Market Overview:

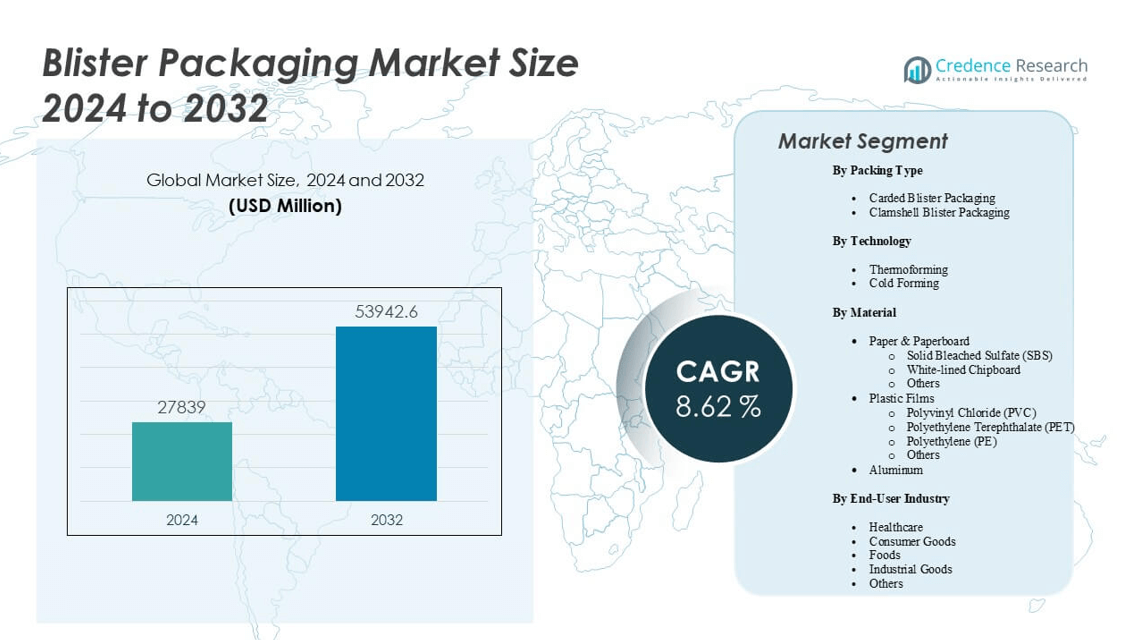

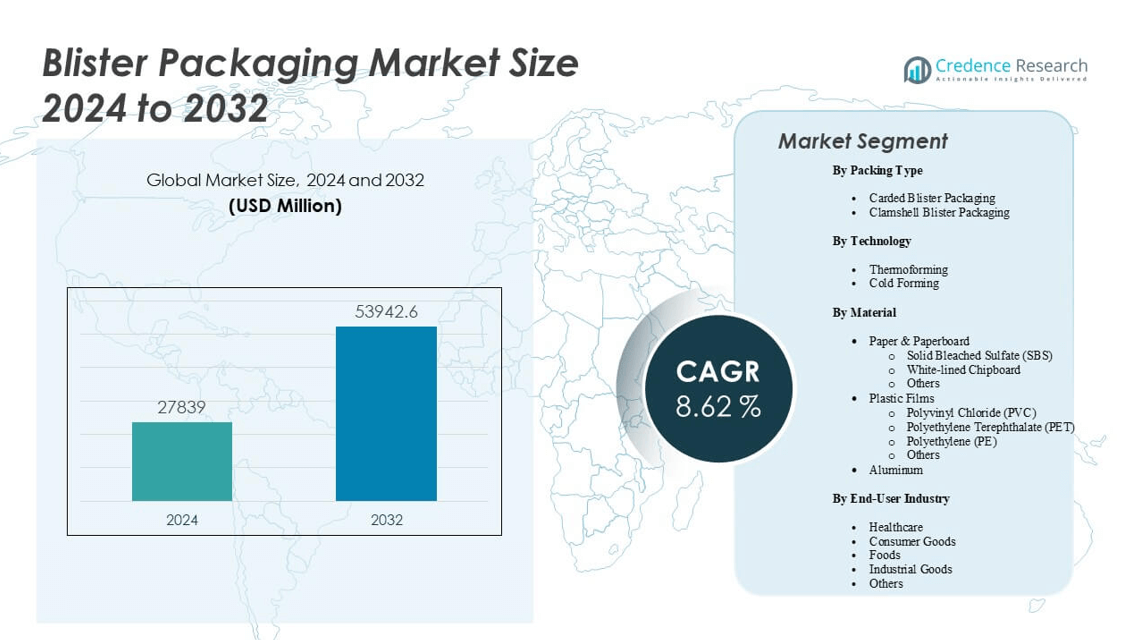

The Blister Packaging Market Size is projected to grow from USD 27,839 million in 2024 to an estimated USD 53,942.6 million by 2032, with a compound annual growth rate (CAGR) of 8.62% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blister Packaging Market Size 2024 |

