Market Overview

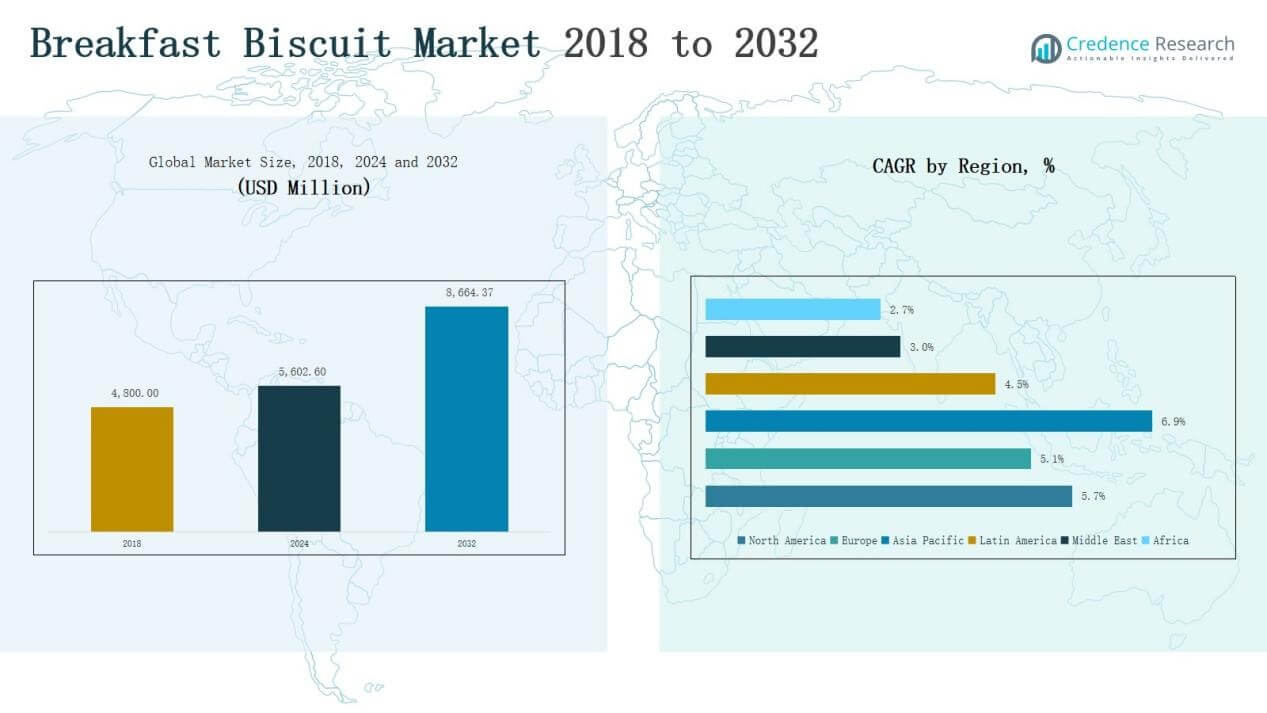

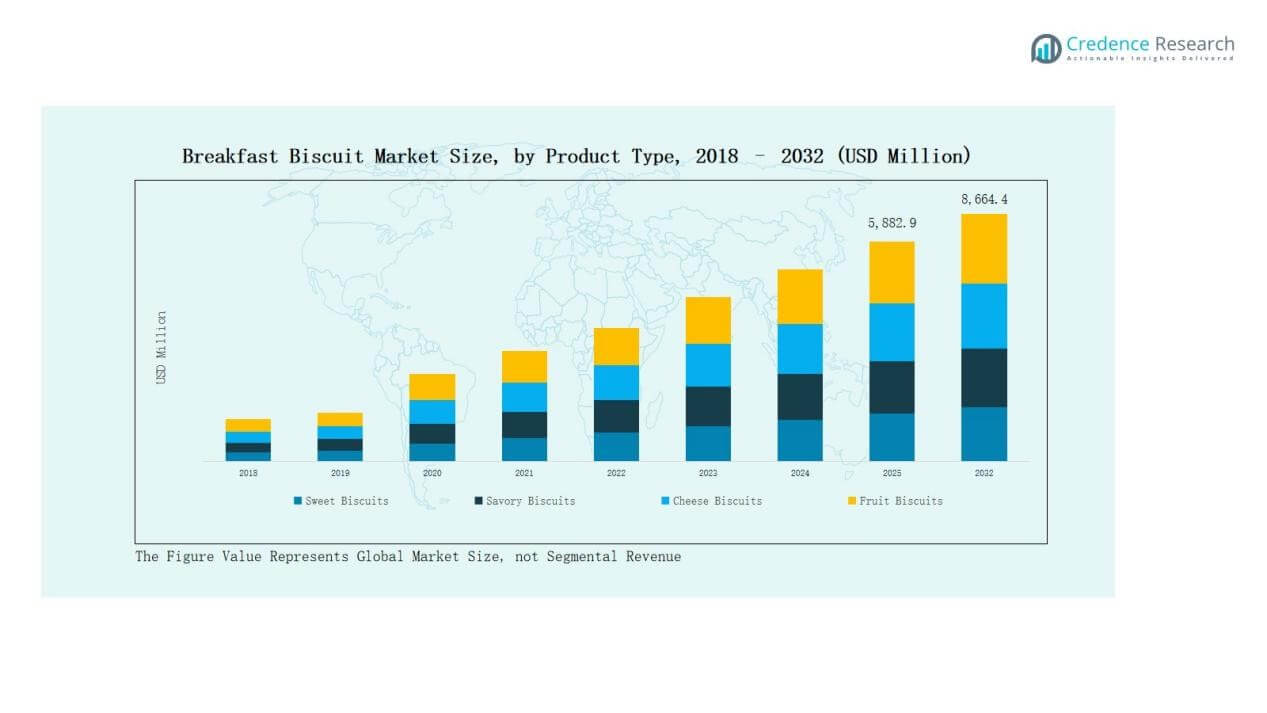

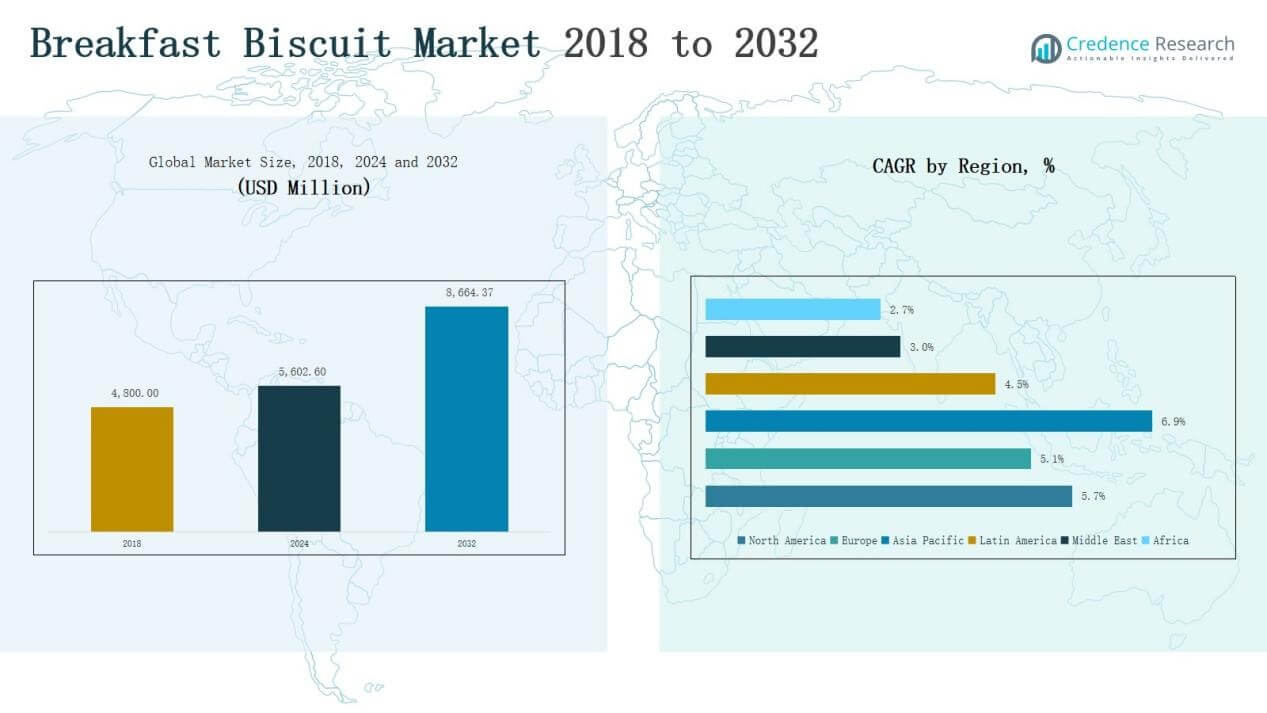

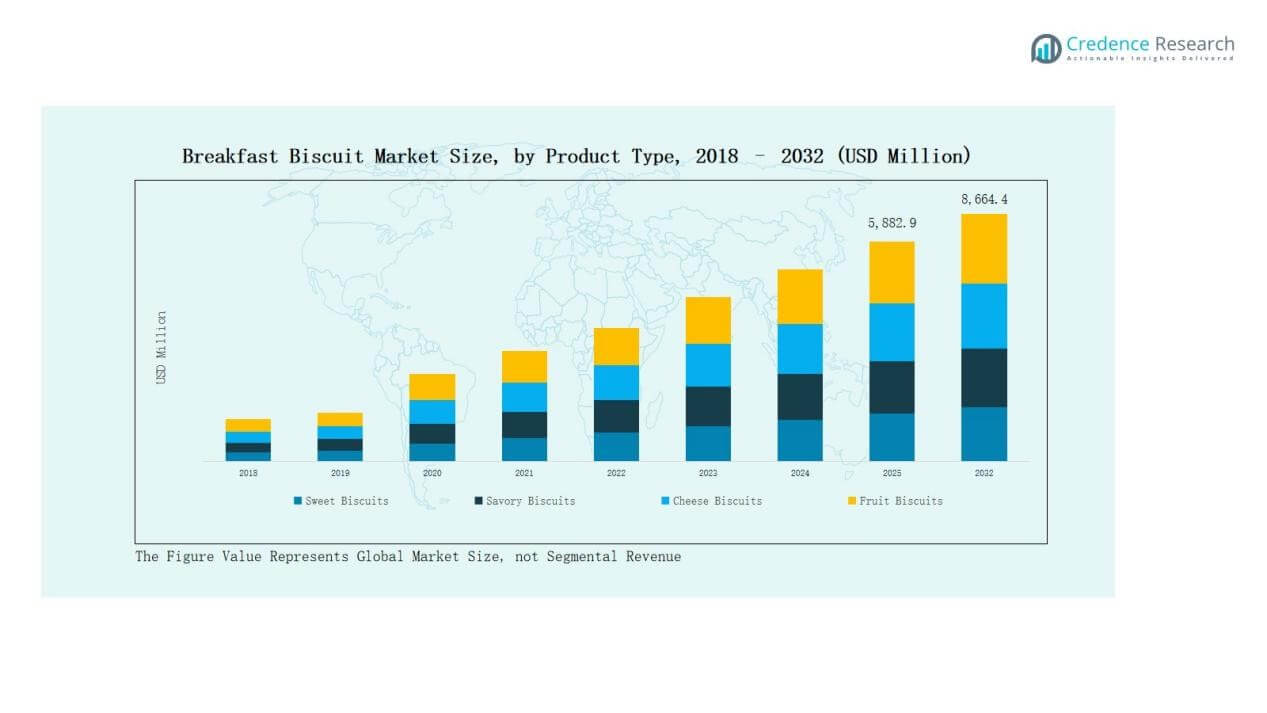

Breakfast Biscuit Market size was valued at USD 4,800.00 million in 2018, reaching USD 5,602.60 million in 2024, and is anticipated to reach USD 8,664.37 million by 2032, at a CAGR of 5.69% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Breakfast Biscuit Market Size 2024 |

USD 5,602.60 Million |

| Breakfast Biscuit Market, CAGR |

5.69% |

| Breakfast Biscuit Market Size 2032 |

USD 8,664.37 Million |

The Breakfast Biscuit Market is shaped by strong competition among global and regional players, with leading companies including Nature Valley, Belvita, Kellogg, Weetabix, Lidl, Bakers Biscuits (South Africa), Nais Oatcakes, Gullón (Spain), Koestlin, Walmart, Lance, McVitie’s, and Chiquilín. These players focus on innovation, healthier formulations, and expanding retail penetration to strengthen market presence. Product diversification into gluten-free, organic, and fortified variants is a key strategy to attract health-conscious consumers, while sustainable packaging and online retail expansion enhance competitiveness. Regionally, North America dominated the Breakfast Biscuit Market in 2024 with a 34.9% share, driven by high demand for convenient, fortified, and premium biscuit products supported by advanced retail infrastructure.

