Market Overview:

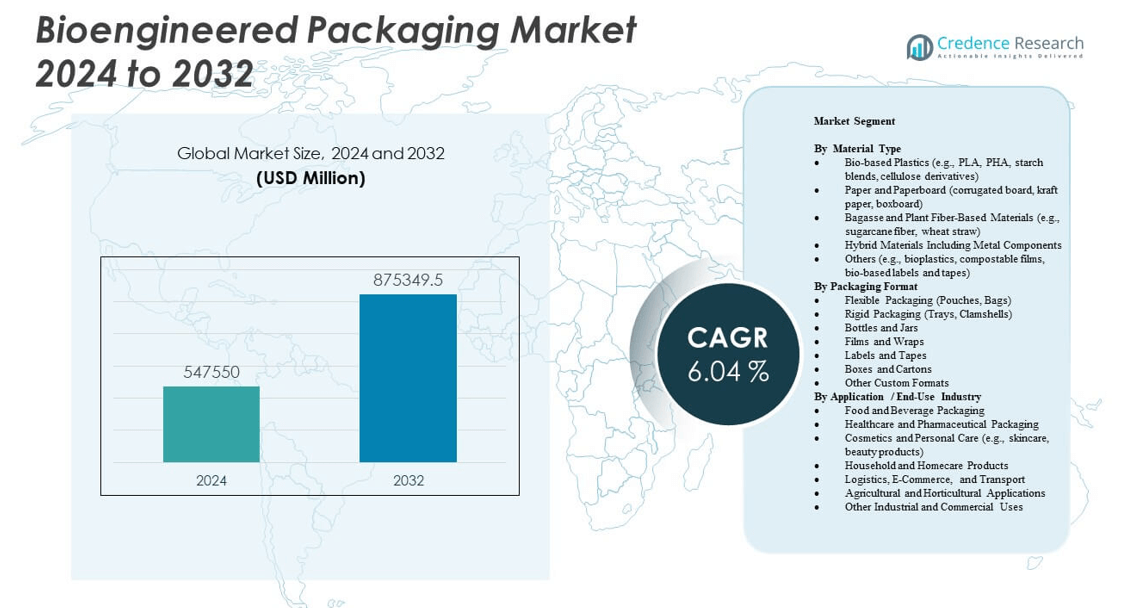

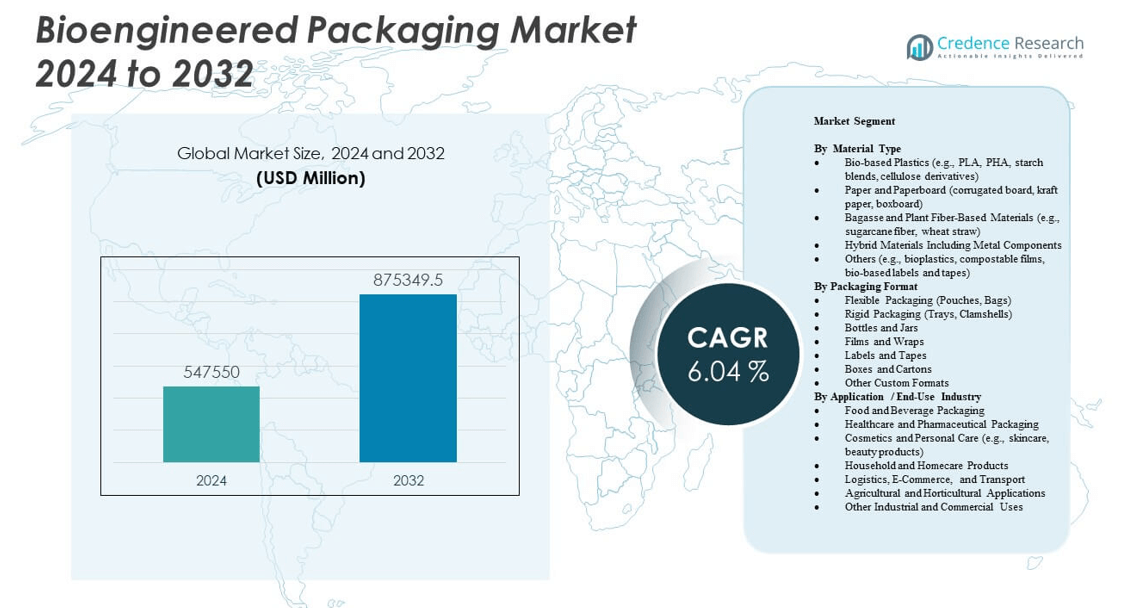

The Bioengineered Packaging Market is projected to grow from USD 547,550 million in 2024 to an estimated USD 875,349.5 million by 2032, with a compound annual growth rate (CAGR) of 6.04% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bioengineered Packaging Market Size 2024 |

USD 547,550 million |

| Bioengineered Packaging Market, CAGR |

6.04% |

| Bioengineered Packaging Market Size 2032 |

USD 875,349.5 million |

The market is being driven by the rising demand for sustainable and environmentally friendly packaging alternatives across various industries. Companies are adopting bioengineered materials derived from renewable sources such as agricultural waste, bioplastics, and fungi-based composites to reduce their environmental footprint. Government regulations banning single-use plastics and promoting compostable packaging have accelerated product development and commercial adoption. Technological advancements in synthetic biology and material science are enhancing the mechanical and barrier properties of bioengineered packaging, making it a viable replacement for conventional plastic in food, beverage, and personal care sectors.

Regionally, North America and Europe lead the market due to strong regulatory frameworks, consumer awareness, and early adoption of sustainable packaging technologies. The United States, Germany, and France are witnessing significant deployment in retail and FMCG sectors. Meanwhile, Asia Pacific is emerging as a high-growth region, with countries like China, India, and Japan investing in bio-packaging startups and increasing eco-conscious production. The region benefits from low-cost biomass feedstocks, growing urbanization, and strong governmental support for green manufacturing, positioning it as a critical hub for future market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Bioengineered Packaging Market is valued at USD 547,550 million in 2024 and is projected to reach USD 875,349.5 million by 2032, growing at a CAGR of 6.04%.

- Demand is rising across food, beverage, and cosmetics sectors due to increasing consumer preference for sustainable and compostable packaging materials.

- Regulatory bans on single-use plastics and extended producer responsibility programs are accelerating adoption across developed and emerging markets.

- High production costs and limited industrial composting infrastructure remain key restraints hindering large-scale commercialization.

- North America leads the market with 38% share, supported by strong R&D investment, while Europe follows with 31%, driven by strict environmental regulations.

- Asia Pacific is the fastest-growing region, benefiting from abundant biomass, policy support, and emerging bio-packaging startups.

- Continued innovation in microbial fermentation and synthetic biology is enhancing packaging performance and scaling industrial adoption.

Market Drivers:

Rising Demand for Sustainable Packaging Across Consumer Goods and Food Industries

The Bioengineered Packaging Market is experiencing strong growth driven by increasing demand for sustainable alternatives to petroleum-based packaging. Consumers are shifting preferences toward eco-friendly materials, pushing manufacturers to innovate with biodegradable and compostable solutions. Major food and beverage companies are replacing conventional plastic with bioengineered films and containers to enhance sustainability credentials. Retailers and brand owners are aligning packaging initiatives with corporate ESG goals, further fueling adoption. Stringent government bans on single-use plastics and landfill restrictions are boosting compliance-led investments. Bioengineered packaging made from agricultural waste and microbial polymers is gaining traction due to low carbon emissions. Companies are also investing in advanced material synthesis to improve packaging strength and barrier properties. These developments position it as a scalable solution for high-volume packaging applications.

- For example, Mycelium-based packaging developed by Ecovative and piloted by IKEA has demonstrated compressive strengths up to 570 kPa and densities near 280 kg/m³ in lab studies. Commercial products, however, typically show lower values, with Ecovative reporting ~51 kPa and ~122 kg/m³ for its protective packaging.

