Market Overview

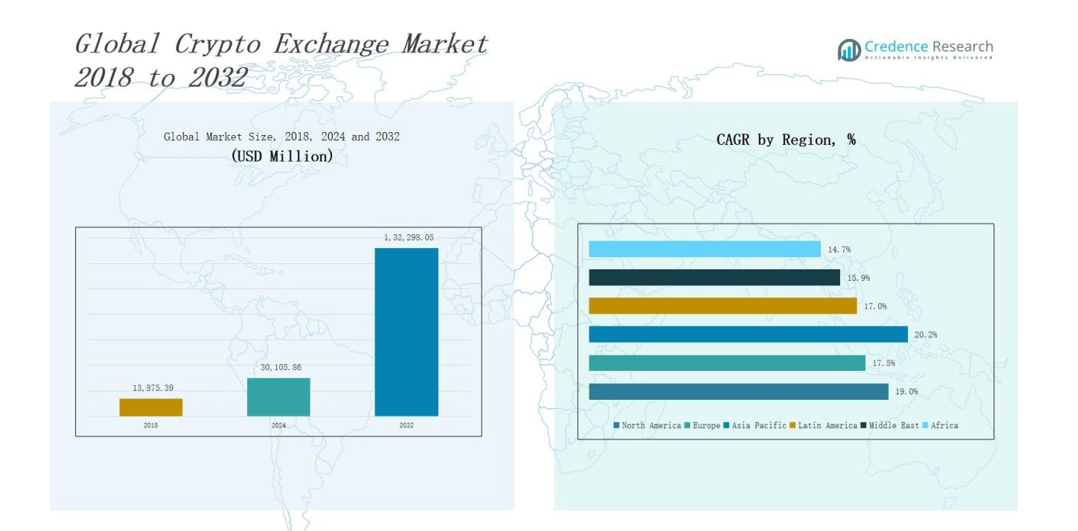

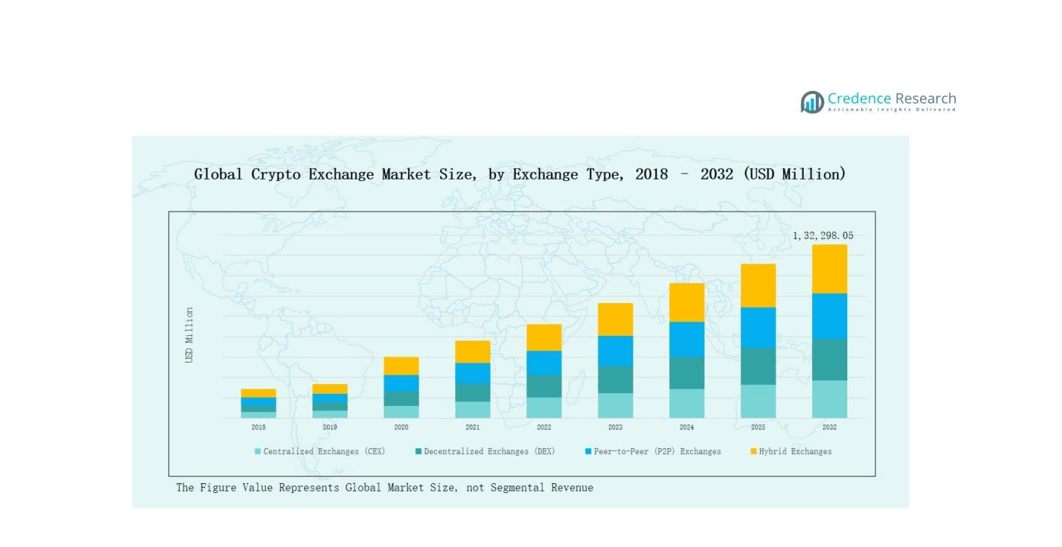

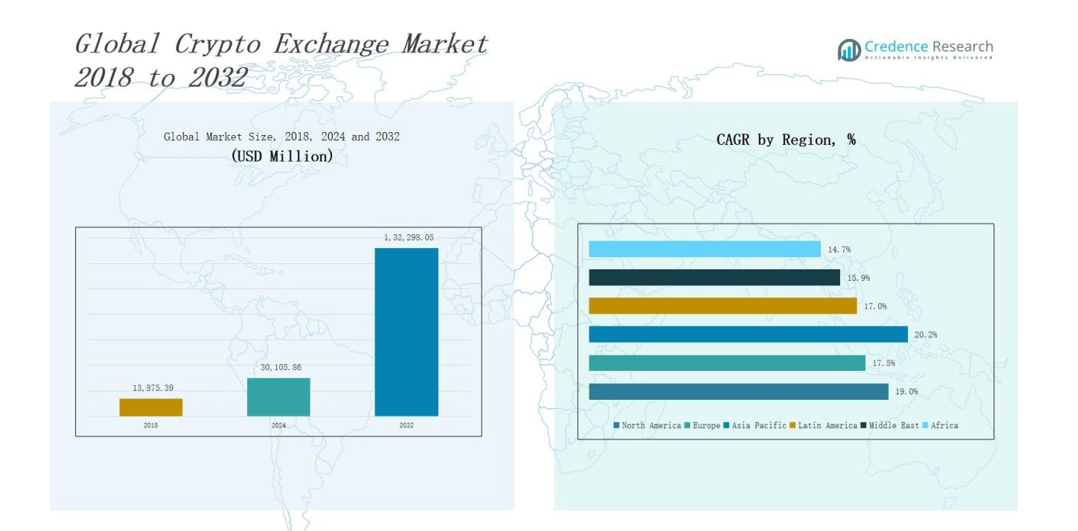

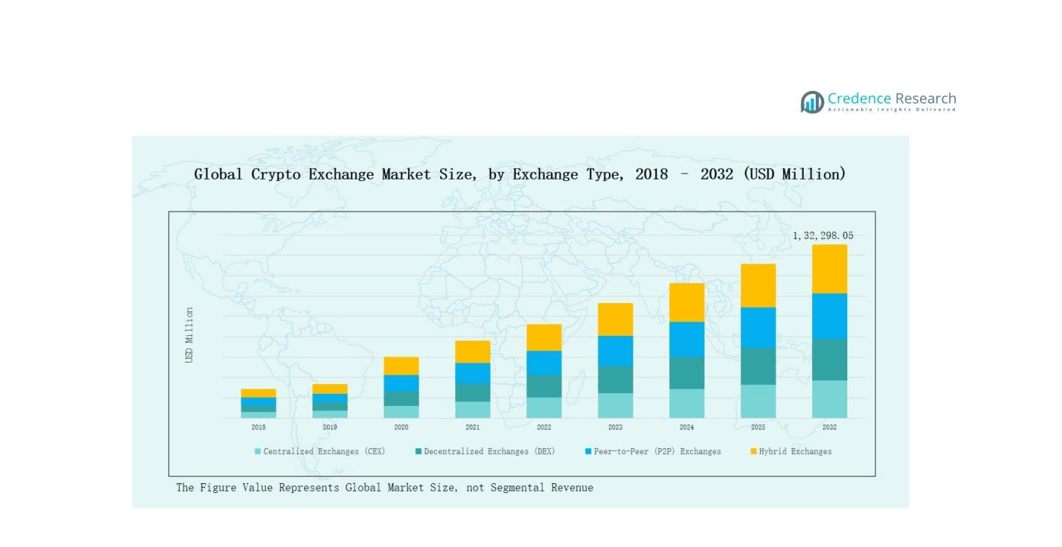

Crypto Exchange Market size was valued at USD 13,875.39 million in 2018 to USD 30,105.86 million in 2024 and is anticipated to reach USD 1,32,298.05 million by 2032, at a CAGR of 18.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crypto Exchange Market Size 2024 |

USD 30,105.86 million |

| Crypto Exchange Market, CAGR |

18.96% |

| Crypto Exchange Market Size 2032 |

USD 1,32,298.05 million |

The crypto exchange market is shaped by top players such as Binance, Coinbase, Kraken, Huobi, Bitfinex, KuCoin, and Gemini, each driving innovation through advanced trading platforms, security upgrades, and diversified service offerings. Binance maintains a dominant position with its broad global user base and extensive product ecosystem, while Coinbase strengthens its market share through regulatory compliance and institutional adoption. Kraken and Huobi expand their influence by offering derivatives and staking solutions, while Bitfinex, KuCoin, and Gemini focus on niche user groups and specialized features. Regionally, North America leads the crypto exchange market with a 38 percent share, supported by strong regulatory oversight, high institutional participation, and robust adoption among retail investors, establishing it as the most significant contributor to global market revenue.

Market Insights

- The Crypto Exchange Market grew from USD 13,875.39 million in 2018 to USD 30,105.86 million in 2024 and is expected to reach USD 1,32,298.05 million by 2032.

- Centralized Exchanges (CEX) dominate with 65 percent share, supported by liquidity, ease of use, fiat on-ramps, and strong security frameworks attracting retail and institutional participants.

- Retail Investors lead with 55 percent share in 2024, driven by mobile trading platforms, lower barriers, and rising global awareness of digital assets.

- North America leads with 36 percent market share in 2024, valued at USD 13,060.22 million, supported by institutional adoption, regulatory clarity, and strong fintech integration.

- Asia Pacific follows with 28 percent share, recording the fastest growth, fueled by high trading volumes, government blockchain initiatives, and rising youth-driven retail participation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Exchange Type:

Centralized Exchanges (CEX) dominate the crypto exchange market with a 65 percent share, driven by their liquidity depth, user-friendly interfaces, and wide range of services including fiat on-ramps, derivatives, and staking solutions. Their regulated frameworks and strong security infrastructure attract both retail and institutional participants. Decentralized Exchanges (DEX) hold 20 percent share, supported by growing demand for self-custody and privacy in trading. Peer-to-Peer (P2P) Exchanges account for 10 percent, catering to regions with limited banking access, while Hybrid Exchanges represent 5 percent, gaining traction by combining the transparency of DEX with the efficiency of CEX.

- For instance, Paxful grew to over 12 million users globally by 2023, primarily in Africa and Latin America.

By User Type:

Retail Investors lead the market with a 55 percent share, supported by the accessibility of mobile trading platforms, lower entry barriers, and increasing global awareness of cryptocurrencies. Institutional Investors represent 25 percent, with their participation rising due to regulatory clarity, the entry of custodial services, and integration of digital assets in investment portfolios. Traders account for 15 percent, driven by demand for margin trading, futures, and high-frequency trading strategies. The Others category, comprising blockchain startups, developers, and niche user groups, contributes 5 percent, supported by specialized exchange services and cross-border payment adoption.

- For instance, BlackRock launched the iShares Bitcoin Trust ETF in January 2024, opening direct Bitcoin exposure to large-scale institutional clients.

Market Overview

Rising Institutional Adoption

Institutional adoption fuels significant growth in the crypto exchange market, with major financial institutions, hedge funds, and asset managers entering the digital asset ecosystem. The availability of custodial services, compliance with global regulations, and integration of crypto into investment portfolios enhance trust and credibility. This influx of institutional capital increases trading volumes and stabilizes liquidity across exchanges. As traditional finance converges with blockchain-based assets, centralized exchanges and regulated platforms benefit most, positioning them as gateways for institutional inflows that accelerate long-term market expansion.

- For instance, BlackRock, the world’s largest asset manager, introduced a blockchain and digital assets advisory group in 2022, signaling increased institutional interest and inflows into regulated crypto exchanges.

Expanding Retail Participation

Retail investors represent a powerful driver of the crypto exchange market, supported by user-friendly mobile apps, social trading features, and growing financial literacy around digital assets. Affordable entry points and micro-investing options attract millennials and Gen Z demographics, while global awareness campaigns amplify adoption. Influences from social media, celebrity endorsements, and gamification also stimulate engagement. Retail-driven demand strengthens spot trading volumes, altcoin diversification, and peer-to-peer exchange growth. With over half of the global trading volume contributed by retail users, their participation ensures sustained growth momentum.

- For instance, Binance’s 2023 launch of its “Copy Trading” feature enabled retail users to mirror professional traders’ strategies, boosting participation from newer entrants.

Advancements in Security and Technology

Technological innovation and enhanced security mechanisms drive market expansion by reducing systemic risks and improving user confidence. Features such as two-factor authentication, biometric access, cold wallet storage, and real-time risk monitoring safeguard exchange operations. Integration of blockchain analytics tools helps exchanges detect illicit activities and maintain compliance with anti-money laundering directives. The adoption of artificial intelligence and machine learning in fraud detection further strengthens operational resilience. These advancements attract both retail and institutional investors, creating an environment of trust essential for the mainstream growth of crypto exchanges.

Key Trends & Opportunities

Growth of Decentralized Exchanges (DEXs)

Decentralized Exchanges are emerging as a transformative trend in the crypto exchange market, offering users greater transparency, privacy, and control over assets. Their growth is fueled by rising demand for self-custody and regulatory concerns around centralized platforms. Smart contracts and automated market makers enable seamless peer-to-peer transactions without intermediaries. DEXs also provide unique opportunities in token innovation and DeFi ecosystems. As scalability and liquidity improve, DEXs are expected to capture more market share, creating an opportunity for hybrid models that combine centralized efficiency with decentralized autonomy.

- For instance, Fluid, a DeFi protocol with a decentralized exchange, recently passed Uniswap in daily trading volume on Ethereum, hitting approximately $1.5 billion in a single day, underscoring the rising competition and innovation within the DEX ecosystem.

Expansion into Emerging Markets

Crypto exchanges are rapidly expanding into emerging markets, where limited banking infrastructure and currency instability create strong demand for digital assets. Countries across Africa, Latin America, and Southeast Asia present major opportunities for P2P and mobile-friendly platforms. Exchanges offering localized payment methods, multilingual interfaces, and compliance with regional regulations gain a competitive edge. These markets also foster innovation in cross-border remittances and micro-transactions. With rising smartphone penetration and youthful demographics, emerging economies represent untapped growth potential that could significantly contribute to global crypto exchange adoption.

- For instance, Coinbase introduced USDC access in parts of Latin America in 2022, allowing residents in countries like Argentina and Colombia to use the stablecoin for everyday transactions, helping them hedge against local currency volatility.

Key Challenges

Regulatory Uncertainty

The crypto exchange market faces persistent challenges from evolving and fragmented regulatory environments across regions. Governments and financial authorities differ in their approaches, ranging from supportive frameworks to outright restrictions. This inconsistency creates compliance hurdles and increases operational risks for exchanges seeking global expansion. Sudden policy changes, such as restrictions on trading or taxation rules, can disrupt user participation and liquidity flows. Without unified standards, exchanges must continually adapt, which raises costs and limits innovation, restraining the industry’s ability to achieve sustainable long-term growth.

Security Threats and Cyberattacks

Despite technological progress, crypto exchanges remain prime targets for cyberattacks, hacking incidents, and fraudulent activities. High-profile breaches undermine investor trust and highlight vulnerabilities in centralized systems. While decentralized models offer alternatives, they too face risks from smart contract bugs and phishing scams. Cybersecurity expenses and insurance requirements add to operational costs. Repeated incidents erode market confidence, discourage institutional entry, and intensify regulatory scrutiny. For exchanges, ensuring uninterrupted services while balancing robust security protocols with usability remains a constant challenge that directly affects adoption and user retention.

Market Volatility and Liquidity Risks

Extreme volatility in digital asset prices poses major risks to crypto exchanges, affecting both revenues and user participation. Rapid price fluctuations can trigger liquidation events, disrupt trading systems, and reduce investor confidence. Liquidity risks also emerge during periods of high volatility, with smaller exchanges struggling to maintain stable trading pairs. This volatility deters risk-averse institutional investors and complicates regulatory acceptance of crypto as a mainstream asset class. Exchanges must invest in advanced risk management tools and partnerships to mitigate volatility, but uncertainty continues to challenge long-term market stability.

Regional Analysis

North America:

North America dominates the crypto exchange market with a 36 percent share in 2024, valued at USD 13,060.22 million, and is projected to reach USD 57,550.98 million by 2032, expanding at a CAGR of 19.0 percent. The region benefits from strong institutional participation, advanced regulatory frameworks, and high adoption of cryptocurrencies among retail users. The United States leads due to robust financial infrastructure and innovation in blockchain technologies. Strategic partnerships between fintech companies and exchanges strengthen liquidity, while Canada and Mexico contribute through favorable regulatory shifts and increasing demand for digital asset investment platforms.

Europe:

Europe holds a 25 percent share of the global crypto exchange market in 2024, reaching USD 5,332.28 million, and is anticipated to grow to USD 21,315.55 million by 2032 at a CAGR of 17.5 percent. The region’s growth is fueled by strict regulatory compliance, expansion of digital banking, and integration of blockchain in financial services. The UK, Germany, and France remain leading markets, driven by institutional adoption and government-backed digital finance initiatives. Strong demand for centralized exchanges, coupled with rising adoption of decentralized finance (DeFi) platforms, positions Europe as a significant contributor to the overall market expansion.

Asia Pacific:

Asia Pacific accounts for the second-largest market share at 28 percent in 2024, with revenues of USD 9,320.50 million, expected to rise to USD 44,615.01 million by 2032 at a CAGR of 20.2 percent, the fastest among all regions. China, Japan, South Korea, and India drive growth through high trading volumes, increasing government involvement in blockchain adoption, and rising retail participation. Rapid smartphone penetration and youth-driven crypto awareness support expansion. While regulatory uncertainty remains a challenge, innovation in decentralized exchanges and the emergence of crypto-friendly hubs in Southeast Asia strengthen the region’s growth outlook.

Latin America:

Latin America captures a 5 percent share of the global crypto exchange market in 2024, valued at USD 1,314.02 million, projected to reach USD 5,065.27 million by 2032 at a CAGR of 17.0 percent. The region’s growth is largely driven by financial instability, inflationary pressures, and high remittance flows, which increase the demand for peer-to-peer exchanges and digital assets. Brazil and Argentina dominate the market, supported by growing interest in decentralized solutions. Favorable demographics, combined with limited access to traditional banking, create opportunities for exchange platforms to expand services across urban and rural populations.

Middle East:

The Middle East represents 3 percent of the crypto exchange market in 2024, valued at USD 657.14 million, projected to reach USD 2,358.54 million by 2032, advancing at a CAGR of 15.9 percent. Growth in the region is supported by government-led blockchain initiatives, the rise of fintech startups, and increasing interest in digital asset investments. The GCC countries, particularly the UAE and Saudi Arabia, are positioning themselves as crypto hubs by offering favorable regulations and infrastructure for exchange operations. Expanding institutional adoption and integration of blockchain in financial services further enhance the regional market outlook.

Africa:

Africa holds a 3 percent share of the global crypto exchange market in 2024, valued at USD 421.69 million, and is projected to grow to USD 1,392.71 million by 2032 at a CAGR of 14.7 percent. Rising adoption of cryptocurrencies for remittances, cross-border trade, and alternative financial services drives demand for exchanges. Nigeria, South Africa, and Egypt lead the market, supported by youthful demographics and increasing smartphone penetration. Limited access to traditional banking strengthens the role of peer-to-peer and mobile-based platforms. Despite regulatory challenges, Africa represents an emerging growth frontier for crypto exchanges.

Market Segmentations:

By Exchange Type

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Peer-to-Peer (P2P) Exchanges

- Hybrid Exchanges

By User Type

- Retail Investors

- Institutional Investors

- Traders

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the crypto exchange market is characterized by intense rivalry among global players that continuously enhance their platforms to capture larger market shares. Leading exchanges such as Binance, Coinbase, Kraken, Huobi, Bitfinex, OKX, KuCoin, Bitstamp, Gemini, and Bittrex dominate through diversified service portfolios, strong liquidity, and global reach. Binance remains the market leader with its vast trading volumes and extensive product ecosystem, while Coinbase leverages regulatory compliance and institutional partnerships to strengthen its presence in North America and Europe. Kraken and Bitfinex attract active traders with advanced derivatives and margin trading solutions, whereas Gemini and Bitstamp emphasize secure, transparent operations to build trust among retail and institutional clients. Competition is further shaped by growing demand for decentralized exchanges, peer-to-peer models, and hybrid platforms, which push established players to innovate continuously. Strategic mergers, acquisitions, and collaborations with fintech companies and payment providers also play a pivotal role in sustaining competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In 2025, Coinbase acquired Deribit, a Dubai-based crypto derivatives exchange, in a $2.9 billion deal to strengthen its global derivatives offerings.

- In July 2025, Robinhood launched stock tokens for EU users, unveiled a Layer 2 blockchain, and expanded its crypto offerings with perpetual futures and staking.

- In 2025, Kraken acquired the technology and assets of Capitalise.ai to integrate automated trading capabilities into its Kraken Pro platform later this year.

- In July 2025, PNC Bank partnered with Coinbase to integrate crypto trading directly into PNC’s banking platform, allowing customers to buy, hold, and sell cryptocurrencies.

Market Concentration & Characteristics

The Crypto Exchange Market demonstrates a moderately concentrated structure, where a few global leaders such as Binance, Coinbase, and Kraken capture a significant portion of trading volume while regional and niche platforms compete for specialized segments. It reflects high competition driven by liquidity depth, security features, regulatory compliance, and technological innovation. It shows strong barriers to entry due to the need for advanced infrastructure, risk management systems, and regulatory approvals, which favor established players. It remains dynamic, with decentralized and hybrid models gradually gaining share alongside dominant centralized exchanges. It exhibits high growth potential supported by expanding institutional participation, rising retail adoption, and increasing penetration in emerging markets. It requires continuous innovation in security protocols, trading products, and user experience to maintain competitiveness. It combines global dominance of leading platforms with opportunities for regional players to differentiate through localized services and compliance with evolving regulatory frameworks.

Report Coverage

The research report offers an in-depth analysis based on Exchange Type, User Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Regulatory frameworks will define operational standards, influencing global exchange competitiveness and regional compliance strategies.

- Institutional adoption will grow steadily, boosting liquidity, credibility, and long-term market stability across exchanges.

- Decentralized exchanges will expand rapidly, driven by user demand for transparency, autonomy, and asset security.

- Hybrid models will evolve, merging centralized efficiency with decentralized governance to attract diverse market participants.

- Retail participation will rise globally, supported by mobile apps, simplified trading tools, and growing financial awareness.

- Security innovation will advance continually, ensuring asset protection, fraud prevention, and enhanced investor trust worldwide.

- Emerging markets will drive adoption, supported by smartphone penetration, limited banking access, and currency instability.

- Strategic partnerships with fintech firms will accelerate growth, expand ecosystems, and strengthen competitive market positions.

- Artificial intelligence integration will optimize fraud detection, automate trading, and enhance risk management efficiency.

- Product diversification will increase significantly, expanding beyond spot trading into derivatives, staking, and tokenized assets.