Market Insights

- The Breakfast Biscuit Market was valued at USD 4,800.00 million in 2018, reached USD 5,602.60 million in 2024, and is projected at USD 8,664.37 million by 2032, growing at a 69% CAGR.

- Sweet biscuits dominated product type with 7% share in 2024, supported by indulgent flavors and retail penetration, while savory biscuits gained momentum due to health-focused and international flavor demand.

- Individual packs led packaging with 4% share in 2024, driven by portability and convenience, while multipacks targeted families and bulk packaging remained strong in institutional and wholesale channels.

- Wheat flour-based biscuits captured 3% share in 2024, reflecting cost efficiency and global acceptance, while gluten-free, oatmeal, whole grain, and organic biscuits showed rapid growth from health-conscious consumers.

- North America led regionally with 9% market share in 2024, generating USD 1,958.64 million, driven by fortified snacks, premium products, strong retail infrastructure, and online retail expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

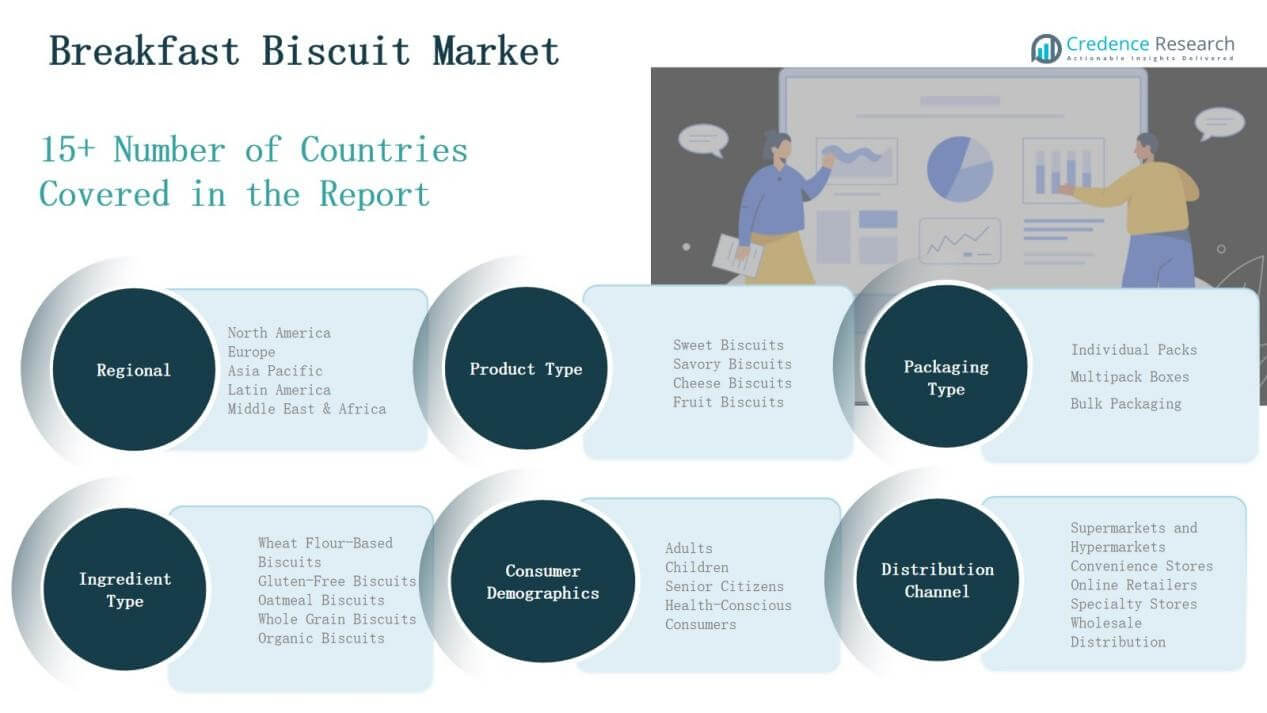

By Product Type

Sweet biscuits dominate the product type segment, accounting for 72.7% of revenue in 2024. Their leadership is supported by broad consumer preference for indulgent flavors, chocolate, and cream fillings, coupled with strong retail availability. While savory, cheese, and fruit biscuits capture smaller portions, savory biscuits show stronger momentum, supported by growing interest in healthier snacks and rising demand for international flavor profiles.

For instance, Mondelēz International expanded its Oreo Chocolate Creme biscuits in India, strengthening its presence in the indulgent sweet biscuit category.

By Packaging Type

Individual packs lead the packaging type segment, securing 58.4% share in 2024. Consumers prefer this format due to convenience, portability, and suitability for single-serve breakfasts or on-the-go snacking. Multipack boxes appeal to families seeking bulk value, while bulk packaging is favored in wholesale and institutional channels. Growing urban lifestyles and rising demand for easy, ready-to-eat formats reinforce the strength of individual packaging.

For instance, Kellogg’s launched individual K-Time Baked Twists portion packs in Australia, responding to rising demand for portable breakfast and snacking options.

By Ingredient Type

Wheat flour-based biscuits dominate the ingredient type segment with 85.3% share in 2024, driven by cost efficiency and widespread consumer acceptance. These products remain staples across global markets due to easy availability of ingredients and consistent taste. However, gluten-free, oatmeal, whole grain, and organic biscuits are expanding rapidly, fueled by increasing health awareness, clean-label demand, and dietary needs like gluten intolerance and high-fiber diets.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Convenient Breakfast Solutions

The growing pace of urban lifestyles and long working hours has significantly boosted demand for convenient and portable breakfast options. Breakfast biscuits provide a quick, energy-rich meal alternative without preparation time, appealing to working professionals and students. Their affordability, shelf stability, and availability in diverse flavors strengthen their appeal. The expansion of retail channels, particularly convenience stores and online platforms, ensures easy accessibility, further driving widespread adoption across developed and emerging markets.

For instance, Britannia offers two separate products in its NutriChoice line: NutriChoice Seeds and NutriChoice Herbs, not a single “Seeds & Herbs” biscuit.

Increasing Health and Nutrition Awareness

Consumers are increasingly conscious of the nutritional value of their daily diets, driving preference for fortified breakfast biscuits. Manufacturers are enriching products with vitamins, minerals, fiber, and protein to attract health-focused buyers. This shift has encouraged the introduction of gluten-free, whole grain, and organic formulations. Health-conscious consumers and senior citizens are fueling this demand, with companies focusing on reduced sugar, natural ingredients, and clean-label certifications to align with evolving dietary expectations.

For instance, Kellogg’s launched a new high-fiber, probiotic-infused cereal called Hi! Happy Inside to target gut health. The company claimed the cereal contained 1 billion live probiotics, prebiotics, and fiber to support digestive wellness.

Expanding Distribution and Retail Penetration

The widespread availability of breakfast biscuits across supermarkets, hypermarkets, and online retailers has strengthened market penetration. Online sales channels, supported by promotional campaigns and direct-to-consumer strategies, are broadening reach among younger demographics. Supermarkets and convenience stores ensure visibility and impulse purchases. Strategic partnerships with retailers, coupled with growing investments in attractive packaging and targeted marketing, continue to enhance consumer access, increasing both brand loyalty and repeat purchases globally.

Key Trends and Opportunities

Key Trends and Opportunities

Innovation in Product Formulation and Flavors

Manufacturers are investing heavily in R&D to deliver innovative product formulations and unique flavors, catering to evolving consumer tastes. Fusion flavors, functional biscuits fortified with proteins or probiotics, and limited-edition seasonal variants are gaining popularity. Flavor innovation helps brands differentiate themselves in a competitive market while addressing regional taste preferences. Such product variety encourages consumer experimentation and contributes to higher premiumization opportunities in the global breakfast biscuit category.

For instance, Nestlé launched its KitKat Pumpkin Pie Limited Edition in the U.S. market as part of its seasonal fall offerings, tapping into consumer appetite for festive, limited-time flavors.

Rising Popularity of Premium and Healthy Segments

Premium breakfast biscuits featuring natural ingredients, organic certifications, and functional benefits are attracting growing attention. The rising health-conscious consumer base across developed and emerging economies creates strong opportunities for brands emphasizing “better-for-you” offerings. This trend allows manufacturers to target niche demographics, including fitness enthusiasts and wellness-focused individuals. Premium products also deliver higher margins, enabling brands to strengthen profitability while catering to evolving dietary priorities and lifestyle-driven consumption patterns worldwide.