USD 27,839 million |

| Blister Packaging Market, CAGR |

8.62% |

| Blister Packaging Market Size 2032 |

USD 53,942.6 million |

The blister packaging market is driven by the rising demand for safe, convenient, and tamper-evident packaging across pharmaceuticals, consumer goods, and food sectors. Manufacturers are increasingly adopting blister packs due to their cost efficiency, product protection, and enhanced shelf appeal. The growing pharmaceutical industry, driven by aging populations and increased healthcare access, has particularly boosted demand. Technological advancements in thermoforming and cold-forming techniques, along with heightened regulatory emphasis on unit-dose packaging and anti-counterfeit features, continue to support sustained market growth globally.

Regionally, North America leads the blister packaging market due to its advanced pharmaceutical infrastructure, strong regulatory standards, and widespread use of unit-dose formats. Europe follows closely, benefiting from stringent packaging regulations and high adoption in healthcare and consumer goods. Meanwhile, Asia Pacific is emerging rapidly as a key growth region, supported by its expanding middle-class population, increasing healthcare expenditures, and the booming manufacturing sector in countries like China and India. Latin America and the Middle East & Africa are gradually gaining momentum, driven by improving industrial capabilities and growing demand for secure, modern packaging solutions.

Market Insights:

- The Blister Packaging Market Size is projected to grow from USD 27,839 million in 2024 to USD 53,942.6 million by 2032, registering a CAGR of 8.62%.

- Growing demand for tamper-evident and unit-dose packaging in pharmaceuticals is driving consistent market expansion.

- Rising focus on consumer convenience and enhanced product visibility boosts adoption in food and consumer goods sectors.

- High raw material costs and complex recycling of multi-layered materials pose challenges to widespread sustainable adoption.

- North America leads the market with 32.5% share, driven by regulatory compliance and pharmaceutical dominance.

- Asia Pacific emerges as the fastest-growing region due to healthcare access expansion and manufacturing scale.

- Europe holds a 28.4% share, supported by strong sustainability mandates and advanced packaging infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from the Pharmaceutical Industry Reinforces Market Growth

The increasing use of blister packaging in the pharmaceutical sector plays a pivotal role in propelling the Blister Packaging Market Size. Blister packs provide unit-dose packaging, safeguard product integrity, and offer clear visibility, which is essential for regulatory compliance. Pharmaceutical companies prefer blister formats due to their ability to prevent contamination and extend shelf life. The growing elderly population and the rising incidence of chronic diseases have increased medication consumption globally. It has created consistent demand for efficient and tamper-evident packaging. Governments and healthcare agencies support the use of blister packaging to promote patient safety. Compliance packaging is gaining traction due to its ability to support accurate dosing. These factors combined continue to push adoption across developed and emerging pharmaceutical markets.

Cost-Effectiveness and Material Efficiency Drive Packaging Preferences

The cost advantages of blister packaging significantly contribute to market expansion across sectors. Compared to traditional packaging forms, blister packs use less material while maintaining protection and presentation. Manufacturers benefit from reduced packaging weight and lower transportation costs. It enables companies to optimize supply chains and achieve sustainability goals. The format supports high-speed automation, which improves production efficiency. Blister packs also allow for easy customization to meet branding and product-specific requirements. The ability to print on backing materials enhances marketing communication. Companies across consumer goods and healthcare leverage these benefits to gain competitive advantage.

- For example, SÜDPACK’s PharmaGuard® uses polypropylene (PP) mono-material films that are fully recyclable. The company’s partnership with IMA ensures that these films run at standard line speeds without major retrofitting, maintaining output rates of over 400 packs/minute while reducing material consumption by as much as 30% compared with traditional PVC/Alu blisters.

Strong Demand for Tamper-Evident and Anti-Counterfeit Solutions

Heightened concerns around product security and authenticity drive increased use of blister packaging. The tamper-evident nature of the format helps protect sensitive items such as medicines, batteries, and electronic components. Counterfeit drugs remain a global concern, especially in low- and middle-income regions. It encourages regulatory bodies to enforce stricter packaging standards. Blister packs support integration of features like holograms, barcodes, and RFID tags. These elements enhance traceability and verification across the supply chain. The format also ensures better compliance with serialization requirements. Major industries prioritize safety and authentication, which fosters consistent demand for secure packaging formats.

