Market Overview

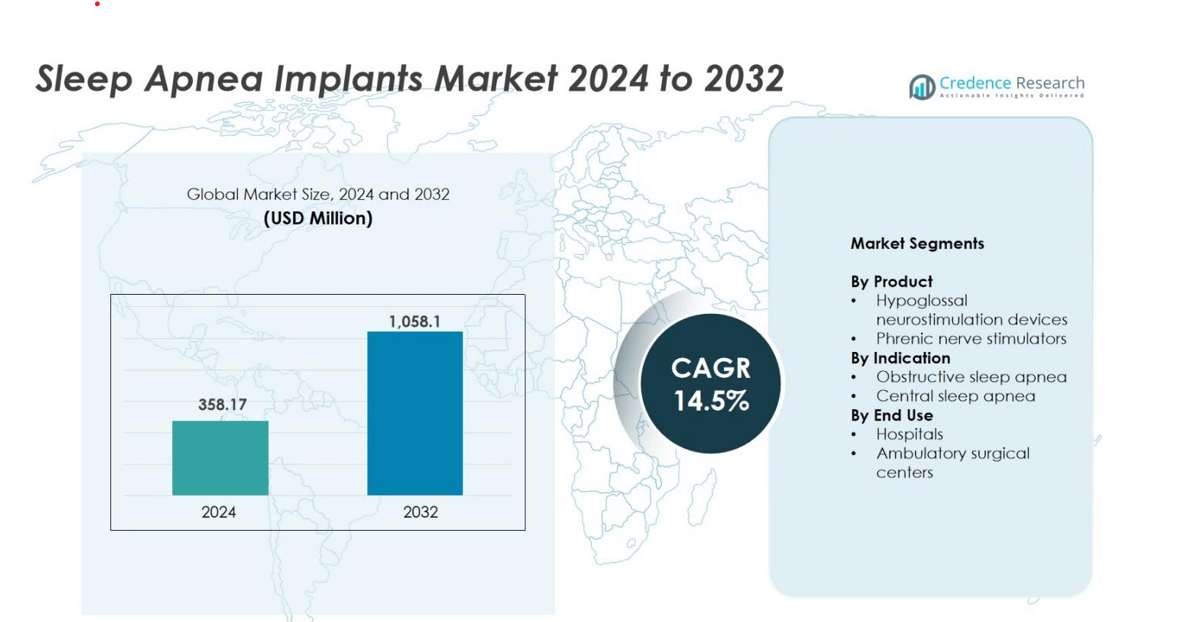

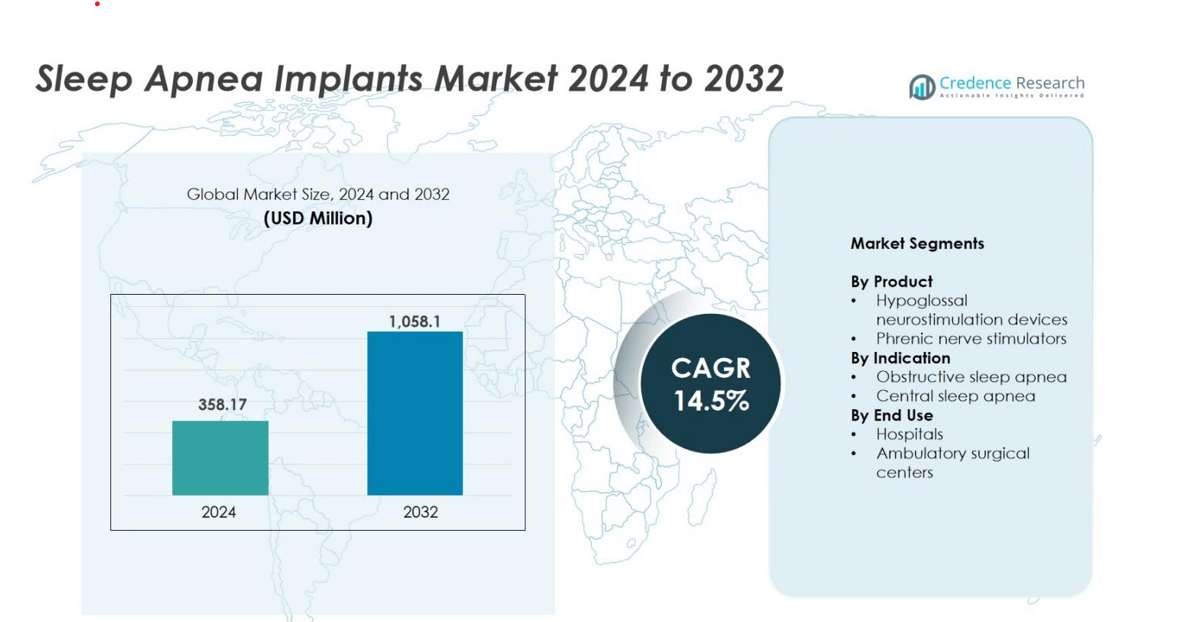

Sleep Apnea Implants market size was valued USD 358.17 million in 2024 and is anticipated to reach USD 1,058.1 million by 2032, at a CAGR of 14.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sleep Apnea Implants Market Size 2024 |

USD 358.17 million |

| Sleep Apnea Implants Market, CAGR |

14.5% |

| Sleep Apnea Implants Market Size 2032 |

USD 1,058.1 million |

Leading firms in the sleep apnea implants market include Inspire Medical Systems, Respicardia, Inc., Medtronic Plc, LivaNova PLC, ZOLL Medical Corporation, Nyxoah SA, Siesta Medical Inc., LinguaFlex, ResMed Inc. and Philips Respironics. These companies compete through advanced hypoglossal and phrenic‑nerve stimulation technologies, global distribution networks and partnerships with sleep‑care providers. The competitive climate is driven by approval success, reimbursement access and clinical outcomes. Regionally, North America leads the market with an approximate 50.3 % share, underscoring its dominant role in device adoption and therapy infrastructure.

Market Insights

- The Sleep Apnea Implants market was valued at USD 358.17 million in 2024 and is projected to reach USD 1,058.1 million by 2032, growing at a CAGR of 14.5%.

- Market growth is driven by rising prevalence of obstructive sleep apnea, technological advancements in hypoglossal neurostimulation devices, and improved reimbursement and healthcare infrastructure.

- Key trends include expansion into emerging regions like Asia-Pacific and Latin America, growth of outpatient implant procedures, and integration of remote monitoring features for better patient management.

- The market is moderately competitive, led by Inspire Medical Systems, Medtronic Plc, ResMed, Philips Respironics, LivaNova PLC, and Nyxoah SA, with a focus on device efficacy, minimally invasive procedures, and global distribution partnerships.

- North America holds the largest regional share at approximately 50.3%, hypoglossal neurostimulation devices lead by 62%, and hospitals dominate end-use applications with 68% share, while high device costs and limited patient awareness constrain growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Hypoglossal neurostimulation devices dominate the Sleep Apnea Implants market with a 62% share, driven by their effectiveness in treating moderate-to-severe obstructive sleep apnea. These devices stimulate tongue muscles to maintain airway patency, offering a less invasive alternative to traditional surgical interventions. Growing adoption is supported by technological innovations, including patient-specific programming and remote monitoring features. Manufacturers such as Inspire Medical Systems and Nyxoah SA focus on enhancing device longevity and reducing implantation complexity, further fueling demand. Phrenic nerve stimulators remain a niche segment, primarily addressing central sleep apnea cases.

- For instance, Inspire Medical Systems’ next-generation Inspire V therapy system includes an updated neurostimulator with Bluetooth-enabled remote control and advanced programmability, enhancing patient comfort and adherence.

By Indication

Obstructive sleep apnea (OSA) represents the dominant indication segment, accounting for 71% of market share, fueled by the rising prevalence of obesity and aging populations. OSA patients benefit from targeted hypoglossal neurostimulation and device-based therapy, improving sleep quality and reducing cardiovascular risks. Technological advancements such as closed-loop stimulation and minimally invasive implantation are expanding patient access. Central sleep apnea (CSA) remains a smaller segment, supported by phrenic nerve stimulators for patients with heart failure or neurological conditions, with manufacturers prioritizing precise synchronization with patient breathing patterns.

- For instance, Nyxoah’s Genio system, recently FDA-approved, which provides bilateral stimulation without implanted batteries, showing 82% of patients had significant improvement in apnea-hypopnea index.

By End Use

Hospitals lead end-use applications with a 68% share due to their capability to manage complex implant procedures and post-operative monitoring. High adoption rates are supported by specialized surgical teams, advanced sleep labs, and integrated patient care pathways. Ambulatory surgical centers are growing, driven by minimally invasive implantation techniques and shorter procedure times, appealing to cost-conscious patients. Market players emphasize training programs and collaborative partnerships with healthcare providers to increase device penetration and ensure patient safety, while expanding access in outpatient and community-based settings.

Key Growth Drivers

Rising Prevalence of Sleep Apnea and Related Comorbidities

The growing occurrence of Obstructive Sleep Apnea (OSA) and its associated conditions significantly fuels the implants market. Aging populations, increasing obesity rates and linked cardiovascular risks drive demand for implantable therapies. Many patients resist or tolerate external therapies poorly, pushing providers to favour implants for long‑term management. As a result, manufacturers gain greater opportunities in diagnosis, treatment and device penetration across regions where sleep apnea remains under‑detected.

- For instance, ResMed introduced its AirCurve 11 bi-level respiratory support device, which adapts therapy to individual breathing patterns using AI algorithms and offers remote monitoring through cloud platforms, expanding options for patients intolerant to standard CPAP therapy.

Technological Innovations in Implantable Therapies

Advances in neurostimulation, sensor integration and minimally invasive delivery boost market momentum. Implant systems for hypoglossal nerve stimulation or phrenic nerve modulators offer tailored therapy for patients intolerant to conventional treatments. Engineers and device makers invest in smaller implants, improved battery life and remote monitoring capabilities, raising procedural adoption and expanding clinical eligibility. This evolution encourages healthcare providers to recommend implants earlier, driving uptake and market expansion.

- For instance, Stimdia Medical has developed the pdSTIM™ System, a bilateral percutaneous electrical phrenic nerve stimulation system. This innovative technology is designed to assist respiratory function by exercising the diaphragm in synchrony with a mechanical ventilator to prevent muscle atrophy and potentially facilitate weaning in patients who have been on prolonged mechanical ventilation.

Improving Reimbursement and Healthcare Infrastructure

Supportive reimbursement policies and enhanced healthcare delivery channels underpin implant growth. In several developed markets, payers recognise the long‑term benefits of sleep apnea implants over chronic external devices, enabling better coverage and access. Simultaneously, hospitals increasingly adopt dedicated sleep‑medicine programs and implant‑capable facilities, creating procedural capacity. Together these factors reduce cost‑barriers for patients and widen market reach into previously underserved geographies.

Key Trends & Opportunities

Expansion into Emerging Geographies

Emerging economies in Asia‑Pacific and Latin America offer strong growth prospects for sleep apnea implants. Growing awareness of sleep disorders, rising healthcare spending and expanding hospital infrastructure in these regions present new markets. With providers seeking cost‑effective alternatives to CPAP, implant adoption accelerates as awareness and access improve. Device makers can partner with regional hospitals and clinics, adapting pricing and service‑models to local needs and unlocking incremental volumes.

- For instance, Nyxoah’s Genio® system secured a CE mark in 2019 and later won FDA approval in August 2025, enabling staged commercial rollouts and post-market studies that facilitate entry into additional markets.

Shift to Ambulatory and Outpatient Implant Procedures

The trend toward outpatient settings and ambulatory surgical centres is gaining traction for implant procedures. Less‑invasive techniques, shorter recovery times and lower procedural costs make ambulatory adoption increasingly viable. Patients prefer convenience, and providers benefit from lower overheads compared to full hospital stays. As this trend matures, device manufacturers and healthcare networks can develop dedicated package‑solutions for outpatient deployment, further increasing the market addressable base.

- For instance, Johnson & Johnson’s DePuy Synthes has launched a comprehensive outpatient joint replacement program that includes physician training and patient recovery support, helping 55% of pilot participants to feel less fear about surgery and recover more quickly at home.

Key Challenges

High Procedure and Device Costs Hamper Adoption

The upfront cost of implantable devices and related procedures remains a key barrier for many patients and payers. Some healthcare systems and insurers hesitate to reimburse new implantable therapies without long‑term cost‑effectiveness data. This slows market penetration in cost‑sensitive regions or among smaller health systems. Device makers must demonstrate robust clinical and economic outcomes and work with payers to create value‑based pricing models in order to overcome this impediment.

Limited Patient Awareness and Diagnostic Gaps

Many individuals with sleep apnea remain undiagnosed or untreated, reducing the pool of potential implant candidates. Limited awareness among both patients and primary care physicians about implant options further restricts uptake. Moreover, standard sleep diagnostics remain under‑utilised in many markets, delaying referral for advanced therapies. To address this challenge, stakeholders must invest in education campaigns and streamline diagnostic pathways so suitable patients can be identified earlier and offered implant solutions.

Regional Analysis

North America

North America dominated the Sleep Apnea Implants Market in 2024, holding approximately 50.3% of total revenue. The high share stems from robust diagnosis rates in the U.S., wide reimbursement coverage for implant therapies, and strong clinical adoption of hypoglossal neurostimulation devices. These implants increasingly serve patients intolerant of traditional treatments such as CPAP. Continued growth is supported by ongoing innovation, mature healthcare infrastructure, and large patient pools with obstructive sleep apnea.

Europe

Europe accounted for 25% of market share in 2024, supported by strong healthcare systems and increasing awareness of sleep‑disordered breathing. The region benefits from public and physician awareness campaigns, favourable regulatory frameworks, and expanding clinical acceptance of implantable therapies. Growth drivers include rising elderly populations, enhanced reimbursement policies in key countries like Germany and the UK, and a shift toward minimally invasive alternatives to CPAP.

Asia‑Pacific

The Asia‑Pacific region represented 20% of the market in 2024 and is projected to register the fastest growth. Growth is driven by rising obesity and aging populations, enhanced diagnosis capabilities, and expanding healthcare infrastructure in countries such as China and India. Device manufacturers increasingly target this region with lower‑cost models and local partnerships. The large undiagnosed patient pool further supports rapid uptake of implantable solutions.

Latin America, Middle East & Africa (LAMEA)

The LAMEA region held 10% of the global market in 2024, constrained by lower diagnosis rates and limited access to advanced procedures. However, the region offers emerging opportunities as healthcare spending rises and awareness of sleep apnea increases. Government initiatives to improve sleep disorder treatment and partnerships between global device makers and local providers are unlocking longer‑term potential, though near‑term growth remains modest compared to developed regions.

Market Segmentations:

By Product

- Hypoglossal neurostimulation devices

- Phrenic nerve stimulators

By Indication

- Obstructive sleep apnea

- Central sleep apnea

By End Use

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Sleep Apnea Implants Market features a mix of established medical‑device firms and emerging specialists, all vying to expand therapy adoption through innovation and strategic growth. Leading companies such as Inspire Medical Systems, Medtronic Plc, LivaNova PLC and Nyxoah SA focus heavily on hypoglossal neurostimulation devices and phrenic‑nerve stimulators for obstructive and central sleep‑apnea patients respectively. These firms differentiate via product efficacy, minimally invasive implantation, connectivity features and tailored patient programs. They pursue growth through strategic alliances, global distribution expansion and reimbursement negotiation to gain market share. At the same time, smaller players such as LinguaFlex and Siesta Medical Inc. concentrate on niche technologies and regional penetration. Overall, the market remains moderately concentrated, with competition centered on technological leadership, regulatory approvals and access to treatment centres.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ResMed

- Philips Respironics

- Medtronic Plc

- Inspire Medical Systems

- LivaNova PLC

- Respicardia, Inc.

- ZOLL Medical Corporation

- Nyxoah SA

- Siesta Medical Inc.

- Fisher & Paykel Healthcar

Recent Developments

- In August 2024, Inspire Medical Systems received FDA approval for its next-generation hypoglossal nerve stimulator, featuring AI-driven adaptive therapy to enhance treatment precision and patient outcomes in sleep apnea management.

- In May 2023, the FDA approved the remed System by Zoll, an Asahi Kasei company, for conditional use with MRI, expanding treatment options for adults with moderate to severe central sleep apnea (CSA) who require regular MRI scans.

- In January 2023, Respicardia, Inc., a subsidiary of Zoll Medical Corporation, launched a clinician training initiative across the United States to expand awareness and surgical expertise in implanting its Remedē System, a fully implantable device for treating CSA.

Report Coverage

The research report offers an in-depth analysis based on Product, Indication, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market players will increasingly target emerging economies to expand treatment access.

- Device innovation will shift toward smaller, fully‑implantable systems with improved battery life.

- Integration of digital health and remote monitoring features will enhance long‑term patient outcomes.

- Growth will accelerate in patient populations intolerant to CPAP therapy, boosting implant adoption.

- Reimbursement frameworks will evolve in more countries, reducing cost‑barriers for implant procedures.

- Hospitals and ambulatory surgical centres will adopt sleep‑apnea implants more broadly, increasing procedural volumes.

- Awareness campaigns and improved diagnostics will uncover undiagnosed cases, expanding the eligible patient pool.

- Strategic partnerships between device manufacturers and sleep clinics will streamline referral pathways.

- High upfront costs and regulatory hurdles will remain but will gradually ease through standardised protocols.

- Central sleep apnea treatment via phrenic‑nerve stimulators will gain credibility, opening additional indication segments.