| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bronchitis Treatment Market Size 2024 |

USD 8,504.87 million |

| Bronchitis Treatment Market, CAGR |

5.12% |

| Bronchitis Treatment Market Size 2032 |

USD 12,627.63 million |

Market Overview

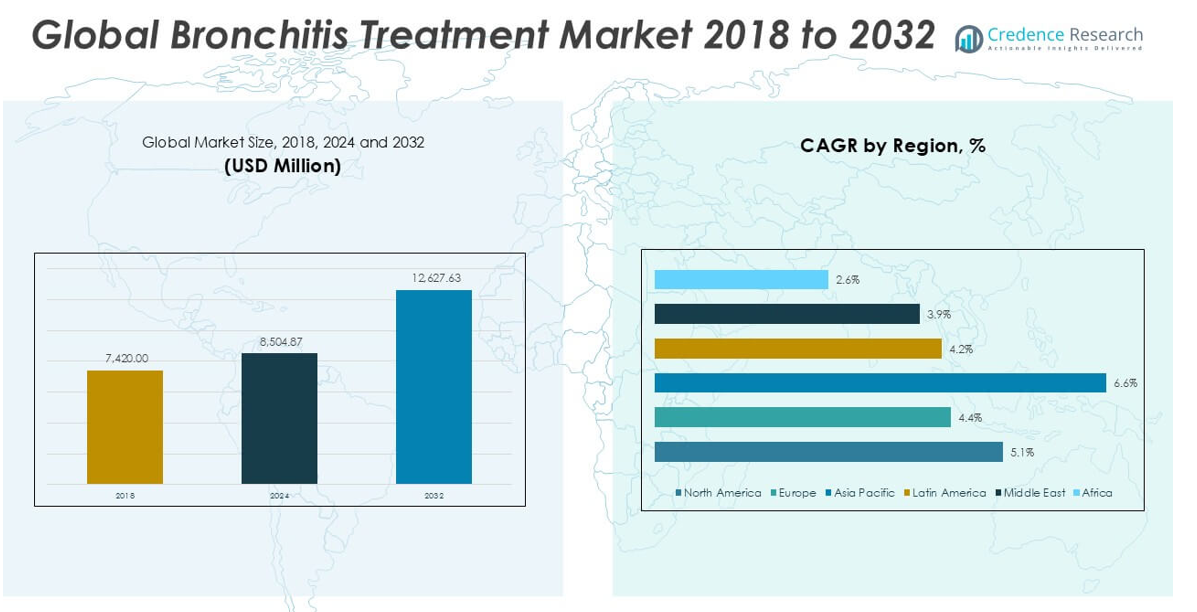

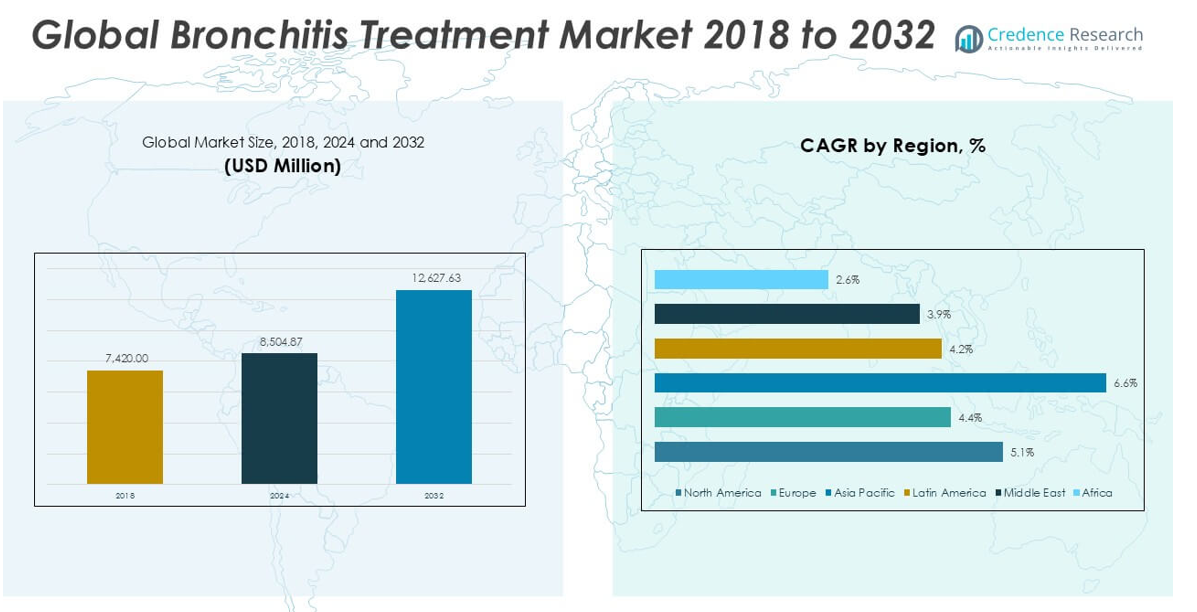

The Bronchitis Treatment Market size was valued at USD 7,420.00 million in 2018, increased to USD 8,504.87 million in 2024, and is anticipated to reach USD 12,627.63 million by 2032, at a CAGR of 5.12% during the forecast period.

The Bronchitis Treatment market is driven by key players such as GlaxoSmithKline plc, AstraZeneca plc, Boehringer Ingelheim GmbH, Pfizer Inc., Novartis AG, Sanofi S.A., and Teva Pharmaceutical Industries Ltd., who actively focus on expanding their respiratory drug portfolios and enhancing global distribution networks. These companies lead the market through continuous drug innovation, strategic collaborations, and strong regional presence. North America dominates the global bronchitis treatment market, holding the largest share of 39.3% in 2024, supported by advanced healthcare infrastructure, high disease awareness, and widespread adoption of bronchodilators and inhalation therapies. The region’s leadership is reinforced by the aggressive market strategies and broad patient access provided by these top pharmaceutical companies.

Market Insights

- The Bronchitis Treatment market was valued at USD 7,420.00 million in 2018, reached USD 8,504.87 million in 2024, and is projected to hit USD 12,627.63 million by 2032, growing at a CAGR of 5.12% during the forecast period.

- Growing cases of chronic respiratory diseases, increasing air pollution, and rising smoking rates are major drivers boosting the demand for bronchitis treatment globally.

- North America holds the largest regional share at 39.3% in 2024, followed by Europe at 24.2%, with the chronic bronchitis segment leading the market by type and bronchodilators dominating by drug class.

- The market is highly competitive with key players like GlaxoSmithKline, AstraZeneca, Boehringer Ingelheim, and Pfizer focusing on innovative therapies, inhalation-based treatments, and expanding their digital and regional presence.

- Misdiagnosis, overuse of antibiotics, and limited curative options for chronic bronchitis continue to restrain the market’s growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

In the Bronchitis Treatment market, chronic bronchitis holds the dominant position, accounting for a substantial market share in 2024. The high prevalence of chronic obstructive pulmonary disease (COPD), increasing air pollution, and rising tobacco consumption significantly contribute to the dominance of this sub-segment. Chronic bronchitis requires long-term management, which drives consistent demand for effective treatment solutions. Additionally, growing awareness about the health risks of chronic respiratory conditions and improved diagnostic capabilities have further propelled the need for chronic bronchitis treatments, solidifying its leading market share within the type segment.

- For instance, GlaxoSmithKline plc reported that over 250,000 patients worldwide were treated with their respiratory drug Breo Ellipta in 2023, specifically targeting chronic respiratory conditions including chronic bronchitis.

By Treatment

The drugs segment leads the Bronchitis Treatment market by treatment type, capturing the largest market share in 2024. Drug-based therapies, including antibiotics, bronchodilators, and anti-inflammatory medications, remain the primary approach for managing both acute and chronic bronchitis. The segment’s growth is driven by the widespread availability of medications, ease of administration, and immediate symptom relief. Additionally, advancements in drug formulations and increasing prescription rates for combination therapies have reinforced the segment’s dominance. Oxygen therapy, while essential in severe cases, holds a comparatively smaller share due to its limited applicability to advanced chronic bronchitis.

- For instance, AstraZeneca’s Symbicort was prescribed in over 6 million patient treatments globally in 2023, reinforcing the dominance of drug-based therapies in bronchitis management.

By Drug Class

Among the drug classes, bronchodilators dominate the Bronchitis Treatment market with the highest market share in 2024. Bronchodilators are widely prescribed to relax airway muscles and improve airflow, offering fast symptom relief, which drives their strong preference among healthcare providers. The increasing incidence of chronic bronchitis and rising demand for inhalation-based therapies have further fueled the growth of this sub-segment. While antibiotics and anti-inflammatory drugs play vital roles, bronchodilators’ ability to provide immediate breathing ease and their extensive use across both acute and chronic cases have solidified their position as the leading drug class.

Market Overview

Increasing Prevalence of Chronic Respiratory Diseases

The rising global burden of chronic respiratory diseases, particularly Chronic Obstructive Pulmonary Disease (COPD), significantly drives the growth of the bronchitis treatment market. Factors such as escalating air pollution, widespread tobacco consumption, and occupational exposure to harmful substances contribute to the growing patient pool. This increasing prevalence has led to higher demand for timely diagnosis and effective treatment solutions, boosting market expansion. The persistent rise in chronic bronchitis cases continues to create sustained demand for long-term treatment regimens, strengthening the overall market outlook.

- For instance, Boehringer Ingelheim’s Spiriva Respimat reached over 4 million COPD patients globally by 2023, highlighting the growing treatment demand linked to chronic respiratory diseases.

Advancements in Drug Therapies and Treatment Modalities

Continuous innovations in drug therapies and the development of combination medications are propelling the bronchitis treatment market. Pharmaceutical companies are focusing on improving the efficacy and safety profiles of bronchodilators, anti-inflammatory drugs, and antibiotics, offering patients more targeted and faster-acting options. Additionally, the introduction of novel inhalation therapies and oxygen delivery systems enhances patient compliance and treatment outcomes. These technological advancements not only expand the available treatment portfolio but also attract healthcare providers seeking optimized solutions for both acute and chronic bronchitis management.

- For instance, in 2024, Verona Pharma’s Ohtuvayre (ensifentrine) demonstrated a significant 40% reduction in COPD exacerbations in its phase 3 clinical trial involving over 800 patients, showcasing a major advancement in bronchodilator therapy.

Growing Awareness and Access to Healthcare Services

Improved awareness of bronchitis symptoms and the importance of early medical intervention have positively influenced treatment-seeking behavior worldwide. Public health initiatives, educational campaigns, and increased screening programs in both urban and rural areas contribute to early diagnosis and higher treatment uptake. Moreover, expanding healthcare infrastructure and increasing access to affordable medications, especially in emerging markets, further drive the growth of the bronchitis treatment market. This trend supports a broader patient base receiving timely care, fueling market progression across both developed and developing regions.

Key Trends & Opportunities

Rising Demand for Inhalation-Based Therapies

The market is witnessing a growing preference for inhalation-based therapies due to their ability to deliver medications directly to the lungs, ensuring faster relief and reduced systemic side effects. Patients with chronic bronchitis increasingly favor inhalers and nebulizers over oral medications, driving significant product innovation. The trend presents a key opportunity for manufacturers to develop advanced inhalation devices with improved drug delivery efficiency and user-friendly designs. This shift towards targeted drug administration is reshaping treatment protocols and enhancing patient adherence to long-term therapies.

- For instance, Philips Respironics reported that over 10 million of its portable nebulizer units were sold globally by 2023, reflecting the strong and rising demand for inhalation-based bronchitis therapies.

Expansion in Telemedicine and Online Pharmacies

Telemedicine services and the growing penetration of online pharmacies are creating new opportunities in the bronchitis treatment market. Patients now have easier access to virtual consultations, remote monitoring, and timely prescription refills, especially beneficial for those with chronic conditions requiring continuous care. This digital transformation is expanding the reach of healthcare providers and improving medication accessibility in remote and underserved regions. The increasing adoption of digital health platforms is likely to support market growth by facilitating more consistent and convenient treatment options.

- For instance, Teladoc Health completed over 18 million telemedicine visits globally in 2023, many of which included consultations and management for chronic respiratory conditions such as bronchitis

Key Challenges

Misdiagnosis and Inappropriate Antibiotic Use

One of the major challenges in the bronchitis treatment market is the frequent misdiagnosis between bacterial and viral bronchitis, often leading to unnecessary antibiotic prescriptions. The inappropriate use of antibiotics not only fails to address viral infections but also contributes to the growing threat of antibiotic resistance. This issue underscores the need for improved diagnostic accuracy and stricter clinical guidelines to ensure appropriate treatment decisions. The challenge of overprescribing antibiotics remains a significant concern for healthcare providers and regulatory agencies.

Limited Treatment Options for Chronic Bronchitis

While various drugs are available for bronchitis management, there remains a lack of curative treatments, particularly for chronic bronchitis. Current therapies primarily focus on symptom relief and disease progression management, with limited options that can reverse or halt the condition. This therapeutic gap restricts the overall effectiveness of long-term care and presents a challenge in meeting patient expectations for more comprehensive treatment solutions. The unmet need for curative approaches highlights the importance of continued research and development in this field.

Adverse Effects Associated with Long-Term Medication Use

Patients undergoing prolonged treatment for chronic bronchitis often face complications related to long-term medication use, including dependency on bronchodilators, systemic side effects from corticosteroids, and potential resistance to antibiotics. These concerns can limit patient adherence and compromise treatment outcomes. The challenge of managing side effects while maintaining therapeutic efficacy calls for the development of safer, more tolerable treatment options. Addressing this issue is crucial for improving patient quality of life and sustaining market growth.

Regional Analysis

North America

In 2024, North America held the largest share of the Bronchitis Treatment market, accounting for approximately 39.3% of the global market, with a valuation of USD 3,345.76 million, up from USD 2,951.68 million in 2018. The market is projected to reach USD 4,961.42 million by 2032, expanding at a CAGR of 5.1%. The strong market position is driven by advanced healthcare infrastructure, high awareness levels, and significant adoption of drug-based therapies. Rising incidences of chronic bronchitis, increasing air pollution, and tobacco use continue to support the steady growth in this region.

Europe

Europe represented around 24.2% of the Bronchitis Treatment market in 2024, with a market size of USD 2,064.75 million, growing from USD 1,877.26 million in 2018. The market is expected to reach USD 2,888.60 million by 2032 at a CAGR of 4.4%. Growth is supported by strong public health initiatives, increasing diagnostic rates, and the availability of advanced treatment options. However, comparatively slower population growth and moderate smoking rates may slightly restrain the pace compared to other regions. Nonetheless, Europe remains a key contributor to the overall market revenue.

Asia Pacific

Asia Pacific accounted for approximately 22.5% of the Bronchitis Treatment market in 2024, with a value of USD 1,912.28 million, rising from USD 1,587.88 million in 2018. The market is set to grow rapidly, reaching USD 3,188.30 million by 2032, registering the highest regional CAGR of 6.6%. Key growth drivers include increasing air pollution, rising smoking rates, growing healthcare access, and a large population base. Expanding awareness, coupled with improving healthcare infrastructure across emerging countries such as China and India, is accelerating the adoption of bronchitis treatments in this region.

Latin America

In 2024, Latin America captured approximately 6.6% of the Bronchitis Treatment market, with a market size of USD 566.34 million, up from USD 498.62 million in 2018. The region is projected to reach USD 783.80 million by 2032, growing at a CAGR of 4.2%. Market growth is supported by rising healthcare investments, improving medical accessibility, and increasing awareness of chronic respiratory diseases. Brazil and Mexico are the primary contributors to regional expansion. However, limited specialist availability in remote areas slightly constrains the growth potential across the entire region.

Middle East

The Middle East held around 3.9% of the Bronchitis Treatment market in 2024, valued at USD 328.23 million, increasing from USD 304.22 million in 2018. The market is forecasted to reach USD 443.30 million by 2032 at a CAGR of 3.9%. Steady growth is supported by rising investments in healthcare infrastructure and increasing cases of respiratory diseases linked to desert climates and air quality issues. However, moderate healthcare accessibility and varying healthcare expenditure across countries may temper the pace of market expansion compared to other regions.

Africa

Africa accounted for 3.4% of the Bronchitis Treatment market in 2024, reaching USD 287.50 million, up from USD 200.34 million in 2018. The market is expected to grow to USD 362.21 million by 2032 at a CAGR of 2.6%, the slowest among all regions. Growth is largely driven by gradually improving healthcare access and rising awareness of respiratory health. However, limited healthcare infrastructure, insufficient diagnostic resources, and economic challenges continue to restrict the region’s growth potential, resulting in a smaller market share compared to other global regions.

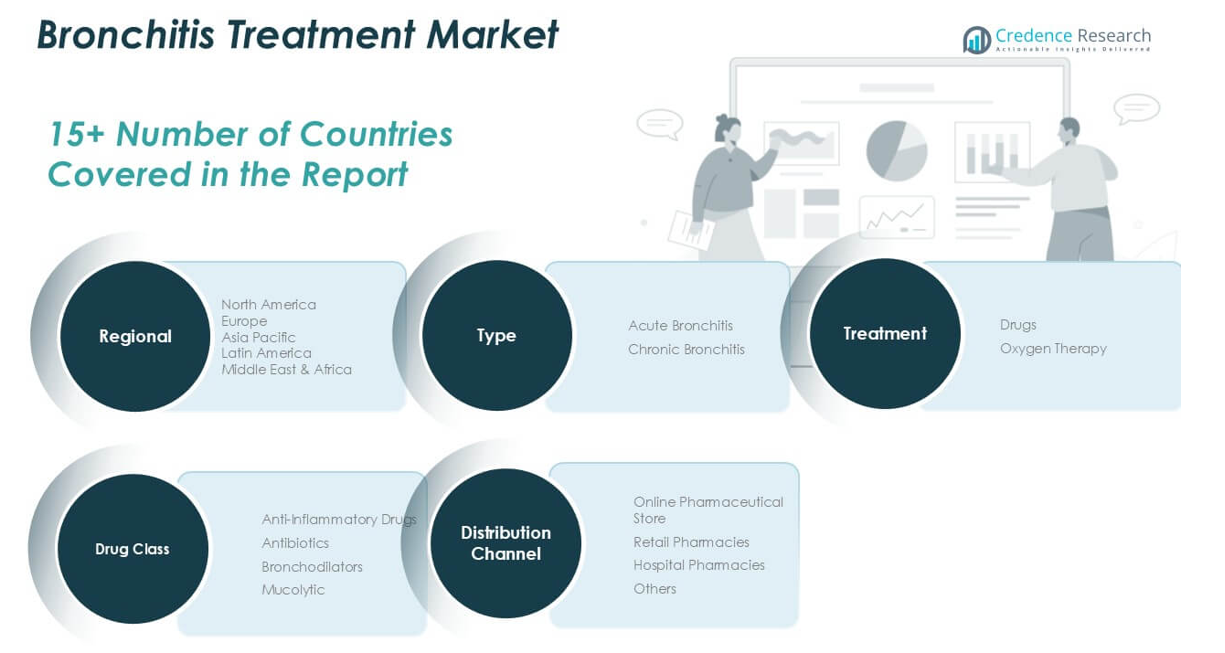

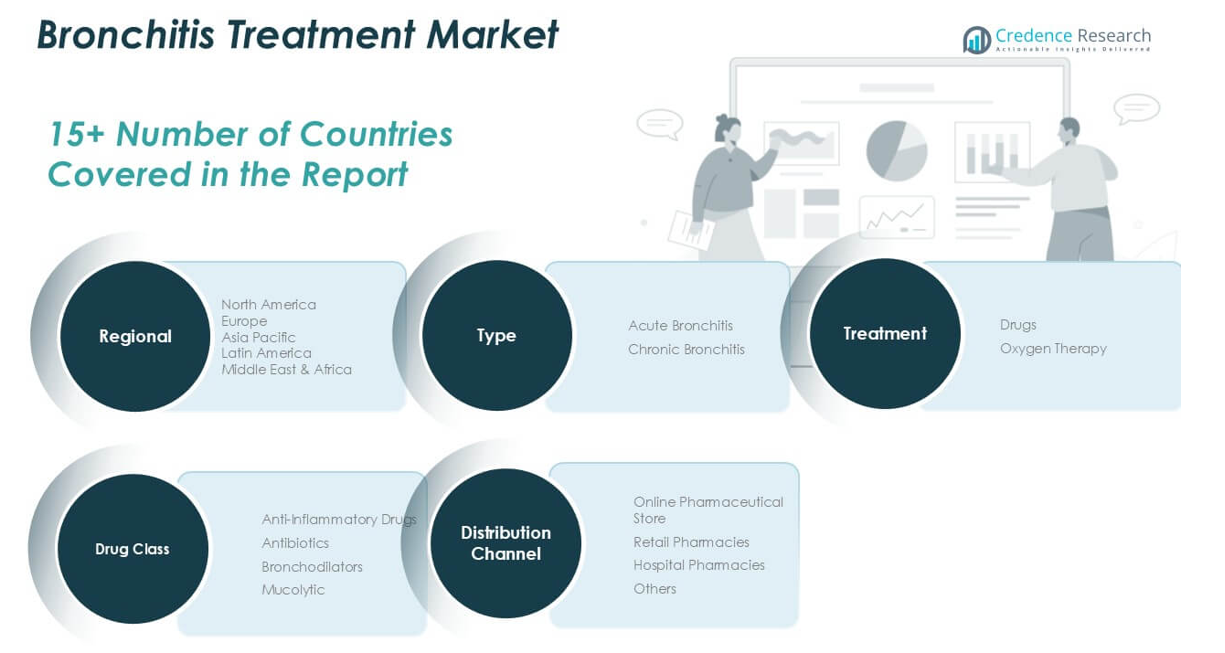

Market Segmentations:

By Type

- Acute Bronchitis

- Chronic Bronchitis

By Treatment

By Drug Class

- Anti-Inflammatory Drugs

- Antibiotics

- Bronchodilators

- Mucolytic

By Distribution Channel

- Online Pharmaceutical Store

- Retail Pharmacies

- Hospital Pharmacies

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Bronchitis Treatment market is highly competitive, with leading pharmaceutical companies focusing on product innovation, strategic partnerships, and portfolio expansion to strengthen their market positions. Key players such as GlaxoSmithKline plc, AstraZeneca plc, Boehringer Ingelheim GmbH, and Pfizer Inc. dominate the landscape through their extensive drug portfolios and global reach. Companies are actively investing in the development of advanced bronchodilators, inhalation therapies, and combination drugs to meet the rising demand for effective bronchitis treatments. Additionally, mergers, acquisitions, and collaborations are commonly pursued to expand geographical presence and enhance research capabilities. Emerging players, particularly from Asia-Pacific, are introducing cost-effective generic medications, intensifying competition in price-sensitive markets. The competitive environment is further shaped by the increasing adoption of online pharmacies and telemedicine, prompting companies to strengthen their digital distribution strategies. Overall, continuous innovation, robust R&D pipelines, and strategic market expansions remain crucial for sustaining competitiveness in the bronchitis treatment industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim GmbH

- Cadila Healthcare Ltd.

- Chiesi Farmaceutici S.p.A.

- Cipla Ltd.

- Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- Gilead Sciences, Inc.

- GlaxoSmithKline plc (GSK)

- Johnson & Johnson

- Lupin Limited

- Merck & Co., Inc.

- Melinta Therapeutics, Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

Recent Developments

- In May 2025, GSK received FDA approval for Nucala (mepolizumab) as add-on maintenance therapy for adults with inadequately controlled COPD and blood eosinophil count ≥ 150 cells/µL, introducing the first biologic for eosinophilic COPD phenotypes.

- In April 2025, Insmed’s brensocatib achieved significant efficacy in Phase 3 bronchiectasis trials, with 48.5% of patients remaining exacerbation-free at week 52 versus 40.3% for placebo, supporting its FDA submission with a December 8 2025 action date.

- In January 2025, Molex, a parent to Phillips Medisize announced that it has completed, through an affiliate, the previously announced acquisition of Vectura Group Ltd. (Vectura) from Vectura Fertin Pharma Inc., a subsidiary of Philip Morris International Inc. The deal allowed Phillips Medisize to offer a broader range of inhalation therapies, including treatments for bronchitis and COPD. This acquisition is expected to strengthen the company’s position in the growing market for chronic respiratory disease therapies.

- In July 2024, CSA Medical Inc., the developer of The RejuvenAir System utilizing liquid nitrogen spray cryotherapy, had completed patient enrolment in its SPRAY-CB pivotal trial. This double-blind, sham-controlled clinical trial enrolled 210 patients globally for the treatment of COPD with Chronic Bronchitis.

- In June 2024, the U.S. FDA approved Ohtuvayre (ensifentrine), the first new inhaled medicine for chronic obstructive pulmonary disease (COPD) in more than two decades. This drug has the combined effects of phosphodiesterase 3 and 4 inhibitors, providing bronchodilation and anti-inflammatory activity. Clinical trials showed a 40% decrease in flare-ups and enhanced lung function without the typical side effects of corticosteroids and conventional bronchodilators.

Market Concentration & Characteristics

The Bronchitis Treatment Market is moderately concentrated, with a few large pharmaceutical companies holding significant market shares. It is characterized by strong competition driven by product innovation, extensive drug pipelines, and a focus on inhalation-based therapies. Leading players consistently invest in research and development to introduce advanced formulations and improve treatment efficacy. The market shows a high degree of price sensitivity in developing regions, where generic drug manufacturers are expanding their presence. It demonstrates steady growth across both acute and chronic bronchitis segments, with chronic bronchitis contributing to long-term revenue streams due to ongoing treatment needs. The increasing preference for bronchodilators and combination therapies shapes the product landscape, while the rising influence of online pharmacies and telemedicine reshapes distribution channels. It benefits from growing healthcare awareness and improving access to respiratory treatments across emerging markets. The market faces ongoing challenges related to misdiagnosis and inappropriate antibiotic use, which impact treatment patterns. Strong regulatory frameworks govern drug approvals and sales, ensuring patient safety but also increasing time-to-market for new therapies. The presence of both branded and generic products enhances competition and creates pricing pressure, particularly in cost-sensitive countries.

Report Coverage

The research report offers an in-depth analysis based on Type, Treatment, Drug Class, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The bronchitis treatment market is expected to witness steady growth driven by the increasing prevalence of chronic respiratory diseases worldwide.

- The demand for inhalation-based therapies will continue to rise due to their faster relief and reduced side effects.

- Telemedicine and online pharmacies will play a larger role in improving access to bronchitis treatments, especially in remote areas.

- Pharmaceutical companies will focus on developing advanced bronchodilators and combination drugs to meet evolving patient needs.

- Growing awareness of respiratory health and the importance of early treatment will support higher diagnosis and treatment rates.

- The use of digital health platforms will expand, allowing more efficient patient monitoring and follow-up care for bronchitis management.

- Increasing healthcare investments in emerging economies will open new growth opportunities for bronchitis treatment providers.

- Stricter antibiotic usage guidelines and improved diagnostic accuracy will help address concerns related to overprescription.

- The market will face continued challenges from the lack of curative treatments for chronic bronchitis, maintaining focus on symptom management.

- Price competition from generic drugs will intensify, particularly in developing regions, impacting profit margins for branded therapies.