- Amcor’s AmSky™ HDPE mono-material blister for example, eliminates PVC and aluminum, enhancing recyclability while maintaining high moisture barrier performance. It operates on standard thermoforming blister machines with minimal adjustments and meets U.S. FDA’s 21 CFR 211.132 requirement for tamper-evident packaging through its push-through design.

Growing Consumer Preference for Convenience and Transparency

Consumer preference for easy-to-use, portable, and visually accessible packaging continues to shape the market. Blister packaging enables users to view product quantity and quality without opening the package. It facilitates informed purchasing decisions and builds consumer trust. For healthcare users, the ease of pushing tablets from blisters supports dosage adherence. Food, electronics, and personal care sectors also adopt blister packs to enhance product presentation and convenience. It helps retailers improve product merchandising and shelf management. Compact designs reduce storage space and packaging waste. This alignment with evolving consumer behavior positively influences the Blister Packaging Market Size.

Market Trends

Adoption of Eco-Friendly and Recyclable Blister Packaging Solutions

Sustainability has emerged as a leading trend across the packaging sector. Companies are shifting to recyclable and biodegradable materials in blister packaging. It includes paper-based substrates and recyclable plastics that reduce environmental impact. Regulatory pressure and consumer expectations have accelerated this transition. Brands position eco-friendly packaging as a differentiator in competitive markets. Innovation in compostable and mono-material blisters continues to gain traction. Packaging manufacturers focus on reducing plastic content without compromising performance. The trend supports circular economy goals and enhances brand image. It contributes to long-term transformation in the Blister Packaging Market Size.

- For example, Bayer, in collaboration with Liveo Research, developed a PET-based mono-material blister pack that eliminates PVC and enhances sustainability. The new design reduces package weight by 18%, water usage by 78%, and cuts carbon footprint by 38% per unit compared to traditional PVC blisters.

Technological Advancements in Manufacturing and Printing Techniques

Advancements in thermoforming and cold-forming technologies are elevating production efficiency and precision. Automated equipment enables high-speed blister formation with minimal errors. It ensures dimensional accuracy and consistent seal integrity. Digital and flexographic printing methods allow brands to personalize packaging and comply with serialization norms. High-resolution printing improves visual appeal and anti-counterfeit capabilities. Machine learning and robotics are being integrated into packaging lines to boost throughput. The use of laser marking and UV inks enhances traceability. It supports a data-driven supply chain and strengthens the packaging ecosystem across multiple industries.

Integration of Smart and Connected Packaging Features

Smart packaging has gained traction with growing demand for real-time data access and product tracking. Blister packs now feature QR codes, NFC tags, and embedded sensors. These elements enable end-users to verify product authenticity and access usage instructions. Healthcare providers use smart blister packs to monitor medication adherence and patient behavior. It also supports remote patient engagement in clinical trials. Smart features reduce risks associated with dosing errors and counterfeit drugs. This trend aligns with digital health strategies and tech-enabled retail packaging. It elevates the functional value of blister packs beyond containment.

Shift Toward Customized, Aesthetic, and Market-Specific Packaging Designs

Customization has become central to packaging strategies across sectors. Brands design blister packs to match regional preferences, regulatory needs, and brand positioning. Personalization supports direct-to-consumer strategies in pharmaceuticals and supplements. Aesthetic designs improve shelf impact in retail spaces. Companies launch seasonal or limited-edition packs to create exclusivity. Blister packaging manufacturers collaborate with clients to create size-efficient, visually distinctive formats. It supports differentiation in crowded product categories. The Blister Packaging Market Size benefits from the rising emphasis on flexible design and product-specific packaging architecture.

- Arcade Beauty, for instance, utilizes highly customized cosmetic blister packs allowing brand-specific shapes and seasonal graphics that connect with consumers at a personal level

Market Challenges Analysis

Fluctuating Raw Material Costs and Regulatory Complexities Limit Market Stability

The volatility in raw material prices, particularly plastics and aluminum, creates cost uncertainty across the blister packaging industry. Packaging manufacturers face challenges in cost planning and procurement strategies. It impacts profitability and delays production schedules for some small and medium enterprises. Regulatory compliance adds further complexity, especially across markets with differing packaging standards. Pharmaceutical blister packaging must meet stringent requirements for barrier properties, labeling, and traceability. Constant updates to global packaging mandates require companies to invest in testing and reformulation. These factors impose high operational costs and hinder smooth market expansion for some participants in the Blister Packaging Market Size.

