Market Overview:

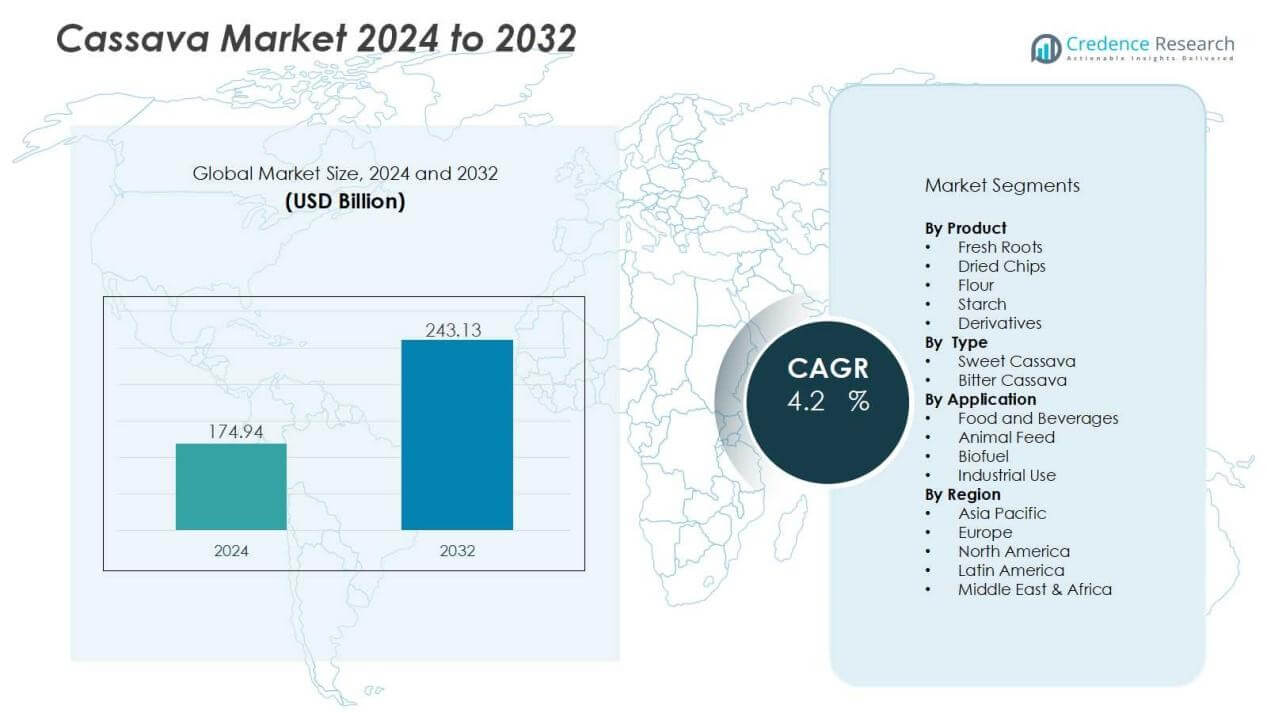

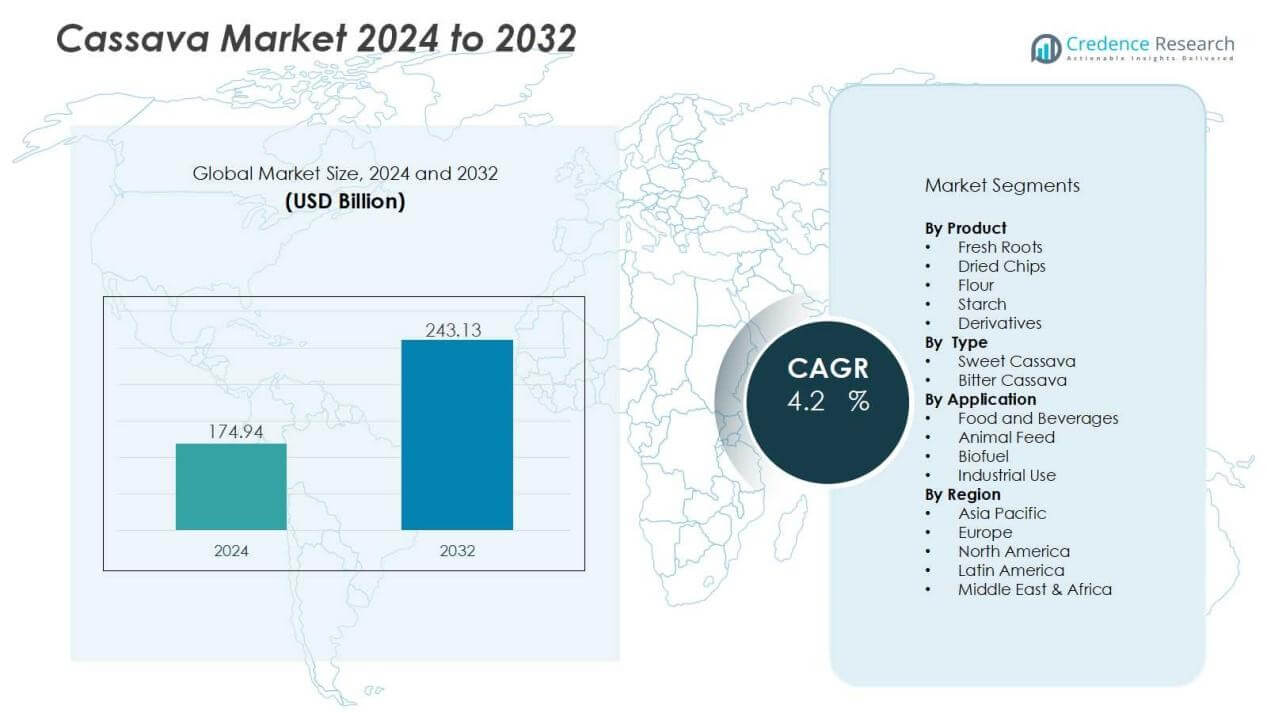

The cassava market size was valued at USD 174.94 billion in 2024 and is anticipated to reach USD 243.13 billion by 2032, at a CAGR of 4.2% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cassava Market Size 2024 |

USD 174.94 Billion |

| Cassava Market, CAGR |

4.2% |

| Cassava Market Size 2032 |

USD 243.13 Billion |

Several factors drive this growth, including cassava’s adaptability to marginal soils and resilience against harsh climates. Its use in food products, animal feed, starch, sweeteners, and biofuels strengthens its market potential. Rising demand for gluten-free food and increasing utilization in processed food industries further boost consumption. The crop’s ability to support food security, especially in emerging economies, reinforces its long-term importance. Regionally, Asia-Pacific dominates the cassava market, with Thailand, Indonesia, and Vietnam serving as leading producers and exporters. Africa follows closely, as cassava remains a staple for millions across Nigeria, the Democratic Republic of Congo, and Ghana. Latin America also contributes steadily, with Brazil and Paraguay playing key roles. Meanwhile, demand in North America and Europe continues to grow, driven by rising interest in cassava-based gluten-free products and biofuel applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The cassava market was valued at USD 174.94 billion in 2024 and is projected to reach USD 243.13 billion by 2032, growing at a CAGR of 4.2% during 2024–2032.

- Cassava’s adaptability to poor soils and harsh climates drives steady production, ensuring food and industrial supply security.

- Rising demand for gluten-free food products and processed food applications strengthens cassava’s position in global diets.

- Its use in starch, sweeteners, ethanol, and animal feed expands industrial demand and diversifies revenue streams.

- Post-harvest losses and fragmented supply chains remain key challenges, limiting incomes for smallholder farmers and reducing industrial availability.

- Asia-Pacific led with 46% share in 2024, supported by Thailand, Vietnam, and Indonesia as leading exporters and processors.

- Africa held 38% share in 2024, with Nigeria as the largest producer, while Latin America contributed 11% through Brazil and Paraguay.

Market Drivers:

Market Drivers:

Rising Demand for Food Security and Staple Consumption:

The cassava market benefits from its role as a vital staple crop for millions of people worldwide. It serves as a key food source in Africa, Asia, and Latin America, where populations rely on its affordability and caloric density. Governments support cassava cultivation to address food security challenges in regions vulnerable to climate variability. It offers a reliable crop option for smallholder farmers and rural communities, strengthening its position in national food systems.

- For Instance, The Islamic Development Bank (IsDB) and the United Nations Development Programme (UNDP), along with partners, are involved in a Regional Cassava Value Chain initiative for Africa. This initiative involves 10 African countries (Benin, Burkina Faso, Cameroon, Côte d’Ivoire, Guinea, Mozambique, Niger, Sierra Leone, Togo, and Uganda) and targets enhanced food security, economic growth, and industrialization.

Expanding Use in Industrial Applications and Value-Added Products:

The cassava market gains momentum from its diverse industrial applications, particularly in starch, sweeteners, and ethanol production. Cassava starch remains a cost-effective raw material for textiles, paper, adhesives, and food processing industries. Demand for ethanol from cassava as a renewable energy source continues to expand, driven by energy transition goals. It strengthens market prospects by diversifying income streams for producers and processors.

- For Instance, Premium Cassava Products Ltd. (PCPL), a subsidiary of Flour Mills of Nigeria (FMN), is described as one of the largest industrial processors of locally grown cassava tubers in Nigeria. The company has the capacity to process over 60,000 metric tons of cassava annually and produces high-quality cassava-based products, including industrial starch and high-quality cassava flour.

Growing Popularity of Gluten-Free and Processed Food Products:

The cassava market experiences growth through rising adoption of gluten-free diets and health-conscious consumer trends. Cassava flour serves as a popular alternative to wheat in baked goods, snacks, and ready-to-eat meals. Global food manufacturers increasingly incorporate cassava derivatives into packaged products to capture shifting consumer preferences. It reinforces cassava’s relevance in both emerging and developed food markets.

Government Support, Research, and Climate Resilience:

The cassava market is supported by investments in research, subsidies, and improved farming practices. Governments and international agencies back cassava research programs to boost yields, resist pests, and enhance nutritional quality. Its natural resilience to drought and poor soils makes it an attractive crop for climate adaptation strategies. Supportive policies and extension services help farmers expand production capacity while ensuring sustainable cultivation practices.

Market Trends:

Rising Adoption of Cassava in Food Processing and Specialty Diets:

The cassava market is witnessing strong momentum from its growing role in food processing and specialty diets. Demand for gluten-free and plant-based products drives cassava flour adoption in bakery, snacks, and ready-to-eat categories. Food manufacturers use cassava starch as a natural thickener, stabilizer, and binder, which supports its use in sauces, dairy alternatives, and processed foods. Rising consumer awareness of healthier alternatives strengthens the appeal of cassava-based products in both developed and emerging markets. It aligns with lifestyle shifts toward clean-label and allergen-free ingredients. Retail shelves increasingly feature cassava derivatives in niche health foods, reflecting both premium and mass-market positioning. The market continues to gain traction with expanding supply chains linking producers in Asia, Africa, and Latin America to global food brands.

- For instance, Chorchaiwat Industry Company Limited launched Sava flour in Thailand, becoming the first Thai company to produce gluten-free all-purpose cassava flour with less than 10 ppm cyanide content through mechanized processing technology licensed from NSTDA.

Increasing Use in Industrial Applications and Sustainable Energy Solutions:

The cassava market is also shaped by its rising demand in industrial and energy applications. Cassava-based ethanol plays a significant role in renewable fuel programs, particularly in countries seeking alternatives to fossil fuels. Starch derived from cassava supports industries such as textiles, adhesives, paper, and pharmaceuticals, offering a cost-competitive option against corn and wheat-based inputs. It provides manufacturers with flexibility in sourcing, while also contributing to supply security in volatile commodity markets. Sustainability trends encourage industries to consider cassava as a renewable, eco-friendly input across multiple sectors. Governments in Asia and Africa continue to prioritize cassava ethanol in blending mandates, reinforcing long-term market opportunities. The combination of industrial versatility and alignment with global energy transition strategies ensures cassava’s growing relevance across value chains.

- For instance, China New Energy constructed a cassava-to-ethanol plant in Ghana with an annual production capacity of 45 million liters of ethanol, primarily used in food industry applications.

Market Challenges Analysis:

Vulnerability to Post-Harvest Losses and Supply Chain Limitations:

The cassava market faces major challenges from post-harvest losses and fragmented supply chains. Cassava roots have a short shelf life, often deteriorating within 48 hours after harvest, which restricts transportation and storage options. Poor infrastructure in producing regions further complicates timely delivery to processing facilities. It limits the ability of smallholder farmers to secure stable incomes and reduces the volume available for industrial use. Seasonal production cycles create fluctuations in supply and pricing, impacting long-term contracts with processors. Investments in preservation technologies and efficient logistics remain critical to overcome these limitations and sustain growth.

Exposure to Climate Risks and Market Volatility:

The cassava market is also challenged by climate risks and market volatility. While cassava is resilient, extreme weather events, pest outbreaks, and disease infestations can still cause significant yield losses. It remains vulnerable to mosaic virus and bacterial blight, which threaten large-scale cultivation. Price fluctuations in global commodity markets affect the competitiveness of cassava against crops like maize, wheat, and corn for industrial inputs. Limited access to improved varieties and modern farming practices restricts productivity growth in many regions. Policy uncertainty in ethanol blending programs and agricultural subsidies adds to market unpredictability. Addressing these challenges requires coordinated efforts between governments, research institutions, and private stakeholders.

Market Opportunities:

Expansion into Global Food and Nutraceutical Markets:

The cassava market holds significant opportunities in food and nutraceutical applications. Rising demand for gluten-free, allergen-free, and clean-label products drives cassava flour and starch integration into bakery, snacks, and health supplements. Food companies increasingly view cassava as a natural and versatile ingredient that aligns with evolving consumer preferences. It supports the growing market for plant-based and functional foods in both developed and emerging economies. Cassava derivatives such as tapioca pearls and syrups also expand their presence in global retail and foodservice chains. Strong branding of cassava as a sustainable, health-friendly crop can further unlock premium market positioning.

Growth Potential in Bioenergy and Industrial Applications:

The cassava market also offers opportunities in bioenergy and industrial sectors. Rising adoption of renewable fuels boosts cassava ethanol production, particularly in countries implementing blending mandates. Its starch provides a cost-effective feedstock for textiles, paper, adhesives, and pharmaceuticals, competing directly with corn and wheat inputs. It creates avenues for producers to diversify revenue streams and reduce dependency on food markets. Governments’ focus on energy security and green growth strengthens cassava’s role in industrial sustainability strategies. Expanding research in bio-based plastics and biodegradable materials can further enhance cassava’s industrial footprint. These developments position cassava as a multipurpose crop with global relevance.

Market Segmentation Analysis:

By Product:

The cassava market is segmented into fresh roots, dried chips, flour, starch, and derivatives. Starch dominates due to its wide use in food processing, textiles, adhesives, and paper industries. Flour is gaining traction in gluten-free bakery and specialty food products. Dried chips continue to serve both animal feed and ethanol production. It reflects the diverse utilization of cassava products across global supply chains.

- For instance, Tidecom Group has successfully delivered over 60 cassava starch turnkey projects worldwide, each tailored to optimize starch extraction and quality for various industrial applications, demonstrating their technical adaptability across regions.

By Type:

Segmentation by type includes sweet cassava and bitter cassava. Sweet cassava holds stronger demand in direct human consumption due to its lower cyanogenic content. Bitter cassava is preferred for industrial uses such as starch and bioethanol production after processing. It highlights the balance between food-focused and industrial-focused cultivation. Both types support the crop’s versatility in meeting multiple market needs.

- For example, global cassava starch production processes generate up to 2.5 tons of bagasse and 100 to 300 kg of peel per ton of fresh processed cassava, which are used in bioenergy production including bioethanol.

By Application:

The cassava market spans applications in food and beverages, animal feed, biofuel, and industrial sectors. Food and beverages remain the leading segment, driven by flour and starch-based applications. Biofuel adoption grows steadily, with ethanol production supported by renewable energy policies. Animal feed maintains consistent demand across developing economies with strong livestock sectors. It showcases cassava’s role in both traditional consumption and advanced industrial value chains.

Segmentations:

By Product:

- Fresh Roots

- Dried Chips

- Flour

- Starch

- Derivatives

By Type:

- Sweet Cassava

- Bitter Cassava

By Application:

- Food and Beverages

- Animal Feed

- Biofuel

- Industrial Use

By Region:

- North America

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific accounted for 46% share of the cassava market in 2024, driven by large-scale cultivation and export activity. Thailand, Vietnam, and Indonesia dominate production, supplying both regional consumption and international starch markets. The region benefits from advanced processing facilities that convert cassava into starch, flour, and bioethanol for industrial and food applications. It strengthens its position by serving as a global hub for cassava-based exports, particularly to China. Rising government support for renewable energy and biofuel blending programs further enhances demand. It positions Asia-Pacific as the leading driver of both production and innovation in cassava value chains.

Africa:

Africa represented 38% share of the cassava market in 2024, reflecting its role as a staple food source. Nigeria remains the largest producer and consumer, supported by extensive smallholder farming systems. The region’s focus on food security ensures cassava continues to serve as a cornerstone of daily diets. It faces challenges from post-harvest losses, but new investments in storage and processing are improving capacity. Governments and regional organizations actively promote cassava commercialization through value-added products like flour and ethanol. It positions Africa as both a consumption powerhouse and an emerging contributor to global trade.

Latin America:

Latin America accounted for 11% share of the cassava market in 2024, supported by Brazil and Paraguay’s strong production base. The region leverages cassava for both domestic consumption and industrial applications, particularly starch and animal feed. North America and Europe held smaller shares but demonstrate rising demand for cassava derivatives in gluten-free and specialty food markets. It reflects the global diversification of cassava use beyond traditional staples. Increasing research into cassava’s role in bio-based plastics and renewable energy further strengthens growth opportunities. These developments ensure steady expansion of cassava adoption across new markets and industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Agrideco Vietnam Co., Ltd..

- Archer Daniels Midland Company

- American Key Food Products Inc

- Grain Millers Inc.

- Ingredion Inc.

- Cargill, Incorporated

- Parchem Fine and Specialty Chemicals

- Tate & Lyle Plc

- Psaltry International Ltd.

- Venus Starch Suppliers

Competitive Analysis:

The cassava market is shaped by strong competition among global and regional players focused on product innovation and value chain integration. Key companies include Agrideco Vietnam Co., Ltd., Archer Daniels Midland Company, American Key Food Products Inc., Grain Millers Inc., Ingredion Inc., Cargill, Incorporated, Parchem Fine and Specialty Chemicals, and Tate & Lyle Plc. These firms invest in processing technologies to expand cassava-based starch, flour, and derivatives across food, feed, and industrial applications. It strengthens their position by targeting both mass-market and specialty product segments, including gluten-free and clean-label categories. Strategic partnerships, distribution networks, and research programs remain central to securing long-term growth. It also benefits from regional producers in Asia and Africa who leverage cassava’s role as a staple crop, supporting both domestic consumption and exports. The competitive landscape reflects a balance of multinational corporations and local suppliers meeting diverse consumer and industrial demands.

Recent Developments:

- In August 2025, ADM announced a partnership with OCOchem to construct a demonstration plant at its Illinois corn processing complex. The plant will convert biogenic CO2 from ethanol production into high-value chemical molecules using OCOchem’s technology.

- In June 2025, Aditya Birla Group acquired Cargill’s specialty chemical manufacturing facility in the US, expanding its footprint in specialty chemicals.

Report Coverage:

The research report offers an in-depth analysis based on Product, Type, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The cassava market will see stronger integration into global food systems, driven by demand for gluten-free and clean-label products.

- It will expand its role in industrial applications, with starch and ethanol gaining broader acceptance across multiple industries.

- Food security strategies in developing economies will continue to prioritize cassava as a reliable staple crop.

- It will attract rising investments in processing technologies to reduce post-harvest losses and improve value chain efficiency.

- Climate resilience and adaptability will strengthen cassava’s importance in regions facing unpredictable weather and soil challenges.

- It will benefit from government policies supporting renewable energy, especially ethanol blending programs in Asia and Africa.

- Research into improved crop varieties will drive higher yields, pest resistance, and enhanced nutritional profiles.

- It will experience growth in international trade as supply chains diversify to meet global industrial and food demand.

- Consumer demand for plant-based and health-conscious diets will accelerate cassava flour and derivative adoption.

- It will establish stronger linkages with sustainability-focused industries, including bio-based plastics, packaging, and eco-friendly materials.

Market Drivers:

Market Drivers: