Market Overview:

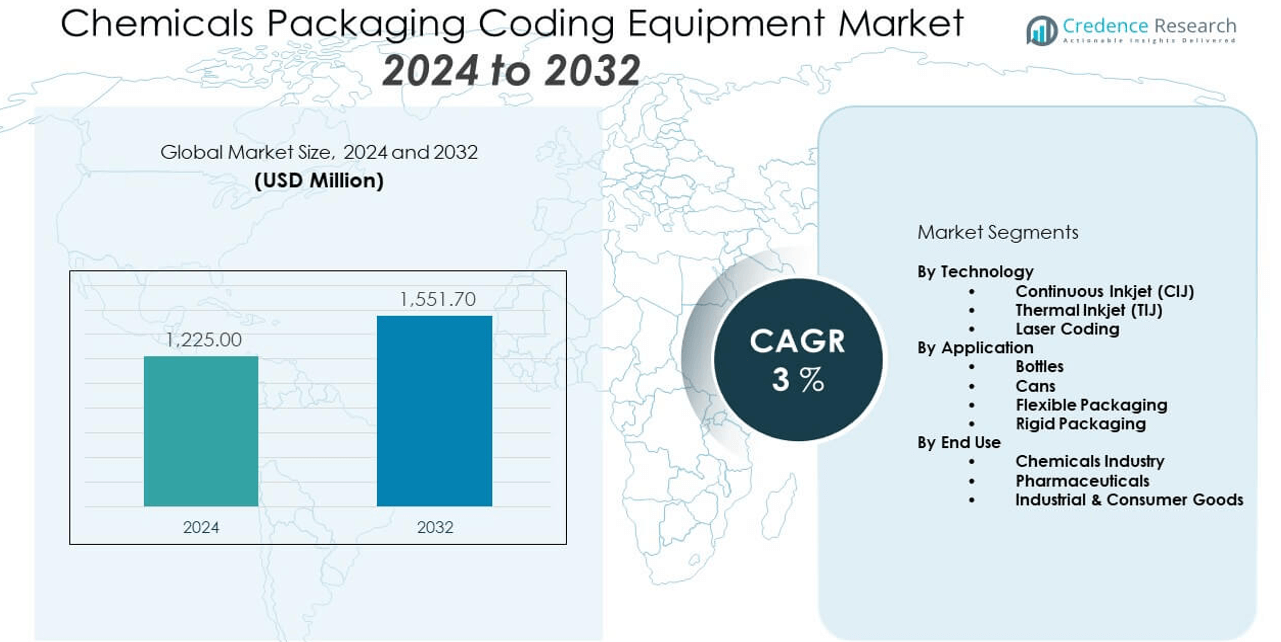

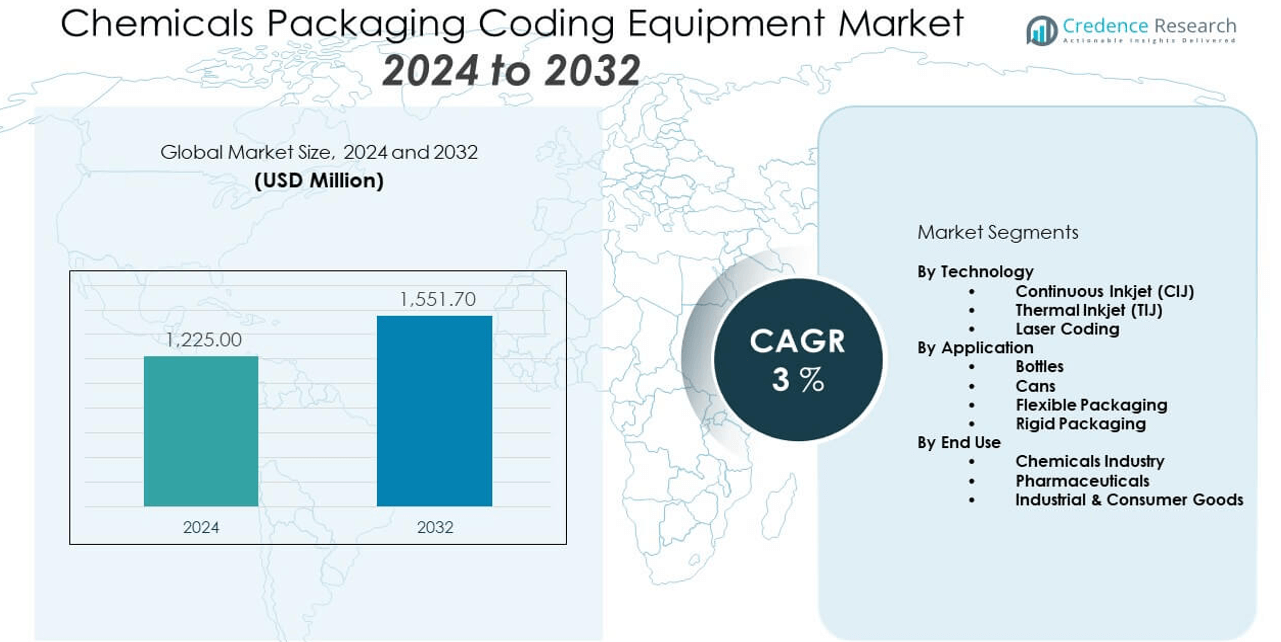

The Chemicals Packaging Coding Equipment Market is projected to grow from USD 1,225 million in 2024 to an estimated USD 1,551.7 million by 2032, with a compound annual growth rate (CAGR) of 3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemicals Packaging Coding Equipment Market Size 2024 |

USD 1,225 million |

| Chemicals Packaging Coding Equipment Market, CAGR |

3% |

| Chemicals Packaging Coding Equipment Market Size 2032 |

USD 1,551.7 million |

The market is experiencing steady growth due to increasing demand for precise labeling and traceability in the chemical industry. Regulatory pressures regarding hazardous material handling have pushed manufacturers to adopt advanced coding solutions for compliance and safety. The expansion of specialty chemicals and industrial chemicals has also led to a higher need for accurate date coding, batch tracking, and real-time monitoring across packaging lines. Additionally, innovations in inkjet and laser coding technologies are enhancing production efficiency and reducing operational errors.

Regionally, North America and Europe lead the market due to their established chemical industries and stringent packaging regulations. The U.S., Germany, and France show high adoption of automated coding systems. Meanwhile, Asia-Pacific is emerging rapidly, driven by industrial growth in China, India, and Southeast Asia. Increasing chemical production, foreign investments, and regulatory modernization in these regions are prompting manufacturers to invest in modern packaging and coding equipment to meet both domestic and export compliance standards.

Market Insights:

- The Chemicals Packaging Coding Equipment Market was valued at USD 1,225 million in 2024 and is projected to reach USD 1,551.7 million by 2032, growing at a CAGR of 3%.