For instance, Mondelez International expanded its belVita breakfast biscuit range in the UK with a high-fiber, wholegrain variant made using natural ingredients to appeal to on-the-go health-conscious consumers.

Key Challenges

Intense Market Competition and Price Pressure

The breakfast biscuit market is highly competitive, with multinational brands and local players offering similar products. Companies frequently face pressure to maintain competitive pricing while investing in innovation and marketing. This situation compresses margins and forces smaller manufacturers to compete aggressively on price. Sustained competition limits differentiation opportunities, requiring players to balance cost control with product innovation and brand-building strategies to retain market share.

Rising Raw Material and Packaging Costs

Volatility in the prices of key raw materials such as wheat, oats, sugar, and dairy products directly impacts production costs. Similarly, the growing push toward sustainable packaging has increased expenses for eco-friendly alternatives. These rising costs often squeeze margins for manufacturers who struggle to pass on increases to price-sensitive consumers. Companies must adopt cost-optimization measures and supply chain efficiencies to offset these financial pressures while maintaining quality standards.

Consumer Shifts Toward Fresh and Alternative Breakfasts

Although breakfast biscuits provide convenience, a growing section of consumers is turning to fresh and alternative breakfast solutions such as smoothies, protein bars, and ready-to-drink beverages. These alternatives often position themselves as healthier or more fulfilling options, creating substitution threats. To address this challenge, manufacturers must consistently innovate with healthier formulations, functional benefits, and marketing strategies that emphasize both nutrition and convenience to retain consumer loyalty in a crowded breakfast market.

Regional Analysis

North America

North America generated USD 1,699.20 million in 2018, rising to USD 1,958.64 million in 2024 and projected to reach USD 3,024.75 million by 2032, at a CAGR of 5.7%. Growth is supported by strong demand for convenient, fortified snacks and a well-developed retail structure. Leading brands such as Belvita, Kellogg, and Nature Valley dominate with innovative flavors and premium products. Expanding online retail presence and consumer preference for portion-controlled breakfast options further boost adoption. The U.S. remains the largest contributor, with Canada and Mexico showing steady consumption patterns driven by urban lifestyles.

Europe

Europe recorded USD 1,452.00 million in 2018, increasing to USD 1,637.49 million in 2024, and is forecasted to reach USD 2,410.88 million by 2032, at a CAGR of 5.1%. Established biscuit consumption culture and growing interest in organic, fortified, and clean-label offerings drive the market. Key countries including the UK, Germany, France, and Italy support demand with strong retail networks. Manufacturers are targeting premiumization and healthier product innovations, aligning with evolving consumer expectations. Seasonal and indulgent biscuits remain popular, but health-conscious formulations are gradually reshaping product portfolios across leading European brands.

Asia Pacific

Asia Pacific achieved USD 1,219.20 million in 2018, expanding to USD 1,483.83 million in 2024, and is expected to reach USD 2,523.94 million by 2032, registering a CAGR of 6.9%. Rapid urbanization, rising disposable incomes, and lifestyle changes in China, India, and Southeast Asia are driving growth. Breakfast biscuits are increasingly replacing traditional meals for busy professionals and students. Global players are expanding through tailored flavors and affordable pack sizes, while local brands strengthen accessibility in rural markets. Online platforms and modern retail formats accelerate distribution, positioning Asia Pacific as the fastest-growing regional market.

Latin America

Latin America generated USD 249.60 million in 2018, reaching USD 287.92 million in 2024, and is projected to achieve USD 406.10 million by 2032, with a CAGR of 4.5%. Brazil and Argentina dominate demand due to urban growth and increasing snack consumption. However, economic instability and price sensitivity constrain premium product uptake. Companies are focusing on affordable formats and localized flavors to strengthen reach. Growing adoption of online sales channels is gradually improving accessibility among younger demographics, while supermarkets and hypermarkets remain the leading distribution hubs for breakfast biscuits in the region.

Middle East

The Middle East market was valued at USD 101.76 million in 2018, rising modestly to USD 105.29 million in 2024, and projected to reach USD 132.61 million by 2032, at a CAGR of 3.0%. Market expansion is limited by cultural preferences for fresh breakfasts, yet urbanization and western lifestyle adoption are driving gradual change. GCC countries, Israel, and Turkey show rising demand for fortified and premium biscuits. Supermarkets and modern retail outlets are supporting availability, while promotional activities by international brands are building awareness. Growth opportunities remain niche, concentrated in urban and health-conscious consumer bases.

