Market Overview

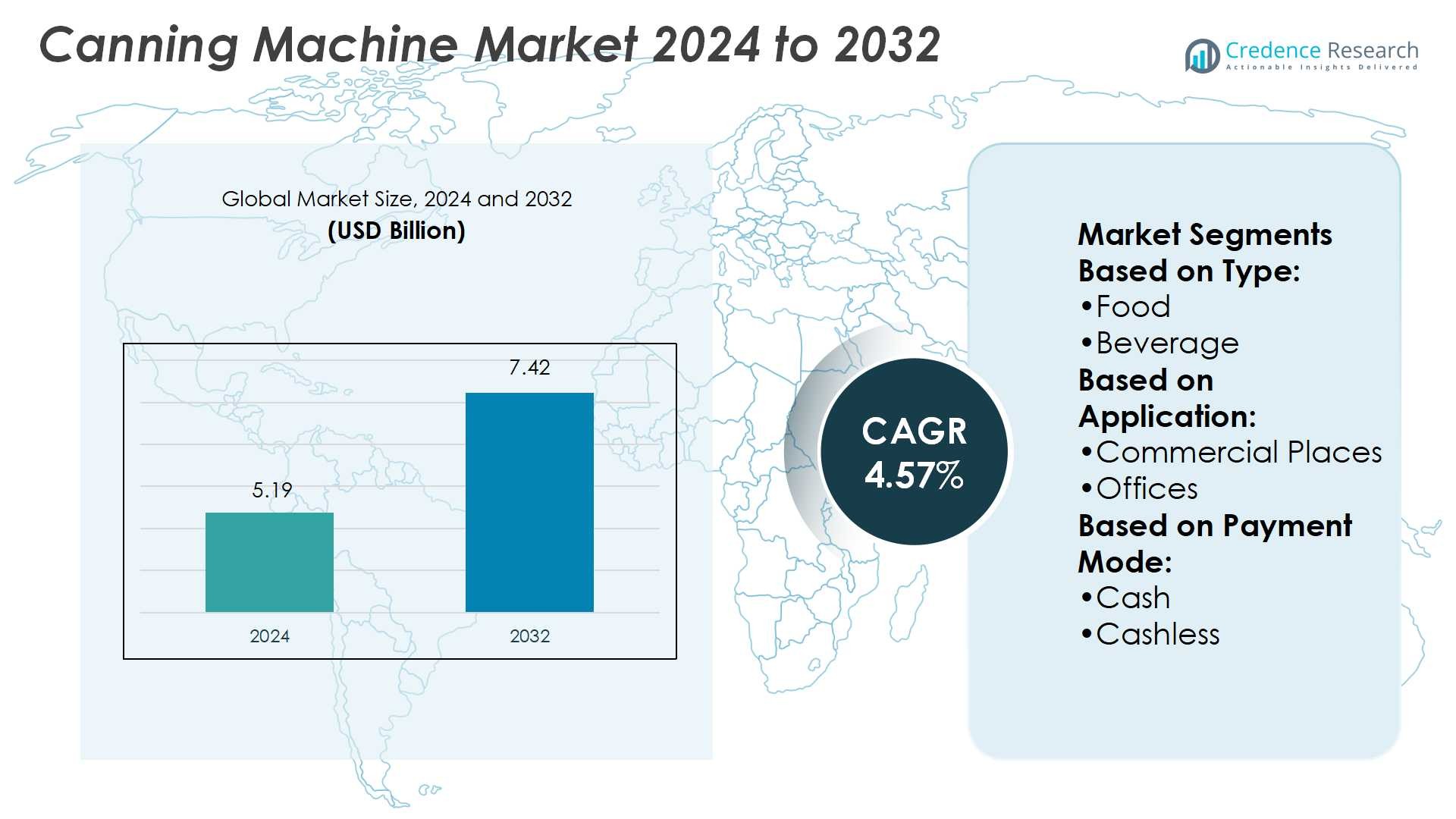

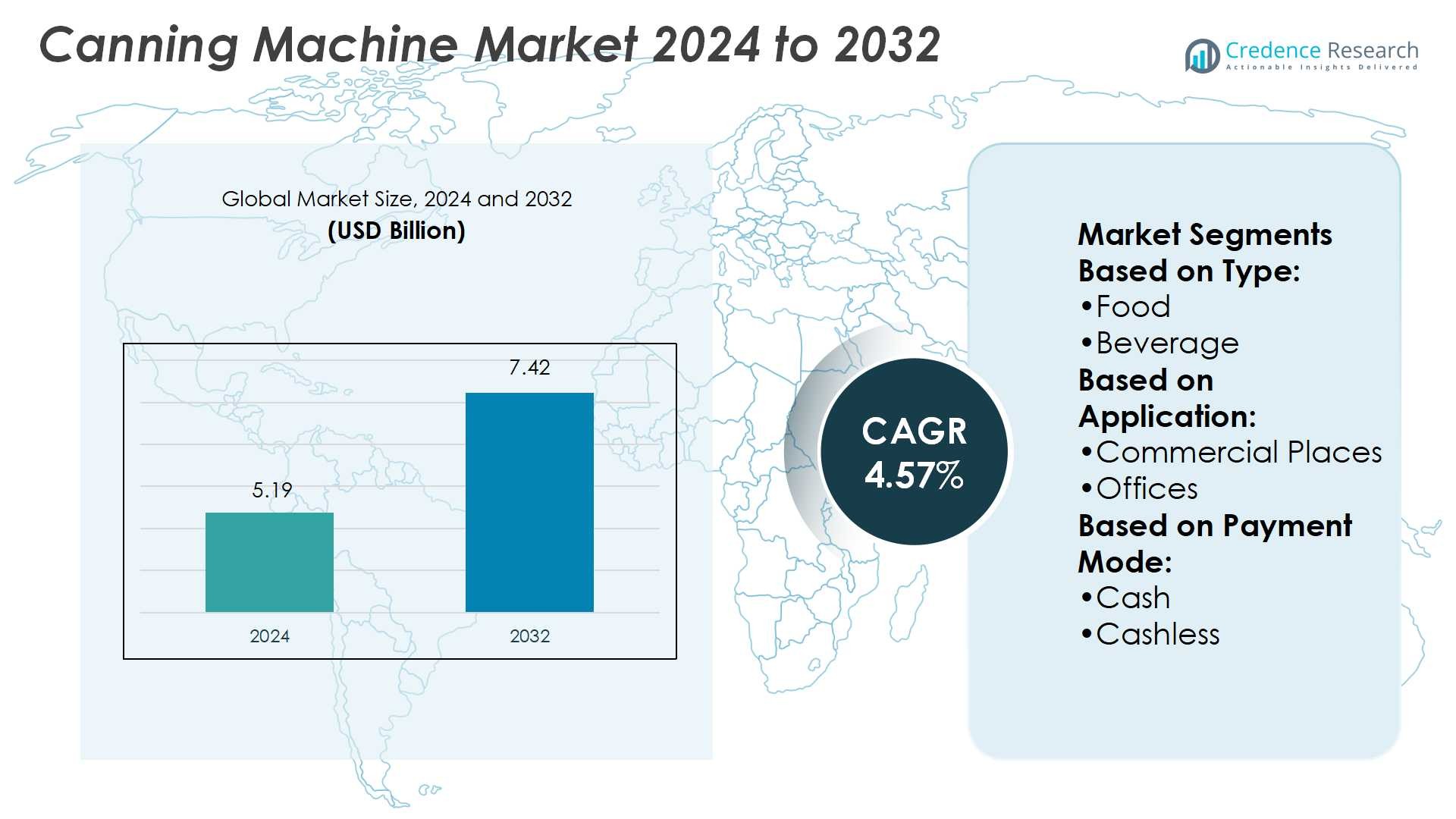

Canning Machine Market size was valued at USD 5.19 billion in 2024 and is anticipated to reach USD 7.42 billion by 2032, at a CAGR of 4.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canning Machine Market Size 2024 |

USD 5.19 Billion |

| Canning Machine Market, CAGR |

4.57% |

| Canning Machine Market Size 2032 |

USD 7.42 Billion |

The Canning Machine Market grows with rising demand for packaged food and beverages, driven by urbanization, busy lifestyles, and consumer preference for long-shelf-life products. It benefits from technological advancements in automation, IoT integration, and energy-efficient systems that enhance productivity and reduce operational costs. Regulatory pressure on food safety and sustainability encourages adoption of machines designed for hygienic processing and recyclable materials. Trends include cashless payment integration, flexible multi-format packaging, and premiumization in beverages. Manufacturers focus on innovation, sustainability, and digital monitoring to strengthen competitiveness and meet evolving global requirements across commercial, industrial, and public sectors.

The Canning Machine Market shows strong geographical presence, with Asia Pacific holding the largest share due to rapid industrial growth and high demand for packaged products, followed by Europe with strict regulatory compliance and North America with advanced automation adoption. Latin America and the Middle East & Africa contribute through emerging consumption trends and modernization efforts. Key players driving competition include Azkoyen Group, Cantaloupe Systems, Crane Merchandising Systems, Fuji Electric Co., Ltd., Glory Ltd., Orasesta S.p.A., and R.S. Hughes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Canning Machine Market size was valued at USD 5.19 billion in 2024 and is projected to reach USD 7.42 billion by 2032, at a CAGR of 4.57%.

- Rising demand for packaged food and beverages drives adoption, supported by urbanization and busy consumer lifestyles.

- Automation, IoT integration, and energy-efficient systems improve productivity and reduce operational costs.

- Regulatory compliance on food safety and sustainability encourages machines designed for hygienic processing and recyclable packaging.

- Competition remains strong, with key players focusing on innovation, sustainability, and digital monitoring solutions.

- High capital costs and complex maintenance requirements act as restraints for small and mid-scale producers.

- Asia Pacific holds the largest share, followed by Europe and North America, while Latin America and the Middle East & Africa show gradual growth through modernization efforts.

Market Drivers

Rising Demand for Packaged Food and Beverages Fuels Equipment Adoption

The Canning Machine Market expands steadily with rising consumption of ready-to-eat foods and beverages. Growing urban populations increase the need for long-shelf-life products supported by automated packaging. Food manufacturers prioritize equipment that preserves nutritional value and flavor while ensuring compliance with global safety standards. It drives strong adoption of advanced canning solutions across both small and large processing facilities. Demand from soft drinks, juices, and convenience foods further strengthens market momentum. Equipment suppliers benefit from consistent investments in food preservation and extended product distribution.

- For instance, R.S. Hughes offers a GfG Instrumentation Sensor 1450005 covering a Lower Explosive Limit (LEL) range of 0-100% for use with their G450 portable gas monitor system.

Technological Advancements in Automation and Efficiency Support Growth

The Canning Machine Market benefits from innovations in automation, robotics, and digital monitoring. Manufacturers invest in machines capable of higher speeds, reduced downtime, and lower energy use. It creates significant value for production plants seeking consistent throughput and reduced operational costs. Smart sensors, predictive maintenance systems, and AI-driven controls enhance reliability and minimize waste. Increased automation also enables flexible canning of multiple product formats on a single line. Global producers gain competitive advantage by upgrading to efficient systems that align with sustainability initiatives.

- For instance, Crane Merchandising Systems manufactures and sells the G Series of vending machines, which includes the G654 combo machine.These combo machines are designed to offer a wide variety of snacks, candy, and drinks.

Regulatory Standards and Food Safety Requirements Drive Modernization

The Canning Machine Market experiences growth due to strict food safety and labeling regulations. Governments emphasize quality standards, encouraging producers to adopt compliant and hygienic equipment. It results in rising adoption of stainless-steel machines that meet sanitation and traceability requirements. Manufacturers focus on sealing technologies that prevent contamination and ensure product integrity. Investment in sterilization processes, automated cleaning systems, and tamper-proof closures strengthens compliance. Regulatory alignment encourages both regional and multinational food processors to modernize their canning infrastructure.

Expansion of Beverage Industry and Global Trade Enhances Market Prospects

The Canning Machine Market gains traction with the growing beverage sector, including alcoholic and non-alcoholic drinks. Rising global exports of canned beverages demand scalable, high-speed equipment for bulk production. It supports manufacturers in meeting international standards and expanding into new markets. Premiumization trends in craft beer, energy drinks, and flavored waters drive investments in advanced packaging lines. Equipment that enables rapid changeovers and flexible volume handling appeals to both established brands and emerging players. Global trade dynamics and rising consumer preference for portable packaging reinforce long-term demand.

Market Trends

Increasing Integration of Smart Technologies and Digital Monitoring in Production

The Canning Machine Market shows strong momentum with the adoption of smart technologies and digital systems. Producers seek machines equipped with IoT sensors, AI-driven controls, and real-time monitoring capabilities. It improves operational efficiency by detecting faults early and reducing unplanned downtime. Data analytics enables manufacturers to track energy use, optimize performance, and ensure consistent output. Remote monitoring supports predictive maintenance and minimizes costly disruptions in production lines. Digital transformation continues to reshape equipment standards across food and beverage industries.

- For instance, Azkoyen Group acquired 100% of Vendon, giving access to more than 100,000 connected machines across Europe, enabling remote stock-level control and real-time telemetry.

Rising Focus on Sustainability and Eco-Friendly Packaging Solutions

The Canning Machine Market experiences a shift toward sustainable production processes and eco-friendly packaging. Equipment suppliers develop machines that minimize material waste and optimize energy consumption. It aligns with regulations targeting reduction of carbon footprints and plastic dependency. Demand for recyclable metal cans and lightweight designs drives innovation in sealing and forming technology. Manufacturers introduce systems that reduce water use during cleaning and sterilization. Global food companies emphasize environmental responsibility, pushing for greener canning machinery adoption.

- For instance, FY 2024 CO₂ emissions (Scope 1 & 2): Glory Ltd. reported its combined Scope 1 and 2 emissions for FY 2024 as 30,174 tonnes. Scope 1 emissions are direct emissions from the company, while Scope 2 are indirect emissions from purchased energy.

Growing Demand for Flexible and Multi-Format Packaging Systems

The Canning Machine Market evolves with demand for machines that handle multiple product types and sizes. Flexibility in packaging becomes critical as food and beverage companies diversify their offerings. It encourages investment in modular canning systems that adapt quickly to changing production needs. Machines capable of handling smaller batch runs support niche markets and seasonal demand. Quick changeover features improve production efficiency and reduce downtime between product shifts. Flexibility strengthens competitiveness and meets the rising consumer preference for variety.

Expansion of Beverage Sector and Premiumization Trends in Packaging

The Canning Machine Market expands with growing beverage consumption, including alcoholic, functional, and flavored drinks. Premiumization trends drive demand for advanced packaging that enhances shelf appeal and product differentiation. It increases investment in high-speed lines that maintain product quality while supporting intricate design requirements. Machines capable of producing sleek, branded cans attract beverage manufacturers targeting global exports. Customizable can shapes and embossing technologies gain traction in premium product categories. Beverage industry expansion ensures steady growth in demand for advanced canning equipment.

Market Challenges Analysis

High Capital Costs and Maintenance Complexities Limit Adoption

The Canning Machine Market faces constraints due to high capital investment requirements for advanced equipment. Small and mid-sized processors often struggle to finance machines with modern automation and digital features. It creates a barrier to entry for businesses in developing regions where budgets remain limited. Maintenance costs add another challenge, as complex systems require skilled technicians and frequent service checks. Unexpected breakdowns disrupt production schedules and increase operational expenses. High acquisition and upkeep costs restrict the pace of technology upgrades among cost-sensitive manufacturers.

Regulatory Compliance and Supply Chain Volatility Create Operational Barriers

The Canning Machine Market encounters challenges from strict regulatory standards and volatile supply chains. Equipment must meet evolving food safety rules, environmental policies, and traceability requirements across multiple regions. It raises compliance costs and forces manufacturers to upgrade systems more frequently. Disruptions in raw material availability and fluctuating metal prices increase uncertainty in machine production. Global supply chain bottlenecks affect timely delivery of spare parts and essential components. These barriers pressure equipment suppliers and end users to balance compliance with cost efficiency.

Market Opportunities

Rising Demand from Emerging Economies and Expanding Food Processing Sectors

The Canning Machine Market holds strong opportunities with rapid growth in emerging economies. Expanding urban populations in Asia, Latin America, and Africa fuel higher demand for packaged food and beverages. It creates a need for scalable and efficient machinery that supports mass production. Local food processors seek cost-effective solutions that enhance shelf life and distribution reach. Growing government initiatives to strengthen food security also drive investments in advanced processing equipment. Rising middle-class consumption patterns strengthen the long-term outlook for machinery suppliers.

Innovation in Automation, Sustainability, and Customization Enhances Market Potential

The Canning Machine Market benefits from opportunities tied to automation, sustainability, and product customization. Manufacturers introduce eco-friendly machines that reduce energy and water use while supporting recyclable materials. It encourages global brands to invest in environmentally aligned production systems. Automated systems with AI integration improve speed, accuracy, and versatility across multiple can formats. Customization features allow producers to meet consumer demand for premium and differentiated packaging. These innovations create strong prospects for suppliers targeting global food and beverage manufacturers.

Market Segmentation Analysis:

By Type

The Canning Machine Market demonstrates diverse applications across multiple product categories. Food and beverage segments dominate, supported by global demand for packaged meals and drinks. It strengthens adoption in both small-scale processors and large multinational brands seeking consistent quality. Candy and confectionery, tobacco, and beauty and personal care categories also drive machine usage, highlighting versatility in product handling. Games, amusement, and ticket applications expand utility in non-food sectors by offering innovative packaging and distribution methods. Other niche segments create opportunities for specialized machines catering to unique consumer preferences.

- For instance, Crane Merchandising Systems introduced the simplifi™ BI Analytics and VendMAX™ 5.0.12 platforms, which integrate with its telemetry hardware to support a large number of connected vending, snack, and beverage machines, enabling real-time data analysis.

By Application

The Canning Machine Market shows strong application in commercial places, where packaged products maintain visibility and accessibility. Offices increasingly adopt canning machines to provide ready-to-consume beverages and snacks for employees. It enhances convenience while supporting workplace wellness and productivity. Public places such as airports, stations, and malls represent a growing demand base due to high traffic and consistent consumption. The “others” category includes educational institutions and entertainment venues, broadening the scope of applications. This segment reflects the adaptability of machines to various end-use environments.

- For instance, Since their baseline Crown has added almost 18 billion cans of capacity into its system. Crown has opened 5 new plants and started up 14 new production lines in the beverage and food can manufacturing businesses.

By Payment Mode

The Canning Machine Market evolves with significant changes in payment preferences. Cash transactions remain common in developing regions, but cashless payments gain prominence in urban and technologically advanced markets. It reflects the shift toward contactless, card, and mobile wallet transactions that improve convenience and speed. Cashless payment integration also reduces risks of theft and improves operational efficiency for vendors. Growing digital payment infrastructure supports wider deployment of automated machines in commercial and public areas. Suppliers invest in systems compatible with hybrid payment options to meet diverse consumer needs.

Segments:

Based on Type:

Based on Application:

- Commercial Places

- Offices

Based on Payment Mode:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 17% of the global Canning Machine Market, supported by its advanced food and beverage industries. The U.S. dominates the region with strong adoption of automated machinery across large-scale processing facilities. Canada contributes steadily with investments in packaging lines that improve operational efficiency and compliance with strict food safety regulations. It reflects a mature market, where growth comes less from new demand and more from replacement and modernization of existing equipment. Digitalization and predictive maintenance technologies see strong uptake as companies focus on reducing downtime and improving consistency. Consumer preference for ready-to-eat meals and canned beverages sustains steady demand. While the market is stable, high operational costs and saturation create challenges, pushing suppliers to focus on efficiency-driven upgrades.

Europe

Europe holds 23% of the global market share, shaped by stringent regulatory frameworks governing food safety, energy use, and environmental sustainability. Countries such as Germany, France, and the U.K. are leaders in adopting advanced packaging technologies. It emphasizes premium and branded packaging, driving investments in sealing technologies and recyclable materials. Equipment suppliers in Europe must align with EU environmental standards, which demand energy-efficient and eco-friendly systems. Demand remains consistent due to consumer focus on high-quality packaged products with strong shelf appeal. Growth is moderate but steady, supported by sustainability-driven innovations and automation. European producers continue to modernize facilities with systems that reduce waste, enhance traceability, and deliver premium packaging experiences.

Asia Pacific

Asia Pacific commands 38% of the global Canning Machine Market, making it the largest and fastest-growing region. China dominates production and consumption, supported by large-scale manufacturing and cost advantages. India and Southeast Asia experience rapid adoption due to rising urbanization and growing packaged food and beverage demand. It benefits from supportive government initiatives focused on food security and industrial expansion. Growing disposable incomes, busy lifestyles, and high demand for canned beverages strengthen the market. Equipment suppliers invest heavily in the region, offering cost-efficient machines suited to both large enterprises and small processors. Asia Pacific remains the most attractive market for global manufacturers, supported by rapid growth, expanding supply chains, and strong domestic consumption.

Latin America

Latin America represents 13% of the global Canning Machine Market, led by Brazil, Argentina, and Chile. Economic development and an expanding middle-class population create rising demand for packaged foods and beverages. It provides opportunities for both global and regional equipment suppliers to serve medium-scale producers modernizing their facilities. Demand is especially strong in canned beverages, confectionery, and ready-to-eat meals. However, challenges such as high import tariffs, currency fluctuations, and underdeveloped infrastructure slow expansion. Local manufacturers often face financing difficulties, limiting access to advanced automation. Despite these constraints, the region holds long-term growth potential, with modernization and food security initiatives expected to drive machine adoption further.

Middle East & Africa

The Middle East & Africa account for 9% of the global Canning Machine Market, representing the smallest regional share but showing gradual growth. Urban centers in the Gulf states and South Africa exhibit stronger adoption, driven by demand for canned beverages and preserved foods suitable for hot climates. It highlights opportunities for rugged, durable, and cost-effective machines that meet regional conditions. Currency instability, high import costs, and uneven regulatory standards limit growth in many countries. Despite these barriers, demand continues to rise due to population growth, urbanization, and changing consumption habits. The region shows niche opportunities for suppliers willing to adapt to local needs with affordable, flexible canning equipment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Canning Machine Market players including Azkoyen Group, Bulk Vending Systems, Cantaloupe Systems, Continental Vending Inc., Crane Merchandising Systems, Fast Vending Machines LLC, Fuji Electric Co., Ltd., Glory Ltd., Orasesta S.p.A., and R.S. Hughes. The Canning Machine Market remains highly competitive, shaped by continuous innovation and evolving customer needs. Manufacturers focus on developing machines with greater efficiency, flexibility, and energy savings to meet rising global demand for packaged food and beverages. Companies invest in automation, smart technologies, and cashless payment integration to enhance performance and user convenience. Sustainability also drives competition, with suppliers designing equipment that supports recyclable materials and reduces environmental impact. Strategic moves such as partnerships, acquisitions, and regional expansions strengthen market presence. Intense rivalry encourages consistent product upgrades and service enhancements, ensuring reliable, compliant, and cost-effective solutions for diverse industries worldwide.

Recent Developments

- In March 2025, Coca-Cola Bottlers Japan Inc. and its partner, Fuji Electric, launched the world’s first hydrogen-powered vending machine at EXPO 2025 in Osaka, Japan. This technology allows the vending machine to function in any location or weather condition without emitting COâ.

- In December 2024, Cantaloupe, a self-service commerce technology provider, launched smart stores as an innovative alternative to traditional vending machines. These 24/7 self-service solutions are designed for retailers, residential buildings, fitness centers, and hotel pantries.

- In March 2024, JBT Corporation introduced the SeamTec 2 Evolute for powder products, which features an enhanced hygienic design and cleanability, machine simplicity and ergonomics while retaining core features for powders, including explosion-proof technology, packaging size flexibility, and spill reduction.

- In February 2024, ProMach, a global leader in processing and packaging technologies, announced its acquisition of Zanichelli Meccanica S.p.A. (Zacmi). Zacmi, based in Parma, Italy, is recognized globally for its filling, seaming, and pasteurization technology expertise.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Payment Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated canning machines will increase with rising packaged food consumption.

- Integration of IoT and AI technologies will enhance monitoring and predictive maintenance.

- Cashless and contactless payment systems will gain wider adoption in canning equipment.

- Sustainability requirements will drive development of energy-efficient and recyclable-compatible machines.

- Asia Pacific will remain the fastest-growing region with strong manufacturing capacity.

- Premiumization in beverages will create demand for advanced and customizable canning lines.

- Small and mid-scale enterprises will adopt compact and cost-effective machines.

- Regulatory compliance will continue to influence design and material choices.

- Global supply chain strengthening will support faster delivery and machine availability.

- Strategic partnerships and acquisitions will shape long-term competitive positioning.