Market Overview:

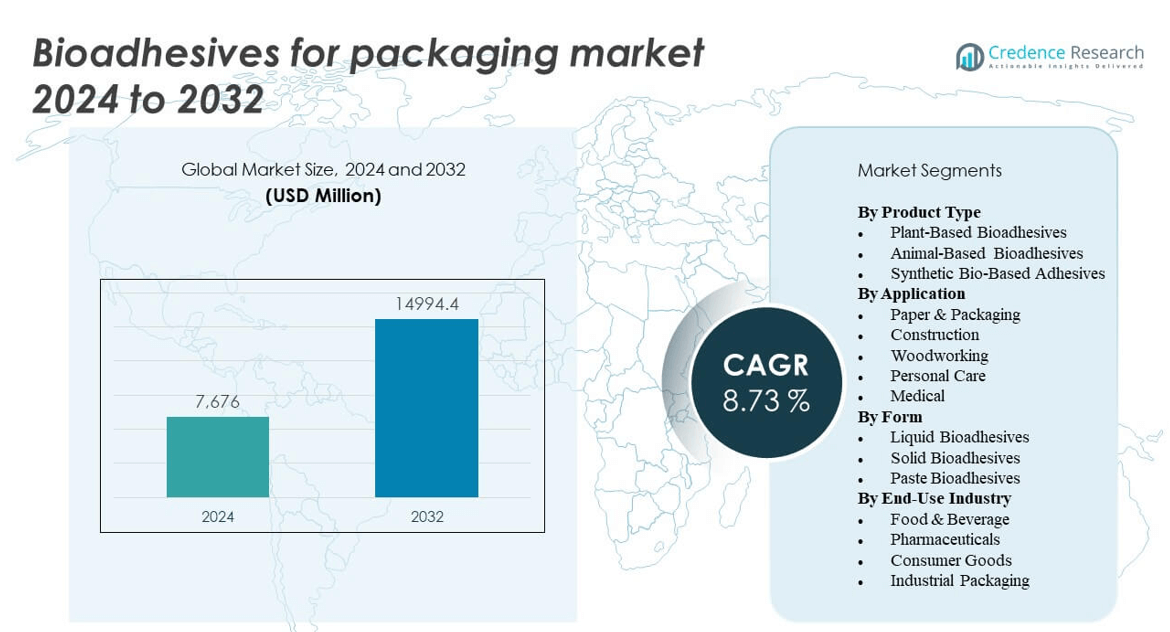

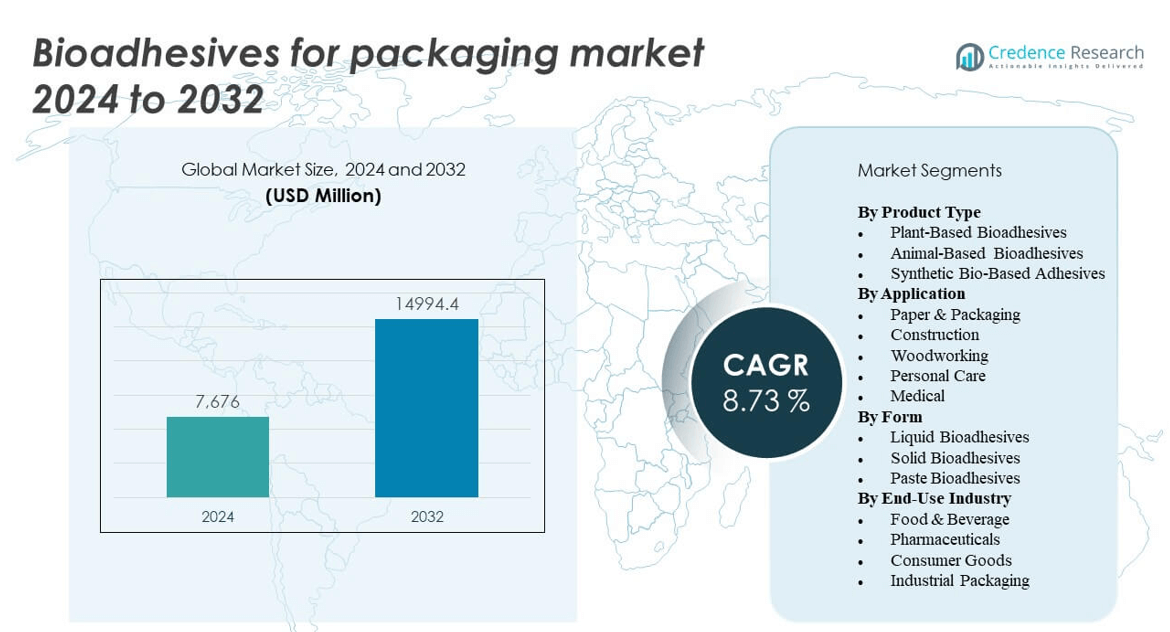

The Bioadhesives for packaging market is projected to grow from USD 7,676 million in 2024 to an estimated USD 14,994.4 million by 2032, with a compound annual growth rate (CAGR) of 8.73% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bioadhesives for Packaging Market Size 2024 |

USD 7,676 million |

| Bioadhesives for Packaging Market, CAGR |

8.73% |

| Bioadhesives for Packaging Market Size 2032 |

USD 14,994.4 million |

This market is gaining traction due to the rising demand for sustainable and environmentally friendly packaging solutions. With increasing regulations on synthetic adhesives and plastic waste, manufacturers are shifting toward bio-based alternatives derived from natural sources such as starch, soy protein, and cellulose. Companies are investing in research to enhance bonding performance and moisture resistance, expanding bioadhesives’ applications in cartons, labels, and flexible packaging. Consumer awareness about eco-conscious packaging is also playing a significant role in driving adoption.

Regionally, Europe leads the market due to strict environmental policies, a strong circular economy agenda, and active investment in green packaging technologies. North America follows closely, supported by growing demand for biodegradable adhesives in the food and beverage industry. In the Asia Pacific region, countries such as China, India, and South Korea are emerging as high-growth markets, fueled by rapid industrialization, expanding e-commerce, and increasing emphasis on sustainable manufacturing practices. Latin America and the Middle East & Africa are also gradually adopting bioadhesives as regulatory frameworks and environmental awareness evolve.

Market Insights:

- The Bioadhesives for packaging market was valued at USD 7,676 million in 2024 and is projected to reach USD 14,994.4 million by 2032, growing at a CAGR of 8.73%.

- Increasing demand for sustainable packaging solutions is driving adoption of plant-based and starch-derived bioadhesives across the food and consumer goods sectors.

- Strict environmental regulations and VOC limitations are encouraging packaging manufacturers to shift from petrochemical adhesives to bio-based alternatives.

- High cost of raw materials and limited performance under extreme conditions continue to restrain large-scale industrial deployment.

- Europe holds the largest market share due to strong regulatory support and circular economy mandates across packaging industries.

- Asia Pacific is emerging as the fastest-growing region, fueled by expanding packaging demand in China and India and rising eco-consciousness.

- Market growth is further supported by advancements in liquid and paste bioadhesive formulations, enabling broader integration into automated packaging lines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Regulatory Pressures on Synthetic Adhesives Fuel Adoption of Bio-Based Alternatives

Governments across key economies are enforcing stricter regulations on petroleum-based adhesives due to their volatile organic compound (VOC) emissions and long-term environmental impact. These rules are encouraging industries to shift toward bio-based adhesives made from renewable materials such as starch, proteins, and natural resins. The Bioadhesives for packaging market benefits directly from this shift. Companies are reevaluating supply chains to comply with eco-labeling and green certification standards. This trend aligns with national sustainability agendas in the EU and North America. Industries that rely heavily on food and beverage packaging now prefer low-toxicity bonding agents. Large-scale brands are integrating bioadhesives into packaging to meet consumer expectations and regulatory mandates. It gives manufacturers a competitive advantage by future-proofing operations. Strong policy support is accelerating product innovation and commercial deployment.

- For instance, Henkel launched the Technomelt Supra 079 Eco Cool hot melt, comprising 49% directly biobased raw materials and 30% ISCC-certified mass-balanced material. This adhesive enables packaging processes at up to 40°C lower temperatures, resulting in an annual reduction of 7,500kg of CO2 emissions for folding carton and tray applications when compared to conventional polyolefin-based hot melts.

Rising Consumer Preference for Green Packaging Materials Encourages Bioadhesive Integration

Today’s consumers are more aware of how packaging choices affect the environment. They demand products wrapped in materials that are recyclable, compostable, and non-toxic. This demand places pressure on manufacturers to incorporate biodegradable components into packaging formats. The Bioadhesives for packaging market is gaining traction through this consumer-driven push. Packaging adhesives made from renewable feedstocks resonate with green purchasing behavior. Major retailers and FMCG companies are setting bio-based content targets for their suppliers. These goals require alternatives to synthetic adhesives in secondary and primary packaging. It provides an opportunity for bioadhesive developers to scale up adoption. Market players are leveraging this behavioral shift to expand product portfolios that align with end-user values.

Sustainable Packaging Goals of FMCG and E-Commerce Giants Drive Volume Demand

Global brands are embedding sustainability into their core procurement and packaging strategies. FMCG and e-commerce companies are publicly committing to reduce plastic and petrochemical adhesive usage. The Bioadhesives for packaging market receives robust demand from this sector-wide transformation. Packaging vendors must provide solutions that meet recyclability, compostability, and zero-waste benchmarks. Bioadhesives align well with these long-term environmental performance targets. Companies like Unilever, Nestlé, and Amazon are shifting to fiber-based, mono-material, and glue-less designs using biobonding agents. It helps reduce waste at the consumer end and facilitates packaging circularity. Their large-scale requirements push suppliers to scale bioadhesive production. This driver is pushing the market toward standardization, scalability, and certification readiness.

Advances in Bioadhesive Performance Enable Expansion into Diverse Packaging Types

R&D investments are enhancing the functional capabilities of natural adhesives. New formulations offer improved bonding strength, moisture resistance, and shelf-life stability. These enhancements make bioadhesives suitable for diverse packaging categories beyond paperboard, including films, foils, and multilayer materials. The Bioadhesives for packaging market is witnessing growth through this performance expansion. Researchers are developing hybrid formulations that combine biopolymers with nanocellulose or enzymes. These innovations support faster curing and heat resistance, enabling compatibility with automated packaging lines. It widens the scope for application in flexible and rigid formats. Manufacturers are filing patents and creating proprietary blends tailored to high-speed operations. The advancements help bridge the performance gap with synthetic adhesives while supporting environmental goals.

- For instance, researchers at Beijing Forestry University have developed a xylan-based hot-melt adhesive that achieves lap-shear strength values of up to 30MPa—surpassing many commercial epoxies and hot-melt adhesives. This product maintains adhesion at –25°C and can be reused over 10 cycles without measurable loss in strength, as demonstrated in recent peer-reviewed performance testing.

Market Trends

Shift Toward Enzyme-Based Bioadhesives to Improve Bonding Specificity and Biodegradability

Enzyme-based bioadhesives are emerging as a key innovation focus. These adhesives utilize biological catalysts to promote targeted adhesion at the molecular level. Companies are developing enzyme-enhanced products that offer precise bonding with biodegradable materials. The Bioadhesives for packaging market is seeing investment in this technology to replace petroleum-derived glues. It helps improve end-of-life decomposition and reduces chemical residues in waste streams. Enzyme formulations also support lower temperature curing and energy efficiency in processing. Research institutes and startups are actively licensing enzyme tech to large adhesive manufacturers. This trend supports applications in sensitive food and pharma packaging formats. The focus remains on scalability and regulatory acceptance across global markets.

- For instance, Henkel launched Loctite HB S ECO and CR 821 ECO, its first bio-based polyurethane adhesives for engineered wood, in late 2023. These adhesives are developed with bio-based materials and reduce CO₂-equivalent emissions by more than 60% compared to fossil-based alternatives.

Development of High-Solids Bioadhesive Formulations to Improve Packaging Line Efficiency

High-solids bioadhesives are gaining industry acceptance due to their operational advantages. These formulations reduce water content, enabling faster drying and bonding times. The Bioadhesives for packaging market is integrating such products to meet packaging speed and throughput requirements. It offers greater viscosity control and minimizes adhesive waste during application. This trend supports compatibility with high-speed machinery used in labeling and folding carton assembly. Manufacturers benefit from shorter cycle times and reduced equipment fouling. High-solids adhesives also offer longer shelf life and simplified storage. Suppliers are working closely with packaging line OEMs to tailor these formulations for commercial deployment. It marks a shift from traditional water-based bioadhesives to performance-optimized solutions.

- For example, Bostik’s Herberts EPS71 is a high-performance adhesive designed for film-to-film and film-to-aluminum laminations, offering strong heat resistance and suitability for sterilization processes. It supports efficient bonding in flexible packaging applications where durability and thermal stability are essential.

Emergence of Protein-Polysaccharide Blends to Achieve Balanced Strength and Flexibility

ormulations using protein-polysaccharide blends are growing in preference due to their mechanical balance. These blends combine the tensile strength of proteins with the flexibility of plant-derived polysaccharides. The Bioadhesives for packaging market is exploring these blends to meet specific packaging demands. It supports sealing in corrugated, molded fiber, and flexible laminate applications. These hybrid bioadhesives offer improved adhesion on porous and semi-gloss surfaces. The trend supports applications where durability and biodegradability must coexist. Universities and private labs are partnering with adhesive brands to create scalable, food-safe variants. These materials are proving useful for use cases where shelf stability and tensile load retention are key. The market is steadily adopting them for mid- to high-volume production.

Growth in Water-Dispersible Bioadhesives to Enable Easy Separation in Recycling Streams

Water-dispersible bioadhesives are gaining relevance in sustainable packaging design. These adhesives allow bonded materials to separate during washing or pulping, improving recyclability. The Bioadhesives for packaging market is incorporating this trend to support circular economy models. It helps maintain fiber quality in paper-based packaging recovered from the waste stream. These adhesives dissolve under controlled conditions without affecting mechanical performance during use. Packaging stakeholders prefer such systems in multi-material structures to enable post-use processing. Brands focused on zero-waste goals are pushing for adhesives that do not compromise end-of-life handling. Suppliers are working on pH-triggered and temperature-sensitive dispersions. This innovation is expanding the market’s footprint in recycled content packaging.

Market Challenges Analysis

Performance Limitations in Extreme Packaging Conditions Hinder Full-Scale Substitution

Bioadhesives often struggle to match the thermal and moisture resistance levels provided by synthetic adhesives. Packaging that must endure freezing, microwaving, or high-humidity environments poses challenges for biobased formulations. The Bioadhesives for packaging market faces constraints in penetrating these segments. It cannot yet provide the same level of durability in aggressive use conditions. Manufacturers require consistent performance across variable supply chain stages, from production to transport. Current bioadhesive technologies may fail under mechanical stress or repeated handling. This limits their application to specific packaging types like folding cartons or dry goods. Companies must invest more in stability-enhancing chemistries to expand market acceptance. Technical validation across different substrates also remains inconsistent, delaying widespread adoption.

Complex Supply Chain and Cost Structures Create Barriers for Widespread Industrial Use

Raw materials for bioadhesives rely on agricultural outputs, which are sensitive to seasonality, yield variability, and land-use policies. Sourcing issues lead to fluctuating prices and inconsistent quality. The Bioadhesives for packaging market experiences cost pressures that reduce competitiveness against mature petrochemical alternatives. Small and medium converters hesitate to switch due to cost-to-benefit uncertainty. Storage and shelf-life management further complicate logistics for bio-based adhesive distributors. Standardization across global markets remains low, creating compliance and certification hurdles. Long-term contracts with suppliers are difficult to negotiate due to fluctuating raw input costs. These challenges make it difficult for bioadhesives to achieve parity in mass-market packaging segments. Without infrastructure investments, market scalability remains constrained.

Market Opportunities

Expansion into Food-Safe and Pharma-Grade Applications Presents New Revenue Streams

The growing need for safe, toxin-free packaging in food and pharmaceutical segments offers significant upside. These sectors demand adhesives with low migration, hypoallergenic properties, and biodegradability. The Bioadhesives for packaging market can gain momentum by developing certified formulations tailored to these regulated sectors. It can replace synthetic adhesives that carry contamination risks. Demand from clean-label and organic product lines further reinforces this opportunity. Companies investing in food-contact-compliant adhesives can build trust with safety-conscious consumers and meet evolving compliance mandates.

Strategic Collaborations with Packaging OEMs and Biopolymer Innovators to Unlock Scale

Partnerships with machinery manufacturers and biopolymer producers can accelerate market penetration. Collaborative R&D enables co-designed solutions that work efficiently on existing equipment. The Bioadhesives for packaging market can benefit from integrating bioadhesive systems into automated lines. It enhances compatibility while reducing changeover costs for converters seeking sustainable transitions. Joint development agreements can speed up market validation while offering shared access to innovation pipelines.

Market Segmentation Analysis:

The Bioadhesives for packaging market is segmented

By product type into plant-based, animal-based, and synthetic bio-based adhesives. Plant-based bioadhesives dominate the market due to their renewable nature, low toxicity, and alignment with eco-friendly packaging standards. Animal-based adhesives remain relevant in niche applications but face limitations in scalability and consumer acceptance. Synthetic bio-based adhesives offer tailored performance and are gaining traction in industrial settings.

- For instance, UPM BioChemicalshas commercialized plant-based bioadhesives under its UPM BioPiva portfolio, using lignin derived from sustainably managed forests.

By application, the paper & packaging segment leads, driven by the demand for sustainable bonding solutions in corrugated boxes, labels, and cartons. Construction and woodworking use bioadhesives for eco-friendly paneling and lamination, while the medical and personal care segments require formulations with biocompatibility and safety.

By form, the market includes liquid, solid, and paste bioadhesives. Liquid bioadhesives are preferred for their ease of application in automated lines. Solid forms provide stability during storage and transport. Paste adhesives cater to specific industrial use cases with controlled viscosity and performance.

By end-use industry, food & beverage packaging generates the highest demand, followed by pharmaceuticals and consumer goods. It supports the need for biodegradable and food-safe adhesive systems. Industrial packaging continues to adopt bioadhesives for improved sustainability and regulatory compliance.

- For instance, BASF’s Ecovio® PS 1606is a compostable, bio-based adhesive for industrial use. BASF’s technical data (2023) notes it meets EN 13432 for industrial compostability and provides peel strengths >2 N/cm on standard paper substrates, supporting sustainable logistics and regulatory compliance.

Segmentation:

By Product Type

- Plant-Based Bioadhesives

- Animal-Based Bioadhesives

- Synthetic Bio-Based Adhesives

By Application

- Paper & Packaging

- Construction

- Woodworking

- Personal Care

- Medical

By Form

- Liquid Bioadhesives

- Solid Bioadhesives

- Paste Bioadhesives

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Consumer Goods

- Industrial Packaging

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe holds the largest share in the Bioadhesives for packaging market, accounting for 38% of the global revenue. Strong environmental policies, circular economy initiatives, and bans on petroleum-based adhesives support rapid adoption. Countries such as Germany, France, and the Netherlands lead innovation and regulatory enforcement. High demand for sustainable packaging in food and personal care sectors drives regional consumption. Governments actively fund R&D and scale-up programs for bio-based materials. It benefits from well-established infrastructure for recycling and compostable packaging formats.

North America accounts for 27% of the Bioadhesives for packaging market. The region sees strong demand from the food, pharmaceutical, and e-commerce sectors. The U.S. leads in both commercial deployment and innovation of protein- and starch-based adhesive technologies. Key market players operate manufacturing and R&D hubs across the region. Brand commitments to zero-waste and sustainable packaging targets accelerate adoption. It continues to benefit from consumer demand for non-toxic and clean-label packaging.

Asia Pacific holds a 22% market share and shows the fastest growth in the Bioadhesives for packaging market. China, India, and Japan drive regional demand, supported by industrial expansion and growing sustainability awareness. The region sees increased investment in biodegradable packaging, especially across FMCG and agriculture sectors. Governments are introducing eco-labelling frameworks and promoting bioeconomy policies. It also benefits from the availability of raw materials like starch, soy, and cellulose. Local manufacturers are forming global partnerships to scale production and enhance export competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Henkel AG & Co. KGaA

- Arkema S.A.

- Ashland Global Holdings Inc.

- B. Fuller Company

- Beardow Adams Group

- Paramelt B.V.

- Jowat SE

- EcoSynthetix Inc.

- Tate & Lyle PLC

- Danimer Scientific LLC

- LD Davis

- Kollodis BioSciences, Inc.

- Bioadhesive Alliance Inc.

- S. Adhesives, Inc.

- Follmann GmbH & Co. KG

- Premier Starch Products Pvt. Ltd

- Avebe

- Everis Group

Competitive Analysis:

The Bioadhesives for packaging market features a competitive landscape dominated by key players such as Henkel AG & Co. KGaA, Arkema S.A., Danimer Scientific, and Ashland Global Holdings Inc. These companies lead in innovation, focusing on high-performance, biodegradable formulations with strong bonding and low environmental impact. Strategic collaborations with packaging machinery firms and raw material suppliers support product scalability and end-use integration. Mid-sized firms contribute through niche innovations, targeting custom applications and region-specific sustainability needs. It maintains a balance between global expansion and localized manufacturing. Mergers, acquisitions, and R&D investments remain central to competitive positioning. Companies aim to secure regulatory certifications and supply chain reliability to attract packaging converters and FMCG brands. The market favors firms that combine technical expertise with sustainable sourcing practices.

Recent Developments:

- In July 2025, EcoSynthetix Inc. received a second purchase order for its SurfLock bio-based adhesive product.

- In July 2025, Henkel launched a solvent-free adhesive system designed for high-performance and sustainable packaging. The new solution enhances safety and supports eco-friendly packaging initiatives under Henkel Adhesive Technologies.

- In March 2023, Jowat SE began offering locally manufactured Jowat hot melt adhesives through a partnership with Pidilite Industries Limited in India. These adhesives cater to packaging and industrial applications, focusing on expanding access to advanced bioadhesive technologies in the region.

Market Concentration & Characteristics

The Bioadhesives for packaging market is moderately concentrated with several leading firms and numerous emerging players. It displays a strong emphasis on sustainability, driven by rising demand for biodegradable and food-safe adhesives. Companies compete through performance metrics such as adhesion strength, moisture resistance, and shelf stability. It evolves through constant material innovation and regulatory alignment. Market dynamics favor firms capable of rapid customization and efficient production at scale. Product certification, supply chain transparency, and alignment with circular economy principles influence buyer preferences.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, Form and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for biodegradable adhesives will rise due to increasing global restrictions on synthetic packaging materials, particularly those containing VOCs and microplastics.

- Advancements in protein-, lignin-, and starch-based formulations will improve bonding strength, moisture resistance, and durability across various packaging types.

- Integration of bioadhesives into high-speed automated packaging lines will enhance operational efficiency and reduce changeover times for converters.

- Food and pharmaceutical sectors will accelerate adoption, driven by regulatory focus on non-toxic, hypoallergenic, and food-safe adhesive compositions.

- Strategic partnerships between bioadhesive manufacturers, biopolymer developers, and packaging OEMs will support technology co-development and large-scale deployment.

- Rising consumer demand for sustainable, compostable, and eco-labeled products will reinforce the need for clean adhesive solutions in retail packaging.

- Asia Pacific will witness significant growth due to rapid industrialization, policy support for green materials, and strong domestic raw material supply.

- Bioadhesives that enable recycling-friendly separation of bonded layers will gain traction under circular economy initiatives.

- Innovations in enzymatic and hybrid adhesive systems will create new use cases and expand the commercial scope of bioadhesives.

- Investment in local raw material sourcing and regional manufacturing facilities will help stabilize supply chains and reduce production costs.