nearly 26% of the global market share. The region’s growth is supported by open banking regulations and widespread adoption of digital payment solutions. Countries such as the UK, Germany, and France lead with strong fintech ecosystems. It benefits from innovation driven by startups and collaboration with traditional banks. Embedded insurance and lending platforms are gaining traction among retailers and e-commerce providers. Data privacy and consumer protection laws enhance trust and adoption. The region’s push toward digital transformation and financial inclusion strengthens its position in global markets.

Asia Pacific

The Asia Pacific Global Embedded Finance Market size was valued at USD 4.46 million in 2018 to USD 16.61 million in 2024 and is anticipated to reach USD 80.64 million by 2032, at a CAGR of 20.5% during the forecast period. Asia Pacific holds about 23% of the total market share, driven by rapid digitalization and large consumer bases. China, India, Japan, and South Korea are key contributors due to strong e-commerce growth and mobile-first economies. It benefits from rising internet penetration and supportive government initiatives promoting fintech. Local startups integrate embedded lending, insurance, and payment systems within super apps. The surge in digital wallet adoption supports regional market momentum. Expanding partnerships between banks and non-banking entities boost financial inclusion. Increasing investments in cloud-based BaaS infrastructure further accelerate innovation.

Latin America

The Latin America Global Embedded Finance Market size was valued at USD 1.09 million in 2018 to USD 3.70 million in 2024 and is anticipated to reach USD 13.88 million by 2032, at a CAGR of 16.6% during the forecast period. Latin America represents around 4% of the global market share. Growth is driven by expanding fintech ecosystems in Brazil and Mexico, where startups are integrating payments and lending features. It benefits from improving regulatory frameworks supporting financial inclusion. Embedded finance platforms help bridge the gap for unbanked populations. Digital wallets and peer-to-peer lending solutions are increasingly popular among SMEs and consumers. E-commerce growth encourages adoption of integrated payment tools. Local collaborations between financial institutions and digital platforms create new growth opportunities. Government-backed fintech innovation programs further sustain market expansion.

Middle East

The Middle East Global Embedded Finance Market size was valued at USD 0.59 million in 2018 to USD 1.81 million in 2024 and is anticipated to reach USD 6.30 million by 2032, at a CAGR of 15.5% during the forecast period. The region holds about 2% of the total global share. Strong digital transformation initiatives and rising demand for Islamic-compliant financial services support growth. It witnesses adoption of embedded payment and insurance models across e-commerce and travel sectors. GCC countries lead due to high smartphone usage and government fintech programs. Embedded lending solutions for SMEs are expanding across regional banks. Partnerships between fintech firms and telecom operators are introducing innovative payment methods. The market continues to evolve toward API-driven integration models. Investments in digital banking infrastructure strengthen financial accessibility.

Africa

The Africa Global Embedded Finance Market size was valued at USD 0.33 million in 2018 to USD 1.26 million in 2024 and is anticipated to reach USD 4.15 million by 2032, at a CAGR of 14.7% during the forecast period. Africa contributes nearly 1% of the global share but shows significant growth potential. Rising smartphone adoption and digital payments drive expansion across key markets such as South Africa, Nigeria, and Kenya. It benefits from mobile money ecosystems that provide accessible financial services. Fintech startups are integrating lending and insurance into mobile platforms to serve unbanked populations. Cross-border remittance platforms are gaining importance in regional trade. Governments are promoting fintech development through national digital finance strategies. The ongoing digital revolution positions Africa as a future growth frontier for embedded financial solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Embedded Finance Market is highly competitive, driven by rapid innovation and diverse participants across fintech, banking, and technology sectors. It includes established firms such as Stripe, Square, Marqeta, and Solarisbank, along with emerging fintech platforms offering niche financial integration services. Companies compete on API scalability, transaction security, and user experience. The market favors providers that enable seamless integration of financial products within non-financial ecosystems. Strategic alliances between banks and digital platforms are shaping new business models. It continues to evolve with heavy investments in AI, blockchain, and Banking-as-a-Service infrastructure.

Recent Developments:

- In August 2025, Stripe announced a partnership with Centerbase (Aug 19) to embed payment-processing solutions for mid-sized law firms.

- In August 2025, Marqeta completed the acquisition of TransactPay (Aug 6) to enhance its card-program management and embedded finance capabilities across the UK and EU.

- In June 2025, Marqeta powered the launch of the Klarna Card in the U.S., enabling a unified debit/pay-later card via Visa’s Flexible Credential.

- In April 2025, Railsr (formerly Railsbank) and Equals Money merged (Apr 30) to combine their embedded finance and BaaS infrastructure into a major European platform.

- In February 2025, Solarisbank introduced a new savings-account product via its partner Tomorrow (Feb 17) to expand embedded banking services into sustainable consumer markets.

Report Coverage:

The research report offers an in-depth analysis based on Component and Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising integration of finance within retail, healthcare, and travel ecosystems.

- Increasing adoption of Banking-as-a-Service among fintech startups.

- Expansion of embedded lending and BNPL models for consumer markets.

- Greater use of AI and data analytics for personalization and credit scoring.

- Strengthening partnerships between banks and technology providers.

- Broader regulatory support promoting open banking and digital inclusion.

- Growth in cloud-based deployment for scalable financial infrastructure.

- Rapid emergence of embedded insurance and micro-investment platforms.

- Heightened cybersecurity measures to safeguard digital transactions.

- Expanding financial access in underbanked and developing economies.