Market Overview:

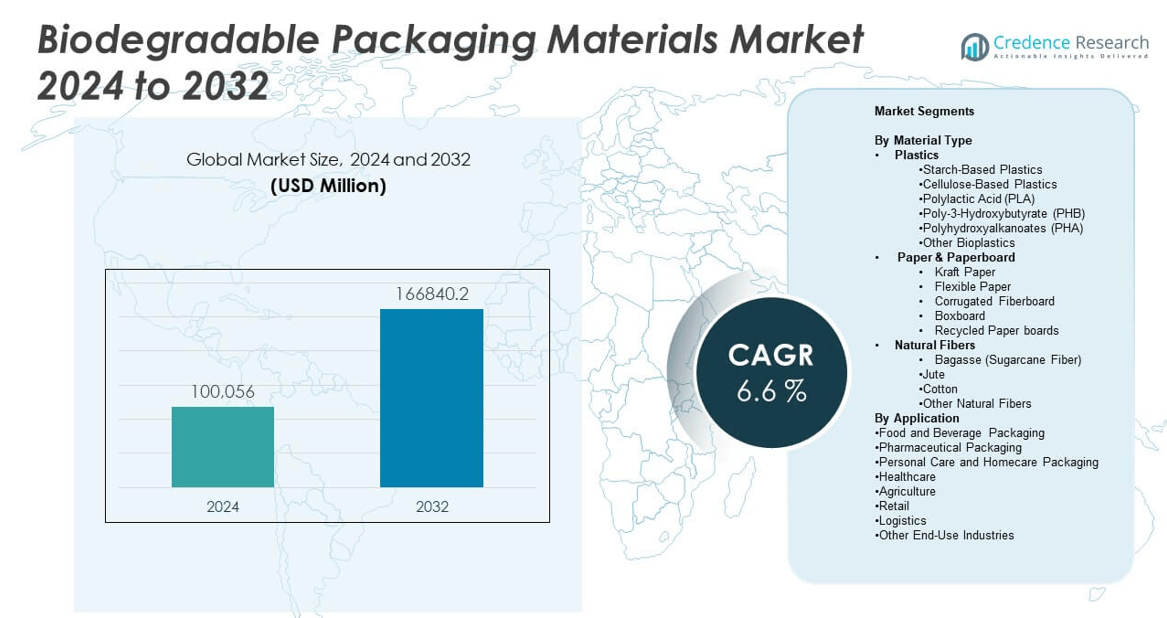

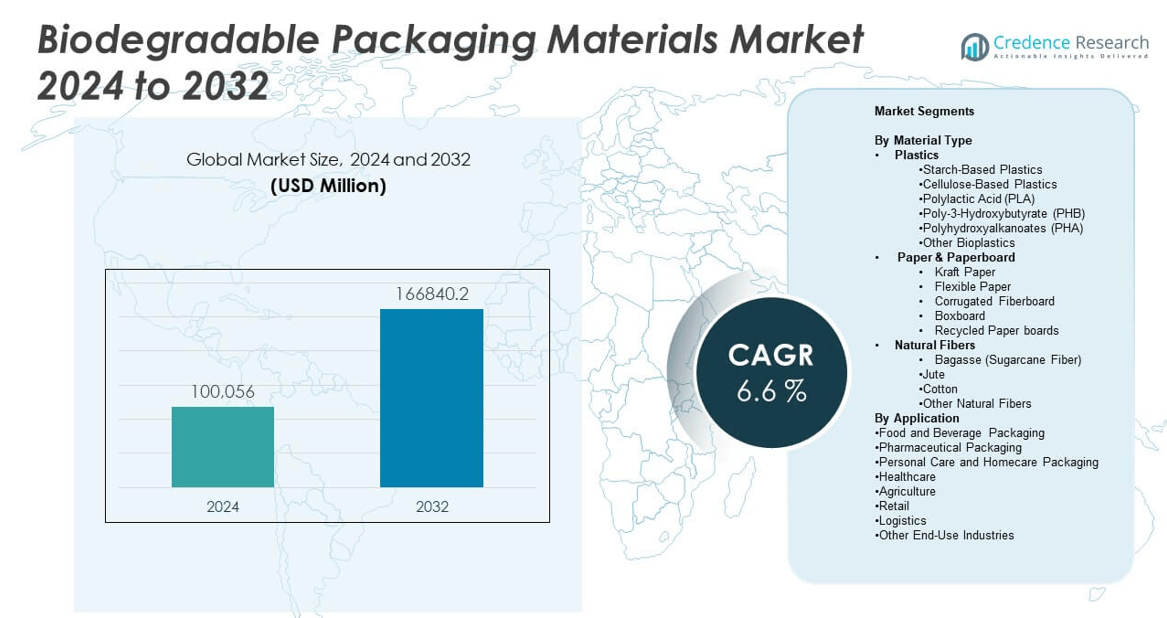

The bioderived packaging film market size was valued at USD 1265 million in 2024 and is anticipated to reach USD 1767.5 million by 2032, at a CAGR of 4.27 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bioderived Packaging Film Market Size 2024 |

USD 1265 million |

| Bioderived Packaging Film Market, CAGR |

4.27% |

| Bioderived Packaging Film Market Size 2032 |

USD 1767.5 million |

Market growth is driven by rising demand for biodegradable and compostable packaging, combined with technological advancements that enhance film durability, transparency, and barrier properties. Brands are focusing on circular economy practices, and bioderived films offer reduced carbon footprints without compromising performance. Consumer preference for eco-friendly packaging solutions is influencing procurement strategies, especially in the fast-moving consumer goods (FMCG) sector. Ongoing R&D efforts and industry collaborations continue to improve cost-efficiency and scalability of production.

Regionally, Europe leads the bioderived packaging film market, supported by strict environmental regulations and active adoption by major packaging manufacturers such as BASF SE, Tipa Corp. Ltd., and Futamura Chemicals Co., Ltd. North America follows, driven by policy support and corporate sustainability commitments, with key participants including Brentwood Plastics, Inc., BioBag Americas, Inc., and Cortec Corporation. The Asia Pacific region is expected to witness the fastest growth, supported by expanding e-commerce, urbanization, and favorable government initiatives in China, India, and Southeast Asia, with regional leaders such as Kingfa Sci. & Tech. Co., Ltd.

Market Insights:

- The bioderived packaging film market reached USD 1,265 million in 2024 and is forecast to reach USD 1,767.5 million by 2032.

- Market growth is driven by increased demand for biodegradable and compostable packaging across food, FMCG, and personal care sectors.

- Technological advancements enhance film durability, transparency, and barrier properties, making bioderived films suitable for broader applications.

- Europe leads with a 37% market share, fueled by strict regulations and rapid adoption by manufacturers like BASF SE and Tipa Corp.

- North America holds a 29% share, driven by policy support, sustainability commitments, and strong industry engagement from players such as Brentwood Plastics, Inc.

- Asia Pacific is the fastest-growing region, accounting for 21% market share, with demand rising from e-commerce and urbanization.

- Challenges include high production costs, limited composting infrastructure, and performance limitations under extreme conditions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Environmental Concerns and Regulatory Pressure Drive Adoption:

The bioderived packaging film market benefits significantly from growing environmental concerns and strict regulations against petroleum-based plastics. Governments across regions are banning or restricting single-use plastics, prompting industries to shift toward biodegradable alternatives. It is gaining traction as a sustainable solution that reduces dependence on fossil fuels and lowers carbon emissions. Regulatory frameworks such as the EU’s Green Deal and extended producer responsibility (EPR) programs further support adoption.

- For instance, Taghleef Industries’ NATIVIA® films are certified OK biobased-4 stars by TÜV and achieve complete biodegradation within six months under industrial composting conditions, complying with EN 13432 standards.

Growing Consumer Preference for Sustainable Packaging Alternatives:

Shifting consumer behavior toward eco-conscious purchasing decisions boosts the bioderived packaging film market. It supports sustainability goals without compromising visual appeal or performance, making it suitable for environmentally aware brands. Increasing demand for transparency and traceability in product sourcing encourages retailers to adopt bioderived materials in their packaging. Brands seeking to improve environmental credentials are replacing conventional films with plant-based, compostable solutions.

- For instance, Dr Bio offers packaging films made 100% from cornstarch, which are compostable and biodegradable; these have replaced conventional plastics for clients in more than 20 countries, providing full decomposition within 6 months in industrial composting conditions.

Technological Advancements Enhance Material Performance and Scalability:

Ongoing R&D initiatives have improved the mechanical, barrier, and thermal properties of bioderived films, making them competitive with traditional plastics. The bioderived packaging film market gains momentum from advancements in polymer chemistry, extrusion technologies, and coating processes. It now meets the functional demands of various end-use sectors, including food preservation and medical product safety. Cost-effective production and improved shelf stability further drive industrial-scale adoption.

Corporate Sustainability Goals Fuel Strategic Shifts in Packaging Procurement:

Major FMCG and retail companies are integrating bioderived packaging into their product portfolios to meet ESG (Environmental, Social, and Governance) objectives. The bioderived packaging film market aligns with these goals, offering renewable, biodegradable, and often compostable options. It enables corporations to meet sustainability targets while appealing to a growing base of eco-conscious consumers. Procurement teams increasingly prioritize suppliers offering certified bioderived films to reduce overall environmental impact.

Market Trends:

Integration of Compostable and Biodegradable Film Formats into Mainstream Packaging Solutions:

The bioderived packaging film market is witnessing a growing trend toward the use of fully compostable and biodegradable film solutions across various industries. Companies are moving beyond partial bio-content and adopting 100% biodegradable films to meet end-of-life sustainability expectations. It supports closed-loop systems by aligning with industrial composting infrastructure and zero-waste goals. These films are being used for wrapping perishables, pouches, liners, and labeling, particularly in food and personal care packaging. Innovations in multilayer structures and moisture-resistant coatings are enhancing performance without compromising sustainability. Brands are focusing on achieving certifications such as ASTM D6400 and EN 13432 to ensure regulatory compliance and boost consumer confidence.

- For instance, NatureFlex™ films by Futamura achieve complete biodegradation in less than 45 days under industrial composting conditions, far exceeding the EN 13432 requirement of 90% biodegradation within 6 months.

Use of Novel Feedstocks and Advanced Polymer Blends to Improve Functional Properties:

Companies are investing in alternative feedstocks such as seaweed, algae, and agricultural waste to diversify raw material sourcing and reduce dependency on traditional biopolymers like PLA and starch. The bioderived packaging film market reflects a shift toward using advanced polymer blends that offer improved mechanical strength, transparency, and sealability. It enables broader application in high-barrier and high-performance packaging formats, including vacuum-sealed and thermoformed products. Research partnerships between biopolymer producers and packaging converters are accelerating product development and commercial scalability. Industry stakeholders are also exploring enzymatic degradation and solvent-free processing to reduce environmental impact during production. These innovations position bioderived films as viable replacements for fossil-based counterparts across diverse packaging needs.

- For instance, London-based Notpla has delivered more than 75 million units of its seaweed-based packaging for foodservice use over three years with Levy UK + Ireland.

Market Challenges Analysis:

High Production Costs and Limited Infrastructure Impede Widespread Commercialization:

The bioderived packaging film market faces cost-related challenges that hinder its large-scale adoption across price-sensitive industries. It requires specialized raw materials and processing equipment, which increases manufacturing expenses compared to conventional plastic films. Inadequate infrastructure for composting and recycling bioderived materials limits their end-of-life advantages. Many regions lack the industrial composting facilities necessary to process these films efficiently. This gap between material capabilities and waste management systems restricts their market penetration. The absence of standardized labeling and disposal instructions adds confusion for consumers and slows down adoption.

Performance Limitations under Specific Conditions Affect Broader Applicability:

While bioderived films have made significant progress in durability and barrier performance, certain product formats still underperform under extreme temperatures or high-moisture environments. The bioderived packaging film market faces resistance from sectors requiring rigorous packaging standards, such as frozen foods or heavy-duty transport. It struggles to match the long shelf life and robustness offered by petroleum-based alternatives in these use cases. Concerns around product spoilage and inconsistent performance create hesitation among manufacturers. Balancing biodegradability with performance characteristics remains a key technical hurdle. Achieving parity in cost and functionality with conventional plastics continues to challenge product developers.

Market Opportunities:

Rising Demand from E-Commerce and Perishable Goods Segments Creates Growth Potential:

The expansion of e-commerce and increased demand for perishable goods packaging offer significant growth opportunities for the bioderived packaging film market. It can provide lightweight, protective, and compostable alternatives for shipping materials, fresh produce, and ready-to-eat foods. Consumers are seeking environmentally responsible packaging from online retailers and grocery delivery services. This demand encourages brands to integrate bioderived films into their fulfillment processes. Rapid growth in online food delivery, particularly in urban areas, presents a key application area for breathable, biodegradable films. Customized solutions for shelf-life extension and aesthetic appeal further increase the appeal of these films.

Supportive Policy Landscape and Green Investment Stimulate Market Expansion:

Governments and financial institutions are promoting circular economy initiatives and sustainable packaging transitions, creating favorable conditions for bioderived film manufacturers. The bioderived packaging film market can leverage subsidies, grants, and public-private partnerships to scale production and reduce costs. It aligns with climate action goals and sustainable development frameworks adopted by major economies. Corporate ESG mandates and investor preference for low-carbon technologies further drive capital toward bioderived film innovations. Collaborations with global packaging converters and logistics providers can accelerate integration into mainstream supply chains. These developments create a supportive ecosystem for innovation and long-term growth.

Market Segmentation Analysis:

By Type:

The bioderived packaging film market includes segments such as polylactic acid (PLA), starch-based films, cellulose films, and others. PLA holds a significant share due to its wide availability, high clarity, and suitability for food contact applications. Starch-based films are gaining traction in short-life packaging applications where quick biodegradability is essential. Cellulose films offer strong performance in moisture control and are used in premium and specialty packaging formats. Manufacturers are optimizing blends to enhance strength, transparency, and compostability.

- For instance, NatureWorks manufactures over 150,000 metric tons of Ingeo PLA annually, which is used in global applications for sustainable food packaging.

By Application:

The market segments by application into food packaging, personal care packaging, pharmaceuticals, and industrial packaging. Food packaging dominates the bioderived packaging film market due to rising demand for sustainable materials in ready-to-eat, fresh produce, and bakery categories. Personal care applications are growing, driven by premium brands adopting biodegradable wrappers and sachets. Pharmaceutical applications rely on moisture- and oxygen-resistant bioderived films to maintain product integrity. Industrial packaging is emerging with pilot use cases in logistics and electronics.

- For instance, oil-infused bacterial cellulose (OBC) films stored strawberries with a 0% mold rate after 5 days at 23°C, compared to 100% with conventional polyethylene, and degraded fully in soil within 9 days—demonstrating strong performance and rapid biodegradability.

By End-Use:

Key end-use sectors include retail, food and beverage, healthcare, personal care, and e-commerce. The food and beverage segment leads in volume due to widespread consumer preference for eco-friendly alternatives. Healthcare and pharmaceutical sectors are adopting bioderived films for unit-dose packaging and secondary wraps. E-commerce platforms are testing compostable mailers and protective films to meet sustainability targets. The personal care industry is integrating bioderived films to support clean-label branding and reduce plastic waste.

Segmentations:

By Type:

- Polylactic Acid (PLA) Films

- Starch-Based Films

- Cellulose Films

- Polyhydroxyalkanoates (PHA) Films

- Other Bioderived Films

By Application:

- Food Packaging

- Personal Care Packaging

- Pharmaceutical Packaging

- Industrial Packaging

- Agricultural Packaging

By End-Use:

- Food and Beverage Industry

- Healthcare and Pharmaceutical Industry

- Personal Care and Cosmetics Industry

- Retail and Consumer Goods

- E-commerce and Logistics

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe:

Europe holds 37% of the global market, positioning it as the leading region in the bioderived packaging film market. It benefits from strong environmental policies, including bans on single-use plastics and mandatory compostability certifications under EN 13432. Governments actively support circular economy strategies, prompting manufacturers to adopt bioderived films across retail, food service, and consumer goods. Countries like Germany, France, and the Netherlands are spearheading commercial adoption through public-private partnerships and green procurement policies. Major packaging converters in the region have integrated bioderived films into their mainstream product lines. High consumer awareness and sustainability-focused supply chains further enhance market maturity.

North America:

North America contributes 29% to global revenue, with the United States playing a central role in product innovation and commercialization. The region shows strong private sector engagement, where major retailers and FMCG brands integrate bioderived films into their sustainability roadmaps. It benefits from R&D investments, a favorable regulatory environment, and increasing demand for compostable packaging in food, healthcare, and personal care. Strategic partnerships between biopolymer producers and packaging manufacturers accelerate time-to-market for high-performance bioderived films. Local and state-level regulations on plastic waste further encourage adoption, especially in states like California and New York. Consumer demand for eco-conscious alternatives continues to influence procurement strategies across industries.

Asia Pacific:

Asia Pacific holds 21% of global market revenue and represents the fastest-growing region due to rising environmental awareness and urbanization. The bioderived packaging film market in this region benefits from expanding middle-class populations, rapid growth in food delivery services, and supportive policy developments in China, India, and Southeast Asia. Local manufacturers are scaling up production with government-backed incentives for biodegradable materials. Multinational brands are investing in regional sourcing and manufacturing to align with low-carbon supply chains. Consumer interest in sustainable products is growing, particularly in urban retail and e-commerce channels. This shift creates new demand pockets across diverse application sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Tipa Corp. Ltd.

- Brentwood Plastics, Inc

- Futamura Chemicals Co., Ltd

- BioBag Americas, Inc.

- Cortec Corporation

- Kingfa Sci. & Tech. Co., Ltd.

- Plastchim-T

- Shreeji Stretch Film Industries

- Clondalkin Group Holding B.V.

Competitive Analysis:

The bioderived packaging film market features strong competition among established chemical companies, innovative biopolymer specialists, and regional film converters. Key players such as BASF SE, Tipa Corp. Ltd., Brentwood Plastics, Inc., Futamura Chemicals Co., Ltd., BioBag Americas, Inc., Cortec Corporation, and Kingfa Sci. & Tech. Co., Ltd. drive industry advancement through R&D investment, new product development, and strategic partnerships. It rewards companies that demonstrate expertise in sustainable material science, scalability, and compliance with global certifications. Players compete by expanding their patent portfolios, securing long-term supply agreements with leading FMCG brands, and offering tailored solutions for food, personal care, and healthcare applications. The market also sees increased collaboration with research institutions to develop novel feedstocks and improve film properties. Continuous innovation and customer-centric strategies define the competitive landscape, creating opportunities for both global leaders and emerging startups.

Recent Developments:

- In April 2025, BASF SE launched three natural-based personal care innovations—Verdessence® Maize, Lamesoft® OP Plus, and Dehyton® PK45 GA/RA—offering biodegradable and sustainable alternatives for the personal care industry.

- In February 2025, Tipa Corp. Ltd. launched an advanced home compostable metallized high-barrier film designed to provide eco-friendly and effective snack packaging solutions.

- In May 2025, Futamura, in collaboration with Repaq and GK Sondermaschinenbau, launched a fully compostable liquid sachet packaging using NatureFlex™ technology, designed for various liquid applications and certified for both home and industrial composting.

Market Concentration & Characteristics:

The bioderived packaging film market exhibits moderate concentration, with a mix of global biopolymer producers, regional packaging converters, and emerging startups. It features a competitive landscape shaped by innovation, sustainability mandates, and supply chain integration. Key players focus on R&D, patent portfolios, and collaboration with FMCG brands to differentiate their offerings. The market favors companies capable of ensuring material consistency, regulatory compliance, and scalable production. It reflects strong entry barriers due to the need for technical expertise, capital-intensive infrastructure, and compliance with compostability standards. Strategic alliances and long-term supply contracts play a central role in market positioning. The demand for certified, high-performance films creates opportunities for niche players focused on novel feedstocks and specialty applications.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Stakeholders will expand focus on sourcing alternative feedstocks like seaweed, algae, and agricultural residues to reduce reliance on traditional biopolymers.

- Manufacturers will scale production capacity by investing in biorefinery partnerships and capacity upgrades across multiple regions.

- Brands will increasingly integrate compostable film solutions into packaging strategies to strengthen ESG commitments and meet consumer expectations.

- Industry collaborations involving biopolymer developers and packaging converters will accelerate commercial rollout of high-barrier films suitable for food and medical sectors.

- Regulatory bodies will extend mandates on single-use plastics and introduce labeling standards for compostable materials, pushing industry adoption.

- Supply chains will evolve to support closed-loop systems, including improved industrial composting and collection infrastructure.

- Innovation teams will refine polymer blends to improve film strength, moisture barrier properties, and clarity for premium packaging formats.

- Retailers and logistics providers will pilot tailored bioderived film solutions for e‑commerce and perishable goods shipping.

- Investment firms will allocate capital toward startups developing enzymatic degradation and solvent-free processing to boost sustainability.

- Technological advances in extrusion and coating processes will lower unit cost, making bioderived films competitive with traditional plastics.