- Stringent global regulations on chemical labeling and traceability are driving the adoption of advanced coding technologies.

- Rising production of specialty chemicals increases demand for flexible and high-resolution coding systems.

- High initial costs and integration challenges with legacy systems hinder adoption, especially among small and mid-sized manufacturers.

- North America and Europe lead due to mature chemical sectors and strong compliance frameworks.

- Asia-Pacific is emerging rapidly with increasing exports, regulatory modernization, and growing demand for automated packaging solutions.

- Complex and evolving regulatory standards across global markets create operational and compliance challenges for chemical manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising regulatory enforcement drives demand for traceability and compliance in chemical labelling:

The chemical industry faces increasingly strict global regulations for hazardous material labelling and traceability. Governments and safety authorities mandate accurate and durable coding on packaging to ensure proper identification, handling, and recall capability. The [Chemicals Packaging Coding Equipment Market] is gaining traction from manufacturers that require high-performance systems to meet these expectations. Coders must apply permanent, legible, and tamper-resistant markings, often under extreme conditions. Compliance pressure compels chemical companies to invest in reliable coding solutions. Print quality, adherence to global standards like GHS and REACH, and real-time serialization are now critical. Inkjet and laser coding technologies play a key role in fulfilling these compliance goals. These systems improve visibility and accountability across production and supply chains.

- For instance, Linx CIJ printers are widely adopted in the industry because they can mark products at speeds of up to 300m/min across both porous and non-porous substrates, and their advanced printhead automatically performs a Full Flush™ cleaning cycle upon shut down, reducing ink build-up and resulting in reduced printer downtime for maintenance staff, thus ensuring reliable compliance with regulatory mandates.

Growing specialty chemical production increases coding complexity and customization needs:

Specialty chemicals often require customized packaging and diversified batch coding due to shorter runs and complex formulations. This production shift creates demand for flexible, high-resolution coding systems capable of rapid changeovers. The [Chemicals Packaging Coding Equipment Market] supports these operations by enabling digital coding technologies that reduce downtime and enhance line adaptability. Manufacturers need to apply unique batch numbers, expiry dates, and barcodes that vary frequently. The market is seeing increased preference for software-integrated systems that support multiple languages and variable data printing. Equipment must handle challenging substrates such as drums, bags, and IBCs. Chemical brands also prioritize aesthetics and print placement precision. Such factors collectively elevate demand for smarter and more agile coding solutions.

- For instance, Videojet’s Wolke TIJ printers have become the preferred choice for pharmaceutical and specialty chemical packaging, offering reliable high-resolution codes up to 600 DPI on semi-porous and non-porous materials, and enabling clean, contactless cartridge changes that ensure line adaptability and reduced downtime in complex production environments.

Automation and smart packaging technologies strengthen efficiency in labelling operations:

Manufacturers continue investing in automated and intelligent packaging lines to minimize errors, reduce labor costs, and increase throughput. The [Chemicals Packaging Coding Equipment Market] benefits from this trend, offering equipment that integrates seamlessly with automated packaging systems. Coding machines with smart sensors and PLC compatibility help reduce print misalignment and packaging waste. Companies seek systems that perform self-diagnostics and adapt dynamically to changes in line speed and product type. Automation enables continuous data capture and traceability across logistics and distribution. Integration with MES and ERP systems enhances visibility and decision-making. Such innovations improve operational efficiency while supporting compliance and product integrity. Advanced coding systems are becoming a core part of digital factory strategies in the chemical sector.

Focus on environmental sustainability encourages adoption of eco-friendly coding solutions:

Environmental regulations and corporate sustainability goals are prompting a shift toward cleaner and more sustainable packaging operations. The [Chemicals Packaging Coding Equipment Market] is responding with solutions that use low-VOC inks, solvent-free technologies, and recyclable packaging materials. Many equipment providers now offer energy-efficient coders that reduce emissions and fluid consumption. Companies are moving away from harmful chemical-based printing and embracing digital and thermal inkjet solutions. Eco-conscious coding supports brand reputation and regulatory alignment. Sustainable packaging initiatives demand coding systems that perform well on recycled substrates. Equipment must minimize consumables without compromising print clarity. Green certifications and life cycle assessments influence purchase decisions in the chemical sector. Vendors that offer sustainable coding solutions gain competitive advantage.

Market Trends:

Adoption of cloud-enabled coding systems for centralized packaging line control:

Manufacturers are incorporating cloud-based platforms into their coding infrastructure to improve data visibility, remote diagnostics, and centralized control. The [Chemicals Packaging Coding Equipment Market] is evolving with systems that connect to cloud services for firmware updates and real-time performance monitoring. Centralized dashboards provide insights across multiple facilities, helping managers reduce downtime and optimize resources. Companies deploy coding solutions that allow remote troubleshooting and software configuration. This trend supports predictive maintenance by identifying issues before equipment failure. Multi-site enterprises benefit from scalable control over coding consistency and regulatory compliance. Connectivity also enables rapid changeovers and centralized print template management. Cloud-based systems enhance agility and responsiveness in production environments.

- For instance, Loftware’s cloud labeling solutions can retrieve and standardize label content from multiple data sources, ensuring compliance with GHS requirements by publishing six distinct data elements (such as hazard statements and pictograms) on every chemical label, and providing centralized monitoring and rapid changeover capabilities across facilities worldwide.

Integration of vision inspection systems with coding equipment for quality assurance:

The chemical industry prioritizes accurate, error-free coding, especially for regulated products and export markets. The [Chemicals Packaging Coding Equipment Market] now includes systems with built-in vision inspection tools that verify printed data in real time. These systems ensure that barcodes, batch codes, and dates are applied correctly and legibly. Cameras detect missing, blurred, or misplaced prints and trigger rejection mechanisms or alarms. Manufacturers can track quality metrics and improve coding performance through analytics. Vision integration reduces manual inspection requirements and boosts line efficiency. The ability to capture image-based records also supports audit trails and documentation. Inspection-enabled coding helps reduce costly recalls and product mix-ups.

- For instance, FSNB-YOLOv8, has reached up to 98.8% mAP50 in experimental settings for object detection tasks.

Customization and modular designs become standard in equipment configurations:

Coding equipment buyers increasingly demand modular systems that can adapt to varying product types, line speeds, and packaging formats. The [Chemicals Packaging Coding Equipment Market] reflects this trend by offering scalable solutions tailored to diverse operational needs. Equipment with swappable components, configurable interfaces, and flexible mounting options allows faster integration. Vendors offer build-to-order systems that support expansion and future upgrades. Customization supports specialized requirements, such as coding on curved surfaces or under high-humidity conditions. Compact and mobile designs address space constraints in legacy lines. Market players differentiate through configurable print heads, user-friendly software, and universal communication protocols. Such modularity enhances system longevity and cost efficiency.

Expansion of digital ink technologies and advanced substrates compatibility:

Digital inkjet and thermal inkjet coders are gaining ground due to their superior resolution, ease of use, and compatibility with modern substrates. The [Chemicals Packaging Coding Equipment Market] is witnessing a shift from traditional contact coders to non-contact, digital systems. These systems support high-resolution barcodes and small-character printing on plastic, metal, paper, and flexible films. New ink formulations ensure adhesion, UV resistance, and fast drying on difficult surfaces. Non-porous containers like drums and HDPE bottles benefit from solvent-based and UV-curable inks. The transition to digital enables faster setup and integration with digital packaging workflows. High contrast and anti-smudge printing improve readability and durability. This trend reflects the industry’s move toward flexible, high-performance coding.

Market Challenges Analysis:

High operational costs and complex integration with legacy systems:

The [Chemicals Packaging Coding Equipment Market] faces resistance due to the high upfront and operational costs of modern coding technologies. Small and mid-sized manufacturers often lack the capital to upgrade to digital or laser systems. Integration with legacy packaging lines poses compatibility issues that require technical adjustments. Skilled labor shortages hinder the effective deployment of advanced equipment. Some facilities operate in challenging environments with dust, humidity, or chemical exposure, which reduces equipment life span and increases maintenance frequency. Cost concerns also include ink and consumables for high-volume applications. Manufacturers must evaluate total cost of ownership, including training, support, and downtime risk. Budget constraints delay technology transitions and limit automation adoption in certain segments.

Global supply chain disruptions and regulatory complexity hinder timely deployment:

The [Chemicals Packaging Coding Equipment Market] is vulnerable to delays in equipment procurement due to semiconductor shortages and logistical bottlenecks. Lead times for key components, such as sensors and processors, extend deployment timelines. Frequent changes in chemical labelling regulations across countries create compliance burdens for exporters. Companies operating in multiple jurisdictions must update coding templates and software frequently. Regulatory inconsistencies add to system complexity and validation requirements. Adapting coders to meet local language or GHS compliance adds pressure to standard operations. Vendors must deliver localized support and software customization services to meet varied customer needs. These factors slow adoption and increase implementation risk.

Market Opportunities:

Expanding chemical exports from Asia unlocks demand for smart coding technologies:

Rapid industrialization and growing export activity in Asia present new opportunities for the [Chemicals Packaging Coding Equipment Market]. Governments in China, India, and Southeast Asia are promoting safer packaging practices. Exporters need compliant, high-resolution coding solutions to meet international standards. Equipment providers can expand their footprint by offering compact, affordable systems tailored to regional conditions. Demand for local-language coding and adaptable software is rising. Growth in contract manufacturing opens new verticals for coding solution providers.

Emergence of hybrid technologies and green initiatives supports market expansion:

The [Chemicals Packaging Coding Equipment Market] benefits from the rise of hybrid coding systems that combine thermal inkjet with laser or CIJ functionality. These flexible solutions support multi-surface and multi-speed applications. At the same time, sustainability pressures drive demand for systems that use recyclable substrates and low-emission inks. Equipment designed for energy efficiency and minimal waste aligns with green corporate strategies. Vendors that innovate around modular, eco-friendly coding systems can unlock new revenue streams.

Market Segmentation Analysis:

By Technology Segment: CIJ Leads with Speed and Versatility

Continuous Inkjet (CIJ) holds the largest share in the technology segment due to its ability to print at high speeds on a wide range of substrates. It suits industrial chemical environments where uptime, fast-drying inks, and continuous operations are critical. Thermal Inkjet (TIJ) follows, known for clean, high-resolution printing in less demanding environments, particularly on cartons and labels. Laser coding is growing steadily due to its permanent, low-maintenance, and consumable-free printing, especially for rigid containers requiring traceability and long-term durability.

- For instance, CIJ technology expels up to 120,000 ink droplets per second, enabling high-speed, non-contact coding even on irregular substrates—a well-documented feature for Linx CIJ printers. Linx 8900 printers support up to 6 lines of code per print cycle and operate at line speeds up to 9.10m/s for demanding applications.

By Application Segment: Bottles and Cans Remain Core Use Cases

The Chemicals Packaging Coding Equipment Market sees high adoption in bottle and can applications, where labeling must withstand exposure to chemicals, abrasion, and environmental conditions. Bottles often require coding on curved or irregular surfaces, while cans demand permanent, corrosion-resistant marks. Flexible packaging is rising rapidly, driven by the demand for refillable or single-use sachets in industrial and consumer applications. Rigid packaging, including plastic drums and bulk containers, also maintains strong relevance, requiring robust systems that ensure legibility under challenging conditions.

- For instance, Videojet’s solutions allow for direct coding on plastic and metal containers, providing up to five lines of text or DataMatrix barcodes on bottles—even those with curved or uneven surfaces—while its ink formulations are engineered for chemical resistance, ensuring codes remain legible despite exposure to harsh solvents and abrasion during storage and transport.

By End Use Segment: Chemical Industry Dominates with Compliance Needs

The chemicals industry continues to dominate end-use demand, driven by strict global regulations on safety labeling, batch traceability, and hazardous material management. Printing equipment in this segment must perform reliably in corrosive environments. Pharmaceuticals contribute significantly due to shared requirements for traceable ingredients and packaging compliance. Industrial and consumer goods also generate consistent demand, particularly in sectors such as paints, adhesives, and cleaning agents. Each end-use vertical shapes system selection, influencing durability, resolution, and coding speed.

Segmentation:

By Technology

- Continuous Inkjet (CIJ)

- Thermal Inkjet (TIJ)

- Laser Coding

By Application

- Bottles

- Cans

- Flexible Packaging

- Rigid Packaging

By End Use

- Chemicals Industry

- Pharmaceuticals

- Industrial & Consumer Goods

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe Dominate Due to Strong Regulatory and Industrial Base

North America holds the largest share of the Chemicals Packaging Coding Equipment Market at approximately 34.5%, driven by well-established chemical manufacturing hubs and stringent regulatory frameworks. The U.S. leads the region with high adoption of automated and compliant coding solutions across bulk and specialty chemical segments. Demand for serialization, traceability, and integration with digital packaging systems strengthens equipment upgrades. Europe follows closely with a market share of 29.2%, supported by sustainability mandates and innovations in eco-friendly coding technologies. Countries like Germany, France, and the UK enforce GHS compliance, which accelerates demand for precise, durable coding systems. The Chemicals Packaging Coding Equipment Market benefits from high investments in R&D and adherence to safety protocols in both regions.

Asia-Pacific Emerges as a High-Growth Region Due to Industrial Expansion

Asia-Pacific accounts for 23.6% of the Chemicals Packaging Coding Equipment Market and represents the fastest-growing region. Rapid urbanization, increased chemical production, and export-driven economies like China and India drive market expansion. Governments are modernizing labelling standards and encouraging automation in chemical packaging operations. Rising demand for export-compliant coding systems fuels investments in digital inkjet, CIJ, and laser coders. It sees growing adoption across both multinational companies and regional chemical manufacturers. Southeast Asian countries are also improving packaging regulations, contributing to regional market momentum. Asia-Pacific continues to attract equipment vendors with localized support, scalable solutions, and adaptable software features.

Latin America and Middle East & Africa Show Gradual Market Uptake

Latin America holds a market share of 7.1%, driven primarily by Brazil and Mexico, where industrialization and exports create moderate demand. Growth is tied to improving infrastructure and alignment with international safety standards. Adoption of automated coding remains limited but shows potential in high-volume chemical production zones. The Middle East & Africa account for 5.6%, where market penetration remains low but improving due to increasing investments in petrochemicals and specialty chemicals. Governments are implementing basic traceability requirements, gradually creating space for modern coding systems. The Chemicals Packaging Coding Equipment Market in these regions relies on imported equipment, vendor partnerships, and regional distributor networks to meet growing compliance and efficiency needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Videojet Technologies

- Domino Printing Sciences

- Markem-Imaje (Market-Image)

- Hitachi Industrial Equipment Systems

- Keyence Corporation

- Danaher Corporation

- Brother Industries Ltd.

- Control Print Ltd.

- Matthews International Corporation

Competitive Analysis:

The Chemicals Packaging Coding Equipment Market features strong competition among global and regional players offering coding technologies tailored for industrial chemical packaging. Leading companies such as Videojet Technologies, Domino Printing Sciences, Markem-Imaje, and Hitachi Industrial Equipment Systems dominate through their extensive product portfolios, technological innovation, and global distribution networks. It sees continuous investment in R&D to improve code quality, equipment reliability, and compliance with safety regulations. Companies focus on providing integrated solutions that combine hardware with software for real-time monitoring and traceability. Competitive advantage hinges on the ability to offer durable coding systems compatible with challenging chemical environments.

Recent Developments:

- In February 2025, Brother Industries launched the TD-2D rangeof compact, desktop thermal label printers. This updated series introduces models capable of printing on linerless labels, reducing waste. The devices feature customizable options, touchscreen interfaces, and accessories to support on-the-go label printing, catering to small-batch and laboratory chemical labelling needs.

- In January 2025, Markem-Imaje announced the launch of the 9712 Bi-Jet continuous inkjet (CIJ) printer, engineered for industries including construction, pharmaceuticals, and food. This printer is designed for printing large codes and extensive product information to meet complex packaging needs. The company also expanded its sustainable ink production capacity and planned a new R&D office in Salem, New Hampshire, to support innovation and growth.

Market Concentration & Characteristics:

The Chemicals Packaging Coding Equipment Market is moderately concentrated, with a few multinational players holding significant market share. It displays characteristics of high product specialization, driven by compliance with global safety and labeling standards. Product differentiation centers around print resolution, speed, durability, and software integration. Smaller players focus on niche applications or regional markets. The market demands continuous innovation to meet evolving regulatory, material, and packaging format requirements. It remains capital-intensive, with a strong focus on after-sales support and system customization.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Application, and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-speed, durable coding systems will grow with rising specialty chemical production.

- Regulatory enforcement will push global chemical companies to adopt traceable and compliant coding technologies.

- Asia-Pacific will emerge as a key growth region due to rapid industrialization and export expansion.

- Integration of coding systems with MES and cloud platforms will improve traceability and operational visibility.

- Laser coding will gain share for its durability, low maintenance, and permanent marking capabilities.

- Eco-friendly coding solutions will see higher adoption due to sustainability mandates.

- Flexible packaging applications will drive innovation in printhead adaptability and substrate compatibility.

- Equipment vendors will focus on modular designs to meet diverse packaging line configurations.

- Demand for smart diagnostics and predictive maintenance features will shape future product offerings.

- Competition will intensify with digital transformation and software-driven differentiation strategies.