Government Support Through Policies, Incentives, and Regulatory Mandates

National and regional policies supporting the circular economy are accelerating the adoption of bioengineered materials. The Bioengineered Packaging Market benefits from incentives such as tax rebates, compostable labeling frameworks, and public funding for research. Regulatory mandates in the European Union, North America, and parts of Asia are enforcing plastic waste reduction and promoting the use of renewable resources. Governments are offering infrastructure grants to develop local biopolymer processing units and composting systems. Certification programs such as EN 13432 and ASTM D6400 guide material compliance, increasing buyer confidence. The inclusion of bioengineered packaging in extended producer responsibility (EPR) schemes is prompting brand conversions. State-level bans on petrochemical plastics in retail and delivery services further increase urgency for change. These policy interventions directly support commercialization efforts and material innovation.

Technological Advancements in Biofabrication and Genetic Engineering

Advances in synthetic biology and precision fermentation are redefining the development pipeline of bioengineered materials. The Bioengineered Packaging Market benefits from the ability to program microorganisms to produce custom biopolymers tailored to packaging applications. Researchers are using CRISPR and metabolic engineering to enhance yield, mechanical properties, and compostability of packaging substrates. Companies are scaling microbial cellulose and mycelium-based materials with optimized growth environments. High-throughput screening and AI-driven simulations help identify novel feedstocks and polymer structures. Hybrid formulations combining bioengineered proteins, starches, and lignin derivatives offer better moisture resistance. Pilot-scale production facilities are now using continuous bioprocessing for faster time-to-market. These innovations allow for better adaptability to diverse end-use industries. Technological maturity is closing the performance gap between traditional and bioengineered solutions.

Corporate Sustainability Commitments and Shift Toward Circular Models

Large corporations are adopting bioengineered packaging as part of broader sustainability roadmaps. The Bioengineered Packaging Market is gaining traction due to proactive commitments by FMCG, retail, and logistics companies to eliminate plastic waste. Many brands are setting deadlines to transition toward 100% recyclable, reusable, or compostable packaging. Procurement teams are sourcing next-gen materials that align with lifecycle assessments and net-zero goals. Supply chain partners are investing in decentralized packaging innovation hubs to localize production. Industry consortia are standardizing material testing and end-of-life disposal pathways. Closed-loop models incorporating take-back programs and biodegradable packaging are being piloted in urban centers. Companies are collaborating with biofoundries to integrate packaging solutions with product design. These shifts reinforce long-term growth for commercially viable bioengineered formats.

- For instance, Amcor reports more than 90% of its global packaging output by weight is now designed for full recyclability or compostability, in alignment with their public 2025 pledge.

Market Trends

Integration of Bioengineered Packaging into Smart Packaging Ecosystems

Smart packaging is expanding beyond RFID and freshness indicators to include bioengineered substrates that actively interact with the product environment. The Bioengineered Packaging Market is witnessing interest in integrating sensors and time-temperature indicators into biodegradable materials. Edible coatings with embedded tracking features are under development to monitor shelf life and product quality. Companies are experimenting with pH-sensitive bioinks and biosensor films derived from engineered proteins. Startups are launching QR-enabled compostable packaging for traceability and consumer engagement. These innovations support transparency and waste reduction while maintaining environmental performance. Smart bioengineered packaging can also inform consumers of disposal methods. Industry players are combining green design with digital connectivity to create multifunctional, low-waste packaging formats. This fusion of sustainability and interactivity defines a new trend in bio-packaging evolution.

- For instance, biopolymer nanocomposite films now incorporate multilayered oxygen and moisture barrierswith verified increases in shelf life by 20–40% for food products.

Expansion of Mycelium and Algae-Based Materials in Industrial Packaging

Mycelium and algae-derived materials are emerging as leading bioengineered packaging substrates due to rapid growth rates and natural biodegradability. The Bioengineered Packaging Market is witnessing increased interest from industrial packaging sectors seeking foam and molded fiber alternatives. Mycelium-based packaging offers lightweight, compostable cushioning for electronics, cosmetics, and specialty goods. Algae polymers are being blended with starches to create water-resistant films and containers. Manufacturers are developing scalable cultivation systems for consistent biomass supply. Brands prefer these materials for their aesthetic and organic appeal in premium packaging. Biocomposite panels made from agricultural waste and fungi are gaining popularity in furniture and appliance shipping. Startups are attracting funding for their potential to replace EPS and PU foam in transit packaging.