Africa

Africa accounted for USD 78.24 million in 2018, increasing to USD 129.44 million in 2024, and is forecasted to reach USD 166.09 million by 2032, at a CAGR of 2.7%. Urbanization, population growth, and rising youth demographics are fueling demand for packaged breakfast biscuits. South Africa and Egypt lead regional consumption, supported by expanding retail infrastructure. However, limited purchasing power and reliance on traditional breakfast foods restrict wider adoption. Manufacturers target affordability through smaller pack sizes, while online retail remains underdeveloped. Growth is steady but modest, making Africa one of the smallest contributors to the global market.

Market Segmentations:

Market Segmentations:

By Product Type

- Sweet Biscuits

- Savory Biscuits

- Cheese Biscuits

- Fruit Biscuits

By Packaging Type

- Individual Packs

- Multipack Boxes

- Bulk Packaging

By Ingredient Type

- Wheat Flour-Based Biscuits

- Gluten-Free Biscuits

- Oatmeal Biscuits

- Whole Grain Biscuits

- Organic Biscuits

By Consumer Demographics

- Adults

- Children

- Senior Citizens

- Health-Conscious Consumers

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Stores

- Wholesale Distribution

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The breakfast biscuit market is highly competitive, featuring a mix of global brands and regional players that compete on product innovation, pricing, and distribution reach. Leading companies such as Belvita, Kellogg, Nature Valley, Weetabix, McVitie’s, and Lidl dominate developed markets with established brand equity, strong retail partnerships, and extensive product portfolios. These players focus on innovation through healthier formulations, fortified ingredients, and flavor diversification to capture health-conscious and premium segments. Regional brands, including Bakers Biscuits (South Africa), Gullón (Spain), Koestlin, and Chiquilín, strengthen their positions by catering to local tastes and offering affordable options. Competitive strategies often emphasize sustainable packaging, smaller pack sizes for price-sensitive consumers, and online retail penetration to reach younger demographics. Mergers, acquisitions, and collaborations with retailers remain common as companies aim to expand their presence. Intense rivalry, coupled with evolving consumer preferences, compels manufacturers to balance cost efficiency with continuous innovation to sustain market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Nature Valley

- Belvita

- Kellogg

- Weetabix

- Lidl

- Bakers Biscuits (South Africa)

- Nais Oatcakes

- Gullón (Spain)

- Koestlin

- Walmart

- Lance

- McVitie’s

- Chiquilín

Recent Developments

- In September 2024, Integrated Industries Ltd’s subsidiary Nurture Well Foods Private Limited launched a new range of biscuits, expanding its product portfolio.

- In July 2025, Mondelez International announced the launch of BelVita Duo Crunch Choco Hazelnut, a new biscuit variant available from August 2025.

- In July 2025, Ferrero announced the acquisition of WK Kellogg Co, which includes manufacturing and marketing of iconic breakfast cereals, expanding Ferrero’s presence in breakfast occasions.

- In June 2024, Mondelez International partnered with Lotus Bakeries to market and distribute Biscoff cookies in India, including plans for co-branded products combining Biscoff with Mondelez chocolate brands.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Packaging Type, Ingredient Type, Consumer Demographics, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will increasingly focus on healthier formulations with whole grains, oats, and organic ingredients.

- Demand for gluten-free and low-sugar breakfast biscuits will continue to expand across global markets.

- Online retail channels will gain stronger importance as consumers shift to e-commerce for convenience.

- Premium product ranges with clean-label certifications and fortified nutrition will attract health-conscious buyers.

- Innovation in packaging formats will enhance portability and on-the-go consumption.

- Regional players will expand by offering localized flavors and affordable options for price-sensitive consumers.

- Sustainability initiatives in raw materials and eco-friendly packaging will influence brand positioning.

- Marketing strategies will target younger demographics and urban professionals with lifestyle-driven campaigns.

- Product diversification with functional benefits such as protein or probiotic enrichment will increase.

- Strategic partnerships and acquisitions will shape competition and expand global distribution networks.

Key Growth Drivers

Key Growth Drivers Key Trends and Opportunities

Key Trends and Opportunities Market Segmentations:

Market Segmentations: