| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Plastic Welding Equipment Market Size 2024 |

USD 381.85 Million |

| Canada Plastic Welding Equipment Market, CAGR |

6.56% |

| Canada Plastic Welding Equipment Market Size 2032 |

USD 635.00 Million |

Market Overview

Canada Plastic Welding Equipment Market size was valued at USD 381.85 million in 2024 and is anticipated to reach USD 635.00 million by 2032, at a CAGR of 6.56% during the forecast period (2024-2032).

The Canada Plastic Welding Equipment market is driven by the rising demand for efficient and cost-effective solutions in industries such as automotive, manufacturing, and construction. Increased adoption of plastic components in various applications, coupled with advancements in welding technologies, is fueling market growth. The shift towards sustainable manufacturing practices and lightweight materials is further propelling the use of plastic welding equipment. Additionally, the growing trend of automation and integration of smart technologies, such as AI and IoT, is enhancing the performance and precision of welding equipment. These trends are expected to contribute significantly to the market’s expansion, as businesses seek solutions that offer higher efficiency, lower operational costs, and reduced environmental impact. The ongoing focus on innovation and energy-efficient technologies is poised to support the industry’s growth trajectory over the forecast period.

The Canadian plastic welding equipment market is shaped by key regional players, with significant contributions from Ontario, Quebec, Western Canada, British Columbia, and Atlantic Canada. Ontario remains a hub for manufacturing and automotive sectors, driving demand for advanced welding technologies. Quebec’s focus on aerospace, automotive, and medical device industries also fosters the growth of plastic welding equipment. Western Canada’s expansion in oil, gas, and construction industries further boosts demand, while British Columbia leads in manufacturing and electronics. Atlantic Canada, though smaller in market size, is gradually increasing its adoption of plastic welding solutions, particularly in construction and packaging sectors. Major players such as Branson Ultrasonics Corporation, Dukane Corporation, and Emerson Electric Co. dominate the market with their advanced technologies in ultrasonic welding, automation, and energy-efficient systems. These companies, alongside regional manufacturers, are key to the ongoing development and growth of the plastic welding equipment market in Canada.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Canada plastic welding equipment market was valued at USD 381.85 million in 2024 and is expected to reach USD 635.00 million by 2032, growing at a CAGR of 6.56%.

- The global plastic welding equipment market was valued at USD 11,340.00 million in 2024 and is projected to reach USD 19,842.36 million by 2032, growing at a CAGR of 7.24% from 2024 to 2032.

- Increasing demand across industries like automotive, packaging, and medical devices is driving market growth.

- Technological advancements in automation, energy-efficient systems, and smart technologies are shaping market trends.

- Key players like Branson Ultrasonics Corporation, Dukane Corporation, and Emerson Electric Co. lead the market with innovations in ultrasonic welding and automation.

- The high initial investment costs and maintenance of advanced welding systems act as market restraints.

- Regional growth is led by Ontario, Quebec, and Western Canada, with Ontario holding the largest market share due to its strong manufacturing base.

- The market is witnessing gradual growth in smaller regions like British Columbia and Atlantic Canada, with increasing adoption of plastic welding solutions.

