Market Overview

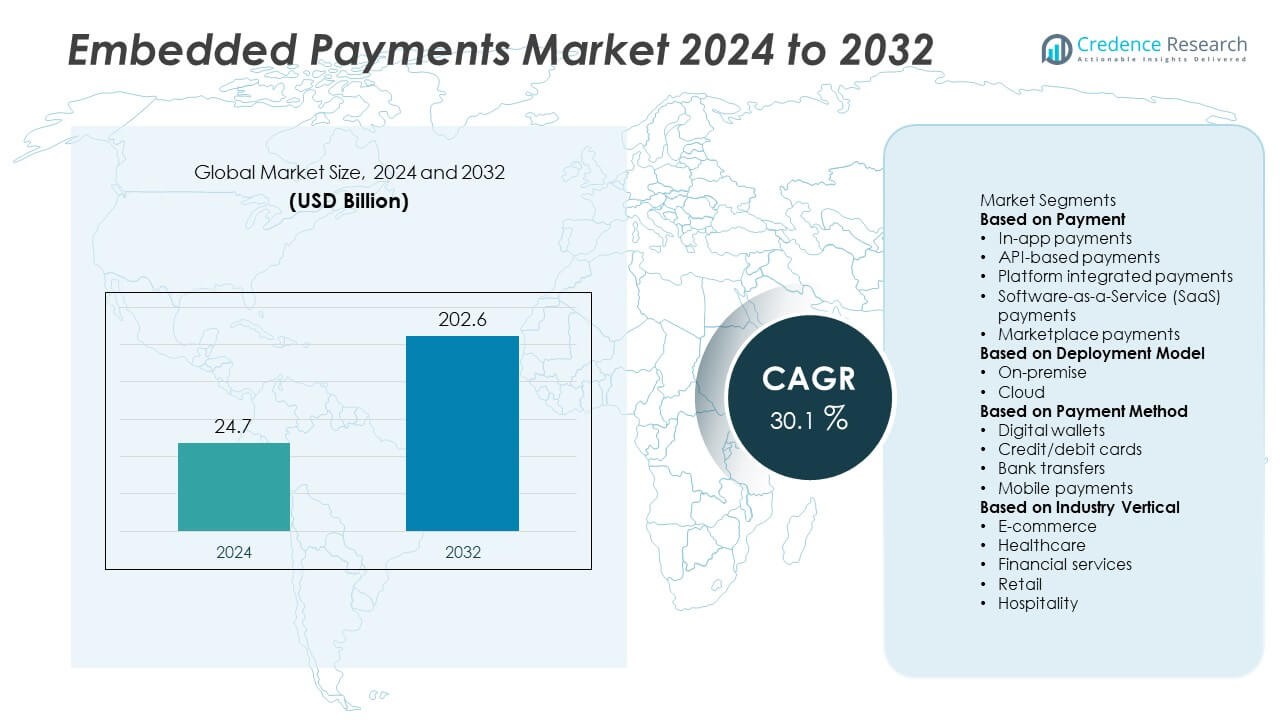

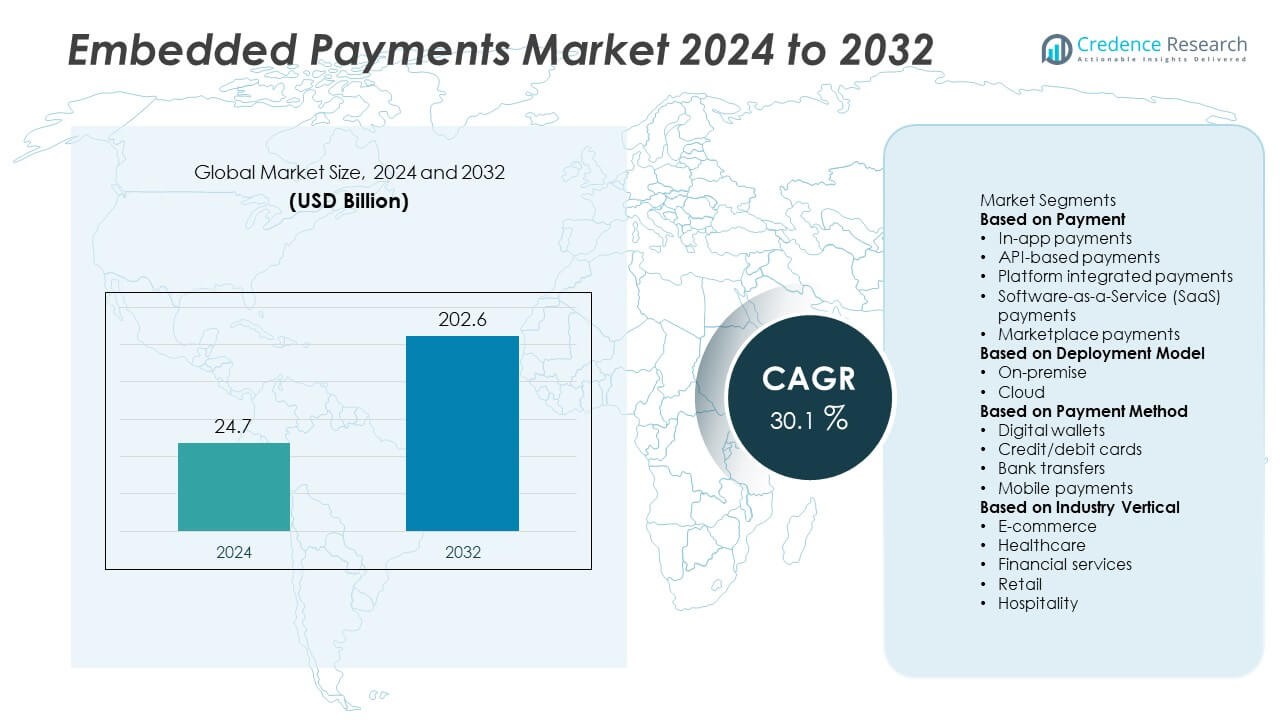

The Embedded Payments Market size was valued at USD 24.7 billion in 2024 and is projected to reach USD 202.6 billion by 2032, growing at a strong CAGR of 30.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Embedded Payments Market Size 2024 |

USD 24.7 Billion |

| Embedded Payments Market, CAGR |

30.1% |

| Embedded Payments Market Size 2032 |

USD 202.6 Billion |

The Embedded Payments Market expands rapidly with rising demand for frictionless digital transactions, strong e-commerce growth, and increasing consumer preference for integrated financial services. Businesses across retail, travel, healthcare, and logistics adopt embedded solutions to streamline payments and enhance user experience.

The Embedded Payments Market demonstrates wide geographical reach, with North America leading adoption through advanced fintech ecosystems and high consumer acceptance of digital platforms. Europe emphasizes regulatory-driven innovation, supported by PSD2 and open banking frameworks that encourage secure integration of payments into retail, healthcare, and financial services. Asia-Pacific shows the fastest expansion, driven by mobile-first economies such as China, India, and Southeast Asian nations where super apps and digital wallets dominate daily transactions. Latin America and the Middle East & Africa also present rising opportunities, supported by financial inclusion initiatives, growing e-commerce, and digital infrastructure investments. It gains further strength from collaborations between financial institutions and technology providers. Key players such as Stripe, PayPal, Adyen, and Worldpay focus on building scalable, secure, and flexible payment ecosystems. Their strategies include partnerships, cloud-based deployments, and continuous investment in innovation to serve both developed and emerging markets effectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Embedded Payments Market size was valued at USD 24.7 billion in 2024 and is projected to reach USD 202.6 billion by 2032, growing at a CAGR of 30.1%.

- Strong drivers include rising e-commerce adoption, growth in digital-first businesses, and increasing demand for frictionless transactions across industries.

- Key trends highlight the rise of Buy Now, Pay Later models, integration into super apps, and growing use of invisible and contextual payments.

- Competitive dynamics feature players such as Stripe, PayPal, Adyen, and Worldpay, which focus on global expansion, cloud-based platforms, and advanced security integration.

- Restraints include regulatory complexities across jurisdictions, cybersecurity risks, and the high cost of compliance for smaller enterprises.

- North America leads adoption with advanced fintech ecosystems, while Europe emphasizes regulatory-driven innovation, and Asia-Pacific shows rapid growth through mobile-first economies.

- Latin America and Middle East & Africa present emerging opportunities driven by financial inclusion programs, expanding digital infrastructure, and rising e-commerce penetration.

Market Drivers

Rapid Growth of Digital Commerce and E-Commerce Platforms

The Embedded Payments Market grows rapidly with the expansion of digital commerce ecosystems. E-commerce platforms integrate seamless payment solutions that reduce transaction friction and improve customer experience. It supports faster checkouts and drives higher conversion rates for online businesses. Embedded payments also enable retailers to build loyalty programs and streamline subscription models. Rising internet penetration and smartphone adoption strengthen usage across diverse consumer segments. This driver remains central to long-term adoption in both developed and emerging markets.

- For instance, Shopify Payments processed USD 43.3 billion in gross payments volume in Q3 2024, serving approximately 1.89 million merchants, highlighting how integrated payment functionality supports widespread adoption and merchant scalability.

Rising Demand for Frictionless Customer Experience

The need for simple, secure, and fast transactions drives growth in the Embedded Payments Market. Businesses integrate payments directly into applications to eliminate extra steps in the purchase process. It improves customer satisfaction and strengthens repeat engagement in industries such as retail, travel, and ride-hailing. Growing consumer preference for one-click checkouts highlights the importance of embedded solutions. Security enhancements, including tokenization and biometrics, ensure safe transactions. This demand for convenience positions embedded payments as a core enabler of digital commerce.

- For instance, As of mid-2025, PayPal has around 432–436 million active users worldwide, with millions of merchant sites using its fast checkout services. One Touch, the predecessor to the newer Fastlane feature, had around 80 million users as of late 2021. PayPal’s embedded solutions have been shown to increase conversion and repeat purchases by simplifying the payment process.

Expansion of Fintech Ecosystems and Open Banking Initiatives

Fintech innovation creates major opportunities for the Embedded Payments Market. Partnerships between banks, payment providers, and technology firms accelerate adoption. It leverages open banking frameworks that allow secure sharing of financial data. New business models emerge where financial services are directly embedded in non-financial platforms. This expands reach across industries such as healthcare, insurance, and logistics. Regulatory support for open banking in regions like Europe and Asia strengthens the shift toward embedded financial services.

Growing Adoption Across Enterprises and SMEs

Businesses of all sizes recognize the efficiency gains offered by the Embedded Payments Market. Large enterprises implement embedded solutions to scale digital offerings globally. It allows small and medium enterprises to compete effectively by reducing costs and improving user experience. Integrated payment solutions also provide access to valuable customer insights and analytics. These tools empower businesses to design personalized services and optimize revenue streams. Widespread adoption across industries ensures embedded payments remain central to digital transformation strategies worldwide.

Market Trends

Integration of Payments into Super Apps and Digital Ecosystems

The Embedded Payments Market shows a strong trend toward integration within super apps and multipurpose platforms. Consumers prefer single applications that combine messaging, shopping, and payments. It enables seamless financial transactions without switching between multiple apps. Companies in Asia-Pacific lead this trend by embedding payments into lifestyle and commerce platforms. Western markets follow with embedded solutions in mobility, food delivery, and retail apps. This integration reflects a shift toward convenience-driven ecosystems shaping global digital finance.

- For instance, In 2023, WeChat was a “super app” that integrated messaging, payments, and social functions, but it recorded approximately 410 million audio and video calls per day.

Adoption of Buy Now, Pay Later and Alternative Credit Solutions

New consumer financing models reshape the Embedded Payments Market. Buy Now, Pay Later (BNPL) services gain traction across retail, travel, and e-commerce sectors. It provides consumers with flexible payment options that boost purchasing power. Merchants adopt BNPL to increase sales conversions and customer loyalty. Alternative credit solutions embedded into checkout systems expand financial access to underbanked groups. This trend strengthens the role of embedded payments in driving inclusivity and consumer engagement.

- For instance, Affirm reported having 23 million users and 377,000 active merchants as of 2025, underscoring its scale as a leading embedded BNPL provider.

Rise of Contextual and Invisible Payments

Contextual and invisible payments emerge as defining trends in the Embedded Payments Market. Transactions become integrated into experiences where users pay automatically without direct intervention. It includes ride-hailing, subscription services, and connected devices. Retailers adopt invisible payments in cashier-less stores that improve speed and efficiency. Voice assistants and IoT devices also extend this capability into homes and workplaces. This trend emphasizes convenience and positions embedded payments as central to frictionless commerce.

Focus on Security, Compliance, and Trust-Building

Security innovation remains a dominant trend in the Embedded Payments Market. Stronger compliance frameworks such as PSD2 in Europe enforce higher transaction security. It pushes adoption of advanced methods like biometrics, tokenization, and AI-driven fraud detection. Businesses prioritize trust-building as cyber risks rise with digital payment adoption. Global vendors design solutions that balance convenience with robust safety standards. This focus ensures long-term sustainability of embedded payments in both consumer and enterprise ecosystems.

Market Challenges Analysis

Regulatory Complexity and Compliance Pressures

The Embedded Payments Market faces significant challenges from diverse regulatory frameworks across regions. Payment service providers must comply with strict rules covering data security, consumer protection, and financial transparency. It creates complexity for global businesses that operate across multiple jurisdictions. Evolving regulations such as PSD2 in Europe and open banking mandates require constant adaptation. Non-compliance risks include heavy fines and reputational damage for businesses and financial partners. The need to balance innovation with regulatory requirements slows implementation in some markets.

Cybersecurity Risks and Consumer Trust Concerns

Rising digital transactions expose the Embedded Payments Market to cybersecurity threats and fraud risks. Hackers target payment ecosystems to exploit vulnerabilities in applications and APIs. It pressures companies to invest heavily in encryption, tokenization, and fraud detection systems. Consumer trust becomes difficult to maintain when breaches or service disruptions occur. Small and medium enterprises face higher risks due to limited resources for advanced security solutions. Ongoing threats to data integrity and privacy remain critical challenges that shape adoption strategies.

Market Opportunities

Expansion Across Non-Financial Industries and Platforms

The Embedded Payments Market presents strong opportunities through integration into non-financial industries such as healthcare, logistics, travel, and retail. Platforms embed payments directly into their services, offering seamless transactions for customers and partners. It creates new revenue streams for businesses while improving efficiency across ecosystems. Growth of subscription-based models and digital platforms in education and media further expands opportunities. Businesses that combine payments with value-added services such as loyalty programs gain stronger engagement. The ability to merge payments with core services strengthens competitiveness and opens access to underserved customer segments.

Rising Adoption in Emerging Economies and SME Ecosystems

High smartphone penetration and growing internet access create strong growth potential for the Embedded Payments Market in emerging economies. Rising digital literacy in Asia-Pacific, Latin America, and Africa drives adoption of cashless transactions. It enables small and medium enterprises to access integrated payment systems at lower cost. Governments promoting digital economies provide incentives that encourage broader deployment of embedded solutions. Access to data insights from embedded payments also empowers SMEs to optimize pricing and expand offerings. This combination of digital growth, supportive policies, and business adoption creates significant opportunities for long-term expansion.

Market Segmentation Analysis:

By Payment

The Embedded Payments Market is segmented by payment into B2B, B2C, and C2C models. B2C transactions dominate due to widespread adoption in retail, e-commerce, and subscription-based services. It ensures a seamless checkout process, boosting customer retention and sales conversion rates. B2B payments also gain momentum with enterprises embedding payment systems into supply chain and procurement platforms. This enables real-time invoicing, faster settlements, and reduced reliance on traditional banking channels. C2C transactions, supported by peer-to-peer applications, remain important in markets with high mobile wallet penetration. Each segment contributes to the growth of embedded payments across industries and customer bases.

- For instance, In 2023, Venmo’s total payment volume was $276 billion, with an active user base of approximately 83 million. The $244 billion figure for total payment volume is from the previous year, 2022.

By Deployment Model

Deployment in the Embedded Payments Market includes on-premises and cloud-based solutions. Cloud deployment holds the largest share due to scalability, flexibility, and cost efficiency. It allows businesses to manage transactions with lower upfront investment and easier integration across digital platforms. On-premises deployment continues to serve sectors with strict compliance requirements and data security needs. Large enterprises adopt hybrid strategies to balance control with efficiency, ensuring data safety while scaling operations. The ongoing shift toward cloud ecosystems reinforces innovation, speed, and access for embedded payment providers.

- For instance, Stripe processed USD 1 trillion in total payment volume in 2023 through its cloud-native infrastructure, supporting millions of businesses across 46 countries, demonstrating the scalability of cloud deployments for embedded payments.

By Payment Method

The Embedded Payments Market also segments by payment method into cards, digital wallets, bank transfers, and others. Digital wallets lead adoption due to convenience, security features, and integration with mobile applications. It drives strong growth in both mature and emerging economies with rising smartphone penetration. Card-based payments continue to hold relevance, particularly in developed regions where credit and debit usage is high. Bank transfers gain importance for B2B transactions and recurring payment models. Other methods, such as cryptocurrency and contactless options, gradually emerge with rising adoption in tech-driven industries. The diversity of payment methods ensures embedded payments can address the unique needs of businesses and consumers worldwide.

Segments:

Based on Payment

- In-app payments

- API-based payments

- Platform integrated payments

- Software-as-a-Service (SaaS) payments

- Marketplace payments

Based on Deployment Model

Based on Payment Method

- Digital wallets

- Credit/debit cards

- Bank transfers

- Mobile payments

Based on Industry Vertical

- E-commerce

- Healthcare

- Financial services

- Retail

- Hospitality

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for a 34% share of the Embedded Payments Market in 2024, driven by advanced digital infrastructure and high adoption of fintech solutions. The United States leads the region with strong penetration of embedded payment platforms across e-commerce, ride-hailing, and retail sectors. It benefits from rapid adoption of subscription-based models and loyalty-driven payment solutions. Canada contributes through expansion in digital banking and government-backed cashless initiatives. Financial institutions and technology firms collaborate to embed payments into everyday consumer and business platforms. Security innovations, compliance with regulatory frameworks, and increasing demand for frictionless transactions sustain growth. North America remains a critical hub for innovation and global adoption strategies in embedded payments.

Europe

Europe holds a 27% share of the Embedded Payments Market, supported by strict regulatory frameworks and strong digital transformation. Countries such as Germany, France, and the United Kingdom drive adoption through widespread integration in retail, banking, and healthcare. It benefits from open banking initiatives and regulations such as PSD2, which encourage secure embedded payment solutions. The demand for Buy Now, Pay Later services in retail enhances usage across younger demographics. Southern and Eastern Europe experience gradual adoption with expanding digital infrastructure and fintech ecosystems. European firms invest in sustainable and secure payment technologies that balance innovation with compliance. This positions the region as a leader in trusted and regulated embedded payment ecosystems.

Asia-Pacific

Asia-Pacific dominates with a 31% share of the Embedded Payments Market, reflecting massive growth in mobile-first economies. China and India lead adoption with super apps, digital wallets, and e-commerce platforms integrating payments into everyday services. It benefits from rapid urbanization, high smartphone penetration, and government-led initiatives promoting digital economies. Southeast Asian nations, including Indonesia, Vietnam, and Thailand, strengthen adoption with strong e-commerce growth and financial inclusion strategies. Japan and South Korea contribute through advanced technological infrastructure and consumer demand for seamless financial services. Asia-Pacific stands out as the fastest-growing region, with embedded payments positioned at the core of financial innovation. Expanding fintech ecosystems and partnerships with global players reinforce its long-term leadership.

Latin America

Latin America represents a 5% share of the Embedded Payments Market, supported by rising digital literacy and e-commerce expansion. Brazil dominates with rapid adoption of digital wallets and government initiatives to expand financial inclusion. It strengthens growth through integration of embedded payments in retail, transport, and online services. Mexico follows with rising adoption in banking and fintech, supported by high mobile penetration. Countries such as Argentina, Chile, and Colombia show increasing demand driven by SMEs and local startups. Limited infrastructure in rural areas presents a challenge, but urban centers see strong adoption. Latin America offers growth opportunities through expanding consumer bases and regulatory support for financial inclusion.

Middle East & Africa

The Middle East & Africa account for a 3% share of the Embedded Payments Market, with growth concentrated in Gulf countries and leading African economies. Saudi Arabia and the United Arab Emirates drive adoption with government-backed digital transformation programs. It benefits from rapid fintech expansion, integration of cashless payments in retail, and increased penetration of ride-hailing and travel services. South Africa leads African demand with embedded payments in banking and retail ecosystems. Other African markets show potential through mobile money platforms and financial inclusion projects. Regional challenges include limited digital infrastructure and lower penetration in rural areas, but growing investments improve conditions. The region represents an emerging growth frontier for embedded payments adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Plaid

- Worldpay

- Cashfree

- Stripe

- Adyen

- Mastercard

- Paddle

- PayPal

- Braintree

- Spreedly

Competitive Analysis

The competitive landscape of the Embedded Payments Market includes Stripe, PayPal, Adyen, Worldpay, Mastercard, Plaid, Braintree, Cashfree, Spreedly, and Paddle. These companies compete by leveraging technology-driven platforms, global reach, and strong integration capabilities across industries. It is shaped by rapid adoption of cloud-based deployments, which enable scalable and secure payment infrastructures for enterprises and SMEs. Leading providers focus on embedding seamless checkout experiences, digital wallets, and Buy Now, Pay Later solutions to increase consumer engagement. Partnerships with fintech firms, e-commerce platforms, and non-financial businesses expand the presence of embedded payments in retail, healthcare, logistics, and travel. Companies invest heavily in compliance, biometrics, tokenization, and AI-driven fraud detection to strengthen trust and security. Growth strategies emphasize regional expansion, open banking integration, and real-time transaction capabilities to meet rising consumer expectations. The market reflects intense competition where innovation, speed, and ecosystem partnerships define leadership and long-term positioning of top players.

Recent Developments

- In August 2025, Stripe partnered with Centerbase to introduce Centerbase Payments, a fully embedded solution for midsize law firms powered by Stripe. Early beta results show firms collecting payments up to 20% faster, doubling cash flow, and eliminating manual reconciliation.

- In July 2025, PayPal introduced AI‑enabled, dynamic scam detection for PayPal and Venmo’s Friends and Family payments, designed to proactively warn users against potential scams and prevent losses before funds transfer.

- In July 2025, Stripe unveiled new embedded-oriented features in Germany at Stripe Tour Berlin, including support for over 25 new payment methods (such as Wero) and a pay‑by‑bank option based on Europe’s open banking system.

- In June 2025, Plaid launched Instant Pay‑Ins via Request for Payment (RfP) on the Real‑Time Payments (RTP) network, enabling businesses to request payments with instant settlement even outside traditional banking hours (e.g., nights and weekends)

Report Coverage

The research report offers an in-depth analysis based on Payment, Deployment Model, Payment Method, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for frictionless and invisible payments will accelerate across industries.

- Super apps will continue to integrate payments into broader consumer ecosystems.

- Buy Now, Pay Later solutions will expand into new retail and service segments.

- Open banking initiatives will drive secure data sharing and embedded financial services.

- Cloud-based deployments will dominate due to scalability and lower operational costs.

- Security technologies such as biometrics and AI-driven fraud detection will gain prominence.

- Small and medium enterprises will adopt embedded payments to enhance competitiveness.

- Asia-Pacific will strengthen leadership with mobile-first adoption and government-backed initiatives.

- Europe and North America will focus on regulatory compliance and innovation-driven growth.

- Emerging economies will present strong opportunities through financial inclusion and digital adoption.