Sustainability Pressure and Limited Recycling Infrastructure Pose Obstacles

The rising demand for sustainable blister packaging is met with infrastructure gaps in recycling systems. Multi-material blister packs often lack compatibility with standard recycling streams. Separation of plastic films and aluminum foils requires specialized facilities, which are not available in many regions. It limits the scalability of eco-friendly blister packaging adoption. Consumers and regulators increasingly expect circular packaging models, but current technologies and systems fall short. Packaging firms must balance sustainability goals with performance and cost. Developing fully recyclable and biodegradable solutions at scale remains a technical challenge. These issues slow down the transition toward greener blister formats.

Market Opportunities

Expansion in Emerging Markets with Rising Healthcare and Consumer Spending

Emerging economies present strong opportunities for blister packaging expansion. Countries in Asia Pacific, Latin America, and Africa show rising demand for packaged pharmaceuticals, electronics, and personal care items. The growing middle class and urbanization create favorable consumption patterns. It enables global and local companies to introduce blister packaging in high-volume, affordable formats. Healthcare investments and access to over-the-counter drugs further amplify the need for safe and cost-efficient packaging solutions. The Blister Packaging Market Size stands to gain significantly from this regional growth momentum.

Innovation in Mono-Material and Biodegradable Blister Solutions

There is growing opportunity for manufacturers investing in recyclable and compostable blister formats. Research and development efforts are focused on creating mono-material blisters that meet performance and sustainability benchmarks. Companies are exploring materials such as PET, PLA, and cellulose-based films. These innovations aim to meet regulatory demands while aligning with corporate ESG commitments. It allows packaging producers to attract environmentally conscious consumers and expand market share across industries.

Market Segmentation Analysis:

The Blister Packaging Market Size is structured across diverse segments, each contributing uniquely to market growth.

By packing type, carded blister packaging dominates due to its wide use in pharmaceuticals and retail consumer goods, while clamshell blister packaging finds application in electronics and hardware products for its enhanced protection and visibility.

- For example, Amcor’s AmSky™ blister system eliminates PVC and uses a high-density polyethylene (HDPE) mono-material design that maintains barrier performance while improving recyclability.

By technology, thermoforming remains the most widely adopted method for its cost efficiency and adaptability, whereas cold forming is preferred for applications requiring superior barrier properties, especially in healthcare.

By material, plastic films account for the largest share, led by polyvinyl chloride (PVC) and polyethylene terephthalate (PET), which offer clarity and strength. Polyethylene (PE) and other films provide flexibility and durability across formats. Paper & paperboard including solid bleached sulfate (SBS) and white-lined chipboard are gaining traction for their eco-friendly profiles. Aluminum remains essential in cold-formed packs due to its excellent barrier properties.

- For example, TekniPlex developed high-barrier blister films that maintain less than 0.05 g/m²/day moisture vapor transmission rate (MVTR), enabling extended shelf life for moisture-sensitive drugs.

By end-user, the healthcare sector leads with strong demand for safe, compliant packaging. Consumer goods, foods, and industrial applications follow, supporting broad adoption across industries. The Blister Packaging Market Size continues to evolve with growing demand for secure, sustainable, and visually appealing packaging solutions.

Segmentation:

By Packing Type

- Carded Blister Packaging

- Clamshell Blister Packaging

By Technology

- Thermoforming

- Cold Forming

By Material

- Paper & Paperboard

- Solid Bleached Sulfate (SBS)

- White-lined Chipboard

- Others

- Plastic Films

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Others

- Aluminum

By End-User Industry

- Healthcare

- Consumer Goods

- Foods

- Industrial Goods

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America accounts for 32.5% of the global Blister Packaging Market Size, driven by advanced pharmaceutical manufacturing, strong regulatory frameworks, and high demand for unit-dose packaging formats. The United States leads the regional market due to its mature healthcare infrastructure, focus on patient safety, and widespread use of OTC medications. Demand from the consumer electronics and nutraceutical sectors supports market stability. Blister packs are favored for their tamper-evident properties and compatibility with automated packaging systems. Regulatory compliance with FDA and serialization norms sustains long-term adoption. Companies in this region invest in recyclable and smart packaging technologies to meet environmental and traceability goals.