- For example, Ecovative Design and GROWN Bio have commercialized patented mycelium molding technologies to produce custom foam packaging cushions. Public data shows these materials typically achieve compressive strengths between 2.1–46 kPa and densities around 115 kg/m³, suitable for protective applications.

Adoption of Decentralized Manufacturing for On-Demand Bio-Packaging

On-site and decentralized bio-packaging production is growing due to demand for low-emission, localized solutions. The Bioengineered Packaging Market is observing a shift toward modular bioproduction units that reduce logistics and supply chain emissions. Small-scale reactors for bacterial cellulose, PHA, and mycelium growth are being deployed near distribution hubs and urban centers. Retailers and foodservice brands are adopting containerized labs for custom, short-run packaging production. This model supports rapid prototyping and low MOQs for seasonal and personalized products. Cloud-connected bioreactors enable remote monitoring and optimization of output quality. Distributed production systems reduce reliance on large centralized plants and fossil-based inputs. Decentralized biomanufacturing aligns with net-zero supply chain goals. It enables agile, demand-responsive packaging strategies for modern retail environments.

Growing Focus on Cosmetic and Luxury Segment Applications

Luxury and cosmetic brands are investing in bioengineered packaging to enhance brand image and sustainability credentials. The Bioengineered Packaging Market is observing strong traction in premium segments due to material aesthetics, tactile appeal, and biodegradability. Brands are launching skincare and fragrance products in mycelium-based boxes and molded biopolymer containers. Algae-derived films and colored bacterial cellulose wraps are being customized for limited edition offerings. High-end brands are prioritizing low-waste and storytelling-driven packaging formats. Design studios are collaborating with biotech labs to co-develop exclusive, nature-inspired materials. These packaging formats support product differentiation and align with clean beauty narratives. Certifications for marine and soil compostability add credibility to luxury packaging claims. This trend strengthens bio-packaging’s position in design-forward, value-driven segments.

Market Challenges Analysis

Performance Limitations Compared to Petrochemical-Based Packaging

Despite advancements, bioengineered materials often struggle to match the mechanical strength, moisture barrier, and shelf life stability of conventional plastics. The Bioengineered Packaging Market faces difficulty in serving high-demand sectors like frozen foods, industrial chemicals, and medical devices. Materials such as microbial polyesters and protein-based films are sensitive to humidity and temperature variations. Consistency in color, transparency, and surface smoothness also remains a concern. Shelf-life validation and food safety compliance take longer for new substrates. Manufacturing scalability with performance parity is still limited in cost-sensitive regions. Converters and brand owners are hesitant to fully replace fossil-based options without demonstrated durability in extreme supply chain conditions. These limitations slow mass-market adoption, especially for mission-critical applications requiring multilayer, high-performance packaging.

High Cost of Production and Limited Infrastructure for Commercialization

Commercial-scale production of bioengineered packaging is still more expensive than traditional materials due to high input and processing costs. The Bioengineered Packaging Market is affected by low economies of scale, especially for advanced substrates like mycelium composites or engineered polysaccharides. Access to feedstock varies across regions, and bioprocessing infrastructure remains underdeveloped in emerging economies. Specialized equipment and trained personnel are required to maintain consistency and meet industrial compliance standards. Limited industrial composting infrastructure also restricts proper disposal pathways. Small and medium enterprises struggle to invest in bioreactor facilities or license proprietary biopolymer technologies. Distribution networks for biodegradable packaging are fragmented and less integrated. These challenges hinder rapid deployment and large-scale substitution of conventional materials.

Market Opportunities

Expansion Potential in Agricultural and Pharmaceutical Packaging Segments

Growing demand for sustainable packaging in agricultural exports and pharmaceutical logistics creates new application opportunities. The Bioengineered Packaging Market is positioned to serve niche applications such as seed coatings, vaccine carriers, and moisture-regulating wraps. Companies are exploring biofilms that extend shelf life and control respiration rates in fresh produce shipments. Pharma companies are piloting bio-based blister packs and vials with tamper-evident features. These applications prioritize product integrity, biodegradability, and low toxicity, aligning with market expectations. Tailored formulations and sector-specific certifications will open new commercialization pathways.

Emergence of Regional Innovation Clusters and Startup Ecosystems

Government-backed incubators and private biotech accelerators are supporting the next wave of bioengineered packaging startups. The Bioengineered Packaging Market benefits from regional innovation ecosystems in Europe, North America, and Asia Pacific. Startups focusing on algae bioplastics, bacterial cellulose, and fungal packaging are attracting VC investments. Partnerships with local food and retail brands enable real-world product testing. These ecosystems promote cross-industry collaboration, licensing of IP, and knowledge exchange that strengthen commercialization readiness.

Market Segmentation Analysis:

By material type, The Bioengineered Packaging Market features a diverse material portfolio led by bio-based plastics such as PLA, PHA, starch blends, and cellulose derivatives. These materials are gaining traction for their biodegradability and compatibility with food safety standards. Paper and paperboard, including corrugated and kraft variants, remain widely adopted for secondary and tertiary packaging. Bagasse and other plant fiber-based materials offer renewable, compostable alternatives for trays, clamshells, and cartons. Hybrid formats with limited metal content are emerging for performance-critical applications, while niche segments include bioplastics, compostable films, and bio-based labels and tapes.

- For example, NatureWorks LLC(USA) produces Ingeo™ PLA (Polylactic Acid), which is certified for both industrial and home composting per EN 13432 and TUV Austria standards.

By packaging format, flexible packaging such as pouches and bags dominates due to its lightweight design and widespread use in consumer goods. Rigid formats like trays, bottles, and jars are being redesigned using bioengineered inputs for durability and shelf appeal. Films, wraps, and labels account for a growing share in branding and preservation-sensitive segments. Boxes and cartons made from fiber or composite materials support e-commerce and shipping demands.

By application, Food and beverage applications lead in end-use, driven by the need for sustainable, food-safe packaging. Healthcare and pharmaceutical packaging is expanding, focusing on sterile, compostable formats. Cosmetics and personal care brands are adopting bioengineered materials to align with clean beauty standards. Homecare, logistics, and agriculture sectors are integrating bio-based solutions to meet regulatory and consumer sustainability expectations. The Bioengineered Packaging Market continues to evolve across applications through material innovation and tailored product design.

- For instance, Coca-Cola Companyin Europe adopted PlantBottle™ technology, combining up to 30% bio-based PET for beverage bottles. Over 60 billion PlantBottles have been sold since launch.

Segmentation:

By Material Type

- Bio-based Plastics (e.g., PLA, PHA, starch blends, cellulose derivatives)

- Paper and Paperboard (corrugated board, kraft paper, boxboard)

- Bagasse and Plant Fiber-Based Materials (e.g., sugarcane fiber, wheat straw)

- Hybrid Materials Including Metal Components

- Others (e.g., bioplastics, compostable films, bio-based labels and tapes)

By Packaging Format

- Flexible Packaging (Pouches, Bags)

- Rigid Packaging (Trays, Clamshells)

- Bottles and Jars

- Films and Wraps

- Labels and Tapes

- Boxes and Cartons

- Other Custom Formats

By Application / End-Use Industry

- Food and Beverage Packaging

- Healthcare and Pharmaceutical Packaging

- Cosmetics and Personal Care (e.g., skincare, beauty products)

- Household and Homecare Products

- Logistics, E-Commerce, and Transport

- Agricultural and Horticultural Applications

- Other Industrial and Commercial Uses

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the largest share of the Bioengineered Packaging Market, accounting for 38% in 2024. The region benefits from robust R&D investments, early adoption of sustainable technologies, and strong regulatory backing for green packaging. The United States leads with widespread use across food, retail, and e-commerce sectors, supported by growing consumer awareness. Canada and Mexico are following with initiatives in compostable packaging for agriculture and personal care. Key players have established localized production and partnerships with research institutions to support market expansion. North America’s mature infrastructure and advanced biomanufacturing capabilities further consolidate its leading position.

Europe accounts for 31% of the global market share, driven by strict environmental mandates and circular economy goals across the EU. Germany, France, and the Netherlands are leading due to proactive regulatory frameworks, plastic bans, and incentives for biodegradable alternatives. The region’s strong presence of packaging multinationals and material innovators boosts early-stage commercialization. Bioengineered materials are widely adopted in food packaging, cosmetics, and premium products. It benefits from structured composting infrastructure and extended producer responsibility programs. The European market continues to grow through cross-border collaborations and government-funded R&D initiatives.

Asia Pacific holds 24% market share and represents the fastest-growing region in the Bioengineered Packaging Market. China, Japan, and India are leading with industrial-scale investments in green packaging startups and low-cost biomass feedstock. Local governments are enforcing waste-reduction targets and promoting bioeconomy programs. Southeast Asia is emerging with strong potential in agricultural exports and biodegradable packaging integration. Local manufacturers are adapting to international sustainability standards to meet export market demands. It benefits from rapid urbanization, e-commerce growth, and public-private partnerships that enable scalable adoption of bioengineered materials. The region is positioned as a key production and export hub.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players Analysis

- Amcor plc

- Mondi Group

- Berry Global Inc.

- Sealed Air Corporation

- Huhtamaki Oyj

- Be Green Packaging

- Better Packaging Co

- Earthware

- Noissue

- Earthfirst

- NatureWorks LLC

- BASF SE

- Novamont S.p.A.

- Danimer Scientific

- Braskem

- Corbion N.V.

- Xampla

- Lactips

- Notpla

- Loliware

Competitive Analysis

The Bioengineered Packaging Market is moderately fragmented with the presence of multinational corporations and a growing number of startups. Key players such as Amcor Plc, BASF SE, Ecovative Design, Danimer Scientific, and NatureWorks LLC are investing heavily in R&D and strategic collaborations. It is witnessing partnerships between packaging companies and synthetic biology firms to develop scalable solutions. Companies are focusing on enhancing performance metrics like strength, compostability, and shelf life. Mergers, acquisitions, and licensing agreements are frequent strategies to expand market presence and access proprietary bio-polymer technologies. Competitive intensity remains high, driven by innovation cycles and regulatory compliance requirements.

Recent Developments

- In March 2025, Amcor plc introduced an industry-first 2oz retort bottle using its proprietary StormPanel™ technology in collaboration with Insymmetry®. This innovation aims to provide highly durable, shelf-stable packaging for nutritional shots and beverages, ensuring product integrity under high-pressure sterilization processes needed for low-acid, shelf-stable drinks.

Market Concentration & Characteristics

The Bioengineered Packaging Market demonstrates moderate concentration with a mix of established global players and regional innovators. It is characterized by high innovation rates, rapid product lifecycle, and niche material specialization. Companies differentiate through certifications, compostability standards, and feedstock versatility. Entry barriers include high R&D costs and regulatory compliance challenges. Buyers prioritize environmental performance, end-of-life impact, and scalability. Customization and co-development of packaging formats are common. Market dynamics are shaped by policy shifts, consumer demand for eco-labels, and increasing material transparency across the packaging supply chain.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Packaging Format and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for biodegradable and compostable packaging solutions will continue to rise across food, retail, and personal care sectors.

- Innovations in microbial fermentation and biofabrication will enhance material strength and shelf-life compatibility.

- Regulatory mandates will expand globally, accelerating commercial adoption of certified bioengineered materials.

- Asia Pacific will emerge as a key manufacturing hub due to abundant biomass and supportive government policies.

- Integration of bioengineered substrates with smart packaging features will gain momentum in logistics and retail.

- Partnerships between biotech startups and packaging giants will drive rapid product development cycles.

- Customization of packaging for specific end-use industries like cosmetics and pharmaceuticals will increase.

- Investment in decentralized production units will improve supply chain agility and reduce emissions.

- Consumer demand for traceable, eco-labeled packaging will influence brand procurement strategies.

- Ongoing research in hybrid biopolymers will bridge performance gaps with conventional materials.