Report Scope

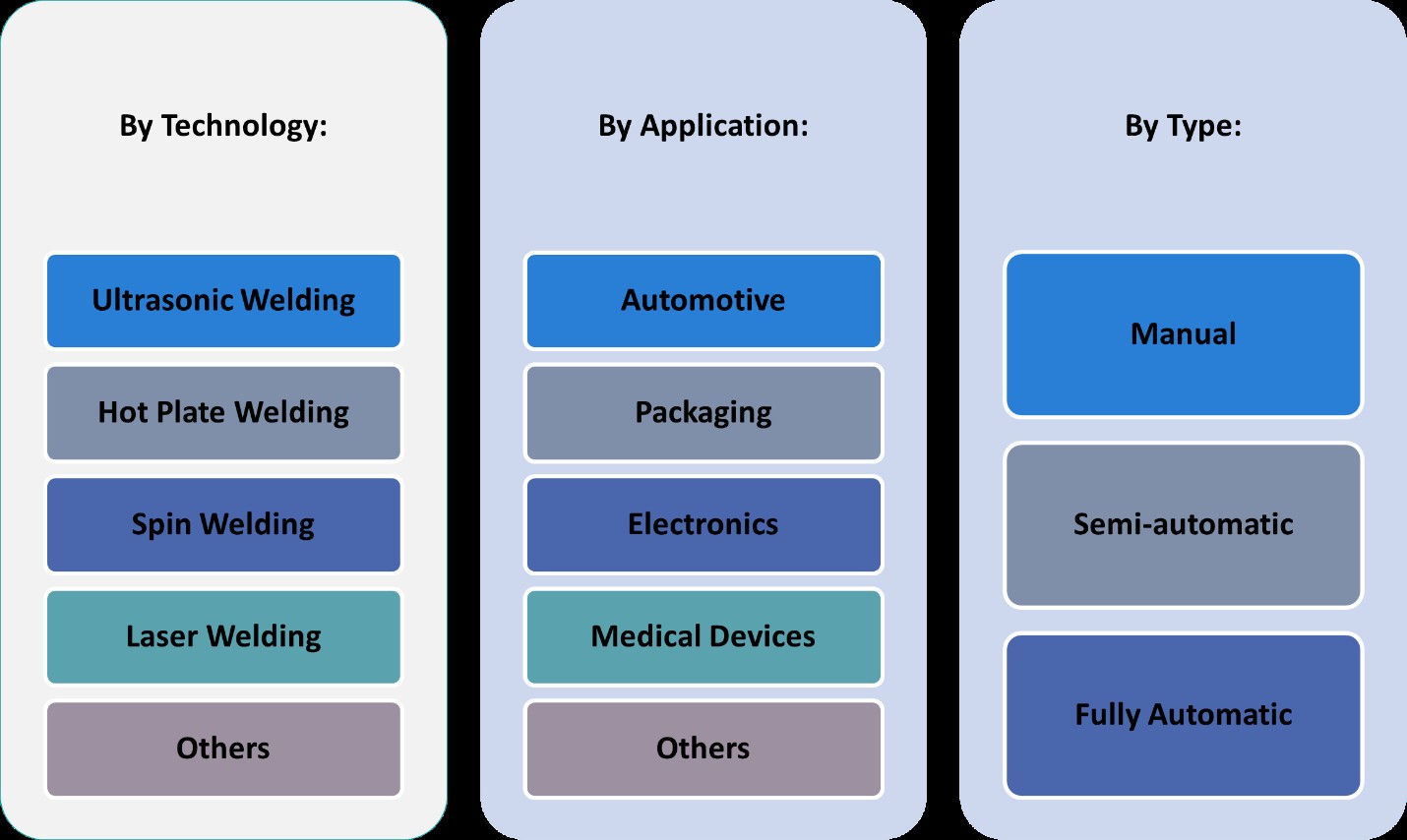

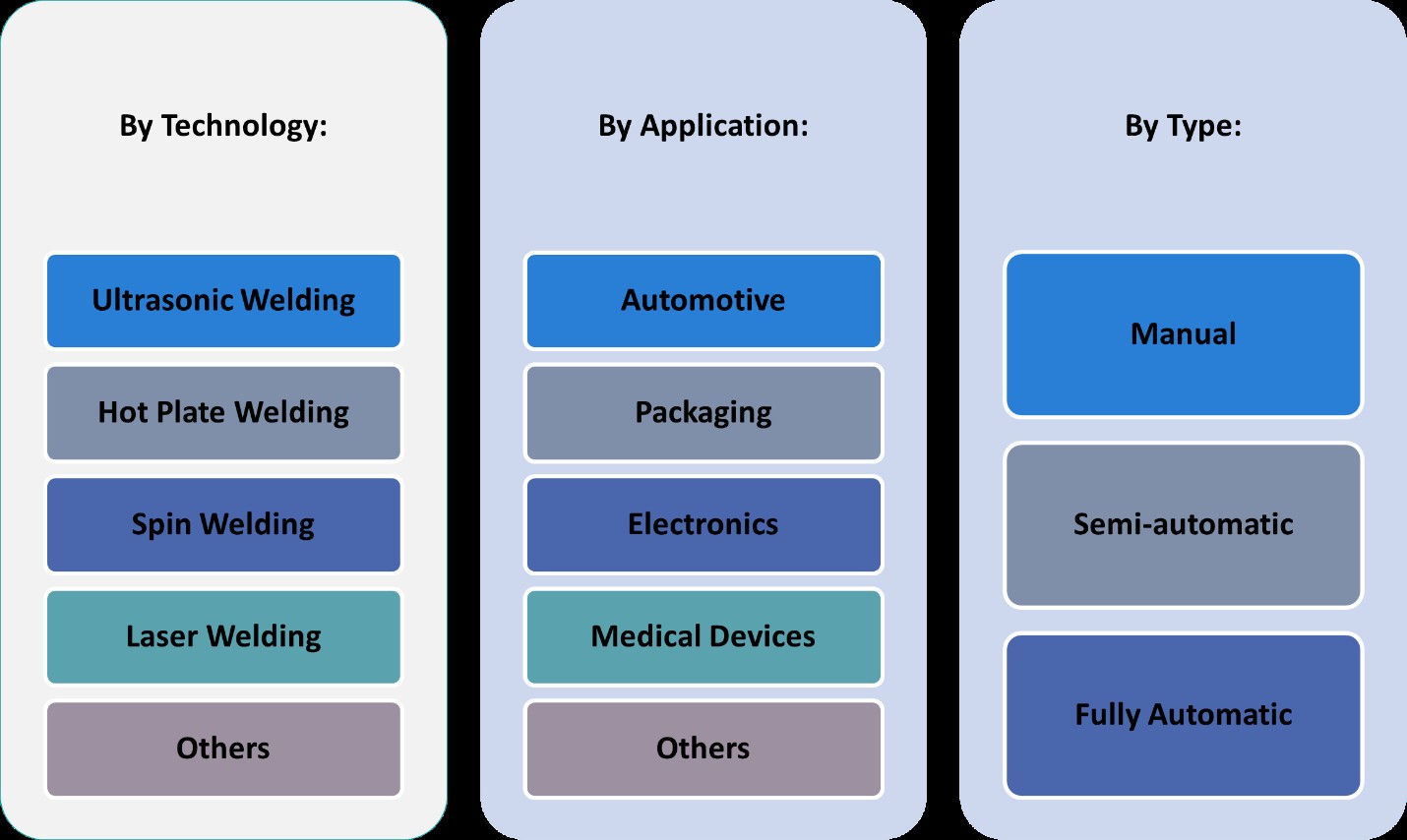

This report segments the Canada Plastic Welding Equipment Market as follows:

Market Drivers

Increasing Demand Across Key Industries

The growing demand for plastic welding equipment in Canada is primarily driven by its widespread application in several key industries, such as automotive, manufacturing, and construction. For instance, reports from Canadian automotive industry associations highlight the increasing use of lightweight plastic components to reduce vehicle weight and improve fuel efficiency, necessitating reliable welding solutions. This surge in demand for plastic parts necessitates the use of plastic welding technology to ensure strong and durable bonds between components. Similarly, in manufacturing, the ability to join plastic materials efficiently and effectively is critical for producing high-quality products. The construction industry also relies on plastic welding for the fabrication of pipes, fittings, and other plastic-based building materials. As these industries continue to expand, the need for advanced welding equipment grows, driving the overall market forward.

Technological Advancements in Welding Solutions

Another significant driver of the plastic welding equipment market in Canada is the continuous technological advancements in welding solutions. The development of more efficient, precise, and energy-saving welding systems is enhancing the overall performance of plastic welding operations. For instance, innovations such as ultrasonic welding, laser welding, and hot plate welding techniques have significantly improved the speed and reliability of plastic joining processes. These advanced methods provide better control over the welding process, resulting in stronger joints with minimal material deformation. Additionally, the introduction of automated and robotic welding systems is enabling manufacturers to achieve higher throughput and reduce labor costs. As businesses seek to optimize production processes, the demand for state-of-the-art plastic welding equipment continues to rise.

Focus on Sustainability and Lightweight Materials

A growing emphasis on sustainability and the use of lightweight materials is another key factor driving the plastic welding equipment market in Canada. For instance, environmental campaigns led by Canadian green organizations have encouraged industries to adopt lightweight, recyclable plastics as alternatives to traditional materials. Plastic, being lightweight, versatile, and recyclable, is increasingly being used across various sectors to replace heavier materials. For example, in the automotive industry, the adoption of plastic components not only reduces the weight of vehicles but also contributes to fuel savings and lower emissions. Plastic welding equipment plays a crucial role in ensuring the quality and durability of these lightweight plastic components. As industries focus more on reducing their environmental footprint, the demand for efficient and sustainable plastic welding solutions is expected to grow.

Rise in Automation and Smart Technologies

The integration of automation and smart technologies is transforming the plastic welding landscape in Canada, acting as a significant driver for market growth. Automated plastic welding systems equipped with artificial intelligence (AI), sensors, and Internet of Things (IoT) capabilities are enhancing precision and reducing the risk of human error. These technologies allow for real-time monitoring and control of the welding process, ensuring consistent and high-quality results. Automated systems also enable manufacturers to reduce labor costs and increase production efficiency, which is particularly beneficial in industries where high volumes of plastic components need to be welded quickly and accurately. The incorporation of smart features such as predictive maintenance further improves the reliability and longevity of welding equipment, making it a key investment for businesses looking to improve operational efficiency. This rise in automation is anticipated to continue driving the demand for plastic welding equipment in Canada.

Market Trends

Growing Adoption of Energy-Efficient Solutions

A prominent trend in the Canadian plastic welding equipment market is the growing adoption of energy-efficient solutions. For instance, surveys conducted by Natural Resources Canada emphasize the increasing use of energy-saving ultrasonic and laser welding systems in manufacturing processes to reduce power consumption. As industries face increasing pressure to reduce their energy consumption and carbon footprints, manufacturers are investing in advanced welding technologies that consume less power. These energy-efficient solutions not only help reduce operational costs but also align with sustainability goals. As environmental regulations tighten and companies prioritize green manufacturing practices, the demand for energy-efficient plastic welding equipment is expected to increase.

Shift Towards Automation and Robotics

The trend towards automation and robotics is significantly transforming the Canadian plastic welding equipment market. Many industries are incorporating automated systems and robotic welding solutions to improve production efficiency and precision. Automated welding systems are capable of performing repetitive tasks with high consistency, reducing human error and improving overall productivity. Robotics in plastic welding also enable manufacturers to handle more complex designs and perform intricate welds that would be difficult or time-consuming with manual labor. As the need for higher throughput and cost efficiency grows, more manufacturers are investing in robotic plastic welding systems, further driving the adoption of automation in the market.

Integration of Smart Technologies

Another key trend shaping the Canadian plastic welding equipment market is the integration of smart technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning. These technologies enable real-time monitoring, data collection, and analysis of the welding process. Smart sensors and AI algorithms optimize the welding conditions, ensuring better precision, higher quality welds, and reduced defects. Additionally, predictive maintenance features integrated into welding equipment allow manufacturers to detect potential issues before they cause downtime, enhancing productivity and equipment lifespan. The integration of these smart technologies is becoming increasingly prevalent as businesses seek to optimize their operations and improve the overall quality of their plastic welding processes.

Increasing Customization and Versatility

As industries demand more tailored and versatile plastic welding solutions, there is a growing trend towards customization in the market. For instance, studies conducted by Innovation, Science, and Economic Development Canada emphasize the importance of modular systems that cater to specific welding methods and material types. This trend is especially relevant in industries like automotive and medical device manufacturing, where precise, specialized welding is often required. The ability to adapt welding systems to meet the unique needs of each application ensures higher levels of efficiency and product quality. As customization becomes more important, plastic welding equipment providers in Canada are focused on developing versatile systems that can handle a wide variety of materials, components, and welding techniques.

Market Challenges Analysis

High Initial Investment and Maintenance Costs

One of the primary challenges facing the Canadian plastic welding equipment market is the high initial investment and ongoing maintenance costs associated with advanced welding technologies. For instance, reports from Canadian manufacturing associations highlight the significant capital expenditure required for robotic, ultrasonic, and laser welding systems, which can be a barrier for small and medium-sized enterprises (SMEs). Additionally, maintaining and servicing these high-tech systems often entails expensive spare parts, specialized labor, and periodic software updates. As a result, businesses may be hesitant to invest in newer technologies, especially during economic uncertainty or when budgets are tight. The financial burden of these investments may limit the accessibility and widespread adoption of advanced plastic welding equipment in certain sectors.

Technological Complexity and Skill Shortages

Another challenge in the market is the technological complexity of modern plastic welding equipment, which requires highly skilled operators to ensure optimal performance. The advanced features, such as smart sensors, automation, and AI integration, demand specialized training and expertise to operate effectively. However, there is a shortage of trained professionals with the necessary skills to manage and maintain these sophisticated systems. This skill gap can lead to inefficiencies, increased downtime, and even poor-quality welds if the equipment is not operated correctly. The need for ongoing training and the difficulty in finding qualified technicians adds to the operational costs and slows the adoption of advanced welding technologies, presenting a significant challenge for businesses looking to capitalize on these innovations.

Market Opportunities

The Canadian plastic welding equipment market presents significant opportunities driven by the growing demand for sustainable and lightweight materials. As industries, particularly automotive and construction, focus on reducing weight and improving energy efficiency, the need for advanced plastic components is increasing. This trend opens up substantial opportunities for plastic welding equipment providers to meet the growing demand for high-quality, durable plastic joining solutions. Additionally, with the rise in environmental consciousness and the push for greener manufacturing practices, there is a growing interest in energy-efficient welding technologies. Manufacturers that can offer equipment that reduces energy consumption and minimizes environmental impact will be well-positioned to capitalize on the sustainability-driven market shift.

Furthermore, the continued expansion of automation and the integration of smart technologies offer exciting prospects for growth. As industries seek to enhance productivity, reduce costs, and improve precision, the demand for automated plastic welding systems is expected to rise. The incorporation of robotics, AI, and IoT in welding equipment can significantly improve operational efficiency and product quality. Companies that innovate by providing smart, automated solutions that require minimal manual intervention can gain a competitive edge in the market. Additionally, the increasing customization of welding equipment to suit specific industry needs presents an opportunity to cater to niche markets, particularly in sectors like medical device manufacturing, where precision and customization are critical. By focusing on these technological advancements and industry-specific solutions, plastic welding equipment providers can tap into growing market segments and expand their customer base.

Market Segmentation Analysis:

By Type:

The Canadian plastic welding equipment market is segmented based on the level of automation in the equipment, which includes manual, semi-automatic, and fully automatic systems. Manual welding equipment remains popular due to its lower initial cost and simplicity, making it ideal for small-scale operations or businesses with less frequent plastic welding needs. Semi-automatic systems offer a balance between cost and efficiency, automating certain aspects of the welding process while still requiring manual input, making them suitable for medium-sized businesses with higher production volumes. Fully automatic systems, on the other hand, are designed for high-volume, precision-based operations, offering superior consistency, reduced human error, and enhanced production rates. These systems are increasingly being adopted in industries requiring large-scale operations and high-quality welding, such as automotive manufacturing and electronics. As the demand for faster, more reliable, and efficient welding processes grows, the fully automatic segment is expected to experience the highest growth, driven by advancements in automation and robotics.

By Application:

The application segment of the Canadian plastic welding equipment market includes electronics, packaging, automotive, medical devices, and others. The automotive sector is one of the largest consumers of plastic welding equipment, driven by the increasing use of lightweight plastic components in vehicle production to improve fuel efficiency and reduce emissions. Similarly, the packaging industry also contributes significantly to market growth due to the rising demand for plastic packaging materials and containers. The electronics industry relies on plastic welding for the assembly of various electronic components, where precision and reliability are critical. The medical device industry, which requires high standards for product quality and sterilization, is also a growing application segment for plastic welding solutions. Other industries, such as construction and textiles, also use plastic welding equipment but to a lesser extent. With technological advancements and the push for efficiency, these sectors will continue to drive demand across different segments, especially as the need for more sustainable and cost-effective manufacturing solutions increases.

Segments:

Based on Type:

- Manual

- Semi-automatic

- Fully Automatic

Based on Application:

- Electronics

- Packaging

- Automotive

- Medical Devices

- Others

Based on Technology:

- Ultrasonic Welding

- Hot Plate Welding

- Spin Welding

- Laser Welding

- Others

Based on the Geography:

- Ontario

- Quebec

- Western Canada

- British Columbia

- Atlantic Canada

Regional Analysis

Ontario

Ontario holds the largest market share, accounting for approximately 40% of the total market. This dominance is primarily due to the province’s strong industrial base, particularly in manufacturing and automotive sectors. Ontario is home to numerous manufacturing facilities that require efficient plastic welding solutions for a variety of applications, including automotive, electronics, and packaging. The region’s well-developed infrastructure, coupled with a robust demand for advanced plastic welding technologies, makes it a key player in driving market growth.

Quebec

Quebec follows Ontario as the second-largest contributor to the Canadian plastic welding equipment market, with a market share of around 30%. Quebec’s thriving aerospace, automotive, and medical device industries create a high demand for plastic welding solutions. The province’s emphasis on innovation and technology adoption further supports the growth of the plastic welding equipment market. Companies in Quebec are increasingly focusing on energy-efficient and automated welding systems to enhance production efficiency, which is contributing to the expanding market presence of modern plastic welding technologies.

Western Canada

Western Canada holds a market share of approximately 15%, driven by the growth of industries such as oil and gas, manufacturing, and construction. In particular, Western Canada’s demand for plastic welding equipment is fueled by the need for durable and cost-effective plastic solutions in construction projects, pipelines, and other large-scale infrastructure developments. The region is also witnessing an increased adoption of advanced welding technologies as industries seek more sustainable and efficient solutions for plastic joining. As these sectors continue to evolve, Western Canada’s market share is expected to grow steadily in the coming years.

British Columbia and Atlantic Canada

British Columbia and Atlantic Canada account for the remaining 15% of the market, with British Columbia holding a larger share of around 10% due to its strong presence in the manufacturing and electronics sectors. The demand for plastic welding solutions in British Columbia is supported by the growing trend of automation and the province’s focus on green manufacturing practices. Atlantic Canada, with a market share of around 5%, is seeing modest growth, mainly driven by the construction and packaging industries. Despite being a smaller market, both regions are expected to experience gradual growth as the demand for plastic welding solutions increases across various industries.

Key Player Analysis

- Branson Ultrasonics Corporation

- Dukane Corporation

- Emerson Electric Co.

- DRADER Manufacturing Industries Ltd.

- Wegener Welding LLC

- Leister Technologies AG

- Herrmann Ultraschalltechnik GmbH & Co. KG

- Bielomatik Leuze GmbH & Co. KG

- Frimo Group GmbH

- Sonics & Materials, Inc.

Competitive Analysis

The Canadian plastic welding equipment market is highly competitive, with several prominent players leading the industry through technological innovation and strategic business initiatives. Key players include Branson Ultrasonics Corporation, Dukane Corporation, Emerson Electric Co., DRADER Manufacturing Industries Ltd., Wegener Welding LLC, Leister Technologies AG, Herrmann Ultraschalltechnik GmbH & Co. KG, Bielomatik Leuze GmbH & Co. KG, Frimo Group GmbH, and Sonics & Materials, Inc. Companies are focusing on integrating smart technologies, such as AI, IoT, and machine learning, into their welding systems to improve operational efficiency, reduce defects, and enhance product quality. Additionally, innovations in ultrasonic, laser, and hot-air welding systems are helping companies cater to the specific requirements of sectors such as automotive, packaging, medical devices, and electronics. To stay ahead in this competitive landscape, players are also investing heavily in research and development (R&D) to introduce cutting-edge solutions, while offering customized products to meet the unique needs of different industries. Moreover, the increasing trend towards automation and robotics in the welding process is pushing companies to develop systems that reduce manual labor, optimize productivity, and ensure consistent, high-quality results. This dynamic market environment encourages continuous innovation and drives companies to enhance their product portfolios, customer service, and operational efficiency to maintain a competitive edge.

Recent Developments

- In March 2025, Leister transferred its laser plastic welding business to Hymson Novolas AG, a subsidiary of Hymson Laser Technology Group Co. Ltd. The transition ensures continuity and further development of existing product lines, with a new Laser Technology Center established in Switzerland. Leister will now focus more on its core competencies: plastic welding (hot air, infrared) and industrial process heat.

- In February 2025, Herrmann continues to set industry standards with its ultrasonic welding solutions, particularly for medical devices and sensitive components. The company emphasizes individualized process development, intelligent process control, and digital quality monitoring for reproducible, high-strength welds. Herrmann will showcase new applications and integration options at K 2025, focusing on automation and sustainability in medical and packaging industries.

- In January 2025, Dukane highlighted its patented Q-Factor, Melt-Match®, Low Amplitude Preheat, and Ultra-High Frequency (260–400 Hz) vibration welding technologies, emphasizing their leadership in process control and diagnostics.

- In May 2024, Emerson launched the Branson™ GLX-1 Laser Welder, designed for the automated assembly of small, intricate plastic parts. The GLX-1 features a compact, modular design suitable for cleanroom environments, advanced servo-based actuation, and the ability to “un-weld” plastics for closed-loop recycling. It uses Simultaneous Through-Transmission Infrared® (STTlr) laser-welding technology for high efficiency, weld strength, and aesthetics. Enhanced connectivity, security, and data collection features support Industry 4.0 integration.

Market Concentration & Characteristics

The Canadian plastic welding equipment market exhibits moderate concentration, with a few key players dominating the industry, particularly in high-end technologies such as ultrasonic and laser welding. However, the market also includes several smaller, specialized companies that cater to niche applications and regional demands. The market is characterized by rapid technological advancements, with an emphasis on automation, energy efficiency, and precision. Companies are increasingly integrating smart technologies like AI, IoT, and robotics into their product offerings to meet the growing need for more efficient and cost-effective solutions. The market also shows a trend towards customization, with manufacturers offering tailored welding solutions for industries such as automotive, medical devices, and packaging. The competitive landscape is driven by innovation, customer service, and the ability to provide flexible and reliable solutions. As a result, companies are continuously adapting their strategies to address evolving market demands and maintain a strong market position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Canadian plastic welding equipment market is expected to witness steady growth due to increasing demand for sustainable and durable materials in various industries.

- Advancements in welding technology will continue to drive innovations in plastic welding equipment, enhancing efficiency and precision.

- The automotive sector will remain a key driver for market growth as manufacturers seek to integrate more plastic components into vehicles for lightweight solutions.

- The rising trend of eco-friendly practices will fuel demand for plastic welding equipment in recycling and waste management industries.

- Industrial automation will play a significant role in boosting demand for automated plastic welding systems, enhancing production speed and reducing labor costs.

- The construction industry is anticipated to increasingly adopt plastic welding equipment for applications in piping, insulation, and other building materials.

- The growing adoption of thermoplastic materials in various sectors will positively impact the demand for plastic welding solutions.

- Governments and regulatory bodies may implement stricter environmental regulations, promoting the use of efficient, eco-friendly plastic welding technologies.

- The need for enhanced safety standards and quality assurance in manufacturing processes will likely result in more advanced plastic welding technologies.

- Increasing competition in the market will lead to product innovations and cost reductions, benefiting consumers and businesses across multiple industries.