Europe holds a 28.4% share of the global market, supported by stringent EU regulations, strong pharmaceutical production, and rising sustainability mandates. Germany, France, and the UK are key contributors, leveraging automation and eco-friendly packaging formats. Demand for cold-form and high-barrier blister packaging remains high across prescription and OTC drugs. The region’s advanced R&D environment enables innovation in material science and barrier coatings. Manufacturers focus on recyclable and mono-material solutions in response to the EU’s circular economy targets. The Blister Packaging Market Size in Europe continues to grow steadily with strong public-private collaboration in packaging technology development.

Asia Pacific captures 26.1% of the market, representing the fastest-growing regional segment due to expanding healthcare access, rising population, and growing consumer markets. China and India drive significant volume growth across pharmaceuticals and consumer goods. Local manufacturers adopt cost-effective blister formats to meet rising demand in urban and rural areas. The region benefits from increasing government support for domestic pharmaceutical production and investments in packaging infrastructure. It offers scalable production capabilities and competitive cost advantages. Southeast Asia and South Korea are emerging hubs, contributing to the region’s strengthening global footprint in blister packaging.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- WestRock Company

- Sonoco Products Company

- Constantia Flexibles

- Klöckner Pentaplast Group

- Honeywell International Inc.

- Tekni-Plex

- UFlex Limited

- WINPAK LTD.

- SteriPack Group

- ACG

- DuPont (E.I. du Pont de Nemours and Company)

- Display Pack

Competitive Analysis:

The Blister Packaging Market Size features a competitive landscape with the presence of global and regional players focusing on innovation, material sustainability, and automation. Leading companies such as Amcor plc, Sonoco Products Company, Constantia Flexibles, and WestRock Company hold significant market shares through extensive product portfolios and strategic partnerships. It encourages investments in recyclable materials, high-barrier films, and smart packaging technologies to meet evolving industry demands. Companies emphasize enhancing speed-to-market and customization capabilities. Mergers, acquisitions, and capacity expansions remain central to their growth strategies. Competitive intensity is high, particularly in pharmaceutical and consumer goods segments where regulatory compliance and quality assurance are critical.

Recent Developments:

- In May 2025, Constantia Flexiblesintroduced EcoVerHighPlus, a recyclable-ready mono PP laminate for coffee packaging. Developed in close collaboration with Delica AG, this innovative packaging delivers robust barrier properties and recyclability, meeting growing industry demands for sustainability. The launch showcases Constantia’s commitment to high-performance, eco-friendly packaging solutions.

- In March 2025, Amcor plcunveiled an industry-first 2oz retort bottle for nutritional shots, featuring proprietary StormPanel™ technology, designed in partnership with Insymmetry. This innovation targets the growing market for durable, shelf-stable packaging for low-acid beverages and is the first of its kind to offer extended 12-month shelf stability for products like energy and wellness shots.

- In June 2024, Sonoco Products Companyannounced the acquisition of Eviosys for approximately $3.9billion. This deal is set to create the world’s largest metal food can and aerosol packaging platform, accelerating Sonoco’s strategy and expanding its global reach.

Market Concentration & Characteristics:

The Blister Packaging Market Size is moderately concentrated, with key players accounting for a large share through integrated manufacturing capabilities and global distribution networks. It exhibits characteristics of innovation-driven competition, regulated quality standards, and demand for customization. Entry barriers remain high due to capital requirements, compliance obligations, and the need for advanced forming and sealing technologies. Companies with in-house design, material development, and automation capabilities maintain a competitive edge. The market favors firms that can offer scalable solutions and meet sustainability targets across multiple regions. Continuous investment in R&D and localization strategies further defines competitive success in this sector.

Report Coverage:

The research report offers an in-depth analysis based on Packing Type, Technology, Material and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will see increased adoption of sustainable materials to align with global environmental regulations.

- Pharmaceutical demand for unit-dose and tamper-evident packaging will continue driving volume growth.

- Technological advancements in cold-forming and thermoforming will enhance production efficiency and customization.

- Growing use of smart packaging features will support product authentication and patient compliance.

- Expansion in emerging markets will create new opportunities across healthcare, personal care, and food sectors.

- Manufacturers will invest more in recyclable mono-material designs to meet circular economy goals.

- Automation and digitization of packaging lines will improve scalability and operational efficiency.

- E-commerce growth will boost demand for protective and consumer-friendly blister formats.

- Regulatory pressures will intensify, prompting higher investment in compliance-ready packaging solutions.

- Strategic mergers and capacity expansions will shape competitive dynamics and global market positioning.