Market Overview

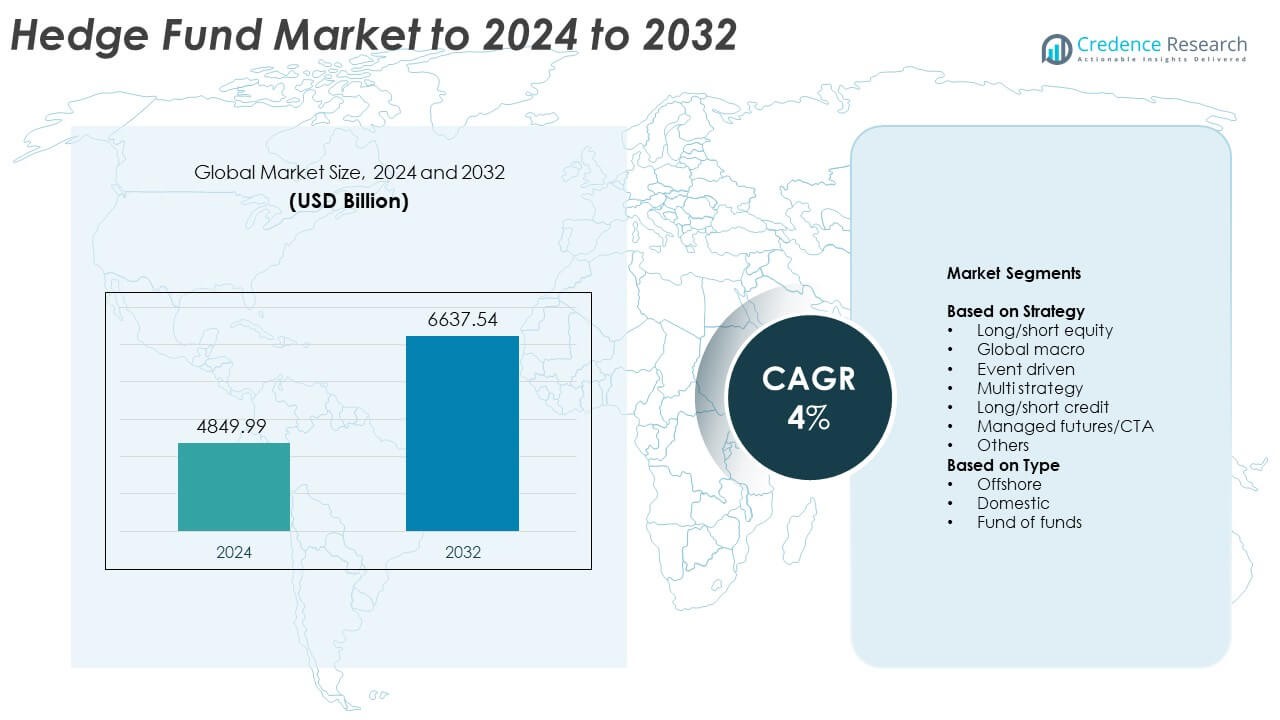

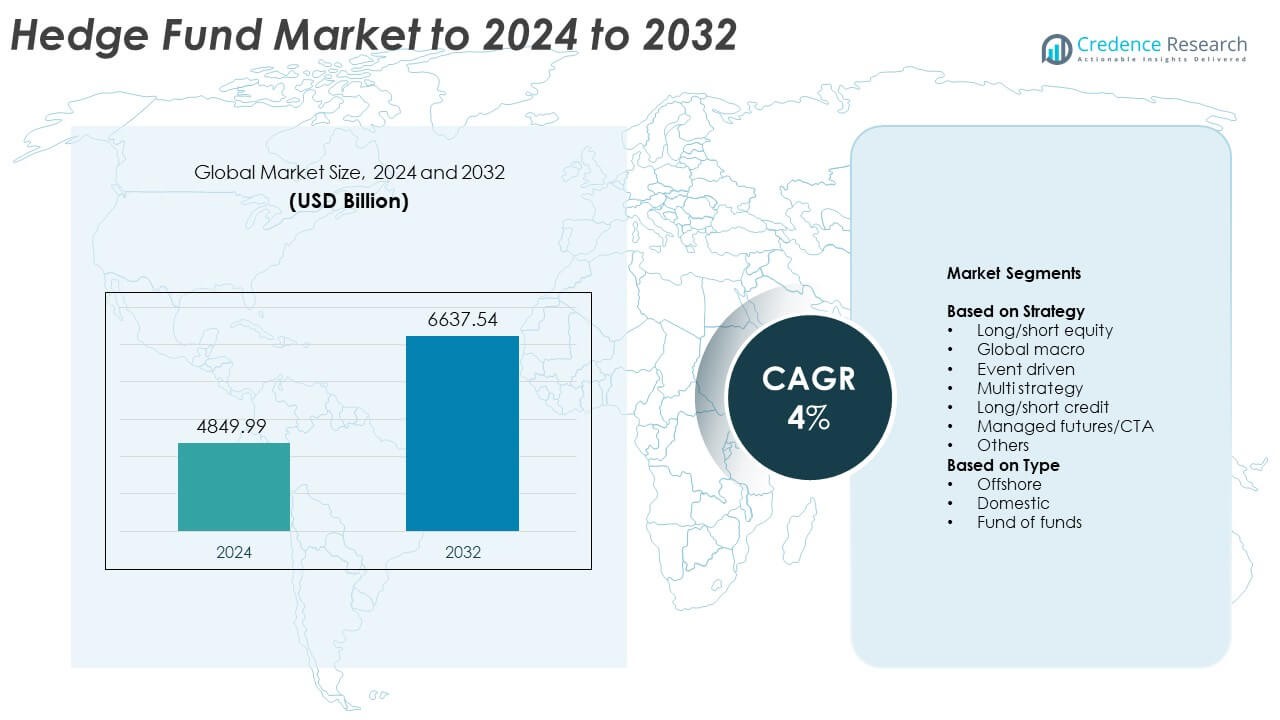

The Hedge Fund Market size was valued at USD 4849.99 billion in 2024 and is anticipated to reach USD 6637.54 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hedge Fund Market Size 2024 |

USD 4849.99 Billion |

| Hedge Fund Market, CAGR |

4% |

| Hedge Fund Market Size 2032 |

USD 6637.54 Billion |

The hedge fund market is driven by prominent players such as Renaissance Technologies, Bridgewater Associates, Millennium Management, Citadel, Man Group, D.E. Shaw Group, TCI Fund Management, Two Sigma Investments/Advisers, Farallon Capital Management, Davidson Kempner Capital Management, and HFR (Hedge Fund Research). These firms dominate through advanced quantitative strategies, algorithmic trading, and diversified global portfolios. North America leads the market with a 45% share, supported by strong institutional participation and technological innovation. Europe follows with 28%, benefiting from regulated financial hubs and sustainable investment trends. Asia Pacific, holding 18%, is rapidly expanding through emerging market investments and growing investor participation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hedge fund market was valued at USD 4849.99 billion in 2024 and is projected to reach USD 6637.54 billion by 2032, growing at a CAGR of 4% during the forecast period.

- Growth is driven by rising institutional investments, the adoption of AI-based trading systems, and a growing focus on risk-adjusted returns.

- Key market trends include the rise of ESG-integrated funds, digital trading platforms, and expansion in emerging economies.

- The market is highly competitive, led by major firms such as Renaissance Technologies, Bridgewater Associates, and Citadel, focusing on innovation and diversification.

- Regionally, North America holds a 45% share, followed by Europe at 28% and Asia Pacific at 18%, while the long/short equity strategy remains the leading segment with a 32% share.

Market Segmentation Analysis:

By Strategy

The long/short equity strategy dominated the hedge fund market in 2024, accounting for around 32% of the total market share. This strategy benefits from the flexibility to take both long and short positions, enabling investors to capture returns in bullish and bearish market conditions. Growing equity market volatility and rising institutional participation have strengthened demand. The use of AI-driven stock selection and advanced quantitative models improves portfolio performance and risk management. Investors continue to favor this strategy for its consistent alpha generation and diversified exposure across global equity markets.

- For instance, Marshall Wace’s TOPS sources ideas from over 1,000 outside contributors.

By Type

The offshore segment held the dominant position in the hedge fund market in 2024, representing approximately 61% of the total market share. This leadership is supported by favorable tax structures, investor confidentiality, and operational flexibility in jurisdictions such as the Cayman Islands and Luxembourg. Offshore funds attract institutional investors and high-net-worth individuals seeking global diversification and regulatory efficiency. These funds benefit from simplified compliance procedures and cross-border investment access. The offshore model remains a preferred choice among fund managers due to its scalability and international investor appeal.

- For instance, Millennium Management operated 330+ investment teams with 6,400+ employees globally, supporting complex offshore fund structures.

Key Growth Drivers

Rising Institutional Investments

Institutional investors, including pension funds and endowments, are increasingly allocating capital to hedge funds for portfolio diversification and higher risk-adjusted returns. These investors value hedge funds for their ability to manage volatility and preserve capital during market downturns. Expanding mandates and custom fund structures enable better alignment with institutional goals. This surge in institutional participation strengthens market stability and promotes large-scale fund development across global financial hubs.

- For instance, New Zealand Super Fund ran revamped multi-factor portfolios with 3 external managers, formalizing a larger role for specialist mandates.

Expansion of Quantitative and AI-Based Strategies

The growing adoption of artificial intelligence, machine learning, and data analytics is transforming hedge fund operations. Quant-driven strategies enhance trade execution, optimize asset allocation, and improve risk forecasting accuracy. Automated decision-making tools allow managers to process vast datasets in real time, improving performance consistency. These technological integrations attract tech-focused investors and provide competitive advantages in fast-changing capital markets.

- For instance, Two Sigma reported 380+ petabytes of data, 10,000+ data sources, and 250+ PhDs powering AI-driven research and trading.

Increased Demand for Portfolio Diversification

Investors are focusing on hedge funds as effective instruments for diversification amid global market uncertainties. Strategies combining equities, commodities, and derivatives help reduce exposure to single-asset risks. Multi-strategy and global macro funds deliver flexible allocations across regions and sectors, supporting stability in volatile conditions. This diversification demand continues to expand as investors seek consistent returns independent of traditional market cycles.

Key Trends & Opportunities

Integration of ESG and Sustainable Investing

Hedge funds are increasingly incorporating environmental, social, and governance principles into investment decisions. Sustainable hedge fund strategies attract institutional investors seeking responsible returns aligned with global sustainability standards. ESG integration not only enhances brand reputation but also mitigates long-term risk exposure. As global ESG reporting frameworks strengthen, hedge funds focusing on ethical investment approaches are expected to experience accelerated inflows.

- For instance, In 2024, M&G Investments’ stewardship team voted at 10,214 company meetings—912 in the UK and 9,302 internationally—and opposed at least one management recommendation at 2,492 meetings

Expansion in Emerging Markets

Emerging economies present new opportunities for hedge fund expansion due to market liberalization and growing capital inflows. Regions in Asia-Pacific and Latin America are witnessing increased participation from global asset managers. Local partnerships, digital trading platforms, and flexible regulatory structures enable better market penetration. This shift toward emerging economies diversifies fund portfolios and drives higher return potential compared to mature markets.

- For instance, Point72’s Singapore office has grown to more than 100 employees as of mid-2023.

Key Challenges

Regulatory Compliance and Oversight

Stringent global regulations pose operational challenges for hedge funds, particularly concerning transparency, reporting, and risk disclosure. Compliance with frameworks such as MiFID II and Dodd-Frank increases administrative costs and operational complexity. Managers face mounting pressure to adopt robust compliance technology and maintain investor confidence. Balancing regulatory adherence while preserving strategic flexibility remains a key challenge for fund operators.

Market Volatility and Liquidity Constraints

High market volatility and tightening liquidity conditions create performance pressures for hedge funds. Rapid changes in interest rates and currency fluctuations can disrupt leveraged positions. Funds employing high-frequency or arbitrage strategies face increased risks during liquidity crunches. Managing liquidity efficiently while maintaining return objectives requires stronger risk controls and adaptive investment frameworks to sustain long-term resilience.

Regional Analysis

North America

North America led the hedge fund market in 2024, accounting for around 45% of the total share. The region’s dominance is supported by the presence of major fund managers and high institutional participation. The United States drives most activity, fueled by sophisticated trading infrastructure, regulatory transparency, and innovation in quantitative and AI-driven strategies. Large pension funds and endowments continue to diversify allocations through hedge funds for stability and returns. Canada’s growing alternative investment ecosystem further supports market growth, with increasing cross-border fund collaborations and new product launches catering to high-net-worth and institutional investors.

Europe

Europe accounted for approximately 28% of the global hedge fund market share in 2024. The region benefits from strong financial centers such as the United Kingdom, Switzerland, and Luxembourg, which host numerous offshore funds and asset managers. Regulatory frameworks like AIFMD and MiFID II ensure transparency and investor protection. Sustainable investing and ESG integration have become key investment themes across European hedge funds. Institutional investors are increasingly allocating assets to multi-strategy and macro funds to navigate inflation and currency fluctuations. The region continues to attract global investors seeking regulatory stability and innovative fund structures.

Asia Pacific

Asia Pacific held a market share of about 18% in 2024, driven by rising investor interest in emerging economies such as China, Japan, Singapore, and Hong Kong. The region’s rapid economic growth and expanding wealth base encourage hedge fund investments focused on equities, currencies, and alternative assets. Governments are easing restrictions to attract global fund managers, while digital trading platforms improve operational efficiency. Japan and Australia host several established funds targeting long/short equity and macro strategies. Asia Pacific’s growing appetite for risk-adjusted returns positions it as a high-potential region for hedge fund expansion.

Latin America

Latin America captured nearly 5% of the global hedge fund market share in 2024. The region’s hedge fund landscape is expanding as investors seek protection against economic volatility and currency risks. Brazil, Mexico, and Chile dominate regional fund activity, supported by reforms that strengthen capital markets. Local managers are increasingly adopting global best practices in fund governance and risk control. The growing participation of private wealth investors and family offices supports fund diversification. As market sophistication improves, regional hedge funds are becoming important vehicles for managing liquidity and portfolio resilience.

Middle East & Africa

The Middle East and Africa region accounted for around 4% of the global hedge fund market share in 2024. Growth is driven by sovereign wealth funds and institutional investors seeking alternative investment exposure. Financial hubs such as Dubai and South Africa are emerging as regional centers for hedge fund management. Economic diversification initiatives, especially in the Gulf region, encourage new fund launches and partnerships with global asset managers. Increasing adoption of fintech solutions and favorable regulatory frameworks enhance transparency. The region’s rising investor sophistication supports gradual but steady hedge fund market expansion.

Market Segmentations:

By Strategy

- Long/short equity

- Global macro

- Event driven

- Multi strategy

- Long/short credit

- Managed futures/CTA

- Others

By Type

- Offshore

- Domestic

- Fund of funds

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The hedge fund market is highly competitive, with leading players such as Renaissance Technologies, Bridgewater Associates, Millennium Management, Citadel, Man Group, D.E. Shaw Group, TCI Fund Management, Two Sigma Investments/Advisers, Farallon Capital Management, Davidson Kempner Capital Management, and HFR (Hedge Fund Research) shaping the global landscape. These firms compete through innovation in quantitative modeling, risk-adjusted performance, and advanced algorithmic trading. Many hedge funds are investing heavily in artificial intelligence, big data analytics, and cloud-based infrastructure to enhance decision-making and trading precision. The growing demand for ESG-aligned funds and multi-strategy approaches is pushing managers to diversify portfolios and adopt flexible investment structures. Strategic collaborations, technological upgrades, and global market expansion remain key focus areas. Additionally, firms are optimizing operations to comply with evolving regulations while maintaining transparency and investor confidence. Continuous innovation and adaptive strategies are essential for sustaining competitive advantage in this dynamic investment environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Renaissance Technologies

- Bridgewater Associates

- Millennium Management

- Citadel

- Man Group

- E. Shaw Group

- TCI Fund Management

- Two Sigma Investments/Advisers

- Farallon Capital Management

- Davidson Kempner Capital Management

- HFR (Hedge Fund Research)

Recent Developments

- In 2025, Citadel acquired the German power trading firm FlexPower, a move designed to expand its energy trading and market-making capabilities. The firm also announced the opening of a new office in Boston’s South Station Tower

- In 2024, Bridgewater reorganized its structure into two main units: “Alpha Engine,” which runs the flagship Pure Alpha fund, and “Total Portfolio Strategies,” which manages the All Weather and Defensive Alpha funds.

- In 2024, HFR (Hedge Fund Research) and Radient AI formed a strategic partnership aimed at enhancing hedge fund analysis through the integration of advanced artificial intelligence capabilities.

Report Coverage

The research report offers an in-depth analysis based on Strategy, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Hedge funds will increasingly adopt AI and machine learning for predictive investment strategies.

- Institutional investors will expand allocations to hedge funds for portfolio diversification and stability.

- ESG-focused hedge fund strategies will gain stronger traction among global investors.

- Multi-strategy and hybrid fund structures will become more popular for risk management.

- Emerging markets in Asia and Latin America will attract higher hedge fund inflows.

- Regulatory technology solutions will streamline compliance and reporting processes.

- Digital platforms will enhance investor transparency and real-time portfolio access.

- Data-driven decision-making will improve risk forecasting and performance optimization.

- Hedge funds will explore tokenized and blockchain-based investment products.

- Collaborations between hedge funds and fintech firms will drive operational efficiency and innovation.